|

시장보고서

상품코드

1850286

농장 관리 소프트웨어 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Farm Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

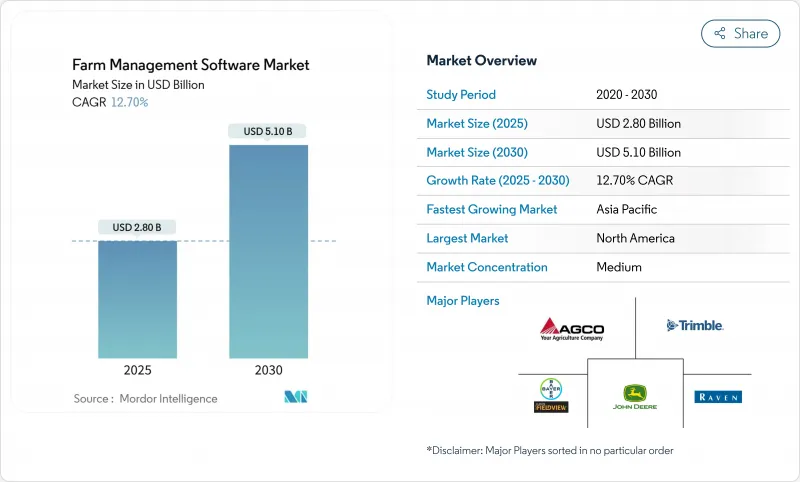

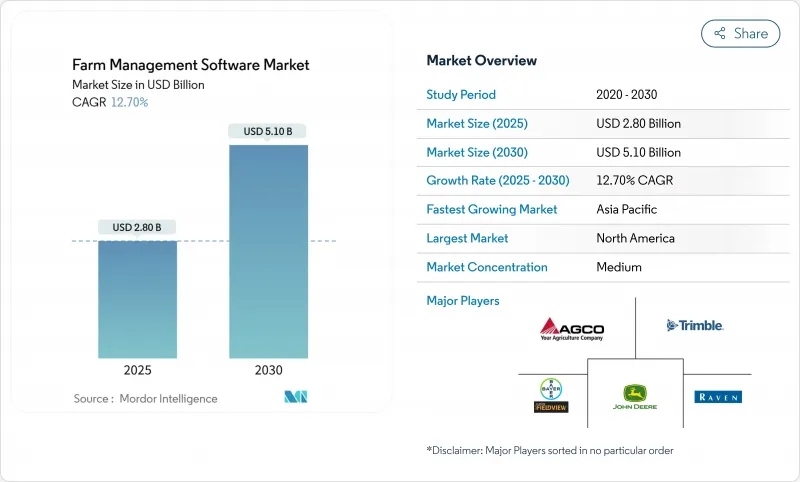

농장 관리 소프트웨어 시장 규모는 2025년에 28억 달러로 평가되었고, 2030년에는 51억 달러에 이를것으로 예측되며, CAGR은 12.70%를 나타낼 전망입니다.

두 자릿수 성장세는 전 세계 농업이 직면한 복합적 압박에서 비롯됩니다. 구조적 농업 인력 부족, 경작지 감소, 기후 변화로 인한 생산 위험, 그리고 하류 구매자를 위한 지속가능성 지표 검증 필요성 등이 그것입니다. 클라우드 기반 플랫폼이 현재 시장을 주도하는 이유는 초기 자본 지출을 낮추고, 업그레이드를 자동화하며, 모든 규모의 농장이 센서, 기계, 위성, 기상 데이터를 실시간으로 통합할 수 있게 하기 때문입니다. 정밀 농업이 주요 활용 사례로 남아 있지만, 지속 가능한 단백질 수요가 생산자들을 데이터 기반 수질 및 사료 효율성 관리로 이끌면서 양식 소프트웨어가 가장 빠른 성장을 기록하고 있습니다. 아시아태평양 지역은 대규모 공공 디지털 농업 프로그램 덕분에 가장 높은 성장률을 보이며, 북미는 초기 도입과 확고한 딜러 지원 네트워크를 바탕으로 매출 선두를 유지하고 있습니다. 장비 제조사, 투입재 공급업체, 스타트업들이 반복적인 구독 수익을 확보하고 농장 관리 소프트웨어 시장을 광범위한 농업 기술 스택의 중심에 위치시키기 위해 오픈 API 생태계 구축을 경쟁적으로 추진하면서 경쟁 강도가 높아지고 있습니다.

세계의 농장 관리 소프트웨어 시장 동향 및 인사이트

농가의 노동력 부족과 경작지 감소가 기계화 촉진

농장 관리 소프트웨어는 자율 주행 트랙터, 로봇 수확기, 정밀 살포기를 조정하는 디지털 백본 역할을 하여 기존 인력보다 낮은 인건비로 24시간 운영을 가능하게 합니다. Bluewhite의 애프터마켓 자율 주행 키트는 장비 경로를 계획하고 실시간에 가까운 기계 상태를 모니터링하는 클라우드 대시보드를 통해 통합될 경우 한 시즌 내 투자 회수가 가능합니다. 토지 가용성이 줄어들면서 생산자들은 상세한 지리공간 분석을 기반으로 한 가변적 처방으로 에이커당 수확량을 극대화합니다. 글로벌 수확 자동화 이니셔티브(GHAI)는 10년 내 미국 특수 작물 수확의 절반을 기계화하는 것을 목표로 하며, 이는 역동적인 현장 조건에서 다중 자율 장비를 동기화할 수 있는 데이터 조정 플랫폼의 광범위한 배포를 전제로 합니다. 노동력 부족과 토지 압박의 교차점은 농장 관리 소프트웨어 시장을 선택적 기술이 아닌 핵심 인프라로 확고히 합니다.

정밀 농업 기술의 급속한 통합이 플랫폼 수요를 창출

농장 내 센서, 드론 영상, 기계 원격 측정 장치의 폭발적 증가로 페타바이트 규모의 데이터가 생성되며, 이는 시의적절한 현장 의사결정을 지원하기 전에 통합되어야 합니다. 가변적 파종률과 센서 기반 비료 조정을 결합한 초기 도입자들은 수확량을 유지하면서 농약 및 영양분 사용량을 최대 80% 절감했다고 보고했으며, 이로 인해 소프트웨어 구독 비용을 2년 만에 회수할 수 있었습니다. 농장 관리 플랫폼은 점차 통합 허브 역할을 수행하며, 토양 수분 프로브, 기상 관측소, 엔진 CAN 버스 데이터를 통합된 대시보드로 융합합니다. 100만 에이커 이상에 도입된 존 디어의 ‘시 앤 스프레이(See and Spray)’ 기술은 알고리즘 제어 타겟팅이 제초제 사용량을 대폭 줄이면서 동시에 탄소 발자국을 감소시키는 방식을 보여줍니다. 유럽연합(EU)은 2024년부터 2027년까지 274,000개 농장에 유사한 디지털 인프라를 확장하기 위해 ‘호라이즌 유럽’ 기금을 배정했으며, 이는 혼합 차량 및 공급업체 생태계 전반에서 데이터 상호운용성을 유지하는 소프트웨어 계층에 대한 수요를 증폭시키고 있습니다. 하드웨어 다양성이 확대됨에 따라 오픈 API 중심의 농장 관리 소프트웨어가 자연스러운 제어 센터로 부상하고 있습니다.

소규모 농가의 지배적 지위가 소프트웨어 투자 수익률을 제한

전 세계 농지 소유의 80%를 차지하는 소규모 농가들은 종종 5헥타르 미만의 경작지를 운영하며, 포괄적인 소프트웨어 구독 비용을 상쇄하기에 부족한 수익을 창출합니다. 사하라 이남 아프리카의 종단 연구에 따르면 신용 접근성, 디지털 리터러시, 기술 보급 지원이 기술 도입의 결정적 요인이며, 어느 한 측면의 결핍도 도입을 좌초시킵니다. 켄터키주 조사에서는 경작 면적과 정밀 기술 도입 간 긍정적 상관관계가 확인된 반면, 고령 농민층은 비용-편익 설명 후에도 디지털 인터페이스 수용을 꺼리는 것으로 나타났다. 라틴아메리카 평가에서는 뿌리 깊은 관행과 불안정한 통신 환경이 추가 장벽으로 부각되었습니다. 결과적으로 농장 관리 소프트웨어 시장은 양극화된 성장을 보이며, 대규모 상업 농가의 강력한 수요와 아시아·아프리카 식량 체계를 주도하는 생계형 소규모 농가의 느린 보급률로 구분됩니다.

부문 분석

클라우드 배포는 2024년 최대 매출을 기록하며 농장 관리 소프트웨어 시장 점유율의 52%를 차지했으며, 해당 연도 14억 6천만 달러에 달했습니다. 2030년까지 연평균 17.40%의 성장률을 보일 것으로 전망됩니다. 클라우드 내에서는 자동 업데이트로 다운타임을 제거하고, 멀티 테넌트 아키텍처로 고정 비용을 수천 명의 사용자에게 분산할 수 있기 때문에 SaaS(서비스형 소프트웨어) 구독이 주류를 이루고 있습니다. 데이터 주권 요구사항이 엄격한 기업에는 여전히 로컬 및 웹 기반 시스템이 사용되나, 농촌 지역 대역폭 개선으로 해당 틈새 시장은 축소되고 있습니다. 존 디어의 운영 센터는 클라우드 통합이 단일 테넌트 로컬 배포로는 불가능한 농장 간 벤치마킹을 가능케 하는 사례를 보여줍니다. 보안 프로토콜은 필드 수준 암호화 및 다중 인증을 포함하도록 성숙해 초기 도입 망설임을 해소했습니다.

네트워크 효과는 데이터 양이 증가할수록 머신러닝 알고리즘의 정확도가 높아짐에 따라 클라우드의 가치를 증폭시킵니다. 500만 개의 익명화된 샘플로 훈련된 토양 유기탄소 예측기는 실험실 테스트 비용을 60% 절감했으며, 이러한 이점은 사용자를 원본 생태계 내에 유지시킵니다. 독립 개발자들이 지역별 관개 스케줄러와 같은 마이크로 서비스를 출시함에 따라, PaaS(Platform as a Service) 계층에 기인한 농장 관리 소프트웨어 시장 규모는 2030년까지 상승할 것으로 전망됩니다. 이러한 마이크로 서비스는 복잡한 코딩 없이도 통합 대시보드에 연결됩니다. 현재 공급업체 간 경쟁은 오픈 API 라이브러리와 타사 앱을 위한 수익 공유 프레임워크에 집중되어 클라우드 모델의 전략적 중요성을 강화하고 있습니다.

지역 분석

북미는 시장 수익의 34%를 차지하며 최대 수익 기여 지역으로 남아 있습니다. 이는 현장 장비가 이미 원격 측정 기능이 탑재된 상태로 공급되어 플랫폼 활성화가 용이하기 때문입니다. 미국 농무부(USDA)의 기후 스마트 상품(Climate-Smart Commodities) 배분은 규정 준수 모듈 수요를 촉진하며, 딜러 네트워크는 현장 교육을 제공하여 기술 격차를 해소합니다. 옥수수 벨트 기업들의 클라우드 보급률은 70%를 초과하며, 농장들은 매출의 2-5%를 디지털 도구에 투자하여 이 지역의 우위를 공고히 하고 있습니다. 초기 도입자들이 시장을 포화시키면서 성장률은 연평균 11.10%로 완화되지만, 특수 작물 및 재생 농업 관행 검증 분야에서 기회는 지속됩니다.

아시아태평양 지역은 16.20% CAGR로 글로벌 성장을 주도하며, 중국·인도·동남아시아 국가들의 정책 지원 디지털화 프로그램의 혜택을 받습니다. 인도의 64억 달러 규모 '디지털 농업 미션'은 400개 지역에 걸쳐 센서 데이터와 위성 이미지를 통합해 수천만 소규모 농가의 플랫폼 비용을 실질적으로 지원합니다. 중국 지방 시범 사업은 농장 소프트웨어를 금융 서비스 워크플로우에 통합해 검증된 수확량 예측에 기반한 투입재 대출을 가능케 합니다. 벤처 투자는 탄력성을 유지했으며, 2024년 지역 농장 소프트웨어 스타트업들은 전반적인 농업식품 기술 투자 축소에도 불구하고 3억 달러를 조달했습니다. 그러나 5헥타르 미만 농장 구조는 시장 침투를 제한합니다. 월 30달러 패키지 비용이 순농가소득을 초과하는 경우가 많아 생계형 농업 운영자들의 도입 속도가 더딘 이유입니다.

유럽의 9.40% 연평균 성장률은 디지털 기록 관리에 대한 공동농업정책(CAP) 규정의 지원으로 일관되지만 성숙한 도입을 반영합니다. 호라이즌 유럽(Horizon Europe) 보조금은 통합 소프트웨어 기반이 필요한 정밀농업 시범사업에 7억 유로(8억 300만 달러)를 지원합니다. 프랑스의 대규모 현장 시범사업(Large-Scale Field Demo)과 같은 국가 프로그램은 장비 보조금과 의무적 데이터 공유 체계를 결합하여 개방형 표준 플랫폼을 더욱 공고히 합니다. 소규모 가족 농장은 세대 교체의 어려움을 겪고 있으며, 다세대 간 지식 전수를 단순화하는 디지털 도구가 주목받고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 농업노동력 부족과 경작지 감소

- 정밀농업기술의 급속한 통합

- 정부의 디지털 농업 인센티브와 보조금

- 실시간 농업 의사 결정 지원 수요

- FMS 플랫폼을 통한 탄소 배출권 수익화

- 슈퍼앱 농업 플랫폼을 가능케 하는 오픈 API 생태계

- 시장 성장 억제요인

- 소규모 농가의 우위성

- 높은 초기 소프트웨어, 하드웨어 및 교육 비용

- 농가의 데이터 프라이버시와 사이버 보안 우려

- 농촌 지역의 농업 데이터 사이언스 인력 부족

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- 로컬/웹 기반

- 클라우드 기반

- 서비스형 소프트웨어(SaaS)

- 서비스형 플랫폼(PaaS)

- 용도별

- 정밀 농업

- 가축 모니터링

- 스마트 온실

- 양식업

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 케냐

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Trimble Inc.

- Climate LLC.(Bayer AG)

- Farmers Edge Inc.

- Deere & Company

- AGCO Corporation

- Raven Industries(CNH Industrial)

- Topcon Corp.

- AGRIVI Ltd.

- CropX Technologies Ltd.

- Traction Ag Inc.

- SemiosBio Technologies

- CropZilla Software Inc.

- BASF Digital Farming GmbH(BASF SE)

- Ag Leader Technology(Ag Leader)

- Eagle IoT(Bentley Systems)

제7장 시장 기회와 장래의 전망

HBR 25.11.19The farm management software market size is valued at USD 2.80 billion in 2025 and is forecast to reach USD 5.10 billion by 2030, expanding at a 12.70% CAGR.

Solid double-digit growth stems from converging pressures on global agriculture: structural farm-labor shortages, shrinking arable land, climate-induced production risk, and the need to verify sustainability metrics for downstream buyers. Cloud-delivered platforms dominate current deployments because they lower upfront capital outlays, automate upgrades, and allow farms of every size to integrate sensor, machine, satellite, and weather data in real time. Precision farming remains the primary use case, yet aquaculture software is registering the fastest growth as demand for sustainable protein pushes producers toward data-driven water-quality and feed-efficiency management. Asia-Pacific is the highest-growth region thanks to large-scale public digital-agriculture programs, while North America remains the revenue leader on the strength of early adoption and entrenched dealer support networks. Competitive intensity is rising as equipment manufacturers, input suppliers, and start-ups race to build open-API ecosystems that lock in recurring subscription revenue and position the farm management software market at the center of the broader ag-tech stack.

Global Farm Management Software Market Trends and Insights

Farm-Labor Shortage and Decreasing Arable Land Push Mechanization

Farm management software acts as the digital backbone that coordinates autonomous tractors, robotic harvesters, and precision sprayers, allowing 24-hour operation with lower labor costs than traditional crews. Bluewhite's aftermarket autonomy kits demonstrate a full season payback when integrated through cloud dashboards that schedule equipment routes and monitor near-real-time machine health. As land availability tightens, producers maximize yield per acre through variable rate prescriptions driven by detailed geospatial analytics. The Global Harvest Automation Initiative targets mechanizing half of the United States specialty-crop harvesting within a decade, a goal that presumes wide deployment of data-orchestrating platforms able to synchronize multiple autonomous units across dynamic field conditions. The intersection of labor shortages and land pressure cements the farm management software market as critical infrastructure rather than optional technology.

Rapid Integration of Precision-Agriculture Technologies Creates Platform Demand

The explosive growth of on-farm sensors, drone imagery, and machine telemetry generates petabytes of data that must be harmonized before it can guide timely field decisions. Early adopters who combined variable rate seeding with sensor-driven fertilizer adjustments reported pesticide and nutrient savings up to 80% while maintaining yield, enabling two-year payback periods on software subscriptions. Farm management platforms increasingly serve as integration hubs, merging soil-moisture probes, weather stations, and engine CAN bus feeds into cohesive dashboards. John Deere's See and Spray technology, deployed on more than 1 million acres, underscores how algorithm-controlled targeting slashes herbicide use while simultaneously reducing carbon footprint. The European Union earmarked Horizon Europe funds to extend similar digital infrastructure to 274,000 farms between 2024 and 2027, amplifying demand for software layers that maintain data interoperability across mixed fleets and vendor ecosystems. As hardware diversity expands, open-API-oriented farm management software becomes the natural control center.

Dominance of Smallholder Farms Limits Software Return on Investment

Smallholders account for 80% of global farm holdings, yet often cultivate plots under five hectares, generating revenue insufficient to offset comprehensive software subscriptions. Longitudinal studies in Sub-Saharan Africa show that credit access, digital literacy, and extension support are decisive factors in technology uptake, and deficits in any one dimension derail adoption. Surveys in Kentucky confirm positive correlations between acreage and precision-tech adoption, while older farmer demographics resist digital interfaces even after cost-benefit explanations. Latin American evaluations highlight entrenched cultural practices and unreliable connectivity as additional barriers. Consequently, the farm management software market sees bifurcated growth, with robust demand from large commercial growers and slower penetration among subsistence-oriented smallholders that dominate food systems in Asia and Africa.

Other drivers and restraints analyzed in the detailed report include:

- Government Digital-Agriculture Incentives Accelerate Platform Adoption

- Demand for Real-Time Agronomic Decision Support Drives Platform Sophistication

- High Upfront Software, Hardware, and Training Costs Create Adoption Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment registered the largest 2024 revenue and held 52% of the farm management software market share, translating to USD 1.46 billion that year, and is forecast to expand at a 17.40% CAGR through 2030. Within the cloud, Software-as-a-service subscriptions dominate because automatic updates eliminate downtime, and multi-tenant architecture spreads fixed costs over thousands of users. Local and web-based systems continue to serve enterprises with strict data sovereignty requirements, yet bandwidth upgrades across rural corridors shrink that niche. John Deere's Operations Center illustrates how cloud aggregation allows cross-farm benchmarking that single-tenant local deployments cannot match. Security protocols have matured to include field-level encryption and multi-factor authentication, easing earlier adoption hesitations.

Network effects amplify the value of the cloud because machine-learning algorithms grow more accurate as data volumes compound. A soil-organic-carbon predictor trained on 5 million anonymized samples cut lab-testing costs by 60%, an advantage that keeps users inside the originating ecosystem. The farm management software market size attributed to Platform as a Service layer is projected to climb through 2030 as independent developers roll out micro-services, for example, localized irrigation schedulers, that plug into overarching dashboards without heavy coding requirements. Vendor competition now centers on open-API libraries and revenue-sharing frameworks for third-party apps, reinforcing the cloud model's strategic importance.

The Farm Management Software Market is Segmented by Type (Local/Web-based and Cloud-Based), Application (Precision Farming, Livestock Monitoring, Smart Greenhouse, Aquaculture, and Other Applications), and Geography (North America, South America, Europe, Asia-Pacific, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest revenue contributor, accounting for 34% in market revenue, in part because field equipment already arrives telemetry-ready, making platform activation straightforward. The USDA's Climate-Smart Commodities allocations drive demand for compliance modules, while dealer networks provide on-site training that bridges skill gaps. Cloud penetration exceeds 70% among corn belt enterprises, and farms devote 2-5% of revenue to digital tools, cementing the region's primacy. Growth moderates to 11.10% CAGR because early adopters saturate the market, yet opportunities persist in specialty crops and regenerative-practice verification.

Asia-Pacific propels global growth with a 16.20% CAGR and benefits from policy-backed digitalization programs in China, India, and Southeast Asian nations. India's USD 6.40 billion Digital Agriculture Mission aims to integrate sensor data and satellite imagery across 400 districts, effectively underwriting platform costs for tens of millions of smallholders. Chinese provincial pilots embed farm software into financial services workflows, enabling input loans contingent on verified yield forecasts. Venture investment remained resilient, with regional farm-software start-ups raising USD 300 million in 2024 despite broader agrifood-tech funding contraction. Nevertheless, sub-five-hectare farm structures constrain addressable penetration; packages priced at USD 30 per month often exceed net farm income, explaining slower uptake among subsistence operators.

Europe's 9.40% CAGR reflects consistent but mature adoption, bolstered by Common Agricultural Policy stipulations for digital record keeping. Horizon Europe grants channel EUR 700 million (USD 803 million) into precision-farming pilots that require integrated software backbones. National programs such as France's Large-Scale Field Demo initiative couple equipment subsidies with mandatory data-sharing frameworks, further entrenching open-standards platforms. Smaller family farms face succession challenges, and digital tools that simplify multi-generational knowledge transfer gain traction.

- Trimble Inc.

- Climate LLC. (Bayer AG)

- Farmers Edge Inc.

- Deere & Company

- AGCO Corporation

- Raven Industries (CNH Industrial)

- Topcon Corp.

- AGRIVI Ltd.

- CropX Technologies Ltd.

- Traction Ag Inc.

- SemiosBio Technologies

- CropZilla Software Inc.

- BASF Digital Farming GmbH (BASF SE)

- Ag Leader Technology (Ag Leader)

- Eagle IoT (Bentley Systems)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Farm-labor shortage and decreasing arable land

- 4.2.2 Rapid integration of precision-agriculture technologies

- 4.2.3 Government digital-agriculture incentives and subsidies

- 4.2.4 Demand for real-time agronomic decision support

- 4.2.5 Monetization of carbon credits through FMS platforms

- 4.2.6 Open-API ecosystems enabling super-app farm platforms

- 4.3 Market Restraints

- 4.3.1 Dominance of smallholder farms

- 4.3.2 High upfront software, hardware and training costs

- 4.3.3 Farmer data-privacy and cyber-security concerns

- 4.3.4 Shortage of ag-data science talent in rural areas

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Local/Web-based

- 5.1.2 Cloud-based

- 5.1.2.1 Software as a Service (SaaS)

- 5.1.2.2 Platform as a Service (PaaS)

- 5.2 By Application

- 5.2.1 Precision Farming

- 5.2.2 Livestock Monitoring

- 5.2.3 Smart Greenhouse

- 5.2.4 Aquaculture

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Spain

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 Rest of Asia-Pacific

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Turkey

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Kenya

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market-level overview, core segments, financials as available, strategic information, market rank/share, products and services, and recent developments)

- 6.4.1 Trimble Inc.

- 6.4.2 Climate LLC. (Bayer AG)

- 6.4.3 Farmers Edge Inc.

- 6.4.4 Deere & Company

- 6.4.5 AGCO Corporation

- 6.4.6 Raven Industries (CNH Industrial)

- 6.4.7 Topcon Corp.

- 6.4.8 AGRIVI Ltd.

- 6.4.9 CropX Technologies Ltd.

- 6.4.10 Traction Ag Inc.

- 6.4.11 SemiosBio Technologies

- 6.4.12 CropZilla Software Inc.

- 6.4.13 BASF Digital Farming GmbH (BASF SE)

- 6.4.14 Ag Leader Technology (Ag Leader)

- 6.4.15 Eagle IoT (Bentley Systems)