|

시장보고서

상품코드

1445745

세계 마이크로니들형 인플루엔자 백신 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Microneedle Flu Vaccine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

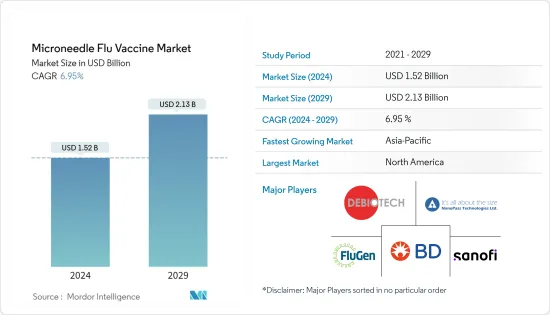

마이크로니들형 인플루엔자 백신 시장 규모는 2024년 15억 2,000만 달러로 추정되고, 2029년까지 21억 3,000만 달러에 이를 것으로 예측되며, 예측기간(2024년-2029년) 동안 복합 연간 성장률(CAGR) 6.95%로 성장할 전망입니다.

코로나바이러스(COVID-19)의 유행과 이어지는 세계 여러 나라에서의 록다운은 주요 마이크로니들형 독감 백신 회사의 재무 건전성에 영향을 미쳤습니다. 팬데믹은 정부의 록다운에 의한 의약품 개발, 생산, 공급 등 다양한 측면에서 세계 마이크로니들형 독감 백신 시장에 악영향을 미쳤습니다.

또한 세계 다양한 제약 사업의 성장에도 부정적인 영향을 미쳤습니다. 예를 들어, 뉴잉글랜드 저널 오브 메디신이 2022년 6월에 발표한 기사에 따르면, 유행의 첫 인플루엔자 시즌 동안 인플루엔자 백신 섭취량은 비교적 안정적이었습니다. 대조적으로, COVID-19 백신이 널리 이용 가능하게 된 후(2021-2022년 시즌), COVID-19 백신 섭취량의 하위 1/2 주에서 성인 인플루엔자 백신의 섭취량이 감소했습니다. 그러나 세계 규제가 완화되고 질병 스크리닝 서비스가 재개됨에 따라 COVID-19 이후의 현재 시나리오에서는 시장 성장이 안정되고 있습니다.

예측 기간 동안, 마이크로니들형 인플루엔자 백신 시장은 세계 인플루엔자 만연 및 마이크로니들형 독감 백신의 연구개발에 초점을 맞춘 주요 기업에 의해 성장할 것으로 예상됩니다. 2022년 1월 CDC의 최신정보에 따르면 2010년부터 2020년까지 미국에서는 900만명이 독감을 앓고 14만명에서 71만명이 입원하여 1만2천명에서 5만2천 사람이 사망했습니다. 또한 WHO가 2010년에 발표한 데이터에 따르면 2021년부터 2022년에 걸쳐 세계 인플루엔자 감시 대응 시스템(GISRS) 연구소는 490,516건 이상의 검체를 검사했습니다. 12,368명이 인플루엔자 바이러스 검사에서 양성 반응을 보였으며, 8,423명(68.1%)이 인플루엔자 A형, 3,945명(31.9%)이 인플루엔자 B형이었습니다.

주요 기업은 세계 마이크로니들형 인플루엔자 백신 시장에서의 입지를 강화하기 위해 합병과 인수와 같은 무기 전략에 초점을 맞추었습니다. 예를 들어, 2021년 6월 Microdermics, Inc.는 세계적으로 유명한 생명 과학 고문회사인 Novateur Ventures와 합병하여 전략적 조언을 제공하며 새로운 마이크로니들형 독감 백신 및 바이오센싱 플랫폼 제품 화를 위한 거래 프로세스를 주도했습니다.

정부기관은 마이크로니들 백신 패치의 연구개발 많은 투자를 하고 있기 때문에 세계 마이크로니들형 인플루엔자 백신 시장은 예측 기간 동안 크게 성장할 것으로 예상됩니다. 예를 들어, 2021년 8월, 미국 정부기관 생물의학 선진 연구개발국(BARDA)은 VaxiPatch의 연구개발을 가속하기 위해 Verndari, Inc에 100만 달러를 수여했습니다. 이 진피 패치 백신 기술은 인플루엔자와 같은 다양한 감염을 치료할 수 있습니다.

그러나 피부 수분 공급과 같은 외부 요인이 약물 전달에 영향을 줄 수 있으며 기존 백신에 비해 미세 바늘 백신 비용이 높기 때문에 예측 기간 동안 시장 성장이 억제 될 수 있습니다. 성이 있습니다.

마이크로니들형 인플루엔자 백신 시장 동향

4가 인플루엔자 백신 부문은 예측 기간 동안 상당한 성장이 예상된다.

4가 인플루엔자(독감) 백신은 2개의 인플루엔자 A 바이러스와 2개의 인플루엔자 B 바이러스를 포함한 4개의 인플루엔자 바이러스를 보호합니다.

4가 인플루엔자 백신 부서는 비용 효과, 바이러스 감염에 대한 효과, 병원 및 클리닉에서 쉽게 입수할 수 있어 마이크로니들형 인플루엔자 백신 시장에서 큰 수익을 차지합니다.

CDC에 따르면, 2021년 12월 현재, 4가 백신은 4가지 인플루엔자 바이러스, 즉 인플루엔자 A(H1N1) 바이러스, 인플루엔자 A(H3N2) 바이러스 및 2개의 인플루엔자 B 바이러스를 방어했습니다.

게다가, 효율과 안전성을 확인하기 위한 마이크로니들형 인플루엔자 백신의 임상개발이 증가하고, 이 분야가 뒷받침될 것으로 예상됩니다. 예를 들어, ClinicalTrials에 따르면. 2022년 2월에 정부가 발표한 바에 따르면, “생후 6-35개월의 건강한 피험자를 대상으로 한 4가 인플루엔자 백신의 임상시험”이라는 제목의 연구가 시노백 바이오텍의 평가하에, 6 세 이상의 건강한 유아를 대상으로 4가 인플루엔자 백신의 안전성과 면역 원성을 평가하기 위해 실시되었습니다. 35개월까지. 이러한 개발은 시장 관계자들에게 이 분야의 활성화가 기대되는 치료 접근법을 개발할 수 있는 큰 기회를 창출합니다.

북미는 시장에서 큰 점유율을 차지하고 있으며 예측 기간 동안에도 그 점유율을 획득할 것으로 예상됩니다.

현재 북미는 마이크로니들형 인플루엔자 백신 시장을 독점하고 있으며, 향후 수년간 그 아성이 계속될 것으로 예상되고 있습니다.

인플루엔자의 높은 유병률은 예측 기간 동안 지역 시장을 견인할 것으로 예상됩니다. 예를 들어 MedAlertHelp가 발표한 통계에 따르면 2022년에는 미국인의 약 5%-20%가 매년 독감으로 진단되고 있습니다. 또한 질병관리예방센터가 발표한 데이터에 따르면 2021년 10월에는 3,500만명이 인플루엔자와 관련된 질병, 38만명이 인플루엔자와 관련하여 입원, 2만명이 인플루엔자와 관련 사망하여 1600만 명이 독감과 관련하여 진찰을 받았다고 보고되었습니다. 질병 부담 증가는 앞으로 수년간 시장 성장에 긍정적 영향을 미칠 것으로 예상됩니다.

북미에서는 헬스케어 기관의 새로운 인플루엔자 예방 캠페인과 노력의 개시로 인플루엔자 백신에 대한 수요가 높아지고 효과적인 백신접종 시스템이 개발될 것으로 예상됩니다. 예를 들어 2021년 10월 CDC와 국립감염재단(NFID), 기타 공중보건 및 의료기관은 공동으로 2020년부터 2021년까지 인플루엔자 백신접종 시즌 시작을 발표하고 백신접종의 중요성을 강조 그리고 다음을 권장했습니다. 생후 6개월 이상의 사람은 일년에 한 번 독감 예방접종을 받습니다.

또한 2022년 12월에는 장기 보존 가능한 백신 패치를 개발하고 있는 생명 과학 기업인 Vaxess Technologies, Inc.가 1가 계절성 인플루엔자 백신 패치인 VX-103의 첫인만에서 긍정적인 중간 결과를 보고했습니다. 57일째의 결과에서 MIMIX(마이크로어레이/마이크로니들)-독감은 2007년 식품의약국(FDA)에 의한 인플루엔자 백신의 조기인가 기준을 크게 상회하고, 15㎍ 패치와 7.5㎍ 패치로 각각 85%로 77%의 혈청 전환율을 얻은 것으로 나타났습니다. 92%의 혈청 방어율도 갖추고 있습니다. Vaxess의 새로운 GMP 시설은 인플루엔자 백신 항원으로 채워진 독특한 실크 피브로인 마이크로니들 패치로 구성된 임상시험용 의약품의 제조에 성공했습니다.

마이크로니들형 인플루엔자 백신 산업 개요

마이크로니들형 인플루엔자 백신 시장은 본질적으로 통합됩니다. BD와 Sanofi는 시장 점유율에 가장 큰 기여를 하고 있습니다. 시장에는 Sanofi SA, Debiotech SA, 3M Company, NanoPass Technologies Limited, Becton, Dickinson and Company, FluGen, Inc 등의 기업이 진입하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 인플루엔자와 바이러스 감염의 만연

- 마이크로니들형 인플루엔자 백신의 연구개발에 주력하는 주요 기업

- 시장 성장 억제요인

- 마이크로니들과 관련된 합병증과 위험

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 제품 유형별

- 고체 마이크로니들

- 중공 마이크로니들

- 백신유형별

- 3가 인플루엔자 백신

- 4가 인플루엔자 백신

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Debiotech SA

- NanoPass Technologies Limited

- Becton, Dickinson and Company

- FluGen, Inc

- CosMED Pharmaceuticals Co., Ltd

- Microdermics

- TSRL Inc.

- Vaxess Technologies

제7장 시장 기회와 미래 동향

BJH 24.03.15The Microneedle Flu Vaccine Market size is estimated at USD 1.52 billion in 2024, and is expected to reach USD 2.13 billion by 2029, growing at a CAGR of 6.95% during the forecast period (2024-2029).

The coronavirus (COVID-19) pandemic and subsequent lockdown in various countries around the world impacted the financial health of major microneedle flu vaccine companies. The pandemic had a negative impact on the global microneedle flu vaccine market in various aspects, such as the development, production, and supply of medicines due to government-imposed lockdowns.

It also had a negative impact on the growth of various pharmaceutical businesses around the world. For instance, as per an article published in June 2022 by The New England Journal of Medicine, influenza vaccine uptake remained relatively stable during the first influenza season of the pandemic. In contrast, after Covid-19 vaccines became widely available (2021-2022 season), adult influenza vaccine uptake decreased within states in the bottom two quartiles of Covid-19 vaccine uptake. However, the market growth is stabilizing in the current scenario after COVID-19 as the worldwide restrictions have eased down and disease screening services have been resumed.

Over the forecast period, the micro-needle flu vaccine market is expected to grow due to the rising global prevalence of influenza and key players focusing on research and development of micro-needle flu vaccines. According to the CDC updates in January 2022, 9 million were affected with flu, and there were140,000-710,000 hospitalizations, and 12,000-52,000 deaths annually in the United States between 2010 and 2020. Furthermore, according to the data published by WHO in 2022, during the years 2021-2022, Global Influenza Surveillance and Response System (GISRS) laboratories tested over 490 516 specimens. 12,368 people tested positive for influenza viruses, with 8,423 (68.1%) being influenza A and 3,945 (31.9%) being influenza B.

Key companies focus on inorganic strategies such as mergers and acquisitions to strengthen their position in the global microneedle flu vaccine market. For instance, in June 2021, Microdermics, Inc. merged with Novateur Ventures, a well-known global life sciences advisory firm, to provide strategic advice and lead the transaction process for the commercialization of a novel microneedle flu vaccine and biosensing platform.

Government agencies are investing more in the research and development of microneedle vaccine patches, hence the global microneedle flu vaccine market is expected to grow significantly during the forecast period. For instance, in August 2021, the United States Government Agency Biomedical Advanced Research and Development Authority (BARDA) awarded Verndari, Inc USD 1 million to accelerate the research and development of VaxiPatch. This dermal patch vaccine technology can treat various infectious diseases such as influenza.

However, external factors such as skin hydration could affect drug delivery, and the high cost of microneedle vaccines compared to traditional vaccines may restrain the market growth over the forecast period.

Microneedle Flu Vaccine Market Trends

Quadrivalent Flu Vaccine Segment is Expected to Projected Significant Growth Over the Forecast Period

The quadrivalent influenza (flu) vaccine protects against four flu viruses, including two influenza A viruses and two influenza B viruses.

The quadrivalent flu vaccine segment accounts for significant revenue in the microneedle flu vaccine market due to its cost-effectiveness, efficacy against viral infections, and easy availability in hospitals and clinics.

According to the CDC, in December 2021, quadrivalent vaccines protected against four flu viruses: an influenza A (H1N1) virus, an influenza A (H3N2) virus, and two influenza B viruses.

Moreover, increasing clinical development of microneedle flu vaccines to check their efficiency and safety is anticipated to boost the segment. For instance, according to ClinicalTrials. Gov updates in February 2022, a study titled "A Clinical Trial of Quadrivalent Influenza Vaccine in Healthy Subjects Aged 6 to 35 Months" was conducted under the evaluation of Sinovac Biotech Co., Ltd to assess the safety and immunogenicity of quadrivalent influenza vaccine in healthy infants aged from 6 to 35 months. Such development creates a huge opportunity for market players to develop a therapeutic approach anticipated to boost the segment.

North America Holds a Significant Share in the Market and is Expected to do so during the Forecast Period

North America currently dominates the market of microneedle flu vaccines and is expected to continue its stronghold for a few more years.

The high prevalence of influenza is expected to drive the regional market over the forecast period. For instance, according to statistics published by MedAlertHelp, in 2022, about 5% to 20% of Americans were diagnosed with influenza yearly. Further, according to the data published by the Centers for Disease Control and Prevention, in October 2021, 35 million flu-related illnesses, 380,000 flu-related hospitalizations, 20,000 flu-related deaths, and 16 million flu-related medical visits were reported in the 2019-2020 season. This growing disease burden is anticipated to impact market growth over the coming years positively.

In North America, the launch of new flu prevention campaigns and initiatives by healthcare organizations is expected to drive demand for influenza vaccines and develop effective vaccination delivery systems. For instance, in October 2021, the CDC and the National Foundation for Infectious Diseases (NFID), along with other public health and medical organizations, jointly announced the opening of the 2020-2021 flu vaccination season, highlighting the importance of vaccination and recommending that everyone six months and older get vaccinated against flu once a year.

Moreover, in December 2022, Vaxess Technologies, Inc., a life sciences company developing a shelf-stable vaccine patch, reported positive interim results from a first-in-man trial of VX-103, a monovalent seasonal influenza vaccine patch. Day 57 results showed that MIMIX (microarray/microneedle)-Flu significantly exceeded the 2007 Food and Drug Administration (FDA) criteria for accelerated licensure of influenza vaccines, with the 15ug and 7.5ug patches leading to seroconversion rates of 85% and 77% respectively along with seroprotection rates of 92%. Vaxess's new GMP facility has successfully produced a clinical trial drug product consisting of a proprietary silk fibroin microneedle patch loaded with influenza vaccine antigens.

Microneedle Flu Vaccine Industry Overview

The microneedle flu vaccine market is consolidated in nature. BD and Sanofi are contributing the maximum in the market in terms of market share. Companies like Sanofi S.A., Debiotech S.A, 3M Company, NanoPass Technologies Limited, Becton, Dickinson and Company, and FluGen, Inc are operating in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Influenza and Viral Infections

- 4.2.2 Key Players Focusing on Research and Development of Micro-Needle Flu Vaccines

- 4.3 Market Restraints

- 4.3.1 Complications and Risks Associated with Microneedles

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Solid Microneedle

- 5.1.2 Hollow Microneedle

- 5.2 By Vaccine Type

- 5.2.1 Trivalent Flu Vaccine

- 5.2.2 Quadrivalent Flu Vaccine

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Debiotech S.A

- 6.1.2 NanoPass Technologies Limited

- 6.1.3 Becton, Dickinson and Company

- 6.1.4 FluGen, Inc

- 6.1.5 CosMED Pharmaceuticals Co., Ltd

- 6.1.6 Microdermics

- 6.1.7 TSRL Inc.

- 6.1.8 Vaxess Technologies