|

시장보고서

상품코드

1689828

바이오 기반 폴리프로필렌 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Bio-based Polypropylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

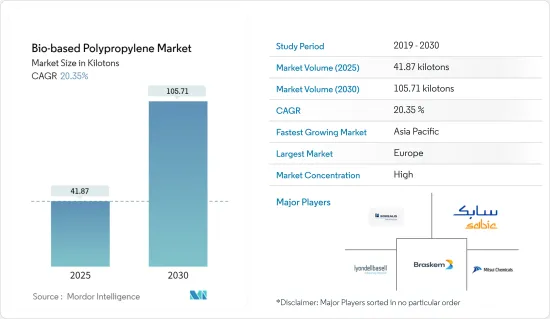

세계의 바이오 기반 폴리프로필렌 시장 규모는 2025년 41.87킬로톤으로 추정되며, 예측기간 중(2025-2030년) CAGR 20.35%로 확대되어, 2030년에는 105.71킬로톤에 이를 것으로 예측됩니다.

COVID-19의 영향은 원료 부족과 수요 감퇴에 의해 마이너스였습니다.

주요 하이라이트

- 시장을 견인하는 주요 요인은 기존의 플라스틱 사용에 관한 환경 문제가 높아지고 화석 유래의 원료를 재생 가능한 재료로 대체하는 움직임이 활발해지고 있다는 것입니다.

- 그 반면, 바이오 원료의 비용이 높은 것이 시장의 성장을 방해하고 있습니다.

- 바이오 기반 재료의 사용을 촉진하는 정부에 의한 장려금 증가는 시장에 새로운 기회를 제공할 것으로 기대되고 있습니다.

- 독일과 프랑스 수요가 급증함에 따라 유럽이 시장을 독점할 것으로 추정됩니다.

바이오 폴리 프로파일렌 시장 동향

사출 성형 용도에서 수요 증가

- 바이오 기반 폴리프로필렌은 그 높은 융점, 뛰어난 피로 특성, 내열성, 내약품성, 친환경성으로부터, 포장, 자동차, 전자 기기, 의료 산업 등 다양한 사출 성형 용도에 사용되고 있습니다.

- 바이오 기반 폴리프로필렌 수요는 유기농 식품이나 고급품, 브랜드품 등, 특수한 요구가 있는 제품을 감싸는 포장 용도로 꾸준히 높아지고 있습니다.

- 또한 세계 각국의 정부는 기술 혁신, 자원효율, 기후 변화에 관한 다양한 시책을 배경으로 바이오플라스틱 포장을 추진하고 있습니다.

- 최근 소비자 조사에 의하면, 세계 소비자의 60%에 있어서 지속가능성은 귀중한 구입 기준이며, 미국은 세계 평균을 조금 웃도는 61%를 자랑하고 있습니다.

- 게다가 중국은 플라스틱의 대량생산에 크게 관여하고 있으며, 무역수출로부터 수입을 얻고 있습니다. 그 때문에 다양한 포장 기업에 큰 생산 능력을 가져오고 있습니다.

- 바이오플라스틱의 세계 생산능력은 2021년에는 16% 증가한 240만 톤이 되었습니다.

- 미델하르니스의 사출 성형 전문업체 SFA Packaging에 의하면, 대부분의 식품은 폴리프로필렌제의 사출 성형 포장에 들어가 있습니다.

- 환경 문제에 대한 우려로부터, 보다 많은 소비자나 제조업체가 에코 친화적인 포장을 선호하게 되어 있어, 바이오 기반의 폴리프로필렌 시장 수요를 밀어 올리고 있습니다.

시장을 독점하는 유럽

- 유럽은 바이오 기반 폴리프로필렌 산업의 중요한 거점이며, 시장 점유율의 약 50%를 차지하고 있습니다.

- 대부분의 유럽 국가에서는 바이오 폴리 프로파일렌을 포함한 생물 분해성 플라스틱의 사용에 관한 정부의 규제가 엄격합니다.

- 바이오 기반 폴리프로필렌은 포장 산업에서 주로 사용되고 있습니다. 유럽은 포장 산업의 주요 지역 중 하나이며, 다양한 포장 부문의 개발을 진행하고 있습니다.

- 독일은 유럽 최대의 플라스틱 소비국입니다. 포장 산업에 있어서의 플라스틱 사용량 증가가 플라스틱 수요를 촉진하고 있습니다.

- 또한 독일 정부는 포장 산업에서 사용되는 바이오 기반와 재활용 재료를 홍보하고 있습니다. 독일 상의원은 포장폐기물의 재활용을 촉진하기 위한 새로운 포장법을 승인했습니다. 이것은 포장 산업에 있어서 중요한 시그널이며, 바이오 기반 재료와 리사이클 재료가, 포장을 보다 지속 가능하게 하고, 한계 있는 화석 자원에의 의존을 줄이기 위한, 동등하게 실행 가능한 솔루션으로서 처음으로 인정되었습니다.

- 게다가 전자상거래 부문의 인기와 소매 시장의 성장은 이 지역의 바이오 폴리프로필렌 시장에 큰 성장 기회를 주었습니다.

- 2021년 독일 B2C 전자상거래 부문의 매출은 약 867억 유로(1,010억 달러)였습니다. COVID-19가 전 세계적으로 확산된 뒤, 온라인 쇼핑은 증가 경향에 있습니다. 전자상거래 부문에서는 2021년에 독일은 중국, 미국, 영국, 일본, 한국에 이어 6위였습니다. 특히, 모바일 커머스의 중요성이 높아지고 있습니다.

- 이상과 같은 요인이, 향후 수년간, 유럽의 바이오 기반 폴리프로필렌 시장을 견인할 것으로 예상됩니다.

바이오 폴리 프로파일렌 산업 개요

바이오 폴리프로필렌 시장은 부분적으로 통합되어 대기업이 상당 부분을 차지하고 있습니다. 시장 진출기업(특별한 순서 없음)에는 Borealis AG, Braskem, Mitsui Chemicals Inc., SABIC, LyondellBasell Industries Holdings BV 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 기존 플라스틱의 사용에 관한 환경 문제 증가

- 화석 원료에서 재생 가능 원료로 대체 증가

- 억제요인

- 바이오 원료의 고비용

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 용도

- 사출 성형

- 섬유

- 필름

- 기타

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 기타

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Biobent Management Services Inc.

- Borealis AG

- Borouge

- Braskem

- FKuR

- INEOS

- INTER Ikea SYSTEMS BV

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- SABIC

제7장 시장 기회와 앞으로의 동향

- 바이오 기반 재료의 이용을 촉진하는 정부에 의한 장려금 증가

- 기타 기회

The Bio-based Polypropylene Market size is estimated at 41.87 kilotons in 2025, and is expected to reach 105.71 kilotons by 2030, at a CAGR of 20.35% during the forecast period (2025-2030).

The impact of COVID-19 was negative due to the raw materials shortage and declined demand for the product. However, an upsurge in the textile industry propelled bio-based polypropylene consumption after the pandemic.

Key Highlights

- The major factors driving the market are the rising environmental concerns regarding using conventional plastics and the increasing replacement of fossil-based feedstock with renewable materials.

- On the flip side, the high cost of bio-based materials is hindering the market's growth.

- Increasing incentives by the government promoting bio-based materials use is expected to provide new opportunities for the market.

- Europe is estimated to dominate the market studied owing to the surging demand in Germany and France.

Bio-based Polypropylene Market Trends

Growing Demand from Injection Molding Application

- Due to its high melting point, good fatigue properties, heat and chemical resistivity, and eco-friendly nature, bio-based polypropylene is used in various injection molding applications in packaging, automotive, electronics, and medical industries.

- The demand for bio-based polypropylene in packaging applications, such as wrapping organic food and premium and branded products with particular requirements, is rising steadily.

- Moreover, governments worldwide are promoting bioplastic packaging in the context of various policies for innovation, resource efficiency, and climate change.

- According to a recent consumer study, sustainability is a valuable purchase criterion for 60% of consumers globally, with the US boasting a percentage a little above the global average at 61%.

- Furthermore, China is significantly involved in producing high amounts of plastics, generating revenues from trade exports. It is, thereby, creating significant production capacities for various packaging companies. According to ITC, in 2021, China exported plastics and articles valued at about USD 131.07 billion, a 36% rise in exports from the previous year (2020), valued at around USD 96.38 billion.

- The global production capacity of bioplastics increased by 16% in 2021 to 2.4 million metric tons. Biodegradable bioplastics accounted for 1.6 million metric tons of the total capacity in 2021.

- According to the injection mold specialist SFA Packaging from Middelharnis, most foods come in injection mold packaging made of polypropylene.

- Due to environmental concerns, more consumers and manufacturers are preferring eco-friendly packaging options, boosting the demand for the bio-based polypropylene market.

Europe to Dominate the Market

- Europe is a significant hub for the bio-based polypropylene industry, with about 50% of the market share. It ranks high in R&D in this industry.

- Government regulations in most European countries regarding using bio-degradable plastics, including bio-based polypropylene, are stringent. The government is continuously pushing the usage of eco-friendly products.

- Bio-based polypropylenes are majorly used in the packaging industry. Europe is one of the leading consumers in the packaging industry and is developing various packaging segments.

- Germany is the largest plastic consumer in Europe. The increasing plastic usage in the packaging industry propelled the plastic demand. In 2021, the packaging industry in Germany generated EUR 29.6 billion (USD 34.55 billion) in revenue. It decreased compared to the previous year to EUR 26.3 billion (USD 30.70 billion).

- Moreover, the German government is promoting bio-based and recycled materials used in the packaging industry. For instance, Germany's Bundesrat, the upper house of parliament, approved a new packaging law to boost the recycling of packaging waste. It is an important signal for the bioplastics industry as, for the first time, bio-based and recycled materials are recognized as equally viable solutions to make packaging more sustainable and reduce our dependency on finite fossil resources.

- Additionally, the popularity of the e-commerce segment and the growing retail market gave a vast growth opportunity to the bio-based polypropylene market in the region through the years.

- In 2021, the B2C e-commerce sector in Germany generated around EUR 86.7 billion (USD 101 billion). Online shopping is on the rise after COVID-19 spread across the globe. In the e-commerce sector, Germany was in sixth place after China, the United States, Great Britain, Japan, and South Korea, in 2021. In particular, mobile commerce is becoming increasingly important. Currently, 7.26 billion people use smartphones, and this is estimated to reach 7.5 billion by 2026.

- The abovementioned factors are expected to drive the market for bio-based polypropylene in Europe in the coming years.

Bio-based Polypropylene Industry Overview

The bio-based polypropylene market is partially consolidated, with the major players dominating a significant portion. Some companies operating in the market (in no particular order) are Borealis AG, Braskem, Mitsui Chemicals Inc., SABIC, and LyondellBasell Industries Holdings BV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Environmental Concerns Regarding the Usage of Conventional Plastics

- 4.1.2 Increasing Replacement of Fossil-based Feedstock with Renewable Materials

- 4.2 Restraints

- 4.2.1 High Cost of Bio-based Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Injection Molding

- 5.1.2 Textiles

- 5.1.3 Films

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Biobent Management Services Inc.

- 6.4.2 Borealis AG

- 6.4.3 Borouge

- 6.4.4 Braskem

- 6.4.5 FKuR

- 6.4.6 INEOS

- 6.4.7 INTER Ikea SYSTEMS BV

- 6.4.8 LyondellBasell Industries Holdings BV

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 SABIC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Incentives by the Government Promoting the Usage of Bio-based Materials

- 7.2 Other Opportunities