|

시장보고서

상품코드

1445936

세계 먼지 제어 시스템 및 억제 화학제품 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Dust Control Systems And Suppression Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

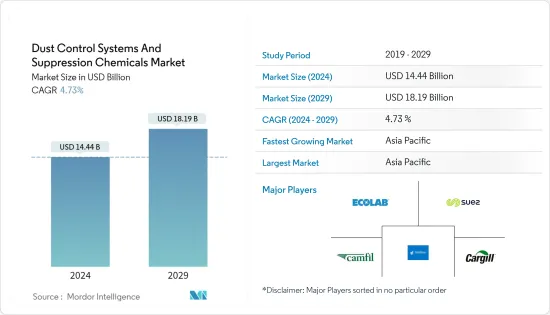

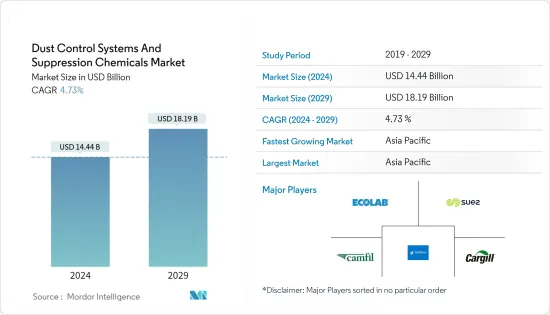

먼지 제어 시스템 및 억제 화학제품 시장 규모는 2024년에 144억 4,000만 달러로 추정되고, 2029년까지 181억 9,000만 달러에 달할 것으로 예측되고 있으며, 예측기간(2024년부터 2029년) 중 복합 연간 성장률(CAGR) 4.73%로 성장할 전망입니다.

COVID-19의 유행은 시장에 부정적인 영향을 미쳤습니다. 그러나 시장은 전염병 이전 수준에 도달하고 예측 기간 동안 꾸준히 성장할 것으로 예상됩니다.

주요 하이라이트

- 단기적으로 시장 성장을 이끌어내는 주요 요인은 아시아태평양의 건설 및 인프라 성장과 규제 준수 강화입니다.

- 식품 및 의약품 산업의 집진 문제는 시장 성장을 방해할 것으로 예상됩니다.

- 아시아태평양은 전 세계 시장을 독점하고 있으며 가장 큰 소비는 중국과 인도에서 왔습니다.

먼지 제어 시스템 및 억제 화학제품 시장 동향

건설 업계가 시장을 독점

- 분진 대책은 정세나 공기중을 이동하는 분진에 의한 대기 오염이나 수질 오염의 가능성이 있는 건설 현장에 적용할 수 있습니다.

- HSE 통계(영국 정부의 안전 및 위생 행정 통계)에 따르면 매년 세계 500명 이상의 건설 근로자가 실리카 먼지에 노출되어 사망합니다. 따라서, 유해한 분진의 배출을 규제하는 것이 중요해져, 최근 몇 년간 먼지 제어 시스템 및 억제 화학제품에 대한 큰 수요가 태어났습니다.

- 기존의 공정에 비해 먼지 억제 솔루션은 시공이 간단하고 극한의 기후 조건에서도 수명이 길어지는 등 건설 용도에 명확한 이점과 큰 이점을 제공합니다.

- 현재 건설 현장과 주요 간선 도로, 고속도로에서 운송 도로, 산업용 도로, 시골도, 주기장, 하드 스탠드에 이르기까지 모든 유형의 도로에서 다양한 분진 제어 문제를 해결할 수 있는 최첨단 분진 제어 솔루션 존재합니다.

- 염화칼슘은 건설 산업에서 사용되는 주요 먼지 억제 화학 물질입니다. 게다가 건설 산업에서는 운반 도로와 접근 도로를 안정시키기 위해 고분자 에멀젼이 사용됩니다.

- 미국은 760만 명 이상의 직원을 고용하는 거대한 건설 부문을 자랑합니다. 미국 인구조사국에 따르면 2022년 건설액은 1조 7,929억 달러로 2021년 1조 6,264억 달러에 비해 10.2% 증가했습니다.

- 또한 미국 인구조사국이 작성한 추가 통계에 따르면 미국의 연간 신축건설액은 2021년 1조 4,998억 2,200만 달러에 비해 2022년에는 1조 6,575억 9,000만 달러에 달했습니다. 게다가 미국의 연간 주택건설은 국내에서 실시된 비주택건설의 연간 가치는 2021년 7,591억 7,700만 달러에 비해 2022년에는 8,084억 2,700만 달러로 2021 연간 7,406억 4,500만 달러에 비해 2022년 비주택 건설의 가치는 8,491억 6,400만 달러에 달했습니다. 시장 소비를 단기적으로 조사했습니다.

- 또한 아시아태평양에서 외국 기업의 존재감이 증가함에 따라 새로운 사무실, 건물, 생산 하우스 등 수요가 탄생하여이 지역의 건설 부문을 견인하고 있습니다.

- 이러한 요인은 건설 업계가 시장을 독점 할 가능성이 높습니다.

중국이 아시아태평양 시장을 독점으로

- 중국의 건설 업계는 항대채무위기를 겪고 있으며 앞으로 잠시 쇠퇴할 것으로 예상됩니다.

- 이 국가는 주로 환경에 대한 우려와 기후 목표를 이유로 지난 몇 년동안 석탄 소비를 줄이는 데 주력해 왔습니다.

- 국내 생산량 감소로 인한 석탄 수입 증가로 정부는 이 조치를 취했습니다.

- 이 나라에서 승인된 신규 탄광은 석탄전용 생산기지에서의 산출량의 통합을 목표로 하는 국가전략에 힘입어 신강, 내몽골, 산서성, 산시성의 지역에 있습니다.

- 이 새로운 광산은 기존 탄광의 확장을 위해 계획됩니다. 이 나라에서는 이러한 새로운 광산의 개발 및 운영을 위해 먼지 제어 시스템 및 억제 화학제품에 대한 높은 수요가 전망되고 있습니다.

- 이 나라의 인구동태는 주택과 상업건설활동에 유리할 것으로 예상됩니다. 인구가 증가함에 따라 민간 부문의 저렴한 주택 식민지에 대한 투자가 활발 해지고 있습니다. 중국 정부는 솔선하여 40개 주요 도시에 약 1,300만 명이 거주할 수 있다고 가정되는 650만 호의 정부 보조 임대 주택을 증정했습니다.

- 게다가 중국 정부는 대규모 건설 계획을 개발하고 있으며, 향후 10년간 2억 5천만 명의 농촌 주민들이 새로운 대도시로 이동할 준비를 포함하고 있으며, 건설 중의 다양한 용도에 미래에 사용되는 건축자재의 큰 범위가 태어났습니다. 건물의 특성을 높이는 활동. 홍콩 주택 당국은 저비용 주택 건설을 홍보하기 위한 몇 가지 조치를 시작했습니다. 정부 당국은 2030년까지 10년간 30만 1,000호의 공영 주택을 공급하는 것을 목표로 하고 있습니다. 이러한 요인으로 인해 국내 건설 업계가 성장할 것으로 예상되며, 이에 따라 미래 조사되는 시장 수요를 뒷받침할 가능성이 높습니다.

- 따라서 다양한 최종 사용자 산업의 성장으로 다양한 용도를 위한 방진 시스템 및 화학 억제제에 대한 수요가 높아지고 있습니다.

먼지 제어 시스템 및 억제 화학제품 업계의 개요

먼지 제어 시스템 및 억제 화학제품 시장은 매우 적은 수의 선수들 사이에서 부분적으로 통합됩니다. 먼지 억제 시스템 시장의 다른 유명한 기업은 Cargill Incorporated, SUEZ, Ecolab, Camfil, Donaldson Company Inc. 등을 포함합니다(순수 부동).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 아시아태평양의 건설 및 인프라 성장

- 규제 준수 증가

- 기타 촉진요인

- 억제요인

- 식품 및 제약 업계의 집진 문제

- 기타 억제요인

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화(금액 베이스 시장 규모)

- 화학 유형

- 리그닌술폰산염

- 염화칼슘

- 염화마그네슘

- 아스팔트 유제

- 유유제

- 폴리머 에멀젼

- 기타

- 시스템 유형

- 건식 컬렉션

- 습식 억제

- 최종 사용자 산업

- 광업

- 건설

- 식품 및 음료

- 석유 및 가스, 석유화학

- 의약품

- 기타

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 합병과 인수, 합작사업, 협업 및 계약

- 시장 점유율(%)/랭킹 분석

- 유력 기업이 채용한 전략

- 기업 프로파일

- Chemical Providers

- ADM

- Benetech Inc.

- Borregaard

- Cargill Incorporated

- Chemtex Speciality Limited

- Evonik Industries AG

- GelTech Solutions

- Hexion

- Quaker Houghton(Quaker Chemical Corporation)

- Shaw Almex Industries Ltd

- SUEZ

- Ecolab

- System Providers

- BossTek

- Camfil

- CW Machine Worx

- Donaldson Company Inc.

- DSH Systems Ltd

- Duztech AB

- Nederman Holding AB

- SLY Inc.

- The ACT Group

- Chemical Providers

제7장 시장 기회와 미래 동향

BJH 24.03.15The Dust Control Systems And Suppression Chemicals Market size is estimated at USD 14.44 billion in 2024, and is expected to reach USD 18.19 billion by 2029, growing at a CAGR of 4.73% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. However, the market is reaching pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- Over the short term, the major factors driving the growth of the market are the growth in construction and infrastructure in Asia-Pacific and the increasing regulatory compliances.

- Dust collection problems in the food and pharmaceutical industry are expected to hinder the market's growth.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from China and India.

Dust Control Systems & Suppression Chemicals Market Trends

Construction Industry to Dominate the Market

- Dust control measures are applicable to any construction site with potential air and water pollution from dust traveling across the landscape or through the air.

- According to HSE statistics (the U.K. government's Health and Safety Executive statistics), every year, more than 500 construction workers die from exposure to silica dust worldwide. Hence, it became important to regulate hazardous dust emissions, creating a significant demand for dust control systems and suppression chemicals over the last few years.

- Compared to conventional processes, dust suppression solutions offer distinct advantages and lucrative benefits for construction applications, including easy application and long-life protection during extreme climatic conditions.

- Currently, there are state-of-the-art dust control solutions that can solve a range of dust control problems at construction sites and on all types of roads, from major highways and freeways to haulage, industrial, and rural roads, tarmacs, hardstand areas, and water-repellent pavements.

- Calcium chloride is the major dust control suppression chemical used in the construction industry. In addition, the construction industry uses polymer emulsions for stabilizing haul and access roads.

- The United States boasts a colossal construction sector that employs over 7.6 million employees. According to U.S. Census Bureau, in 2022, the value of construction was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Further, as per further statistics generated by the U.S. Census Bureau, the annual value for new construction in the United States accounted for USD 1,657,590 million in 2022, compared to USD 1,499,822 million in 2021. Moreover, the annual residential construction in the United States was valued at USD 849,164 million in 2022, compared to USD 740,645 million in 2021. The annual value of non-residential construction put in place in the country was valued at USD 808,427 million in 2022, compared to USD 759,177 million in 2021, thereby decreasing the consumption of the market studied in the short term.

- Moreover, the increasing presence of foreign companies in the Asia-Pacific region has created a demand for new offices, buildings, production houses, etc., thereby driving the construction sector in the region.

- Such factors are likely to help the construction industry dominate the market.

China to Dominate the Asia-Pacific Market

- China's construction industry has been going through the Evergrande debt crisis, and it is expected to decline for a short while in the future.

- The country has been focusing on reducing coal consumption for the past few years, mainly due to environmental concerns and climate goals.

- The government took this step in accordance with the growing coal imports of the country due to the reduction in domestic production.

- The new coal mines approved in the country are located in the regions of Xinjiang, Inner Mongolia, Shanxi, and Shaanxi, supported by the national strategy toward consolidating the output at dedicated coal production bases.

- These new mines are planned for the expansion of the existing collieries. The country is expected to witness high demand for dust control systems and suppression chemicals for developing and operating such new mines.

- The country's demographics are expected to favor housing and commercial construction activities. The growing population has triggered investments in affordable residential colonies by the public and private sectors. China's government has taken the initiative to gift 40 key cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people.

- Additionally, the Chinese government has rolled out massive construction plans, which include making provisions for the movement of 250 million rural people to its new megacities over the next ten years, creating a major scope for construction materials used in the future in various applications during construction activities to enhance the building properties. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030. These factors are expected to raise the construction industry in the country and thereby are likely to support the demand for the market studied in the future.

- Thus, growth in various end-user industries is boosting the demand for dust control systems and suppression chemicals for various applications.

Dust Control Systems & Suppression Chemicals Industry Overview

The dust suppression chemicals market is partially consolidated among very few players. Some of the other prominent players in the dust suppression systems market include Cargill Incorporated, SUEZ, Ecolab, Camfil, and Donaldson Company Inc. (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in Construction and Infrastructure in Asia-Pacific

- 4.1.2 Increase in Regulatory Compliances

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Dust Collection Problems in Food and Pharmaceutical Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Lignin Sulfonate

- 5.1.2 Calcium Chloride

- 5.1.3 Magnesium Chloride

- 5.1.4 Asphalt Emulsions

- 5.1.5 Oil Emulsions

- 5.1.6 Polymeric Emulsions

- 5.1.7 Other Chemical Types

- 5.2 System Type

- 5.2.1 Dry Collection

- 5.2.2 Wet Suppression

- 5.3 End-user Industry

- 5.3.1 Mining

- 5.3.2 Construction

- 5.3.3 Food and Beverage

- 5.3.4 Oil and Gas and Petrochemical

- 5.3.5 Pharmaceutical

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemical Providers

- 6.4.1.1 ADM

- 6.4.1.2 Benetech Inc.

- 6.4.1.3 Borregaard

- 6.4.1.4 Cargill Incorporated

- 6.4.1.5 Chemtex Speciality Limited

- 6.4.1.6 Evonik Industries AG

- 6.4.1.7 GelTech Solutions

- 6.4.1.8 Hexion

- 6.4.1.9 Quaker Houghton (Quaker Chemical Corporation)

- 6.4.1.10 Shaw Almex Industries Ltd

- 6.4.1.11 SUEZ

- 6.4.1.12 Ecolab

- 6.4.2 System Providers

- 6.4.2.1 BossTek

- 6.4.2.2 Camfil

- 6.4.2.3 CW Machine Worx

- 6.4.2.4 Donaldson Company Inc.

- 6.4.2.5 DSH Systems Ltd

- 6.4.2.6 Duztech AB

- 6.4.2.7 Nederman Holding AB

- 6.4.2.8 SLY Inc.

- 6.4.2.9 The ACT Group

- 6.4.1 Chemical Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments in the Chemical Sector

- 7.2 Emergence of Green Products for Dust Control