|

시장보고서

상품코드

1521711

무균 주사제 수탁생산 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Sterile Injectable Contract Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

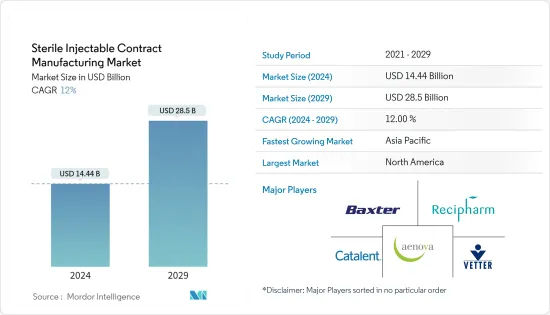

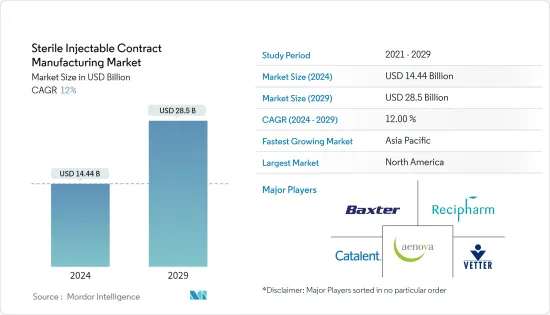

무균 주사제 수탁생산 시장 규모는 2024년 144억 4,000만 달러로 추정 및 예측되며, 2029년에는 285억 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 12%의 CAGR로 성장할 것으로 예상됩니다.

주사제 파이프라인의 증가와 승인은 무균 주사제 수탁생산 시장의 주요 촉진요인으로 작용하고 있습니다. 제약사들은 빠른 약효 발현, 정확한 투여, 환자의 순응도 향상 등의 장점으로 인해 주사제 개발을 추진하고 있습니다. 예를 들어, 2023년 1월에 발표된 FDA의 보고서에 따르면, CDER는 2022년에 신약승인신청(NDA)에 근거한 신규 분자생물학적 제제(NME) 또는 생물학적 제제 승인신청(BLA)에 근거한 신규 치료용 생물학적 제제로서 37개의 새로운 의약품을 승인했습니다. 이러한 의약품에는 주사제가 포함되어 있어, 강력한 파이프라인으로 인해 상업적 및 연구 목적의 위탁 생산에 대한 수요가 증가하여 시장 성장에 기여할 것으로 예상됩니다.

세포 치료제와 유전자치료제에 대한 수요가 급증하면서 시장 확대가 가속화되고 있습니다. 이러한 치료제의 파이프라인이 확대됨에 따라 수탁생산업체(CMO)의 전문 제조 역량에 대한 수요가 증가하고 있습니다. 예를 들어, ClinicalTrials.gov에 따르면 2024년 3월 현재 북미에서 581개 이상의 임상시험이 다양한 질병 치료에 대한 세포 치료 및 관련 접근법의 가능성을 조사하고 있습니다. 따라서 세포 기반 치료제의 임상 개발 연구량이 많기 때문에 예측 기간 동안 세포 기반 치료제의 제조 위탁이 증가할 것으로 예상됩니다.

또한, 무균 제조 시설 확장, 제휴 및 파트너십과 같은 시장 기업의 전략적 활동은 예측 기간 동안 시장 성장에 기여할 것으로 보입니다. 예를 들어, 2023년 11월 사모펀드 회사인 NorthEdge는 Torbay and Devon NHS Foundation Trust로부터 Torbay Pharmaceuticals의 무균 주사제 위탁 생산업체 및 라이선스 보유자를 인수한 후, 2023년 3월에 투자하여 다음 단계의 국제적 성장을 지원했다, 2023년 3월, PCI Pharma Services는 일리노이주 록포드에 위치한 무균 주사제 제조 시설에 5,000만 달러 규모의 확장 계획을 발표했습니다. 이 프로젝트는 20만 평방피트 규모의 시설을 추가하여 주사제 및 장치 결합 제품의 생산능력을 강화할 예정입니다.

따라서, 제품 파이프라인에서 세포 및 유전자 치료에 대한 수요 증가와 무균 제조 시설의 확장은 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다. 그러나 품질 관리의 어려움과 높은 운영 비용으로 인해 시장 성장이 제한될 것으로 예상됩니다.

무균 주사제 수탁생산 시장 동향

암 분야가 예측 기간 동안 큰 비중을 차지할 것으로 전망

암 치료에는 약물의 안정성과 유효성을 보장하는 세심한 제조 기술이 필요합니다. 복잡한 제제 및 생물학적 제제 취급에 정통한 무균 주사제 수탁 제조업체는 암 치료제의 고유한 과제에 대응하는 데 유리한 위치에 있습니다. 많은 암 치료에는 복잡한 생물학적 제제나 새로운 치료 접근법이 포함됩니다. 무균 주사제는 이러한 첨단 치료제를 전달할 수 있는 신뢰할 수 있고 효과적인 수단을 제공함으로써 무균 주사제 위탁 생산 시장의 확대에 기여하고 있습니다.

캐나다 암협회(CCS)의 2023년 보고서에 따르면, 암은 캐나다에서 큰 의료비 부담으로 작용하고 있으며, 암 발병률은 꾸준히 증가하고 있다고 강조하고 있습니다. 따라서 암의 높은 부담은 캐나다에서 새로운 무균 주사제 CMO의 기회를 창출하고 이 분야의 성장을 주도하고 있습니다. 같은 자료에 따르면, 2023년 캐나다에서 239,100명의 암 환자가 발생할 것으로 보고되고 있습니다. 이러한 암 발병률 증가는 수탁생산 서비스에 대한 수요를 창출하고 이 부문의 성장에 기여할 것으로 예상됩니다.

아웃소싱의 견조한 성장은 예측 기간 동안 이 부문의 성장을 촉진할 것으로 예상됩니다. 암 분야를 포함한 제약사들은 업무 간소화, 비용 절감, 제조 아웃소싱 업체의 전문성 활용을 위해 제조 아웃소싱을 점점 더 많이 추진하고 있습니다. 이러한 추세는 암 분야 무균 주사제 수탁생산 시장의 성장에 기여하고 있습니다.

따라서 암 발병률 증가와 아웃소싱 증가 추세는 예측 기간 동안 이 분야의 성장을 촉진할 것으로 예상됩니다.

예측 기간 동안 북미가 큰 시장 점유율을 차지할 것으로 예상

북미에서는 위탁 생산 시설의 설립, 만성 질환의 증가, 첨단 생물학적 제제 개발로 인해 무균 주사제 위탁 생산 시장이 성장할 것으로 예상됩니다. 무균 주사제는 복잡한 치료를 제공하는 데 필수적이며, 위탁 제조는 이러한 수요를 충족시킬 수 있는 확장 가능한 솔루션을 제공합니다.

무균 주사제를 필요로 하는 생물학적 제제 및 바이오시밀러에 대한 관심이 높아지면서 수탁생산 시장의 성장에 크게 기여하고 있습니다. 예를 들어, 2023년 3월에 발표된 식품의약국 보고서에 따르면, 2022년에 15개의 생물학적 제제가 승인되었으며, 이 중 6개는 다양한 암 치료에 대한 적응증을 가지고 있습니다. 예상된 생물학적 제제의 승인 급증은 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다.

제조시설 확장, 제휴, 파트너십, 인수 등 시장 진입 기업들의 전략적 활동은 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다. 예를 들어, 샤프는 2023년 10월 임상 및 상업용 무균 주사제를 제공하는 매사추세츠주 소재 개발 및 제조 수탁기관(CDMO)인 버크셔 스테일 매뉴팩처링(Berkshire Sterile Manufacturing, BSM)을 인수했습니다. 또한, 2022년 3월 샌드캐나다는 퀘벡주 부셰빌에 위치한 제조 공장을 CMO인 델팜(Delpharm)에 매각을 완료했다고 발표했습니다. 이 공장은 캐나다 최대 규모의 무균 주사제 제조 시설로 캐나다와 미국의 의료 시스템(주로 병원)에 전략적이고 생명을 구할 수 있는 의약품을 공급하고 있습니다.

이렇게 이 지역의 CMO와의 제휴 및 CMO에 대한 제조 위탁은 전체 시장 성장에 기여하고 있습니다.

무균 주사제 수탁생산 산업 개요

무균 주사제 위탁 생산 시장은 통합되어 있으며 소수의 대기업으로 구성되어 있습니다. 시장 점유율은 현재 특정 대기업이 시장을 독점하고 있습니다. 시장 경쟁력을 유지하기 위해 시장 진입 기업들은 제조 시설 확장, 제휴, 제휴 등 다양한 전략을 채택하고 있습니다. 현재 시장을 독점하고 있는 기업으로는 Baxter, Catalent Inc., Vetter Pharma, Recipharm AB, Aenova Group 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 주사제 파이프라인과 승인 증가

- 생물학적 제제와 바이오시밀러 수요 확대

- 신규 치료제 개발을 위한 연구개발 투자 증가

- 시장 성장 억제요인

- 품질 관리에 관한 과제

- 높은 운영 비용

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자/소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화(시장 규모 - 금액)

- 분자 유형별

- 저분자

- 대형 분자

- 치료 분야별

- 암

- 당뇨병

- 심혈관질환

- 중추신경계 질환

- 감염증

- 근골격계

- 항바이러스

- 기타

- 투여 경로별

- 피하(SC)

- 정맥내 투여

- 근육내(IM)

- 기타

- 최종사용자별

- 제약회사 및 바이오 제약회사

- 연구기관

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 일본

- 중국

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 상황

- 기업 개요

- Baxter

- Catalent Inc.

- Vetter Pharma

- Recipharm AB

- Aenova Group

- Fresenius Kabi

- Unither Pharmaceuticals

- Famar

- Cipla Inc.

- NextPharma Technologies

제7장 시장 기회와 향후 동향

ksm 24.08.01The Sterile Injectable Contract Manufacturing Market size is estimated at USD 14.44 billion in 2024, and is expected to reach USD 28.5 billion by 2029, growing at a CAGR of 12% during the forecast period (2024-2029).

The increasing pipeline and approvals of injectable drugs are significant drivers of the sterile injectable contract manufacturing market. Pharmaceutical companies are developing injectable drugs due to their advantages, including faster onset of action, precise dosing, and improved patient compliance. For instance, according to the FDA report published in January 2023, CDER approved 37 novel drugs, either as new molecular entities (NMEs) under New Drug Applications (NDAs) or as new therapeutic biological products under Biologics License Applications (BLAs) in 2022. These drugs include injectables, and hence, a strong pipeline is expected to increase the demand for contract manufacturing for commercial and research purposes, thereby contributing to market growth.

The burgeoning demand for cellular and genetic treatments propels the expansion of the market. As the pipeline of these therapies expands, there is a growing need for specialized manufacturing capabilities, which contract manufacturing organizations (CMOs). For instance, according to ClinicalTrials.gov, as of March 2024, more than 581 clinical trials were investigating the potential of cell therapies and related approaches for treating various diseases in North America. Therefore, the high amount of research in clinical development for cell-based therapy is expected to boost contract manufacturing over the forecast period.

Moreover, strategic activities by the market players, such as the expansion of sterile manufacturing facilities, collaboration, and partnership, are expected to contribute to the market growth over the forecast period. For instance, in November 2023, private equity firm NorthEdge invested in a Torbay Pharmaceuticals sterile injectable contract manufacturer and license holder to support its next phase of international growth after acquiring it from Torbay and Devon NHS Foundation Trust. In March 2023, PCI Pharma Services unveiled plans for a USD 50 million expansion at its Rockford, Illinois, sterile injectables site. The project will add a 200,000-square-foot facility to boost the plant's capacity for injectable drug-device combination products.

Hence, the growing demand for cell and gene therapy in the product pipeline and the expansion of sterile manufacturing facilities are expected to boost market growth over the forecast period. However, challenges related to quality control and high operational costs are anticipated to restrain the market's growth.

Sterile Injectable Contract Manufacturing Market Trends

The Cancer Segment is Expected to Hold a Significant Share Over the Forecast Period

Cancer therapies necessitate meticulous manufacturing techniques that guarantee drug stability and effectiveness. Sterile injectable contract manufacturers with expertise in handling complex formulations and biologics are well-positioned to meet the unique challenges of oncology drugs. Many cancer treatments involve complex biologics and novel therapeutic approaches. Sterile injectables provide a reliable and effective means of delivering these advanced therapies, contributing to the expansion of the sterile injectable contract manufacturing market.

The Canadian Cancer Society's (CCS) 2023 report highlighted that cancer poses a significant healthcare burden in Canada, with its incidence steadily rising. Thus, the high burden of cancer is creating opportunities for new sterile injectables CMO in the country, driving the segment's growth. The same source stated that 239,100 cancer cases were reported in Canada in 2023. Thus, the growing burden of cancer is expected to create demand for contract manufacturing services, likely contributing to segmental growth.

The robust growth in outsourcing practices is projected to fuel segment expansion throughout the forecast period. Pharmaceutical companies, including those focused on oncology, are increasingly outsourcing manufacturing activities to streamline operations, reduce costs, and leverage the specialized capabilities of contract manufacturers. This trend has contributed to the growth of the sterile injectable contract manufacturing market within the cancer segment.

Hence, growing cancer prevalence and the increasing trend of outsourcing are expected to boost the segment's growth over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

In North America, the sterile injectable contract manufacturing market is expected to grow due to the establishment of contract manufacturing facilities, the rise in chronic diseases, and the development of advanced biologics. Sterile injectables are crucial for delivering complex therapies, and contract manufacturing provides a scalable solution for meeting this demand.

The increasing emphasis on biologics and biosimilars, which often require sterile injectable formulations, contributes significantly to the growth of the contract manufacturing market. For instance, according to a report by the Food and Drug Administration published in March 2023, 15 biologics were approved in 2022; of this, six were indicated for the treatment of a diversity of cancers. An anticipated surge in biologics drug approvals is projected to boost market growth during the forecast period.

Strategic activities by the market players, such as manufacturing facility expansion, collaboration, partnerships, and acquisitions, are expected to boost the market's growth over the forecast period. For instance, in October 2023, Sharp acquired Berkshire Sterile Manufacturing (BSM), a contract development and manufacturing organization (CDMO) in Massachusetts that offers clinical and commercial sterile injectable products. Additionally, in March 2022, Sandoz Canada announced the completion of the sale of its Boucherville, Quebec, manufacturing plant to Delpharm, a CMO. This plant is Canada's largest sterile injectable production facility and provides strategic and potentially lifesaving medicines to the Canadian and US healthcare systems, primarily hospitals.

Thus, collaborations with or outsourcing manufacturing to CMOs in the region contribute to the overall growth of the market.

Sterile Injectable Contract Manufacturing Industry Overview

The sterile injectable contract manufacturing market is consolidated and consists of a few major players. In terms of market share, certain major players currently dominate the market. Market players adopt various strategies such as expanding manufacturing facilities, collaborating, and partnering to stay competitive. Some of the companies currently dominating the market are Baxter, Catalent Inc., Vetter Pharma, Recipharm AB, and Aenova Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pipeline and Approvals of Injectables

- 4.2.2 Growing Demand for Biologics and Biosimilars

- 4.2.3 Rise in Investment Across Research and Development Activities for the Development of Novel Therapeutics.

- 4.3 Market Restraints

- 4.3.1 Challenges Related to Quality Control

- 4.3.2 High Operational Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Molecule Type

- 5.1.1 Small Molecule

- 5.1.2 Large Molecule

- 5.2 By Therapeutic Area

- 5.2.1 Cancer

- 5.2.2 Diabetes

- 5.2.3 Cardiovascular Diseases

- 5.2.4 Central Nervous System Diseases

- 5.2.5 Infectious Disorders

- 5.2.6 Musculoskeletal

- 5.2.7 Anti-viral

- 5.2.8 Others

- 5.3 By Route of Administration

- 5.3.1 Subcutaneous (SC)

- 5.3.2 Intravenous (IV)

- 5.3.3 Intramuscular (IM)

- 5.3.4 Others

- 5.4 End User

- 5.4.1 Pharmaceutical and Biopharmaceutical Companies

- 5.4.2 Research Institutes

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 Japan

- 5.5.3.3 China

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of the Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Baxter

- 6.1.2 Catalent Inc.

- 6.1.3 Vetter Pharma

- 6.1.4 Recipharm AB

- 6.1.5 Aenova Group

- 6.1.6 Fresenius Kabi

- 6.1.7 Unither Pharmaceuticals

- 6.1.8 Famar

- 6.1.9 Cipla Inc.

- 6.1.10 NextPharma Technologies