|

시장보고서

상품코드

1910460

액체 도포막 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Liquid Applied Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

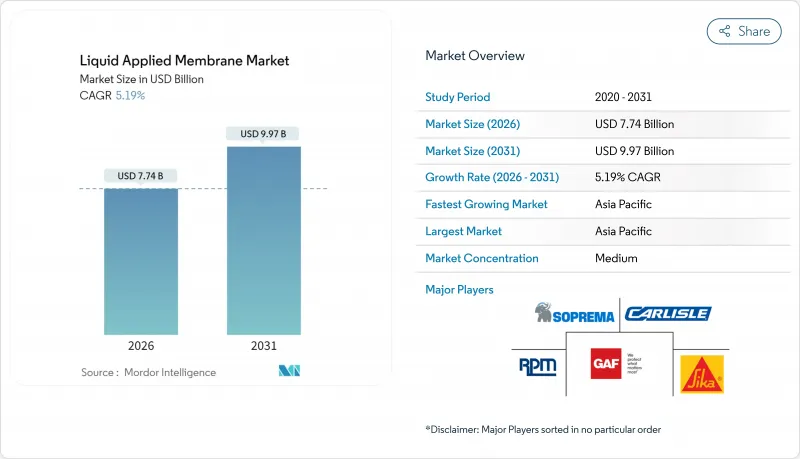

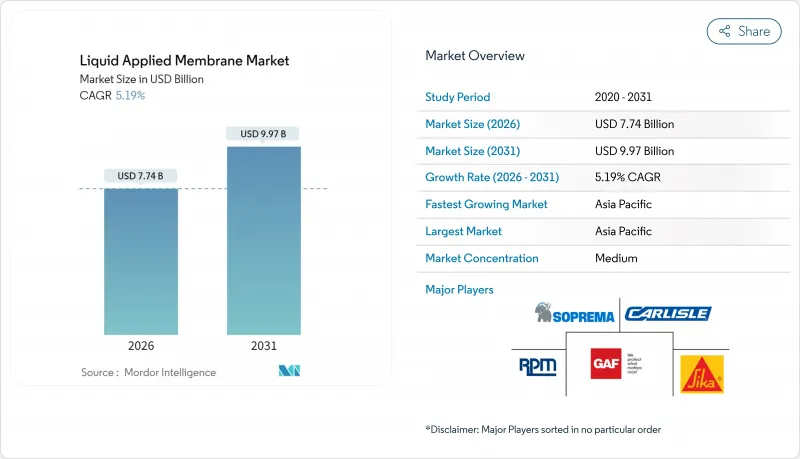

액체 도포막 시장은 2025년에 73억 6,000만 달러로 평가되었으며, 2026년 77억 4,000만 달러, 2031년까지 99억 7,000만 달러에 이를 것으로 예측됩니다. 예측기간(2026-2031년)의 CAGR은 5.19%를 나타낼 전망입니다.

최종 사용자는 롤형 제품에서 원활한 코팅으로의 전환을 계속하고 있습니다. 후자는 균열을 수리하고, 움직임을 견디고, 더 긴 서비스 수명을 실현하기 때문에 라이프 사이클 비용을 줄일 수 있습니다. 중국, 인도, 미국의 인프라 업데이트가 수요를 지원하는 반면, 캘리포니아, 캐나다, 유럽 연합(EU)의 엄격한 저휘발성 유기 화합물(VOC) 규제가 수성 화학제품에 대한 사양 변경을 촉진하고 있습니다. 쿨루프, 태양광발전 통합, 그린루프 조립을 장려하는 건축기준이 더욱 보급을 가속화하고 있습니다. 제조업체는 혼잡한 현장에서의 다운타임을 삭감하는 자기 수복형, 태양광 발전 대응형, 급속 경화형 시스템을 투입하는 것으로, 이익률의 저하에 대항하고 있습니다.

세계 액체 도포막 시장 동향과 인사이트

건물의 장수명화를 위한 방수막의 활용 확대

소유자는 현재 첨단 코팅을 예기치 않은 수리를 억제하는 자본 자산으로 취급하고 있습니다. 오클리지 국립연구소의 시산에 의하면, 상업용 지붕의 수명을 불과 5년 연장하는 것만으로, 미국의 폐기물 처리 코스트를 연간 25억 달러 삭감해, 매립지의 용량도 삭감할 수 있다고 하고 있습니다. MAPEI의 Mapelastic AquaDefense와 같은 액체 시스템은 최대 3.2mm의 균열을 가로 지르고 열 사이클 하에서도 유연성을 유지하기 때문에 지진 다발 지역에서 매력적인 선택입니다. 보험 회사는 소유자가 긴 수명 방수 시트를 지정할 때 보험료 할인을 제공하기 시작했으며 도입을 촉진하는 경제적 인센티브가 추가되었습니다.

성숙 경제권에서 노후화 지붕의 비용 효율적인 리노베이션

캐나다에서는 SOPREMA사가 CF 샴플레인 쇼핑센터의 지붕을 재포장해 전면 철거에 비해 자재비를 45% 삭감, 공사기간을 35% 단축하면서 수명를 더욱 25년 연장했습니다. 코팅은 불규칙한 기초에 밀착되기 때문에 시공업자는 갑판의 철거라는 혼란을 피할 수 있고, 쇼핑몰, 병원, 학교는 영업을 계속할 수 있습니다. 또한 재포장은 폐기물 처리량과 매장탄소량을 삭감하여 시설관리팀이 거액의 설비투자예산 없이 ESG 목표를 달성하는 데 도움이 됩니다.

시트형 및 조립식 방수 시트공급 상황

TPO 등의 열가소성 롤재는 광대한 물류시설에서 시공속도의 우위성을 유지하며, 시공업자는 1시프트당 900㎡ 이상의 시공이 가능합니다. 제조업체는 코팅의 성장에 대응해, 토치 사용 리스크를 저감하는 자기 접착 시트를 발매해, 액체 방수재의 차별화 요인의 하나를 깎았습니다. 그러나, 복잡한 관통부, 수직면에의 접속부, 거주 공간에서의 개수 공사 등, 화기 사용이 금지되는 현장에서는 액체 방수재가 여전히 강한 지지를 얻고 있습니다.

부문 분석

아스팔트계 코팅은 수십년에 걸친 현장 실적과 저단가를 배경으로 2025년의 액체 도포막 시장에서 30.10%의 점유율을 차지했습니다. 폴리우레탄계는 태양광 모듈, 쿨루프 안료, 무브먼트 조인트를 견딜 수 있는 엘라스토머 성능에 CAGR 6.24%로 가치 성장을 견인했습니다.

아크릴계 분산액은 롤러 시공이 가능해 물 세정에 의한 청소가 용이하기 때문에 개수 공사로 채택이 증가하고 있습니다. PMMA(폴리메틸메타크릴레이트)는 30분이라는 단시간에 경화하기 때문에 고교통량의 발코니나 스타디움 콩코스 등, 공기 확실성이 요구되는 현장에서 활용되고 있습니다. 폴리우레탄과 아스팔트의 혼합물이나 폴리우레아 변성 엘라스토머 등의 하이브리드 화학제품은 초단시간에 사용 재개나 한랭지 시공 등 틈새 수요에 대응하여 설계자의 설계 자유도를 확대하고 있습니다.

액체 도포막 시장 보고서는 유형별(시멘트계, 아스팔트계, 폴리우레탄계, 폴리우레아계, 아크릴계 등), 용도별(지붕, 벽, 지하 및 터널, 기타 용도), 최종사용자 섹터별(주택, 상업, 공업, 공공시설 및 인프라), 지역별(아시아태평양, 북미, 유럽) 시장 예측은 금액(달러) 기준으로 제공됩니다.

지역별 분석

아시아태평양은 2025년 세계 수익의 52.70%를 차지했으며 2031년까지 연평균 복합 성장률(CAGR) 6.65%로 확대될 것으로 전망됩니다. 중국 지하철 연신, 인도의 스마트 시티 회랑, ASEAN의 홍수 대책 터널은 함께 수억 평방미터의 방수재가 필요합니다. 현지 개발업체는 EN 14891 및 GB 50108 준수를 점차 요구하고 있으며, 시험 인증서 갱신을 목적으로 수입을 촉진하고 있습니다.

북미 시장은 성숙하면서도 기회 풍부한 영역이며, 지붕 개수가 주류입니다. 미국 지자체에서는 쿨루프 보조금 제도를 확충, 캐나다에서는 2025년 시행의 연방 VOC 규제가 수성 기술 보급을 가속시키고 있습니다. 멕시코 코아차코알코스 침수식 터널에서는 GCP사의 Integritank 시스템이 원활한 부식 방지 대책으로 채택되어 복잡한 프로젝트의 지역 기술력을 뒷받침하고 있습니다.

유럽의 개수 붐은 탈탄소화가 중심이며, 독일의 BEG 보조금 제도에서는 기밀성 향상이 요구되고 유동성 기밀재의 채택이 일반적입니다. 조지아 주가 EU의 VOC 규제 상한을 채택한 것은 규제의 동쪽으로의 조화를 보여줍니다. 중동 및 아프리카는 높은 성장성을 보이는 한편 기후의 극단성이 과제입니다. 두바이의 엑스포시티 공원에서는 45℃의 여름을 초킹(백화 현상) 없이 견디기 위해, 지방족 폴리우레아가 채택되었습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 건물 수명 연장을 위한 방수막 보급 확대

- 선진국 노후 지붕에 대한 비용 효율적 개보수(Retrofit) 수요

- 아시아태평양 및 아프리카의 인프라 정비 급증

- VOC 프리 솔루션을 의무화하는 규제

- 태양광 발전 대응형 액체 지붕재의 급속한 보급

- 시장 성장 억제요인

- 시트 및 조립식 막의 가용성

- 석유화학 원료 가격의 변동성

- 신흥 시장에서의 시공 기술자 부족

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 유형별

- 시멘트계

- 아스팔트

- 폴리우레탄

- 폴리우레아

- 아크릴(분산)

- PMMA

- 하이브리드(폴리우레탄/폴리우레아(PU/PUA), 개질 폴리우레탄-아스팔트계 등)

- 용도별

- 지붕재

- 벽체

- 지하 및 터널

- 기타 용도(바닥, 발코니, 보도, 포디움, 탱크, 식수 탱크, 화분 박스 등)

- 최종 용도 분야별

- 주택용

- 상업용

- 산업용

- 공공시설 및 인프라

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

제7장 시장 기회와 장래의 전망

SHW 26.01.26The Liquid Applied Membrane Market was valued at USD 7.36 billion in 2025 and estimated to grow from USD 7.74 billion in 2026 to reach USD 9.97 billion by 2031, at a CAGR of 5.19% during the forecast period (2026-2031).

End-users continue shifting from roll goods to seamless coatings because the latter bridge cracks, tolerate movement, and deliver longer service life, all of which lower lifecycle costs. Infrastructure renewal programs in China, India, and the United States keep demand resilient, while stringent low-VOC rules in California, Canada, and the European Union tilt specifications toward water-borne chemistries. Architectural codes that reward cool roofs, photovoltaic integration, and green-roof assemblies further accelerate uptake. Manufacturers counter margin pressure by launching self-healing, PV-ready, and rapid-cure systems that cut downtime on congested job sites.

Global Liquid Applied Membrane Market Trends and Insights

Growing Usage of Waterproofing Membranes for Building Longevity

Owners now treat advanced coatings as capital assets that curb unplanned repairs. Oak Ridge National Laboratory estimates that extending commercial roof life by just five years could trim United States disposal costs by USD 2.5 billion annually while cutting landfill volume. Liquid systems such as MAPEI's Mapelastic AquaDefense bridge cracks up to 3.2 mm and remain flexible under thermal cycling, making them attractive in seismic zones. Insurance carriers have begun offering premium discounts when owners specify long-life membranes, adding a financial incentive that reinforces adoption.

Cost-Effective Retrofitting for Aging Roofs in Mature Economies

In Canada, SOPREMA resurfaced the CF Champlain shopping center roof, slicing material spend 45% and shortening construction schedules 35% versus full tear-off, all while extending service life another 25 years. Because coatings conform to irregular substrates, contractors avoid disruptive deck removal, allowing malls, hospitals, and schools to stay open. Resurfacing also reduces waste disposal volume and embodied carbon, helping facilities teams achieve ESG goals without large cap-ex budgets.

