|

시장보고서

상품코드

1851634

무인 지상 차량(UGV) 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Unmanned Ground Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

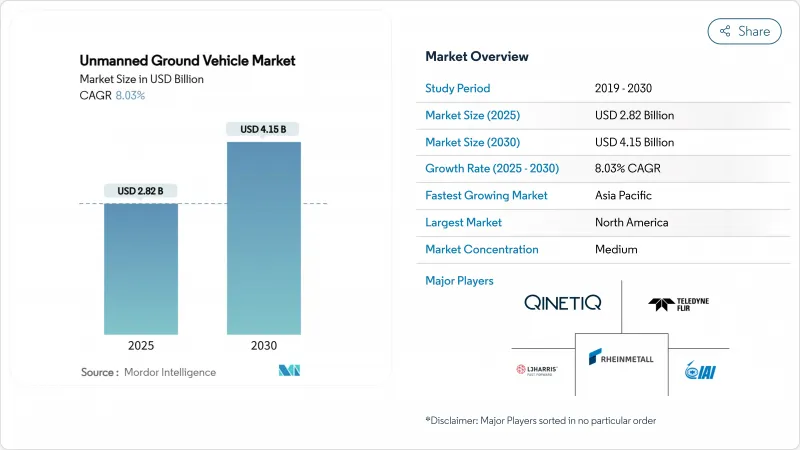

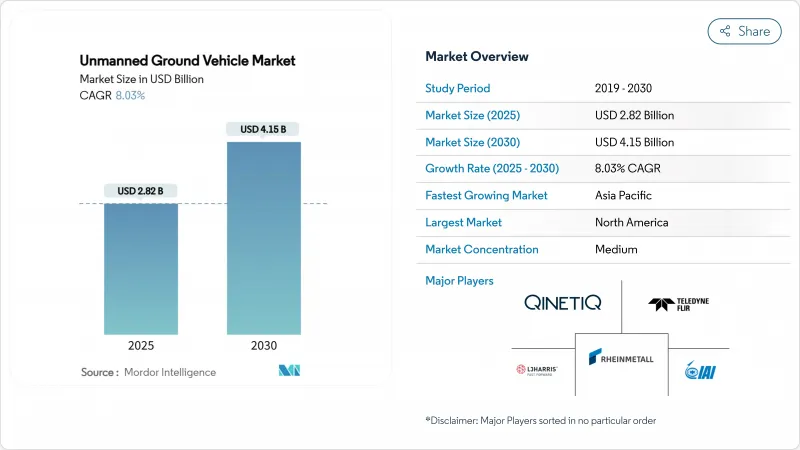

무인 지상 차량(UGV) 시장의 2025년 시장 규모는 34억 4,000만 달러로 추정되고, 2030년에는 47억 4,000만 달러에 이를 전망이며, CAGR 6.62%로 성장할 것으로 예측됩니다.

국방 현대화 프로그램 증가, 사상자 감소에 대한 날카로운 초점, 물류 및 채굴의 자동화 가속화가 공동으로 대응할 수 있는 수요를 확대하고 있습니다. 무인 지상 차량 시장은 또한 센서와 컴퓨팅의 비용 저하로부터 혜택을 받으며 가격 상승에 비례하지 않고 높은 자율성을 실현합니다. 동시에 듀얼 유스 조달 전략을 통해 방위 바이어가 상업적 혁신을 활용하는 반면, 창고와 채굴 운영자는 입증된 군사적 신뢰성을 활용할 수 있습니다. 소프트웨어 차별화, 모듈식 페이로드 베이, 안전한 5G 링크는 구매자가 금속이 아닌 코드로 업그레이드할 수 있는 플랫폼을 요구하는 가운데 결정적인 구매 기준이 되고 있습니다. 지역별 지출 패턴이 이 상황을 두드러지게 합니다. : 북미는 절대적인 예산으로 리드를 유지하고 있지만, 아시아태평양의 자본 지출은 급상승하고 있으며, 무인 지상 차량 시장에 가장 큰 증분을 공급하고 있습니다.

세계의 무인 지상 차량 시장 동향 및 인사이트

전투 환경에서 부상자 반송용 UGV에 대한 군사 수요

미국 육군의 TRV-150 실증기가 NATO 훈련 중에 68kg의 물자를 70km 이상 수송해, 부정된 공역에서의 가치를 증명했습니다. 2024년 12월 우크라이나의 UGV 주도 공격은 총격하에서 자율적인 지상 작전을 더욱 검증하는 것입니다. 방위 기관은 지상 로봇이 헬리콥터가 대공 위협에 직면하는 도시의 핫 존에 도달하고 최소한의 변화로 기존 물류 네트워크에 통합할 수 있음을 주목합니다. 이 추진력은 위험물의 제거에 이 기술을 적응시키는 재해 대응 기관에도 파급됩니다. 이러한 요인들이 결합되어 미션 범위가 확대되고 취득 사이클이 단축됨으로써 무인 지상 차량 시장이 활성화됩니다.

루트 소탕 임무에 대 IED 로봇 플릿의 전개

루트 소탕의 닥트린은 단일의 로봇으로부터, 노스롭 그라만의 ANDROS나 Wheelbarrow Mk9와 같은 제휴한 플릿으로 이행하고 있습니다. 멀티 센서 페이로드는 지중 레이더와 화학 스니퍼를 결합하여 숨겨진 위협을 무력화하는 동시에 IED 공격으로 인한 위험과 경제적 손해를 줄입니다. 민간 폭탄 처리반도 이에 추종하고 있어, 최전선의 군 이외 수요를 강화해, 범용성이 높은 시큐리티 툴로서 무인 지상 차량 시장을 확고한 것으로 하고 있습니다.

자체 UGV 명령 및 제어 프로토콜 간의 상호 운용성 간극

단편화된 무선 링크나 소프트웨어 스택이 공동 작전의 방해가 되어, 방위 바이어는 라이프 사이클 코스트를 부풀리는 미들웨어에 자금을 투입하게 됩니다. AUVSI의 'Trusted UGV' 이니셔티브는 보안 인증을 받고 있지만 세계 공통 언어에 이르지 못했습니다. 물류 사업자는 다른 공급업체의 창고 로봇을 혼합할 때 유사한 두통의 종에 직면하여 무인 지상 차량 시장의 단기적인 확장 템포를 약화시키고 있습니다.

부문 분석

군사 프로그램은 2024년에 22억 달러를 창출해 총 매출의 64.10%를 차지했으며, 무인 지상 차량 시장을 지원하고 있습니다. 미국 육군의 S-MET Increment II와 같은 대형 계약은 수요를 안정시키지만 예산 주기가 길기 때문에 연간 수량 상승이 느립니다. 국방 구매자는 견고성, 안전한 통신, NATO 등급의 상호 운용성을 중시하며 프리미엄 가격과 높은 마진을 지원합니다.

민간 및 상업용 플랫폼은 2024년 12억 달러를 출하했고, CAGR 9.84%로 확대되었으며 그 차이는 해마다 줄어들고 있습니다. 완성 센터의 노동력 제약, 광산 무해화 의무, 자율 농업 시도는 무인 지상 차량 시장의 고객 기반을 확대하는 다양한 인계를 창출합니다. 현재의 동향이 계속되면, 민간 사업자는 2028년까지 국방량에 필적하게 되어, 혁신의 과제가 창고 그레이드의 안전 시스템과 채굴 대응의 지각 소프트웨어에 기울어질 가능성이 있습니다.

원격 조작 유닛은 지휘관과 창고 관리자가 복잡한 작업을 루프 내에서 수행하기 때문에 2024년 매출을 55.56%의 점유율로 견인했습니다. 이 분야의 성숙도와 입증된 신뢰성은 무인 지상 차량 시장의 핵심 수요를 지원하고 있습니다. 그러나 인건비가 멈추고 대역폭이 제한되어 원격지에서의 확장성이 제한되기 때문에 성장은 완만합니다.

자율 및 하이브리드 플랫폼은 CAGR 10.58%로 확장되었습니다. Komatsu의 FrontRunner 시스템은 현재 700대 이상의 트럭을 인간 운전사 없이 조종하고 있습니다. 소프트웨어가 업데이트될 때마다 인식 정밀도 및 페일세이프 중복성이 향상되어 구매자의 신뢰를 높입니다. 2027년까지 자율주행 모드는 원격조작의 대수에 필적하는 기세이며, 컨트롤룸의 인력 배치 모델을 재구축해, 무인 지상 차량 시장에 있어서 차량 1대당의 소프트웨어 컨텐츠를 증가시키고 있습니다.

지역 분석

북미는 2024년 13억 5,000만 달러를 생산했으며, 무인 지상 차량 시장의 39.34%를 차지했습니다. 정부 테스트 코리도, FAA BVLOS 면제, 성숙한 방위 공급망이 이 리더십을 지원합니다. S-MET 증분 II 프로토타입 계약과 같은 계약은 미국 육군의 지속적인 의욕을 보여주는 반면, 아마존의 자동화 지출은 대규모 상업량을 주입합니다. 캐나다는 RPAS 규칙을 정립하고 국경을 넘어선 함대 운영을 원활하게 하며 대륙 규모의 우위를 강화합니다.

유럽은 유럽연합의 협조적 자금 지원이 공통 기준에 박차를 가하여 약 9억 5,000만 달러를 기부했습니다. Milrem이 이끄는 팀에 대한 3,060만 유로(3,529만 달러)의 ICUPS 상은 상호 운용성을 목표로 하며 시장의 주요 억제요인을 직접 다루고 있습니다. 독일에 의한 텔레다인 사의 프리어 시스템즈의 127대의 주문과 스웨덴의 미션 마스터의 평가는 군에 의한 구체적인 도입의 징후를 나타냅니다. 자율주행차 사이버 보안에 관한 유엔유럽위원회(UN ECE) 규정이 명확해짐에 따라 공급업체의 투자가 촉진되어 세계 무인 지상차 시장에서 표준 수출국으로서 유럽의 역할이 강화되었습니다.

아시아태평양은 2024년에 6억 7,500만 달러를 창출했으며, CAGR 9.62%로 가장 빠른 성장이 전망됩니다. 중국의 Yimin 프로젝트는 대량 전개 능력과 5G-A의 확장성을 보여주며, 호주의 907 자율 채굴 자산은 화웨이에 수출 가능한 운영 모델을 제공합니다. 한국은 보병 여단에 로봇 라바를 투입해, 일본은 경기 자극책 자금을 스마트 팩토리 로지스틱스에 돌려줍니다. 비용 효율적인 제조 및 대규모 조달 프로그램을 통해 아시아태평양은 2028년까지 무인 지상 차량 시장 점유율로 북미를 몰아내는 명확한 길을 볼 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 분쟁 환경에서 사상자 구조용 UGV의 군사 수요

- 대 IED 로봇 플릿에 의한 루트 확보 미션 전개

- 전자상거래 창고에서 자율형 물류 카트의 급속한 도입

- 광업 분야의 무해화에 대한 대처를 향한 무인 운반으로의 시프트

- 고체 LiDAR의 진보가 내비게이션 센서의 비용 저하 초래

- 유인-무인 팀(MUM-T) 컨셉에 대한 국방자금 원조

- 시장 성장 억제요인

- 독자적인 UGV 커맨드 앤 컨트롤 프로토콜 간 상호 운용성의 갭

- 장기 내구 미션에 있어서 SWaP(사이즈 중량-파워) 트레이드 오프의 과제

- 원격 원격 조작 링크에서 사이버 보안 취약점

- 공도에 있어서 육안외(BVLOS) 지상 자율 주행에 대한 규제의 지연

- 밸류체인 분석

- 규제 또는 기술적 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력 및 소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 용도별

- 군용

- 민간 및 상업

- 모빌리티별

- 장륜

- 장궤

- 다리

- 사이즈별

- 마이크로(10 kg 미만)

- 소형(10-200 kg)

- 중형(200-500 kg)

- 대형(500-1,000 kg)

- 중중량(1,000kg 이상)

- 운용 모드별

- 원격 조작

- 자율주행 및 하이브리드

- 컴포넌트별

- 하드웨어(섀시, 센서, 파워트레인, 페이로드)

- 소프트웨어 및 AI 스택

- 서비스(통합, MRO)

- 동력원별

- 전기전지

- 하이브리드 및 전기

- 내연기관

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Teledyne FLIR LLC

- General Dynamics Land Systems(General Dynamics Corporation)

- Rheinmetall AG

- Oshkosh Corporation

- Exail SAS

- Israel Aerospace Industries Ltd.

- Milrem AS

- QinetiQ Group plc

- Robo-Team Ltd.

- Textron Systems Corporation(Textron Inc.)

- Peraton Corp.

- Nexter Robotics(KNDS NV)

- Clearpath Robotics(Rockwell Automation, Inc.)

- AeroVironment, Inc.

- HORIBA MIRA Ltd.

- Aselsan AS

- Hyundai Rotem Company

- Leonardo SpA

- L3Harris Technologies, Inc.

제7장 시장 기회 및 향후 전망

AJY 25.11.24The unmanned ground vehicle (UGV) market is valued at USD 3.44 billion in 2025 and is forecast to reach USD 4.74 billion by 2030, advancing at a 6.62% CAGR.

Rising defense modernization programs, a sharp focus on casualty reduction, and accelerating automation across logistics and mining jointly expand addressable demand. The unmanned ground vehicle market also benefits from falling sensor and computing costs that enable sophisticated autonomy without proportionate price increases. At the same time, dual-use procurement strategies let defense buyers tap commercial innovation while warehouse and mining operators leverage proven military reliability. Software-defined differentiation, modular payload bays, and secure 5G links are becoming decisive purchase criteria as buyers seek platforms that can be upgraded through code rather than metal. Regional spending patterns accentuate the picture: North America keeps the lead on absolute budgets, yet Asia-Pacific's fast-rising capital expenditure supplies the highest incremental volume for the unmanned ground vehicle market.

Global Unmanned Ground Vehicle Market Trends and Insights

Military Demand for Casualty-Evacuation UGVs in Contested Environments

Combat medical evacuation drives near-term procurement as the US Army's TRV-150 demonstrator ferries 68 kg of supplies over 70 km during NATO drills, proving value in denied airspace. Ukraine's December 2024 UGV-led assault further validates autonomous ground operations under fire. Defense agencies note that ground robots can reach urban hot zones where helicopters face anti-air threats, integrating into existing logistics networks with minimal change. This driver also spills into disaster-response agencies that adapt the technology for hazardous-material removal. Together, these factors lift the unmanned ground vehicle market by expanding mission envelopes and shortening acquisition cycles.

Deployment of Counter-IED Robot Fleets for Route-Clearance Missions

Route-clearance doctrine is shifting from single robots to coordinated fleets such as Northrop Grumman's ANDROS and Wheelbarrow Mk9, which now sweep roads in synchronized swarms. Multi-sensor payloads combine ground-penetrating radar with chemical sniffers to neutralize hidden threats while cutting the human risk and economic toll of IED strikes. Civil bomb-disposal squads are following suit, reinforcing demand beyond front-line militaries and solidifying the unmanned ground vehicle market as a versatile security tool.

Interoperability Gaps Across Proprietary UGV Command-and-Control Protocols

Fragmented radio links and software stacks hinder joint operations, pushing defense buyers to fund middleware that inflates lifecycle costs. The Defense Innovation Unit flags integration delays as a key brake on large-scale fielding, while the AUVSI "Trusted UGV" initiative tackles security certification yet stops short of a universal language. Logistics operators face similar headaches when mixing warehouse robots from different vendors, dampening the near-term expansion tempo of the unmanned ground vehicle market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Autonomous Logistics Carts in E-commerce Warehouses

- Mining Sector's Shift Toward Unmanned Haulage for Zero-Harm Initiatives

- Challenging SWaP Trade-offs for Long-Endurance Missions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Military programs generated USD 2.2 billion in 2024, 64.10% of total revenue, anchoring the unmanned ground vehicle market. Large contracts such as the US Army's S-MET Increment II keep demand steady, yet lengthy budget cycles slow annual volume ramp-up. Defense buyers value ruggedization, secure communications, and NATO-grade interoperability, supporting premium pricing and high margins.

Civil and commercial platforms delivered USD 1.2 billion in 2024 and are scaling at 9.84% CAGR, narrowing the gap each year. Labor constraints in fulfillment centers, zero-harm mandates in mines, and autonomous agriculture trials create diversified pull that widens the customer base for the unmanned ground vehicle market. If current trends persist, commercial operators could match defense volumes by 2028, tilting innovation agendas toward warehouse-grade safety systems and mining-ready perception software.

Tele-operated units led 2024 sales with a 55.56% share as commanders and warehouse supervisors stayed in the loop for complex tasks. The segment's maturity and proven reliability sustain core demand within the unmanned ground vehicle market. Yet growth is modest because manpower costs persist and bandwidth limits throttle scaling in remote areas.

Autonomous and hybrid platforms are expanding at 10.58% CAGR. Komatsu's FrontRunner system now steers more than 700 trucks without human drivers.With each software update, perception accuracy and fail-safe redundancy improve, raising buyer confidence. By 2027, autonomous modes are poised to equal tele-operated volumes, remaking control-room staffing models and uplifting the software content per vehicle in the unmanned ground vehicle market.

The Unmanned Ground Vehicle Market Report is Segmented by Application (Military, and Civil and Commercial), Mobility (Wheeled, Legged, and Tracked), Size Class (Micro, Small, and More), Mode of Operation (Tele-Operated, and More), Component (Hardware, and More), Power Source (Electric Battery, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced USD 1.35 billion in 2024, equal to 39.34% of the unmanned ground vehicle market. Government test corridors, FAA BVLOS waivers, and a mature defense supply chain underpin this leadership. Contracts like the S-MET Increment II prototype deal demonstrate continued US Army appetite, while Amazon's automation spend injects large commercial volumes. Canada aligns its RPAS rules, smoothing cross-border fleet operations and reinforcing continental-scale advantages.

Europe contributed roughly USD 950 million as coordinated EU funding spurs common standards. The EUR 30.6 million (USD 35.29 million) ICUPS award to the Milrem-led team targets interoperability, directly addressing a leading market restraint. Germany's order for 127 Teledyne FLIR units and Sweden's Mission Master evaluation signify tangible military uptake. Regulatory clarity from UN ECE on cybersecurity for automated vehicles drives supplier investment, strengthening Europe's role as a standards exporter in the global unmanned ground vehicle market.

Asia-Pacific generated USD 675 million in 2024 but delivered the fastest 9.62% CAGR. China's Yimin project showcases mass deployment ability and 5 G-A scalability, while Australia's 907 autonomous mining assets provide an exportable operations model for Huawei. South Korea fields robotic mules for infantry brigades, and Japan channels stimulus funds into smart-factory logistics. Cost-effective manufacturing and large procurement programs give Asia-Pacific a clear path to overtake North America in the unmanned ground vehicle market share before 2028.

- Teledyne FLIR LLC

- General Dynamics Land Systems (General Dynamics Corporation)

- Rheinmetall AG

- Oshkosh Corporation

- Exail SAS

- Israel Aerospace Industries Ltd.

- Milrem AS

- QinetiQ Group plc

- Robo-Team Ltd.

- Textron Systems Corporation (Textron Inc.)

- Peraton Corp.

- Nexter Robotics (KNDS N.V.)

- Clearpath Robotics (Rockwell Automation, Inc.)

- AeroVironment, Inc.

- HORIBA MIRA Ltd.

- Aselsan AS

- Hyundai Rotem Company

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Military demand for casualty-evacuation UGVs in contested environments

- 4.2.2 Deployment of counter-IED robot fleets for route-clearance missions

- 4.2.3 Rapid adoption of autonomous logistics carts in e-commerce warehouses

- 4.2.4 Mining sector's shift toward unmanned haulage for zero-harm initiatives

- 4.2.5 Advancements in solid-state LiDAR lowering navigation-sensor costs

- 4.2.6 Defense funding for manned-unmanned teaming (MUM-T) concepts

- 4.3 Market Restraints

- 4.3.1 Interoperability gaps across proprietary UGV command-and-control protocols

- 4.3.2 Challenging SWaP (size-weight-power) trade-offs for long-endurance missions

- 4.3.3 Cyber-security vulnerabilities in remote tele-operation links

- 4.3.4 Regulatory lag for beyond-visual-line-of-sight (BVLOS) ground autonomy on public roads

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Military

- 5.1.2 Civil and Commercial

- 5.2 By Mobility

- 5.2.1 Wheeled

- 5.2.2 Tracked

- 5.2.3 Legged

- 5.3 By Size Class

- 5.3.1 Micro (Less than 10 kg)

- 5.3.2 Small (10 to 200 kg)

- 5.3.3 Medium (200 to 500 kg)

- 5.3.4 Large (500 to 1,000 kg)

- 5.3.5 Heavy (Greater than 1,000 kg)

- 5.4 By Mode of Operation

- 5.4.1 Tele-operated

- 5.4.2 Autonomous/Hybrid

- 5.5 By Component

- 5.5.1 Hardware (Chassis, Sensors, Powertrain, Payloads)

- 5.5.2 Software and AI Stack

- 5.5.3 Services (Integration, MRO)

- 5.6 By Power Source

- 5.6.1 Electric Battery

- 5.6.2 Hybrid-Electric

- 5.6.3 Internal-Combustion

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 France

- 5.7.2.3 Germany

- 5.7.2.4 Russia

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Teledyne FLIR LLC

- 6.4.2 General Dynamics Land Systems (General Dynamics Corporation)

- 6.4.3 Rheinmetall AG

- 6.4.4 Oshkosh Corporation

- 6.4.5 Exail SAS

- 6.4.6 Israel Aerospace Industries Ltd.

- 6.4.7 Milrem AS

- 6.4.8 QinetiQ Group plc

- 6.4.9 Robo-Team Ltd.

- 6.4.10 Textron Systems Corporation (Textron Inc.)

- 6.4.11 Peraton Corp.

- 6.4.12 Nexter Robotics (KNDS N.V.)

- 6.4.13 Clearpath Robotics (Rockwell Automation, Inc.)

- 6.4.14 AeroVironment, Inc.

- 6.4.15 HORIBA MIRA Ltd.

- 6.4.16 Aselsan AS

- 6.4.17 Hyundai Rotem Company

- 6.4.18 Leonardo S.p.A.

- 6.4.19 L3Harris Technologies, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment