|

시장보고서

상품코드

1850067

자동차 서스펜션 시스템 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Automotive Suspension System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

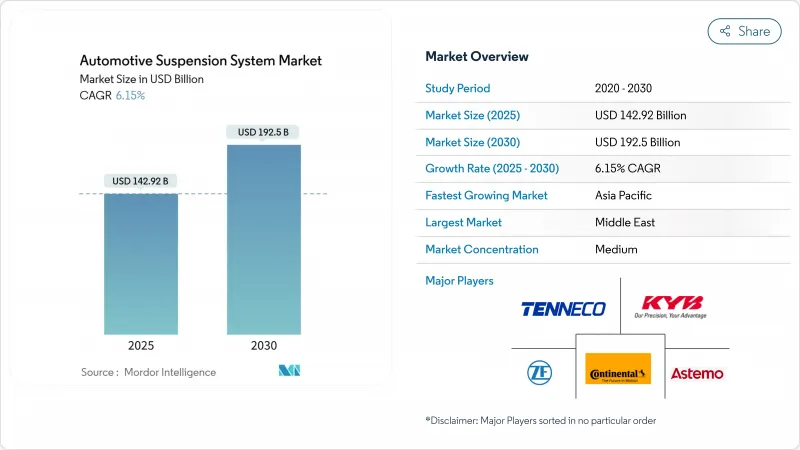

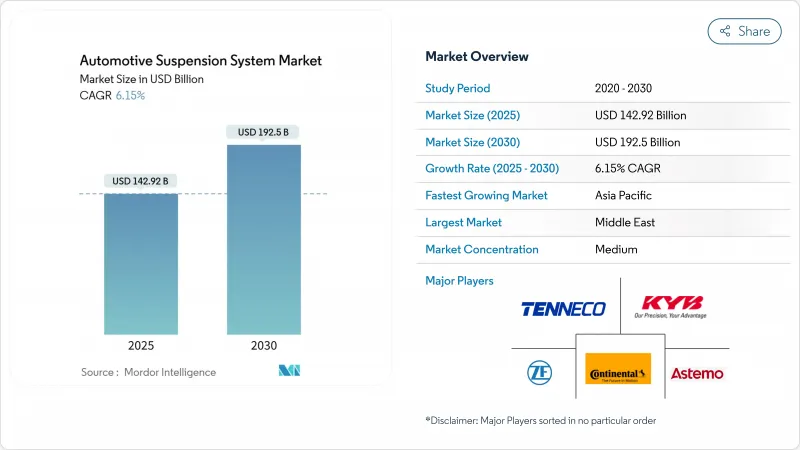

자동차 서스펜션 시스템 시장의 2025년 시장 규모는 1,429억 2,000만 달러로 평가되었고, 2030년에 CAGR은 6.15%를 나타낼 것으로 예측되며 1,925억 달러에 달할 전망입니다.

이러한 확장은 전기화, 소프트웨어 정의 차량 아키텍처, 강화되는 안전 규정이 전 지역에서 섀시 컴포넌트를 어떻게 재편하는지를 반영합니다. 자동차 제조사들은 순수 기계식 레이아웃에서 전자 제어식 세미액티브 및 액티브 설계로 전환 중이며, 이는 배터리 전기 플랫폼에서 승차감, 에너지 회수, 패키징 제약 조건 간의 균형을 맞춥니다. 센서, 제어 장치, 클라우드 연결성이 이제 서스펜션 전략의 핵심이 되어 무선(OTA)으로 지속적인 성능 업데이트를 가능하게 합니다. 동시에 희토류 소재와 반도체의 공급망 불확실성은 재료 집약도를 낮추고 조달처를 다각화하는 재설계를 강요하고 있습니다. 이러한 배경 속에서 자동차 서스펜션 시스템 시장은 기계적 노하우와 첨단 전자기기, 소프트웨어, 데이터 분석을 융합할 수 있는 기업들에게 계속해서 기회를 제공하고 있습니다.

세계의 자동차 서스펜션 시스템 시장 동향 및 인사이트

승차감과 핸들링 향상에 대한 수요 증가

소비자의 정숙하고 진동 없는 실내 공간에 대한 기대가 높아지면서 자동차 제조사들은 모든 가격대의 차량에 실시간 댐핑 제어를 적용하고 있습니다. 자기유변학 댐퍼는 밀리초 단위로 유체 점도를 조절하는 기능을 갖추고 있으며, 이 기술은 럭셔리 모델에 처음 적용된 MagneRide와 같은 시스템으로 상용화되어 현재는 대량 생산되는 크로스오버 차량으로 확산되고 있습니다. 전기차는 엔진 소음이 없어 승객에게 서스펜션의 미세한 거친 느낌까지 전달되므로 이러한 관심사가 더욱 부각됩니다. 공유 모빌리티 차량과 자율주행 프로토타입은 운전에 집중하지 않는 승객들이 승차감을 예민하게 인지하게 되어 또 다른 차원의 검증을 추가합니다. 공급업체들은 가속도계, 스트로크 센서, 에지 프로세서를 통합하여 바퀴별로 감쇠력을 조정하면서도 에너지 소모를 최소화하는 방식으로 대응하고 있습니다.

전동화 주도의 섀시 재 설계

배터리 팩은 차량의 무게 중심을 낮추지만 수백 킬로그램의 무게를 추가합니다. 이에 서스펜션 엔지니어들은 강도를 저하시키지 않으면서 질량 증가를 상쇄하는 복합 링크와 중공식 스태빌라이저 바를 채택하고 있습니다. 전기-수압식 재생 댐퍼 연구에 따르면 최대 45%의 에너지 회수율이 가능하며, 차량 에너지 관리 로직과 통합 시 5.25g/km의 CO2 절감 효과를 제공합니다.

스마트 서스펜션 아키텍처의 높은 초기 비용과 수명주기 비용

능동형 시스템은 모터, 솔레노이드 밸브, 가속도 센서, 도메인 컨트롤러를 결합하여 수동형 설비 대비 차량당 수백 달러의 부품 비용을 증가시킵니다. OEM들은 마진이 얇은 대중 시장 부문에서 이러한 비용을 부담하는 것을 주저하며, 의무화되거나 상당한 보조금이 지원되지 않는 한 도입을 꺼립니다. 서비스 제공업체에 특수 진단 도구와 캘리브레이션 장비가 필요해짐에 따라 총 소유 비용도 상승합니다. 이러한 경제성 문제로 인해 고급 트림에만 적용이 제한되며, 기반 기술이 성숙해도 대중 시장 도입이 지연됩니다.

부문 분석

2024년 쇼크 업소버가 차지한 39.07%의 점유율은 핵심 에너지 소산 요소로서의 지속적인 역할을 입증합니다. 그러나 전자 제어 장치(ECU)와 센서는 ADAS 통합, 에지 프로세싱 성능 향상, 클라우드 연계 업데이트로의 전환에 힘입어 9.82%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장하는 분야입니다. 자동차 서스펜션 시스템 시장은 이제 다중 안전 기능을 호스팅하는 제어 모듈의 혜택을 받으며, OTA 캘리브레이션을 가능하게 하고 하드웨어 개정의 필요성을 줄입니다. 그 결과, 전자 장치에 기인한 자동차 서스펜션 시스템 시장 규모는 2030년까지 2024년 기준의 두 배로 성장할 전망입니다. 내구성이 정교함보다 중요한 상업용 운송 수단에서는 코일 스프링과 리프 스프링이 여전히 널리 사용되는 반면, 에어 스프링은 고급 세단과 하이루프 밴에서 점유율을 높이고 있습니다.

소프트웨어 정의 차량 로드맵은 제어 장치를 모듈형 컴퓨팅 노드로 전환하여 ASIL-D 안전 수준을 충족하는 동시에 휠 트래블 센서, 로드 셀, 스티어링 인코더의 데이터를 통합합니다. AI 지원 예측 알고리즘은 클라우드 기반 도로 정보를 감쇠 전략에 반영하여 예측 불가능한 노면에서도 선제적 제어와 승객 편의성을 제공합니다. 기계 부품과 디지털 지능의 이러한 융합은 양 분야를 대규모로 제조할 수 있는 공급업체의 경쟁 우위를 강화하며 자동차 서스펜션 시스템 시장을 주도하고 있습니다.

수동형 구성은 단순성과 낮은 운영 비용으로 2024년 자동차 서스펜션 시스템 시장 점유율 65.28%를 유지했습니다. 반면 세미액티브 방식은 완전 액티브 설계의 에너지 소모와 부품 수 증가 없이도 의미 있는 승차감 향상을 제공하여 12.04%의 연평균 성장률(CAGR)을 기록 중입니다. 이러한 채택은 ZF의 이지턴 액슬(EasyTurn axle)과 같은 새로운 조향 혁신의 기반이 되며, 이는 조향 각도를 80도로 확대해 도시 주행 기동성을 향상시킵니다.

자기유변학 및 전기기계식 밸브는 고속 주행 시 차체 롤링과 피칭을 완화하는 밀리초 단위의 감쇠 변화가 가능합니다. 클라우드 기반 포트홀 지도를 활용한 예측 분석과 결합된 세미액티브 시스템은 액티브 시스템에 근접한 성능 범위를 달성합니다. 전망 기간 동안 배터리 에너지 밀도 향상과 회생식 댐퍼의 운영 손실 상쇄 효과로 능동 서스펜션의 가시성이 높아질 수 있으나, 자동차 서스펜션 시스템 시장 내 유리한 비용-편익 비율 덕분에 세미액티브 설계가 증가분의 대부분을 차지할 것으로 예상됩니다.

지역 분석

아시아태평양 지역은 2024년 48.96%의 점유율로 자동차 서스펜션 시스템 시장을 주도하며, 이는 중국의 규모와 인도의 급속한 생산 능력 확장에 힘입은 바 큽니다. 중국의 신에너지차 보조금 정책과 엄격한 승차감 기준은 대중형 세단에 세미 액티브 댐핑 기술의 채택을 촉진하고 있습니다. 동시에 인도 OEM 업체들은 소형 상용 트럭의 적재 효율성 향상을 위해 경량 복합 스프링을 통합하고 있습니다. 인도의 '자동차 미션 플랜 2047'과 같은 정부 정책은 고부가가치 섀시 어셈블리의 현지 생산을 지원하여 지역 공급망 회복탄력성을 강화하고 있습니다. 일본 및 한국 공급업체들은 정밀 밸브, 스마트 부싱, 소프트웨어 스택을 제공하며, 현재 전 세계로 첨단 서스펜션 키트를 수출하는 생태계에 깊이를 더하고 있습니다.

중동 및 아프리카 지역은 연평균 7.65% 성장률로 사막의 고온과 험준한 지형을 견뎌야 하는 프리미엄 SUV 및 상용차 수요의 중심지로 부상하고 있습니다. 걸프 항공사들의 모터스포츠 엔터테인먼트 사업 다각화와 사우디아라비아 그랑프리 투자는 극한 열 부하를 견딜 수 있는 고성능 댐퍼 기술에 대한 관심을 촉진합니다. 공급업체들은 마모성 모래 환경을 위해 설계된 특수 씰, 장스트로크 에어 벨로우즈, 내식성 코팅으로 대응합니다. 현지화 프로그램과 자유무역지대는 수입 관세를 낮춰 자동차 서스펜션 시스템 시장 내 1차 공급망 제조 라인의 지역적 매력을 높입니다.

북미와 유럽은 규제 수요와 프리미엄 모델 집중을 통해 강력한 가치 점유율을 유지합니다. 미국 인플레이션 감축법의 국내 배터리 인센티브는 전기 픽업트럭의 바닥 장착형 배터리 팩을 보호하는 경량 멀티링크 리어 액슬 수요를 증폭시킵니다. 유럽의 ‘비전 제로(Vision Zero)’ 및 일반 안전 규정 II(General Safety Regulation II) 집중은 세미액티브 댐핑과 차고 높이 제어를 인증 체크리스트에 포함시켜 지능형 서스펜션을 OEM 규정 준수의 사실상 필수 요건으로 만듭니다. 성숙한 공급망, 첨단 시뮬레이션 인프라, 견고한 테스트 트랙은 양 지역이 글로벌 자동차 서스펜션 시스템 시장에 파급 효과를 미치는 성능 및 안전 기준을 계속 설정하도록 보장합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 승차감과 핸들링 향상에 대한 수요 증가

- 전기화 주도 차체 재설계(경량 적응형 서스펜션)

- ADAS 연동형 섀시 안전성의 규제 강화

- 신흥 경제국에서 SUV 및 프리미엄 차량 판매 급증

- 구독 기반 OTA 업그레이드를 통한 능동 서스펜션 기능 활성화

- 공구 비용 절감을 위한 3D 프린팅 복합 서스펜션 부품

- 시장 성장 억제요인

- 스마트 서스펜션 아키텍처의 높은 초기 및 수명 주기 비용

- 가혹한 환경에서 신뢰성 및 유지보수 과제

- 사이버 보안 및 기능 안전 규정 준수 부담

- 희토류 MR 유체 및 반도체 센서 공급 병목 현상

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력/소비자

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 컴포넌트 유형별

- 코일 스프링

- 리프 스프링

- 에어 스프링

- 쇼크 업소버

- 스태빌라이저/안티롤 바

- 서스펜션 암 & 링크

- 전자 제어 장치 및 센서

- 기타 컴포넌트

- 서스펜션 시스템 유형별

- 수동형 서스펜션

- 반능동형 서스펜션

- 능동형 서스펜션

- 기하학적 구조/아키텍처별

- 맥퍼슨 스트럿

- 더블 위시본

- 멀티링크

- 토션 빔/트위스트 빔

- 기타 형상

- 차량 유형별

- 승용차

- 소형 상용차

- 대형 상용차

- 판매 채널별

- OEM

- 애프터마켓

- 추진별

- 내연 기관차

- 전기자동차 및 하이브리드 자동차

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 아시아태평양의 나머지

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 이집트

- 튀르키예

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO(ZF CVS)

제7장 시장 기회와 장래의 전망

HBR 25.11.14The Automotive Suspension Systems Market is valued at USD 142.92 billion in 2025 and is forecast to reach USD 192.50 billion by 2030, advancing at a 6.15% CAGR.

The expansion reflects how electrification, software-defined vehicle architectures, and tightening safety mandates reshape chassis components in every region. Automakers are switching from purely mechanical layouts to electronically controlled semi-active and active designs that balance ride comfort, energy recuperation, and packaging constraints in battery-electric platforms. Sensors, control units, and cloud connectivity now center suspension strategies, enabling continuous performance updates delivered over the air. At the same time, supply-chain uncertainty in rare-earth materials and semiconductors is forcing redesigns that lessen material intensity and diversify sourcing. Against this backdrop, the automotive suspension systems market continues to reward players capable of blending mechanical know-how with advanced electronics, software, and data analytics.

Global Automotive Suspension System Market Trends and Insights

Increasing Demand for Enhanced Ride Comfort and Handling

Rising consumer expectations for quiet, vibration-free cabins push automakers to embed real-time damping control across all price points. Magnetorheological dampers modulate fluid viscosity within milliseconds, a capability commercialized in systems such as MagneRide that first appeared in luxury models and now migrate into high-volume crossovers. Electric vehicles magnify this focus because the absence of engine noise exposes even slight suspension harshness to occupants. Shared-mobility fleets and autonomous prototypes add another layer of scrutiny, as passengers disengaged from driving become acutely aware of ride quality. Suppliers respond by integrating accelerometers, stroke sensors, and edge processors that adjust damping on a wheel-by-wheel basis while minimizing energy draw.

Electrification-Driven Chassis Redesign

Battery packs lower a vehicle's center of gravity but add hundreds of kilograms, prompting suspension engineers to adopt composite links and hollow stabilizer bars that counteract mass increases without compromising strength. Research on electro-hydrostatic regenerative dampers shows 45% peak energy recovery, equating to 5.25 g/km CO2 savings when integrated with vehicle energy-management logic.

High Upfront & Lifecycle Cost of Smart Suspension Architectures

Active systems combine motors, solenoid valves, acceleration sensors, and domain controllers, inflating the bill-of-materials by several hundred USD per vehicle compared with passive setups. OEMs hesitate to bundle such costs in mainstream segments with thin margins unless mandated or heavily subsidized. Total ownership expenses also rise, as specialized diagnostic tools and calibration rigs become necessary for service providers. These economics restrict penetration to premium trims, slowing mass-market adoption even when the underlying technology matures.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for ADAS-Linked Chassis Safety

- Rapid SUV & Premium-Vehicle Sales in Emerging Economies

- Rare-earth MR-fluid and Semiconductor Sensor Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 39.07% share held by shock absorbers in 2024 confirms their enduring role as the core energy-dissipation element. Yet, electronic control units and sensors are the fastest climbers at a 9.82% CAGR, supported by ADAS integration, edge-processing power gains, and the pivot toward cloud-linked updates. The automotive suspension systems market benefits from control modules that now host multiple safety functions, allowing OTA calibration and reducing the need for hardware revisions. As a result, the automotive suspension systems market size attributed to electronics is on track to double its 2024 baseline by 2030. Coil and leaf springs remain prevalent in commercial transport where durability outweighs finesse, while air springs gain share in luxury sedans and high-roof vans.

Software-defined vehicle roadmaps turn control units into modular compute nodes that meet ASIL-D safety levels while orchestrating data from wheel-travel sensors, load cells, and steering encoders. AI-assisted predictive algorithms feed cloud-derived road information into damping strategies, delivering proactive control and elevating occupant comfort even on unpredictable surfaces. This convergence between mechanical parts and digital intelligence reinforces the competitive moat of suppliers capable of manufacturing both domains at scale, propelling the automotive suspension systems market forward

Passive configurations retained a 65.28% share of the automotive suspension systems market size in 2024 due to simplicity and low running costs. Semi-active setups, however, are registering an 12.04% CAGR because they deliver meaningful ride gains without the energy draw and component count of fully active designs. Their adoption also underpins new steering innovations such as ZF's EasyTurn axle, which increases steering lock to 80 degrees, improving urban agility.

Magnetorheological and electromechanical valves allow millisecond-scale damping shifts that flatten body roll and pitch during high-speed maneuvers. Paired with predictive analytics drawn from cloud-sourced pothole maps, semi-active systems achieve near-active performance envelopes. Over the forecast horizon, active suspensions may gain greater visibility as battery energy density rises and regenerative dampers offset operational losses, but semi-active designs are expected to capture the bulk of incremental volume thanks to favorable cost-benefit ratios within the automotive suspension systems market.

The Automotive Suspension Systems Market Report is Segmented by Component Type (Coil Spring, Leaf Spring, and More), Suspension System Type (Passive Suspension and More), Geometry (MacPherson Strut, Double Wishbone, and More), Vehicle Type (Passenger Cars, LCV, and More), Sales Channel (OEM and Aftermarket), Propulsion (ICE and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchors the automotive suspension systems market with a 48.96% share in 2024, underpinned by China's scale and India's rapid capacity additions. Beijing's new-energy-vehicle subsidies and stringent ride-comfort benchmarks drive the adoption of semi-active damping in mass-market sedans. At the same time, Indian OEMs integrate lightweight composite springs to improve payload efficiency in small commercial trucks. Government schemes such as India's Automotive Mission Plan 2047 support local production of high-value chassis assemblies, reinforcing regional supply resilience. Japanese and South Korean suppliers contribute precision valves, smart bushings, and software stacks, lending depth to an ecosystem that now exports advanced suspension kits worldwide.

The Middle East and Africa, advancing at 7.65% CAGR, is emerging as a focal point for premium-SUV and commercial-vehicle demand that must withstand desert heat and rugged terrain. Gulf airlines' diversification into motorsport entertainment and Saudi Arabia's Grand Prix investments spur interest in high-performance damper technology capable of coping with severe thermal loads. Suppliers respond with specialized seals, long-stroke air bellows, and corrosion-resistant coatings designed for abrasive sand environments. Localization programs and free-trade zones lower import duties, enhancing the region's appeal for tier-1 manufacturing lines within the automotive suspension systems market.

North America and Europe maintain strong value shares through regulatory pull and premium-model concentration. The U.S. Inflation Reduction Act's domestic-battery incentives amplify demand for lightweight multi-link rear axles that protect floor-mounted packs in electric pickups. Europe's focus on Vision Zero and General Safety Regulation II embeds semi-active damping and ride-height control into homologation checklists, making intelligent suspensions a de facto requirement for OEM compliance. Mature supply chains, advanced simulation infrastructure, and robust test tracks ensure both regions continue to set performance and safety benchmarks that ripple across the global automotive suspension systems market.

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Co. Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO (ZF CVS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for enhanced ride comfort & handling

- 4.2.2 Electrification-driven chassis redesign (lightweight adaptive suspensions)

- 4.2.3 Regulatory push for ADAS-linked chassis safety

- 4.2.4 Rapid SUV & premium-vehicle sales in emerging economies

- 4.2.5 Subscription-based OTA upgrades unlocking active-suspension features

- 4.2.6 3-D printed composite suspension parts reducing tooling cost

- 4.3 Market Restraints

- 4.3.1 High upfront & lifecycle cost of smart suspension architectures

- 4.3.2 Reliability & maintenance challenges in harsh conditions

- 4.3.3 Cyber-security & functional-safety compliance burden

- 4.3.4 Rare-earth MR-fluid & semiconductor sensor supply bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Component Type

- 5.1.1 Coil Springs

- 5.1.2 Leaf Springs

- 5.1.3 Air Springs

- 5.1.4 Shock Absorbers

- 5.1.5 Stabilizer / Anti-roll Bars

- 5.1.6 Suspension Arms & Links

- 5.1.7 Electronic Control Units & Sensors

- 5.1.8 Other Components

- 5.2 By Suspension System Type

- 5.2.1 Passive Suspension

- 5.2.2 Semi-Active Suspension

- 5.2.3 Active Suspension

- 5.3 By Geometry / Architecture

- 5.3.1 MacPherson Strut

- 5.3.2 Double Wishbone

- 5.3.3 Multi-Link

- 5.3.4 Torsion Beam / Twist Beam

- 5.3.5 Other Geometries

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Propulsion

- 5.6.1 Internal-Combustion-Engine Vehicles

- 5.6.2 Electric & Hybrid Vehicles

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Aisa-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 South Africa

- 5.7.5.1.4 Egypt

- 5.7.5.1.5 Turkey

- 5.7.5.1.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Tenneco Inc.

- 6.4.4 KYB Corporation

- 6.4.5 Hitachi Astemo Ltd.

- 6.4.6 Thyssenkrupp AG

- 6.4.7 Mando Corporation

- 6.4.8 Marelli Corporation

- 6.4.9 Hyundai Mobis Co. Ltd.

- 6.4.10 BWI Group

- 6.4.11 Sogefi SpA

- 6.4.12 Parker LORD Corporation

- 6.4.13 Benteler International AG

- 6.4.14 Fox Factory Holding Corp.

- 6.4.15 Hendrickson International

- 6.4.16 Ohlins Racing AB

- 6.4.17 Showa Corporation

- 6.4.18 Multimatic Inc.

- 6.4.19 SAF-HOLLAND SE

- 6.4.20 WABCO (ZF CVS)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment