|

시장보고서

상품코드

1523371

에어택시 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2024-2029년)Air Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

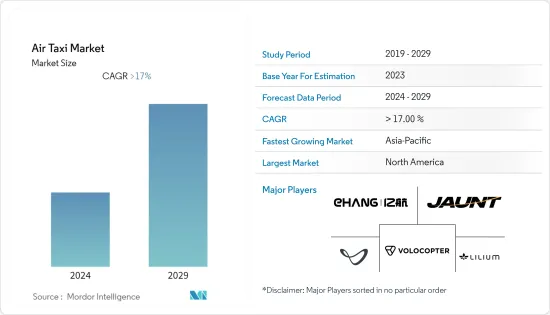

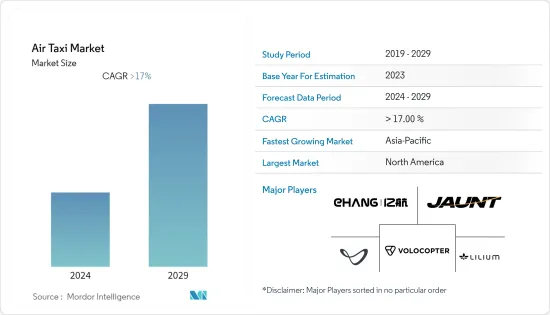

에어택시 시장 규모는 2024년 14억 1,000만 달러로 추정되고, 2029년 40억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 동안 복합 연간 성장률(CAGR)은 23.32%로 성장할 전망입니다.

에어택시 시장 수요를 견인하고 있는 것은 대체교통수단에 대한 요구와 대도시에서의 교통정체 문제의 증대입니다. 도시 인구가 계속 증가하고 있는 가운데, 종래의 지상 교통기관에서는 한계에 직면하고 있습니다. 에어 택시는 단거리 이동의 유망한 솔루션으로 편의성과 효율성을 제공합니다.

항공업계의 대기업이 시장 개척에 투자하고 있는 경우도 있어, 에어택시 시스템 시장은 향후 수년간 큰 성장이 예상됩니다. 이러한 성장은 지속가능한 스마트 시티 프로젝트와 관련된 다양한 정부의 이니셔티브에 의해 더욱 강화됩니다. 이러한 에어 택시 시스템의 상업 전개는 예측 기간 동안 이루어질 것으로 예상됩니다.

그러나 기존 운송 시스템과 에어 택시 간의 높은 가격 차이와 항공 면허에 대한 엄격한 정부 규정은 예측 기간 동안 에어 택시 시장의 성장을 억제할 수 있습니다. 이러한 요인에도 불구하고, 에어택시 시장은 R&D 투자의 급증을 목격하고 있으며, 이 영역에서 큰 성장 가능성을 발견하는 수많은 신흥기업과 항공우주기업을 유치하고 있습니다. 그 결과, 이러한 요인들이 예측 기간 동안 시장의 성장 궤도를 촉진할 것으로 예측됩니다.

에어택시 시장 동향

예측 기간 동안 파일럿 부문이 시장 점유율을 독점

에어택시의 초기 단계에서 에어택시 업계의 이해관계자는 파일럿이 주도하는 에어택시 서비스를 중시하고 있습니다. 에어택시의 인프라 정비에는 상당한 투자가 필요합니다. GDP가 높은 국가일수록 바티포트, 충전소, 항공 교통 관리 시스템 등 필요한 인프라에 투자하기 쉬운 입장에 있습니다. 예를 들어, 2024년에는 미국, 중국, 독일, 일본, 인도가 GDP와 1인당 GDP 측면에서 주요 경제국의 일부가 되었습니다. 이 국가들은 국가 전역에서 다양한 에어 택시 서비스를 개발하는 단계에 있습니다.

또한, 규제 상황은 에어택시의 성공적인 도입을 위한 중요한 요소입니다. 현행 규제 프레임워크을 철저히 평가하고 에어택시가 가져오는 독자적인 과제를 해결하기 위한 새로운 규제를 수립해야 합니다. 예를 들어, 2023년 7월, FAA는 전동 에어 택시가 4,000ft보다 높고, 관제공역의 도시 상공을 비행해서는 안 된다고 발표했습니다. 에어택시를 조종하는 파일럿에는 항공관제의 허가가 필요하며, 항공기는 자동종속감시방송(ADS-B) Out 시스템이 필요합니다.

또한, 세계 각국은 여객 운송을 위한 에어택시 서비스의 개발을 중시하고 있으며, 많은 프로젝트가 개발 중입니다. 예를 들어, 2023년 10월, EHang사의 EH216-S 전기 수직 이착륙기(eVTOL)는 중국 민용 항공국으로부터 형식 증명서를 수여되며, 회사는 상업 서비스를 시작하기 전에 운행 허가를 취득할 전망 .

전체적으로, 자율형 에어택시의 운행이 개시될 때까지는 파일럿의 배치가 에어택시에 익숙해지게 하는 데 도움이 됩니다. 이를 통해 예측 기간 동안 에어택시의 가치 제안이 구축될 것으로 기대됩니다. 이러한 신흥국 시장의 개척은 예측 기간 동안 파일럿 시장 부문의 성장을 가속할 것으로 예상됩니다.

예측기간 중 북미가 최대 시장 점유율을 차지할 전망

도시 지역에서의 빈 이동에 필요한 항공 인프라가 존재하기 때문에 북미는 앞으로 몇 년간 에어 택시 서비스를 재빨리 채용하는 지역이 됩니다. 이 지역의 주요 시장인 미국은 이 지역에서 에어택시 서비스의 엄청난 수요를 창출할 것으로 예상됩니다. 높은 소비자 수요와 함께 고도로 발달한 항공 교통 관제 인프라와 유인,무인 교통 관리를 중시하는 경향이 강해지고 있으며, 이들은 에어 택시 서비스의 운영에 이상적인 파라미터이기 때문에 이 지역 시장 성장에 기여할 것으로 예상됩니다.

Joby Aviation, Wisk Aero, Kitty Hawk Corporation 등 미국에 본사를 둔 다양한 에어택시 회사들이 이미 이 지역에서 에어택시 사업의 틀을 적극적으로 개발하고 있습니다. 이 회사는 에어 택시 서비스의 영역에서 전면 러너의 일부입니다. 환경 친화적 인 운송으로 인해 이동성 회사는 전기 기반 에어 택시 개발에 주력하고 있습니다. 예를 들어, 2023년 11월, Joby Aviation, Inc.는 뉴욕시에서 전시 비행에 성공했다고 발표했습니다. 이 회사는 eVOTL을 도시에서 비행시킨 것은 이것이 처음이라고 말했습니다.

UAM 생태계를 홍보하기 위한 미국 정부의 여러 이니셔티브가 시장 성장을 가속할 것으로 보입니다. 2023년 4월, FAA는 Urban Air Mobility(UAM) Concept of Operations(ConOps) 버전 2.0을 발표했습니다. 이 청사진은 기본적으로 에어택시를 국가공역에 통합하기 위한 기술적 세부사항과 운영 요건을 개략적으로 설명합니다. 이러한 요소는 예측 기간 동안 북미의 에어 택시 시장의 성장을 도울 것으로 기대됩니다.

에어택시 산업 개요

에어 택시 시장은 반 고유의 특성을 가지고 있으며 다양한 사업자에 의해 특징 지어집니다. Volocopter GmbH, Guangzhou EHang Intelligent Technology, Jaunt Air Mobility Corporation, Lilium GmbH, Joby Aero, Inc.는 에어 택시 시장의 유명한 기업 중 일부입니다.

이 시장은 여명기에 있으며 각 회사는 에어 택시 시스템용 항공기의 프로토타입 모델을 개발하고 있습니다. 각 회사는 예측 기간 동안 다른 기업와 경쟁 우위를 차지하기 위해 제휴, 계약, R&D 투자 증가 등 다양한 사업 전략을 실시했습니다.

이 분야에서는 연구개발 및 기술적 전문지식의 초기 비용이 높기 때문에 신규 진입업체의 위협은 적당합니다. The Boeing Company와 같은 전통적인 항공기 제조 기업도 이 시장에 대한 투자를 늘리고 있습니다. 예를 들어, 2022년 1월, The Boeing Company는 선진 항공기동성(AAM) 기업인 Wisk Aero에 약 4억 5,000만 달러를 투자했습니다. 이 투자는 6세대 eVTOL 항공기의 개발과 인증에 위스크를 지원할 것으로 기대됩니다. 보다 깨끗하고 혼잡하지 않은 운송 수단에 대한 요구 증가와 정부 규제의 변화는 신규 진출기업을 유치하고 시장 간 경쟁 기업간 경쟁 관계를 높일 것으로 예상됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자,소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 사업 형태

- 파일럿

- 자율형

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 이집트

- 이스라엘

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Airbus SE

- Textron Inc.

- The Boeing Company

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Joby Aero, Inc.

- Volocopter GmbH

- Hyundai Motor Company

- Lilium GmbH

- Jaunt Air Mobility Corporation

- Wisk Aero LLC

The Air Taxi Market size is estimated at USD 1.41 billion in 2024, and is expected to reach USD 4.04 billion by 2029, growing at a CAGR of 23.32% during the forecast period (2024-2029).

The air taxi market demand is driven by the need for an alternative mode of transportation and the increasing problem of traffic congestion in metro cities. As urban populations continue to rise, traditional ground transportation faces limitations. Air taxis offer a promising solution for short-distance travel, providing convenience and efficiency.

The market for air taxi systems is expected to witness significant growth in the coming years, with major companies in the aviation industry investing in their development. This growth is further aided by various government initiatives related to sustainable smart city projects. Commercial deployment of these air taxi systems is expected to take place during the forecast period.

However, high differential pricing between the existing transportation systems and air taxis and strict government regulations regarding aviation licensing can restrain the growth of the air taxi market during the forecast period. Despite this factor, the air taxi market is witnessing a surge of research and development investments, attracting numerous start-ups and aerospace firms that see tremendous growth potential in this domain. As a result, these factors are projected to fuel the market's growth trajectory in the forecast period.

Air Taxi Market Trends

Piloted Segment to Dominate Market Share During the Forecast Period

During the initial stages of the operation of the air taxis, stakeholders in the air taxi industry are emphasizing more on pilot-driven air taxi services. Developing air taxi infrastructure requires substantial investment. Countries with higher GDP are better positioned to invest in necessary infrastructure such as vertiports, charging stations, and air traffic management systems. For instance, in 2024, the US, China, Germany, Japan, and India are some of the major economies in terms of GDP and GDP per capita. These countries are in the phase of developing various air taxi services across their countries.

In addition, the regulatory landscape is a critical factor in the successful implementation of air taxis. The current regulatory framework needs to be thoroughly evaluated, and new regulations need to be developed to address the unique challenges posed by air taxis. For instance, in July 2023, the FAA announced that electric air taxis should not fly higher than 4,000ft and above urban areas in controlled airspace. The pilots who operate the air taxis will require air traffic control clearances, and the aircraft needs automatic dependent surveillance-broadcast (ADS-B) Out systems.

Furthermore, various global countries are emphasizing the development of air taxi services for passenger travel, with many projects in development. For instance, in October 2023, EHang's EH216-S electric vertical take-off and landing (eVTOL) was awarded a type certificate by the Civil Aviation Administration of China, and the company is expecting to obtain an operation permit before it can begin commercial service.

Overall, until autonomous air taxi operations become operational, pilot deployment will aid the public in increasing familiarity with the air taxis. This is expected to build the value proposition for air taxis in the forecast period. Such developments are expected to aid the growth of the piloted market segment in the forecast period.

North America to Exhibit the Largest Market Share During the Forecast Period

The presence of the necessary aviation infrastructure required for urban air mobility makes the North American region the early adopter of air taxi services in the years to come. The US, a key market in the region, is anticipated to generate a huge demand for air taxi services in the region. Along with the high consumer demand, highly developed air traffic control infrastructure and the growing emphasis on manned and unmanned traffic management are expected to help the growth of the market in the region, as these are the ideal parameters for the operation of air taxi services.

Various US-based air taxi companies, such as Joby Aviation, Wisk Aero, and Kitty Hawk Corporation, are already actively developing frameworks for air taxi operations in the region. These companies are some of the front runners in the domain of air taxi services. For eco-friendly transport, mobility companies are emphasizing on development of electric-based air taxis. For instance, in November 2023, Joby Aviation, Inc. announced that it had successfully performed an exhibition flight in New York City. The company mentioned that it's the first time it has flown the eVOTL in an urban setting.

Several US government initiatives aimed at promoting the UAM ecosystem will drive market growth. In April 2023, the FAA published version 2.0 of its Urban Air Mobility (UAM) Concept of Operations (ConOps), which is a comprehensive plan that lays out the framework for the future of air taxi operations in the national airspace. This blueprint essentially outlines the technical details and operational requirements for the integration of air taxis into the national airspace. Such factors are expected to aid the growth of the air taxi market in the North American region during the forecast period.

Air Taxi Industry Overview

The market of air taxi market is semi-consolidated in nature and is characterized by various operators. Volocopter GmbH, Guangzhou EHang Intelligent Technology Co. Ltd, Jaunt Air Mobility Corporation, Lilium GmbH, and Joby Aero, Inc. are some of the prominent players in the air taxi market.

The market is in the nascent stage, and companies in this market are developing prototype models of their aircraft for air taxi systems. The companies are implementing various business strategies such as partnerships, agreements, increasing R&D investments, etc., to gain a competitive edge over other players in the forecast period.

The threat of new entrants in this domain is moderate as the initial cost of research and development, as well as technical expertise, is high. Traditional aircraft manufacturing companies, such as The Boeing Company, are also increasing their investments in the market. For instance, in January 2022, The Boeing Company invested around USD 450 million in the advanced air mobility (AAM) company Wisk Aero. The investment is expected to support Wisk in developing and certification 6th-generation eVTOL aircraft. The increasing necessity for cleaner and congestion-free modes of transportation and the changing government regulations are expected to attract new players, increasing competitive rivalry in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Mode of Operation

- 5.1.1 Piloted

- 5.1.2 Autonomous

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Australia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Egypt

- 5.2.5.3 Israel

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Airbus SE

- 6.2.2 Textron Inc.

- 6.2.3 The Boeing Company

- 6.2.4 Guangzhou EHang Intelligent Technology Co. Ltd.

- 6.2.5 Joby Aero, Inc.

- 6.2.6 Volocopter GmbH

- 6.2.7 Hyundai Motor Company

- 6.2.8 Lilium GmbH

- 6.2.9 Jaunt Air Mobility Corporation

- 6.2.10 Wisk Aero LLC