|

시장보고서

상품코드

1521522

거담제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Expectorant Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

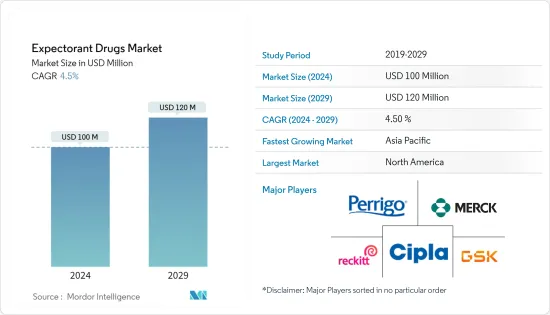

2024년 거담제 시장 규모는 1억 달러로 추정되고, 2029년에는 1억 2,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년)의 CAGR은 4.5%로 성장할 전망입니다.

COVID-19 팬데믹은 거담제 시장에 큰 영향을 미쳤습니다. 최초의 바이러스 발생으로 인해 COVID-19와 관련된 호흡기 증상의 완화를 요구하는 사람들이 늘어나고, 시판(OTC) 거담제 수요가 급증했습니다. 인플루엔자와 같은 호흡기 질환 증가는 기도 점액을 제거하는 거담제 수요 증가로 이어집니다. 이것은 공급망에 부담을 주고 세계 거담제의 부족으로 이어질 수 있습니다. COVID-19 이후에는 폐 섬유증과 만성 폐색성 폐 질환(COPD)과 같은 합병증이 우려됩니다. 거담제는 이러한 병태를 관리하는 역할을 하며 시장 성장을 뒷받침할 수 있습니다. 예를 들어, COPD는 매년 300만 명 이상의 생명을 빼앗아 세계 전반에 걸쳐 추정된 3억 9,200만 명에 영향을 미치고 있습니다. 이 중 4분의 3은 중저소득 국가에 사는 COPD 환자입니다. COPD 환자는 또한 이 질병을 치료하기 위해 거담제를 필요로 하기 때문에 거담제 시장 수요가 더욱 높아질 것으로 예상됩니다.

또한 호흡기 감염의 이환율 증가, 계절 변동 증가, 약물 접근 용이성 등이 시장을 확대할 것으로 예상됩니다. 감각, 독감, 만성 폐색성 폐질환(COPD)과 같은 호흡기 질환은 세계적으로 증가하고 있습니다. 예를 들어 2022년 10월 질병대책예방센터(CDC)에 따르면 2021-2022년 시즌 동안 인플루엔자는 의료시스템에 큰 부담을 가져오고 추정 940만 명이 이 질병에 걸려 430만 명이 의료 기관의 진찰을 필요로 하였고, 100만 명이 입원을 요구했습니다. 게다가 2023년 10월, 세계보건기구(WHO)가 발표한 데이터에 의하면, 매년 약 10억 명이 계절성 인플루엔자에 걸려, 300만-500만 명이 중증화한다고 합니다. 따라서 호흡기 질환에서는 거담제가 많이 사용되어 거담제에 대한 수요가 높아지고 있습니다.

또한 노인들은 면역력 저하, 폐 기능 저하, 기초 질환으로 인해 기관지염, 폐렴, 천식 등 호흡기 질환에 걸리기 쉽습니다. 예를 들어, 2023년 11월 유니세프(유엔 아동 기금)에 따르면, 폐렴은 소아들 사이에서 유행하는 감염이며, 세계 소아 10만 명당 폐렴 환자 수는 1,400명입니다. 성인과 소아의 폐렴 환자가 증가함에 따라 거담제에 대한 요구가 더욱 커지고 예측 기간 동안 시장 확대가 예상됩니다.

호흡기 감염 환자 증가, 원격 의료 도입, 호흡기 질환에 대한 사람들의 의식, 노인 인구 증가 등 위의 요인으로 시장은 앞으로도 계속 성장할 것으로 예상됩니다.

그러나 정부와 규제 기관은 거담제의 판매와 사용에 대한 엄격한 지침을 부과합니다. 일부 국가에서는 안전에 대한 우려로 코데인 함유 기침제의 사용이 금지되거나 제한됩니다.

거담제 시장 동향

시판약은 편의성과 저렴한 가격으로 소비자들 사이에서 인기가 높아지고 있습니다.

시판 약은 의료 전문가의 처방전 없이 구입할 수 있습니다. 이 의약품은 일반적으로 기침이나 코 막힘과 같은 일반적인 호흡기 질환에 사용되며 점액을 풀고 기도를 확보하는 데 도움이 됩니다. 시판 거담제는 일반적으로 처방 거담제보다 저렴합니다. 약국과 슈퍼마켓에서 쉽게 이용할 수 있는 시판 거담제는 기침이나 코 막힘과 같은 경미한 호흡기 증상을 가진 환자의 접근을 단순화합니다. 따라서 의사의 진찰이나 처방전을 필요로 하지 않고 시간과 비용을 절약할 수 있습니다. 예를 들어, 2023년 2월, International Journal of Pharmaceutical Research and Applications는 2022년에 인도에서 임산부가 복용한 시판약은 약 20.8%로 시판약의 사용 증가 동향으로 말했습니다.

또한, 시판 거담제는 일반적으로 처방약 및 기타 호흡 기관용 약물보다 저렴합니다. 이 저렴한 가격은 예산에 민감한 소비자에게 더 매력적인 선택입니다. 또한 제조업체는 시장 출시를 보장하기 위해 시판 거담제의 FDA 승인에 주력하고 있습니다. 예를 들어, 2023년 8월, Markanss Pharma는 미국 FDA에서 600mg 및 1,200mg의 상업용 과이페네신 서방정(시판약) 판매 승인을 받았습니다. 또한, 제약 회사는 거담제의 효능과 인간의 사용 편의성을 홍보합니다. 이러한 브랜드의 인지도와 대상을 좁힌 마케팅은 소비자가 OTC 옵션을 선호하는 데 중요한 역할을 합니다.

따라서, 시판약의 사용을 늘리고 시장에서 쉽게 입수할 수 있게 하는 것도 호흡기 질환에 대한 효과적인 치료 옵션이 되어 향후 수년에 성장할 것으로 예상됩니다.

북미가 거담제 시장을 독점할 전망

북미는 호흡기 질환 유병률 증가, 주요 기업 존재, 연구개발비 증가, 노인 인구 급증 등의 요인으로 시장을 독점할 것으로 예상됩니다. 호흡기 질환은 북미에서 심각한 건강 문제이며, 감기, 독감, 폐렴 등이 가장 흔한 질병의 원인입니다. 예를 들어, 2022년 미국 질병 예방 관리 센터(CDC)가 발표한 데이터에 따르면 성인의 4.6%가 COPD, 폐기종, 만성 기관지염으로 진단되었다고 보고했습니다. 천식의 주요 증상은 기도의 과도한 점액 분비로 코 막힘, 기침, 호흡 곤란을 유발합니다. 과이페네신이나 암브록솔과 같은 거담제는 점액을 얇게 하거나 느슨하게 하는 것으로 도움이 되고, 이 요인에 의해 예측기간 중에 시장이 확대될 것으로 예상됩니다. 예를 들어, 2023년 11월 미국 질병 예방관리센터(CDC)는 2022년에는 성인의 8.7%, 18세 이하 소아의 6.2%가 미국에서 천식과 싸우고 있다고 보고했습니다.

거담제는 천식 환자에게 큰 완화를 제공함으로써 중요한 역할을 수행하고 예측 기간 동안 시장 확대를 증가시킵니다. 예를 들어, 2023년 3월 캐나다 통계국에 따르면 천식은 380만 명의 캐나다인을 앓고 있으며, 그 유병률은 앨버타주에서 7-2%였습니다. 이 지역에서는 거담제의 채용이 증가하고 있기 때문에 이 시장은 향후 수년간 유리한 성장 기회에 축복될 것으로 예상됩니다.

이 지역에서는 제약회사가 거담제을 적극적으로 발매 및 판매하고 있습니다. 예를 들어, 2021년 3월, 머크 KGaA는 연구 중 경구 투여 선택적 P2X3 수용체 길항제인 Gefapixant의 FDA 승인을 받았습니다. Gefapixant는 성인의 난치성 만성 기침의 치료로 사용될 수 있습니다.

따라서 호흡기 질환의 유병률 증가, 노인 인구 증가, 신제품 제조 및 개발 등 위와 같은 이유로 이 지역 시장은 큰 성장이 예상됩니다.

거담제 산업 개요

거담제 시장은 세계 및 지역적으로 사업을 전개하는 다수의 기업이 존재하기 때문에 그 성질상 적당히 부문화되어 있습니다. 이 시장의 주요 기업은 세계 시장에서의 존재를 확대하기 위해 특정 국가에서의 약사 승인 및 제품의 출시에 주력하고 있습니다. 경쟁 구도는 Merck KGaA, ARPIMED, Perrigo company plc, Sun Pharmaceutical Industries Ltd, Johnson & Johnson Private Limited, Sanofi, Aurobindo Pharma, Genexa Inc., GSK plc, Reckitt Benckiser Group PLCC, 점유율을 가진 지명도가 높은 국제 기업과 현지 기업의 분석이 포함됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 호흡기 질환의 유병률 증가

- OTC 의약품 수요 증가

- 시장 성장 억제요인

- 정부와 규제기관의 엄격한 가이드라인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(금액 베이스 시장 규모)

- 제품별

- 시판약(OTC)

- 처방약

- 제형별

- 흡입제

- 경구 고형제

- 경구액제

- 유통 채널

- 병원 약국

- 소매점

- 약국

- 온라인 약국

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Merck KGaA

- ARPIMED

- Perrigo company plc

- Sun Pharmaceutical Industries Ltd.

- Johnson & Johnson Private Limited

- Sanofi

- Aurobindo Pharma

- Genexa Inc.

- GSK plc

- Reckitt Benckiser Group PLC

- Cipla Inc.

- AstraZeneca

제7장 시장 기회 및 향후 동향

AJY 24.08.05The Expectorant Drugs Market size is estimated at USD 100 million in 2024, and is expected to reach USD 120 million by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on the expectorant drugs market. The initial virus outbreak led to a surge in the demand for over-the-counter (OTC) expectorants as people sought relief from respiratory symptoms associated with COVID-19. The rise in respiratory illnesses like influenza has led to a higher demand for expectorants, which help clear mucus from the airways. This can strain supply chains and lead to shortages of expectorant drugs globally. Post-COVID-19 complications like lung fibrosis and chronic obstructive pulmonary disease (COPD) were growing concerns. Expectorants can play a role in managing such conditions, potentially boosting market growth. For instance, COPD takes over 3 million lives each year, impacting an estimated 392 million people globally. Out of these, three-quarters of individuals live in low-middle countries with COPD conditions. People with COPD Condition further require expectorant drugs to treat the disease, which is expected to increase the demand for the expectorant market further.

Furthermore, the growing incidence of respiratory infections, rising seasonal fluctuations, and easier medication access are expected to expand the market. Respiratory illnesses like the common cold, influenza, and chronic obstructive pulmonary disease (COPD) are rising globally. For instance, in October 2022, according to the Centers for Disease Control and Prevention (CDC), during the 2021-2022 season, influenza caused a significant burden on healthcare systems, with an estimated 9.4 million people suffering from the illness, 4.3 million required medical visits and 1,00,000 seeking hospitalizations. Additionally, in October 2023, data published by the World Health Organization (WHO) showed that about 1 billion people experience seasonal influenza yearly, with 3 to 5 million cases progressing to severe illness. Thus, expectorant drugs are used heavily in respiratory conditions, raising the demand for expectorant drugs.

Moreover, the senior population is more susceptible to respiratory illnesses like bronchitis, pneumonia, and asthma due to a weakened immune system, slower lung function, and underlying health conditions. For instance, in November 2023, according to UNICEF (United Nations Children's Fund), pneumonia is a prevalent infectious disease among children, with 1,400 cases of pneumonia per 100,000 children worldwide. Due to rising cases of pneumonia among adults and children, there will be a further need for expectorant drugs to treat the patient, which will increase the market expansion in the forecast period.

Due to the factors above, such as rising cases of respiratory infections, adoption of telemedicine, awareness among people about respiratory conditions, and increasing geriatric population, the market is expected to continue to grow in the coming years.

However, governments and regulatory bodies impose strict guidelines regarding the sale and use of expectorant drugs. Certain countries have banned or restricted codeine-containing cough suppressants due to safety concerns.

Expectorant Drugs Market Trends

Over-the-counter medications are increasingly popular among consumers due to their convenience and affordability

Over-the-counter drug medications can be purchased without a prescription from healthcare professionals. These drugs are generally used in common respiratory conditions, such as coughs and congestion, by helping to loosen mucus and clear the airways. OTC expectorants are usually less expensive than prescription expectorants. OTC expectorants readily available at pharmacies and supermarkets simplify access for patients with mild respiratory symptoms like cough and congestion. This eliminates the need for doctors' visits and prescriptions, saving time and cost. For instance, in February 2023, the International Journal of Pharmaceutical Research and Applications stated that as a trend of increased use of OTC medications, approximately 20.8% of over-the-counter medications were taken by pregnant women during pregnancy in India in the year 2022.

Furthermore, OTC expectorants are generally cheaper than prescription or other respiratory medications. This affordability makes them a more attractive option for budget-conscious consumers. Also, manufacturers focus on FDA approval for OTC expectorants to ensure a market launch. For instance, in August 2023, Marksans Pharma received U.S. FDA approval to sell over-the-counter guaifenesin extended-release tablets in 600 mg and 1200 mg (OTC). Additionally, pharmaceutical companies promote expectorant drug effectiveness and ease of use for humans. This brand awareness and targeted marketing play a significant role in driving consumers' preference towards OTC options.

Hence, increasing the use of OTC medications and making them readily available in the market can also be effective treatment options for respiratory conditions, which are expected to grow in the coming years.

North America is Expected to Dominate the Expectorant Drugs Market

North America is expected to dominate the market owing to factors such as the high prevalence of respiratory diseases, the presence of key players, rising R&D expenditure, and the rapidly rising older population. Respiratory diseases are a significant health concern in North America, with the common cold, influenza, and pneumonia being among the most common causes of illness. For instance, in 2022, according to data published by the Centers for Disease Control and Prevention (CDC), 4.6% of adults in the U.S. reported having been diagnosed with COPD, emphysema, or chronic bronchitis. The primary symptom of asthma is excessive mucus production in the airways, leading to congestion, coughing, and difficulty breathing. Expectorant drugs like guaifenesin and ambroxol are helping by thinning and loosening mucus; due to this factor, the market will expand in the forecast period. For instance, in November 2023, the Centers for Disease Control and Prevention (CDC) reported that in 2022, 8.7% of adults and 6.2% of children younger than 18 years struggled with asthma in the U.S.

Expectorant drugs play a crucial role by providing significant relief to asthma patients, which increases the market expansion in the forecast period. For instance, in March 2023, according to Statistics Canada, asthma affected an estimated 3.8 million Canadians, with a prevalence ranging from 7-2% in Alberta. Due to the increasing adoption of expectorant drugs in the region, the market will see lucrative growth opportunities in the upcoming years.

The pharmaceutical companies actively launched and promoted expectorant drugs in the region. For instance, in March 2021, Merck KGaA received FDA approval for Gefapixant, an investigational, orally administered, selective P2X3 receptor antagonist. Gefapixant is used as a potential treatment for refractory chronic cough in adults.

Therefore, the market is expected to witness significant growth in the region due to those above, like the growing prevalence of respiratory disease, the rising geriatric population, and the manufacturing and development of new products.

Expectorant Drugs Industry Overview

The expectorant drugs market is moderately fragmented in nature due to the presence of several companies operating globally as well as regionally. Major players in the market are majorly focused on regulatory approval in particular countries as well as product launches to expand their presence in the global market. The competitive landscape includes an analysis of a few international as well as local companies that hold the market shares and are well known including Merck KGaA, ARPIMED, Perrigo company plc, Sun Pharmaceutical Industries Ltd, Johnson & Johnson Private Limited, Sanofi, Aurobindo Pharma, Genexa Inc., GSK plc, Reckitt Benckiser Group PLC, Cipla Inc., AstraZeneca and among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Respiratory Disease

- 4.2.2 Growing Demand for OTC Medications

- 4.3 Market Restraints

- 4.3.1 Governments and Regulatory Bodies Impose Strict Guidelines

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 By Product

- 5.1.1 Over-the-Counter (OTC)

- 5.1.2 Prescription Drug

- 5.2 By Dosage Form

- 5.2.1 Inhalant

- 5.2.2 Oral Solid

- 5.2.3 Oral Liquid

- 5.3 Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Stores

- 5.3.3 Drug Store

- 5.3.4 Online Pharmacies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Merck KGaA

- 6.1.2 ARPIMED

- 6.1.3 Perrigo company plc

- 6.1.4 Sun Pharmaceutical Industries Ltd.

- 6.1.5 Johnson & Johnson Private Limited

- 6.1.6 Sanofi

- 6.1.7 Aurobindo Pharma

- 6.1.8 Genexa Inc.

- 6.1.9 GSK plc

- 6.1.10 Reckitt Benckiser Group PLC

- 6.1.11 Cipla Inc.

- 6.1.12 AstraZeneca