|

시장보고서

상품코드

1521653

레저용 차량 금융 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Recreational Vehicle Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

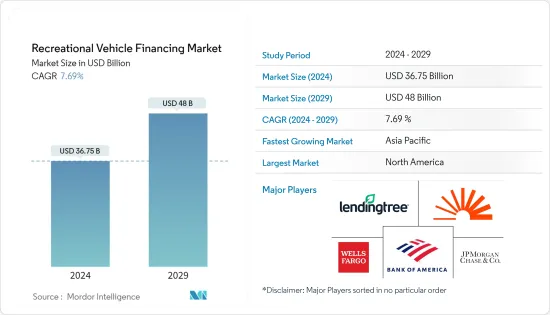

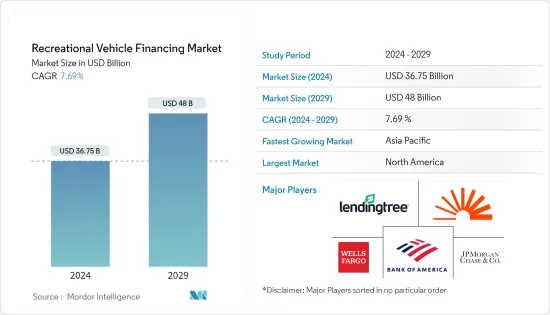

세계 레저용 차량 금융 시장 규모는 2024년 367억 5,000만 달러에 달할 것으로 예상되며, 2024-2029년 연평균 7.69% 성장하여 2029년에는 480억 달러에 달할 것으로 전망됩니다.

레저용 차량 금융 시장은 LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase(JPMorgan Chase) 등 소수의 대형 세계 플레이어가 지배하는 중간 정도의 통합 상태를 보이고 있습니다. 중등도의 통합 상황을 보이고 있습니다. 이들 기업은 광범위한 상품 포트폴리오, 기술 발전, 전략적 제휴를 통해 시장 내 입지를 다져왔습니다.

최근 몇 년 동안 레저용 차량 금융 분야는 레저용 차량 여행의 인기 증가, 레저용 차량 기술의 발전, 혁신적인 금융 솔루션의 등장 등의 요인으로 인해 크게 성장하고 있습니다. 레저용 차량 산업 협회에 따르면, 미국에서만 레저용 차량 산업은 연간 500억 달러의 경제 효과를 창출하고 있습니다. 현재 23,000개 이상의 기업이 이 산업에 종사하고 있으며, 약 45,000개의 직접 고용 기회와 30억 달러의 직접 임금을 창출하고 있습니다. 그 결과, 레저용 차량 금융 산업은 더 넓은 레저용 차량 시장에서 필수적인 요소로 자리 잡았습니다.

레크리에이션용 차량 금융에 대한 수요 증가에는 몇 가지 촉진요인이 있습니다. 우선, COVID-19 사태로 인해 해외여행을 대신할 수 있는 안전한 대안으로 국내 여행과 아웃도어 활동으로 소비자들의 선호가 이동하고 있습니다. 또한, 레저용 차량 기술의 발전으로 연비가 좋고, 친환경적이며, 기술적으로 진보된 차량이 등장하면서 더 많은 사람들에게 점점 더 매력적으로 다가갈 수 있게 되었습니다. 또한, 긱 이코노미와 원격 근무의 증가로 인해 장기 휴가를 떠나는 사람들이 늘어나면서 편안하고 유연한 숙박 옵션으로 레저용 차량에 대한 수요가 증가하고 있습니다. 마지막으로, 사용자 친화적인 온라인 플랫폼과 융자 옵션은 잠재적 구매자가 원하는 레저용 차량을 쉽게 조사, 비교하고 융자를 받을 수 있도록 돕고 있습니다.

레저용 차량 금융 시장은 몇 가지 도전과 기회에 직면해 있습니다. 주요 과제 중 하나는 경기 변동과 소비자 심리에 영향을 받는 레저용 차량 산업의 순환적 특성입니다. 경기 침체기에는 잠재적 구매층이 지출에 신중해지기 때문에 레저용 차량 판매와 대출이 감소할 수 있습니다. 하지만 이는 레저용 차량 금융회사들이 이러한 시기에 구매를 촉진할 수 있는 매력적인 거래와 인센티브를 제공할 수 있는 좋은 기회이기도 합니다. 친환경 레저용 차량과 지속가능한 활동을 촉진하는 혁신적인 금융 옵션은 곧 이러한 문제를 극복하고 업계의 지속가능한 미래에 기여할 수 있을 것입니다.

레저용 차량 금융의 미래는 소비자의 니즈 변화에 따라 진화하는 레저용 차량 금융의 미래가 밝다고 할 수 있습니다. 또한, 레저용 차량에 스마트 기술 및 커넥티비티 기능이 점점 더 많이 통합됨에 따라, 이러한 첨단 차량에 맞는 첨단 금융 솔루션에 대한 수요가 증가할 것으로 예상됩니다. 마지막으로, 지속가능성에 대한 지속적인 관심은 환경 친화적인 금융 옵션의 증가로 이어져 친환경 레저용 차량 모델 개발을 지원하고 책임감 있는 여행 관행을 장려할 것입니다. 전반적으로, 레저용 차량 금융 시장은 앞으로도 레저용 차량 산업 전반에 걸쳐 역동적이고 필수적인 요소로 남을 것으로 예상됩니다.

레저용 차량 금융 시장 동향

소비자 선호도 변화로 시장 수요 증가

레크리에이션용 차량(RV) 금융에 대한 관심이 높아진 것은 COVID-19 사태 이후 국내 여행과 아웃도어 활동에 대한 관심이 높아졌기 때문으로 분석됩니다. 이러한 소비자 행동의 변화로 인해 휴가나 여행을 위한 편안하고 편리한 숙박 시설로 RV에 대한 수요가 증가하고 있습니다.

이 변화에는 몇 가지 요인이 있습니다. 첫째, 건강과 안전에 대한 우려로 인해 해외 여행의 매력이 사라지고 국내 휴가에 대한 수요가 급증했으며, RV 휴가는 기존 호텔 휴가에 비해 60 % 이상 저렴하기 때문에 RV를 구입하는 것은 주로 가족 캠핑과 비용 절감을 위해 RV를 구입하는 것입니다. 인기 있는 RV 유형에는 여행용 트레일러, A형 모터홈, 5륜차, 공원형 레저용 차량(PMRV) 등이 있습니다. 미국에서는 RV 5 대 중 1 대가 여행용 트레일러이며, 5 륜 차량이 인기를 끌고 있습니다.

또한, 팬데믹(전 세계적인 유행병)은 사람들이 자연을 즐기고 집에서 벗어나려고 노력하면서 야외 활동과 경험에 대한 관심을 불러 일으켰고, RV는 국립공원, 경치 좋은 길, 다양한 야외 명소를 탐험할 수 있는 편안한 거점이 될 수 있습니다. 또한, RV 대출에 대한 소비자의 선호도 변화는 가족 및 친구와의 유대감을 회복하려는 욕구에 힘입어 RV는 안전하고 사적인 환경을 유지하면서 가족과 친구들이 함께 여행할 수 있는 특별한 기회를 제공하기 때문에 RV 대출에 대한 소비자의 선호도가 증가하고 있습니다.

한 가구의 평균 RV 융자 금액은 4만 5,000달러 이상입니다. 미국에서는 4,000만 명이 RV 캠핑에 참여하고 있으며, 미국인이 가장 큰 시장 진입자입니다. 밀레니얼 세대가 RV 캠핑에 점점 더 많이 참여하고 있으며, 캠핑카의 38%를 차지하고 있지만, X세대와 베이비붐 세대가 여전히 시장을 독점하고 있습니다. 전형적인 RV 소유 가구의 소득은 약 6만 2,000달러이며, RV 사용 기간은 연평균 4주이며, 2001년 이후 미국에서는 RV 소유자가 16% 증가하여 1980년 대비 60%의 가구가 RV를 소유하고 있습니다.

마지막으로, 원격 근무의 부상으로 많은 사람들이 장기 휴가를 떠나 다양한 장소에서 일할 수 있게 되었으며, RV는 이러한 원격 근무자들에게 편리하고 편안한 거주 공간을 제공하여 새로운 목적지를 탐험하면서 일과 삶의 균형을 유지할 수 있게 해줍니다. 요약하면, 레저용 차량 금융에 대한 소비자의 선호도 변화는 건강과 안전에 대한 우려, 유연성, 경제성, 야외 경험에 대한 욕구, 가족 및 친구와 연결하려는 욕구, 가족 및 친구와의 연결 능력 등의 요인으로 인해 국내 여행 및 휴가에 적합한 숙박 옵션 로서 RV의 인기를 높이고 있습니다.

예측 기간 동안 아시아태평양이 가장 높은 성장세를 기록할 것으로 예상

레크리에이션 차량(RV) 금융 시장은 예측 기간 동안 아시아태평양이 가장 높은 성장률을 기록할 것으로 예상됩니다. 이러한 성장은 가처분 소득 증가, 중산층 인구 증가, 국내 관광객 증가 등 여러 요인에 기인합니다. 아시아태평양의 경제가 계속 성장함에 따라 가처분 소득이 증가하고 있습니다. 이러한 가처분 소득의 증가로 더 많은 사람들이 RV를 구매할 수 있게 되었고, 이에 따라 RV용 대출에 대한 수요가 증가하고 있으며, 2022년 아시아 가계 가처분 소득은 21조 2,000억 달러에 달해 2019년(19조 4,000억 달러)을 넘어설 것으로 예상됩니다. 이에 따라 금융기관과 대부업체들은 이 성장 시장 부문에 대응하기 위해 다양한 대출 옵션을 제공하고 있습니다.

아시아태평양의 중산층은 빠르게 성장하고 있으며, RV 여행을 포함한 레크리에이션 활동을 점점 더 많이 찾고 있으며, RV에 투자하는 중산층이 증가함에 따라 RV 금융에 대한 수요도 증가하여 이 지역의 RV 금융 시장의 성장을 촉진하고 있습니다. 편의성, 비용 절감, 건강상의 이유 외에도 아시아태평양에서는 국내 관광이 크게 증가하고 있으며, RV는 이러한 국내 여행객들에게 편안하고 유연한 숙박 옵션을 제공하여 다양한 목적지를 자신의 속도에 맞게 탐색할 수 있도록 합니다. 이러한 국내 관광의 증가는 RV 차량에 대한 수요 증가와 RV 차량에 대한 융자 증가로 이어지고 있습니다.

일본과 같은 국가에서는 고령화가 진행되면서 편안하고 편리한 여행과 관광을 제공하는 RV에 대한 수요가 증가하고 있습니다. 일본은 고령화가 진행 중이며, 28% 이상이 65세 이상입니다. 이 계층은 캠핑이나 관광과 같은 레저 활동을 점점 더 많이 찾고 있으며, 캐러밴과 모터홈은 노인들이 편안하고 편리하게 여행하고 일본의 아름다운 경치를 탐험할 수 있는 방법을 제공합니다. 일본 RV협회에 따르면, 일본 내 캠핑카 연간 총 판매액은 2022년 약 762억 5,000만 엔에 달할 것으로 예상하고 있습니다. 이는 레저용 차량 금융이 사람들에게 더 나은 선택이 될 것임을 보여줍니다.

또한, 아시아태평양 정부들은 RV 공원과 캠핑장 인프라를 정비하고 개선하여 국내 관광을 장려하고 있습니다. 이러한 이니셔티브는 더 많은 사람들이 RV에 투자하고 자국을 탐험하기 위해 RV 금융 시장의 성장에 유리한 환경을 조성하고 있습니다. 인도 정부는 숲, 요새 기슭, 산기슭, 언덕 역, 댐 등 완충지대의 사유지나 국유지에 민간업체가 캐러밴 공원을 설치할 수 있도록 허용할 예정입니다. 캐러밴 파크는 마하라슈트라 관광개발공사(MTDC)의 숙박시설 근처나 공터, 농어촌관광센터에도 설치할 수 있습니다.

