|

시장보고서

상품코드

1690864

위성통신 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

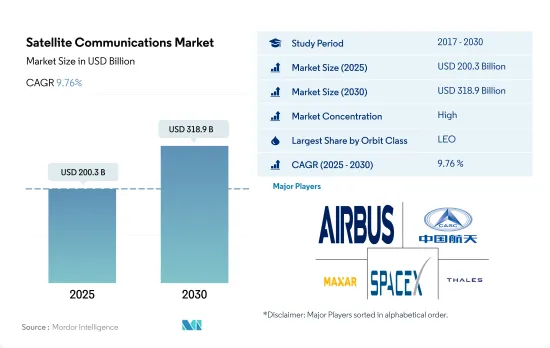

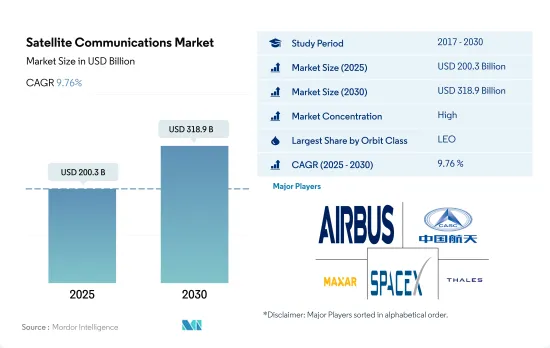

세계의 위성통신 시장 규모는 2025년 2,003억 달러로 예측되고, 2030년에는 3,189억 달러에 이르고, 예측 기간 중(2025-2030년) CAGR 9.76%를 나타낼 것으로 예측됩니다.

LEO 위성이 주요 부문을 차지할 전망

- 위성과 우주선은 대개 지구를 돌아 다니는 많은 특별한 궤도 중 하나에 배치됩니다. 지구궤도에는 정지궤도(GEO), 중궤도(MEO), 저궤도(LEO)의 3유형이 있습니다. 많은 기상 위성과 통신 위성은 지상에서 가장 먼 지구 높은 궤도를 돌아 다니는 경향이 있습니다. 중궤도에 있는 위성에는 특정지역을 감시하도록 설계된 항법위성 및 특수위성이 포함됩니다. NASA의 지구관측 시스템을 포함한 대부분의 과학 위성은 지구 낮은 궤도에 있습니다.

- 소형 위성의 급속한 개발과 그 부가적인 장점으로 지구 저궤도에 배치하면 LEO 부문의 성장을 이끌고 있습니다. 2017년부터 2019년까지 시장의 대부분의 점유율을 GEO 위성이 차지했습니다. 2020년에는 LEO 위성이 기세를 늘리고 예측 기간 동안에도 성장 궤도를 계속할 것으로 보입니다. 2029년에는 LEO 부문이 79.5% 시장 점유율을 차지한 다음 GEO가 18%의 점유율을 차지할 것으로 예상됩니다.

- 제조 및 발사할 수 있는 위성의 용도는 각각 다릅니다. 2017년부터 2022년 사이에 MEO에서 발사된 57대의 위성 중 8대는 통신 목적으로 제조되었습니다. 마찬가지로 GEO에서는 147대의 위성 중 105대가 통신 목적으로 배치되었습니다. 제조 및 발사된 약 4,131기의 LEO 위성은 세계의 여러 조직이 소유하고 있습니다. 그 중 약 2,976기가 통신용으로 설계된 위성입니다.

통신 용도 수요 증가가 세계 시장을 견인

- 위성통신 시장은 통신, 군 및 방위, 방송 등 다양한 분야에 중요한 인프라를 제공하는 세계 산업입니다. 위성 발사에 관해서는 2017-2022년 사이 통신 위성의 약 80%가 북미에서 제조 및 발사되고, 이어 유럽이 15%, 중국이 3%, 기타가 2%였습니다.

- 북미에는 위성기술에 많은 투자를 하는 강력한 군 및 방위부문이 있으며, SpaceX, MDA, HughesNet, Telesat 등의 기업이 광대역 인터넷, 텔레비전 방송, 기타 서비스용으로 대규모 위성 플릿을 운용하고 있으며, 상업부문도 중요합니다.

- Thales Alenia Space와 Airbus Defence and Space 등 주요 위성 제조업체가 있습니다. 유럽 우주 기관(ESA)은 국가 안보 및 방어 이니셔티브를 지원하기 위해 우주 기술에 많은 투자를 하고 있습니다. 상업 위성통신 시장도 중요하며, Uutelsat 및 SES와 같은 기업이 통신, 방송 및 기타 서비스를 위해 대규모 위성 플릿을 운영하고 있습니다.

- 아시아태평양은 고속 데이터 트랜스미션 수요 증가와 위성 기술에 대한 투자 증가에 견인되어 위성통신 시장의 급성장이 전망되고 있습니다. 중국과 인도는 이 지역의 2대 시장이며, 양국은 국가안보와 방위이니셔티브를 지원하고 경제 성장을 가속하기 위해 우주기술에 많은 투자를 하고 있습니다.

세계 위성통신 시장 동향

위성 소형화에 대한 세계 수요 증가

- 소형 위성은 기존의 위성의 거의 모든 기능을 약간의 비용으로 실현할 수 있기 때문에 소형 위성 별자리의 구축, 발사, 운용의 실현성이 높아지고 있습니다. 북미 수요는 매년 가장 많은 소형 위성을 생산하는 미국이 주로 견인하고 있습니다. 북미에서는 2017년부터 2022년까지 지역의 다양한 기업들이 총 596대의 초소형 위성을 궤도에 투입했습니다. NASA는 현재 이러한 위성 개발을 목표로 하는 여러 프로젝트에 참여하고 있습니다.

- 유럽에는 Surrey Satellite Technology Ltd나 GomSpace Group AB 등 유명한 위성 제조 사업체가 여러 개 존재하기 때문에 유럽은 초소형 위성 제조의 허브가 되고 있습니다. 2018년 11월, ESA는 DoT-4라고 불리는 저비용 35kg의 달 통신 위성 미션 설계 참여를 발표하고 2021년 발사를 목표로 했습니다. DoT-4는 Goonhilly Deep Space Network를 이용하여 지구로 통신 중계를 하고 월면의 로버와 링크하도록 설계되었습니다.

- 아시아태평양 수요는 주로 중국, 일본, 인도가 견인하고 있으며, 이들 국가는 매년 가장 많은 소형 위성을 생산하고 있습니다. 2017년부터 2022년 사이에 190대 이상의 초소형 위성이 이 지역의 다양한 기업들에 의해 궤도에 투입되었습니다. 중국은 우주 기반의 능력 증강에 엄청난 자원을 투입하고 있습니다. 이 나라는 아시아태평양에서 가장 많은 초소형 위성을 발사하고 있습니다.

시장에서 투자 기회 증가

- 북미 우주 개발에 대한 정부 지출은 2021년 약 370억 달러에 달했습니다. 이 지역은 세계 최대의 우주 기관인 NASA가 존재하는 우주 혁신과 연구의 진원지입니다. 2022년 미국 정부는 우주 프로그램에 약 620억 달러를 지출하여 우주 프로그램에 대한 지출액이 세계 최대가 되었습니다. 미국에서 연방 정부 기관은 매년 예산으로 알려진 323억 3,000만 달러의 자금을 의회에서 받고 있습니다.

- 영국 정부는 군용 위성통신 능력의 75억 달러 상당 업그레이드를 계획하고 있습니다. 2020년 7월 영국 국방부(MoD)는 Airbus Defence and Space에 6억 3,000만 달러 상당의 계약을 발주하고, 군사력 강화를 위한 응급조치로서 새로운 통신위성을 건설했습니다. 2022년 11월, ESA는 지구관측에서 유럽의 리드를 유지하고 항법 서비스를 확대하고 미국과의 탐사 파트너가 되기 위해 향후 3년간 우주 자금을 25% 증액할 것을 제안한다고 발표했습니다. ESA는 22개국에 2023-2025년 예산을 약 185억 유로로 요청했습니다.

- 아시아태평양에서 우주 관련 활동이 증가함에 따라 일본 예산안에 따르면 2022년 우주 예산은 14억 달러를 넘는데, 이는 H3 로켓, 기술 시험 위성 9호, 정보 수집 위성(IGS) 계획의 개발을 포함합니다. 22년도 인도의 우주개발 예산안은 18억 3,000만 달러였습니다. 2022년 한국의 과학정보통신부는 인공위성, 로켓 및 기타 주요 우주 장비 제조를 위해 6억 1,900만 달러의 우주 예산을 발표했습니다.

위성통신 산업 개요

위성통신 시장은 상당히 통합되어 있으며 상위 5개사에서 98.46%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Airbus SE, China Aerospace Science and Technology Corporation(CASC), Maxar Technologies Inc., Space Exploration Technologies Corp., Thales(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 위성의 소형화

- 위성의 질량

- 우주 개발에 대한 지출

- 규제 프레임워크

- 세계

- 호주

- 브라질

- 캐나다

- 중국

- 프랑스

- 독일

- 인도

- 이란

- 일본

- 뉴질랜드

- 러시아

- 싱가포르

- 한국

- 아랍에미리트(UAE)

- 영국

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 위성의 질량

- 10-100kg

- 100-500kg

- 500-1000kg

- 10kg 미만

- 1000kg 이상

- 궤도 클래스

- GEO

- LEO

- MEO

- 최종 사용자

- 상업

- 군사 및 정부

- 기타

- 지역

- 아시아태평양

- 유럽

- 북미

- 세계 기타 지역

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Airbus SE

- China Aerospace Science and Technology Corporation(CASC)

- Cobham Limited

- EchoStar Corporation

- Intelsat

- L3Harris Technologies Inc.

- Maxar Technologies Inc.

- SES SA

- SKY Perfect JSAT Corporation

- Space Exploration Technologies Corp.

- Swarm Technologies, Inc.

- Thales

- Thuraya Telecommunications Company

- Viasat, Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Satellite Communications Market size is estimated at 200.3 billion USD in 2025, and is expected to reach 318.9 billion USD by 2030, growing at a CAGR of 9.76% during the forecast period (2025-2030).

LEO satellites are expected to comprise the leading segment

- A satellite or spacecraft is usually placed into one of many special orbits around the Earth, or it can be launched into an interplanetary journey. There are three types of Earth orbits: geostationary orbit (GEO), medium Earth orbit (MEO), and low Earth orbit (LEO). Many weather and communications satellites tend to have high Earth orbits, which are farthest from the surface. Satellites in medium Earth orbit include navigational and specialized satellites designed to monitor a specific area. Most science satellites, including NASA's Earth Observation System, are in low Earth orbit.

- The rapid development of small satellites and their deployment in low Earth orbit because of their added advantages are driving the growth of the LEO segment. During 2017-2019, the majority share of the market was occupied by GEO satellites. In 2020, LEO satellites gained momentum, and they are expected to continue their growth trajectory during the forecast period as well. The LEO segment is expected to occupy a market share of 79.5% in 2029, followed by GEO, with a share of 18%.

- The different satellites manufactured and launched have different applications. During 2017-2022, of the 57 satellites launched in MEO, eight were built for communication purposes. Similarly, of the 147 satellites in GEO, 105 were deployed for communication purposes. Around 4,131 LEO satellites manufactured and launched were owned by various organizations across the world. Of that, nearly 2,976 satellites were designed for communication purposes.

Rising demand for communication application is driving the demand in the market globally

- The satellite communications market is a global industry that provides critical infrastructure for various sectors, including telecommunications, military and defence, and broadcasting. Regarding satellite launches, during 2017-2022, approximately 80% of the communication satellites were manufactured and launched by North America, followed by Europe with 15%, China with 3%, and the rest with 2%, respectively.

- North America has a strong military and defence sector that invests heavily in satellite technology, and the commercial sector is also significant, with companies like SpaceX, MDA, HughesNet, and Telesat operating large fleets of satellites for broadband internet, TV broadcasting, and other services.

