|

시장보고서

상품코드

1521492

ESG 평가 서비스 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)ESG Rating Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

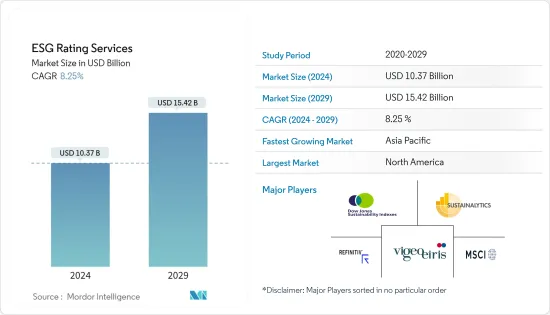

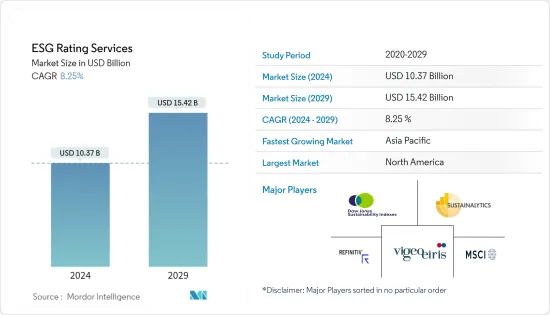

ESG 평가 서비스 시장 규모는 2024년 10억 3,370만 달러로 추정되며, 2029년에는 15억 4,200만 달러에 달할 것으로 예상되며, 시장 추정 및 예측 기간(2024-2029) 동안 8.25%의 CAGR로 성장할 것으로 예상됩니다.

투자자, 고객, 직원, 규제 당국 등 이해관계자들이 기업의 투명성과 책임성을 높이면서 ESG 평가의 중요성이 점점 더 커지고 있으며, ESG 평가 서비스 시장의 전망은 매우 유망합니다. 지속가능성, 책임투자, 기업지배구조 관행에 대한 인식과 중요성이 높아지면서 ESG 보고에 대한 수요가 증가하고 있습니다. 기업들은 리스크를 줄이고, 업무 효율성을 개선하고, 이해관계자의 신뢰를 높이기 위해 ESG 고려사항을 사업 전략에 통합해야 할 필요성을 인식하고 있습니다. 이에 따라 ESG 보고 서비스에 대한 수요가 크게 증가할 것으로 예상됩니다.

규제 당국이 ESG 보고를 의무화하면서 관련 산업도 성장하고 있습니다. 금융기관은 유럽연합의 지속가능금융정보공개규정(SFDR)에 따라 지속가능성 정책 및 ESG 리스크에 대한 정보를 공개해야 합니다. 이러한 규제는 시장 확대에 긍정적인 영향을 미칠 것으로 보입니다. 또한, 인공지능, 빅데이터 분석 등 기술 혁신으로 ESG 데이터 수집과 분석이 용이해지면서 ESG 보고의 효과성과 정당성이 향상되고 있습니다. 이러한 기술 발전으로 기업들이 ESG 평가 서비스를 이용하는 빈도가 높아질 것으로 예상됩니다.

ESG 평가 서비스 시장 동향

기술 발전의 증가가 시장을 주도

투자가 증가함에 따라 정책 입안자, 투자자 및 기타 주요 이해관계자들의 지속가능성과 품질에 대한 기준이 높아지고 있습니다. ESG 기준은 기업의 성과를 결정하고 평가하며, 지속가능성은 책임감 있는 비즈니스 관행을 포괄하는 개념으로, 투자자들은 종합적인 방식으로 윤리적 비즈니스 관행을 요구하고 있습니다. 다양한 기업들이 환경 및 사회 문제와 관련된 사업의 잠재적 위험과 기회를 고려하여 지속가능하고 책임감 있는 관행에 맞게 포트폴리오를 조정하려고 노력하고 있습니다. 기업이 사회적, 환경적 문제를 해결할 수 있는 기술의 발전과 진보로 인해 지속가능하고 포용적인 경제를 만들기 위한 ESG의 노력은 더욱 가속화되고 있습니다. 지속가능한 투자 솔루션에 대한 수요는 투자 절차에 ESG 평가의 통합을 가속화하고 있습니다.

재생에너지, 에너지 효율, 청정기술, 지속가능한 농업 관련 기술이 시장을 활성화시키고 있습니다. 이러한 기술들은 ESG 실천을 진전시키는 데 중요한 역할을 하고 있습니다. 이러한 기술은 ESG 요소와 관련된 대량의 데이터를 효율적으로 수집, 저장, 분석할 수 있게 해줍니다.

북미, 기후 및 에너지 전환으로 시장 독점 전망

북미 시장은 기후 변화 완화 및 재생에너지로의 전환에 대한 관심 증가, ESG 임무를 가진 대규모 기관 투자자의 존재, 지속가능한 투자 옵션에 대한 수요 증가로 인해 성장하고 있으며, 이 지역 시장을 주도하고 있습니다. 북미는 세계 시장 성장에 41% 기여할 것으로 예상됩니다.

미국은 환경, 지속가능성, 거버넌스(ESG) 보고 소프트웨어를 대규모로 도입하여 환경 리스크를 최소화하는 북미 최대 시장으로, ESG 보고 소프트웨어는 소재, 화학, 에너지, 유틸리티(E&U) 등 다양한 산업과 산업안전보건국(OSHA)과 같은 규제 기관에서 의무적으로 도입하고 있습니다. 산업안전보건국(OSHA)과 같은 규제 기관에서 ESG 보고 소프트웨어를 의무화하고 있습니다. 그 결과, 노동 위험은 감소했습니다. 미국의 대기 정화법과 같은 규제와 법률을 준수하도록 유도하는 몇 가지 기술적 진보도 있습니다. 이는 산업 배출량을 줄이고 지속가능성 관리와 환경, 지속가능성, 거버넌스(ESG) 보고 소프트웨어의 도입을 촉진했습니다.

ESG 평가 서비스 산업 개요

ESG 평가 서비스에 대한 주요 기업들의 주요 전략적 움직임입니다. 경쟁사로는 Sustainalytics, Refinitiv, MSCI Inc, Vigeo Eiris, Dow Jones Sustainability Indices 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 윤리적이고 지속가능한 투자에 대한 수요 증가

- 기업 데이터 양의 꾸준한 증가

- 시장 성장 억제요인

- 표준화된 프레임워크의 결여

- 조직에 의한 자가 보고 데이터

- 시장 기회

- AI 등의 첨단 기술 채용

- ESG 투자를 촉진하는 정부 정책 증가

- 밸류체인 분석

- 업계의 매력 Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 업계의 기술적 진보에 관한 인사이트

- 시장을 형성하는 다양한 규제 동향에 대한 인사이트

- COVID-19의 시장에 대한 영향

제5장 시장 세분화

- 유형별

- ESG에 대한 기대

- ESG 보고서 작성

- ESG 데이터 보증

- ESG 전략 전달

- 기타 유형

- 용도별

- 금융 업계

- 소비재·소매

- 제조업

- 에너지·천연자원

- 부동산

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트

- 남아프리카공화국

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 상황

- 시장 집중 개요

- 기업 개요

- Sustainalytics

- Refinitiv

- MSCI Inc.

- Vigeo Eiris

- Dow Jones Sustainability Indices

- PwC

- Deloitte

- Smith & Williamson

- KPMG

- EY*

제7장 향후 시장 동향

제8장 면책사항 및 출판사 소개

ksm 24.07.31The ESG Rating Services Market size is estimated at USD 10.37 billion in 2024, and is expected to reach USD 15.42 billion by 2029, growing at a CAGR of 8.25% during the forecast period (2024-2029).

ESG rating has become increasingly important as stakeholders, including investors, customers, employees, and regulators, demand better company transparency and accountability. The outlook of the ESG rating services market is highly promising. The growing awareness and importance of sustainability, responsible investment, and corporate governance practices are driving the demand for ESG reporting. Companies are realizing the need to integrate ESG considerations into their business strategies to mitigate risks, improve operational efficiency, and enhance stakeholder trust. As a result, the demand for ESG reporting services is expected to witness significant growth.

The industry is also growing since regulatory authorities are mandating ESG reporting to increase. Financial institutions are required to publish information about their sustainability policies and ESG risks under the Sustainable Finance Disclosure Regulation (SFDR) of the European Union. Such regulations are likely to impact the market's expansion positively. Technological breakthroughs like Artificial Intelligence and Big Data analytics are also making it easier to gather and analyze ESG data, which improves the effectiveness and legitimacy of ESG reporting. It is anticipated that corporations may use ESG rating services more frequently due to these technical developments.

ESG Rating Services Market Trends

The Growing Number of Technological Advancements is Driving the Market

The rising number of investments is leading to increased sustainability and quality standards by policymakers, investors, and other key stakeholders. Ethical business practice in a holistic manner is highly demanded by investors. The ESG standards determine or evaluate the company's performance, while sustainability encompasses responsible business practices. Various businesses seek to align their portfolios with sustainable and responsible practices, considering the potential risks and opportunities for the business associated with environmental and social issues. Technological developments and advancements that allow businesses to address social and environmental concerns are driving ESG's efforts to create a sustainable and inclusive economy. Demand for sustainable investing solutions is driving an increasing integration of ESG ratings into investment procedures.

Technologies involved in renewable energy, energy efficiency, clean technology, and sustainable agriculture are fueling the market. These technologies play a crucial role in advancing ESG practices. They enable the efficient collection, storage, and analysis of large volumes of data related to the ESG factor.

North America is Expected to Dominate the Market owing to Climate and Energy Transitions

The North American market is growing, owing to the increasing focus on climate change mitigation and renewable energy transition, the presence of large institutional investors with ESG mandates, and the growing demand for sustainable investing options driving the market in the region. North America is expected to contribute 41% to the growth of the global market.

The United States is the largest market in North America due to the large-scale implementation of environmental, sustainability, and governance (ESG) reporting software to minimize environmental hazards. ESG reporting software has been mandated by numerous industries, including materials, chemicals, energy, and utilities (E&U), and regulatory bodies like the Occupational Safety and Health Administration (OSHA), which promote worker safety rules. As a result, occupational risks were reduced. There are several technological advancements to guide compliance with regulations and acts, such as the Clean Air Act in the United States. These have reduced industrial emissions and promoted the adoption of sustainability management and environmental, sustainability, and governance (ESG) reporting software.

ESG Rating Services Industry Overview

The ESG rating services market is moderately consolidated. Partnerships, expansions, and product enhancements are the key strategic moves adopted by major players to strengthen their presence across regions. The competitive landscape of the market is analyzed, and some of the major players include Sustainalytics, Refinitiv, MSCI Inc., Vigeo Eiris, and Dow Jones Sustainability Indices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Ethical and Sustainable Investments

- 4.2.2 Steady Growth in Corporate Data Volumes

- 4.3 Market Restraints

- 4.3.1 Lack of Standardized Frameworks

- 4.3.2 Self-Reported Data by Organizations

- 4.4 Market Opportunities

- 4.4.1 Adoption of Advanced Technologies such as AI

- 4.4.2 Increasing Government Initiatives to Promote ESG Investments

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Insights into Various Regulatory Trends Shaping the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Addressing ESG Expectations

- 5.1.2 Preparing ESG Reports

- 5.1.3 Assuring ESG Data

- 5.1.4 Communicating ESG Strategy

- 5.1.5 Other Types

- 5.2 By Application

- 5.2.1 Financial Industry

- 5.2.2 Consumer and Retail

- 5.2.3 Industrial Manufacturing

- 5.2.4 Energy and Natural Resources

- 5.2.5 Real Estate

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Sustainalytics

- 6.2.2 Refinitiv

- 6.2.3 MSCI Inc.

- 6.2.4 Vigeo Eiris

- 6.2.5 Dow Jones Sustainability Indices

- 6.2.6 PwC

- 6.2.7 Deloitte

- 6.2.8 Smith & Williamson

- 6.2.9 KPMG

- 6.2.10 EY*