|

시장보고서

상품코드

1851811

트랜스펙션 시약 및 장비 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Transfection Reagents And Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

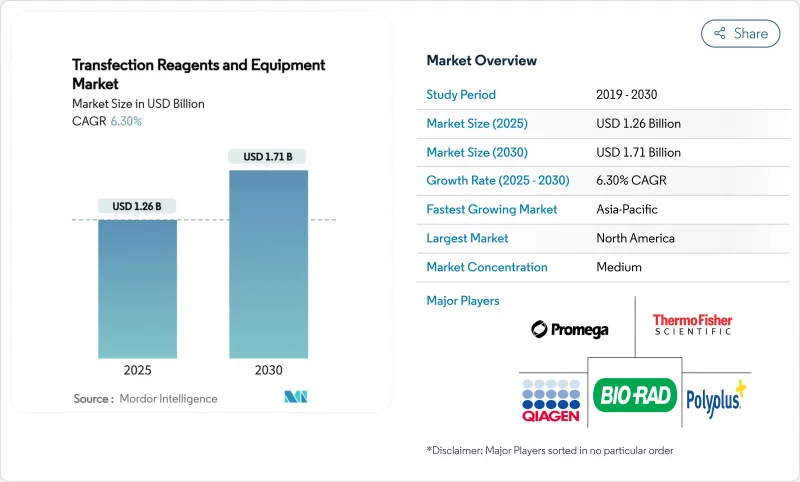

세계의 트랜스펙션 시약 및 장비 시장 규모는 2025년 12억 6,000만 달러에 이르고, CAGR 6.30%를 반영하여 2030년까지 17억 1,000만 달러로 확대될 것으로 예측됩니다.

이러한 꾸준한 확대는 세포 및 유전자 치료에서 규제의 기세, 제약 제조업체에 의한 지속적인 연구 개발비, 상업 생산의 확장성을 향상시키는 방법 수준의 급속한 기술 혁신에 의해 추진되고 있습니다. 공급업체 간 통합, 인공지능 시약 설계 상승, 개발 및 제조 위탁기관(CDMO)으로의 아웃소싱 활성화는 최종 사용자의 선택을 넓히는 한편 경쟁 장벽을 강화하고 있습니다. 아시아태평양의 두 자리 성장, 유럽의 첨단 치료제에 대한 규제의 조화, 북미의 확립된 제조거점은 GMP 등급의 형질감염 솔루션에 대한 세계 수요를 강화하고 있습니다. 실험실이 수동 프로토콜을 일관성, 추적성, 자동화된 매개변수 제어를 위해 최적화된 높은 처리량의 전기천공, 마이크로플루이딕스, 나노파티클 플랫폼으로 대체함에 따라 장비 판매는 시약을 초과하는 속도로 증가하고 있습니다. 이러한 요인들이 결합되어, 트랜스펙션 시약 및 장비 시장은 2030년까지 지속적인 확대 사이클이 지속될 것으로 예상됩니다.

세계 트랜스펙션 시약 및 장비 시장 동향 및 통찰

비 바이러스 형질감염 화학의 기술적 진보

여러 연구 그룹은 높은 트랜스펙션 효율을 유지하면서 콜레스테롤과 인지질을 제거하고, 독성을 감소시키고, 장기를 타겟으로 하는 전달을 가능하게 하는 생분해성 코어를 가진 이온화 가능한 양이온성 지질을 엔지니어링하고 있습니다. Polyplus는 GMP 환경 하에서 바이러스 역가를 높이는 산업용 AAV 생산용으로 조정된 시약인 FectoVIR-AAV로 이러한 진보를 보완했습니다. 폴리머 기반 및 하이브리드 나노튜브 캐리어의 확장은 비 바이러스성 섭취를 더욱 촉진하고 배치의 편차를 완화하며 바이러스 안전성의 우려를 완화합니다. 제조업체는 현재 시약 비율을 실시간으로 조정하는 예측 알고리즘을 통합하여 서로 다른 세포주간에 일관된 성능을 보장하며 개발 기간을 단축하고 있습니다. 비 바이러스 효율이 바이러스 벤치마크에 가까워짐에 따라, 이 기술은 대규모 치료제 제조에 필수적이 되어 고성능 시약의 소비를 촉진합니다.

제약 및 바이오테크놀러지 기업에 의한 연구개발비 증가

광범위한 비용 압력에도 불구하고, 주요 생명 과학 기업은 유전자 치료 예산을 유지하거나 증가하고 특수 적응증에서 더 높은 가격을 설정할 수 있는 프리미엄 자산을 확보하고 있습니다. Roche는 독일 유전자 치료 센터에 9,000만 유로를, AstraZeneca는 미국의 세포 치료 플랜트에 3억 달러를 투자하고, 모두 대용량 형질감염 라인을 필요로 합니다. 이 프로젝트는 데이터가 풍부한 퀄리티 바이 디자인 프로토콜을 준수하는 플랫폼 시약에 대한 수요를 확대하고 있습니다. 일반 AI는 스크리닝 사이클을 더욱 가속화하고 매주 수만 개의 최적화 된 형질 감염을 수행 할 수 있는 자동화 장치를 의무화합니다. 이 설비 투자의 변화는 공급망에 연결되어 높은 처리량 장치의 설치 기반 및 경상 시약 판매를 확대합니다.

고급 시약 및 장비의 높은 비용

GMP 규격 시약은 고가격대에서 출하되고 임상 등급의 전기 천공장치는 30만 달러를 넘는 경우가 있어 신흥기업이나 학술연구소의 발판이 되고 있습니다. 장비의 임대와 시약의 구독 모델이 등장하여 초기 부담이 줄어들고 있지만, 신흥 시장의 많은 기업은 여전히 조달을 연기하거나 확장성을 방해하는 낮은 사양의 대체품에 의존합니다. UniQure의 생산 공장 매각과 같은 시설 매각은 중견 혁신자의 운영 비용 부담을 부각하고 있습니다. 세계 서비스 기지와 자금 조달 프로그램을 갖춘 공급업체는 프리미엄 플랫폼에 대한 액세스를 민주화함으로써 경쟁력을 얻고 있습니다.

부문 분석

시약은 2024년 트랜스펙션 시약 및 장비 시장의 74.01%를 차지하며 각 실험 및 생산 배치에 필요한 반복 소모품의 안정적인 수요를 반영합니다. 이러한 이점은 트랜스펙션 시약 및 장비 시장 규모의 시약 매출 9억 3,000만 달러 이상으로 이어졌으며, 장비는 그 나머지에 기여했습니다. 지질 기반 시약은 확립된 안전성 프로파일에 의해 여전히 가장 큰 서브세트이며, 폴리머 및 하이브리드 지질 폴리머 시스템은 면역원성 감소의 혜택을 받는 용도에서 점유율을 늘리고 있습니다. 시약 카테고리는 또한 mRNA, CRISPR 가이드, AAV 생산용으로 설계된 제제를 12-18개월마다 발표하고 있어 기술 혁신 사이클이 짧다는 이점도 있습니다.

장비 매출은 절대 기준으로는 작지만 제조업체가 수작업 및 낮은 처리량 방법을 대체함에 따라 CAGR 12.85%로 증가하고 있습니다. 전기천공 플랫폼은 장비 매출의 최대 점유율을 차지합니다. 최근 모델에는 교차 오염의 위험을 최소화하는 카트리지 기반 일회용이 있습니다. 미세분사 시스템은 노동 집약적인 워크플로우임에도 불구하고, 배아 줄기세포 적용에는 여전히 필수적이지만, 마이크로플루이딕스 장치는 초기 단계 스크리닝에 자동화된 처리량을 제공합니다. 전계 강도와 펄스 지속 시간을 실시간으로 조정하는 AI 대응 전기 천공 챔버는 오랜 변동성 문제를 해결합니다. CDMO와 대기업 제제 제조업체가 생산 능력을 확대하는 가운데 장비 백로그는 견조한 앞으로 수요를 지지하고 있습니다.

2024년 트랜스펙션 시약 및 장비 시장에서 바이러스 접근법은 43.12%의 시장 점유율을 차지했습니다. 스폰서는 CAR-T와 같은 생체 외 치료에서 중요한 높은 통합 효율을 가진 AAV와 렌티 바이러스의 전달에 의존합니다. 바이러스 시스템은 규제 당국에 익숙하고 기성품 벡터 플랫폼을 사용할 수 있으므로 개발 위험을 줄일 수 있습니다. 그러나, 면역원성과 삽입 돌연변이 유발에 대한 우려가 대체 기술의 탐구의 동기가 되고 있습니다.

물리적 방법은 바이러스 단백질 없이 90% 이상의 효율을 달성하는 강력한 전기천공법과 초음파 천공법의 기술에 의해 추진되어 14.71%의 연평균 복합 성장률(CAGR)을 실현하고 있습니다. 이러한 시스템은 폐쇄 시스템 제조를 지원하고 오염 위험을 최소화함으로써 GMP의 기대에 부합합니다. Sonoporation은 또한 생체 내 유전자 치료에서 매력적인 기능인 초음파를 통한 멤브레인 투과를 통해 형질감염이 어려운 조직에 대한 적용 가능성을 확대합니다. 칼슘 포스페이트 침전과 같은 생화학적 접근법은 기초 연구에 뿌리를 두고 있으며 차세대 접근법이 처리량을 확대하고 세포 독성을 줄이면서 시장 점유율이 점차 감소하고 있습니다.

지역 분석

북미는 2024년 시장 점유율 38.12%를 차지하며 FDA의 리더십과 왕성한 벤처 자금에 지지를 받고 있습니다. 이 지역에는 AstraZeneca의 3억 달러를 투자한 새로운 세포 치료 시설과 같은 대규모 시설이 있으며, 생산 규모의 시약 및 전기천공 장비에 대한 국내 수요를 강화하고 있습니다. 그럼에도 불구하고, 생산 능력의 제약과 운영비 증가는 보다 저비용의 나라나 지역에서 CDMO와의 제휴를 모색하는 기업의 동기부여가 되고 있습니다.

아시아태평양의 CAGR은 10.31%로 가장 높으며, 2024년 228 의약품이 승인되는 중국과 2027년까지 ICH 가이드라인으로의 완전 수렴을 목표로 하는 규제 개혁에 힘쓰고 있습니다. 국내 공급업체는 GMP 등급 벡터 및 시약 생산을 확대하고 다국적 CDMO는 국내 및 수출 파이프라인 모두를 수용하기 위해 거점을 확대하고 있습니다. 일본과 한국은 선진의료에 특화된 틀을 성문화하여 동종제품의 임상참가를 합리화하고 있습니다. 동남아시아 정부는 세제 우대조치와 그린필드 바이오파크를 제공하고 있으며, 이 지역을 미래의 트랜스펙션 제조 허브로 자리잡고 있습니다.

유럽에서는 ATMP 지침의 조화와 CRISPR 기반 CASGEVY 요법과 같은 EMA의 적극적인 승인이 엔드 투 엔드 형질 감염 솔루션에 대한 수요를 지원합니다. Roche의 9,000만 유로를 투입한 유전자 치료 센터는 노동력 전문성과 합리화된 릴리스 테스트를 활용하여 세계적인 기존 기업이 EU 역내 생산을 어떻게 정착시키고 있는지를 예증하고 있습니다. 환경 컴플라이언스에 대한 노력은 생분해성 지질 제제의 기술 혁신에 박차를 가하고 공급망의 추적성 규제는 장비 플랫폼의 디지털화를 촉진하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 비바이러스성 형질감염 화학의 기술적 진보

- 제약 및 바이오테크놀러지 기업에 의한 연구 개발비 증가

- 합성 유전자와 MRNA 수요의 급증

- 세포 및 유전자 치료 임상 파이프라인의 확대

- AI에 의한 시약 처방 최적화

- 마이크로플루이딕스 고 처리량, 형질 감염 플랫폼

- 시장 성장 억제요인

- 고급 시약 및 장비의 고비용

- 한정된 세포형 특이성 및 세포독성 문제

- GMP 등급 플라스미드 공급 병목

- 상업 생산의 스케일업 과제

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 시약

- 지질 베이스

- 폴리머 베이스

- 단백질 베이스

- 장비

- 일렉트로포레이션 시스템

- 마이크로 인젝션 시스템

- 나노입자를 이용한 시스템

- 시약

- 방법별

- 생화학 방법

- 리포펙션

- 인산칼슘

- 물리적 방법

- 일렉트로포레이션

- 마이크로인젝션

- 소노포레이션

- 바이러스법

- 레트로바이러스

- 렌티바이러스

- AAV

- 생화학 방법

- 용도별

- 단백질 생산

- 유전자 및 mRNA 발현 연구

- 세포 및 유전자 치료 제조

- 암 연구

- 신약개발 및 스크리닝

- 셀 유형별

- 포유류 세포

- 세균 세포

- 효모 및 진균

- 곤충 세포

- 식물 세포

- 최종 사용자별

- 제약 및 바이오테크놀러지 기업

- 학술기관 및 연구기관

- CRO 및 CMO

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Thermo Fisher Scientific Inc.

- Lonza Group Ltd.

- Merck KGaA(Millipore Sigma)

- Bio-Rad Laboratories Inc.

- Qiagen NV

- MaxCyte Inc.

- Mirus Bio LLC

- Polyplus-transfection SA

- Promega Corporation

- Agilent Technologies Inc.

- Takara Bio Inc.

- Bio-Techne(R&D Systems)

- OriGene Technologies Inc.

- Integrated DNA Technologies(IDT)

- SignaGen Laboratories

- Altogen Biosystems

- Biontex Laboratories GmbH

- Celetrix LLC

제7장 시장 기회와 장래의 전망

JHS 25.11.25The transfection reagents and equipment market size reached USD 1.26 billion in 2025 and is forecast to advance to USD 1.71 billion by 2030, reflecting a 6.30% CAGR.

This steady expansion is propelled by regulatory momentum in cell and gene therapies, sustained R&D spending by pharmaceutical manufacturers, and rapid method-level innovation that improves scalability for commercial production. Consolidation among suppliers, the emergence of AI-guided reagent design, and heightened outsourcing to contract development and manufacturing organizations (CDMOs) are reinforcing competitive barriers while widening end-user options. Asia-Pacific's double-digit growth, Europe's regulatory harmonization around advanced therapies, and North America's established manufacturing base collectively intensify global demand for GMP-grade transfection solutions. Equipment revenues are rising faster than reagents as laboratories replace manual protocols with high-throughput electroporation, microfluidic, and nanoparticle platforms optimized for consistency, traceability, and automated parameter control. Together, these factors confirm a durable expansion cycle for the transfection reagents and equipment market through 2030.

Global Transfection Reagents And Equipment Market Trends and Insights

Technological Advancements in Non-Viral Transfection Chemistries

Multiple research groups are engineering ionizable cationic lipids with biodegradable cores that remove cholesterol and phospholipids while maintaining high transfection efficiency, lowering toxicity and enabling organ-targeted delivery. Polyplus supplemented this progress with FectoVIR-AAV, a reagent calibrated for industrial AAV production that boosts viral titers in GMP environments. The expansion of polymer-based and hybrid nanotube carriers furthers non-viral uptake, mitigating batch variability and reducing viral safety concerns. Manufacturers now embed predictive algorithms that adjust reagent ratios in real time, assuring consistent performance across different cell lines and reducing development timelines. As non-viral efficiencies approach viral benchmarks, the technology becomes integral to large-scale therapeutic manufacturing, driving consumption of high-performance reagents.

Growing R&D Spend by Pharma & Biotech Firms

Despite broader cost pressures, leading life-science companies preserve or raise gene-therapy budgets to secure premium assets that command higher pricing in specialty indications. Roche deployed EUR 90 million in a German gene-therapy center, while AstraZeneca invested USD 300 million in a U.S. cell-therapy plant, both requiring high-capacity transfection lines. These projects expand demand for platform reagents that adhere to data-rich quality-by-design protocols. Generative AI further accelerates screening cycles, mandating automated equipment that can execute tens of thousands of optimized transfections each week. This capex shift cascades down the supply chain, widening the installed base of high-throughput devices and recurring reagent sales.

High Cost of Advanced Reagents & Instruments

GMP-compliant reagents ship at premium price points, and clinical-grade electroporation devices can exceed USD 300,000, deterring start-ups and academic labs. Equipment leasing and reagent subscription models are emerging to soften upfront burdens, yet many emerging-market firms still defer procurement or rely on lower-spec alternatives that hinder scalability. Facility divestitures-such as UniQure's sale of a production plant-highlight the operational cost strain on mid-tier innovators. Suppliers with global service footprints and financing programs gain a competitive edge by democratizing access to premium platforms.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Synthetic Gene & mRNA Demand

- Expansion of Cell & Gene-Therapy Clinical Pipelines

- Limited Cell-Type Specificity / Cytotoxicity Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents represented 74.01% of the transfection reagents and equipment market in 2024, reflecting steady demand from repeat consumables required for each experiment or production batch. This dominance translated into more than USD 930 million in reagent revenues within the transfection reagents and equipment market size, while equipment contributed the balance. Lipid-based chemistries remain the largest subset due to established safety profiles; polymer and hybrid lipid-polymer systems gain share in applications that benefit from reduced immunogenicity. The reagents category also benefits from shorter innovation cycles, with suppliers introducing formulations engineered for mRNA, CRISPR guides, or AAV production every 12-18 months.

Equipment revenues, though smaller in absolute terms, are increasing at 12.85% CAGR as manufacturers replace manual or low-throughput methods. Electroporation platforms account for the largest share of equipment sales; recent models include cartridge-based disposables that minimize cross-contamination risk. Microinjection systems remain essential for embryonic stem-cell applications despite labor-intensive workflows, whereas microfluidic devices offer automated throughput for early-stage screens. AI-enabled electroporation chambers that adjust field strength and pulse duration in real time address long-standing variability challenges. As CDMOs and large biologics producers expand capacity, equipment backlogs support robust forward demand.

Viral approaches held 43.12% market share in 2024 within the transfection reagents and equipment market. Sponsors rely on AAV and lentiviral delivery for their high integration efficiency, critical in ex vivo therapies such as CAR-T. The regulatory familiarity of viral systems and the availability of readymade vector platforms reduce development risk. However, concerns around immunogenicity and insertional mutagenesis motivate exploration of alternative techniques.

Physical methods are realizing 14.71% CAGR propelled by potent electroporation and sonoporation technologies that reach efficiencies above 90% without viral proteins. These systems support closed-system manufacturing, aligning with GMP expectations by minimizing contamination risk. Sonoporation further extends applicability to hard-to-transfect tissues via ultrasound-mediated membrane permeabilization, a feature attractive in in vivo gene therapies. Although biochemical methods like calcium-phosphate precipitation persist in basic research, their market share is gradually declining as next-generation modalities scale throughput and reduce cytotoxicity.

The Transfection Reagents and Equipment Market Report is Segmented by Product (Reagents, Equipment), Method (Biochemical Methods, Physical Methods, and Viral Methods), Application (Protein Production, and More), Cell Type (Mammalian Cells, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.12% market share in 2024, underpinned by FDA leadership and robust venture funding. The region hosts large-scale facilities like AstraZeneca's new USD 300 million cell-therapy site, reinforcing domestic demand for production-scale reagents and electroporation equipment. Integer capacity constraints and rising operating expenses nevertheless motivate select companies to explore CDMO partnerships in lower-cost jurisdictions.

Asia-Pacific records the highest regional CAGR at 10.31%, energized by China's 228 drug approvals in 2024 and regulatory reforms that target full convergence with ICH guidelines by 2027. Domestic suppliers scale up GMP-grade vector and reagent production, while multinational CDMOs expand footprint to serve both local and export pipelines. Japan and South Korea are codifying dedicated advanced-therapy frameworks, streamlining clinical entry for allogeneic products. Southeast Asian governments are offering tax incentives and greenfield bioparks, positioning the sub-region as a future transfection manufacturing hub.

Europe benefits from harmonized ATMP guidelines and proactive EMA approvals such as the CRISPR-based CASGEVY therapy, sustaining demand for end-to-end transfection solutions. Roche's EUR 90 million gene-therapy center exemplifies how global incumbents anchor production within the EU, leveraging workforce expertise and streamlined release testing. Environmental compliance initiatives spur innovation in biodegradable lipid formulations, while supply-chain traceability regulations encourage digitalization of equipment platforms.

- Thermo Fisher Scientific

- Lonza Group Ltd.

- Merck

- Bio-Rad Laboratories

- QIAGEN

- MaxCyte

- Mirus Bio

- Polyplus-transfection

- Promega

- Agilent Technologies

- Takara Bio

- Bio-Techne (R&D Systems)

- OriGene Technologies

- Integrated DNA Technologies (IDT)

- SignaGen Laboratories

- Altogen Biosystems

- Biontex Laboratories GmbH

- Celetrix LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements In Non-Viral Transfection Chemistries

- 4.2.2 Growing R&D Spend By Pharma & Biotech Firms

- 4.2.3 Surge In Synthetic Gene & Mrna Demand

- 4.2.4 Expansion Of Cell & Gene-Therapy Clinical Pipelines

- 4.2.5 AI-Driven Reagent-Formulation Optimization

- 4.2.6 Microfluidic High-Throughput Transfection Platforms

- 4.3 Market Restraints

- 4.3.1 High Cost Of Advanced Reagents & Instruments

- 4.3.2 Limited Cell-Type Specificity / Cytotoxicity Issues

- 4.3.3 GMP-Grade Plasmid Supply Bottlenecks

- 4.3.4 Scale-Up Challenges For Commercial Manufacturing

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Reagents

- 5.1.1.1 Lipid-based

- 5.1.1.2 Polymer-based

- 5.1.1.3 Protein-based

- 5.1.2 Equipment

- 5.1.2.1 Electroporation Systems

- 5.1.2.2 Microinjection Systems

- 5.1.2.3 Nanoparticle-mediated Systems

- 5.1.1 Reagents

- 5.2 By Method

- 5.2.1 Biochemical Methods

- 5.2.1.1 Lipofection

- 5.2.1.2 Calcium-Phosphate

- 5.2.2 Physical Methods

- 5.2.2.1 Electroporation

- 5.2.2.2 Microinjection

- 5.2.2.3 Sonoporation

- 5.2.3 Viral Methods

- 5.2.3.1 Retroviral

- 5.2.3.2 Lentiviral

- 5.2.3.3 AAV

- 5.2.1 Biochemical Methods

- 5.3 By Application

- 5.3.1 Protein Production

- 5.3.2 Gene & mRNA Expression Studies

- 5.3.3 Cell & Gene Therapy Manufacturing

- 5.3.4 Cancer Research

- 5.3.5 Drug Discovery & Screening

- 5.4 By Cell Type

- 5.4.1 Mammalian Cells

- 5.4.2 Bacterial Cells

- 5.4.3 Yeast & Fungi

- 5.4.4 Insect Cells

- 5.4.5 Plant Cells

- 5.5 By End User

- 5.5.1 Pharmaceutical & Biotechnology Companies

- 5.5.2 Academic & Research Institutes

- 5.5.3 CROs & CMOs

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Lonza Group Ltd.

- 6.3.3 Merck KGaA (Millipore Sigma)

- 6.3.4 Bio-Rad Laboratories Inc.

- 6.3.5 Qiagen N.V.

- 6.3.6 MaxCyte Inc.

- 6.3.7 Mirus Bio LLC

- 6.3.8 Polyplus-transfection SA

- 6.3.9 Promega Corporation

- 6.3.10 Agilent Technologies Inc.

- 6.3.11 Takara Bio Inc.

- 6.3.12 Bio-Techne (R&D Systems)

- 6.3.13 OriGene Technologies Inc.

- 6.3.14 Integrated DNA Technologies (IDT)

- 6.3.15 SignaGen Laboratories

- 6.3.16 Altogen Biosystems

- 6.3.17 Biontex Laboratories GmbH

- 6.3.18 Celetrix LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment