|

시장보고서

상품코드

1523321

도로 건설기계 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2024-2029년)Road Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

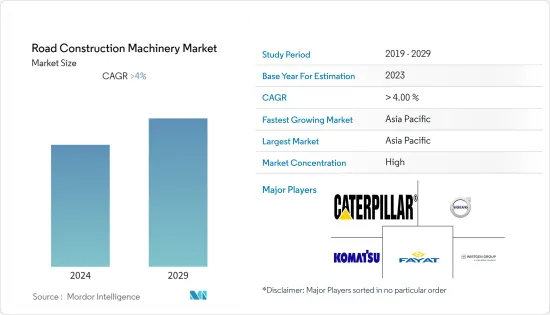

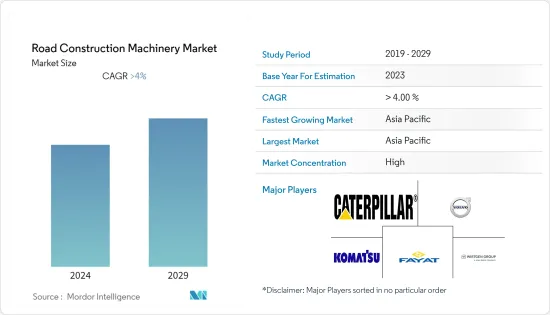

도로 건설기계 시장 규모는 2024년 1,891억 6,000만 달러로 추정되고, 2029년에는 2,318억 1,000만 달러에 이를 것으로 예측되며, 예측 기간 동안의 복합 연간 성장률(CAGR)은 4.15%로 성장할 전망입니다.

도로 건설 활동 증가는 도로 건설 기계 수요를 견인할 것으로 예상됩니다. 경기자극책과 인프라 개척 등 다양한 정부 프로그램이 도로 건설기계를 뒷받침해 2024년부터 2029년까지 시장 확대가 예상됩니다.

장기적으로는 도로 프로젝트에 대한 투자 증가, 전기 도로 건설 기계 출시, 신형 기계에 의한 구식 차량의 교체가 도로 건설 기계의 판매 급증에 따른 건설 기계 업계 수요를 창출하고 있습니다. 그러나 임대기계 서비스에 대한 수요 증가는 시장 성장 억제요인으로 작용할 것으로 예상됩니다. 임대기계는 인건비, 교육훈련비, 기계구매비를 줄이기 위해 중소기업에 선호되기 때문입니다.

또한 디지털화, 연결성 및 자동화가 시장 개척을 추진하고 건설 프로젝트에 큰 영향을 미치고 있습니다. 건설,건설자재기업은 첨단 건설기계에 대한 수요 증가에 대응하기 위해 신기술에 대한 투자를 실시하여 구식 건설기계를 신규 또는 업그레이드된 기계군으로 대체하고 있습니다. 게다가 관민 파트너십(PPP) 모델을 장려하기 위한 유리한 정부 정책 증가는 2024년부터 2029년까지 도로 건설 기계 시장의 성장에 좋은 징조를 가져올 것으로 예상됩니다.

도로 건설 기계 시장 동향

모터 그레이더 부문이 2024년부터 2029년까지 가장 빠른 성장을 기록할 전망

도로 건설 산업은 세계 모터 그레이더 수요를 크게 견인하고 있습니다. 고속도로, 공항, 공공시설 등의 대규모 프로젝트에서는 도로 및 기타 노면을 정지 및 평준화하기 위해 이러한 기계를 사용해야 합니다.

도시화의 동향도 개발업자가 혼잡한 도심부에서 보다 좋은 도로나 교통망을 건설,유지하려고 하기 때문에 모터 그레이더 수요를 촉진하고 있습니다. 모터 그레이더의 필요성이 밝혀진 결과, 세계 여러 장비 제조업체들이 시장 수요에 부응하기 위해 신제품을 투입하고 있습니다. 예를 들면

- 2023년 4월, Bell Equipment's의 모터 그레이더의 새로운 시리즈, G140이 발표되었습니다. 이 새로운 기종은 모든 유지 보수 및 경/중형 건설 작업에 적합하며 ZF 에르고 파워 트랜스미션을 탑재하고 있습니다.

- 2023년 3월, Clairemont Equipment Company는 고마츠의 판매 지역을 샌디에고에서 로스앤젤레스까지 확장하여 사업 범위를 확대합니다. 이 확대로 이 회사는 미국 캘리포니아주 남부 전역에 있어서의 코마츠제 건설기계의 판매,서비스 거점이 됩니다.

또, 개발도상국에서는 마을이나 마을을 연결하는 고속도로의 연신이나 고속도로 등의 대규모 프로젝트가 진행되고 있습니다. 그 결과, 도로 건설기계는 2024년부터 2029년까지 큰 수요가 예상됩니다. 모터 그레이더, 백호 로더 및 굴삭기의 수가 증가함에 따라 도로 건설 기계 시장이 점차 증가하고 있습니다.

- 2023년 9월 독일 정부는 전국 도로 교통 인프라 정비를 위해 2,696억 유로(2,996억 달러)의 투자를 발표했습니다.

앞서 언급한 요인과 건설 및 인프라 개발 활동 증가로 이 시장 부문은 2024년부터 2029년에 걸쳐 큰 성장률을 나타낼 것으로 예측됩니다.

아시아태평양이 시장의 주요 점유율을 차지할 것으로 예측됨

아시아태평양이 큰 역할을 하고 북미와 유럽이 이어질 것으로 예상됩니다. 아시아태평양은 모터 그레이더, 컴팩터, 로드 롤러, 페이바 등 도로 건설 기계의 중요한 시장입니다. 인도와 중국은 세계 최대의 도로 기계 시장이며 세계 도로 기계 매출의 25% 이상을 차지하기 때문에 아시아태평양은 도로 건설 기계에 가장 유리한 시장이 되었습니다.

인도 정부는 2026년까지 이 나라를 수조 달러 규모의 경제로 성장시키는 것을 목표로 하고 있으며, 인프라 정비는 매우 중요한 역할을 담당하고 있습니다. 인도의 GDP의 약 8%를 차지하고 2위의 고용자 수를 자랑하는 건설 부문은 5,000만명 이상의 고용 기회를 제공해, 큰 성장의 태세를 정돈하고 있습니다. 향후 수년간 1조 4,000억 달러의 평가가 예상되는 건설 부문에는 전례없는 비즈니스 기회가 있습니다. 예를 들면

- 2022년 6월, 도로교통,고속 도로부 장관은 비하르주 파트나와 헤지푸르에서 총투자액 17억 달러의 국도관련 15개 프로젝트를 출범시켰습니다.

- 인도는 2022년 PM GATI SHAKTI 이니셔티브 하에 국도 네트워크를 25,000km 확대하기 위해 26억 7,000만 달러를 할당했습니다.

- 마찬가지로 중국은 2022년 인프라 지출을 촉진하기 위해 746억 9,000만 달러의 인프라 기금을 설립했습니다. 이러한 노력으로 아시아태평양의 도로 건설 기계에 대한 수요가 더욱 높아질 것으로 예상됩니다.

또한, 아시아태평양 도로 건설 기계 시장의 일부 기업은 시장 제공을 강화하기 위해 다양한 비즈니스 전략을 수립하고 일부 기업은 신제품을 도입하고 있습니다. 예를 들면

- 2023년 3월 스웨덴에 본사를 둔 건설 및 광산기계 제조업체인 Sandvik AB는 말레이시아에 갱내 로더 및 건설용 덤프 트럭을 제조하기 위한 새로운 생산 부문을 설립할 것이라고 발표했습니다. 장비 생산은 2023년 4분기에 시작될 예정입니다. 이 회사는 2030년까지 로더와 덤프 트럭을 300대, 배터리 케이지를 500대까지 단계적으로 증가시킬 예정인 연간 제조 능력을 설정했습니다.

- 2023년 9월 중국을 거점으로 하는 산업기계,건설기계 제조업체인 SANY그룹은 필리핀의 마닐라, 케손시에 자회사를 개설했습니다.

앞서 언급한 요인과 인도, 중국, 일본, 말레이시아, 필리핀의 등 주요 국제 시장에서의 제품 투입을 고려하면, 아시아태평양 도로 건설 기계 시장은 조사 기간 동안 안정된 성장이 예상됩니다.

도로 건설 기계 산업 개요

도로 건설 기계 시장은 적당히 단편화됩니다. 시장 특징은 선도적인 인프라 기업과 정부 기관과 장기 공급 계약을 체결하는 기업이 여러 개 존재한다는 것입니다. 이 선수들은 또한 브랜드 포트폴리오를 확대하고 시장에서의 입지를 강화하기 위해 합작 투자, M&A, 신제품 출시, 제품 개척을 실시했습니다. 예를 들면

- 2023년 7월, 스웨덴에 본사를 둔 건설 기계 제조업체인 Volvo Construction Equipment는 고객에게 더 나은 서비스를 제공하기 위해 말레이시아의 보르네오에 새로운 딜러 시설을 설립할 것이라고 발표했습니다. 보르네오 VCE 딜러는 볼보 컨스트럭션 이익먼트 말레이시아의 서브딜러로서 아티큘레티드 홀러, 컴팩트 굴삭기, 컴팩트 휠 로더, 크롤러 굴삭기, 휠 로더, 휠 굴삭기의 판매를 담당합니다. 또한 기업의 제품 라인업 판매 및 서비스를 총체적으로 지원합니다.

- 2023년 4월NBK 그룹의 자회사 인 Nasser Bin Khaled Heavy Equipment는 Shandong Hixen Machinery의 유명 브랜드 "Hixen"의 최신 기계 장비를 카타르 시장에 공급할 것이라고 발표했습니다. Hixen 기계는 주로 크롤러 굴삭기, 휠 굴삭기, 휠 로더, 백호 로더, 스키드 스티어 로더를 포함합니다.

- 2023년 2월, CASE Construction Equipment는 836C 및 856C 모터 그레이더를 위한 새로운 조이스틱 레버를 출시했습니다. 새로운 조이스틱 레버는 그레이더의 뛰어난 기능 외에도 스티어링 업그레이드와 함께 몰드 보드 컨트롤의 향상을 실현합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 인프라 개척과 고속도로 건설 활동의 활성화가 시장을 견인

- 시장 성장 억제요인

- 숙련 노동자의 부족이 시장 확대의 방해가 될 가능성

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(시장 규모 단위 : 억미 달러)

- 기계 유형별

- 모터 그레이더

- 로드 롤러

- 휠 로더

- 콘크리트 믹서

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Sany Heavy Industry Co. Ltd

- Caterpillar Inc.

- Palfinger AG

- Terex Corporation

- Liebherr-International AG

- Deere & Company

- Zoomlion Heavy Industry Science and Technology Co. Ltd

- Komatsu Ltd

- Wirtgen Group

- Fayat Group

- Wacker Neuson Group

- Ammann Group

- CNH Industrial

- Volvo CE

- Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd

제7장 시장 기회와 앞으로의 동향

BJH 24.08.09The Road Construction Machinery Market size is estimated at USD 189.16 billion in 2024, and is expected to reach USD 231.81 billion by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The increase in road construction activity is expected to drive the demand for road construction machinery. Various government programs, such as stimulus packages and infrastructure developments, encouraged road construction equipment to drive market expansion between 2024 and 2029.

Over the long term, increasing investments in road projects, the launch of electric road construction machinery, and the replacement of older fleets by newer machines are creating demand in the construction equipment industry with a surge in sales of road construction machinery. However, the increasing demand for rental machinery services is expected to act as a restraint for the market's growth, as renting machinery is preferred by small and medium-scale companies to lessen the costs of labor, training, and equipment purchases.

Furthermore, digitalization, connectivity, and automation are driving market development forward, substantially impacting construction projects. Construction and construction materials companies are geared up to invest in new technologies to cope with the increasing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleets. Additionally, an increase in the number of favorable government policies aimed at encouraging the Public-Private Partnership (PPP) model is also expected to bode well for the growth of the road construction equipment market from 2024 to 2029.

Road Construction Machinery Market Trends

The Motor Graders Segment is Expected to Register the Fastest Growth Between 2024 and 2029

The road construction industry is a significant driver of demand for motor graders across the world, with major projects such as highways, airports, and public facilities requiring the use of these machines for grading and leveling roads and other surfaces.

The increasing trend toward urbanization also fuels demand for motor graders as developers seek to build and maintain better roads and transport networks in crowded city centers. As a result of the evident need for motor graders, multiple equipment manufacturers across the world have been introducing new products to cater to the market demand. For instance,

- In April 2023, Bell Equipment's new range of motor graders, G140, was announced. This new equipment is well suited to all maintenance and light to medium construction tasks and is fitted with the ZF Ergopower transmission.

- In March 2023, Clairemont Equipment Company is set to broaden its operational reach by extending its Komatsu territory from San Diego to Los Angeles. This expansion positions the company as the designated sales and service provider for Komatsu construction equipment across the entirety of southern California, United States.

Moreover, developing nations are undertaking large-scale projects such as highway extensions and expressways to connect towns and villages. As a result, road construction equipment is expected to see a significant demand between 2024 and 2029. The increase in motor graders, backhoe loaders, and excavators count indicates the road construction equipment market's incremental growth.

- In September 2023, the Government of Germany announced an investment of EUR 269.6 billion (USD 299.6 billion) for the development of road transport infrastructure across the country.

Due to such aforementioned factors and the rise in construction and infrastructure development activities, this market segment is anticipated to witness a significant growth rate between 2024 and 2029.

Asia-Pacific is Anticipated to Capture a Major Market Share in the Market

Asia-Pacific is expected to play a significant role, followed by North America and Europe. Asia-Pacific is a significant market for road construction machinery, such as motor graders, compactors, road rollers, and pavers. India and China are some of the largest markets for road machinery in the world, contributing more than 25% of the worldwide road machinery sales, thus making Asia-Pacific the most lucrative market for road construction machinery.

The Indian government aims to elevate the country to a multi-trillion-dollar economy by 2026, with infrastructure development playing a pivotal role. The construction sector, constituting about 8% of India's GDP and being the second-largest employer, is poised for significant growth, offering over 50 million job opportunities. With an expected valuation of USD 1.4 trillion in the coming years, the construction segment presents unprecedented opportunities. For instance,

- In June 2022, the Minister of Road Transport and Highways inaugurated 15 projects related to national highways in Patna and Hajipur, Bihar, with a total investment of USD 1.7 billion.

- India allocated USD 2.67 billion to expand its national highway networks by 25000 kilometers under the PM GATI SHAKTI initiative in 2022.

- Similarly, China had set up a USD 74.69 billion infrastructure fund to spur infrastructure spending in 2022. These initiatives are anticipated to further boost the demand for road construction machinery in Asia-Pacific.

Furthermore, several players in the Asia-Pacific road construction machinery market are establishing various business strategies to enhance the market offering, and a few companies are introducing new products. For instance,

- In March 2023, Sandvik AB, a Sweden-based construction and mining equipment manufacturer, announced the establishment of a new production unit in Malaysia for manufacturing underground loaders and construction dump trucks. Equipment production is planned to begin in Q4 2023. The company set an annual manufacturing capacity that is planned to increase gradually to 300 loaders and dump trucks and 500 battery cages by 2030.

- In September 2023, SANY Group, a China-based industrial and construction equipment manufacturer, opened its subsidiary in Quezon City, Manila, Philippines.

Considering the aforementioned factors and product launches in major international markets, like India, China, Japan, Malaysia, and the Philippines, the Asia-Pacific road construction machinery market is expected to have steady growth during the study period.

Road Construction Machinery Industry Overview

The road construction machinery market is moderately fragmented. The market is characterized by the presence of several players who have secured long-term supply contracts with major infrastructure companies and government agencies. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions. For instance,

- In July 2023, Volvo Construction Equipment, a Sweden-based construction equipment manufacturer, announced a new dealership facility in the Malaysian state of Borneo to better serve customers. The Borneo VCE dealership is a sub-dealer of Volvo Construction Equipment Malaysia, and it will be responsible for sales of articulated haulers, compact excavators, compact wheel loaders, crawler excavators, wheel loaders, and wheeled excavators. It will provide total sales and service support to the company's product line.

- In April 2023, Nasser Bin Khaled Heavy Equipment, a subsidiary of NBK Group, announced the supply of the latest machinery and equipment from the prominent brand "Hixen" by Shandong Hixen Machinery to the Qatari market. Hixen machinery mainly includes crawler excavators, wheel excavators, wheel loaders, backhoe loaders, and skid steer loaders.

- In February 2023, CASE Construction Equipment launched the new joystick levers for the 836C and 856C motor graders. The new joystick control delivers improved moldboard control, along with a range of steering upgrades, which are an addition to the grader's already great features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Infrastructure Development and Highway Construction Activities to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Lack of Skilled Labor May Hamper the Market Expansion

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size Value in USD billion)

- 5.1 By Machine Type

- 5.1.1 Motor Graders

- 5.1.2 Road Roller

- 5.1.3 Wheel Loaders

- 5.1.4 Concrete Mixer

- 5.1.5 Others

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Sany Heavy Industry Co. Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Palfinger AG

- 6.2.4 Terex Corporation

- 6.2.5 Liebherr-International AG

- 6.2.6 Deere & Company

- 6.2.7 Zoomlion Heavy Industry Science and Technology Co. Ltd

- 6.2.8 Komatsu Ltd

- 6.2.9 Wirtgen Group

- 6.2.10 Fayat Group

- 6.2.11 Wacker Neuson Group

- 6.2.12 Ammann Group

- 6.2.13 CNH Industrial

- 6.2.14 Volvo CE

- 6.2.15 Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd