|

시장보고서

상품코드

1910634

선량계 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

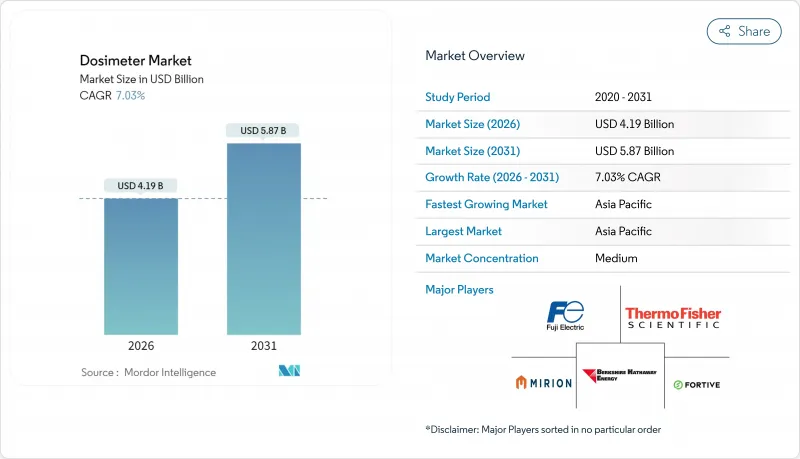

선량계 시장은 2025년에 39억 1,000만 달러로 평가되었으며, 2026년 41억 9,000만 달러에서 2031년까지 58억 7,000만 달러에 이를 것으로 예측됩니다.

예측기간(2026-2031년)의 CAGR은 7.03%로 전망됩니다.

최근의 매출 확대는 방사선 안전 규제 강화, 소형 모듈로 도입 및 선량 데이터를 실시간으로 전송하는 연결형 전자개인선량계(EPD)의 급속한 혁신과 밀접한 관련이 있습니다. 국제 규제당국이 연간 허용 피폭선량 제한을 대폭 하향함에 따라 의료기관에서는 안내 렌즈 모니터의 구매량이 증가하고 있습니다. 한편, 산업용 비파괴 검사(NDT) 팀은 여러 기지에서 컴플라이언스 문서화를 간소화하는 무선 배지로 전환하고 있습니다. 또한 공급업체는 기존 하드웨어에 인공지능(AI) 분석 기능을 통합하여 안전팀이 누적 피폭 동향을 예측하고 보고를 자동화할 수 있도록 하고 있습니다. 아시아태평양에서는 원자력 발전소의 건설 확대와 영상진단 분야의 급성장이 결합되어, 이 지역은 선량 측정 솔루션이 가장 크고 빠르게 확대하는 수요 거점으로서의 지위를 확립하고 있습니다. 한편, 주요 업체들이 틈새 기술 기업의 인수를 계속하고 지역 서비스 거점을 확대하여 장기 고객을 확보하는 구독형 데이터 플랫폼을 제공하고 있기 때문에 시장은 중간 정도의 분산 상태가 계속되고 있습니다.

세계의 선량계 시장의 동향 및 인사이트

종양 영상진단 및 방사선 치료의 수요 증가

정밀 방사선 치료와 고처리량 영상진단 검사에 대한 수요 증가에 따라 지속적인 모니터링을 필요로 하는 방사선 작업 종사자가 증가하고 있습니다. 현대의 선형 가속기는 고에너지 산란 중성자를 방출하기 때문에 시설에서는 혼합 방사선장을 포착하는 버블 검출기와 반도체 배지의 도입이 진행되고 있습니다. 양성자 치료 센터에서는 복잡한 방사선장 내의 선량 분포를 매핑하는 다중 사이트 마이크로 선량계의 조기 도입이 진행되고 있습니다. 병원에서는 배지 데이터에 AI 대시보드를 통합하여 관리자가 누적 노출량을 예측하고 한계값에 도달하기 전에 직원을 교체할 수 있습니다. 그 결과 분기별 필름 배지에서 병원 정보 시스템과 통합된 실시간 EPD(추정 피폭선량)로의 명확한 전환이 진행되어 엄격화된 직업 피폭 제한 준수가 확보되고 있습니다.

