|

시장보고서

상품코드

1536796

자동차 내비게이션 시스템 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Automotive Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

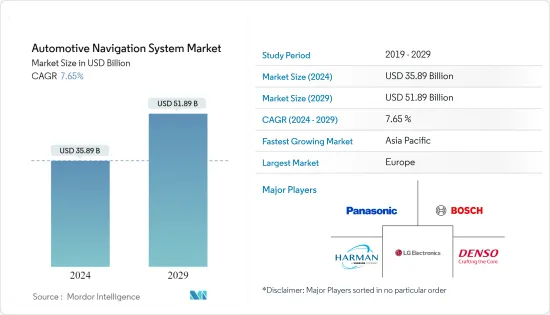

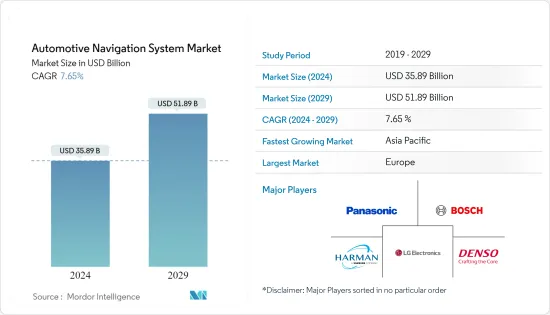

세계의 자동차 네비게이션 시스템 시장 규모는 2024년에 358억 9,000만 달러로 추정되고, 2024년부터 2029년까지 예측 기간 동안 CAGR 7.65%로 성장할 전망이며, 2029년에는 518억 9,000만 달러에 달할 것으로 예측됩니다.

향후 수년간 자동차 내비게이션 시스템에서 실시간 교통 데이터, 지도 업데이트, 스마트폰 이용의 통합이 큰 고객 수요를 끌어들이는 주요 요인이 될 것으로 보입니다. 게다가 자율주행차와 커넥티드 차량 기술의 급속한 강화는 도로상의 다른 차량에 대한 실시간 정보에 크게 의존하기 때문에 고급 자동차 네비게이션 시스템 수요를 촉진할 것으로 예상됩니다. 그러나 사이버 보안 문제 증가 및 네비게이션 시스템의 고비용은 예측 기간 동안 시장 성장을 방해하는 요인이 되고 있습니다.

게다가 소비자의 사적인 교통수단의 이용에 있어서의 기호의 변화와 세계의 물류산업의 확대가 승용차와 상용차 부문의 성장에 기여하고 있으며, 나아가 자동차 내비게이션 시스템의 보급에 긍정적인 영향을 미칩니다. 상용차는 화물과 여객 운송을 위해 장시간 이동해야 하기 때문에 이러한 차량의 운전자는 이동의 가동 중지 시간을 줄이기 위해 고속 경로의 신속한 지식이 필요합니다. 이러한 요인은 자동차 네비게이션 시스템 시장의 성장에 영향을 미칠 것으로 예상됩니다.

*국제자동차공업회(OICA)에 따르면 승용차의 세계 신차 판매 대수는 2021년 5,640만 대에 비해 2022년 5,740만대로 전년대비 1.9% 증가했습니다.

*마찬가지로 소형 상용차의 신차 판매 대수는 2021년의 1,860만 대에 비해 2022년에는 1,980만 대가 되어 전년대비 7%의 대폭적인 성장을 기록했습니다.

아시아태평양은 자동차 내비게이션 시스템의 주요 지역 시장으로 부상할 것으로 예측되고 있으며, 일본, 인도 및 중국은 예측 기간 동안 자동차 제조의 주요 기지로 발전하고 있습니다. 북미 및 유럽 국가에서는 자동차용 미세 전기 기계 시스템(MEMS) 센서의 보급으로 수요가 증가할 것으로 보입니다. 이러한 센서는 가장 눈에 띄는 신흥 용도 중 하나이며 자동차 네비게이션 시스템 시장의 전자 제어 장치 및 타이어 공압 모니터링 시스템에서 점점 더 많이 사용되고 있습니다.

자동차 내비게이션 시스템 시장 동향

예측 기간 동안 애프터마켓 부문이 견인 역할

순정 제조업체에 의한 네비게이션 시스템의 공장 장착과는 별도로, 애프터마켓 채널로부터의 장착율도 예측 기간 중에 상당한 성장을 보인다고 합니다.

세계 전자상거래 산업의 성장으로 전자상거래 기업은 고객에게 제 시간에 제품을 납품해야 한다는 압박이 증가하고 있습니다. 이 요구사항 때문에 많은 전자상거래 기업은 기업 대 고객(B2C) 배송을 위해 기존 물류업체와 제휴를 맺고 있습니다. 이 수요에 대응하기 위해 물류회사는 더 많은 차량을 투입하여 서비스를 확대하고 있습니다. 이 차량에는 주로 위성 내비게이션 시스템이 탑재되어 일정대로 고객에게 도착하게 되어 있습니다. 게다가 전자상거래 기업은 더 많은 소비자를 끌어들이기 위해 '어디서나 배달', '당일 배달', 심지어 '동일 시간 배달' 등의 제안을 도입하고 있습니다.

*미국 전자상거래 이용자 수는 2021년 2억 2,376만 명에 비해 2022년 2억 4,072만 명에 이르렀으며 전년 대비 7.5% 증가했습니다.

*India Brand Equity Foundation(IBEF)에 따르면 인도는 2019년부터 2022년까지 1억 2,500만명의 쇼핑객을 획득했으며, 2025년 말까지 추가로 8,000만명 증가가 전망되고 있습니다.

최근 출시된 대부분의 자동차에는 네비게이션 시스템이 탑재되어 있어 탑승자를 즐겁게 하면서 목적지까지 도착을 서포트합니다. 공장 출하 시 내비게이션 시스템이 장착되지 않은 오래된 차량에서도 애프터마켓 내비게이션 시스템을 대시보드에 설치할 수 있으며, 촉진요인은 휴대용 내비게이션 시스템을 사용할 수도 있습니다. 또한 OEM이 제공하는 차량 모델에 장착되지 않은 고급 네비게이션 시스템을 통합하려는 고객은 이러한 제품을 구입하기 위해 애프터마켓 판매 채널을 사용하는 것을 선호합니다. 따라서 이산화탄소 배출량 감소를 위한 정부의 적극적인 뒷받침으로 소비자가 전기차를 선호하는 것은 애프터마켓 판매 채널의 확대로 이어지고 있습니다.

*국제에너지기구(IEA)에 따르면 배터리식 전기자동차의 세계 판매 대수는 2021년 460만대에 비해 2022년 730만대에 달하고, 전년 대비 58.6% 증가했습니다.

다양한 네비게이션 시스템 공급업체가 전자상거래 플랫폼에 제품을 게재하고 있기 때문에 시장의 애프터마켓 분야는 예측 기간 동안 급성장을 기록할 것으로 예상됩니다.

자동차 네비게이션 시스템 시장을 선도하는 유럽

최근 유럽 자동차 산업은 세계 자동차 수출 대국으로 부상하고 있으며, 유럽 자동차 소유자는 내비게이션을 자동차의 중요한 안전 대책으로 생각하고 있습니다. 각 지역 정부 당국은 향후 몇 년동안 모든 자동차에 GPS 시스템을 연결할 의무가 있습니다. 유럽 표준화 위원회(CEN)와 유럽 통신 표준화 기구(ETSI)는 최근 협력형 지능형 교통 시스템에 규정된 초기 표준 세트를 발행했습니다.

이 지역은 판매량이 급증하고 있습니다. 또한 Renault, Mitsubishi Electric Corporation, Denso, Bosch, Nissan, Garmin, Hyundai, Toyota와 같은 자동차 OEM의 존재도 눈에 띄고 있습니다. 안전 및 보안 서비스는 유럽 시장 전체의 자동차 산업에 가장 기여하고 있으며, 내비게이션은 자동차의 중요한 안전 대책으로 간주됩니다.

*독일연방자동차국(KBA)에 따르면 2023년 10월 동국 승용차 신차 등록 대수는 전년 동월 대비 4.9% 증가한 21만 8,959대였습니다. 2023년 1-10월의 신차 등록 대수는 225만 7,025대(전년 동기 대비 13.5% 증가)였습니다.

*영국자동차공업회(SMMT)에 따르면 2023년 11월 영국의 승용차 판매 대수는 10월 대비 9.5% 증가한 15만 6,525대였습니다. 또한 이 나라의 2023년 1-11월 승용차 판매 대수는 170만대에 달하고, 전년 동기 대비 18.6%의 성장을 보였습니다.

유럽 각국의 자동차 제조업체와 Tier 1 공급업체는 이동성 관리 및 네비게이션 기술과 같은 분야에서 디지털 서비스를 개발하기 위해 데이터 기반 솔루션으로 네비게이션 플랫폼 제공업체의 강점을 지속적으로 시도하고 있습니다. 유럽의 다양한 자동차 제조업체들은 고객의 운전 경험을 향상시키고 생태계에서 경쟁 우위를 확보하기 위해 첨단 네비게이션 솔루션을 제공하기 위해 적극적으로 노력하고 있습니다.

*2023년 5월, 중국 자동차 제조업체인 Lynk & Co.는 혁신적인 what3words 네비게이션 시스템을 유럽 차량에 채용한다고 발표했습니다. what3words의 참신한 시스템은 세계를 57조의 3m 사방으로 나누고, 각각의 사방에 3개의 단어의 독특한 조합을 주고, what3words의 주소를 형성하고 있습니다.

전기자동차에 대한 수요 증가, 무선 통신 기술의 높은 보급률, 첨단 통신 인프라의 가용성 증가는 유럽 각국의 자율 주행 차량과 종속 네비게이션 시스템 시장을 견인하는 주요 요인 중 하나입니다.

자동차 네비게이션 시스템 산업 개요

자동차용 네비게이션 시스템 시장은 에코시스템에서 사업을 전개하는 다양한 국제적 및 지역적 기업에 의해 단편화되어 경쟁이 심합니다. 주요 기업으로는 Panasonic Holdings Corporation, Robert Bosch GmbH, Harman International Industries, LG Electronics Inc., Denso Corporation, Aisin Corporation, Mitsubishi Electric Corporation, Garmin Ltd. 등이 있습니다. 이러한 기업들은 AI(인공지능)와 AR(증강현실) 등 신기술을 통합하여 네비게이션 시스템의 기능성을 향상시켜 세계적으로 높아지는 자동차의 첨단 네비게이션 시스템 수요에 대응 점점 더 주력하고 있습니다.

*2023년 12월, Genesys International은 ADAS Show 2023에서 ADAS 맵의 최신 개발을 발표했습니다. Genesys의 쇼케이스 하이라이트는 830만km의 도로를 커버하고 4,000만 이상의 POI(Point of Interest)를 갖춘 인도의 고충실도 2D 표준 정의(SD) 지도였습니다.

*2022년 4월, Mapbox는 북미 도요타 자동차가 개발한 차세대 멀티미디어 시스템을 일부 도요타 자동차와 렉서스 자동차용으로 출시해 고객의 기대를 뛰어넘는 드라이브 체험을 제공한다고 발표했습니다. Mapbox Maps 소프트웨어 개발 키트는 Toyota의 차세대 멀티미디어 시스템을 보완하는 지도 디자인을 통합하여 턴바이턴 탐색을 촉진요인에 직관적으로 제공합니다.

이 시장은 자율주행차를 생태계에 통합함으로써 자동차 네비게이션 시스템 기술이 급속히 강화될 것으로 예상됩니다. 주요 기업들은 산업에서 경쟁력을 얻기 위해 자동차 제조업체와 적극적으로 전략을 반영하고 장기적인 파트너십을 맺을 것으로 예상됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 자가용 교통수단에 대한 소비자의 기호의 변화

- 시장 성장 억제요인

- 높은 구입 및 설치 비용

- 업계의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(시장 규모 : 금액 기준-달러)

- 자동차 유형별

- 승용차

- 상용차

- 판매 채널별

- 상대방 상표 제품 제조업체(OEM)

- 애프터마켓

- 화면 사이즈별

- 6인치 미만

- 6-10인치

- 10인치 이상

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Harman International Industries

- LG Electronics Inc.

- Denso Corporation

- Aisin Corporation

- Mitsubishi Electric Corporation

- Garmin Ltd

- Visteon Corporation

- TomTom International BV

- Faurecia Clarion Electronics Co. Ltd

- JVC Kenwood Corporation

제7장 시장 기회 및 향후 동향

- 인공지능(AI) 및 사물인터넷(IoT) 등 첨단기술의 내비게이션 시스템에 대한 통합이 시장 수요 촉진

제8장 공급자 정보

AJY 24.08.27The Automotive Navigation System Market size is estimated at USD 35.89 billion in 2024, and is expected to reach USD 51.89 billion by 2029, growing at a CAGR of 7.65% during the forecast period (2024-2029).

Over the coming years, the integration of real-time traffic data, map updates, and smartphone usage in automotive navigation systems will serve as major factors for attracting significant customer demand. Further, rapid enhancement in autonomous vehicles and connected vehicle technology is expected to fuel the demand for advanced automotive navigation systems as they heavily rely on real-time information concerning other vehicles on the road. However, increasing cybersecurity issues and the high cost of navigation systems are a few factors that are likely to hinder the market's growth during the forecast period.

Moreover, consumers' shifting preference toward availing private transportation mediums and the expanding logistics industry worldwide are contributing to the growth of the passenger and commercial vehicle segments, which, in turn, positively impacts the penetration of automotive navigation systems. Commercial vehicles are required to travel for a longer duration for cargo and passenger transportation purposes, and therefore, the drivers of these vehicles require swift knowledge of the faster routes to reduce travel downtime. Such factors are expected to impact the growth of the automotive navigation system market.

* According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger vehicle sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a Y-o-Y growth of 1.9%.

* Similarly, new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7%.

Asia-Pacific is projected to emerge as the key regional market for automotive navigation systems, with Japan, India, and China developing as major automotive manufacturing hubs during the forecast period. The demand across North American and European countries is likely to increase due to the penetration of automobile micro-electro-mechanical systems (MEMS) sensors. These sensors are among the most prominent emerging applications and are increasingly being used in electronic control units and tire pressure monitoring systems in the automotive navigation systems market.

Automotive Navigation System Market Trends

Aftermarket Segment to Gain Traction during the Forecast Period

Apart from the factory fitment of the navigation system from the original equipment manufacturer's end, the fitment rate from the aftermarket channels is also likely to witness considerable growth during the forecast period.

Growth in the e-commerce industry worldwide has resulted in increased pressure on e-commerce companies to deliver products to customers on time. Due to this requirement, many e-commerce companies are forming alliances with existing logistic providers for business-to-customer (B2C) deliveries. To cater to the demand, logistics companies have been expanding their services by entering more vehicles into service. These vehicles are primarily equipped with satellite navigation systems to reach customers as per schedule. Furthermore, e-commerce companies have introduced offers like 'anywhere delivery,' 'same day delivery,' and even 'same hour delivery' to attract a larger number of consumers.

* The number of e-commerce users in the United States reached 240.72 million units in 2022 compared to 223.76 million units in 2021, showcasing a Y-o-Y growth of 7.5%.

* According to the India Brand Equity Foundation (IBEF), India gained 125 million shoppers between 2019 and 2022, with another 80 million expected by the end of 2025.

Most vehicles rolled out in recent years have been equipped with navigation systems that assist drivers in reaching their destinations while also entertaining their occupants. Older cars that were not originally manufactured with a factory-fitted navigation system can have aftermarket navigation systems fitted to their dashboards, or drivers can even use portable navigation systems. Moreover, customers looking to integrate advanced navigation systems that are not equipped in vehicle models offered by OEMs are also increasingly preferring to avail themselves of aftermarket sales channels for purchasing these products. Therefore, consumers' preference toward availing electric vehicles owing to an aggressive government push toward reducing carbon emissions is leading to the expansion of the aftermarket sales channel.

* According to the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 58.6%.

With various navigation system suppliers listing their products on e-commerce platforms, the aftermarket segment of the market is expected to register surging growth during the forecast period.

Europe Leading the Automotive Navigation System Market

In recent years, the European automotive industry has emerged as a major exporter of automobiles worldwide, and European vehicle owners consider navigation a key safety measure in vehicles. Government authorities across regional countries are aiming to ensure that all cars must be connected with GPS systems over the coming years. The European Committee for Standardization (CEN) and the European Telecommunications Standards Institute (ETSI) recently issued an initial set of standards prescribed for cooperative intelligent transport systems.

The region is actively witnessing a surge in sales. It also has a notable presence of automotive OEMs like Renault, Mitsubishi Electric Corporation, Denso, Bosch, Nissan, Garmin, Hyundai, and Toyota. Safety and security service is the largest contributor to the automotive industry across the European market, with navigation considered a crucial safety measure for vehicles.

* According to the Germany Federal Motor Vehicle Office (KBA), in October 2023, new passenger car registrations in the country increased by 4.9% Y-o-Y to 218,959 units. During the first ten months of 2023, 2,257,025 new cars were registered (up 13.5% Y-o-Y).

* According to the Society of Motor Manufacturers and Traders (SMMT), in November 2023, passenger vehicle sales in the United Kingdom increased by 9.5% to 156,525 units compared to October 2023. Furthermore, passenger car sales in the country touched 1.7 million units in the first 11 months of 2023, showcasing a Y-o-Y growth of 18.6% compared to the same period in 2022.

Automakers and tier-1 suppliers across European countries are also consistently testing the strength of navigation platform providers in data-based solutions to develop digital services in fields such as mobility management and navigation technology. Various automakers in Europe are actively engaged in offering advanced navigation solutions to customers to enhance their driving experience and gain a competitive edge in the ecosystem. For instance,

* In May 2023, Lynk & Co., a China-based car manufacturer, announced the adoption of an innovative what3words navigation system for its European fleet, providing customers with an alternative to traditional systems such as Google Maps. The what3words' novel system has divided the world into 57 trillion 3 m squares, and each square has been given a unique combination of three words, forming its what3words address.

Growing demand for electric vehicles, high penetration of wireless communication technology, and increasing availability of advanced telecom infrastructure are among the major factors driving the market for autonomous cars and dependent navigation systems across European countries.

Automotive Navigation System Industry Overview

The automotive navigation system market is fragmented and highly competitive due to various international and regional players operating in the ecosystem. Some of the major players include Panasonic Holdings Corporation, Robert Bosch GmbH, Harman International Industries, LG Electronics Inc., Denso Corporation, Aisin Corporation, Mitsubishi Electric Corporation, and Garmin Ltd. These companies are increasingly focusing on improving their navigation system functionalities through the integration of emerging technologies, such as AI (artificial intelligence) and AR (augmented reality), to cater to the growing demand for advanced navigation systems in vehicles worldwide.

* In December 2023, Genesys International announced its latest development in ADAS Maps at the ADAS Show 2023, which comprises solutions that enhance the safety and support for autonomous vehicles with highly detailed road information. The highlight of Genesys' showcase was their high fidelity 2D Standard Definition (SD) map for India, which covers 8.3 million km of roads and features over 40 million Points of Interest.

* In April 2022, Mapbox announced the launch of the next-generation multimedia system developed by Toyota Motor North America for select Toyota and Lexus vehicles to offer a driving experience exceeding customer expectations. The Mapbox Maps software development kit incorporates a map design that complements Toyota's next-generation multimedia system, making turn-by-turn navigation intuitive for drivers.

The market is anticipated to witness rapid enhancements in automotive navigation system technology owing to the integration of autonomous vehicles into the ecosystem. Major players are expected to actively strategize and form long-term partnerships with automakers to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Shifting Preference of Consumers to Avail Private Medium of Transportation

- 4.2 Market Restraints

- 4.2.1 High Purchase and Installation Costs

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Sales Channel

- 5.2.1 Original Equipment Manufacturers (OEMs)

- 5.2.2 Aftermarket

- 5.3 By Screen Size

- 5.3.1 Less than 6 Inches

- 5.3.2 6-10 Inches

- 5.3.3 More than 10 Inches

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Panasonic Holdings Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Harman International Industries

- 6.2.4 LG Electronics Inc.

- 6.2.5 Denso Corporation

- 6.2.6 Aisin Corporation

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.8 Garmin Ltd

- 6.2.9 Visteon Corporation

- 6.2.10 TomTom International BV

- 6.2.11 Faurecia Clarion Electronics Co. Ltd

- 6.2.12 JVC Kenwood Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Advanced Technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) into Navigation Systems Propelling Market Demand