비용 절감, 유연성, 자연과의 교감 등 RV 여행의 장점이 아시아태평양의 많은 사람들에게 인식됨에 따라 RV 차량 및 RV 차량에 대한 수요가 증가할 것으로 예상됩니다. 이러한 RV의 인기 상승은 예측 기간 동안 아시아태평양에서 가장 높은 성장세를 보일 것으로 예상됩니다.

레저용 차량 금융 산업 개요

레저용 차량 금융 시장은 LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase(JPMorgan Chase)와 같은 소수의 대형 세계 플레이어가 지배하고 있으며, 적당히 통합된 통합된 상황을 보여주고 있습니다. 이들 기업은 광범위한 제품 포트폴리오, 기술 발전, 전략적 제휴를 통해 이 시장에서 입지를 다지고 있습니다.

2023년 12월, KKR은 72억 달러 규모의 프라임 레저용 차량 대출 포트폴리오를 인수했습니다. 이는 KKR이 성장하는 RV 산업에 대한 지속적인 관심을 보여주는 것으로, 소비자 금융 부문에서 KKR의 입지를 강화하는 계기가 될 것으로 보입니다.

미국 은행은 2023년 7월 롤릭(Rollick)과 공동으로 개발한 레저용 차량과 보트를 위한 새로운 온라인 마켓플레이스를 발표했습니다. 이 플랫폼은 고객에게 원활한 쇼핑 경험을 제공하고 RV 및 보트 구매에 대한 융자 옵션과 전문가 조언을 제공하는 것을 목표로합니다.

2023년 12월, Sidley는 KKR의 대리인으로서 70억 달러 규모의 포트폴리오를 인수했습니다. 이 거래는 KKR이 소비자 금융 산업, 특히 레저용 차량 분야에서 지속적으로 입지를 확대하는 데 있어 또 하나의 중요한 이정표가 될 것입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 가처분 소득 증가, 금융기관 저금리가 시장 수요를 높인다

- 시장 성장 억제요인

- 높은 초기 비용이 성장을 억제할 가능성

- 밸류체인/공급망 분석

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- PESTLE 분석

제5장 시장 세분화

- 차량별

- Motorhomes

- 클래스 A

- 클래스 B

- 클래스 C

- Caravans

- 여행 트레일러

- 피프스 휠

- 토이 하울러

- 트럭 캠핑카

- 팝업 트레일러

- 접이식 캠핑 트레일러

- Motorhomes

- 재원별

- 은행·신용조합

- RV 딜러 금융

- 제조업체 금융

- 온라인 대출기관

- 정부 지원 대출

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 상황

- 벤더 시장 점유율

- 인수합병

- 기업 개요

- LendingTree

- LightStream

- Wells Fargo Bank

- SouthEast Financials

- Bank of America

- Chase(JPMorgan Chase)

- GreatRVLoan

- Good Sam

- Camping world finance

- Thor Industries Inc.

- Swift Group

- Knaus Tabbert GmbH

- Eura Mobil GmbH

- Avant Garde India

제7장 시장 기회와 향후 동향

ksm 24.08.02The Recreational Vehicle Financing Market size is estimated at USD 36.75 billion in 2024, and is expected to reach USD 48 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

In recent years, the recreational vehicle financing sector has experienced substantial growth, driven by factors such as the increasing popularity of recreational vehicle travel, advancements in recreational vehicle technology, and the emergence of innovative financing solutions. As per the Recreational Vehicle Industry Association, in the US alone, the recreational vehicle industry creates USD 50 billion in economic impact annually. More than 23,000 businesses are currently involved in the industry, creating nearly 45,000 direct employment opportunities and USD 3 billion in direct wages. As a result, the recreational vehicle financing industry has become an essential component of the broader recreational vehicle market.

Several driving factors have contributed to the increasing demand for recreational vehicle financing. Firstly, the COVID-19 pandemic has shifted consumer preferences toward domestic travel and outdoor activities as people seek safer alternatives to international vacations. Additionally, advancements in recreational vehicle technology have resulted in more fuel-efficient, eco-friendly, and technologically advanced vehicles, making them increasingly appealing to a wider audience. Furthermore, the rise of the gig economy and remote work has enabled more individuals to take extended vacations, fuelling the demand for recreational vehicles as a comfortable and flexible accommodation option. Lastly, user-friendly online platforms and financing options have made it easier for potential buyers to research, compare, and secure financing for their desired recreational vehicle.

The recreational vehicle financing market faces several challenges and opportunities. One of the primary challenges is the cyclical nature of the recreational vehicle industry, which is influenced by economic fluctuations and consumer confidence. During economic downturns, recreational vehicle sales and financing may decline as potential buyers become more cautious with their spending. However, this also presents an opportunity for recreational vehicle financing companies to offer attractive deals and incentives to encourage purchases during these periods. Soon, innovative financing options that promote eco-friendly recreational vehicles and sustainable practices can help overcome these challenges and contribute to a more sustainable future for the industry.

The future of recreational vehicle financing looks promising as the market continues to adapt and evolve to meet the changing needs of consumers. Additionally, the increasing integration of smart technology and connectivity features in recreational vehicles will drive demand for advanced financing solutions tailored to these high-tech vehicles. Lastly, the ongoing focus on sustainability will lead to more environmentally conscious financing options, supporting the development of eco-friendly recreational vehicle models and promoting responsible travel practices. Overall, the recreational vehicle financing market is expected to remain a dynamic and essential component of the broader recreational vehicle industry in the years to come.

Recreational Vehicle Financing Market Trends

Shift in Consumer Preferences Increases the Demand in the Market

The growing interest in recreational vehicle (RV) financing is primarily due to the increased focus on domestic travel and outdoor activities, which has become more prominent since the COVID-19 pandemic. This shift in consumer behavior has led to a higher demand for RVs as a comfortable and convenient accommodation choice for vacations and trips.

Several factors have contributed to this change. Firstly, concerns about health and safety have made international travel less appealing, causing a surge in demand for domestic vacations. People buy RVs mainly for family camping and cost savings, as an RV vacation can be over 60% cheaper than a traditional hotel-based vacation. Popular RV types include travel trailers, Type A motorhomes, fifth wheels, and park-model recreational vehicles (PMRVs). In the United States, one in five RVs is a travel trailer, while fifth wheels are gaining popularity.

Additionally, the pandemic has sparked an interest in outdoor activities and experiences as people seek to enjoy nature and escape their homes. RVs provide a comfortable base for exploring national parks, scenic routes, and various outdoor attractions. Furthermore, the shift in consumer preferences for RV financing is driven by the desire to reconnect with family and friends, as RVs offer a unique opportunity for families and friends to travel together while maintaining a safe and private environment.

The average RV financing amount for a household is over USD 45,000. In the United States, 40 million people participate in RV camping, with Americans being the largest market segment. Millennials are increasingly engaging in RV camping, accounting for 38% of campers, although Generation X and Baby Boomers still dominate the market. The typical RV-owning household has an income of around USD 62,000 and uses their RV for an average of four weeks per year. Since 2001, there has been a 16% increase in RV ownership in the US, and 60% more households own an RV compared to 1980.

Lastly, the rise of remote work has enabled many individuals to take extended vacations and work from various locations. RVs provide a convenient and comfortable living space for these remote workers, allowing them to maintain their work-life balance while exploring new destinations. In summary, the shift in consumer preferences for recreational vehicle financing is driven by factors such as health and safety concerns, flexibility, affordability, the desire for outdoor experiences, and the ability to connect with family and friends, all of which contribute to the growing popularity of RVs as a preferred accommodation option for domestic travel and vacations.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

Asia-Pacific is anticipated to register the highest growth during the forecast period for the Recreational Vehicle (RV) Financing Market. This growth can be attributed to several factors, including increasing disposable income, a growing middle-class population, and rising domestic tourists. As economies in Asia-Pacific continue to grow, disposable incomes are increasing. This growth in disposable income enables more people to afford RVs, leading to a higher demand for RV financing. In 2022, the household disposable income in Asia accounted for USD 21.20 trillion, which is greater than 2019 (USD 19.04 trillion). As a result, financial institutions and lenders are offering various financing options to cater to this growing market segment.

The middle class in Asia-Pacific is expanding rapidly, and this demographic is increasingly seeking recreational activities, including RV travel. As more people from the middle class invest in RVs, the demand for RV financing also increases, driving the growth of the RV Financing Market in the region. In addition to convenience, cost savings, and health concerns, there has been a significant increase in domestic tourism in Asia-Pacific. RVs offer a comfortable and flexible accommodation option for these domestic travelers, allowing them to explore various destinations at their own pace. This rise in domestic tourism has led to a higher demand for RVs and, consequently, RV financing.

In countries like Japan, the country's aging population also drives the demand for these products as they offer a comfortable and convenient way to travel and explore the country. Japan has an aging population, with over 28% being 65 years or older. This demographic is increasingly seeking out leisure activities such as camping and sightseeing, as they offer a chance to connect with nature and enjoy a slower pace of life. Caravans and motorhomes provide a comfortable and convenient way for seniors to travel and explore the country's scenic beauty. As per the Japan RV Association, the total annual sales value of camping vehicles in Japan amounted to around JPY 76.25 billion in 2022. This shows that recreational vehicle financing will be the better option for people.

Furthermore, governments in the Asia-Pacific are promoting domestic tourism by developing and improving infrastructure for RV parks and camping sites. These initiatives create a favorable environment for the growth of the RV Financing Market, as they encourage more people to invest in RVs and explore their own countries. In India, the government will allow private players to set up caravan parks on private or government land in buffer zones such as forests, the foot of the fort, hill stations, and dams. Caravan parks can be set up near Maharashtra Tourism Development Corporation (MTDC) accommodations or on their open land, as well as at Agri-tourism centers.

As more people in Asia-Pacific become aware of the benefits of RV travel, such as cost savings, flexibility, and the ability to connect with nature, the demand for RVs and RV financing is expected to grow. This increased popularity of RVs will contribute to the highest growth in Asia-Pacific during the forecast period.

Recreational Vehicle Financing Industry Overview

The recreational vehicle financing market exhibits a moderately consolidated landscape, dominated by a few major global players such as LendingTree, LightStream, Wells Fargo Bank, Bank of America, Chase (JPMorgan Chase), and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

* In December 2023, KKR acquired a USD 7.2 billion portfolio of prime recreational vehicle loans. This move demonstrates KKR's continued interest in the growing RV industry and strengthens its presence in the consumer finance sector.

* In July 2023, US Bank unveiled a new online marketplace for recreational vehicles and boats, developed in collaboration with Rollick. The platform aims to provide a seamless shopping experience for customers, offering financing options and expert advice on RV and boat purchases.

* In December 2023, Sidley represented KKR in the acquisition of a USD 7 billion portfolio. This transaction marks another significant milestone for KKR as it continues to expand its presence in the consumer finance industry, particularly within the recreational vehicle sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing disposable income and Low-interest rates from lenders increase the market demand

- 4.3 Market Restraints

- 4.3.1 High initial costs may obstruct the growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Vehicle

- 5.1.1 Motorhomes

- 5.1.1.1 Class A

- 5.1.1.2 Class B

- 5.1.1.3 Class C

- 5.1.2 Caravans

- 5.1.2.1 Travel Trailers

- 5.1.2.2 Fifth Wheels

- 5.1.2.3 Toy Haulers

- 5.1.2.4 Truck Campers

- 5.1.2.5 Pop-up Trailers

- 5.1.2.6 Folding Camping Trailers

- 5.1.1 Motorhomes

- 5.2 By Financing Sources

- 5.2.1 Banks and Credit Unions

- 5.2.2 RV Dealership Financing

- 5.2.3 Manufacturer Financing

- 5.2.4 Online Lenders

- 5.2.5 Government-backed Loans

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 LendingTree

- 6.3.2 LightStream

- 6.3.3 Wells Fargo Bank

- 6.3.4 SouthEast Financials

- 6.3.5 Bank of America

- 6.3.6 Chase (JPMorgan Chase)

- 6.3.7 GreatRVLoan

- 6.3.8 Good Sam

- 6.3.9 Camping world finance

- 6.3.10 Thor Industries Inc.

- 6.3.11 Swift Group

- 6.3.12 Knaus Tabbert GmbH

- 6.3.13 Eura Mobil GmbH

- 6.3.14 Avant Garde India