|

시장보고서

상품코드

1690923

솔리드 등급 열가소성 아크릴(비즈) 수지 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Solid-grade Thermoplastic Acrylic (Beads) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

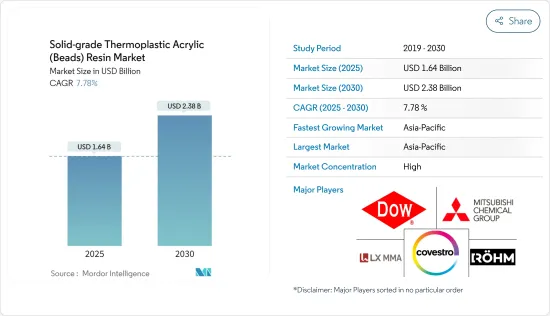

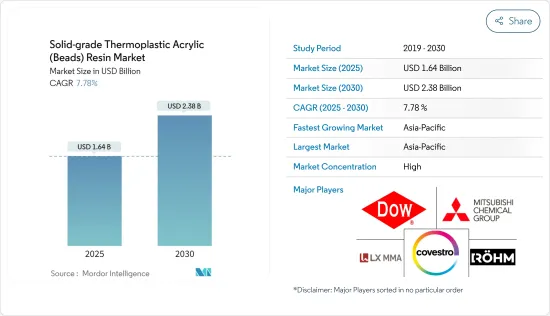

솔리드 등급 열가소성 아크릴 수지 시장 규모는 2025년에 16억 4,000만 달러로 추정되고, 2030년에는 23억 8,000만 달러에 이를 것으로 예측되며, 예측 기간인 2025-2030년 CAGR 7.78%로 성장할 전망입니다.

COVID-19 팬데믹은 공급망의 혼란과 다양한 제조업 및 건설 활동의 폐쇄로 이어진 전국적인 봉쇄와 사회적 거리두기의 의무화로 2020년 시장에 부정적인 영향을 미쳤습니다. 그러나 규제가 해제된 이후에는 순조롭게 회복되고 있습니다. 내장 및 외장 용도의 다양한 분야로부터 페인트 및 코팅 수요 증가는 조사 대상 시장에 긍정적인 영향을 줄 것으로 예상됩니다.

주요 하이라이트

- 단기적으로는 페인트 및 코팅 산업의 확대와 솔리드 등급 열가소성 아크릴(비즈) 수지가 제공하는 다양한 이점이 시장 수요를 견인하는 요인의 하나입니다.

- 반대로, 원료에 관한 정부의 엄격한 규제는 시장의 성장을 방해합니다.

- 전기자동차 산업의 확대는 향후 수년간 시장에 기회를 가져올 것으로 예상됩니다.

- 아시아태평양이 시장을 독점하고 예측 기간 중에 가장 높은 CAGR로 추이할 것으로 전망됩니다.

솔리드 등급 열가소성 아크릴(비드) 수지 시장 동향

페인트 및 코팅 산업에 있어서의 용도 증가

- 솔리드 등급 열가소성 아크릴(비드) 수지는 페인트 및 코팅제의 배합에 널리 사용됩니다. 또한, 이들 수지는 주로 페인트 및 코팅 부문의 공업용 페인트, 건축용 페인트, 수송용 페인트, 코일 페인트에 사용되고 있습니다.

- 솔리드 등급 열가소성 아크릴(비드) 수지는 페인트 및 코팅의 강력한 바인더입니다. 이 수지는 유기 용매와 UV 단량체에 쉽게 용해됩니다. 또한 자일렌, 에스테르, 케톤에도 녹습니다.

- 이 수지는 금속, 플라스틱, 시멘트계 등 여러 가지 기재에 접착됩니다. 또한, 내구성이 뛰어나 광택이 있고, 내알칼리성이 우수하며, 속건성이 있어, 폭넓은 기재에 용이하게 접착합니다. 솔리드 등급 열가소성 아크릴 수지는 목재 페인트 및 전자 페인트 등에도 사용됩니다.

- Coating World의 보고서에 따르면 모든 국가에서 다양한 페인트 수출액을 합산하면 2020년 216억 달러에 비해 2021년에는 249억 달러에 이르렀습니다. 연도의 현저한 증가도 나타내고 있습니다. 게다가 세계의 페인트 및 코팅 시장은, 2022년에는 약 1,980억 달러가 되었습니다.

- Coating World의 보고서에 따르면, 페인트 및 코팅 산업에서 아시아는 세계 시장 점유율의 45% 가까이를 차지하는 최대 지역이며, 이어 북미 점유율 23%, 라틴아메리카 점유율 7%, 중동 및 아프리카 점유율 6%가 되고 있습니다.

- 아시아태평양의 지속적인 경제력과 이에 대응하는 인프라, 기계, 제조 장비 등에 대한 요구 증가는 이 지역의 페인트 및 코팅제에 대한 수요를 촉진하는 것으로 예상됩니다. 또한 철강, 화학, 석유 및 가스, 제조, 건설 등의 최종 사용자 산업에서는 생산 설비의 확대나 투자 증가가 새로운 비즈니스 기회로 이어질 것으로 예상됩니다.

- 미국 코팅 협회의 보고서에 따르면, 2022년 미국에서의 건축용 코팅 시장 규모는 약 159억 달러였습니다. 2023년 말에는 170억 달러 이상에 이른 것으로 보입니다.

- 캐나다에는 약 260사의 페인트 및 도장 제조업체가 있습니다. 캐나다 국내의 페인트 및 도장 제조업은 미국보다 적고, 연간 GDP에서 차지하는 비율은 0.5% 이하입니다.

- 유럽에는 많은 대규모 페인트 산업이 있으며 독일, 프랑스, 이탈리아를 포함한 4대 주요 경제권이 있습니다. 이 지역에는 오래된 기업이 여러 곳 존재하기 때문에 예측 기간 동안 페인트 및 코팅 부문은 확대될 것으로 예측됩니다. 독일은 유럽에서 페인트 및 코팅의 주요 생산국 중 하나입니다. Haltermann Carless에 따르면 이 나라는 연간 약 260만 톤의 페인트 및 코팅제를 생산하고 있으며 자동차, 건축, 일반 산업, 부식 방지 등 다양한 용도로 사용되고 있습니다.

- 중동 및 아프리카에서는 구조 개혁이 진행되고 있기 때문에 공업용 페인트 수요가 왕성해질 것으로 예상됩니다. 또, 사우디아라비아에서는, 비전 2030의 발표와 그에 따른 국가 변혁 계획(NTP)에 의해, 의료나 교육 등 다양한 부문에 대한 투자가 증가했습니다.

- 이러한 모든 요인으로부터, 솔리드 등급 열가소성 아크릴(비즈) 수지 시장은 예측 기간 중에 안정된 성장이 전망됩니다.

시장을 독점하는 아시아태평양

- 아시아태평양이 시장을 독점할 것으로 예상됩니다. 이 지역에서는 중국이 GDP에서 가장 큰 경제대국입니다. 중국과 인도는 세계에서 가장 빠르게 성장하고 있는 신흥국 중 하나입니다.

- Coatings World의 보고서에 따르면 아시아태평양은 2022년도 세계의 페인트 및 코팅 산업에서 가장 활기찬 지역입니다. 이는 호조된 경제성장과 양호한 인구동향으로 이 지역이 오랜 기간 세계에서 가장 급성장하고 있는 페인트 및 코팅 시장이 되었기 때문입니다.

- 아시아태평양은 가처분소득 증가와 함께 중류계급 인구 증가가 전망되고 있습니다. 그것은 이 지역의 주택 분야의 확대를 촉진했습니다. 따라서 건설 산업 시장 개척으로 인해 건축용 페인트 시장으로서 가장 중요한 위치를 차지하고 있습니다.

- 게다가 아시아태평양은 세계에서 가장 빠르게 성장하고 있는 지역으로, 새롭게 산업화하는 국가도 늘고 있습니다. 이러한 산업성장은 에너지 인프라 수요를 부추겨 그 수요도 증대하고, 페인트나 코팅의 필요성을 높이고 있습니다. 그러나 COVID-19 팬데믹에 의한 폐쇄로 인해 아시아태평양의 페인트 및 코팅 시장의 성장은 균일하지 않고, 그 결과 수요에 큰 흔들림이 발생하고 있습니다.

- 게다가 아시아태평양의 솔리드 등급 열가소성 아크릴(비드) 수지의 소비 수준은 수송, 건축, 건축 및 건설, 전자, 석유 및 가스, 태양광 발전 및 기타 산업 부문의 아크릴 복합재료, 페인트 및 코팅 수요 증가로 향후 수년간 상당한 비율로 상승할 것으로 예상됩니다.

- 아시아는 가장 규모가 큰 지역이며 세계 시장 점유율의 45% 가까이를 차지하며 2022년에는 900억 달러에 이르렀습니다. 아시아 중 가장 큰 작은 지역은 중화권으로, 아시아의 페인트 및 코팅 시장의 거의 58%를 차지하고 있습니다.

- European Coatings에 따르면 10,000곳에 가까운 페인트 제조업체가 중국에 진출하고 있습니다. 일본 페인트, 악조노벨, 중국 해양 페인트, PPG 인더스트리즈, BASF SE, 액살타 코팅스 등 세계의 주요 페인트 제조업체의 대부분이 중국에 제조 거점을 두고 있습니다. 페인트 및 코팅 기업은 이 나라에 대한 투자를 점점 늘리고 있습니다.

- 2022년 인도의 페인트 산업은 6,200억 루피(80억 달러) 이상으로 평가되었습니다. 지난 20년간 두자릿수대의 꾸준한 성장세를 이어오고 있으며, 세계적으로 가장 급성장하고 있는 페인트 경제입니다. 국내에는 3,000개 이상의 페인트 제조업체가 있으며 거의 모든 세계 기업이 진출하고 있습니다. 건축용 페인트는 시장 전체의 약 75%를 차지하고, 공업용 도료는 25%의 점유율을 차지하고 있습니다.

- Coatings World에 따르면, 태국은 가장 활기찬 페인트 및 코팅 시장의 하나입니다. 태국의 페인트 및 코팅 시장은 고도로 통합되어 있으며, 상위 4개사(TOA Paint(Thailand) Public Company Limited, Akzo Nobel Paints(Thailand) Company Limited, Jotun Thailand Limited, Berger)가 시장 점유율의 75% 이상을 차지하고 있습니다.

- 경제산업성에 의하면, 2021년의 일본의 합성 수지 페인트의 생산량은 약 101만 톤으로, 페인트의 생산량은 막대합니다. 페인트 전체 생산량은 2020년 150만 톤에 비해 2021년에는 약 153만 톤으로 증가했습니다.

- 한국의 페인트 및 도장 시장은 아시아태평양에서 4번째로 큽니다. KCC, 삼화파인트, Kangnam Jevisco(구 Kunsul Chemical Industrial Company, 통칭 KCI), Noroo Paints, Chokwang Paints가 주요 페인트 및 코팅 업체입니다. 그들은 한국의 페인트 및 코팅 시장을 약 75%의 누적 시장 점유율로 지배하고 있으며, 산업에서 아크릴산의 사용량을 높이고 있습니다.

- 게다가, 약 80개의 대, 중, 소규모의 페인트 및 코팅 제조업체가 존재하는 말레이시아의 페인트 및 코팅 산업은 동남아시아 지역에서 가장 선진적인 제품의 하나입니다.

- 호주 페인트 공업 연합회(APMF)는 이 나라의 페인트 및 코팅 산업의 기능을 모니터링하는 공식 단체입니다. 국내에는 220사 이상의 페인트 제조업체가 있습니다. 주요 기업으로는 듀룩스그룹, PPG인더스트리, 셔윈윌리엄스, 악조노벨, 악살타, 헤임스파인트 등이 있습니다.

- 이와 같이, 상기의 요인은 예측 기간 중, 아시아태평양의 솔리드 등급 열가소성 수지(비즈) 수요를 촉진할 것으로 예상됩니다.

솔리드 등급 열가소성 아크릴(비즈) 수지 산업 개요

솔리드 등급 열가소성 아크릴(비드) 수지 시장은 그 특성상 통합되어 있습니다. 시장의 주요 기업에는 Covestro AG, Dow, Mitsubishi Chemical Corporation, LX MMA, Rohm GmbH등이 있습니다(순부동).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 페인트 및 코팅 산업의 확대

- 솔리드 등급 열가소성 아크릴(비드) 수지의 장점

- 성장 억제요인

- 원료와 관련된 엄격한 정부 규제

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 용도별

- 아크릴 복합 수지

- 페인트 및 코팅

- 코일 코팅

- 공업용 페인트

- 건축 페인트

- 수송용 페인트

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 기타

- 남미

- 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Chansieh Enterprises Co. Ltd.

- Covestro AG

- Dow

- Heyo Enterprises Co. Ltd.

- LX MMA

- Makevale Group

- Mitsubishi Chemical Corporation

- Pioneer Chemicals Co. Ltd.

- Polyols & Polymers Pvt. Ltd.

- Rohm Gmbh

- Suzhou Direction Chemical Co. Ltd.

- Trinseo

제7장 시장 기회 및 향후 동향

- 전기자동차 산업 확대

The Solid-grade Thermoplastic Acrylic Resin Market size is estimated at USD 1.64 billion in 2025, and is expected to reach USD 2.38 billion by 2030, at a CAGR of 7.78% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020 due to nationwide lockdowns and social distancing mandates which led to supply chain disruption and the closure of various manufacturing industries and construction activities. However, the sector is recovering well since restrictions were lifted. Increasing demand for paints and coatings from different sectors in interior and exterior applications is expected to impact the studied market positively.

Key Highlights

- Over the short term, the expansion of the paint and coatings industry and the various benefits offered by solid-grade thermoplastic acrylic (beads) resins are some of the factors driving the market demand.

- Conversely, stringent government regulations regarding raw materials hinder the market's growth.

- Expansion of the electric vehicle industry is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Solid-grade Thermoplastic Acrylic (Beads) Resin Market Trends

Increasing Usage in the Paints and Coatings Industry

- Solid-grade thermoplastic acrylic (beads) resins are widely used in the formulation of paints and coatings. Furthermore, these resins are used primarily in industrial, architectural, transportation, and coil coatings in the paints and coatings segment.

- Solid-grade thermoplastic acrylic (beads) resins are a strong binder for paints and coatings. These resins can be easily dissolved in organic solvents or UV monomers. They are also soluble in xylene, esters, and ketones.

- These resins offer adhesion to multiple substrates such as metal, plastics, and cementitious. Furthermore, they are durable, have a high gloss, offer good alkali resistance, are fast drying, and easily adhere to a broad substrate range. Solid-grade thermoplastic acrylic resins are also used in wood coatings, electronic coatings, and others.

- According to the Coating World report, the combined exports of various types of paint from all countries amounted to around USD 24.9 billion in 2021, compared to USD 21.6 billion in 2020. It also indicates a notable increase in years. Furthermore, the global paints and coatings market stood at around USD 198 billion in 2022.

- For the paints and coatings industry, Asia is the largest region, with nearly 45% of the global market share, followed by Europe with a 23% share, North America with a 19% share, Latin America with a 7% share, and the Middle East and Africa with a 6% share, as per the Coating World report.

- Asia-Pacific region's continuing economic strength and corresponding increasing need for infrastructure, machinery, manufacturing units, and others are likely to propel the demand for paints and coatings in the region. In addition, expanding production units and increasing investments in the area will likely offer newer opportunities in the end-user industries such as iron and steel, chemical, oil and gas, manufacturing, construction, and others.

- According to the report of the American Coatings Association, in 2022, the market value of architectural coatings in the United States was around USD 15.9 billion. It will likely reach more than USD 17 billion by the end of 2023.

- Canada includes around 260 paint and coating manufacturers. Canada's domestic paint and coating manufacturing industries are fewer than the United States and contribute less than 0.5% to its annual GDP.

- Europe is home to many large paint industries, with the four largest mainland economies, including Germany, France, Italy, and Spain. The presence of several well-established players in the region is projected to expand the paints and coatings segment over the forecast period. Germany is among the leading producers of paints and coatings in Europe. According to Haltermann Carless, the country produces approximately 2.6 million tons of paints and coatings annually, used in various applications such as automotive, architectural, general industry, corrosion protection, and others.

- Due to the region's increasing structural reforms, the Middle East and African regions are anticipated to witness strong demand for industrial coatings. In addition, the announcement of Vision 2030, coupled with the associated National Transformation Plan (NTP), increased investments in various sectors, including healthcare and education in Saudi Arabia.

- Due to all such factors, the market for solid-grade thermoplastic acrylic (beads) resins is expected to grow steadily during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market. In the area, China is the largest economy in terms of GDP. China and India are among the fastest emerging economies in the world.

- As per the report by Coatings World, the Asia-Pacific region continued to be the most dynamic in the paint and coatings industry worldwide in 2022. It happened to owe to strong economic growth coupled with favorable demographic trends that have made this region the fastest-growing paint and coatings market across the globe for many years.

- The Asia-Pacific region is anticipated to witness an increasing middle-class population coupled with rising disposable income. It facilitated the expansion of the residential sector in the area. Hence, it is the most significant architectural coatings market due to the construction industry's development.

- In addition, Asia-Pacific is the fastest-growing region in the world, with more and more countries becoming newly industrialized. This industrial growth is fuelling the demand for energy infrastructure, which is also multiplying, driving the need for paints and coatings. However, due to COVID-19 pandemic-induced lockdowns, the paints and coatings market growth in the Asia-Pacific region was uneven, resulting in large swings in demand.

- Moreover, the consumption levels of solid-grade thermoplastic acrylic (beads) resins in the Asia-Pacific region are expected to rise at a significant rate in the coming years, owing to the increasing demand for acrylic composites, paints, and coatings from the transportation, architectural, building, and construction, electronics, oil and gas, solar power, and other industrial sectors.

- Asia is the largest region, with nearly 45% of the global market share, amounting to USD 90 billion in 2022. Within Asia, the largest sub-region is Greater China which accounts for almost 58% of the Asian paint and coatings market.

- According to European Coatings, nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BASF SE, and Axalta Coatings, have manufacturing bases in China. Paints and coatings companies have been increasingly growing investments in the country.

- In 2022, the Indian Paint Industry was valued at over INR 62,000 crores (USD 8 billion). It is the fastest-growing paint economy globally, with stable double-digit growth over the last two decades. The country includes over 3,000 paint manufacturers, with nearly all global companies present. Architectural paints constitute around 75% of the overall market, and industrial paints take a 25% share.

- As per the Coatings World, Thailand is one of the most vibrant paints and coatings markets. Thailand's paints and coatings market is highly consolidated in nature, with the top four players [TOA Paint (Thailand) Public Company Limited, Akzo Nobel Paints (Thailand) Company Limited, Jotun Thailand Limited, and Berger Co. Ltd] accounting for more than 75% of market share.

- According to the Ministry of Economy, Trade, and Industry (Japan), the production volume of synthetic resin paints in Japan amounted to approximately 1.01 million metric tons in 2021, making up an enormous production volume of paints. Overall, paints' production volume increased to nearly 1.53 million metric tons in 2021, compared to 1.50 million metric tons in 2020.

- The South Korean paint and coating market is the fourth-largest in the Asia-Pacific region. KCC, Samhwa Paints, Kangnam Jevisco (formerly Kunsul Chemical Industrial Company, popularly called KCI), Noroo Paints, and Chokwang Paints are the primary paint and coating producers. They dominate the South Korean paints and coating market with a cumulative market share of approximately 75%, enhancing acrylic acid usage in the industry.

- Furthermore, catered by about 80 large, mid-sized, and small-scale paint and coatings producers, the Malaysian paints and coatings industry is one of the most advanced product offerings in the Southeast Asian region.

- The Australian Paint Manufacturers' Federation Inc. (APMF) is the official association that monitors the functioning of the paints and coatings industry in the country. There were more than 220 manufacturers of paints and coatings in the country. The major companies include Dulux Group, PPG Industries, Sherwin-Williams, Akzo Nobel, Axalta, and Haymes Paints.

- Thus, the above factors are expected to propel the demand for solid-grade thermoplastic resins (beads) in the Asia-Pacific region during the forecasted period.

Solid-grade Thermoplastic Acrylic (Beads) Resin Industry Overview

The solid-grade thermoplastic acrylic (beads) resin market is consolidated in nature. Some of the major players in the market include Covestro AG, Dow, Mitsubishi Chemical Corporation, LX MMA, and Rohm GmbH, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion of the Paints and Coatings Industry

- 4.1.2 Benefits of Solid-grade Thermoplastic Acrylic (beads) Resins

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Related to Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Acrylic Composite Resins

- 5.1.2 Paints and Coatings

- 5.1.2.1 Coil Coatings

- 5.1.2.2 Industrial Coatings

- 5.1.2.3 Architectural Coatings

- 5.1.2.4 Transportation Coatings

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chansieh Enterprises Co. Ltd.

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Heyo Enterprises Co. Ltd.

- 6.4.5 LX MMA

- 6.4.6 Makevale Group

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Pioneer Chemicals Co. Ltd.

- 6.4.9 Polyols & Polymers Pvt. Ltd.

- 6.4.10 Rohm Gmbh

- 6.4.11 Suzhou Direction Chemical Co. Ltd.

- 6.4.12 Trinseo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of the Electric Vehicle Industry