|

시장보고서

상품코드

1445941

수술부위 감염 관리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029)Surgical Site Infection Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

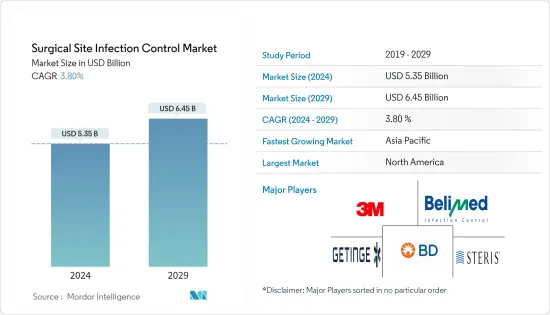

수술부위 감염 관리 시장 규모는 2024년 53억 5,000만 달러로 추정됩니다. 2029년까지 64억 5,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) 동안 3.80%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

코로나19는 전 세계에서 진행되는 수술에 영향을 미쳤습니다. 긴급하지 않은 수술을 금지하는 규제 당국의 엄격한 지침으로 인해 전염병 기간 동안 수술 건수가 크게 감소했습니다. 예를 들어, 2021년 10월 미국 국립의학도서관이 발표한 연구에 따르면, 전 세계적으로 일반 수술 입원 건수가 42.8% 감소했습니다. 그 결과, 코로나19 사태는 수술부위 감염 관리 시장에 큰 영향을 미쳤습니다. 그러나 코로나19 팬데믹은 손 위생과 전통적인 감염 관리 방법의 사용의 중요성이 강조되었습니다. 또한, 대기 수술이 재개되고 코로나19 확진자 수가 안정화됨에 따라 시장은 빠르게 팬데믹 이전 수준으로 회복되었습니다.

병원 내 감염 증가는 총 수술 건수 증가와 노인 인구 증가로 인한 것입니다. Update가 2022년 4월에 발표한 기사에 따르면 수술 부위 감염(SSI)은 수술 후 의료 관련 감염 중 가장 흔한 것으로 나타났습니다. 이는 심각한 이환율과 사망률, 중환자실 이송, 장기 입원 및 재입원과 관련이 있습니다. 매년 미국에서 수술을 받는 사람 중 2-45명이 SSI에 걸리며, 이는 의료 시스템에 심각한 부담을 주고 있습니다. 이러한 수술 부위 감염의 높은 부담은 시장 성장을 가속할 것으로 예상됩니다.

또한, 유엔의 'World Ageing Population 2022 highlights(2022년 세계 고령화 인구 하이라이트)에 따르면, 세계 인구에서 65세 이상 인구가 차지하는 비중은 2022년 10%에서 2050년 16%로 증가할 것으로 예측됩니다. 2050년까지 전 세계 65세 이상 인구는 5세 미만 아동 수의 2배 이상, 12세 미만 아동 수는 12세 미만 아동 수와 거의 같을 것으로 예측됩니다. 따라서 연령이 증가함에 따라 사람들은 여러 만성 질환에 걸리기 쉽고 외과 적 수단이 필요하며 예측 기간 동안 수술부위 감염 관리 시장의 성장을 가속할 것으로 예상됩니다. 또한, 2022년 3월 보건 자원 서비스국이 발표한 데이터에 따르면, 2021년 미국에서 약 4만 건의 장기 이식이 이루어졌습니다. 또한 2021년에 미국에서 2만 6,670건의 신장 이식과 9,236건의 생체 이식이 이루어졌습니다. 따라서 장기 이식이 증가함에 따라 수술 부위 감염이 증가하고 이러한 감염을 제어하는 수요가 증가할 것으로 예상됩니다. 시장은 예측 기간 동안 급등할 것으로 예상됩니다.

또한, 기술 발전과 수술 중 수술 부위 감염 증가는 조사 대상 시장의 성장을 더욱 촉진할 것입니다. 예를 들어, TELA Bio는 2022년 3월에 씻어내지 않는 항균 솔루션인 SiteGuard를 출시했습니다. SiteGuard는 넥스트 사이언스의 독자적인 XBIO 기술을 활용하여 기존의 항균제, 소독제 및 숙주의 면역 방어에 대한 박테리아의 내성을 증가시키는 바이오필름을 처리하여 수술 부위 및 수술 후 감염 제어를 지원합니다.

그러나 개인들의 SSI에 대한 인식 부족으로 인해 예측 기간 동안 시장은 억제되었습니다.

수술부위 감염(SSI) 대책 시장 동향

표층 절개 부문은 예측 기간 동안 높은 성장률을 보일 것으로 예상됩니다.

표재성 절개 SSI에서는 절개 부위의 피부와 피하 조직만 감염됩니다. 이 감염은 피부 절개 부위에서만 발생합니다.

제왕절개 수술 증가와 만성 질환의 유병률 증가가 이 분야를 견인할 것으로 예상됩니다. 예를 들어, 2021년 6월 세계보건기구(WHO)의 최신 정보에 따르면 제왕절개 수술은 전 세계적으로 계속 증가하고 있으며, 출산 5건 중 1건 이상(21%)을 차지하고 있습니다. 이러한 추세가 계속된다면 2030년까지 동아시아(63%), 라틴아메리카 및 카리브해(54%), 서아시아(50%), 북아프리카(48%), 남유럽(47%), 호주 및 뉴질랜드(45%)에서 가장 높은 비율을 차지할 것으로 예상됩니다. 따라서 이러한 수술 사례가 증가하면 수술 부위 감염 발생 위험이 높아져 수술부위 감염 관리 제품에 대한 수요가 증가하고 예측 기간 동안 시장 부문의 성장을 가속할 것으로 예상됩니다.

또한 2021년 5월 Becton, Dickinson, and Company는 상처 파편을 기계적으로 풀고 제거하는 최초이자 유일한 즉시 사용 가능한 수성 포비돈 요오드(PVP-I) 세정액인 BD Surgiphor Sterile Wound Irrigation System을 출시했습니다. 이러한 출시는 시장 성장을 가속할 것으로 기대됩니다.

따라서 수술 부위 감염과 병원 내 감염 질환 증가 등 위의 모든 요인이 이 부문의 성장을 가속하고 있습니다.

북미가 큰 시장 점유율을 차지하며 우위를 유지할 것으로 예상

수술 부위 감염 관리 시장은 북미가 독점하고 있으며, 미국이 지역 매출에서 가장 큰 비중을 차지하고 있습니다. 만성 질환 및 수술로 인한 입원 일수 증가, 입원 횟수 증가, 병원 내 감염에 대한 부담 증가, 감염을 제어하는 장비에 구현된 혁신적인 기술과 결합하여 의료기기 시장의 성장을 가속할 것으로 예상됩니다. 지역.

SSI는 미국 급성기 병원 입원 환자들 사이에서 가장 흔한 의료 관련 감염(HAI)입니다(폐렴과 관련이 있음). 2021년 업데이트된 CDC 데이터에 따르면 2019년과 2020년 사이 중심정맥혈류감염(CLABSI)은 약 24% 증가했고, 인공호흡기 관련 사건(VAE)은 35% 증가했습니다. 이러한 높은 수술 부위 감염률은 수술부위 감염 관리(SSIC) 제품의 필요성을 창출하고 시장 성장을 가속할 것입니다.

AHA의 2022년 자료에 따르면, 2022년 입원 환자 수는 약 3,335만 6,853명이었습니다. 이러한 입원의 대부분은 만성 질환 및 심장 우회 수술과 같은 중요한 시술로 인한 입원입니다. 따라서 입원 환자 수가 증가함에 따라 SSI 환자 수도 증가할 것으로 예상되며, 그 결과 이 지역 시장을 견인할 것으로 예상됩니다.

또한 2021년 2월, 펜 메디슨은 미국 필라델피아 남서부에 가장 유명한 기구 처리 및 수술 용품 준비 시설 중 하나인 새로운 인터벤션 지원 센터(ISC)를 오픈했습니다. ISC는 펜실베이니아 주 최초의 시설 중 하나이며, 직원들은 매일 기본 가위와 클램프에서 고급 로봇기구에 이르기까지 수천 개의 기구를 멸균하고 포장하여 수술 및 시술에 대비합니다. 이러한 시설의 설립은 시장 성장을 가속할 것으로 예상됩니다.

따라서 위의 모든 요인들이 예측 기간 동안 이 지역 시장을 끌어올릴 것으로 예상됩니다.

수술 부위 감염(SSI) 관리 산업 개요

수술부위 감염 관리 시장은 본질적으로 세분화되어 있습니다. 3M Company, Becton, Dickinson and Company, Biomerieux SA, Getinge Group, Johnson &Johnson은 수술부위 감염 관리 시장에서 중요한 기업입니다. 전 세계적으로 지속적인 제품 혁신이 이루어지면서 조사 대상 시장의 경쟁 업체들 간의 적대적 관계가 심화되고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 제품별

- 수동 재처리 장비 솔루션

- 소독제

- 손가락 소독제

- 피부 소독제

- 외과용 스크럽제

- 헤어 클리퍼

- 수술용 드레이프

- 외과적 세정

- 피부 준비 솔루션

- 의료용 부직포

- 수술용 장갑

- 기타 제품

- 수술 및 시술별

- 백내장 수술

- 제왕 절개

- 치과 수복

- 위 우회술

- 기타 수술/시술

- 감염증 유형별

- Superficial Incisional SSI

- Deep Incisional SSI

- Organ or Space SSI

- 최종사용자별

- 병원

- 외래수술센터(ASC)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- 3M

- Becton, Dickinson and Company

- Belimed AG

- Getinge Group

- Johnson &Johnson

- Kimberly-Clark Corporation

- Sotera Health

- Ansell Limited

- Steris Corporation

- Lac-Mac Limited

- Pacon Manufacturing Corp.

- American Polyfilm Inc.

제7장 시장 기회와 향후 동향

LSH 24.03.19The Surgical Site Infection Control Market size is estimated at USD 5.35 billion in 2024, and is expected to reach USD 6.45 billion by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

COVID-19 had an impact on surgical operations performed globally. Due to regulatory authorities' strict guidance to prevent any non-emergent surgeries, the volume of surgeries drastically decreased throughout the pandemic. For instance, according to the study published in October 2021 by the National Library of Medicine, there was a 42.8% decrease in general surgery admissions globally. As a result, the COVID-19 pandemic substantially impacted the surgical site infection control market. However, the COVID-19 pandemic underlined the critical necessity of hand hygiene and the use of conventional infection control methods. Moreover, owing to the resumption of elective surgeries and stabilizing COVID-19 cases, the market soon bolstered to its pre-pandemic levels. For instance, in March 2022, PDI launched Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray, innovative disinfectants to help infection prevention professionals in the fight against rising healthcare-associated infections (HAIs) as well as the ongoing battle against COVID-19.

The increasing number of hospital-acquired infections is due to the rising total number of surgeries and the growing geriatric population. According to an article published in April 2022 by UpToDate, surgical site infection (SSI) is the most common healthcare-associated infection following surgery. It is associated with significant morbidity and mortality, transfer to an intensive care unit setting, prolonged hospitalizations, and hospital readmission. Among those who undergo surgical procedures annually in the United States, 2 to 45 will develop an SSI, representing a significant burden on the health care system. Such a high burden of surgical site infection is expected to drive the market's growth.

Furthermore, according to the United Nations' World Ageing Population 2022 highlights, The share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. By 2050, the number of persons aged 65 years or over worldwide is projected to be more than twice the number of children under 5 years and about the same that of children under 12 years. Thus, with the growing age, people are more prone to several chronic diseases and need surgical measures, which are expected to boost the growth of the surgical site infection control market over the forecast period. Moreover, as per the data published by the Health Resources and Services Administration in March 2022, about 40,000 organ transplants were performed in the United States in 2021. In addition, 26,670 kidney transplants and 9,236 live transplants were performed in 2021 in the United States. Therefore, the increased organ transplant is expected to increase surgical site infections and increase the demand for the control of such infections. The market is expected to see a surge over the forecast period.

Additionally, technological advancements, and an increase in the number of surgical site infections during surgical procedures, further drive the growth of the market studied. For instance, in March 2022, TELA Bio launched SiteGuard, a no-rinse antimicrobial solution. SiteGuard utilizes Next Science's proprietary XBIO Technology that supports surgical site and post-operative infection control by addressing the biofilms that make bacteria more resistant to traditional antimicrobial agents, disinfectants, and host immune defenses.

However, a lack of awareness about SSI among individuals restrained the market over the forecast period.

Surgical Site Infection (SSI) Control Market Trends

Superficial Incisional Segment is Expected to Exhibit Fast Growth Rate Over the Forecast Period

Only the skin and subcutaneous tissue of the incision are infected in a superficial incisional SSI. This infection occurs only in the areas where the incision was made on the skin.

The rising cesarean surgeries and increasing prevalence of chronic diseases are expected to boost the segment. For instance, According to World Health Organization (WHO) updates from June 2021, cesarean section use continues to rise globally, accounting for more than 1 in 5 (21%) childbirths. If this trend continues, by 2030, the highest rates are likely to be in Eastern Asia(63%), Latin America and the Caribbean (54%), Western Asia (50%), Northern Africa (48%), Southern Europe (47%) and Australia and Newzealand (45%). Thus, the increasing cases of such surgeries have a higher risk of developing surgical site infections, which is expected to increase the demand for surgical site infection control products and boost the market segment's growth over the forecast period.

Additionally, in May 2021, Becton, Dickinson, and Company launched BD Surgiphor Sterile Wound Irrigation System, the first and only ready-to-use aqueous povidone-iodine (PVP-I) irrigation solution that mechanically loosens and removes wound debris. Such launches are expected to propel the growth of the market.

Thus, all the factors above, such as rising surgical site infections and hospital-acquired disorders, boost the segment's growth.

North America Captured the Large Market Share and is Expected to Retain its Dominance

The surgical site infection control market has been dominated by North America, with the United States accounting for the largest share of regional revenue. The increase in hospital stays due to chronic diseases and surgeries, the rising number of hospital admissions, the increasing burden of hospital-acquired infection coupled with the innovative technologies implemented in devices that control infection, and others are expected to boost the market's growth in the region.

SSIs are the most common healthcare-associated infection (HAI) among inpatients in acute care hospitals in the United States (tied with pneumonia). According to the CDC data updated in 2021, about a 24% increase in central line bloodstream infection (CLABSI) and a 35% increase in Ventilator-Associated events (VAE) between 2019-2020. Such a high surgical site infection rate creates the need for Surgical Site Infection Control (SSIC) products and thus propels the growth of the market.

According to 2022 data from the AHA, there were approximately 33,356,853 hospital admissions in 2022. Many of these admissions were due to chronic diseases and critical procedures, like heart bypass surgery. Thus increasing number of hospital admissions is expected to have more SSIs, thereby boosting the market in the region.

Additionally, in February 2021, Penn Medicine opened its new Interventional Support Center (ISC), one of the most prominent instrument processing and surgical supply preparation facilities in Southwest Philadelphia, United States. The ISC is one of the first facilities of its kind in Pennsylvania, where staff will sterilize and package thousands of instruments each day in preparation for surgeries and procedures, from basic scissors and clamps to advanced robotic instruments. Establishing such facilities is also expected to propel the market's growth.

Thus, all factors above are expected to boost the market in the region over the forecast period.

Surgical Site Infection (SSI) Control Industry Overview

The surgical site infection control market is fragmented in nature. 3M Company, Becton, Dickinson and Company, Biomerieux SA, Getinge Group, and Johnson & Johnson are some significant players in the surgical site infection control market. The competitive rivalry of the market studied has intensified, owing to the constant product innovations worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Hospital Acquired Infection Along with Regulatory Guidelines for Hospital Infection Prevention and Control

- 4.2.2 Increasing Number of Surgeries

- 4.2.3 Rapidly Growing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness of Hospital Infection Prevention and Control

- 4.3.2 Increased Use of Outpatient Treatment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD Million)

- 5.1 By Product

- 5.1.1 Manual Reprocessors Solution

- 5.1.2 Disinfectants

- 5.1.2.1 Hand Disinfectants

- 5.1.2.2 Skin Disinfectants

- 5.1.3 Surgical Scrubs

- 5.1.4 Hair Clippers

- 5.1.5 Surgical Drapes

- 5.1.6 Surgical Irrigation

- 5.1.7 Skin Preparation Solution

- 5.1.8 Medical Nonwovens

- 5.1.9 Surgical Gloves

- 5.1.10 Other Products

- 5.2 By Surgery/Procedure

- 5.2.1 Cataract Surgery

- 5.2.2 Cesarean Section

- 5.2.3 Dental Restoration

- 5.2.4 Gastric Bypass

- 5.2.5 Other Surgeries/Procedures

- 5.3 By Type of Infection

- 5.3.1 Superficial Incisional SSI

- 5.3.2 Deep Incisional SSI

- 5.3.3 Organ or Space SSI

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Becton, Dickinson and Company

- 6.1.3 Belimed AG

- 6.1.4 Getinge Group

- 6.1.5 Johnson & Johnson

- 6.1.6 Kimberly-Clark Corporation

- 6.1.7 Sotera Health

- 6.1.8 Ansell Limited

- 6.1.9 Steris Corporation

- 6.1.10 Lac-Mac Limited

- 6.1.11 Pacon Manufacturing Corp.

- 6.1.12 American Polyfilm Inc.