|

시장보고서

상품코드

1523396

항공 구급 서비스 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2024-2029년)Air Ambulance Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

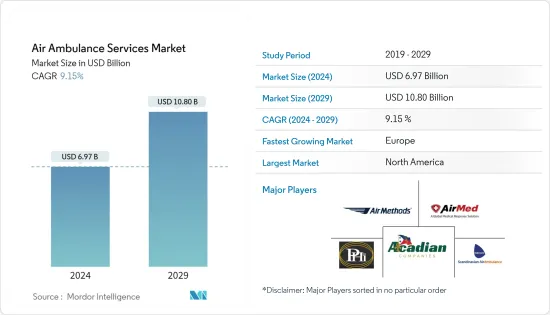

항공 구급 서비스 시장 규모는 2024년 69억 7,000만 달러로 추정되고, 2029년에는 108억 달러에 이를 전망이며 예측 기간 동안 복합 연간 성장률(CAGR) 9.15%를 나타낼 것으로 예측됩니다.

구급기는 현재 건강 문제로 고통받는 환자의 운반에 점점 이용되고 있습니다. 사고, 심장 마비, 뇌졸중 및 기타 의료 응급 상황과 같은 위협 증가는 항공 구급 서비스에 대한 수요를 창출하고 있습니다. 정부와 헬리콥터 응급의료서비스(HEMS) 제공업체와의 파트너십 증가는 시장 성장을 뒷받침하고 있습니다. 항공 구급 서비스의 기술적 진보도 진행되고 있습니다. 예를 들어, 응급 헬기에는 필요한 의료 장비와 액세서리가 장착되어 있으며 환자에게 초기 응급 의료를 제공하는 훈련을받은 숙련된 의료 승무원이 있습니다.

게다가 구급기는 기존의 노상 구급 서비스보다 뛰어나 이동 시간의 길이나 원격지에의 액세스 제한 등의 문제를 경감할 수 있습니다. 고급 인공호흡기 시스템과 심장 모니터링 시스템과 같은 신기술은 환자가 안전하게 가장 가까운 병원으로 이송될 때까지 생존할 가능성을 높입니다. 게다가, 통신 시스템의 측면에서도 첨단 기술은 환자의 실시간 데이터를 병원으로 전송하여 의사가 환자를 구하기 위해 필요한 조치를 인식할 수 있도록 합니다.

그러나 운영상의 제약, 고비용, 항공사고 발생 등의 요인이 이 부문의 성장을 억제할 것으로 예측되고 있습니다. 이러한 요인에도 불구하고, 보다 나은 응급의료를 제공하고 보다 수익성이 높은 수익을 창출하기 위해 구급기의 자산을 최대한 활용할 필요성은 예측 기간 동안 부문 수익을 홍보할 것으로 예상됩니다.

항공 구급 서비스 시장 동향

예측기간 동안 회전익 항공기 부문이 시장을 독점

항공 구급 서비스 시장은 생존율 향상, 빠르고 편안한 운송, 짧은 시간 내에 광범위한 범위를 커버할 수 있는 등 몇 가지 장점이 있기 때문에 증가하는 경향이 있습니다. 이러한 이점으로부터, 회전익 헬리콥터는 구급 의료 반송의 유력한 선택이 되고 있습니다. 예를 들어, 2019년부터 2023년 사이에 전 세계적으로 총 268대의 헬리콥터가 다양한 응급,의료 서비스를 실시하기 위해 운용되고 있었습니다. 항공 구급 서비스를 수행하기 위한 헬리콥터는 상대방 브랜드 제조업체(OEM)에 의해 경량화됩니다. 이러한 헬리콥터의 설계에 탄소섬유를 도입함으로써 기체가 경량화되어 긴급시의 신속한 착륙,이륙이 가능하게 되는 등 많은 이점이 가져오고 있습니다. 또한, 헬리콥터의 모델에 탄소섬유 구조를 채용함으로써 헬리콥터의 수명이 연장되어 오랫동안 사용할 수 있게 되었습니다. 또한 비행 운송 중에 발생하는 손상에 대한 내구성도 향상되었습니다. 이러한 발전으로 인해 다양한 국가, 군 및 기타 항공 구급 서비스를 제공하는 기업들은 항공 구급 서비스를 제공하기 위해 신형하고 고급 헬리콥터를 조달해야 합니다.

예를 들어, 2023년 11월, 노르웨이 항공 구급대는 덴마크에서 헬리콥터에 의한 응급 의료 서비스를 실시하기 위해 3대의 H135와 2대의 5장 날개의 H145를 납품하는 계약을 에어 버스에 주문했습니다. 마찬가지로 2023년 12월, 가마 항공은 웨일스 항공 응급 자선을 위해 헬리콥터 응급 의료 서비스(HEMS)를 시작했습니다. 7,000만 달러의 계약에 의해 에어버스 H145 헬리콥터 4기가 운항,정비되고, 그 거점은 동자선 단체의 기존 시설이 됩니다. 이와 같이 상대방 브랜드 제조업체(OEM)에 의한 이러한 기술적 진보로 로터 크래프트 분야는 예측 기간 동안 눈부신 성장을 보일 것으로 보입니다.

예측기간 중 북미가 최대 시장 점유율을 차지

현재 북미는 항공 구급 서비스 시장에서 가장 높은 점유율을 차지하고 있습니다. 이러한 이점은 다수의 항공 구급 서비스 제공업체가 존재하고 헬스케어 분야에서의 지출이 증가하고 있기 때문입니다. 예를 들어, 2023년 8월 항공 의료 서비스 협회는 미국에서 매년 55만 명 이상의 환자가 항공 구급 서비스를 이용하고 있다고 발표했습니다. Air Methods Corporation, Acadian Companies, PHI Inc.와 같은 주요 기업의 존재가 지역 전체 시장 성장을 가속하고 있습니다. 예를 들어, 2024년 1월에 미국 심장협회가 발표한 바에 따르면, 미국에서는 매년 약 60만 5,000건의 심장 발작이 새롭게 발생하고, 20만건의 발작이 재발합니다. 또한 지난 10년간 고혈압으로 인한 연령 조정 사망률은 65.6% 증가했으며 실제 사망자 수는 91.2% 증가했습니다. 고혈압은 심장 질환과 뇌졸중의 주요 위험 요소입니다. 이러한 요인으로 인해 전국적으로 항공 구급 서비스에 대한 수요가 높아지고 있습니다. 따라서 다양한 항공 구급 서비스 제공업체가 긴급 항공 구급 서비스를 제공하기 위해 새로운 모델 헬리콥터를 조달하고 있습니다.

항공 구급 서비스 산업 개요

항공 구급 서비스 시장은 세분화되어 있으며 다양한 유형의 응급 의료 서비스를 제공하는 여러 사업자가 특징입니다. 유명한 시장 진출 기업으로는 Air Methods Corporation, Acadian Companies, PHI Group, Inc, Babcock International Group, Global Medical Response, Inc 등이 있습니다. 헬리콥터에 고급 의료기기가 탑재되어 응급 치료 및 운반이 가능해짐에 따라 시장 성장이 더욱 가속될 것으로 예상됩니다. 또한, 탄소섬유 등의 복합재료를 사용함으로써 구급기의 수명을 연장하고, 강한 충격을 받았을 때의 보호 성능을 높이는 등, 구급기의 설계에 다양한 진보가 보이고, 구급기로 반송 하는 환자를 추가로 보호할 수 있으며, 이는 예측 기간 동안 시장의 성장으로 이어질 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자,소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 서비스 사업자

- 병원계

- 독립계

- 정부계

- 항공기 유형

- 고정날개

- 회전날개

- 서비스 유형

- 국내선

- 국제선

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 이집트

- 이스라엘

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Air Methods Corporation

- AirMed International(Global Medical Response, Inc.)

- Acadian Companies

- PHI Group, Inc.

- REVA Inc.

- European Air Ambulance

- Babcock Scandinavian Air Ambulance(Babcock International Group)

- Air Charter Services Group

- Gulf Helicopters

- CareFlight

제7장 시장 기회와 앞으로의 동향

BJH 24.08.09The Air Ambulance Services Market size is estimated at USD 6.97 billion in 2024, and is expected to reach USD 10.80 billion by 2029, growing at a CAGR of 9.15% during the forecast period (2024-2029).

Air ambulances are now being increasingly used for the transportation of patients suffering from health issues. An increase in the number of accidents and other threats such as heart attacks, strokes, and other medical emergencies creates demand for air ambulance services. Increasing partnerships between governments and helicopter emergency medical services (HEMS) providers boost the market's growth. There have been increasing advancements in terms of technology for air ambulance services. For instance, air ambulance helicopters are equipped with the required medical equipment and accessories, along with skilled medical crew trained in providing initial emergency medical care to patients.

In addition, air ambulance provides advantages over conventional road ambulance services, as the former helps mitigate the issue of prolonged travel durations and limited access to remote areas. New technologies such as advanced ventilator systems and heart monitoring systems increase the chances of patients' survival until they are safely transported to the nearest hospital. Additionally, advanced technology in terms of communication systems leads to the transfer of real-time data of patients to the hospitals so that the doctors are aware of the necessary steps to be taken to save the patient.

However, factors like operational constraints, high costs, and air ambulance accident incidences are projected to restrain the growth of the segment. Despite this factor, the need for maximizing the use of air ambulance assets to offer better emergency care and the generation of more profitable returns is anticipated to propel the revenues of the segment during the forecast period.

Air Ambulance Services Market Trends

The Rotary-Wing Aircraft Segment Dominates the Market During the Forecast Period

The market for air ambulance services is on the rise owing to several benefits, such as increased survival rates, swift and comfortable transportation, and a vast coverage range in a shorter time. These advantages make rotary-wing helicopters a compelling choice for emergency medical transportation. For instance, during 2019-2023, a total of 268 helicopters were in operation performing various emergency and medical services globally. Helicopters for carrying out air ambulance services have been made lightweight by original equipment manufacturers (OEMs). The introduction of carbon fiber while designing such helicopters has provided many benefits by making the craft lighter in weight and thus adding the benefit of quick landings and take-offs during emergencies. Making use of a carbon fiber structure for the helicopter model has also led to increasing the life of the helicopter so that it can be used in service for many years. It has also made the helicopters more durable towards damages occurring during flight transportation. Such advancements are compelling various countries, militaries, and other air ambulance service-providing companies to procure new and advanced helicopters to provide air ambulance services.

For instance, in November 2023, the Norwegian Air Ambulance awarded a contract to Airbus to deliver three H135s and two five-bladed H145s to carry out helicopter emergency medical service missions in Denmark. Similarly, in December 2023, Gama Aviation launched its Helicopter Emergency Medical Services (HEMS) for the Wales Air Ambulance Charity. Under a USD 70 million contract, a fleet of four Airbus H145 helicopters will be operated and maintained, with their base of operations being the charity's existing sites. Thus, such technological advancements being made by the original equipment manufacturers or OEMs will lead to the rotor-craft segment showing impressive growth during the forecast period.

North America to Exhibit the Largest Market Share During the Forecast Period

Currently, North America holds the highest shares in the air ambulance market. The dominance is due to the presence of a large number of air ambulance service providers and rising spending in the healthcare sector. For instance, in August 2023, the Association of Air Medical Services published that more than 550,000 patients in the U.S. use air ambulance services every year. The presence of key players such as Air Methods Corporation, Acadian Companies, PHI Inc., and others drives the growth of the market across the region. In addition, the demand for air ambulance services in the region is driven by the presence of the U.S. For instance, in January 2024, the American Heart Association published that every year, there are about 605,000 new heart attacks and 200,000 recurrent attacks in the U.S. And the past 10 years, the age-adjusted death rate from high blood pressure increased by 65.6%, and the actual number of deaths rose by 91.2%. High blood pressure is a leading risk factor for heart disease and stroke. Such factors are driving the demand for air ambulance services across the country. Hence, various air ambulance service providers are procuring newer helicopter models to provide emergency air ambulance services.

For instance, in February 2023, Bell Textron Inc. was awarded a contract by Global Medical Response (GMR) to deliver three additional Bell 407GXi aircraft. The delivery happened at the end of 2023, and the three Bell 407GXis have joined GMR's exclusive 220 Bell helicopter fleet used for emergency medical operations throughout North America. Similarly, in May 2023, Ascent Helicopters, a Canadian company based in Parksville, was awarded a contract by the provincial government to provide the B.C. Emergency Health Services (BCEHS) with six new air ambulances for USD 544.4 million. By 2025, six new air ambulances are expected to be added to the fleet for B.C. Emergency Health Services. Growing investments by various original equipment manufacturers as well as companies in the North American region to better develop air ambulance services at times of medical requirements are expected to fuel the market growth in the region.

Air Ambulance Services Industry Overview

The market of air ambulance services is fragmented in nature and is characterized by several operators who provide various types of emergency medical services. Some of the prominent market players include Air Methods Corporation, Acadian Companies, PHI Group, Inc., Babcock Scandinavian Air Ambulance (Babcock International Group), and AirMed International (Global Medical Response, Inc.). The market growth is anticipated to receive a boost with the incorporation of sophisticated medical equipment in helicopters that enable emergency treatment and transportation. In addition, various advances to the design of air ambulances by making use of composite materials such as carbon fiber to increase the life of the air ambulance in service, as well as offer better protection during heavy impact, may provide additional protection to the patient being transported by the air ambulance and this is likely to lead to the growth of the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Operator

- 5.1.1 Hospital-based

- 5.1.2 Independent

- 5.1.3 Government

- 5.2 Aircraft Type

- 5.2.1 Fixed-Wing

- 5.2.2 Rotary-Wing

- 5.3 Service Type

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Egypt

- 5.4.5.3 Israel

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Air Methods Corporation

- 6.2.2 AirMed International (Global Medical Response, Inc.)

- 6.2.3 Acadian Companies

- 6.2.4 PHI Group, Inc.

- 6.2.5 REVA Inc.

- 6.2.6 European Air Ambulance

- 6.2.7 Babcock Scandinavian Air Ambulance (Babcock International Group)

- 6.2.8 Air Charter Services Group

- 6.2.9 Gulf Helicopters

- 6.2.10 CareFlight