|

시장보고서

상품코드

1445736

불안장애 및 우울증 치료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Global Anxiety Disorders and Depression Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

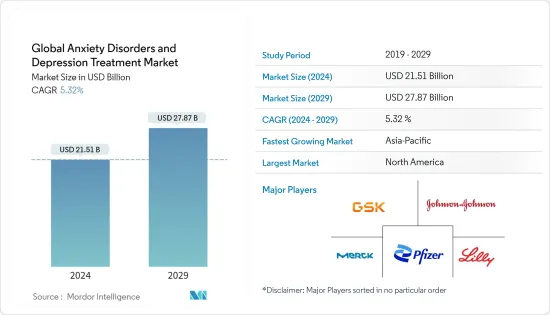

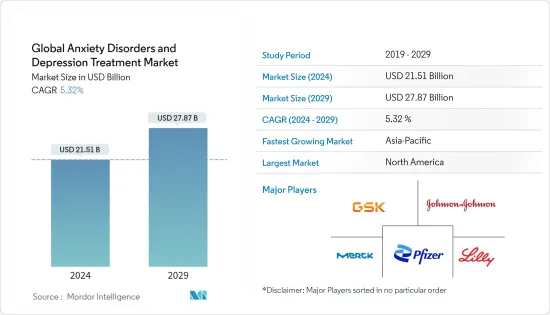

세계 불안장애 및 우울증 치료 시장 규모는 2024년 215억 1,000만 달러로 추정되며, 2029년에는 278억 7,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 5.32%의 CAGR로 성장할 것으로 예상됩니다.

COVID-19의 발생은 대유행 기간 동안 불안과 우울증 환자 수가 증가함에 따라 성장에 큰 영향을 미쳤습니다. 예를 들어, 2022년 3월에 발표된 WHO의 보고서에 따르면, COVID-19 팬데믹 첫 해인 2021년에 불안과 우울증의 전 세계 유병률이 25% 증가했다고 합니다. 또한 2021년 10월에 발표된 스프링거 저널(Springer Journal)의 기사에 따르면 COVID-19 팬데믹으로 인해 전 세계적으로 5,320만 명의 주요우울장애가 발생했고, 2021년에는 불안장애가 7,620만 명 더 늘어났다고 합니다. 따라서 팬데믹으로 인한 불안 및 우울 장애의 증가는 팬데믹 이후 시장 성장에 눈에 띄는 영향을 미쳤습니다. 또한 불안과 우울증에 대한 세계 인구의 인식이 높아짐에 따라 수요는 그대로 유지될 것으로 예상되며, 이는 예측 기간 동안 시장 성장을 증가시킬 것으로 예상됩니다.

불안장애와 우울증의 유병률 증가, 인식 수준 향상, 주요 시장 기업의 제품 출시 등의 요인으로 인해 시장 점유율이 확대될 것으로 예상됩니다. 예를 들어, 2021년 9월 세계보건기구(WHO)가 발표한 논문에 따르면, 우울증은 전 세계적으로 흔한 질병으로 성인의 5.0%, 60세 이상 성인의 5.7%를 포함한 인구의 약 3.8%가 앓고 있는 것으로 추정됩니다. 2021년에는 전 세계적으로 약 2억 8,000만 명이 우울증에 걸릴 것으로 예상됩니다. 또한, 2022년에 발표된 TRV 데이터에 따르면 2021년에는 전 세계적으로 약 2억 6,400만 명이 불안 장애를 경험했다고 합니다. 이처럼 전 세계적으로 불안과 우울증의 유병률이 증가함에 따라 시장 성장에 기여할 것으로 예상됩니다.

한편, 제품 승인 증가는 시장 성장을 촉진할 것으로 예상되는 또 다른 요인입니다. 예를 들어, 2021년 7월 Alembic Pharmaceuticals는 USP 10mg, 25mg, 50mg, 75mg, 100mg, 150mg의 데시프라민 염산염 정제 USP, 10mg, 25mg, 50mg, 75mg, 100mg, 150mg에 대한 미국 FDA의 단축 신청(ANDA)에 대한 최종 승인을 획득했습니다. 이번에 승인된 ANDA는 참조 등재 의약품(RLD)인 Validus Pharmaceuticals LLC의 노르프라민 10mg, 25mg, 50mg, 75mg, 100mg, 150mg과 치료상 동등합니다. 데시프라민 염산염 정제 및 USP는 우울증 치료에 적응증을 가지고 있습니다.

그러나 브랜드 의약품의 특허 만료는 예측 기간 동안 시장 성장을 저해할 것입니다.

불안장애 및 우울증 치료 시장 동향

대우울장애 부문은 예측 기간 동안 상당한 시장 점유율을 유지할 것으로 예상

대우울장애(MDD)는 전 세계 정신질환으로 인한 건강 관련 부담의 주요 원인으로, COVID-19 감염병 대유행 기간 동안 바이러스 감염, 봉쇄 및 금지, 대중교통 제한, 학교 및 기업 폐쇄, 사회적 교류 감소 등 정신건강에 영향을 미치는 많은 불확실한 요인들이 누적되어 잠재적 위험이 증가했습니다. 잠재적 위험 증가로 이어졌습니다. MDD는 전 세계 건강 관련 부담을 더욱 증가시킬 것입니다. 주요 우울 장애의 유병률 증가와 다양한 주요 기업의 제품 출시 증가와 같은 요인으로 인해 예측 기간 동안 시장 성장이 증가할 것으로 예상됩니다. 예를 들어, 2021년 10월 Elsevier Journal에 게재된 기사에 따르면 2021년 주요우울장애 유병률이 26.7% 증가하여 2020년 인구 10만 명당 3152.9명의 유병률을 기록할 것으로 예상했습니다. 이러한 세계 인구의 주요 우울장애 유병률은 효과적인 치료에 대한 수요를 촉진하여 예측 기간 동안 시장 성장에 기여할 것으로 예상됩니다.

한편, 다양한 주요 시장 기업의 제품 출시 증가는 조사 대상 부문의 또 다른 성장 요인이 될 것으로 예상됩니다. 예를 들어, 2021년 12월, 레이디 박사는 미국 시장에서 벤라팍신 ER 정제를 출시했습니다. 이 제품은 Osmotica Pharmaceutical USA LLC의 Venlafaxine 서방형 정제 150mg 및 225mg과 치료상 동등합니다. 선택적 세로토닌 및 노르에피네프린 재흡수 억제제(SNRI)인 벤라팍신 서방정은 주요우울장애(MDD) 및 사회불안장애(SAD)에 적응증을 갖고 있습니다. 또한 2021년 10월, Biogen Inc.와 Sage Therapeutics Inc.는 MDD 치료제로 Zulanolone의 FDA 승인을 요청하기로 결정했습니다. MDD에 대한 첫 번째 제출 패키지에는 진행 중인 약리학 및 임상 연구 데이터와 상황 및 NEST 임상시험 프로그램 연구의 데이터가 포함될 예정입니다. 여기에는 다양한 용량, 치료 패러다임 및 임상 평가변수에서 수천 명의 환자를 대상으로 즐라론의 효능을 조사하는 여러 연구가 포함됩니다.

따라서, 주요 우울장애의 유병률 증가와 제품 개발 등 위의 요인으로 인해 이 부문의 성장이 더욱 가속화될 수 있습니다.

북미 지역은 예측 기간 동안 시장에서 상당한 점유율을 차지할 것으로 예상

북미 지역은 예측 기간 동안 시장에서 상당한 점유율을 차지할 것으로 예상됩니다. 북미 인구의 불안 및 우울 장애 유병률 증가, 주요 시장 기업의 존재, 강력한 임상 파이프라인 등의 요인으로 인해 시장 성장이 촉진될 것으로 예상됩니다.

예를 들어, 2022년 미국불안우울증협회가 발표한 자료에 따르면, 불안장애는 미국 성인 680만 명에게 영향을 미치며, 2021년에는 13세에서 18세 사이의 청소년 중 31.9% 이상이 불안장애를 앓고 있습니다. 2021년 7월 발표된 데이터에 따르면 2021년 캐나다 인구의 약 5.4%가 주요우울장애를 앓고 있으며, 인구의 4.6%가 불안장애를 앓고 있는 것으로 나타났습니다.

이 지역에서의 제품 승인 증가도 시장 성장을 촉진할 것으로 예상됩니다. 예를 들어, 2022년 8월 미국 FDA는 Axsome Therapeutics의 제품인 Auvelity를 성인 주요우울장애 치료제로 승인했습니다. 이 제품은 새로운 작용 기전을 가진 경구 투여형 제품입니다.

따라서 불안 장애와 우울증의 유병률 증가와 다양한 주요 시장 참여자들의 제품 승인 증가는 예측 기간 동안 시장 성장에 기여할 것으로 예상됩니다.

불안장애 및 우울증 치료 산업 개요

불안장애 및 우울증 치료 시장은 부분적으로 세분화되어 있으며 여러 주요 기업으로 구성되어 있습니다. 경쟁 상황에는 시장 점유율을 보유하고 잘 알려진 여러 국제 및 국내 기업에 대한 분석이 포함됩니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 우울증 유병률 증가

- 신흥 신규 생물학적 제제

- 시장 성장 억제요인

- 브랜드 의약품 특허 만료

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 강도

제5장 시장 세분화

- 제품별

- 항우울제

- 치료와 장비

- 기타

- 적응증별

- 강박장애

- 주요우울장애

- 공포증

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 상황

- 기업 개요

- Abbvie

- Bristol-Myers Squibb Company

- Eli Lily &Co

- GlaxoSmithKline

- H. Lundbeck A/S

- Johnson &Johnson

- Merck &Co. Inc

- Pfizer Inc,

- Sanofi-Aventis

- Axsome Therapeutics

- Forest Laboratories

- AstraZeneca

제7장 시장 기회와 향후 동향

ksm 24.03.18The Global Anxiety Disorders and Depression Treatment Market size is estimated at USD 21.51 billion in 2024, and is expected to reach USD 27.87 billion by 2029, growing at a CAGR of 5.32% during the forecast period (2024-2029).

The COVID-19 outbreak significantly impacted the growth due to the increased number of cases of anxiety and depression during the pandemic period. For instance, a WHO report published in March 2022 stated that in the first year of the COVID-19 pandemic, the global prevalence of anxiety and depression increased by 25% in 2021. Additionally, the Springer Journal article published in October 2021 estimated an additional 53.2 million cases of major depressive disorders globally due to the COVID-19 pandemic and an additional 76.2 million cases of anxiety disorders in 2021. Thus, the increased anxiety and depression disorders due to the pandemic had a notable impact on the market's growth over the pandemic period. In addition, the demand is expected to remain intact due to the rising awareness among the global population regarding anxiety and depression, thereby increasing the market growth over the forecast period.

Factors such as the increasing prevalence of anxiety disorders and depression, increasing awareness levels, and product launches by key market players are expected to increase the market share. For instance, in September 2021, an article published by WHO stated that depression is a common illness worldwide, with an estimated 3.8% of the population affected, including 5.0% among adults and 5.7% among adults older than 60. Approximately 280 million people in the world will have depression in 2021. Additionally, the TRV data published in 2022 mentioned that an estimated 264 million people globally experienced an anxiety disorder in 2021. Such an increasing prevalence of anxiety and depression worldwide is expected to contribute to the market's growth.

On the other hand, increasing product approvals is another factor expected to drive the market's growth. For instance, in July 2021, Alembic Pharmaceuticals received final approval from the US FDA for its Abbreviated New Drug Application (ANDA) for Desipramine Hydrochloride tablets USP, 10 mg, 25 mg, 50 mg, 75 mg, 100 mg, and 150 mg. The approved ANDA is therapeutically equivalent to the reference listed drug product (RLD), Norpramin Tablets, 10 mg, 25 mg, 50 mg, 75 mg, 100 mg, and 150 mg, of Validus Pharmaceuticals LLC. Desipramine Hydrochloride Tablets and USP are indicated for the treatment of depression.

However, the patent expiration of branded drugs will hinder the market's growth over the forecast period.

Anxiety Disorders & Depression Treatment Market Trends

Major Depressive Disorder Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Major depressive disorder (MDD) is the leading cause of the global health-related burden of mental health conditions. During the COVID-19 pandemic, many uncertain factors affecting mental health accumulated, such as virus transmission, blockade and ban, public transport restrictions, closure of schools and enterprises, and reduction of social interaction, which led to an increase in the potential risk of MDD, further increasing the global health-related burden. Factors such as the increasing prevalence of major depressive disorder and rising product launches by various key players are expected to increase market growth in the forecast period. For instance, the article published in Elsevier Journal in October 2021 mentioned that the prevalence of major depressive disorder increased by 26.7% in 2021, and the total prevalence was 3152.9 cases per 100,000 population in 2020. Such prevalence of major depressive disorder among the global population is expected to drive the demand for effective treatment, thereby contributing to the market's growth over the forecast period.

On the other hand, increasing product launches by various key market players are expected to be another factor in the growth of the studied segment. For instance, in December 2021, Dr. Reddy launched venlafaxine ER Tablets in the U.S. market. The product is therapeutically equivalent to Venlafaxine Extended-Release Tablets, 150mg and 225mg, of Osmotica Pharmaceutical U.S. LLC. A selective serotonin and norepinephrine reuptake inhibitor (SNRI), Venlafaxine Extended-Release tablets, are indicated for major depressive disorder (MDD) and social anxiety disorder (SAD). Also, in October 2021, Biogen Inc. and Sage Therapeutics Inc. decided Sought FDA approval for zuranolone to treat MDD. The initial submission package for MDD will include data from ongoing pharmacology and clinical studies and data from the LANDSCAPE and NEST clinical trial program studies, including several studies examining the effectiveness of zuranolone in several thousand patients in various dosing, treatment paradigms, and clinical endpoints.

Thus, the abovementioned factors, such as the increasing prevalence of major depressive disorders and product developments, will likely increase the segment's growth.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

The North American region is expected to hold a notable share of the market over the forecast period. Factors such as the increasing prevalence of anxiety and depression disorders among the North American population, the presence of key market players, and a strong clinical pipeline are expected to increase the market's growth.

For instance, the data published by the Anxiety and Depression Association of America in 2022, anxiety disorder affects 6.8 million adults in the United States and affects over 31.9% of adolescents between 13 and 18 years old in 2021. Additionally, the Canadian Mental Health Association data published in July 2021, major depressive disorder affected approximately 5.4% of the Canadian population, and anxiety disorders affected 4.6% of the population in 2021. Thus, the increasing prevalence of anxiety disorders and depression among North American countries is expected to contribute to the growth of the market over the forecast period.

Likewise, the rising product approvals in this region are also expected to drive the growth of the market. for instance, in August 2022, the US FDA approved Axsome Therapeutics products, Auvelity for the treatment of major depressive disorder in adults. It is an orally administered product with a novel mechanism of action.

Thus, the increasing prevalence of anxiety disorder and depression, and increasing product approvals by various key market players are expected to contribute to the growth of the market over the forecast period.

Anxiety Disorders & Depression Treatment Industry Overview

The anxiety disorders and depression treatment market is partially fragmented and consists of several major players. The competitive landscape includes analyzing a few international and local companies that hold market shares and are well known. Pfizer Inc., GlaxoSmithKline, Merck & Co. Inc, Eli Lily & Co, and Johnson & Johnson are currently dominating the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Depression

- 4.2.2 Emerging Novel Biologics

- 4.3 Market Restraints

- 4.3.1 Patent Expiration of Branded Drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Antidepressant Drugs

- 5.1.2 Therapy and Devices

- 5.1.3 Others

- 5.2 By Indication

- 5.2.1 Obsessive-Compulsive Disorder

- 5.2.2 Major Depressive Disorder

- 5.2.3 Phobia

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbvie

- 6.1.2 Bristol-Myers Squibb Company

- 6.1.3 Eli Lily & Co

- 6.1.4 GlaxoSmithKline

- 6.1.5 H. Lundbeck A/S

- 6.1.6 Johnson & Johnson

- 6.1.7 Merck & Co. Inc

- 6.1.8 Pfizer Inc,

- 6.1.9 Sanofi-Aventis

- 6.1.10 Axsome Therapeutics

- 6.1.11 Forest Laboratories

- 6.1.12 AstraZeneca