|

시장보고서

상품코드

1521618

일본의 E-Commerce 물류 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Japan E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

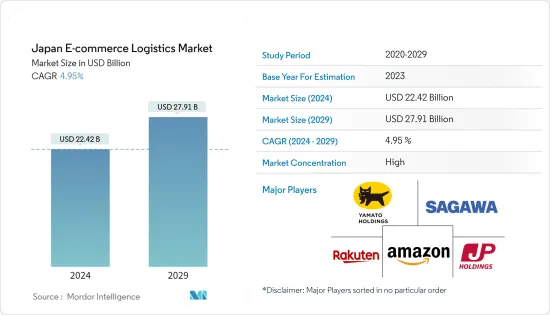

일본의 E-Commerce 물류(E-Commerce Logistics) 시장 규모는 2024년에 224억 2,000만 달러로 추정되고, 2029년에는 279억 1,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년)의 CAGR은 4.95%로 추이하며 성장 할 것으로 예측됩니다.

일본의 E-Commerce 산업은 최근 몇 년동안 눈부신 성장을 이루고 있습니다. 기술에 익숙한 인구와 강력한 디지털 인프라를 갖춘 일본은 세계 E-Commerce 시장의 주요 기업이 되었습니다. 그 결과 효율적이고 신뢰할 수 있는 물류 서비스에 대한 수요도 급증하고 있습니다.

일본에서 E-Commerce의 성장을 가속하는 주요 요인 중 하나는 인터넷과 스마트폰 보급이 진행되고 있다는 것입니다. 일본의 모바일 인터넷 보급률은 2023년에는 약 93.8%이며, 2028년에는 95.6% 가까이에 이를 것으로 예상됩니다. 일본 인구는 2023년 약 1억 2,360만 명에서 2028년에는 약 1억 2,210만 명으로 감소할 것으로 예측됩니다.

이러한 소비자 행동의 변화는 E-Commerce 사업자에게 절대적인 기회를 가져왔지만 동시에 물류사업자에게도 과제를 쏟았습니다.

급성장하는 E-Commerce 시장 수요를 충족시키기 위해 일본 물류기업은 기술과 인프라에 많은 투자를 해왔습니다. 첨단 분류 설비와 실시간 추적 시스템을 채택하여 효율적인 주문 처리와 운송을 실현하고 있습니다.

일본의 물류·운송 서비스 제공업체인 Sagawa Express는 SG Holdings Co. Ltd의 자회사인 Sumitomo Corporation, Dexterity의 자회사인 Dexterity Inc.와 제휴해, 인공지능(AI)를 탑재한 로봇을 이동하는 것으로, 소포 트럭에 무작위 상자를 적재할 수 있습니다. Sagawa Express와 세계 유수의 물류·운송 서비스 제공업체인 Dexterity Inc.는 Dexterity의 AI를 이용해, 트럭에 상자를 쌓는 로봇을 움직입니다. DexR의 듀얼 암 로봇은 배포를 확대하기 전에 Sagawa의 물류 업무에서 학습하고 Sagawa의 기존 물류 인프라에 원활하게 통합됩니다.

Last Mile Delivery는 일본 물류업체에게 특히 중요한 과제입니다. 일본의 밀집한 도시와 복잡한 주소 체계가 라스트마일 딜리버리를 곤란하게 하고 있습니다. 그러나 각 회사는 이러한 과제를 극복하기 위해 혁신적인 솔루션을 활용해 왔습니다. 예를 들어, 크라우드소싱을 활용한 운송 네트워크 구축, 지역 편의점과의 제휴에 의한 수하물 수집, 무인 항공기 및 무인 차량을 이용한 운송 모색 등이 있습니다.

예를 들어, Amazon은 도쿄, 오사카, 나고야와 같은 주요 도시로 다양한 상품의 라스트마일 딜리버리를 제공합니다. 이 회사는 새로운 창고 및 운송 센터 건설 등 일본 물류 인프라에 많은 투자를 하고 있습니다.

Japan Post는 'Yu-Pack Tokkyu'이라는 당일 운송 서비스를 제공합니다. 이 서비스는 전국에서 사용할 수 있으며 최대 25kg까지 수하물을 배달 할 수 있습니다. 일본의 인프라 정비가 진행됨에 따라 당일 운송업체는 보다 효율적이고 효과적인 업무를 할 수 있게 되었습니다. 이는 일본의 당일 배달 시장 성장을 뒷받침하고 있습니다.

일본의 E-Commerce 물류 시장 동향

운송부문은 큰 성장 예측

일본에서는 활황을 보이는 E-Commerce 시장의 확대되는 수요에 대응하기 위해 수송부문이 크게 발전하고 있습니다.

일본 E-Commerce 운송 부문은 국내 택배 시장의 90% 이상을 차지하는 거대 기업 3개사에 의해 지배되고 있습니다. 최대 기업인 Yamato Transport는 연간 18억 개 이상의 소포를 운송하고 있습니다. 그 뒤를 잇는 Sagawa Express는 Amazon과 같은 주요 고객에게 물류 서비스를 제공합니다.

운송 부문에서 중요한 과제 중 하나는 효율적이고 시기 적절한 상품의 운송입니다. 일본과 같은 인구가 많아 지리적으로 다양한 국가의 물류기업들은 이러한 과제를 극복하기 위해 혁신적인 솔루션을 개발해야 했습니다. Worldometer의 최신 유엔 데이터 분석에 따르면 일본 인구는 2024년 현재 1억 2,289만 5,594명입니다.

국내 제3위의 우편조직인 Japan Post는 기본배달료를 인상하고 주요 고객과 보다 경쟁요금을 협상함으로써 이에 추종할 가능성이 높습니다. Japan Post는 제한 전략에 따라 Yamato와 Sagawa가 남긴 국내 화물 관리 기회를 활용해 왔습니다. 이전에는 법인 기업만이 이용 가능했던 택배 서비스 'Yu-Pack'이, 현재는 개인에서도 이용할 수 있게 되어, 현저한 성장을 이루고 있습니다.

그러나 40억 건에 육박하는 택배 배송 수요가 지속적으로 증가하면서 업계 전반의 성장을 견인하고 있지만, 일본 내 배송이 필요한 품목의 엄청난 양으로 인해 이들 업체는 비용 절감과 프로세스 개선을 모색해야 하는 압박을 받고 있습니다.

인터넷과 스마트폰의 높은 보급률이 시장을 견인

일본은 최근 몇 년간 인터넷과 스마트폰 보급률이 눈부시게 성장하고 있으며, 세계에서 가장 인터넷에 접속하고 있는 국가의 하나가 되고 있습니다. 첨단 기술 인프라와 하이테크에 정통한 국민성으로 일본은 디지털 혁명을 직접적으로 받아들여 왔습니다.

일본의 인터넷 보급률은 눈부신 수준까지 급상승해 인구의 상당 부분이 인터넷에 액세스할 수 있게 되었습니다. 최신 데이터에서 일본의 인터넷 보급률은 약 93.13%에 달할 전망입니다. 이는 일본 국민의 대부분이 인터넷에 접속하고 그 방대한 서비스와 기회를 누릴 수 있음을 의미합니다.

2023년 초 일본 액티브 소셜미디어 이용자 수는 9,290만명으로 일본 인구의 74.4%를 차지합니다. 2023년 초 일본 휴대전화 접속자 수는 1억 8,440만명으로 인구의 149.1%를 차지했습니다.

일본의 인터넷 보급률이 높은 원동력의 하나는 그 견고한 통신 인프라입니다. 일본은 광섬유 케이블의 발전된 네트워크를 자랑하며 도시와 지방 모두에 빠르고 안정적인 인터넷 연결을 제공합니다. 이 광범위한 네트워크를 통해 전국 사람들이 인터넷에 쉽게 액세스할 수 있습니다.

일본의 E-Commerce의 상승은 효율적이고 신뢰할 수 있는 물류 서비스에 대한 수요가 증가하게 되었습니다. 더 많은 사람들이 온라인 쇼핑을 이용할수록 매끄러운 운송과 선불이 매우 중요해지고 있습니다. 이에 따라 일본의 E-Commerce 물류시장의 발전길을 열었습니다.

일본의 E-Commerce 물류 산업 개요

일본의 E-Commerce 물류 시장은 매우 역동적이고 경쟁적이며, 여러 주요 기업들이 시장 점유율을 다투고 있습니다. 시장의 주요 기업으로는 Yamato Holdings, Sagawa, Japan Post, Amazon Japan, Rakuten 등이 있습니다.

또한 이 업계에서 두각을 나타내는 소규모 물류기업과 신흥기업도 많이 존재합니다. 시장 경쟁은 치열하며 각 회사는 E-Commerce 부문의 진화하는 니즈를 충족시키기 위해 항상 혁신적인 서비스를 구축하고 있습니다.

AI 서비스의 백본인 Amazon.com의 클라우드 컴퓨팅 인프라는 일본에서 크게 확대될 예정입니다. Amazon.com은 2027년까지 도쿄와 오사카의 대도시 지역 클라우드 컴퓨팅 시설에 22억 6,000만 달러를 투자하여 고객 수요 증가에 대응할 계획입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건과 시장 정의

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 현재의 시장 시나리오

- 업계의 기술 동향

- 정부의 대처와 규제

- E-Commerce에 관한 통찰

- 밸류체인/서플라이체인 분석

- 수요 및 공급 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 성장 촉진요인

- E-Commerce 보급 확대

- 국경을 넘은 무역활동의 급증

- 억제요인

- 시장에 영향을 주는 인프라의 과제

- 시장에 영향을 미치는 복잡한 규제

- 기회

- 라스트마일 운송의 혁신이 시장을 견인

- 지속 가능한 물류에 대한 수요

- 업계의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자/구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계 강도

제6장 시장 세분화

- 서비스별

- 수송(운송)

- 창고 및 재고 관리

- 부가가치 서비스(라벨링, 포장 등)

- 사업별

- B2B

- B2C

- 운송지별

- 국내

- 국제/국경 간(크로스 보더)

- 상품별

- 패션 및 의류

- 소비자용 전자 기기

- 소비자 가전 제품

- 가구

- 미용 및 퍼스널케어

- 기타 제품(완구, 식품 등)

제7장 경쟁 구도

- 기업 프로파일

- Yamato Holdings

- Sagawa

- Japan Post

- Amazon Japan

- Rakuten

- DHL Japan

- Nippon Express

- Kokusai Express

- Blue Dart

- JP Logistics Hub*

- 기타 기업

제8장 시장의 미래

제9장 부록

LYJThe Japan E-commerce Logistics Market size is estimated at USD 22.42 billion in 2024, and is expected to reach USD 27.91 billion by 2029, growing at a CAGR of 4.95% during the forecast period (2024-2029).

The e-commerce industry in Japan has witnessed remarkable growth in recent years. With a tech-savvy population and a strong digital infrastructure, Japan has become a major player in the global e-commerce market. Consequently, the demand for efficient and reliable logistics services has also surged.

One of the key factors driving the growth of e-commerce in Japan is the increasing penetration of the Internet and smartphones. Japan's mobile internet penetration was about 93.8% in 2023 and is expected to reach nearly 95.6% by 2028. Japan's population is projected to decline from approximately 123.6 m in 2023 to approximately 122.1 m in 2028.

This shift in consumer behavior has created immense opportunities for e-commerce businesses but has also posed challenges for logistics providers.

To meet the demand of the booming e-commerce market, logistics companies in Japan have been investing heavily in technology and infrastructure. They adopt advanced sorting facilities and real-time tracking systems to ensure efficient order processing and delivery.

Sagawa Express, a Japanese logistics and delivery service provider, has partnered with Sumitomo Corporation, a subsidiary of SG Holdings Co. Ltd, and Dexterity Inc., a subsidiary of Dexterity, to power robots powered by Artificial Intelligence (AI) that can load parcel trucks with random boxes. Sagawa Express and Dexterity, one of the world's leading logistics and delivery services providers, will use Dexterity's AI to power robots that can load trucks with boxes. Before scaling deployment, the DexR's dual-arm robot learns from Sagawa Express's logistics operations, seamlessly integrating into Sagawa's existing logistics infrastructure.

Last-mile delivery has been a particular focus for logistics providers in Japan. The country's dense urban areas and complex address systems make last-mile delivery challenging. However, companies have been leveraging innovative solutions to overcome these challenges. For instance, they are utilizing crowdsourced delivery networks, partnering with local convenience stores for parcel pick-up, and exploring using drones and autonomous vehicles for delivery in certain areas.

For example, Amazon offers last-mile delivery on a wide range of products in major cities such as Tokyo, Osaka, and Nagoya. The company has invested heavily in logistics infrastructure in Japan, including building new warehouses and delivery centers.

Japan Post offers a same-day delivery service called Yu-Pack Tokkyu. This service is available nationwide and can be used to deliver packages weighing up to 25 kilograms. The growing infrastructure in Japan is making it possible for same-day delivery companies to operate more efficiently and effectively. This is helping to drive the growth of the same-day delivery market in Japan.

Japan E-commerce Logistics Market Trends

Immense growth projection for transportation segment

In Japan, the transportation segment has seen significant advancements to meet the growing demand of the booming e-commerce market.

Japan's e-commerce transportation segment is dominated by three giant companies that account for more than 90 percent of the domestic parcel delivery market. The biggest one, Yamato Transport, ships more than 1.8 billion parcels annually. A close competitor, Sagawa Express, supplies logistics services to major customers such as Amazon.

One of the key challenges in the transportation segment is the efficient and timely delivery of goods. Logistics companies in a highly populated and geographically diverse country like Japan have had to develop innovative solutions to overcome these challenges. Japan has a population of 122,895,594 as of 2024, according to Worldometer's analysis of the most recent United Nations data.

Japan Post, the country's third-largest domestic post organization, is likely to follow suit by raising its basic delivery charge and negotiating more competitive rates with key customers. Japan Post has also taken advantage of the domestic shipment management opportunities left by Yamato and Sagawa following the restriction strategy. It has seen tremendous growth in its parcel delivery service, 'Yupack,' which was previously available only to enterprise businesses and is now available to private individuals.

However, while the ever-growing demand of nearly 4 billion package deliveries is driving growth in the industry overall, the sheer volume of items that require delivery within Japan is putting pressure on these companies and forcing them all to look for cost savings and process improvements.

High internet and smart phone penetration driving the market

Japan has witnessed remarkable growth in internet and smartphone penetration over the years, making it one of the most connected countries in the world. With its advanced technological infrastructure and tech-savvy population, Japan has embraced the digital revolution with open arms.

Internet penetration in Japan has soared to impressive levels, with a significant portion of the population having access to the internet. As of the latest data, the internet penetration rate in Japan stands at around 93.13%. This means that majority of the Japanese citizens can connect to the internet and enjoy its vast array of services and opportunities.

Japan had 92.9 million active social media users at the beginning of 2023, making up 74.4% of the country's population. At the start of 2023, there were 184.4m cellular mobile connections in the country, making up 149.1% of the population.

One of the driving forces behind Japan's high internet penetration is its robust telecommunications infrastructure. The country boasts a well-developed network of fiber-optic cables, providing high-speed and reliable internet connections to both urban and rural areas. This extensive network ensures that people across the country can access the internet wit ease.

The rise in ecommerce in Japan has led to an increased demand for effcient and reliable logistics services. As more and more people turn to online shopping, the need for seamless delivery and fulfillment becomes crucial. This has paved the way for the evlution of the ecommerce logistics market in Japan.

Japan E-commerce Logistics Industry Overview

The e-commerce logistics market in Japan is quite dynamic and competitive, with several key players vying for market share. Some of the major players in the market include Yamato Holdings, Sagawa, Japan Post, Amazon Japan, and Rakuten.

There are also numerous smaller logistics companies and startups that are making their mark in the industry. The competition in the market is intense, with companies constantly innovating and expanding their services to meet the evolving needs of the e-commerce sector.

Amazon.com's cloud computing infrastructure, which is the backbone for AI services, is set to expand significantly in Japan. By 2027, Amazon.com plans to invest USD 2.26 billion in cloud computing facilities in the Tokyo and Osaka metropolitan areas to meet the increasing demand from customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Current Market Scenario

- 4.3 Technological Trends in the Industry

- 4.4 Government Initiatives and Regulations

- 4.5 Insights into the Ecommerce

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increasing ecommerce penetration

- 5.1.2 Surge in Cross-Border Trade Activities

- 5.2 Restraints

- 5.2.1 Infrastructure challenges affecting the market

- 5.2.2 Regulatory Complexities Affecting the Market

- 5.3 Opportunities

- 5.3.1 Last-Mile Delivery Innovations Driving the Market

- 5.3.2 Demand for Sustainable Logistics

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added services (labeling, packaging, etc.)

- 6.2 By Business

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By product

- 6.4.1 Fashion and pparel

- 6.4.2 Consumer electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal care

- 6.4.6 Other products (toys, food products, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Yamato Holdings

- 7.2.2 Sagawa

- 7.2.3 Japan Post

- 7.2.4 Amazon Japan

- 7.2.5 Rakuten

- 7.2.6 DHL Japan

- 7.2.7 Nippon Express

- 7.2.8 Kokusai Express

- 7.2.9 Blue Dart

- 7.2.10 JP Logistics Hub*

- 7.3 Other Companies