|

시장보고서

상품코드

1640448

배터리 재활용 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

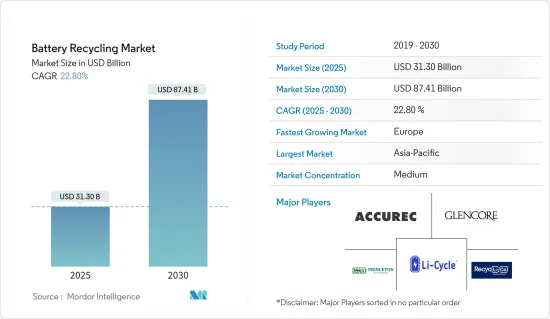

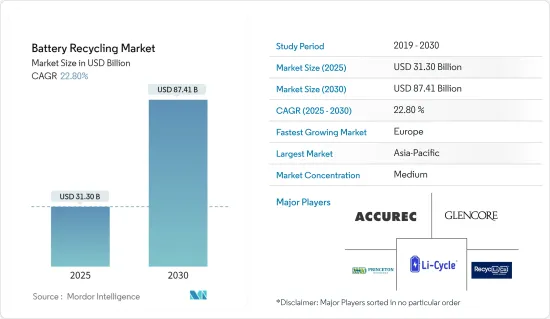

배터리 재활용 시장 규모는 2025년에 313억 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR은 22.8%로, 2030년에는 874억 1,000만 달러에 달할 것으로 예측됩니다.

전기자동차 보급 확대, 배터리 폐기물 처리에 대한 우려 상승, 정부의 엄격한 시책 등의 요인이 예측 기간 중 배터리 재활용 시장을 견인할 것으로 보입니다.

한편, 비용이 높고 견고한 공급사슬 부족, 배터리 재활용과 관련된 낮은 수율 등이 향후 수년간 시장 성장을 방해할 것으로 예상됩니다.

배터리 재활용 전략의 혁신은 시장 개척에 큰 기회를 제공합니다.

유럽은 배터리 사용량이 증가함에 따라 예측 기간 동안 가장 빠르게 성장하는 시장이 될 것으로 예상됩니다. 이 성장은 전기자동차(EV)의 배터리 사용 증가에 기인합니다.

배터리 재활용 시장 동향

리튬 이온 배터리 부문이 현저한 성장을 이룰 전망

- 리튬 이온 배터리 기술은 특히 자동차(EV)와 재생 가능 에너지 산업에서 각광받고 있습니다. 저렴한 가격과 뛰어난 화학적 성질은 기술 수요를 증가시키고 있습니다. 리튬 배터리의 수명은 3-4년이며, 그 후에는 재활용하여 새 것으로 교체할 수 있습니다.

- 국제에너지기구(IEA)의 전기자동차 전망 보고서에 따르면 2023년에는 세계에서 1,330만대 이상의 전기자동차(BEV와 PHEV)가 판매되고, 2024년에는 추가로 35% 증가하여 1,700만대에 달할 것으로 예상되고 있습니다. 자동차 시장 전체에서 차지하는 전기자동차의 점유율은 2020년의 약 4%에서 2023년에는 18%로 상승했습니다. 예측 기간 동안 리튬 이온 배터리의 재활용 요구가 있기 때문에 전기자동차 증가는 배터리 재활용 시장에 탄력을 줄 것으로 예상됩니다.

- 세계 기업들이 배터리 재활용을 강화하기 위해 다양한 프로젝트를 시작하고 있습니다. 예를 들어, 2023년 6월 미국 에너지부의 첨단 재료 및 제조 기술(AMMTO) 부서는 아르곤 국립 연구소(ANL)의 ReCell 센터가 운영하는 리튬 이온 배터리 재생, 재활용 및 재사용을 위한 프로그램에 200만 달러를 할당할 것이라고 발표했습니다.

- 또한 2023년 12월에는 아랍에미리트(UAE)의 에너지 인프라부, 중동의 혁신적이고 지속가능한 솔루션 제공업체인 BEEAH, 인도의 배터리 재활용 기업인 Lohum Cleantech Pvt는 배터리 재활용 시설을 설립하기로 협정을 맺었습니다. 이 시설은 연간 3,000톤의 리튬 이온 배터리를 재활용하고 15MWh의 배터리용량을 지속가능한 에너지 저장 시스템(ESS)으로 변환할 것으로 기대됩니다.

- 또한 비용 절감과 재활용 공정의 효율성을 높이기 위해 Umicore, Glencore PLC, Cirba Solutions, Raw Materials Company Inc는 다양한 첨단 기술을 도입하고 있습니다. 따라서 미래에는 배터리 재활용이 증가할 것으로 예상됩니다.

- 그러므로 배터리 재활용 활동을 뒷받침하는 정부의 이니셔티브와 전기자동차 및 에너지 저장 시스템에 대한 리튬 이온 배터리의 사용이 예측 기간 동안 세계 리튬 이온 배터리 재활용 시장을 이끌 것으로 예상됩니다.

유럽은 더욱 성장할 것으로 기대

- 유럽에서는 신흥 기업의 상승으로 배터리 재활용 시장이 지속적으로 성장하고 있습니다. 배터리 재활용의 또 다른 주요 촉진요인은 이 지역의 전기자동차 시장 확대 및 에너지 저장 프로젝트입니다.

- 국제에너지기구(IEA)에 따르면 2023년 배터리 전기차 판매량은 220만대를 기록했으며 2019년에 비해 4.95배 증가했습니다. 세계 각국이 NET 제로 탄소 배출 목표에 초점을 맞추고 탄화수소를 깨끗한 연료 에너지원으로 대체하고 있기 때문에 전기차 판매량은 크게 증가하고 있습니다.

- 세계에너지 데이터 통계 보고서에 따르면 유럽에서는 2022년 발전량이 2021년 대비 3.5% 감소했는데, 이는 지역 전체에서 여러 태양광 및 풍력 채널이 정비되었기 때문입니다. 발전량의 대부분은 재생가능 에너지 발전에 의한 것입니다. 발전량과 소비량의 차이는 해마다 확대되고 있어, 예측 기간 중에 배터리 재활용 수요는 상승할 것으로 예상됩니다.

- 프랑스 리튬 이온 배터리 재활용 시장은 여러 요인에 의해 큰 성장을 이루고 있습니다. 성장의 주요 요인 중 하나는 국가적으로 지속가능한 에너지와 운송 실천에 집중하고 있다는 것입니다. 예를 들어 2023년 3월 Li-Cycle은 프랑스 Harnes에 연간 1만 톤의 리튬 이온 배터리 재활용 시설을 건설할 계획을 발표했습니다. 이 시설은 2024년까지 완성될 예정이며, 다음 해에는 최대 연산 2만 5,000톤의 생산 능력을 예상하고 있습니다.

- 마찬가지로 2023년 3월에는 Altilium Metals가 연간 3만 톤에 가까운 능력을 가진 국내 최대의 리튬 이온 재활용 공장 개발을 가속화할 계획을 발표했습니다. 영국의 축전지 용량은 2022년 시점에서 2.3GW 였으며, 국가 축전지 목표의 일환으로 2030년까지 약 20GW가 설치될 예정입니다. 이는 다양한 공공 및 민간 개발자들에게 배터리 에너지 저장 프로젝트에 투자할 기회를 제공합니다.

- 스페인은 재활용을 위한 휴대용 배터리 회수 목표를 2023년에 45%, 2027년에 63%, 2030년에 73%로, 경운송 수단에서 배터리를 2028년에 51%, 2031년에 61%로 설정했습니다. 배터리 회수 증가는 배터리를 적절히 재활용하는 데 필요한 단계입니다.

- 유럽에서 에너지 저장 시장이 계속 성장함에 따라 배터리 재활용 시장에도 큰 영향을 미칠 것으로 예상됩니다. 태양광 발전의 잉여 에너지를 저장하거나 피크시에 사용하기 위해 에너지 저장 솔루션에 투자하는 가정과 기업이 늘어나면서 배터리 수요가 증가하고 재활용해야 하는 배터리의 양이 늘어나게 됩니다.

- 이러한 개발로 인해 유럽은 향후 수년간 큰 성장을 이룰 것으로 예상됩니다.

배터리 재활용 산업 개요

배터리 재활용 시장은 적당히 분할되어 있습니다. 시장의 주요 기업(순서부동)에는 Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., Recyclico Battery Materials Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 전기자동차의 보급 확대

- 배터리 폐기물 처리에 대한 관심의 고조와 엄격한 정부 시책

- 억제요인

- 재활용 작업의 고비용

- 촉진요인

- 공급사슬 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 배터리 유형

- 납축 배터리

- 니켈 배터리

- 리튬 이온 배터리

- 기타 배터리 유형

- 지역

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 노르딕

- 튀르키예

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 카타르

- 이집트

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Accurec Recycling GmbH

- Aqua Metals Inc.

- Battery Recycling Made Easy

- Battery Solutions Inc.

- Call2Recycle Inc.

- Eco-Bat Technologies Ltd

- Exide Technologies

- Neometals Ltd

- Raw Materials Company

- Recupyl SAS

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 배터리 재활용 기술 혁신

The Battery Recycling Market size is estimated at USD 31.30 billion in 2025, and is expected to reach USD 87.41 billion by 2030, at a CAGR of 22.8% during the forecast period (2025-2030).

Factors such as the increasing adoption of electric vehicles, rising concerns over battery waste disposal, and stringent government policies are likely to drive the battery recycling market in the forecast period.

On the other hand, higher costs, lack of a strong supply chain, and low yield related to battery recycling are expected to hinder market growth in the coming years.

Nevertheless, technological innovations in battery recycling strategies create tremendous opportunities for market development.

Europe is expected to be the fastest-growing market during the forecast period due to the rising number of battery applications. This growth is due to the growing battery usage in electric vehicles (EVs).

Battery Recycling Market Trends

The Lithium-ion Battery Segment is Expected to Witness Significant Growth

- Lithium-ion battery technology has gained prominence, particularly in the automobile (EV) and renewable energy industries. Low pricing and favorable chemistry enhanced technology demand. A lithium battery has a lifetime of three to four years, after which it can be recycled and replaced with a new one.

- According to the International Energy Agency Electric Vehicle Outlook Report, more than 13.3 million electric cars (BEV and PHEV) were sold worldwide in 2023, and sales are expected to grow by another 35% in 2024 to reach 17 million. This significant growth in electric cars' share of the overall car market rose from around 4% in 2020 to 18% in 2023. The rise in electric vehicles is likely to give impetus to the battery recycling market, as there is a need for Li-ion batteries to be recycled during the forecast period.

- The companies across the world are launching various projects to enhance battery recycling. For instance, in June 2023, the Advanced Materials and Manufacturing Technologies (AMMTO) branch of the US Department of Energy announced that USD 2 million would be allocated to programs for the rejuvenation, recycling, and reuse of lithium-ion batteries run by the ReCell Center at Argonne National Laboratory (ANL).

- Additionally, in December 2023, the UAE's Ministry of Energy & Infrastructure, BEEAH, the Middle East's provider of innovative and sustainable solutions, and Lohum Cleantech Pvt. Ltd (Lohum), India's top battery recycling company, inked a deal to construct the country's first electric vehicle (EV) battery recycling facility. According to the terms of the joint development agreement, Lohum will establish an 80,000-square-foot facility for recycling and refurbishing lithium batteries. This facility is anticipated to recycle 3000 tons of lithium-ion batteries annually and convert 15 MWh of battery capacity into sustainable energy storage systems (ESS).

- Furthermore, to cut costs and boost efficiency in the recycling processes, leading industry participants like Umicore, Glencore PLC, Cirba Solutions, Raw Materials Company Inc. (RMC), and RecycLiCo Battery Materials Inc. are employing various technological advancements. This is expected to lead to an increase in battery recycling in the future.

- Therefore, government initiatives to boost battery recycling activities and lithium-ion battery utilization for electric vehicles and energy storage systems are anticipated to drive the global lithium-ion battery recycling market during the forecast period.

Europe Expected to Witness Faster Growth

- The battery recycling market has been witnessing continuous growth in Europe due to the blooming start-ups in the field. Other big drivers for battery recycling are the growing electric vehicle market and energy storage projects in the region.

- According to the International Energy Agency (IEA), in 2023, battery electric vehicle sales were recorded at 2.2 million, an increase of 4.95 times compared to 2019. The number has risen significantly as countries worldwide focus on NET zero carbon emission targets and replace hydrocarbons with clean fuel energy sources.

- According to the Statistical Review of World Energy Data, in Europe, electricity generation reduced by 3.5% in 2022, compared to 2021, due to the maintenance of several solar and wind channels across the region. The majority of electricity generation comes from renewable sources of energy. The difference between generations and consumption is increasing every year, and this is likely to increase the demand for battery recycling during the forecast period.

- The lithium-ion battery recycling market in France is experiencing significant growth due to several factors. One of the primary drivers of growth is the country's strong focus on sustainable energy and transportation practices. For instance, in March 2023, Li-Cycle announced its plans to build a 10,000 mt/year lithium-ion battery recycling facility in Harnes, France. The facility is expected to be completed by 2024 and will boost capacity by up to 25,000 mt/year in the following years.

- Similarly, in March 2023, Altilium Metals announced plans to accelerate the development of the country's largest lithium-ion recycling plant, with a capacity of nearly 30,000 tonnes per year. The battery storage capacity in the United Kingdom was 2.3 GW as of 2022. As a part of the national battery storage target, about 20 GW of power will be installed by 2030. This signifies an opportunity for various public and private developers to invest in battery energy storage projects.

- Spain has set a target of portable battery collection for recycling to 45% in 2023, 63% in 2027, and 73% in 2030, and for batteries from light means of transport, the target is set at 51% in 2028 and 61% in 2031. An increase in battery collection is a necessary step for the proper recycling of batteries.

- As the energy storage market continues to grow in Europe, there will be a significant impact on the battery recycling market. With more and more households and businesses investing in energy storage solutions to store excess solar energy or to use during peak hours, the demand for batteries will increase, leading to an increase in the volume of batteries that need to be recycled.

- Owing to such developments, Europe is expected to witness significant growth in the coming years.

Battery Recycling Industry Overview

The battery recycling market is moderately fragmented. Some of the major players in the market (in no particular order) include Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., and Recyclico Battery Materials Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Electric Vehicles

- 4.5.1.2 Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Recycling Operations

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid Battery

- 5.1.2 Nickel Battery

- 5.1.3 Lithium-ion battery

- 5.1.4 Other Battery Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Accurec Recycling GmbH

- 6.3.2 Aqua Metals Inc.

- 6.3.3 Battery Recycling Made Easy

- 6.3.4 Battery Solutions Inc.

- 6.3.5 Call2Recycle Inc.

- 6.3.6 Eco-Bat Technologies Ltd

- 6.3.7 Exide Technologies

- 6.3.8 Neometals Ltd

- 6.3.9 Raw Materials Company

- 6.3.10 Recupyl SAS

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in the Battery Recycling