Availability of Sheet and Prefabricated Membranes

Thermoplastic rolls such as TPO retain a labor-speed edge on wide-open logistics buildings, enabling contractors to install over 900 m2 per shift. Manufacturers responded to coating growth by launching self-adhered sheets that reduce torch risk, eroding one differentiator of liquids. Nonetheless, liquids hold strong in complex penetrations, vertical transitions, and occupied retrofits where flame-free work is mandatory.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Boom in Asia-Pacific and Africa

- Regulations Mandating VOC-Free Solutions

- Applicator Skill Shortages in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bituminous coatings accounted for 30.10% of the liquid-applied membranes market share in 2025, reflecting decades of field data and low unit cost. Polyurethane led value growth at a 6.24% CAGR, supported by elastomeric performance that tolerates solar modules, cool-roof pigments, and movement joints without embrittlement.

Acrylic dispersions gain traction in refurbishments because crews can apply them with rollers and clean up using water. PMMA fills high-traffic balconies and stadium concourses where rapid 30-minute cure delivers schedule certainty. Hybrid chemistries such as polyurethane-bitumen blends and polyurea-modified elastomers address niche demands for ultra-fast return-to-service or cold-weather application, expanding design flexibility for specifiers.

The Liquid-Applied Membranes Report is Segmented by Type (Cementitious, Bituminous, Polyurethane, Polyurea, Acrylic, and More), Application (Roofing, Walls, Underground and Tunnels, and Other Applications), End-User Sector (Residential, Commercial, Industrial, and Institutional and Infrastructure), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 52.70% of 2025 global revenue and is expected to climb at a 6.65% CAGR through 2031. Chinese metro extensions, Indian smart-city corridors, and ASEAN flood-control tunnels collectively require hundreds of millions of square meters of waterproofing. Local developers increasingly demand EN 14891 and GB 50108 compliance, pushing imports to upgrade testing certificates.

North America represents a mature but opportunity-rich arena dominated by reroofing. U.S. municipalities expand cool-roof rebates, while Canada's federal VOC rule effective 2025 accelerates water-borne technology penetration. Mexico's Coatzacoalcos immersed-tube tunnel specified GCP's Integritank system for seamless corrosion protection, underscoring regional competence in complex projects.

Europe's renovation wave centers on decarbonization, with Germany's BEG subsidy requiring airtightness upgrades that often incorporate fluid air-barriers. Georgia's adoption of EU VOC caps signals regulatory harmonization eastward. Middle East and Africa present high growth but challenging climatic extremes; Dubai's Expo City parks selected aliphatic polyurea to survive 45 °C summers without chalking.

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Waterproofing Membranes for Building Longevity

- 4.2.2 Cost-Effective Retrofitting for Aging Roofs in Mature Economies

- 4.2.3 Infrastructure Boom in APAC And Africa

- 4.2.4 Regulations Mandating VOC-Free Solutions

- 4.2.5 Rapid Adoption of PV-Ready Liquid Roof Skins

- 4.3 Market Restraints

- 4.3.1 Availability of Sheet and Prefabricated Membranes

- 4.3.2 Volatile Petrochemical Feedstock Prices

- 4.3.3 Applicator Skill Shortages in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Cementitious

- 5.1.2 Bituminous

- 5.1.3 Polyurethane

- 5.1.4 Polyurea

- 5.1.5 Acrylic (Dispersion)

- 5.1.6 PMMA

- 5.1.7 Hybrid (polyurethane/polyurea (PU/PUA), modified polyurethane-bituminous, etc.)

- 5.2 By Application

- 5.2.1 Roofing

- 5.2.2 Walls

- 5.2.3 Underground and Tunnels

- 5.2.4 Other Applications (Floors, Balconies, Walkways, Podiums, Tanks, Potable Water Tanks, Planter Boxes, etc.)

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional and Infrastructure

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alchimica

- 6.4.2 ARDEX Group

- 6.4.3 Bostik

- 6.4.4 Carlisle Companies Incorporated

- 6.4.5 Fosroc Inc.

- 6.4.6 GAF Materials LLC

- 6.4.7 HB Fuller

- 6.4.8 Holcim

- 6.4.9 Johns Manville

- 6.4.10 MAPEI SpA

- 6.4.11 RPM INTERNATIONAL INC.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 SOPREMA Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment