|

시장보고서

상품코드

1689733

독성 약물 스크리닝 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Toxicology Drug Screening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

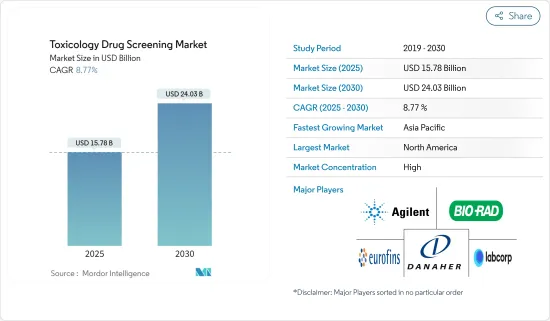

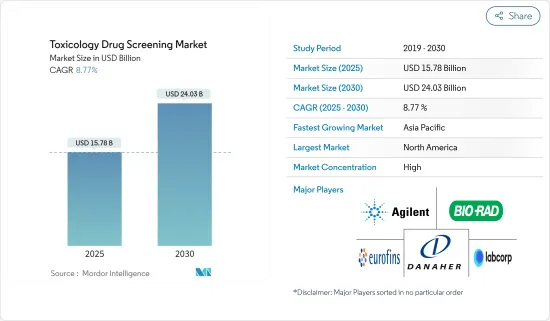

세계의 독성 약물 스크리닝 시장 규모는 2025년 157억 8,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 8.77%로 확대되어, 2030년에는 240억 3,000만 달러에 이를 것으로 예측됩니다.

COVID-19 팬데믹의 출현은 조사한 시장에 큰 영향을 미쳤습니다. COVID-19의 발병은 백신과 효과적인 치료 개발의 필요성을 증가시켰습니다. 이는 의약품 개발에서 독성 약물 스크리닝 방법의 광범위한 이용을 더욱 증가시켰습니다. 2022년 7월에 PMC 저널에 게재된 논문에 따르면, 다양한 정부 당국이 비임상 및 임상 데이터를 사전에 입수할 수 없었던 신규 제품 유형으로 구성된 COVID-19 백신 후보의 인간 최초 임상시험(FIH)으로 진행하기 전에 유효성, 생체내 분포, 독성 시험 등의 비임상 안전성 시험을 권장합니다. 이와 같은 사례는 유행기간 동안 독물검사에 대한 수요가 증가하여 시장 성장을 가속하였으며, 조사한 시장은 예측기간 동안 성장을 나타낼 가능성이 높습니다.

조사 시장은 연구 개발비 증가, 독성 스크리닝 기술 진보, 독성 약물 스크리닝 수요 증가 등 세 가지 주요 요인에 의해 견인되고 있습니다.

만성 질환은 창약 수요와 연구 개발 비용 증가를 촉진하는 주요 요인입니다. 암과 심장병은 세계적으로 의료 부담의 주요 원인입니다. Cancer Research UK'의 2022년 최신 정보에 따르면, 주요 암 이환율과 인구 증가의 최근 동향이 일관된 경우, 새로운 암 이환 환자는 2040년까지 세계에서 2,750만 명에 이릅니다. 이환율이 증가함에 따라 대기업은 신약과 치료제의 개발에 주력하고 있으며, 이에 따라 독성 약물 스크리닝에 대한 수요도 높아지고 있습니다. 따라서 조사된 시장은 예측 기간 동안 성장을 나타낼 것으로 예상됩니다.

독성시험의 용도는 생명공학과 의약품의 진보에 따라 증가하여, 이 시험에 대한 수요가 높아지고 있습니다. 일부 새로운 분야와 기술은 인간 조직에서 화학 물질에 대한 생물학적 반응을 이해하기 위한 새로운 통찰력을 제공합니다. 또한 세계적으로 의약품의 연구 개발비가 증가하고 있습니다. IFPMA의 2021년판 보고서에 따르면 바이오의약품산업의 연간 연구개발비는 항공우주 및 방위산업의 7.3배, 화학산업의 6.5배, 소프트웨어 및 컴퓨터 서비스산업의 1.5배였습니다. 위의 출처는 또한 바이오 의약품 산업이 2021년에 1,960억 달러를 소비했고, 2024년에는 2,130억 달러로 증가할 전망이라고 말했습니다. 따라서, 의약품 개발을 위한 바이오의약품 산업에서 R&D 증가는 의약품의 독물학적 스크리닝을 촉진하고 조사된 시장의 성장을 부추기고 있습니다.

또한 시장 기업와 연구자의 최근 기술 동향이 조사한 시장 성장에 기여하고 있습니다. 예를 들어, 2022년 4월, 장기 칩(OOC) 기업인 CN Bio는 비알코올성 지방간염(NASH)용 PhysioMimix "in-a-box" 시약 키트를 출시했습니다. NASH-in-a-box(NIAB) 키트는 CN Bio의 PhysioMimix 미세생리시스템(MPS)과 연동하여 연구자들에게 질병 메커니즘, 인간의 약효 및 안전 독성에 대한 생리학적으로 관련된 통찰력을 얻기 위한 내부 기능을 제공합니다. 이러한 개발은 연구 시장의 성장을 가속할 것으로 예상됩니다.

그러므로 R&D 활동 증가와 제약 및 생명공학 산업에서 독성 약물 스크리닝 수요 증가는 분석 기간 동안 시장 성장에 기여할 것으로 예상됩니다. 그러나 시료시험 기간이 길고 인간 약물분자의 독성학적 시험에 관한 정부의 규제가 엄격하기 때문에 예측기간 동안 시장 성장을 방해할 것으로 예상됩니다.

독성 약물 스크리닝 시장 동향

In Silico 부문이 예측 기간 동안 큰 성장을 이룰 전망

독성 약물 스크리닝 시장에서 In Silico 분야는 큰 시장 점유율을 차지하며 예측 기간 동안에도 견조한 성장이 예상됩니다. In Silico 방법은 바이오인포매틱스 툴을 이용하여 의약품 타겟을 확인하는 데 도움이 됩니다. 또한, 표적 구조를 분석하여 후보 분자를 생성하고, 가능한 결합 부위와 활성 부위를 찾아내고, 약물다움을 확인하고, 분자를 최적화하여 결합 특성을 개선하는 데에도 사용됩니다.

이 In Silico 플랫폼은 백신 후보의 면역 반응을 예측하기 위해 COVID-19와 관련된 다양한 연구에서 잠재적인 도구로 간주됩니다. Universal Immune System Simulator(UISS) In Silico 플랫폼은 COVID-19 바이러스에 대한 백신 접종 전략의 결과를 예측할 수 있는 강력한 잠재력을 가지고 있습니다. 이 플랫폼은 백신의 발견 파이프라인을 가속화하고 추진하기 위해 다양한 연구에서 자주 채택됩니다. 따라서 이 부문은 성장을 나타낼 것으로 예상됩니다.

창약은 현재 가파르게 성장하고 있습니다. 최근 몇 년동안 신약 파이프라인이 급증하고 있습니다. 그러나 FDA에 승인된 것은 매우 소수입니다. 다양한 단백질체학, 유전체학, 바이오인포매틱스, in silico ADMET 스크리닝 및 구조 기반 드래그 디자인, 가상 스크리닝, de novo 디자인과 같은 효율적인 기술을 도입함으로써, 약물 약물 독성을 감지하는 데 도움이 됩니다. 따라서 현재 의약품 스크리닝의 안전성과 효능을 향상시키기 위해 In Silico 스크리닝이 채택되었습니다. 예를 들어, 2022년 3월에 NLM에 게재된 연구 논문에 따르면, In Silico 스크리닝은 컴퓨터 모델링과 시뮬레이션을 이용하여 의약품 및 고급 치료제의 효능과 안전성을 평가합니다. 따라서 In Silico 독성 스크리닝은 더 나은 효율성과 의약품의 안전성과 효능에 대한 더 나은 지식을 제공합니다. 따라서, 이 부문은 분석 기간 동안 성장할 것으로 예상됩니다.

예측기간 중 북미가 큰 시장 점유율을 차지할 전망

북미는 세계 독성 약물 스크리닝 시장에서 큰 시장 점유율을 차지할 것으로 예상됩니다. 이 지역에서는 인체 내 독성 수준을 조기에 검출하기 위한 연구개발(R&D) 활동이 활발해지고 있는 것, 의약품 및 생명공학에서 독성 약물 스크리닝에 대한 수요가 증가하고 있는 등이 시장 개척에 박차를 가하고 있습니다.

이 지역에는 확립된 제약산업이 존재하는 것, 연구개발비가 높고, 대기업 서비스 제공업체의 존재감이 강한 것, 동 지역의 제약 및 바이오제약기업에 의한 분석시험의 아웃소싱 동향의 높아짐은 시장 전체의 성장에 기여하는 몇 가지 주요인입니다. 예를 들어, OECD에 의한 2022년 10월 갱신에 따르면 2020년 미국, 캐나다, 멕시코의 의약품 지출은 각각 2.08, 1.72, 1.34(국내총생산(GDP)비)였습니다. 이는 정부기관과 함께 대기업과 제조업체가 제품 개발에 높은 참여를 하고 있음을 보여줍니다. 이러한 지출 증가는 주로 경쟁업체보다 우위를 차지하는 데 중점을 두고 신개발 제품에서 얻은 높은 이익으로 이어집니다.

또한 기존 시장 기업의 존재와 신약의 연구개발에 주력하고 있기 때문에 미국의 임상시험 시장은 확대되고 있어 독성 약물 스크리닝 시장에도 플러스의 영향을 주고 있습니다. Regulatory Affairs Professionals Society(RAPS)의 2022년 1월 업데이트에 따르면, 2021년에는 50개의 신약이 CDER에 의해 승인되었으며, 그 중 38개의 신약이 미국에서 승인되었습니다. 이와 같이 이러한 투자와 의약품 개발 활동에 의해 혁신적이고 비용 효율적인 스크리닝이 급속히 개발되어 시장 성장의 원동력이 되었습니다. 이것은이 지역 시장 성장에 기여할 것으로 기대됩니다.

독성 약물 스크리닝 산업 개요

독성 약물 스크리닝 시장의 경쟁은 중간 정도이며 소수의 주요 기업이 존재합니다. 현재 시장을 독점하고 있는 기업으로는 Agilent Technologies Inc., Bio-Rad Laboratories Inc., Eurofins Scientific, Danaher, Laboratory Corporation of America Holdings, BioReliance Inc., Thermo Fisher Scientific Inc., Enzo Life Sciences Inc. 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 연구개발 활동의 활성화

- 독성 약물 스크리닝의 기술적 진보

- 의약품 및 생명공학에서 독성 약물 스크리닝 수요 증가

- 시장 성장 억제요인

- 샘플 검사에 필요한 시간의 장기화

- 헬스케어 분자의 승인에 관한 규제상의 문제

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 검사 유형별

- In Vitro

- In Vivo

- In Silico

- 제품별

- 기기

- 시약 및 소모품

- 동물 모델

- 소프트웨어

- 기타 제품

- 용도별

- 면역독성

- 전신독성

- 발달 및 생식 독성(DART)

- 내분비 교란작용

- 기타 용도

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- BioReliance Inc.(Merck)

- Charles River Laboratories International Inc.

- Enzo Life Sciences Inc.

- Eurofins Scientific

- Danaher

- Laboratory Corporation of America Holdings

- Promega Corporation

- The Jackson Laboratory

- Thermo Fisher Scientific Inc.

- Wuxi AppTec

제7장 시장 기회와 앞으로의 동향

JHS 25.04.07The Toxicology Drug Screening Market size is estimated at USD 15.78 billion in 2025, and is expected to reach USD 24.03 billion by 2030, at a CAGR of 8.77% during the forecast period (2025-2030).

The emergence of the COVID-19 pandemic had a significant impact on the market studied. Due to the onset of COVID-19, the need for vaccines and effective treatment development increased. This further increased the extensive use of toxicological screening methods in drug development. According to an article published in the PMC journal in July 2022, various government authorities recommended nonclinical safety studies such as efficacy, biodistribution, and toxicology studies prior to proceeding to First-in-human (FIH) clinical trials for COVID-19 vaccine candidate consisting of a novel product type for which no prior nonclinical and clinical data were available prior. Such instances show that the demand for toxicology testing increased during the pandemic, fueling the market growth, and the studied market is likely to witness growth during the forecast period.

The studied market is driven by three major factors such as increasing research and development (R&D) expenditure, technological advancements in toxicity screening, and rising demand for toxicological drug screening.

Chronic diseases are major factors that are fueling the demand for drug discovery and increase in R&D expenditure. Cancer and heart diseases are the major cause of healthcare burden globally. According to the 2022 update by 'Cancer Research UK,' if the recent trends in the incidence of major cancers and population growth are consistent, the new cancer cases will reach 27.5 million worldwide by 2040. With the rise in disease incidence, the major companies are concentrating on developing new drugs and therapeutics, followed by a demand generation for toxicology drug screenings for the same. Hence, the studied market is expected to witness growth over the forecast period.

The applications of toxicity testing are set to increase with advances in biotechnology and pharmaceuticals, resulting in a demand for the same. Several emerging fields and techniques are providing new insights into understanding biological responses to chemicals in human tissues. Furthermore, there is an increase in pharmaceutical R&D spending globally. According to the IFPMA's 2021 report, the annual R&D spending by the biopharmaceutical industry is 7.3 times higher than that of the aerospace and defense industries, 6.5 times more than the chemicals industry, and 1.5 times more than the software and computer services industry. The source above also mentioned that the biopharmaceutical industry spent USD 196,000 million in 2021, and it is expected to increase to USD 213,000 million by 2024. Thus, the increasing R&D in the biopharmaceutical industry for pharmaceutical product development is garnering the toxicology screening of the drug products, fueling the studied market growth.

Additionally, the recent technological developments by the market players and researchers are contributing to the growth of the market studied. For instance, in April 2022, CN Bio, an organ-on-a-chip (OOC) company, launched PhysioMimix 'in-a-box' reagent kit for non-alcoholic steatohepatitis (NASH), a disease that has no regulatory-approved therapeutics for treatment till date. The NASH-in-a-box (NIAB) kit works in conjunction with CN Bio's PhysioMimix micro-physiological systems (MPS) to provide researchers with in-house capabilities to gain physiologically relevant insights into the mechanism of disease, human drug efficacy, and safety toxicology. Such developments are anticipated to fuel the studied market growth.

Therefore, the increasing R&D activities and the rise in demand for toxicology drug screening in the pharmaceutical and biotechnology industries are expected to contribute to the market growth during the analysis period. However, the long duration of sample testing and stringent government regulations on the toxicological testing of human drug molecules are expected to hinder market growth over the forecast period.

Toxicology Drug Screening Market Trends

In Silico Segment is Expected to Witness Significant Growth Over the Forecast Period

The in-silico segment holds a significant market share in the toxicology drug screening market and is anticipated to show robust growth over the forecast period. In silico methods help identify drug targets via bioinformatics tools. They are also used to analyze the target structures to generate candidate molecules, find possible binding/active sites, check their drug-likeness, and further optimize the molecules to improve their binding characteristics.

The in-silico platform is considered a potential tool in various COVID-19-related research in predicting the immune responses of potential candidate vaccines. The Universal Immune System Simulator (UISS) in silico platform has a strong potential to predict the outcome of a vaccination strategy against the COVID-19 virus. It has been frequently employed in various research to speed up and drive the discovery pipeline of the vaccine. Hence, the segment is expected to show growth.

Drug discovery is currently growing at a rapid pace. There has been an upsurge in the pipeline of novel drugs in recent years. But a handful of them is approved by the FDA. The drug discovery process is being revolutionized by deploying various proteomics, genomics, bioinformatics, and efficient technologies like in silico ADMET screening and structure-based drug design, virtual screening, and de novo design, which help in the detection of drug toxicology. Hence, in silico screening is adopted nowadays to improve the screening safety and efficacy of drugs. For instance, according to a research article published in NLM in March 2022, in silico screening make use of computer modeling and simulation to assess the efficacy and safety of a drug product or a medicinal advanced therapeutic product. Thus, in-silico toxicity screenings provide better efficiency and better knowledge of the safety and efficacy of a drug. Thus, the segment is expected to grow over the analysis period.

North America is Expected to Hold a Major Market Share During the Forecast Period

North America is expected to hold a significant market share in the global toxicology drug screening market. Factors such as growing research and development (R&D) activities in this region to detect toxicity levels in the human body at early stages and the rise in demand for toxicology drug screening in pharmaceuticals and biotechnology in the region are fueling the market growth in the country.

The presence of a well-established pharmaceutical industry in the region, the high R&D expenditure, the strong presence of major service providers, and the growing trend of outsourcing analytical testing by pharmaceutical and biopharmaceutical companies in the region are several major factors that contribute to the overall market growth. For instance, according to the October 2022 update by OECD, pharmaceutical spending in the United States, Canada, and Mexico was 2.08, 1.72, and 1.34 (% of gross domestic product (GDP)), respectively, in 2020. This shows the high involvement of major players and manufacturers, along with government organizations, in product development. This increase in expenditure is primarily driven by the focus on having the edge over their competitors and the high returns gained on newly developed products.

In addition, due to the presence of established market players and the focused R&D of new drugs, the market for clinical trials in the United States has been growing, which is also impacting the toxicology drug screening market positively. According to the January 2022 update by Regulatory Affairs Professionals Society (RAPS), 50 novel drugs were approved by CDER in 2021, among which 38 drugs were approved in the United States. Thus, such investments and drug development activities led to the rapid development of innovative and cost-effective screening, fueling market growth. This is expected to contribute to the market growth in the region.

Toxicology Drug Screening Industry Overview

The toxicology drug screening market is moderately competitive, with the presence of a few key players. Some companies currently dominating the market are Agilent Technologies Inc., Bio-Rad Laboratories Inc., Eurofins Scientific, Danaher, Laboratory Corporation of America Holdings, BioReliance Inc., Thermo Fisher Scientific Inc., and Enzo Life Sciences Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing R&D Activities

- 4.2.2 Technological Advancements in Toxicology Drug Screening

- 4.2.3 Rise in Demand for Toxicology Drug Screening in Pharmaceuticals and Biotechnology

- 4.3 Market Restraints

- 4.3.1 Longer Time for Sample Testing

- 4.3.2 Regulatory Issues Regarding Approval of Healthcare Molecule

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Testing Type

- 5.1.1 In Vitro

- 5.1.2 In Vivo

- 5.1.3 In Silico

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Reagents and Consumables

- 5.2.3 Animal Models

- 5.2.4 Software

- 5.2.5 Other Products

- 5.3 By Application

- 5.3.1 Immunotoxicity

- 5.3.2 Systemictoxicity

- 5.3.3 Developmental and Reproductive Toxicity (DART)

- 5.3.4 Endocrine Disruption

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies Inc.

- 6.1.2 Bio-Rad Laboratories Inc.

- 6.1.3 BioReliance Inc. (Merck)

- 6.1.4 Charles River Laboratories International Inc.

- 6.1.5 Enzo Life Sciences Inc.

- 6.1.6 Eurofins Scientific

- 6.1.7 Danaher

- 6.1.8 Laboratory Corporation of America Holdings

- 6.1.9 Promega Corporation

- 6.1.10 The Jackson Laboratory

- 6.1.11 Thermo Fisher Scientific Inc.

- 6.1.12 Wuxi AppTec