|

시장보고서

상품코드

1851142

사물인터넷(IoT) 전문 서비스 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)IoT Professional Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

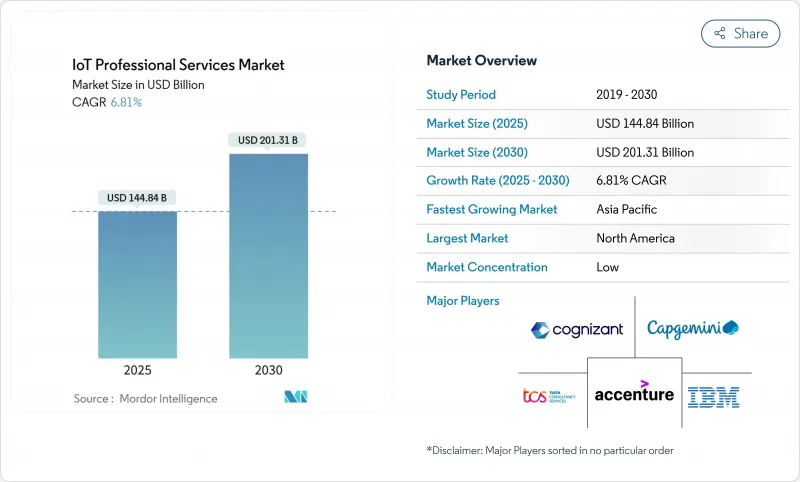

사물인터넷(IoT) 전문 서비스 시장은 2025년에 1,448억 4,000만 달러를 창출하고, 2030년에는 2,013억 1,000만 달러에 이를 것으로 예상되며, CAGR은 6.81%를 나타낼 전망입니다.

커넥티드 디바이스 에코시스템 확장, 5G 배포, 엣지 컴퓨팅에 대한 투자를 통해 기업은 실험에서 본격적인 배포로 전환하고 있으며 전문 컨설팅, 시스템 통합 및 관리 서비스에 대한 전문 지식이 필요합니다. 성과 기반 가격 설정, 특정 분야에 특화된 솔루션, Industry 4.0을 둘러싼 규제 의무화는 공급업체의 패키징과 가치 제공 방법을 재구성하고 있습니다. 디바이스 수와 데이터 중심의 비즈니스 모델이 융합되는 곳에서 수요는 가장 강하지만, 사이버 리스크 증가와 인력 부족이 당분간의 성장 기대를 약화시키고 있습니다. 전반적으로 사물인터넷(IoT) 전문 서비스 시장은 단편적인 프로젝트 업무에서 기술 성과를 비즈니스 성과에 연결하는 반복적인 플랫폼 대응 업무로 전환하고 있습니다.

세계의 사물인터넷(IoT) 전문 서비스 시장 동향과 인사이트

커넥티드 디바이스의 보급과 센서 비용의 저하

세계 연결 장치의 수는 188억대로 증가하고 있으며, 다양한 하드웨어, 펌웨어 및 통신 프로토콜을 관리하는 기업의 용량이 확대되고 있습니다. 센서의 저가격화로 인해 대규모 배포가 경제적으로 실행될 수 있지만, 디바이스의 이종성은 수명 주기 관리의 복잡성을 증가시킵니다. 따라서 전문 서비스 파트너는 멀티 공급업체 플릿을 지원하는 프로비저닝, 구성 및 모니터링 프레임 워크를 설계해야합니다. 경량 M2M, 제로 터치 온보딩, 보안 요소 인증은 모범 사례의 청사진으로 지지를 모으고 있습니다. 엣지 컴퓨팅에 대한 투자는 2028년까지 총 3,780억 달러에 이를 것으로 예상되며, On-Premise 처리와 클라우드 분석의 균형을 맞추는 통합 서비스에 대한 수요가 더욱 높아지고 있습니다.

기업의 디지털 변화 로드맵

이사회는 IoT 데이터를 전략적 자산으로 취급하고 커넥티드 디바이스 프로젝트를 보다 광범위한 디지털 코어 프로그램에 통합하는 경향이 커지고 있습니다. IBM은 디지털 변환과 관련된 컨설팅 수익 49억 6,000만 달러를 보고하고 고립된 파일럿에서 기업 전체의 현대화로의 전환을 강조하고 있습니다. 서비스 제공업체는 현재 측정 가능한 ROI를 제공하는 센서 아키텍처와 애널리틱스 파이프라인에 비즈니스 KPI를 매핑하는 능력으로 평가되고 있습니다. 구매자가 업타임, 비용 절감 및 수익 업 보장을 요구함에 따라 성과 기반 가격 설정이 뒷받침됩니다. 디지털 코어가 성숙함에 따라 디바이스, 네트워크 및 용도의 성능을 지속적으로 최적화하는 관리형 서비스 랩에 대한 수요가 증가하고 있습니다.

데이터 프라이버시 및 사이버 보안에 대한 우려

Ordr은 Healthcare IoT 환경의 82%가 적어도 하나의 심각한 취약점을 가지고 있음을 발견했으며, 랜섬웨어, 안전 위험 및 규제 벌금에 대한 이사회 수준의 불안을 부추기고 있습니다. 따라서 기업은 보안 부팅 칩에서 암호화된 데이터 파이프라인, 마이크로부문화된 네트워크에 이르기까지 다층 방어가 필요합니다. 필요한 기술은 임베디드 보안, OT 프로토콜, 클라우드 IAM에 걸쳐 있지만 대부분의 IT 팀은 인력 부족으로 남아 있습니다. SOC-as-a-Service, 레드팀 테스트, 제로 트러스트 레퍼런스 아키텍처에 투자하는 서비스 제공업체는 보안 불안을 다년간 리테이너 계약으로 바꾸는 데 가장 적합한 위치에 있습니다.

부문 분석

IoT 컨설팅은 공급업체 중립 전략, ROI 모델링, 비즈니스 케이스 검증에 대한 지속적인 수요를 반영해 2024년 매출 점유율은 32.5%를 유지했습니다. 그러나 복잡한 미들웨어, 데이터 레이크 및 애널리틱스 오케스트레이션을 포함한 로드맵을 기업이 프로덕션 배포로 전환함에 따라 시스템 설계 및 통합이 CAGR 7.2%로 확대되고 있습니다. 공급업체는 도메인 가속기, 레퍼런스 아키텍처, 공장 가동 시간 및 에너지 효율 향상에 요금을 연결하는 성과 기반 계약을 통해 차별화를 도모하고 있습니다. 설계 및 통합된 사물인터넷(IoT) 전문 서비스 시장 규모는 5G 및 에지 프로젝트가 파일럿에서 확장됨에 따라 급증할 것으로 예측됩니다.

또한 장치 모니터링, 예측 유지보수 및 원격 업데이트 오케스트레이션을 결합한 관리 서비스 랩에도 기세가 있습니다. 공급업체는 플랫폼 구독을 SLA에 뒷받침된 운영 센터와 번들하여 연금 소득을 확보하고 고객의 잠금을 늘리고 있습니다. 통합의 복잡성이 증가함에 따라 펌웨어 CI/CD, 디지털 트윈 시뮬레이션, AI 주도 테스트 자동화 등의 도구에 대한 투자가 시장 경쟁력을 유지하기 위한 중요한 과제가 되고 있습니다.

대기업은 다양한 포트폴리오, 세계 공급망 및 대규모 현대화 예산으로 2024년 지출의 63.7%를 창출했습니다. 그러나 중소기업은 CAGR 7.5%로 가장 급성장하는 구매자 그룹으로, 자본 지출을 줄이고 도입 기간을 단축하는 종량 과금의 클라우드 플랫폼에 의해 실현되고 있습니다. 중소기업의 경우 서비스 파트너는 패키징된 스타터 키트, 모듈화된 가격 및 단기적인 현금 흐름에 비용을 맞출 수 있는 대출 브리지를 제공해야 합니다. 거버넌스 템플릿, 보안 기준선 및 ROI 대시보드를 리소스 제한 팀에 맞게 사용자 지정하는 공급자는 사물인터넷(IoT) 전문 서비스 시장의 확장된 하위 부문에서 결정적인 이점을 얻습니다.

대규모 고객의 경우 권고, 통합 및 관리 런 운영에 걸친 멀티 타워 계약이 볼륨 규모입니다. 이 프로젝트는 종종 하이브리드 딜리버리 센터를 통해 조정되는 단계적 세계 배포를 특징으로 합니다. 이와는 대조적으로 중소기업의 경우에는 빠른 시간 값, ERP 및 CRM과의 사전 구성된 통합, 콜드체인 모니터링 및 에너지 서브미터링과 같은 수직 템플릿이 중요합니다. 이 양극화를 통해 공급업체는 포춘 500 고객을 위해 깊이를 유지하면서 사물인터넷(IoT) 전문 서비스 시장 전반에 걸친 고속 중소기업 기회를 위해 납품을 산업화하는 이중 시장 진입 운동을 수행해야 합니다.

사물인터넷(IoT) 전문 서비스 시장은 서비스 유형별(IoT 컨설팅, IoT 인프라 서비스 등), 조직 규모별(중소기업, 대기업), 배포 형태별(클라우드 기반, On-Premise, 하이브리드), 최종 사용자 산업별(제조업, 소매업 등), 지역별로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미는 2024년 매출의 37.5%를 차지하며, 고급 5G 커버리지, 왕성한 벤처 자금, NIST의 국가 IoT 전략 등 연방 정부의 이니셔티브에 지지되었습니다. 미국 기업은 제로 트러스트 보안 및 AI 지원 분석을 선호하고 엔드 투 엔드 포트폴리오를 가진 공급자에게 유리한 복잡한 멀티 타워 계약을 추진하고 있습니다. 캐나다는 니어 쇼어링의 동향과 산업용 IoT의 현대화로부터 혜택을 누리고 있으며, 멕시코는 실시간 공급망 가시성에 의존하는 국경을 넘어 제조 회랑을 활용하고 있습니다.

아시아태평양은 CAGR 8.1%로 가장 빠르게 성장하는 지역입니다. 중국은 제조 디지털화를 위해 많은 양의 스마트 시티 예산을 할당하고 산업용 인터넷 플랫폼을 추진하고 있습니다. 일본의 Society 5.0 프로그램과 싱가포르의 Smart Nation 구상은 컴플라이언스 가능하고 확장 가능한 솔루션에 대한 지역 수요를 강화하고 있습니다. 인도의 반도체 및 AI 정책은 대응 가능한 기반을 더욱 확대합니다. 공급업체는 사물인터넷(IoT) 전문 서비스 시장에서 이 기세를 활용하기 위해 비용 경쟁력 있는 배달과 문화적 깊은 협력, 현지 언어 지원의 균형을 맞추어야 합니다.

유럽에서는 GDPR(EU 개인정보보호규정), EU 사이버 보안법, 각국의 인더스트리 4.0 프레임워크 등에 힘입어 컨설팅 및 인증 지원에 대한 거버넌스 주도 수요가 창출되어 꾸준한 성장을 유지하고 있습니다. 독일, 프랑스, 영국은 디지털 트윈 프로그램에 많은 투자를 하고 있으며, 동유럽 경제는 EU의 자금을 활용하여 인프라 근대화를 추진하고 있습니다. 중동 및 아프리카는 아직 시작되었지만 걸프 국가가 비전 2030의 스마트 시티 포트폴리오를 가속화하고 있으며 턴키 전문 서비스 참여가 필요하기 때문에 미래가 기대되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 커넥티드 디바이스의 보급과 센서 비용의 저하

- 기업의 디지털 변혁 로드맵

- 5G와 엣지 컴퓨팅의 전개

- 인더스트리 4.0과 스마트 인프라에 대한 규제의 뒷받침

- IoT 서비스의 성과 기반 가격 모델

- 통합 수요를 창출하는 AI 주도의 AIOps 플랫폼

- 시장 성장 억제요인

- 데이터 프라이버시와 사이버 보안에 대한 우려

- 상호 운용성과 규격의 단편화

- 숙련된 IoT 인재의 부족

- 하이퍼스케일 클라우드 워크로드의 탄소 풋 프린트 조사

- 공급망 분석

- 규제 상황

- IoT 생태계 분석

- 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 거시경제 요인이 시장에 미치는 영향

제5장 시장 규모와 성장 예측

- 서비스 유형별

- IoT 컨설팅

- IoT 인프라 서비스

- 시스템 설계 및 통합

- 기타

- 조직 규모별

- 중소기업

- 대기업

- 배포 모드별

- 클라우드 기반

- On-Premise

- 하이브리드

- 최종 사용자 업계별

- 제조업

- 소매

- 헬스케어

- 에너지 및 유틸리티

- 운송 및 물류

- 기타 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- GCC

- 튀르키예

- 이스라엘

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- IBM Corporation

- Accenture PLC

- ATandT Inc.

- Oracle Corporation

- Cognizant Technology Solutions

- Capgemini SE

- General Electric Company

- DXC Technology Company

- Tata Consultancy Services

- Wipro Ltd.

- Virtusa Corp.

- Infosys Ltd.

- Huawei Technologies

- Siemens AG

- Bosch.IO GmbH

- Tech Mahindra Ltd.

- PwC

- HCLTech Ltd.

- KPMG International

- Deloitte

제7장 시장 기회와 향후 전망

KTH 25.11.20The IoT professional services market generated USD 144.84 billion in 2025 and is forecast to reach USD 201.31 billion by 2030, advancing at a 6.81% CAGR.

Expanding connected-device ecosystems, 5G rollouts, and edge-computing investments are moving enterprises from experimentation to full-scale deployments that require specialized consulting, system integration, and managed-service expertise. Outcome-based pricing, domain-specific solutions, and regulatory mandates around Industry 4.0 are reshaping how suppliers package and deliver value. Demand is strongest where device volumes and data-driven business models converge, yet rising cyber-risk and talent shortages temper near-term growth expectations. Overall, the IoT professional services market is transitioning from fragmented project work to recurring, platform-enabled engagements that link technology performance to business outcomes.

Global IoT Professional Services Market Trends and Insights

Proliferation of Connected Devices and Falling Sensor Costs

Global connected-device volumes climbed to 18.8 billion units, stretching enterprise capacity to manage diverse hardware, firmware, and communication protocols. Lower sensor prices make large-scale rollouts financially viable, yet device heterogeneity magnifies lifecycle-management complexity. Professional-service partners are therefore asked to design provisioning, configuration, and monitoring frameworks that accommodate multivendor fleets. Lightweight M2M, Zero-Touch onboarding, and secure element authentication are gaining traction as best-practice blueprints. Edge-computing investment, projected to total USD 378 billion by 2028, further amplifies demand for integration services that balance on-premises processing with cloud analytics.

Enterprise Digital-Transformation Roadmaps

Boards increasingly treat IoT data as a strategic asset, folding connected-device projects into broader digital-core programs. IBM reported USD 4.96 billion in consulting revenue tied to digital-transformation engagements, underscoring the shift from isolated pilots to enterprise-wide modernization.Service providers are now evaluated on their ability to map operational KPIs to sensor architectures and analytics pipelines that deliver measurable ROI. Outcome-based pricing is gaining favor as buyers demand guarantees on uptime, cost savings, or revenue uplift. As digital cores mature, demand rises for managed-service wraps that continuously optimize device, network, and application performance.

Data-Privacy and Cyber-Security Concerns

Ordr found 82% of healthcare IoT environments host at least one serious vulnerability, fuelling board-level anxiety over ransomware, safety risks, and regulatory fines. Enterprises therefore require layered defenses ranging from secure-boot chips to encrypted data pipelines and micro-segmented networks. The skills needed cut across embedded security, OT protocols, and cloud IAM, yet most IT teams remain understaffed. Service providers investing in SOC-as-a-service, red-team testing, and zero-trust reference architectures are best placed to convert security fears into multi-year retainer contracts.

Other drivers and restraints analyzed in the detailed report include:

- 5G and Edge-Computing Rollout

- Regulatory Push for Industry 4.0 and Smart Infrastructure

- Interoperability and Standards Fragmentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IoT consulting retained 32.5% revenue share in 2024, reflecting sustained demand for vendor-neutral strategy, ROI modeling, and business-case validation. System design and integration, however, is expanding at a 7.2% CAGR as enterprises convert roadmaps into production rollouts that involve complex middleware, data lake, and analytics orchestration. Providers differentiate via domain accelerators, reference architectures, and outcome-based contracts that link fees to plant-floor uptime or energy-efficiency gains. The IoT professional services market size for design and integration is projected to widen sharply as 5G and edge projects graduate from pilot to scale.

Momentum is also building in managed-service wraps that combine device monitoring, predictive maintenance, and remote-update orchestration. Suppliers bundle platform subscriptions with SLA-backed operations centers to secure annuity revenue and deepen client lock-in. As integration complexity rises, tooling investments in CI/CD for firmware, digital twin simulation, and AI-driven test automation become table stakes for staying competitive in the IoT professional services market.

Large enterprises generated 63.7% of 2024 spending due to diversified portfolios, global supply chains, and sizeable modernization budgets. Yet SMEs are the fastest-growing buyer group at a 7.5% CAGR, enabled by pay-as-you-go cloud platforms that cut capital outlay and compress deployment timelines. For SMEs, service partners must offer packaged starter kits, modular pricing, and financing bridges that align costs with near-term cash flows. Providers that tailor governance templates, security baselines, and ROI dashboards to resource-constrained teams gain decisive advantage within this swelling sub-segment of the IoT professional services market.

In larger accounts, volume scale yields multi-tower engagements that span advisory, integration, and managed run operations. Projects often feature phased global rollouts coordinated through hybrid delivery centers. In contrast, SME deals emphasize rapid time to value, pre-configured integrations with ERP and CRM, and vertical templates such as cold-chain monitoring or energy sub-metering. This bifurcation forces suppliers to run dual go-to-market motions, preserving depth for Fortune 500 clients while industrializing delivery for high-velocity SME opportunities across the IoT professional services market.

Iot Professional Services Market is Segmented by Service Type (IoT Consulting, Iot Infrastructure Services, and More), Organization Size (SMEs and Large Enterprises), Deployment Mode (Cloud-Based, On-Premises, and Hybrid), End-User Industry (Manufacturing, Retail, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.5% of 2024 revenue, supported by advanced 5G coverage, robust venture funding, and federal initiatives such as NIST's national IoT strategy. Enterprises in the United States prioritize zero-trust security and AI-enabled analytics, driving complex multi-tower engagements that favor providers with end-to-end portfolios. Canada benefits from near-shoring trends and industrial IoT modernization, while Mexico leverages cross-border manufacturing corridors that rely on real-time supply-chain visibility.

Asia-Pacific is the fastest-growing region at an 8.1% CAGR. China allocates sizable smart-city budgets and promotes Industrial Internet platforms to digitize manufacturing. Japan's Society 5.0 program and Singapore's Smart Nation initiatives reinforce regional demand for compliance-ready, scalable solutions. India's semiconductor and AI policies further expand the addressable base. Providers must balance cost-competitive delivery with deep cultural alignment and local-language support to capitalize on this momentum in the IoT professional services market.

Europe maintains steady growth underpinned by GDPR, the EU Cybersecurity Act, and national Industry 4.0 frameworks that create governance-driven demand for consulting and certification support. Germany, France, and the United Kingdom invest heavily in digital-twin programs, while Eastern European economies leverage EU funds to modernize infrastructure. Middle East and Africa remain nascent but show promise as Gulf states accelerate Vision 2030 smart-city portfolios that require turnkey professional-service engagement.

- IBM Corporation

- Accenture PLC

- ATandT Inc.

- Oracle Corporation

- Cognizant Technology Solutions

- Capgemini SE

- General Electric Company

- DXC Technology Company

- Tata Consultancy Services

- Wipro Ltd.

- Virtusa Corp.

- Infosys Ltd.

- Huawei Technologies

- Siemens AG

- Bosch.IO GmbH

- Tech Mahindra Ltd.

- PwC

- HCLTech Ltd.

- KPMG International

- Deloitte

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of connected devices and falling sensor costs

- 4.2.2 Enterprise digital-transformation roadmaps

- 4.2.3 5G and edge-computing rollout

- 4.2.4 Regulatory push for Industry 4.0 and smart infrastructure

- 4.2.5 Outcome-based pricing models for IoT services

- 4.2.6 AI-driven AIOps platforms creating integration demand

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cyber-security concerns

- 4.3.2 Interoperability and standards fragmentation

- 4.3.3 Shortage of skilled IoT talent

- 4.3.4 Carbon-footprint scrutiny of hyperscale cloud workloads

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 IoT Ecosystem Analysis

- 4.7 Technological Outlook

- 4.8 Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro Economic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IoT Consulting

- 5.1.2 IoT Infrastructure Services

- 5.1.3 System Design and Integration

- 5.1.4 Others

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Mode

- 5.3.1 Cloud-based

- 5.3.2 On-premises

- 5.3.3 Hybrid

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Retail

- 5.4.3 Healthcare

- 5.4.4 Energy and Utilities

- 5.4.5 Transportation and Logistics

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Accenture PLC

- 6.4.3 ATandT Inc.

- 6.4.4 Oracle Corporation

- 6.4.5 Cognizant Technology Solutions

- 6.4.6 Capgemini SE

- 6.4.7 General Electric Company

- 6.4.8 DXC Technology Company

- 6.4.9 Tata Consultancy Services

- 6.4.10 Wipro Ltd.

- 6.4.11 Virtusa Corp.

- 6.4.12 Infosys Ltd.

- 6.4.13 Huawei Technologies

- 6.4.14 Siemens AG

- 6.4.15 Bosch.IO GmbH

- 6.4.16 Tech Mahindra Ltd.

- 6.4.17 PwC

- 6.4.18 HCLTech Ltd.

- 6.4.19 KPMG International

- 6.4.20 Deloitte

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment