|

시장보고서

상품코드

1519911

자동차용 브레이크 캘리퍼 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Automotive Brake Caliper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

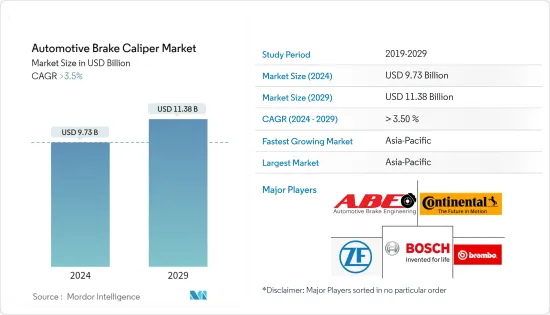

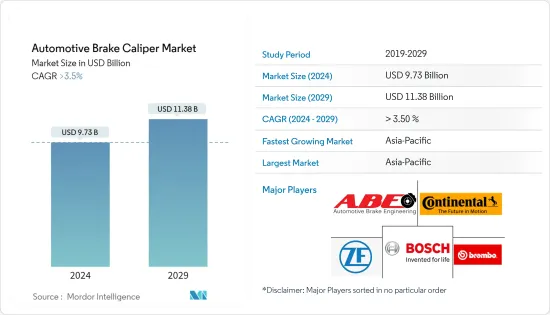

자동차용 브레이크 캘리퍼(Automotive Brake Caliper) 시장 규모는 2024년에 99억 7,000만 달러로 추정되고, 2029년에는 135억 달러에 이를 것으로 예측되며, 예측기간 중(2024-2029년)의 CAGR은 3.80% 이상으로 추이하며 성장할 전망입니다.

자동차용 브레이크 캘리퍼 수요는 주로 자동차의 안전성에 대한 관심 증가, 드럼 브레이크에서 디스크 브레이크의 자동차로의 채택 확대, 각국 정부의 자동차 안전 기준, 세계의 자동차 생산 대수 증가 등에 기인하고 있다 합니다. 이러한 요인은 예측 기간 동안 시장 성장을 뒷받침할 것으로 예상됩니다.

이러한 시나리오를 고려하여 브레이크 캘리퍼 제조업체는 첨단 기술을 채택하고 있습니다. 2025년 7월부터 유로 7의 배기가스 규제가 시행될 예정이며, Continental은 2023년 6월 브레이크 더스트를 줄이고 브레이크 더스트 규제를 충족하는 브레이크 캘리퍼를 개발했습니다.

올바른 교체 브레이크 라이닝을 선택하는 것은 차량 전반의 안전에 중요한 요소입니다. 보다 가벼운 전기자동차와 하이브리드 자동차를 생산하기 위해 경량 재료와 복합재료로 점진적으로 이동하고 있으며, 앞으로 등장하는 자동차를위한 고급 브레이크 시스템을 개발하는 것이 시장 성장을 밀어 올릴 것으로 예상됩니다. 브레이크 캘리퍼를 차량 안전 모듈에 채택하는 데 주로 정부 규제와 기준이 기여합니다.

2023년 6월, 미국 도로 안전국은 새로운 연방 자동차 안전 기준을 제안했습니다. 이는 보행자 AEB(PAEB)를 포함한 자동 긴급 브레이크(AEB) 시스템을 경차에 의무화하도록 지시하는 것입니다.

FMVSS 기준은 신형 차량이 안전 운전에 필요한 일정 거리 내에서 정지할 수 있도록 보장하기 위한 것입니다. 현재 FMVSS135와 126 기준이 신차와 도로를 달리는 대부분의 차량에 적용되고 있습니다. 이전의 FMVSS 105 표준과 비교하면 FMVSS 135는 동일한 정지 거리에서 페달의 답력을 -25% 줄일 필요가 있습니다.

2025년 7월에 시행되는 유로 7배기 가스 규제는 가장 엄격한 규제이며 기존의 꼬리 파이프 배기 가스에 그치지 않고 전기자동차(EV)에도 적용됩니다. 보고에 의하면, 이러한 차기 규제는 처음으로 브레이크 더스트의 발생량과 타이어의 마모에 의한 마이크로 플라스틱의 방출을 규제하게 된다고 합니다.

고도의 안전기능과 기술에 대한 소비자의 의식이 높아짐에 따라, 기업도 고도의 안전시스템을 탑재한 자동차 제조에 주력하고 있습니다. 이 요인은 예측 기간 동안 시장 성장을 촉진 할 것으로 예상됩니다.

자동차용 브레이크 캘리퍼 시장 동향

고정식 브레이크 캘리퍼 수요가 높아질 전망

자동차용 브레이크 캘리퍼 시장은 R&D와 기술 혁신에 의해 견인되고 있습니다. 자동차에 성공적으로 통합될 수 있는 신뢰할 수 있는 브레이크 부품 및 부품을 제조하기 위한 신기술이 발견되었습니다.

Honda, BMW, Toyota, Mercedes-Benz, Nissan과 같은 주요 기업들은 자동차가 최단 거리와 최단 시간에 멈추고 차량 내 승객에게 흔들림이나 충격을주지 않는 최고의 브레이크 시스템을 제공하고자 합니다. 3D 프린팅과 라미네이션 모델링을 통해 제조업체는 복잡한 부품과 부품을 생산할 수 있습니다. 어드벤처 스포츠와 레이스 성장이 브레이크 캘리퍼 시장 확대에 박차를 가할 것으로 예상됩니다.

고정식 브레이크 캘리퍼는 차량의 경량화와 잔류 토크 등 이점을 제공하므로 높은 수요가 예상됩니다. 고성능·저탄소차에 대한 수요 증가가 고정식 브레이크 캘리퍼의 필요성을 높일 것으로 예상됩니다. 고압 다이캐스트 공정은 강철 캘리퍼의 제조에 널리 사용되고 있기 때문에 업계에서 큰 기세를 얻을 가능성이 높습니다.

자동차 수요가 확대됨에 따라 브레이크 캘리퍼 제조업체는 시장에 새로운 제품과 기술을 제공하기 위해 노력하고 있습니다. 예를 들어, 2023년 11월, Neotech는 SEMA 2023에서 첨단 6피스톤 브레이크 캘리퍼를 발표하여 자동차 성능에 혁명을 일으켰습니다.

아시아 태평양이 시장의 주요 점유율을 차지할 전망

예측 기간 동안 아시아 태평양이 시장의 주요 점유율을 차지할 것으로 예상됩니다. 이 지역의 성장을 견인하고 있는 것은 주로 인도, 중국, 일본 등 자동차 생산 상위국입니다. 또한 이러한 시장에서 승용차 수요 증가는 인구 가처분 소득 증가, 자동차 산업 발흥, 신차 구매 대출 및 자금 조달 가능성 증가 등 많은 요인으로 인한 것입니다.

예를 들어, 인도의 자동차 산업은 소형차와 중형차를 포함한 승용차의 판매가 주류입니다. 전년도의 자동차 수출 대수는 428만 5,809대였습니다.

자동차용 브레이크 캘리퍼는 자동차를 감속하거나 완전히 정지시키는 것을 유일한 목적으로 하는 복잡한 부품의 배치이기 때문에 자동차에서 중요한 역할을 하고 있습니다.

따라서 위의 요인으로 인해 아시아 태평양이 자동차 업계에서 가장 큰 시장 점유율을 차지할 것으로 예상되어 자동차용 브레이크 캘리퍼 수요를 촉진합니다.

자동차용 브레이크 캘리퍼 산업 개요

자동차용 브레이크 캘리퍼 시장은 세계 및 지역적으로 확립된 선수에 의해 통합되고 주도되고 있습니다. 각 회사는 시장에서 지위를 유지하기 위해 신제품 출시, 제휴, 합병 등 전략을 채택하고 있습니다. 예를 들면

- 2023년 12월, Apec Automotive는 브레이크 기능을 크게 확장하고 다양한 차종의 제동력을 강화하도록 설계된 6개의 브레이크 캘리퍼를 포함한 32개의 새로운 부품 번호를 다양한 제품군에 도입 했습니다.

- 2023년 9월, Continental은 2016년부터 2021년까지 BMW, 폭스바겐, 아우디, 볼보 등 유럽 인기 브랜드를 포함한 500만 개 이상의 차량 식별 번호(VIO)를 지원하는 애프터마켓용 ATE 전자 주차 브레이크 캘리퍼의 확충을 발표했습니다.

- 2023년 6월, Continental은 회생 브레이크 시스템과 기존 브레이크 시스템을 모두 활용하여 전기자동차(EV)를 지원하고 브레이크 먼지와 에너지 소비를 줄이는 새로운 그린 캘리퍼스를 발표했습니다.

Comline의 캘리퍼스 시리즈는 2020년 데뷔 이후 영국 자동차용 브레이크 시장에서 두드러지며 브랜드의 높은 평가를 받은 1,000개 이상의 독특한 캘리퍼스를 제공합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 자동차의 안전성에 대한 관심 증가

- 시장 성장 억제요인

- 디스크 브레이크를 대체하는 효율적이고 비용 효율적인 브레이크 개발

- 업계의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계 강도

제5장 시장 세분화

- 차량 유형별

- 승용차

- 상용차

- 이륜차

- 캘리퍼 유형별

- 고정식

- 부동/슬라이딩식

- 피스톤 재료 유형별

- 알루미늄

- 스틸

- 티타늄

- 페놀

- 최종 사용자별

- OEM

- 애프터마켓

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아 태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아 태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- ZF Friedrichshafen AG

- Automotive Brake Engineering(ABE)

- Continental AG

- Brakes International

- Brembo SpA

- Akebono Brake Corporation

- Centric Parts

- Wilwood Engineering Inc.

- EBC Brakes

- Apec Braking

- ATL Industries

- Robert Bosch GmbH

제7장 시장 기회 및 향후 동향

LYJThe Automotive Brake Caliper Market size is estimated at USD 9.97 billion in 2024, and is expected to reach USD 13.5 billion by 2029, growing at a CAGR of greater than 3.80% during the forecast period (2024-2029).

The demand for the automotive brake caliper market is mainly attributed to increasing concerns toward vehicle safety, growing adoption of disc brakes in vehicles over drum brakes, governments' vehicle safety norms, and growth in global vehicle production. These factors are anticipated to boost the market's growth during the forecast period.

Considering the scenario, brake caliper manufacturers are adopting advanced technologies. In June 2023, Continental developed a brake caliper that reduces brake dust and meets the brake dust regulations, as Euro 7 emission regulations are scheduled to come into effect from July 2025.

Selecting the correct replacement brake linings is an important component in the overall safety of the vehicle. The gradual shift toward lightweight and composite materials to produce lighter electric and hybrid vehicles and develop advanced braking systems for upcoming vehicles are expected to boost the market's growth. Government regulations and standards have mainly contributed toward the adoption of brake calipers in vehicle safety modules.

In June 2023, the National Highway Safety Administration proposed a new Federal Motor Vehicle Safety Standard. It directs that light vehicles should require automatic emergency braking (AEB) systems, including pedestrian AEB (PAEB).

The FMVSS standards are designed to ensure that new vehicles can stop within a certain distance, which is necessary for safe driving. Currently, FMVSS 135 and 126 standards are applied to new cars and most vehicles on the road. Compared to the earlier FMVSS 105 standard, FMVSS 135 requires ~25% reduction in pedal effort for the same stopping distance.

The Euro 7 emission standards, set to take effect in July 2025, are described as the most stringent regulations, extending beyond traditional tailpipe emissions to encompass electric vehicles (EVs). Reports indicate that these upcoming regulations will, for the first time, govern the quantity of brake dust produced and the release of microplastics from tire wear.

As consumers are gaining awareness about advanced safety features and technologies, companies are also focusing on manufacturing vehicles with advanced safety systems. This factor may boost the market's growth during the forecast period.

Automotive Brake Caliper Market Trends

Fixed Brake Calipers are Expected to be in High Demand

The automotive brake caliper market is driven by research, development, and innovation. New technologies are being discovered to manufacture reliable braking parts and components that can be incorporated well into an automobile.

Some key players, such as Honda, BMW, Toyota, Mercedes-Benz, and Nissan, aspire to offer the best braking systems to help vehicles stop at minimum distance and time without any jerks and shocks to the passenger inside. 3-D printing and additive manufacturing have allowed manufacturers to produce complex parts and components. Growth in adventure sports and racing is expected to fuel the expansion of the brake caliper market.

Fixed brake calipers are expected to be in high demand as they offer advantages like weight reduction and residual torque to vehicles. The growing demand for high-performance and low-carbon-emitting vehicles is expected to fuel the need for fixed brake calipers. The high-pressure die-casting process is likely to gain significant momentum in the industry as it is extensively used in making steel calipers.

With the growing automotive demand, brake caliper manufacturers are working to provide new offerings and technologies to the market. For instance, in November 2023, Neotech revolutionized automotive performance with the launch of an advanced 6 Piston Brake Caliper at SEMA 2023.

Asia-Pacific is Expected to Hold a Major Share in the Market

Asia-Pacific is expected to hold a major share of the market studied during the forecast period. The regional growth is mainly driven by the top-producing automotive countries like India, China, and Japan. Moreover, the growing demand for passenger vehicles in these markets is due to the growing disposable income of the population, the rising automotive industry, the growing availability of loans and funding to purchase new vehicles, and many others.

For instance, the Indian automotive industry is dominated by passenger car sales, which include small and midsized cars. The total number of automobiles exported stood at 42,85,809 in the previous year.

Automotive brake calipers play an important role in vehicles as they are complex arrangements of components with the sole objective of slowing down or bringing the vehicle to a complete stop.

Therefore, as per the above-mentioned factors, Asia-Pacific is expected to hold the largest market share in the automotive industry, thereby boosting the demand for automotive brake caliper market.

Automotive Brake Caliper Industry Overview

The automotive brake caliper market is consolidated and led by globally and regionally established players. The companies are adopting strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance,

- In December 2023, Apec Automotive elevated its braking capabilities with a significant expansion, introducing 32 new part numbers to its diverse range, including six brake calipers designed to enhance stopping power across various vehicles.

- In September 2023, Continental unveiled the expansion of its aftermarket ATE electronic parking brake calipers, catering to over 5 million vehicle identification numbers (VIO), including popular European brands like BMW, Volkswagen, Audi, and Volvo between 2016 and 2021.

- In June 2023, Continental introduced a new Green Caliper to reduce brake dust and energy consumption, catering to electric vehicles (EVs) by leveraging both regenerative and conventional braking systems.

Comline's caliper range has stood out in the UK automotive brake market since its debut in 2020, offering over 1,000 unique caliper references bolstered by the brand's esteemed reputation.

Some of the major players in the market include Continental AG, Automotive Brake Engineering (ABE), Robert Bosch GmbH, and ZF Friedrichshafen AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Concerns Toward Vehicle Safety

- 4.2 Market Restraints

- 4.2.1 Development of Efficient and Cost-effective Braking Alternatives to Disc Brakes

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Two-wheelers

- 5.2 By Caliper Type

- 5.2.1 Fixed

- 5.2.2 Floating/Sliding

- 5.3 By Piston Material Type

- 5.3.1 Aluminum

- 5.3.2 Steel

- 5.3.3 Titanium

- 5.3.4 Phenolics

- 5.4 By End User

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Automotive Brake Engineering (ABE)

- 6.2.3 Continental AG

- 6.2.4 Brakes International

- 6.2.5 Brembo SpA

- 6.2.6 Akebono Brake Corporation

- 6.2.7 Centric Parts

- 6.2.8 Wilwood Engineering Inc.

- 6.2.9 EBC Brakes

- 6.2.10 Apec Braking

- 6.2.11 ATL Industries

- 6.2.12 Robert Bosch GmbH