원자력 발전 용량 확대(소형 모듈로 및 수명 연장 프로젝트)

아시아태평양의 수십 개의 전력 회사가 소형 모듈로(SMR)의 도입을 승인했습니다. SMR은 기존 원자로와 비교하여 설치 메가와트당 선량계의 설치 밀도를 높여야 합니다. 노후화된 원자로군의 수명 연장 프로그램에서는 종래의 필름 배지를 집중 관리에 의한 선량 기록이 가능한 무선식 EPD로 대체함으로써 추가 수요가 발생하고 있습니다. 미리온사와 같은 공급업체는 SMR 전용 모니터링 제품군을 출시하고 이 분야에서 두 자릿수의 수익 증가를 보고했습니다. 업계의 ALARA(피폭 최소화) 문화는 보다 미세한 측정 입도를 요구하고 있으며, 전력회사는 저레벨 감마선 환경을 위한 고감도 반도체 검출기의 구매를 추진하고 있습니다.

교정용 방사성 물질의 부족과 동위원소 공급망의 혼란

몰리브덴 99, 세슘 137, 코발트 60의 만성 부족은 교정 일정을 방해하고, 서비스 기관에 인증 사이클의 연장을 초래하여 배지의 정확성에 대한 신뢰를 해치고 있습니다. 신흥 시장은 수입원에 의존하고 국내 조사시설이 한정되어 있어 가장 심각한 영향을 받고 있습니다. 일부 연구소에서는 대체 광자원을 실험하고 있지만 규제 당국은 신기술 승인에 시간이 걸리고 인증 기간을 연장하여 배지 조달을 늦추고 있습니다.

부문 분석

전자개인선량계는 2025년 선량계 시장의 38.72%를 차지하였고 시설이 즉각적인 피폭 피드백으로 이행하는 가운데 CAGR 8.75%로 확대될 것으로 전망됩니다. 무선 연결, GPS 태그 탑재, 누적 선량 동향을 초과했을 때 사용자에게 경고하는 AI 분석 기술이 본 부문의 강점입니다. 열형광선량계는 입증된 정확도를 추구하는 가격 중심 프로그램에 여전히 인기를 얻고 있습니다. 한편, 광자극 발광선량계는 신속한 판독이 중요한 틈새 시장에서 주목을 받고 있습니다. 필름 배지는 일부 개발 도상 지역에 남아 있지만, 규제 당국이 신속한 감사 사이클을 지원하는 시스템을 선호하는 경향 때문에 점유율이 계속 감소하고 있습니다. 하이브리드형 직접 이온 축적 장치는 장수명성과 전자 판독의 편리성을 양립하여, 전자선량계의 본격 도입에 신중한 사업자에게 있어서 이행 경로를 원활하게 하고 있습니다.

EPD 벤더는 온도, 습도 및 기압을 기록하는 환경 센서를 통합하여 안전 담당자가 피폭량과 변화하는 작업 환경을 연관짓도록 하고 있습니다. 대규모 산업 시설에서는 부문 횡단적인 선량 분포를 시각화하는 클라우드 대시보드에 연결된 수천 대의 장비가 도입되었습니다. 펌웨어 업데이트를 통한 새로운 센서 기능의 추가로 중간 교환주기가 장기화되고 있지만 SaaS 계약의 지속적인 수익은 공급업체 종속을 강화하고 있습니다.

수동형 모니터링은 확립된 규제 수용을 통해 2025년 선량계 시장 규모의 52.10%를 차지했습니다. 그러나 능동형 시스템은 8.52%의 연평균 복합 성장률(CAGR)로 더욱 빠르게 성장하고 있습니다. 고선량 인터벤션적 심장학 스위트를 도입하는 병원에서는 가청 경보와 실시간 선량 대시보드를 요구하여 능동형 배지의 조달을 추진하고 있습니다. 원자력발전소에서는 작업 시간이 단축되어 피폭선량이 급격하게 변동하는 정지 작업에서 능동형 시스템이 선호됩니다. 서비스 제공업체는 제한량 추적을 자동화하는 클라우드 기반 분석 기능을 번들로 하여 방사선 안전 담당자의 관리 부담을 완화합니다.

수동형 배지는 저비용, 경량, 최소한의 사용자 교육으로 대규모 스크리닝 프로그램에서 여전히 인기가 있습니다. 저소득지역에서는 정부 보건기구가 진료소에 수동형 필름 배지를 배포하고 있지만, 현재는 기부금에 의한 파일럿 프로젝트에서 광자극 발광(OSL) 리더가 도입되어 결과의 신속화를 도모하고 있습니다. 수동 및 능동 기술을 모두 다루는 호환 가능한 생태계를 제공하는 공급업체는 고객의 전체 업그레이드 수명주기를 포착하는 데 유리한 위치에 있습니다.

지역별 분석

아시아태평양은 2025년 선량계 시장에서 28.45%의 점유율을 차지하였고 중국, 인도 및 동남아 국가들이 신규 원자로의 인가와 방사선 치료 능력의 확대를 진행하는 가운데 8.63%의 연평균 복합 성장률(CAGR)로 성장을 가속화하고 있습니다. 중국의 원자력 건설 계획과 대규모 동위원소 생산 시설은 전력 회사 및 제약 부문에서 안정적인 배지 수요를 보장합니다. 일본에서는 후쿠시마 원자력발전소 사고 이후 개보수에서 디지털 선량 추적이 우선시되고, 말레이시아와 필리핀에서는 소형 모듈로(SMR)의 도입이 진행되고 있습니다. 이들 모두 모듈형 사이트 주변에 고밀도 개인 선량 측정 네트워크가 필요합니다.

북미에서는 구식 원자로의 설치 기반과 전국 규모의 의료용 화상 장치군이 여전히 존재하고 있습니다. 미국 원자력 규제 위원회의 실시간 작업자 모니터링에 중점을 두고 병원은 분기별 배지 프로그램에서 실시간 EPD 대시보드로 전환하고 있습니다. 캐나다의 CANDU 원자로 개보수와 우라늄 채굴 사업에서는 중성자 대응 검출기가 조달되는 한편, 멕시코의 산업용 방사선 촬영 계약자는 국가의 노동 위생 규제에 대응하기 위해 배지 구독을 확대하고 있습니다.

유럽에서는 원자로 수명 연장 프로젝트에 따른 선량계의 업그레이드나 폐쇄된 독일의 원자로를 해체하는 기술자용으로 제염팀이 장비를 구비하는 등 도입이 서서히 진행되고 있습니다. 영국의 선진로 파일럿 사업에서는 프로젝트 개시부터 차세대 반도체 검출기를 통합하고 있습니다. GDPR(EU 개인정보보호규정) 규정이 제품 설계에 영향을 미치고 공급업체는 데이터 암호화 모듈의 인증 취득 및 온프레미스 서버 제공을 추진하고 있습니다. 동유럽 국가에서는 소형 모듈로(SMR) 도입을 검토하는 국가들이 현지 호스트형 선량 측정 서비스 기지를 설립하여 지역 판매를 더욱 촉진하고 있습니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 종양학 이미징 및 방사선 치료 수요 증가

- 원자력 발전 용량의 확대(소형 모듈로 및 수명 연장 프로젝트)

- 수정체 선량 제한 강화 및 실시간 컴플라이언스 감사

- 산업용 방사선 검사의 디지털화(배관 용접 품질 관리, 5G 인프라 정비)

- EPD 하드웨어와 통합된 AI 탑재 선량 해석 플랫폼

- 신흥 시장에서의 바이오도시메트리 연구소 증가와 긴급 대응 능력의 강화

- 억제요인

- 교정원의 부족과 동위원소 공급망의 혼란

- 저에너지 중성자 분야에서의 지속적인 정밀도 격차

- 데이터 통합에서의 사이버 보안상의 책임

- 배지 처리의 구독 비용에 의한 최종 사용자의 부담 증가

- 업계 밸류체인 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 제품 유형별

- 전자개인선량계(EPD)

- 열형광선량계(TLD)

- 광자극 발광(OSL)

- 필름 배지

- 직접 이온 축적 및 DIS-OSL

- 용도별

- 액티브

- 패시브

- 최종 사용자 산업별

- 의료

- 원자력 발전 및 연료 사이클

- 석유 및 가스

- 광업 및 금속

- 산업용 비파괴 검사 및 제조

- 방위 및 안전 보장

- 검출기술별

- 반도체(실리콘, 탄화규소, PIN)

- 신틸레이터 베이스

- 가스 충전식 GM/비례식

- 고체 수동 소자(LiF, Al2O3, BeO)

- 버블 및 과가열 물방울

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Mirion Technologies Inc.

- LANDAUER(Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp.(Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co.(I) P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

제7장 시장 기회 및 미래 전망

CSM 26.01.28The dosimeter market was valued at USD 3.91 billion in 2025 and estimated to grow from USD 4.19 billion in 2026 to reach USD 5.87 billion by 2031, at a CAGR of 7.03% during the forecast period (2026-2031).

Recent revenue expansion is closely tied to stricter radiation-safety regulations, the roll-out of small modular reactors, and rapid innovation in connected electronic personal dosimeters (EPDs) that stream dose data in real time. Health-care providers are purchasing higher volumes of eye-lens monitors after international regulators slashed permissible annual exposure limits, while industrial non-destructive-testing (NDT) crews are upgrading to wireless badges that simplify multi-site compliance documentation. Suppliers are also layering artificial-intelligence analytics onto existing hardware so safety teams can predict cumulative exposure trends and automate reporting. Asia-Pacific's nuclear build-out, coupled with its fast-growing diagnostic-imaging sector, positions the region as the largest and fastest-advancing demand center for dosimetry solutions. Meanwhile, moderate market fragmentation persists because leading manufacturers continue to acquire niche technology firms, expand regional service bureaus, and offer subscription-based data platforms that lock in long-term customers.

Global Dosimeter Market Trends and Insights

Heightened Oncology Imaging and Radiotherapy Volumes

Growing demand for precision radiotherapy and high-throughput diagnostic imaging is swelling the population of radiation workers who need continuous monitoring. Modern linear accelerators emit higher-energy stray neutrons, prompting facilities to add bubble detectors and semiconductor badges that capture mixed-field exposure. Proton-therapy centers are early adopters of multi-site microdosimeters that map dose distributions inside complex radiation fields. Hospitals are also layering AI dashboards onto badge data so managers can forecast cumulative exposure and rotate staff before limits are reached. The result is a clear shift from quarterly film badges to real-time EPDs that integrate with hospital information systems, ensuring compliance with tightened occupational limits.

Expansion of Nuclear-Power Capacity (SMRs and Life-Extension Projects)

Dozens of Asia-Pacific utilities have approved small modular reactors that require a denser network of dosimeters per installed megawatt than conventional units. Life-extension programs in aging fleets add further demand by replacing legacy film badges with wireless EPDs capable of centralized dose logging. Vendors such as Mirion have released SMR-specific monitoring suites and report double-digit revenue gains from the segment. The industry's ALARA culture calls for even finer measurement granularity, encouraging utilities to purchase high-sensitivity semiconductor detectors for low-level gamma fields.

Calibration-Source Shortages and Isotope Supply Chain Shocks

Chronic shortages of molybdenum-99, cesium-137, and cobalt-60 disrupt calibration schedules and force service bureaus to extend certification cycles, undermining confidence in badge accuracy. Emerging markets suffer most because they rely on imported sources and have limited domestic irradiation facilities. Some labs experiment with alternative photon sources, but regulatory bodies are slow to approve new methods, lengthening qualification timelines and slowing badge procurement.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Eye-Lens Dose Limits and Real-Time Compliance Audits

- Industrial Radiography Digitization (Pipe-Weld QC, 5G Infra Build-Out)

- Persistent Accuracy Gaps for Low-Energy Neutron Fields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic Personal Dosimeters captured 38.72% dosimeter market share in 2025 and are forecast to expand at a 8.75% CAGR as facilities pivot toward instant exposure feedback. The segment benefits from wireless connectivity, GPS tagging, and AI analytics that warn users when cumulative dose trends accelerate. Thermoluminescent Dosimeters still appeal to price-sensitive programs seeking proven accuracy, while Optically Stimulated Luminescence gains niche traction where faster readout is critical. Film badges persist in some developing regions, but their share continues to shrink as regulatory bodies favor systems that support rapid audit cycles. Hybrid Direct Ion Storage devices now bridge passive longevity with electronic readout ease, smoothing migration paths for operators cautious of full-scale EPD deployment.

EPD vendors are integrating environmental sensors that record temperature, humidity, and air pressure so safety officers can correlate exposure with changing work conditions. Larger industrial sites deploy thousands of units tied into cloud dashboards that visualize dose distribution across departments. As firmware updates add new sensor modalities, mid-cycle replacement rates lengthen, but software-as-a-service contracts keep revenue recurring, reinforcing vendor lock-in.

Passive monitoring accounted for 52.10% of the dosimeter market size in 2025, thanks to entrenched regulatory acceptance, yet active systems are growing faster at an 8.52% CAGR. Hospitals rolling out high-dose interventional cardiology suites want audible alarms and real-time dose dashboards, pushing procurement toward active badges. Nuclear utilities favor active systems for outage work where job times are compressed and exposure rates fluctuate sharply. Service providers bundle cloud-based analytics that automate limit tracking, reducing administrative load on radiation-safety officers.

Passive badges remain popular in large-scale screening programs because they are inexpensive, lightweight, and require minimal user training. In lower-income regions, government health agencies still distribute passive film badges to clinics, though donor-funded pilot projects now introduce optically stimulated luminescence readers to accelerate result turnaround. Vendors that offer compatible ecosystems spanning both passive and active technologies position themselves well to capture the full lifecycle of customer upgrades.

The Dosimeter Market Report is Segmented by Product Type (Electronic Personal Dosimeter, Thermoluminescent Dosimeter, and More), Application (Active, and Passive), End-User Industry (Healthcare, Oil and Gas, Mining and Metals, and More), Detection Technology (Semiconductor, Scintillator-Based, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the dosimeter market with 28.45% share in 2025 and is accelerating at a 8.63% CAGR as China, India, and Southeast Asian countries greenlight new reactors and expand radiotherapy capacity. China's nuclear construction pipeline, coupled with large-scale isotope-production facilities, secures steady badge demand across utility and pharmaceutical segments. Japan's post-Fukushima retrofits prioritize digital dose tracking, while Malaysia and the Philippines embrace SMRs, each requiring dense personal-dosimetry networks around modular sites.

North America retains a substantial installed base of legacy reactors and nationwide medical imaging fleets. The U.S. Nuclear Regulatory Commission's focus on real-time worker monitoring drives hospitals to swap quarterly badge programs for live EPD dashboards. Canada's CANDU refurbishments and uranium mining operations procure neutron-capable detectors, whereas Mexico's industrial-radiography contractors expand their badge subscriptions to meet national occupational-health mandates.

Europe witnesses incremental uptake as reactor life-extension projects roll out dosimeter upgrades and decommissioning teams outfit technicians dismantling shuttered German plants. The United Kingdom's advanced-reactor pilots integrate next-generation semiconductor detectors from project inception. GDPR constraints influence product design, pushing suppliers to certify data-encryption modules and offer on-premises servers. Eastern European states exploring SMR options establish locally hosted dosimetry service bureaus, further propelling regional sales.

- Mirion Technologies Inc.

- LANDAUER (Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp. (Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co. (I) P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened oncology imaging and radiotherapy volumes

- 4.2.2 Expansion of nuclear-power capacity (SMRs and life-extension projects)

- 4.2.3 Tightening eye-lens dose limits and real-time compliance audits

- 4.2.4 Industrial radiography digitization (pipe-weld QC, 5-G infra build-out)

- 4.2.5 AI-enabled dose-analytics platforms bundled with EPD hardware

- 4.2.6 Rising emerging-market biodosimetry labs for emergency surge response

- 4.3 Market Restraints

- 4.3.1 Calibration-source shortages and isotope supply chain shocks

- 4.3.2 Persistent accuracy gaps for low-energy neutron fields

- 4.3.3 Data-integration cyber-security liabilities

- 4.3.4 End-user fatigue from badge-processing subscription costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Electronic Personal Dosimeter (EPD)

- 5.1.2 Thermoluminescent Dosimeter (TLD)

- 5.1.3 Optically Stimulated Luminescence (OSL)

- 5.1.4 Film Badge

- 5.1.5 Direct Ion Storage and DIS-OSL

- 5.2 By Application

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Nuclear Power and Fuel Cycle

- 5.3.3 Oil and Gas

- 5.3.4 Mining and Metals

- 5.3.5 Industrial NDT / Manufacturing

- 5.3.6 Defence and Security

- 5.4 By Detection Technology

- 5.4.1 Semiconductor (Si, SiC, PIN)

- 5.4.2 Scintillator-based

- 5.4.3 Gas-filled GM / Proportional

- 5.4.4 Solid-State Passive (LiF, Al2O3, BeO)

- 5.4.5 Bubble / Superheated-Drop

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mirion Technologies Inc.

- 6.4.2 LANDAUER (Berkshire Hathaway Energy)

- 6.4.3 Thermo Fisher Scientific Inc.

- 6.4.4 Fuji Electric Co., Ltd.

- 6.4.5 Fortive Corp. (Fluke Biomedical)

- 6.4.6 ATOMTEX JSC

- 6.4.7 Polimaster Ltd.

- 6.4.8 Ludlum Measurements Inc.

- 6.4.9 Panasonic Industrial Devices

- 6.4.10 Arrow-Tech Inc.

- 6.4.11 SE International Inc.

- 6.4.12 Automess Automation & Measurement GmbH

- 6.4.13 Radiation Detection Company Inc.

- 6.4.14 Unfors RaySafe AB

- 6.4.15 ECOTEST Group Ukraine

- 6.4.16 Dosimetrics GmbH

- 6.4.17 Kromek Group PLC

- 6.4.18 Electronic & Engineering Co. (I) P. Ltd.

- 6.4.19 Bubble Technology Industries Inc.

- 6.4.20 Qingdao TLead International Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment