|

시장보고서

상품코드

1521607

농업기계 금융 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Agriculture Equipment Finance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

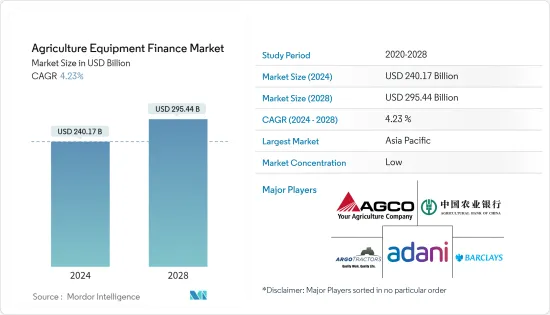

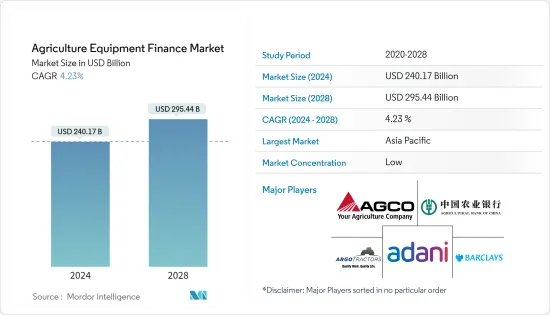

농업기계 금융 시장 규모는 2024년 2,401억 7,000만 달러로 추정되며, 2028년에는 2,954억 4,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2028년) 동안 4.23%의 CAGR을 기록할 것으로 예상됩니다.

세계 농업 기계화 추세는 이 시장의 주요 원동력이 되고 있습니다. 또한 온라인 금융 플랫폼을 통한 간편하고 신속한 자금 조달에 대한 수요 증가도 시장을 주도하고 있습니다. 또한, 세계 차원에서 모든 이해관계자에게 대출에 대한 실시간 정보 투명성을 보장하는 블록체인 기술의 출현도 시장을 주도하고 있습니다. 시장 성장에 기여하는 다른 요인으로는 낮은 농업기계 수입 관세 등이 있습니다.

또한, 온라인 금융 플랫폼은 농부, 계약자 및 딜러가 자본에 쉽게 접근할 수 있도록 돕고 있습니다. 이러한 플랫폼에서 사용자는 등록 후 몇 분 안에 대출을 신청할 수 있으며, 대출이 승인되는 즉시 자금이 입금됩니다. 신속하고 편리한 대출 접근성은 향후 몇 년 동안 세계 농업기계 금융 시장의 성장을 이끄는 주요 원동력이 될 것으로 예상됩니다.

농업기계 렌탈업체가 증가함에 따라, 일류 고품질 장비에 투자하고자 하는 금융회사도 증가하고 있습니다. 이는 향후 몇 년 동안 농업기계 금융 시장의 성장을 촉진할 것으로 보입니다. 농업 대출 면제와 같은 제도는 농부들이 농업기계를 구입하도록 장려하기 위한 것입니다. 세계 각국 정부는 농민들이 부채에서 벗어나 기계화 농업으로 전환하도록 장려하기 위해 이러한 프로그램을 시행하고 있습니다.

대안 금융은 빠르고 쉬운 신용을 제공함으로써 비즈니스를 지원합니다. 다양한 대안금융에서 중소규모의 무담보 대출이 많이 제공되고 있어 중소기업의 자금 조달이 용이해지고 있습니다. 이에 따라 농업 관련 사업의 신용 수요는 향후 몇 년 동안 증가할 것으로 예상되며, 이는 농업 및 농업 관련 금융 시장의 성장을 견인할 것으로 보입니다.

농업기계 금융 시장 동향

농업용 트랙터에 대한 수요 증가

농업용 트랙터 시장 규모는 농업의 기계화와 생산성 및 효율성 향상에 대한 요구로 인해 지속적으로 확대되고 있습니다. 인구 증가, 도시화, 식량 수요 증가, 농법 혁신 등의 요인으로 인해 농업용 트랙터 시장 규모는 꾸준히 성장하고 있습니다.

도시화와 도시로의 인구 이동으로 인해 인건비는 놀라운 속도로 상승하고 있습니다. 인건비는 생산 비용과 직결됩니다. 기계화는 노동 임금을 낮춥니다. 노동 임금이 상승하고 농업 노동력이 부족하기 때문에 기계화율이 높아지고 있습니다. 정부도 높은 수확량을 얻기 위해 보조금을 지급하며 농업 기계화를 장려하고 있습니다. 기술 발전도 기계화 증가에 기여하고 있으며, 농업 기계화의 이점에 대한 농부들의 인식이 높아지고 있습니다.

아시아태평양의 농업기계 판매 증가

아시아태평양은 농업기계의 가장 큰 시장 중 하나입니다. 인구가 많고 농업 경제에 대한 의존도가 높으며 가처분 소득이 증가함에 따라 인도, 일본, 중국 등 APAC 지역의 신흥국 정부는 농업 생산량을 늘리기 위해 비용 효율적인 솔루션에 주목하고 있습니다.

2023년에는 중국이 아시아태평양 농업기계 시장을 장악할 것으로 예상됩니다. 중국의 높은 시장 점유율은 많은 농가 수, 넓은 농업 경작지, 노동력 부족으로 인한 첨단 농업기계에 대한 수요 증가, 농업 부문의 현대화 및 기계화를 위한 정부의 노력 증가, 많은 농업기계 제조업체의 존재 등으로 인해 높은 시장 점유율을 차지할 것으로 예상됩니다.

아시아태평양 농업기계 시장 점유율은 인도와 중국이 60%를 차지하고 있습니다. 인도와 중국에서는 농업 기계화에 대한 수요가 꾸준히 증가하고 있습니다. 주요 시장 촉진요인은 노동력 부족, 농작업 효율화의 필요성, 계약 재배, 정부 인센티브, 높은 노동 임금입니다. 또한 인도 정부는 보조금, 농업기계에 대한 낮은 수입세, 쉬운 융자 제도를 제공하여 농가의 농업 기계화를 장려하고 있습니다.

농업기계 금융 산업 개요

농업기계 금융 시장은 파편화되어 있습니다. 농업기계 금융 시장의 기업들은 전략적 제휴, 파트너십, 인수합병, 지역 확장, 제품 및 서비스 출시 등을 통해 시장 진입을 시도하고 있습니다. 시장 주요 기업으로는 Adani Group, AGCO Corp, Agricultural Bank of China Ltd, Argo Tractors S.A., Barclays PLC 등이 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 농업 분야의 여성 지원을 위한 융자가 시장 성장을 형성하는 주요 동향입니다.

- 저금리로 융자를 제공하는 정부 이니셔티브

- 시장 성장 억제요인

- 은행 대출금리 상승은 시장 성장에 영향을 미치는 과제입니다.

- 시장 성장의 최대 장애 중 하나는 계속 진화하는 배기가스 규제입니다.

- 시장 기회

- 융자로의 신속하고 용이한 액세스가 세계의 농업기계 융자 시장 성장을 촉진합니다.

- 현대적 기술 이용 증가와 식품·농업 생산 고품질화에 대한 수요 증가

- 밸류체인/공급망 분석

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 농업의 기술 개발과 진보에 관한 인사이트

제5장 시장 세분화

- 파이낸스 유형별

- 리스

- 대출

- 신용범위

- 제품별

- 트랙터

- 수확기

- 건초기계

- 기타

- 지역별

- 아시아태평양

- 북미

- 유럽

- 남미

- 중동 및 아프리카

제6장 경쟁 상황

- 벤더 시장 점유율

- 인수합병

- 기업 개요

- Adani Group

- AGCO Corp.

- Agricultural Bank Ltd.of China

- Argo Tractors SpA

- Barclays PLC

- BlackRock Inc.

- BNP Paribas SA

- Citigroup Inc.

- Deere and Co.

- ICICI Bank Ltd.

- IDFC FIRST Bank Ltd.*

제7장 시장 기회와 향후 동향

ksm 24.08.01The Agriculture Equipment Finance Market size is estimated at USD 240.17 billion in 2024, and is expected to reach USD 295.44 billion by 2028, growing at a CAGR of 4.23% during the forecast period (2024-2028).

The market is mainly driven by the growing trend of farm mechanization around the world. The market is also driven by the increasing demand for simplified and fast financing through online finance platforms. The market on a global level is also being driven by the emergence of blockchain technology, which ensures real-time information transparency of a loan to all parties involved. Other factors that are contributing to the market growth include low import duty on agricultural equipment.

In addition, online financial platforms have made it easier for farmers, contractors, and dealers to access capital. These platforms allow users to apply for credit within minutes of registering, and funds are credited as soon as the loan is approved. Quick and convenient access to loans is expected to be a major driver of growth in the global farm equipment financing market over the next few years.

As the number of providers of agricultural equipment rental grows, so too does the number of finance companies willing to invest in top-notch quality equipment. This will drive the growth of the agriculture equipment finance market over the next several years. Programs like farm loan waivers are designed to encourage farmers to purchase farm equipment. Governments around the world have implemented these programs to help farmers get out of debt and encourage them to switch to mechanized farming.

Alternative finance helps businesses by providing fast and easy credit. There are many small to medium-size unsecured loans available from various alternative finance sources, which make it easier for small to medium-sized businesses to get funding. As a result, the demand for credit in agriculture-related works is expected to increase in the coming years, thus driving the growth of the agriculture & agriculture finance market.

Agriculture Equipment Finance Market Trends

Rising Demand For Tractors In Agriculture Industry

The market size of the agricultural tractor market is constantly increasing due to the increasing mechanization of the agriculture industry and the need for increased productivity and efficiency. Factors such as population increase, urbanization, food demand increase, and technological innovation in farming practices have contributed to the steady growth of the market size of agricultural tractors.

Labor costs have been rising at an alarming rate due to urbanization and the migration of people into urban areas. Labor costs are directly related to production costs. Mechanization reduces labor wages. As labor wages are rising and there is a shortage of farm labor, the rate of mechanization is increasing. The government is also supporting the increase in farm mechanization to get high yields by offering subsidies. Technological advances are also contributing to the increase in mechanization and increasing awareness among farmers of the advantages of agricultural mechanization.

Rise In The Sales Of Agriculture Equipment In Asia-Pacific

Asia Pacific is one of the largest markets for agricultural machinery. With a large population and high dependency on the agricultural economy, rising disposable income, the governments of emerging countries in the APAC region like India, Japan and China are focusing on cost-effective solutions for high agricultural production.

China is expected to dominate the Asia-Pacific agricultural equipment market in 2023. The country's high market share is due to its large number of farmers, a large area under agricultural cultivation, growing demand for advanced agricultural equipment due to labor shortage, increasing government initiatives to modernize and mechanize the agriculture sector, and the presence of many agriculture equipment manufacturers.

India and China account for 60% of the farm machinery share in Asia-Pacific. Demand for farm mechanization has been steadily increasing in India and China. The main market drivers are labor shortage, the need to improve farm efficiency, contract farming, government incentives, and a high labor wage. In addition, the Indian government offers subsidies, low import taxes on agricultural equipment, and easy financing programs that encourage farmers to mechanize their farms.

Agriculture Equipment Finance Industry Overview

The agriculture equipment finance market is fragmented. Agricultural equipment finance market companies are implanting strategic alliances, partnerships, mergers and acquisitions, geographic expansion, and product/service launches. Key players in the market are Adani Group AGCO Corp Agricultural Bank of China Ltd and Argo Tractors S.A. Barclays PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Financing to support women in the agricultural sector is the primary trend shaping the growth of the market

- 4.2.2 Government initiatives to provide loans at a lower interest rate

- 4.3 Market Restraints

- 4.3.1 Costlier bank lending rates are a challenge that affects the growth of the market.

- 4.3.2 One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 4.4 Market Opportunities

- 4.4.1 Quick and easy access to loans will drive the growth of the global agricultural equipment financing market

- 4.4.2 Increased usage of modern technologies and growing demand for high quality of food & agricultural production

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into technological developments and advancements in agricultural industry

5 MARKET SEGMENTATION

- 5.1 By Type of Finance

- 5.1.1 Lease

- 5.1.2 Loan

- 5.1.3 Line of Credit

- 5.2 By Product

- 5.2.1 Tractors

- 5.2.2 Harvesters

- 5.2.3 Haying Equipment

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Adani Group

- 6.3.2 AGCO Corp.

- 6.3.3 Agricultural Bank Ltd.of China

- 6.3.4 Argo Tractors SpA

- 6.3.5 Barclays PLC

- 6.3.6 BlackRock Inc.

- 6.3.7 BNP Paribas SA

- 6.3.8 Citigroup Inc.

- 6.3.9 Deere and Co.

- 6.3.10 ICICI Bank Ltd.

- 6.3.11 IDFC FIRST Bank Ltd.*