|

시장보고서

상품코드

1445686

세계 커넥티드 약물전달 기기 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Connected Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

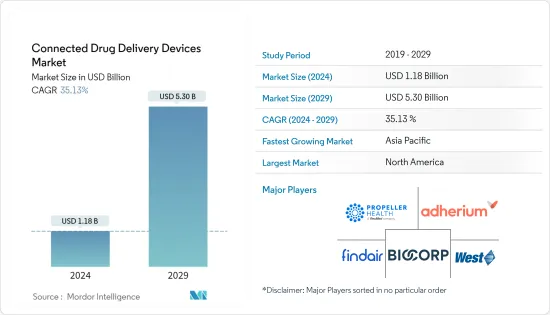

커넥티드 약물전달 기기 시장 규모는 2024년에 11억 8,000만 달러로 추정되고, 2029년까지 53억 달러에 이를 것으로 예측되며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 35.13%로 성장할 전망입니다.

COVID-19의 팬데믹은 환자 케어가 보다 재택 기반 기술로 이동했기 때문에 초기 단계에서는 시장에 적당한 영향을 주었고, 이에 따라 약물전달의 이용도 증가할 것으로 예상되었습니다. 예를 들어, 2021년 9월에 Lancet Regional Health에 게재된 기사에 따르면 COVID-19의 유행이 시작된 이래 병원에의 압력을 줄이기 위해 재택 케어가 전례 없이 요구되고 있으며, 같은 증상을 가진 환자가 안심하고 치료를 받을 수 있게 되어 있는 것이 관찰되고 있습니다. 만성 질환은 집에서 관리하고 모니터링해야합니다. 이것은 환자를 원격 모니터링하기 위해 특별히 만들어진 약물전달 장치의 사용이 유행 중에 증가하고 있음을 보여줍니다. 그러므로 COVID-19의 유행은 당초 시장에 큰 영향을 미쳤지만, 현재는 유방이 침전되고 있기 때문에 가정 환경에서 환자 관리의 전환이 약간 감소했지만 조사 대상 시장은 예측 기간 동안 안정적인 성장이 예상됩니다.

시장 성장을 가속하는 주요 요인으로는 천식, COPD, 당뇨병 등 만성 질환의 유병률 증가, 환자 연결 및 참여 증가, 처방된 치료 준수에 대한 환자 의식 증가 등 됩니다.

커넥티드 약물전달 장치는 주로 만성 폐색성 폐질환(COPD), 당뇨병 등 만성 질환의 유병률 증가와 노인 인구 증가로 시장 성장을 가속할 것으로 예상됩니다. 앞서 언급한 질병. 예를 들어, 2022년 9월에 만성 폐색성 폐질환에 대한 세계 이니셔티브가 발표한 데이터에 따르면, 2022년에는 세계 2억명이 COPD를 앓고 있는 것으로 추정되고 있습니다. 마찬가지로 2021년 12월에 폐인도가 발표한 기사에 따르면 인도에서 체계적인 검토가 실시되었으며 2021년 성인의 COPD 유병률은 9.23%임을 보여주었습니다. 따라서 COPD의 높은 부담이 시장 성장을 가속할 것으로 예상됩니다.

혈중 케톤체 측정기가 당뇨병 모니터링에 사용되기 때문에 전 세계적으로 당뇨병의 유병률이 상승하고 있는 것도 시장 성장을 가속하는 주요 요인입니다. 예를 들어, 2021년 12월에 IDF가 갱신한 데이터에 의하면, 2021년에는 20-79세의 연령층의 성인 약 5억 3,700만명이 당뇨병을 안고 있는 것으로 추정되고, 당뇨병을 안고 사는 사람의 총 수는 2030년까지 6억 4,300만 명, 2045년까지 7억 8,300만 명으로 증가합니다.

또한 Journal of Asthma Allergy가 2022년 7월에 발표한 기사에 따르면 천식은 독일에서 가장 흔한 만성 질환 중 하나이며 매년 추정으로 전체 성인의 4-5%, 소아의 10%가 앓고 있습니다. 또한 2022년 7월 BMC 공중보건이 발표한 기사에 따르면 중국에서 실시한 연구에서는 65세 이상의 중국인 당뇨병의 추정 유병률, 인식률, 대조율은 18.80%, 77.14%, 각각 41.33%. 따라서 천식과 당뇨병의 유병률이 높다는 것은 연결 약물전달 장치의 사용을 촉진하고 시장 성장을 가속할 것으로 예상됩니다.

따라서 천식, COPD, 당뇨병과 같은 만성 질환의 유병률이 증가하고 노인 인구가 증가하는 등의 요인이 시장 성장을 가속할 것으로 예상됩니다. 하지만 기기 비용이 증가하고 데이터 프라이버시와 전송에 대한 우려가 높아짐에 따라 시장 성장이 방해될 것으로 예상됩니다.

커넥티드 약물전달 기기 시장 동향

재택 관리 부문은 예측 기간 동안 상당한 성장률을 기록하는 것으로 추정됩니다.

홈 케어 부문은 심혈관 질환(CVD), 당뇨병, 만성 폐색성 폐 질환(COPD) 및 건강 기록의 적절한 유지를 필요로하는 다른 만성 질환의 증례 증가로 예측 기간 동안 크게 성장률을 나타낼 것으로 추정됩니다. 게다가, 연결 약물전달 기기에서의 혁신의 진전은 이 분야의 성장을 가속할 것으로 예상됩니다.

노인은 주로 집에서 치료가 필요하기 때문에 노인 인구가 증가함에 따라 당뇨병의 유병률이 증가하면이 부문의 성장을 가속하는 주요 요인이되었습니다. 예를 들어, 2022년 국제 당뇨병 연맹(IDF)이 발표한 데이터에 따르면, 2022년 전 세계에서 새롭게 발생한 1형 당뇨병 환자 전체의 62%가 20세 이상인 것으로 추정되고 있습니다. 또한 같은 출처가 2021년에 발표한 데이터에 따르면 2021년 아프리카에서는 추정 2,400만명, 유럽에서는 6,100만명, 중동,북아프리카에서는 7,300만명, 동남아시아에서는 9,000만명이 당뇨병을 안고 살고 있다고 추정됩니다.

게다가 King's Fund가 2022년 11월 발표한 기사에 따르면 심혈관질환(CVD)에는 심장병이나 뇌졸중 등 영국에서 가장 널리 만연한 질환의 일부가 포함되어 있다고 추측됩니다. 하지만 여전히 이환율과 신체장애의 주요 원인이 되고 있습니다. 사망률, 그리고 건강 격차의 주요 요인이며, 의료 제도와 경제에 상당한 비용을 가져옵니다. 이 정보통은 또한 CVD와 당뇨병이 2022년 4월 이후 잉글랜드와 웨일즈에서 과도한 사망 증가의 주요 원인이라는 초기 징후가 있다고 말했습니다. 따라서 전 세계적으로 CVD와 당뇨병 부담이 증가하고 있기 때문에 가정 환경에서 연결 약물전달 장치의 사용이 증가할 것으로 예상됩니다.

그러므로 세계 만성 질환 유병률 증가와 이러한 질병의 치료를 위한 조사 증가와 같은 위의 요인으로 인해 이 부문의 성장이 더욱 가속될 것으로 예상됩니다.

북미는 예측 기간 동안 약물전달 기기 시장에서 큰 점유율을 유지할 것으로 예상

북미는 만성 질환의 발병률이 증가하고 거대한 대상 인구 기반의 존재로 인해 연결된 약물전달 장치에 매우 큰 시장이 될 것으로 예상됩니다.

2022년 미국 천식,알레르기재단(AAFA)이 발표한 보고서에 따르면 미국에 사는 약 2,500만 명이 천식을 앓고 있는 것으로 추정되고 있으며, 성별, 인종, 민족, 사회경제적 지위 등 요인이 관련되어 있습니다. 천식과 관련된 질병으로,이 질병은 어린 시절에는 여성보다 남성에게 더 많이 나타납니다. 따라서 미국에서는 천식 부담이 커서 커넥티드 약물전달 장치의 채용이 촉진될 것으로 예상됩니다.

마찬가지로 CDC가 2022년 10월에 업데이트한 데이터에 따르면 COPD는 기류 차단 및 호흡 관련 문제를 일으킬 수 있는 일련의 질병을 가리키며 매년 1500만 명 이상의 미국인이 COPD를 앓고 있습니다. 하고 있다고 추정됩니다. 따라서 미국에서 COPD의 높은 유병률도 시장 성장을 가속할 것으로 예상됩니다.

또한 캐나다 통계국이 2022년 7월에 발표한 데이터에 따르면 캐나다의 65세 이상의 인구는 약 7,330,605명으로 추정되고, 이는 총 인구의 18.8%를 차지합니다. 따라서 노인 인구는 만성 질환에 걸리기 쉽기 때문에 노인 인구 증가로 인해 연결된 약물전달 장치 수요가 증가하여 이 지역 시장 성장을 가속할 것으로 예상됩니다.

따라서 만성질환의 유병률 증가와 노인 인구 증가 등 위의 요인으로 인해 이 지역 시장 성장이 증가할 것으로 예상됩니다.

커넥티드 약물전달 기기 산업 개요

약물전달 장치 시장은 본질적으로 세분화됩니다. 시장의 주요 기업은 경쟁을 유지하기 위해 전략적 제휴, 인수, 신제품 출시를 추진하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 천식, COPD, 당뇨병 등 만성 질환의 유병률 증가

- 환자의 연결과 참여도 향상

- 처방된 치료의 준수에 관한 환자의 의식의 향상

- 시장 성장 억제요인

- 기기 비용 증가

- 데이터의 프라이버시와 전송에 관한 우려 증가

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 제품별

- 커넥티드 센서

- 통합 커넥티드 기기

- 기술별

- Bluetooth

- 근거리 무선 통신(NFC)

- 기타

- 최종 사용자별

- 의료 제공업체

- 재택 케어

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Propeller Health(ResMed Inc.)

- Findair Sp. z oo

- Bio Corp

- Teva Pharmaceuticals Industries Ltd

- Adherium Limited

- West Pharmaceutical Services Inc.

- Aptar Pharma

- Ypsomed AG

- Phillips-Medisize

제7장 시장 기회와 미래 동향

BJH 24.03.15The Connected Drug Delivery Devices Market size is estimated at USD 1.18 billion in 2024, and is expected to reach USD 5.30 billion by 2029, growing at a CAGR of 35.13% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market moderately during the initial phase as patient care shifted to more home-based technologies, and along with it the usage of connected drug delivery also expectedly increased. For instance, according to an article published by the Lancet Regional Health in September 2021, it has been observed that since the beginning of the COVID-19 pandemic, home-based care has been unprecedently solicited to relieve the pressure on hospitals, enabling patients with chronic conditions to be taken care of and monitored at home. This indicates the increased usage of connected drug delivery devices during the pandemic, as they are specially made for remotely monitoring a patient. Thus, the COVID-19 pandemic significantly impacted the market initially, however as the pandemic has subsided currently, the shift of patient care in home settings has decreased a bit, but the market studied is expected to have stable growth during the forecast period of the study.

The major factors driving the growth of the market include the increasing prevalence of chronic diseases, such as asthma, COPD, and diabetes, increased patient connectivity and engagement, and rising patient awareness about adherence to prescribed therapies.

The increasing prevalence of chronic diseases such as asthma, chronic obstructive pulmonary disease (COPD), and diabetes among others coupled with the rising geriatric population is expected to boost the market growth, as the connected drug delivery devices are mainly used by patients suffering from the aforementioned diseases. For instance, according to the data published by Global Initiative for Chronic Obstructive Lung Disease in September 2022, it was estimated that 200 million people around the world had COPD in 2022. Similarly, according to an article published by Lung India in December 2021, a systematic review was conducted in India which showed that the pooled COPD prevalence in adults was 9.23% in 2021. Thus, the high burden of COPD is expected to boost market growth.

The rising prevalence of diabetes around the world is also a major factor driving the market growth, as blood ketone meters are used for diabetes monitoring. For instance, according to the data updated by IDF in December 2021, it was estimated that approximately 537 million adults in the age group of 20-79 years were living with diabetes in 2021, and the total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045.

Moreover, according to an article published by the Journal of Asthma Allergy in July 2022, asthma is one of Germany's most common chronic diseases, which affects an estimated 4-5% of all adults and 10% of children each year. Additionally, according to an article published by BMC Public Health in July 2022, a study was conducted in China which showed that the estimated prevalence, awareness, and control rates of diabetes in Chinese individuals aged over 65 years were 18.80%, 77.14%, and 41.33%, respectively. Hence, the high prevalence of asthma and diabetes is also expected to boost the usage of connected drug-delivery devices, thus enhancing market growth.

Hence, the aforementioned factors such as the rising prevalence of chronic diseases such as asthma, COPD, and diabetes coupled with the rising geriatric population are expected to boost the market growth. However, the increased cost of devices and the increasing concerns about data privacy and transfer are expected to impede market growth.

Connected Drug Delivery Devices Market Trends

Homecare Segment is Estimated to Register a Significant Growth Rate Over the Forecast Period

The home care segment is estimated to register a significant growth rate over the forecast period due to the increasing cases of cardiovascular diseases (CVDs), diabetes, chronic obstructive pulmonary disease (COPD), and other chronic diseases, which require proper maintenance of health records. Moreover, the rising innovations in connected drug delivery devices are also expected to boost segment growth.

The increasing prevalence of diabetes coupled with the rising geriatric population is a major factor driving the segment growth, as older people mainly need their treatment to be done at home. For instance, according to the data published by the International Diabetes Federation (IDF) in 2022, it has been estimated that 62% of all new type one diabetes cases around the world in 2022 were in people aged 20 years or older. Furthermore, according to the data published by the same source in 2021, an estimated 24 million people were living with diabetes in Africa in 2021, 61 million in Europe, 73 million in the Middle East and North Africa, and 90 million in South-East Asia.

Furthermore, according to an article published by the King's Fund in November 2022, it is speculated that cardiovascular diseases (CVD) include some of the most widely prevalent diseases in England such as heart disease and stroke, it remains a leading cause of morbidity, disability and mortality, and a key driver of health inequalities, with significant costs to the health system and the economy. The source also stated that the early indications are that CVD and diabetes are the major contributors to the rise in excess deaths in England and Wales since April 2022. Thus, the rising burden of CVDs and diabetes around the world is expected to increase the usage of connected drug-delivery devices in home settings.

Therefore, the abovementioned factors such as the rising prevalence of chronic diseases around the world and the increasing research for the treatment of these diseases are expected to increase the segment growth.

North America is Expected to Hold a Significant Share in the Connected Drug Delivery Devices Market Over the Forecast Period

North America is anticipated to be a significantly large market for connected drug delivery devices owing to the rising incidence rate of chronic diseases as well as the presence of a huge target population base.

According to a report published by the Asthma and Allergy Foundation of America (AAFA) in 2022, it is estimated that around 25 million people living in the United States have asthma, and factors such as sex, race, ethnicity, and socioeconomic status are associated with asthma, with the disease being more common in males than females in childhood. Thus, the high burden of asthma in the United States is expected to boost the adoption of connected drug-delivery devices.

Similarly, according to the data updated by CDC in October 2022, COPD refers to a group of diseases that can cause airflow blockage and breathing-related problems and it is estimated that COPD affects more than 15 million Americans every year. Thus, the high prevalence of COPD in the United States is also expected to boost market growth.

Moreover, according to the data published by Statistics Canada in July 2022, it is estimated that around 7,330,605 people are aged 65 years or older in Canada, and this accounts for 18.8% of the total population. Thus, as the geriatric population is more prone to chronic diseases, the rising geriatric population is expected to rise the demand for connected drug delivery devices, thereby driving the market's growth in the region.

Therefore, the abovementioned factors such as the rising prevalence of chronic diseases and the increasing geriatric population are expected to increase the market's growth in the region.

Connected Drug Delivery Devices Industry Overview

The connected drug delivery devices market is fragmented in nature. The key market players are involved in strategic collaborations, acquisitions, and new product launches to sustain the competition. Some of the prominent players in the connected drug delivery devices market are Propeller Health (ResMed Inc.), BioCorp, Findair Sp. z.o.o, and Adherium Limited among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Chronic Diseases Such as Asthma, COPD, and Diabetes

- 4.2.2 Increased Patient Connectivity and Engagement

- 4.2.3 Rising Patient Awareness About Adherence to Prescribed Therapies

- 4.3 Market Restraints

- 4.3.1 Increased Cost Of Devices

- 4.3.2 Increasing Concerns About Data Privacy And Transfer

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Connected Sensors

- 5.1.1.1 Connected Inhaler Sensors

- 5.1.1.2 Connectable Injection Sensors

- 5.1.2 Integrated Connected Devices

- 5.1.2.1 Connected Inhaler Devices

- 5.1.2.2 Connected Injection Devices

- 5.1.1 Connected Sensors

- 5.2 By Technology

- 5.2.1 Bluetooth

- 5.2.2 Near-field communication (NFC)

- 5.2.3 Other Technologies

- 5.3 By End User

- 5.3.1 Healthcare Providers

- 5.3.2 Homecare

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Propeller Health (ResMed Inc.)

- 6.1.2 Findair Sp. z o.o.

- 6.1.3 Bio Corp

- 6.1.4 Teva Pharmaceuticals Industries Ltd

- 6.1.5 Adherium Limited

- 6.1.6 West Pharmaceutical Services Inc.

- 6.1.7 Aptar Pharma

- 6.1.8 Ypsomed AG

- 6.1.9 Phillips-Medisize