- Europe is another significant player in the global satellite communications market, and it is home to several leading satellite manufacturers, including Thales Alenia Space and Airbus Defence and Space. The European Space Agency (ESA) invests heavily in space technology to support national security and defence initiatives. The commercial satellite communications market is also significant, with companies like Eutelsat and SES operating large fleets of satellites for communication, broadcasting, and other services.

- The Asia-Pacific region is expected to be the fastest-growing market for satellite communications, driven by increasing demand for high-speed data transmission and rising investments in satellite technology. China and India are two of the largest markets in the region, with both countries investing heavily in space technology to support national security and defence initiatives and drive economic growth.

Global Satellite Communications Market Trends

The global demand for satellite miniaturization is rising

- The ability of small satellites to perform nearly all of the functions of a traditional satellite at a fraction of its cost has increased the viability of building, launching, and operating small satellite constellations. The demand from North America is primarily driven by the United States, which manufactures the most small satellites each year. In North America, during 2017-2022, a total of 596 nanosatellites were placed in orbit by various players in the region. NASA is currently involved in several projects aimed at developing these satellites.

- Europe has become the hub for nano and microsatellite manufacturing due to the presence of several prominent satellite manufacturing entities in the region, including Surrey Satellite Technology Ltd and GomSpace Group AB. In November 2018, ESA announced its participation in designing a low-cost 35 kg lunar communications satellite mission called DoT-4, which was targeted for a 2021 launch. DoT-4 was designed to provide the communications relay back to Earth using the Goonhilly Deep Space Network and link up with a rover on the surface of the Moon.

- The demand from Asia-Pacific is primarily driven by China, Japan, and India, which manufacture the largest number of small satellites annually. During 2017-2022, more than 190 nano and microsatellites were placed into orbit by various players in the region. China is investing significant resources in augmenting its space-based capabilities. The country has launched the most significant number of nano and microsatellites in Asia-Pacific to date.

Investment opportunities are increasing in the market

- Government expenditure for space programs in North America reached approximately 37 billion in 2021. The region is the epicenter of space innovation and research, with the presence of the world's biggest space agency, NASA. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space programs in the world. In the United States, federal agencies receive funding of USD 32.33 billion from Congress every year, known as budgetary resources, for their subsidiaries.

- The UK government has planned an upgradation, worth USD 7.5 billion, of the satellite telecommunication capabilities of the armed forces. In July 2020, the UK Ministry of Defence (MoD) awarded a contract worth USD 630 million to Airbus Defence and Space for constructing a new telecommunications satellite as a stopgap to bolster military capabilities. In November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. ESA asked its 22 nations to back a budget of around EUR 18.5 billion for 2023-2025.

- Considering the increase in space-related activities in the Asia-Pacific region, in 2022, according to the draft budget of Japan, the space budget amounted to over USD 1.4 billion, which included the development of the H3 rocket, Engineering Test Satellite-9, and the nation's Information Gathering Satellite (IGS) program. The proposed budget for India's space programs for FY22 was USD 1.83 billion. In 2022, South Korea's Ministry of Science and ICT announced a space budget of USD 619 million for manufacturing satellites, rockets, and other key space equipment.

Satellite Communications Industry Overview

The Satellite Communications Market is fairly consolidated, with the top five companies occupying 98.46%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), Maxar Technologies Inc., Space Exploration Technologies Corp. and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Satellite Mass

- 5.1.1 10-100kg

- 5.1.2 100-500kg

- 5.1.3 500-1000kg

- 5.1.4 Below 10 Kg

- 5.1.5 above 1000kg

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.2 Europe

- 5.4.3 North America

- 5.4.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 China Aerospace Science and Technology Corporation (CASC)

- 6.4.3 Cobham Limited

- 6.4.4 EchoStar Corporation

- 6.4.5 Intelsat

- 6.4.6 L3Harris Technologies Inc.

- 6.4.7 Maxar Technologies Inc.

- 6.4.8 SES S.A.

- 6.4.9 SKY Perfect JSAT Corporation

- 6.4.10 Space Exploration Technologies Corp.

- 6.4.11 Swarm Technologies, Inc.

- 6.4.12 Thales

- 6.4.13 Thuraya Telecommunications Company

- 6.4.14 Viasat, Inc.

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms