|

시장보고서

상품코드

1523398

자동차 산업용 시험/검사/인증 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2024-2029년)Testing, Inspection, And Certification For The Automotive Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

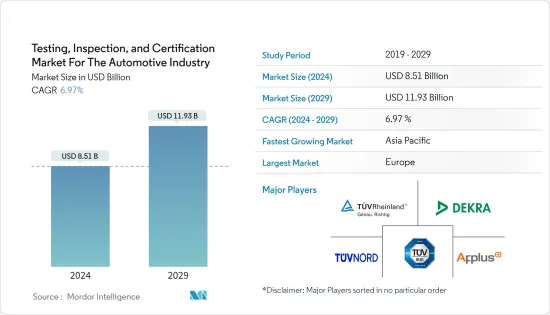

세계 자동차 산업용 시험/검사/인증 시장 규모는 2024년 85억 1,000만 달러로 추정되고 예측 기간 동안 복합 연간 성장률(CAGR) 6.97%로 성장할 전망이며, 2029년에는 119억 3,000만 달러에 달할 것으로 예측됩니다.

TIC 기업은 검사 및 시험 서비스를 통해 자동차 부품 및 장비 제조업체의 문제를 줄이고 최종 사용자에게 좋은 사용감을 제공하는 것을 목표로 하고 있습니다. TIC은 제품이 제조업체의 주장 또는 지정된 요구사항에 따라 작동하는지 확인함으로써 브랜드 명성을 보호하고 소비자의 신뢰와 신용을 홍보하는 데 도움이 됩니다.

EV로의 전환은 가속화되고 있으며, 2022년 초부터 자동차 제조업체는 보다 정교한 기능을 갖춘 전기자동차 생산에 주력하고 있습니다. EV는 유럽, 미국, 중국에서 높은 시장 점유율을 얻고 내연 기관차의 판매량을 초과할 것으로 보입니다.

미국은 EV 시장과 그 판매에 중요한 지역 중 하나입니다. COX 엔터프라이즈에 따르면 미국의 배터리 전기자동차 판매량은 2023년 1분기에 약 25만 8,900대에 달했습니다. 이는 2022년 동시기 판매량에 비해 전년 동기 대비 약 44.9%의 대폭적인 성장을 보였습니다. 게다가 2023년 1분기는 2022년 4분기를 넘어 지난 2년간 BEV 판매가 가장 호조적인 분기였습니다.

게다가 전기자동차(EV)를 중심으로 하는 자동차 산업이 가장 현저한 섹터이며, 전기 제품,부품 수요 증가로 이어지고 있습니다. 또한, 특히 자동차 산업에서는 센서 채용이 크게 증가하고 있습니다. 이러한 수요의 급증은 다른 시장에도 뒷받침되며 앞으로 수년간은 고수준으로 지속될 것으로 예상됩니다. 보조금 및 이산화탄소 배출 목표 달성을 위한 노력 등 정부 이니셔티브는 이 지역의 EV 부문에 대한 투자를 뒷받침하여 시장 성장 전망을 확대할 것으로 예상됩니다.

게다가 자동차 사고 감축에서 ADAS의 중요성에 대한 의식이 증가하는 것은 최근 이러한 시스템 수요를 촉진하는 주요 요인 중 하나입니다. 유럽, 북미 및 아시아의 많은 국가에서는 승용차 부문에서 다양한 유형의 ADAS 사용을 의무화하는 규정을 도입하고 있습니다. 예를 들어, 2018년 이후 캐나다에서 판매되는 신차에는 백업 카메라와 ADAS 기능의 탑재가 의무화되고 있습니다.

다양한 요구 사항, 적절한 이해 부족, 적절한 인프라 부재 등으로 인해 산업이 직면하는 표준, 규제 및 인증 문제가 있습니다.

자동차 생산 대수의 성장은 특히 선진국에서 수요감퇴로 인해 2024년에는 둔화될 것으로 예상됩니다. 그러나 시장에서 EV의 인기가 높아짐과 발전 단계에서 EV와 관련된 위험에 대한 우려가 높아지면서 자동차 시장에서 TIC 수요를 후퇴시키는 데 중요한 역할을 하고 있습니다.

자동차 산업용 TIC 시장 동향

전기차가 현저한 성장을 이루

- 전통적인 자동차가 환경에 미치는 악영향과 우려 증가로 인해 시장은 전기자동차와 같은 대체품에 문을 열고 있습니다.

- 전기자동차의 보급이 진행됨에 따라 이러한 자동차의 신뢰성, 성능 및 안전성을 보장하기 위해 엄격한 안전 및 규정 준수 규정이 제공됩니다. TIC 시장은 EV가 배터리 안전성, 전자기 호환성, 충돌 시험 요건 등 이러한 규제 기준을 충족하는지 검증하는데 중요한 역할을 합니다. 엄격한 시험과 인증은 EV 모델의 안전과 품질에 대한 소비자의 신뢰를 구축하는 데 도움이 됩니다.

- 배터리 팩과 전동 파워트레인과 같은 EV의 핵심 부품은 최적의 성능, 내구성 및 긴 수명을 보장하기 위해 광범위한 테스트 및 검증이 필요합니다. 전기자동차의 보급에는 EV 배터리의 안전성, 효율성, 신뢰성을 보장하기 위한 시험 및 동종요법 규칙이 필수적입니다. EV 배터리가 엄격한 안전 및 성능 기준을 충족하는지 여부는 시험 및 동종요법 절차를 통해 검증됩니다. 이러한 공정은 제조업체, 규제 당국 및 소비자에게 배터리가 필요한 사양을 충족하고 다양한 조건에서 사용할 수 있음을 보증합니다.

- 또한 최신 EV는 ADAS(첨단 운전 지원 시스템) 및 OTA(Over-the-Air) 업데이트와 같은 복잡한 소프트웨어 및 연결 기능에 점점 더 의존하고 있습니다. TIC 시장은 이러한 소프트웨어 중심의 EV 시스템의 사이버 보안, 데이터 프라이버시 및 기능 안전을 보장하는 데 도움이 되며, 이는 고객의 신뢰와 규제 준수를 유지하는 데 매우 중요합니다.

- 게다가 독일에 본사를 두고 있는 TUV SUD TIC 대기업은 프로젝트의 두 번째 단계로서 인도에 EV 배터리 실험실을 설치하는 것에 관심을 보이고 있습니다. 이러한 노력이 시장 성장을 가속할 것으로 기대됩니다.

유럽이 큰 성장을 이루다.

- 자동차 제조의 회복과 전기자동차, 자율 주행 차량 등의 동향은 독일 자동차 산업에서 TIC 수요를 견인하는 중요한 요인 중 하나입니다. 또한 ADAS(선진운전지원시스템)와 센서, 카메라, 레이저 스캐너를 이용한 차량 등의 안전기술의 성장은 향후 수년간 조사 대상 시장의 벤더에게 큰 성장 기회를 가져올 것으로 예상됩니다.

- 독일은 Robert Bosch GmbH, Volkswagen AG, Daimler AG와 같은 주요 자동차 제조업체와 OEM 제조 회사가 있기 때문에 전 세계적으로 자동차의 주요 기지가되었습니다. 차차간, 차차간 인프라, 차재 엔터테인먼트 기술의 일관된 개척이 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

- 스페인은 유럽 2위, 세계 9위 자동차 제조업체입니다. 스페인 자동차 산업은 이 나라의 GDP의 약 10%에 기여하며 수출의 약 18%를 차지하고 있습니다. 스페인 자동차 산업은 외국인 투자자에게 매력적인 투자 대상입니다. FDI가 제공하는 인사이트에 따르면 최근 몇 년간 다국적 기업에 의한 신규 그린필드 프로젝트에서 스페인은 유럽에서 두 번째로 선호되는 투자처가 되고 있습니다.

- 폴란드 자동차 산업은 전체 생산액의 11.1%를 차지하고 식품 산업에 이어 폴란드에서 가장 중요한 제조업 중 하나입니다. 최근 폴란드는 자동차 제조업에 대한 외국 직접 투자를 크게 유치해 중동유럽에서 자동차, 자동차 부품, 컴포넌트의 주요 제조 거점으로 대두하고 있습니다.

자동차 산업용 TIC 시장 개요

자동차 산업용 시험/검사/인증 시장은 세분화되어 있어 복수의 기업이 존재합니다. 자동차 수요가 증가함에 따라 신규 진입하는 기업도 늘어나 시장 경쟁을 촉진하고 있습니다. 기존 시장 기업은 시장에서의 프레즌스와 서비스 포트폴리오를 더욱 확대하고, 파트너십을 확립하고, 시장에서의 프레즌스를 더욱 강화하기 위한 인수에 주력하고 있습니다. 시장에 진입하는 주요 기업으로는 DEKRA SE, TUV Rheinland, TUV SUD, Applus Services SA, TUV Nord 등이 있습니다.

2024년 2월 DEKRA는 SERMI 체계의 공식 적합성 평가 기관(CAB)이 되었습니다. SERMI는 브랜드 독립적인 자동차 관련 기업에게 차량 안전 관련 수리 및 유지보수 정보(RMI)에 대한 액세스를 제공합니다. SERMI 인증을 위한 공인 적합성 평가기관(CAB)으로서 DEKRA는 승인,인가 검사를 실시합니다.

2023년 12월, TUV SUD는 인도의 벵갈루에 'TUV SUD Bengaluru Campus'로 알려진 최첨단 시설을 공개했습니다. 이 시설은 국내외 규격에 준거한 전기 및 전자제품 및 의료기기의 시험,인증에 특화되어 있습니다. 3에이커의 광대한 부지를 가진 「TUV SUD Bengaluru Campus」는 초기 단계에서 총 면적 7만 평방 피트(약 8,000평방미터)에 이릅니다. 이 첨단 캠퍼스는 최신 기술과 지속 가능한 건축자재를 통합하고 에너지 효율과 환경의 지속가능성을 보장하기 위해 철저히 설계되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- COVID-19가 시장에 미치는 영향/후유증 및 기타 거시적 동향이 산업에 미치는 영향

- 산업의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

- TIC 산업의 제품 사이클

- 향후 수요가 전망되는 규격?인증과 서비스의 유형

- 충전소 인프라 분석(세계 시나리오)

제5장 시장 역학

- 시장의 원동력

- 스마트 차량의 진화

- 환경기준의 중요성 증가와 교통안전 급증에 따른 자동차 배출가스 시험 및 인증 증가

- 시장 성장 억제요인

- 국제규격의 부족

제6장 시장 세분화

- 서비스 유형별

- 시험

- 검사

- 인증

- 지역별

- 아메리카

- 미국

- 멕시코

- 브라질

- 유럽

- 독일

- 스페인

- 프랑스

- 아시아

- 중국

- 일본

- 한국

- 인도

- 호주 및 뉴질랜드

- 중동 및 아프리카

- 아메리카

제7장 경쟁 구도

- 기업 프로파일

- DEKRA SE

- TUV Rheinland

- TUV SUD

- Applus Services SA

- TUV Nord

- Bureau Veritas

- Intertek Group PLC

- SGS SA

- UL Solutions Inc.

- National Technical Systems(NTS)

- Eurofins Scientific

- Element Materials Technology

- KIWA NV

- ATIC(Guangzhou) Co. Ltd

제8장 벤더의 시장 점유율 분석

제9장 시장의 미래

BJH 24.08.09The Testing, Inspection, And Certification Market For The Automotive Industry is expected to grow from USD 8.51 billion in 2024 to USD 11.93 billion by 2029, at a CAGR of 6.97% during the forecast period (2024-2029).

Through inspection/testing services, TIC companies aim to help automotive component and device manufacturers reduce problems and provide a positive end-user experience. They help protect brand reputation and drive consumer confidence and trust by confirming that products perform according to a manufacturer's claims or specified requirements.

* The migration toward EVs is accelerating, and from the start of 2022, car manufacturers have been focused on producing even more electric cars fitted with more advanced capabilities. EVs will gain higher market shares in Europe, the United States, and China and outpace ICE vehicle sales.

* The United States is one of the significant regions in the EV market and its sales. COX Enterprise reported that sales of battery electric vehicles in the United States reached nearly 258,900 units in the first quarter of 2023. This marked a significant year-over-year growth of approximately 44.9% compared to the sales figures from the same period in 2022. Furthermore, the first quarter of 2023 also outperformed the fourth quarter of 2022, establishing itself as the country's most successful quarter for BEV sales over the past two years.

* Moreover, the automotive industry, primarily focused on electric vehicles (EVs), is the most prominent sector, leading to a rise in demand for electrical products and components. Moreover, sensor adoption is significantly increasing, particularly in the automotive industry. This surge in demand is expected to persist at elevated levels in the coming years, supported by other markets as well. Government initiatives, such as subsidies and efforts to meet carbon emission targets, are anticipated to boost investments in the region's EV sector, consequently expanding growth prospects for the market.

* Furthermore, the rising awareness about the importance of ADAS in reducing car accidents is one of the primary factors driving the demand for these systems in recent years. Many countries in Europe, North America, and Asia have introduced regulations to mandate the use of different types of ADAS in the passenger car segment. For instance, since 2018, new vehicles sold in Canada must be equipped with a backup camera and an ADAS feature.

* There are challenges faced by the industry related to standards, regulations, and certification due to varying requirements, lack of proper understanding, absence of suitable infrastructure, etc.

* The production growth of automotive is expected to slow down in 2024 as weaker demand takes hold of the industry, particularly in advanced economies. However, the growing popularity of EVs in the global market and surging concerns related to dangers associated with them during their evolution phase have played a vital role in rolling back the TIC demand in the automotive market.

TIC Market For The Automotive Industry Trends

Electric Vehicles to Witness Significant Growth

- Due to the increasing environmental concerns and adverse effects of traditional vehicles, the market is opening up for alternatives such as electric vehicles.

- As the adoption of EVs continues to rise, stringent safety and compliance regulations have been put in place to ensure these vehicles' reliability, performance, and safety. The TIC market plays a crucial role in verifying that EVs meet these regulatory standards, such as battery safety, electromagnetic compatibility, and crash-test requirements. Rigorous testing and certification help build consumer confidence in the safety and quality of EV models.

- The core components of an EV, such as the battery pack and electric powertrain, require extensive testing and validation to ensure optimal performance, durability, and longevity. For the widespread adoption of electric vehicles, the rules for testing and homologation of EV batteries are essential to ensure their safety, efficiency, and reliability. The compliance of EV batteries with strict safety and performance standards is verified by testing and homologation procedures. These processes assure manufacturers, regulators, and consumers that the batteries comply with the necessary specifications and can be used in various conditions.

- Moreover, modern EVs increasingly rely on complex software and connectivity features, such as advanced driver assistance systems (ADAS) and over-the-air (OTA) updates. The TIC market helps ensure these software-driven EV systems' cybersecurity, data privacy, and functional safety, which are crucial for maintaining customer trust and regulatory compliance.

- Furthermore, Germany-based TUV SUD TIC giant expressed interest in setting up an EV battery lab in India in the second phase of its project. These initiatives are expected to drive the market's growth.

Europe to Witness Major Growth

- The recovery in automotive manufacturing and trends like electric vehicles and autonomous cars are some of the significant factors driving the demand for TIC in the German automotive industry. Moreover, growth in safety technologies such as advanced driver-assistance systems (ADAS) and vehicles using sensors, cameras, and laser scanners, among others, is expected to create massive growth opportunities for the vendors of the market studied in the coming years.

- Germany is a major automotive hub globally due to the presence of major automotive and OEM manufacturing companies such as Robert Bosch GmbH, Volkswagen AG, and Daimler AG. Consistent development of vehicle-to-vehicle, vehicle-to-infrastructure, and in-vehicle entertainment technologies is expected to drive the market studied during the forecast period.

- Spain is the second largest automaker in Europe and also the 9th largest in the world. The automotive industry in Spain contributes approximately 10% to the country's GDP and represents approximately 18% of the exports. The Spanish automotive industry is an attractive destination for foreign investors. Based on insights provided by FDI, it has been the second preferred destination in Europe for new Greenfield Projects by multinational companies in the last few years.

- Poland's automotive industry stands as one of the country's most significant manufacturing sectors, accounting for 11.1% of the total production value, second only to the food industry. In recent years, Poland has attracted substantial foreign direct investment in automotive manufacturing, emerging as a major manufacturing hub for cars, car parts, and components in Central and Eastern Europe.

TIC Market For The Automotive Industry Overview

The automotive industry testing, inspection, and certification market is fragmented and has several players. With the growing demand for automobiles, an increasing number of new players are also entering the market, driving the market competition. Established market players focus on further expanding their market presence and service portfolio, establishing partnerships, and making acquisitions to consolidate their market presence further. Some major players operating in the market include DEKRA SE, TUV Rheinland, TUV SUD, Applus Services SA, and TUV Nord, among others.

* In February 2024, DEKRA became an official conformity assessment body (CAB) for the SERMI scheme. SERMI offers brand-independent automotive businesses access to vehicle safety-related repair and maintenance information (RMI). As an accredited Conformity Assessment Body (CAB) for SERMI certification, DEKRA conducts approval and authorization inspections.

* In December 2023, TUV SUD unveiled its cutting-edge establishment, known as the 'TUV SUD Bengaluru Campus,' in Bengaluru, India. This facility is dedicated to the testing and certifying of electrical and electronic products and medical devices, adhering to national and international standards. Spanning over an impressive 3 acres, the 'TUV SUD Bengaluru Campus' encompasses a total area of 70,000 square feet in its initial phase. This state-of-the-art campus has been meticulously designed to incorporate the latest technology and sustainable building materials, ensuring energy efficiency and environmental sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact/After-effects of COVID-19 on the Market and Other Macro Trends on the Industry

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Product Cycle of TIC Industry

- 4.5 Standards/Certifications and Types of Services that Might Be in Demand in the Future

- 4.6 Analysis of Charging Stations Infrastructure (Global Scenario)

5 MARKET DYNAMICS

- 5.1 Market Drives

- 5.1.1 Increasing Evolution of Smart Vehicles

- 5.1.2 Rising Automotive Emission Testing and Certification with Surging Importance of Environmental Standards as well as Surge Road Safety

- 5.2 Market Restraints

- 5.2.1 Lack of International Accepted Standards

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Testing

- 6.1.2 Inspection

- 6.1.3 Certification

- 6.2 By Geography***

- 6.2.1 Americas

- 6.2.1.1 United States

- 6.2.1.2 Mexico

- 6.2.1.3 Brazil

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 Spain

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 India

- 6.2.3.5 Australia and New zealand

- 6.2.4 Middle East and Africa

- 6.2.1 Americas

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 DEKRA SE

- 7.1.2 TUV Rheinland

- 7.1.3 TUV SUD

- 7.1.4 Applus Services SA

- 7.1.5 TUV Nord

- 7.1.6 Bureau Veritas

- 7.1.7 Intertek Group PLC

- 7.1.8 SGS SA

- 7.1.9 UL Solutions Inc.

- 7.1.10 National Technical Systems (NTS)

- 7.1.11 Eurofins Scientific

- 7.1.12 Element Materials Technology

- 7.1.13 KIWA NV

- 7.1.14 ATIC (Guangzhou) Co. Ltd