|

시장보고서

상품코드

1521691

자율무인잠수정 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Autonomous Underwater Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

자율무인잠수정 시장 규모는 2024년 21억 3,000만 달러로 추정되며, 2029년에는 54억 5,000만 달러에 달할 것으로 예상되며, 시장 추정 및 예측 기간(2024-2029) 동안 20.62%의 CAGR로 성장할 것으로 예상됩니다.

자율무인잠수정(AUV)이 탐사 및 조사, 자원 탐사, 환경 모니터링, 국방 및 안보, 인프라 점검, 과학 연구 등 여러 분야에서 광범위하게 응용되고 있는 것이 시장을 주도하고 있습니다.

AUV의 안정성과 낮은 배치 비용, 향상된 데이터 품질, 우수한 탐색 알고리즘으로 인해 AUV의 채택이 증가하고 있습니다. 이러한 장점으로 인해 자율무인잠수정은 많은 사람들에게 안전한 선택이 되고 있습니다. 예를 들어, AUV는 석유 및 가스 산업에서 해저지도를 작성하기 위해 배치되고 있습니다. 또한 군대도 검사 및 식별을 위해 사용하고 있습니다. 이는 많은 국가에서 상업과 안보에 도움이 되고 있습니다.

잠수정 기술은 제조 기업에게 매력적인 비즈니스 기회를 제공할 것으로 예상됩니다. 우수한 간섭 저항성을 가진 수중 항행체를 위한 비용 효율적인 통신 기술의 개발은 시장 성장을 크게 촉진할 것으로 보입니다.

그러나 운영 비용의 증가와 AUV의 운영 성능에 대한 불확실성이 시장 성장의 걸림돌이 될 가능성이 높습니다.

자율무인잠수정 시장 동향

군 및 방위 산업이 큰 시장 점유율을 차지

자율무인잠수정(AUV)은 수중 환경에서 자율적으로 작동하고 귀중한 정보를 수집할 수 있기 때문에 다양한 군사 및 방위 분야에서 활용되고 있습니다. AUV는 감시, 정찰, 기뢰 제거, 특수 작전 등 수중 작전을 위한 귀중한 능력을 군과 방위군에 제공하여 복잡하고 어려운 환경에서 해상 보안과 상황 인식을 강화합니다.

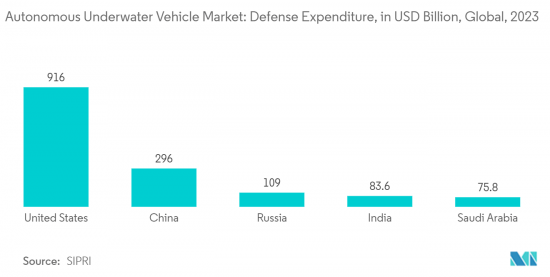

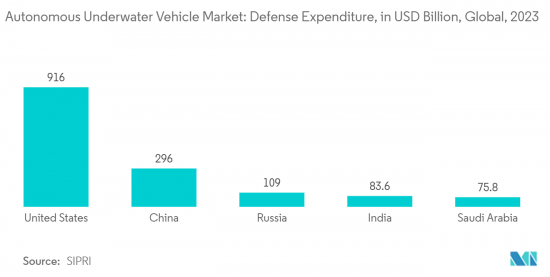

안보 문제, 분쟁 지역에 대한 우려와 위협으로 인해 국방비가 크게 증가하고 있습니다. 스톡홀름 국제평화연구소(SIPRI)가 2024년 4월 발표한 세계 군사비 관련 새로운 데이터에 따르면, 2022년 세계 군사비 총액은 실질 기준 6.8% 증가한 2조 4,430억 달러에 달할 것으로 예상됩니다. 각국은 수중 위협으로부터 국경을 보호하기 위해 최첨단 기술을 활용하고 있습니다.

국제해사기구(ICC) 국제해사국(IMB)의 연례 해적 및 무장강도 보고서에 따르면, 선박에 대한 해적 및 무장강도 사건은 2022년 115건에서 2023년 120건으로 증가할 것으로 예상됩니다. 이러한 위협의 증가는 해상 국경을 넘어선 안보 문제를 야기합니다. 따라서 위의 요인들이 시장 성장을 촉진할 것으로 예상됩니다.

예측 기간 동안 북미가 가장 높은 성장세를 보일 것

북미 자율주행차 시장은 신흥국 시장의 존재, 미국 해군의 AUV 수요 증가, 광범위한 연구 개발로 인해 예측 기간 동안 가장 높은 성장세를 보일 것으로 예상됩니다.

2024년 2월, 미 해군은 경쟁 환경에서 분산형, 장거리, 영구적인 수중 감지 및 페이로드 전달을 위한 프로토타입으로 Anduril과 그 대형 자율무인잠수정(AUV) 다이브(Dive) 제품군을 선택했습니다. Anduril은 광범위한 방위 및 상업적 임무를 수행하도록 설계된 AI 지원 AUV 제품군을 제공하고 있습니다.

인도 태평양 지역, 특히 해양 환경의 긴장이 고조되는 가운데 미국 국방부(DoD)는 국가 안보를 강화하기 위해 자율 시스템 개발에 많은 투자를 하고 있습니다. 예를 들어, 보잉은 미 해군의 자금 지원을 받아 Orca XLUUV를 개발하고 있으며, 2019년에는 보잉의 에코 보이저(Echo Voyager) 설계를 기반으로 한 4대의 AUV를 4,300만 달러에 수주했습니다. 이들은 2024년에 완성될 예정입니다. 이러한 요인들이 북미 시장 성장을 촉진할 것으로 보입니다.

자율무인잠수정 산업 개요

자율무인잠수정 시장은 세분화되어 있으며, 여러 기업이 존재하고, 기존 기업과 신생 벤처기업이 혼재되어 있습니다. 주요 기업으로는 Kongsberg Gruppen ASA, General Dynamics Corporation, Lockheed Martin Corporation, The Boeing Company, SAAB AB 등이 있습니다.

이러한 기업들은 인수, 제휴, 사업 확장, 제품 및 기술 발표와 같은 전략적 이니셔티브를 도입하여 이 시장에서의 입지를 유지하고 경쟁 우위를 확보하기 위해 노력하고 있습니다. 예를 들어, 2022년 7월 Kongsberg Gruppen ASA는 HUGIN AUV에 대한 몇 가지 중요한 계약을 확보했습니다. 이 회사는 해양 로봇에 대한 수요 증가와 함께 광범위한 포트폴리오를 통해 새로운 용도에 대응할 수 있다고 선언했습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자·소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 유형별

- 소형

- 중형

- 대형

- 용도별

- 군·방위

- 석유 및 가스

- 환경보호·감시

- 해양학

- 고고학·탐사

- 수색·구난 활동

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트

- 사우디아라비아

- 이스라엘

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 상황

- 벤더 시장 점유율

- 기업 개요

- The Boeing Company

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- SAAB AB

- Teledyne Technologies Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

- BAE Systems plc

- Exail Technologies SA

제7장 시장 기회와 향후 동향

ksm 24.08.01The Autonomous Underwater Vehicle Market size is estimated at USD 2.13 billion in 2024, and is expected to reach USD 5.45 billion by 2029, growing at a CAGR of 20.62% during the forecast period (2024-2029).

The market is driven by the wide applications of autonomous underwater vehicles (AUVs) in multiple sectors, such as exploration and research, resource exploration, environment monitoring, defense and security, infrastructure inspection, and scientific research.

The adoption of AUVs has also increased due to their stability, low deployment cost, improved data quality, and excellent navigation algorithms. These benefits have made applying autonomous underwater vehicles a safe option for many. For instance, they are deployed in the oil and gas industry to create seafloor maps. The military also uses them for inspection and identification. This has aided commerce and security in many nations.

Underwater vehicle technology is expected to lead to attractive opportunities for manufacturing companies. Developing cost-effective communication technology for underwater vehicles with excellent disturbance tolerance will significantly fuel market growth.

However, increasing operational costs and uncertainty in the operational performance of AUVs are likely to hinder market growth.

Autonomous Underwater Vehicles Market Trends

Military & Defense will a Hold Significant Market Share

Autonomous underwater vehicles (AUVs) are utilized in various military and defense applications due to their ability to operate autonomously and gather valuable information in underwater environments. These vehicles provide military and defense forces with valuable capabilities for underwater operations, including surveillance, reconnaissance, mine countermeasures, and special operations, enhancing maritime security and situational awareness in complex and challenging environments.

Defense spending has significantly increased due to security issues, concerns over contested territories, and threats. According to new data on global military expenditure published by the Stockholm International Peace Research Institute (SIPRI) in April 2024, total global military spending increased by 6.8% in real terms in 2022, reaching USD 2,443 billion. Countries use cutting-edge technologies to protect their borders from underwater threats.

According to the ICC International Maritime Bureau (IMB) 's annual Piracy and Armed Robbery Report, 120 incidents of maritime piracy and armed robbery against ships were reported in 2023 compared to 115 in 2022. This increase in threats creates security issues across marine borders. Thus, the factors mentioned above are expected to drive market growth.

North America will Witness the Highest Growth During the Forecast Period

The autonomous vehicle market in North America is expected to showcase the highest growth during the forecast period, owing to the presence of leading manufacturers, rising demand for AUVs from the US Navy, and extensive research and development.

In February 2024, the US Navy selected Anduril and its Dive family of large autonomous underwater vehicles (AUVs) to prototype distributed, long-range, persistent underwater sensing and payload delivery in contested environments. Anduril provides a family of AI-enabled AUVs that are designed to perform a wide range of defense and commercial missions.

Amid rising tensions in the Indo-Pacific region, particularly in the maritime environment, the US Department of Defense (DoD) is heavily investing in the development of autonomous systems to strengthen national security. For instance, The Boeing Company is developing the Orca XLUUV with funding from the US Navy. In 2019, the company won a USD 43 million contract to build four of the AUVs based on the design of Boeing's Echo Voyager. They are planned to be finished in 2024. Such factors will stimulate the market growth in North America.

Autonomous Underwater Vehicles Industry Overview

The autonomous underwater vehicles market is fragmented, with several players and a mix of established companies and emerging startups. Some of the leading players include Kongsberg Gruppen ASA, General Dynamics Corporation, Lockheed Martin Corporation, The Boeing Company, and SAAB AB.

These players incorporate strategic initiatives such as acquisitions, partnerships, expansions, and product/technology launches to maintain their positions and gain a competitive advantage in this market. For instance, in July 2022, Kongsberg Gruppen ASA secured several significant contracts for HUGIN AUVs. The company declared that, in addition to the increasing demand for marine robots, its broader portfolio allows it to address new applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Small

- 5.1.2 Medium

- 5.1.3 Large

- 5.2 By Application

- 5.2.1 Military & Defense

- 5.2.2 Oil & Gas

- 5.2.3 Environment Protection & Monitoring

- 5.2.4 Oceanography

- 5.2.5 Archaeology & Exploration

- 5.2.6 Search & Salvage Operations

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Israel

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 The Boeing Company

- 6.2.2 Kongsberg Gruppen ASA

- 6.2.3 L3Harris Technologies Inc.

- 6.2.4 Lockheed Martin Corporation

- 6.2.5 SAAB AB

- 6.2.6 Teledyne Technologies Inc.

- 6.2.7 Lockheed Martin Corporation

- 6.2.8 General Dynamics Corporation

- 6.2.9 BAE Systems plc

- 6.2.10 Exail Technologies SA