|

시장보고서

상품코드

1910558

인슈어테크 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Insurtech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

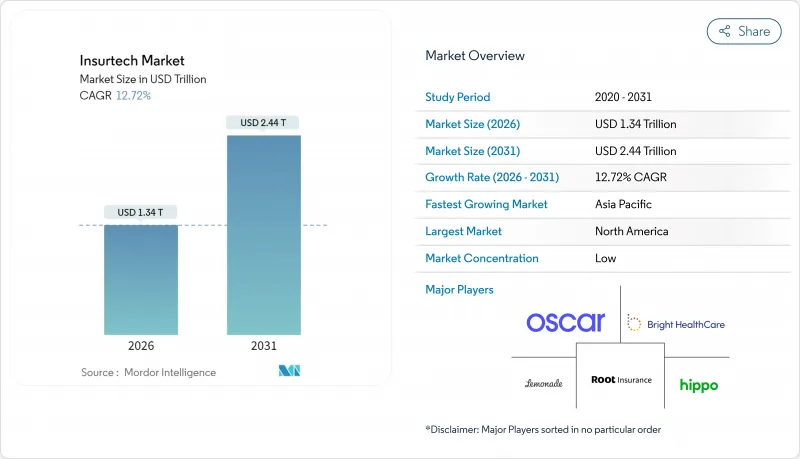

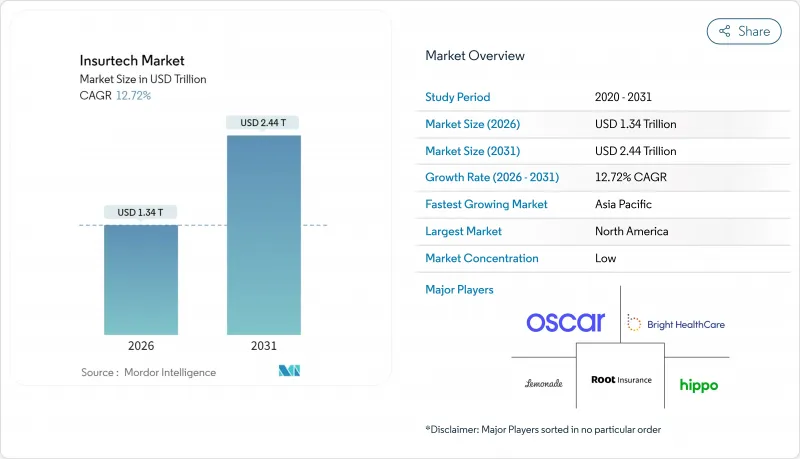

세계의 인슈어테크 시장은 2025년 1조 1,900억 달러로 평가되었으며, 2026년 1조 3,400억 달러에서 2031년까지 2조 4,400억 달러에 이를 것으로 예측됩니다. 예측 기간 중(2026-2031년) CAGR은 12.72%로 예상됩니다.

이러한 급성장은 디지털 퍼스트 체험이 필수 조건이 되는 가운데 보험사가 보험 계약을 설계, 판매, 서비스 제공하는 방식의 구조적 변화를 반영하고 있습니다. 클라우드 네이티브로의 전환, 인공지능을 활용한 인수 업무, 임베디드 보험은 시험적인 노력에서 기업 표준으로 전환하여 보험 회사가 운영 비용을 절감하고 시장 출시까지의 속도를 향상시키고 새로운 고객층에 도달할 수 있도록 합니다. 10개 이상의 관할 구역의 정부 주도 샌드박스가 솔루션 개발을 가속화함과 동시에 이동성 및 IoT 플랫폼과의 전략적 제휴가 자동차 보험 및 손해 보험 분야의 위험 평가 개념을 재정의하고 있습니다. 경쟁 차별화 요인은 더 이상 대차 대조표의 규모뿐만 아니라 데이터 액세스, 플랫폼 민첩성 및 보험 이외의 구매 프로세스에 원활하게 보상 범위를 통합하는 능력에 의존합니다.

세계의 인슈어테크 시장 동향과 통찰

인수 및 보험금 청구 업무에서 AI 및 머신러닝의 채용 확대

AI 구동형 의사결정 엔진은 보험증권 발행 및 보험금 청구의 트리아지 업무 대부분을 자동화하여 평균 처리 시간 단축과 예측 정밀도 향상을 실현하고 있습니다. Swiss Re는 보험금 청구 분석을 Microsoft Azure로 마이그레이션함으로써 대부분의 인프라를 자동화하고 평가 시간을 절반으로 줄였다고 보고했습니다. 자사 데이터세트를 이용한 지도 학습을 습득한 보험사는 경쟁 우위성을 확립하고 경쟁사에게 데이터 엔지니어링 계획의 가속을 강요하고 있습니다. 또, 이 기술에 의해 사용량 기반의 모빌리티 보험 등, 새로운 마이크로 기간 상품을 실현 가능하게 됩니다. 이는 리스크를 실시간으로 가격을 책정할 수 있기 때문입니다. 규제 당국이 설명 가능한 모델에 익숙해짐에 따라 AI 침투는 개인 자동차 보험, 소규모 상업 보험 및 사이버 보험 분야에서 가장 빠르게 진행될 것으로 예측됩니다. 클라우드 마켓플레이스에서 사전 학습된 모델을 제공하는 공급업체 생태계는 도입 장벽을 더욱 줄여줍니다.

맞춤형 온디맨드 보험 상품에 대한 수요 증가

소비자는 보험이 EC 사이트의 결제 흐름을 모방하기를 점점 더 기대하고 있으며, 보상 금액과 기간을 선택하는 작업이 장바구니에 상품을 추가하는 것처럼 간단해질 것을 요구하고 있습니다. Allianz와 Cosmo Connected의 제휴는 월간 고정 요금으로 사고 보상을 커넥티드 헬멧에 통합하고 있으며, IoT 데이터가 서류 절차 없이 자동 보험 계약을 활성화할 수 있는 실례를 보여줍니다. 마찬가지로, Parametric의 보험 상품은 사전 정의된 트리거 조건이 충족되는 시점에 지불이 발생하기 때문에 긴 보험금 청구 절차를 피할 수 있으며 여행, 농업 및 기후 위험에 대한 공백을 채웁니다. 건강 지도와 사이버 감시 등 부가가치 서비스를 조합한 마켓플레이스는 일상적인 요구에 맞는 제안에 따라 갱신률이 높아지고 있습니다. 이러한 변화로 보험사는 기존의 보험계약관리시스템을 재구축할 수밖에 없고, 부대조항이나 한도액을 동적으로 조정할 수 있는 구조로 이행하여 고정적인 연간계약에서 탈각하고 있습니다.

레거시 기간 시스템 통합의 복잡성

수십년전부터 운영되고 있는 메인프레임은 현대적인 API가 없는 경우가 많으며, 실시간 데이터 교환을 비용이 많이 들고 위험도가 높습니다. 따라서 보험사는 전체 시스템의 쇄신과 부분적인 랩 & 리뉴(기존 시스템을 감싸는 형태로 갱신) 어프로치 사이에서 트레이드오프에 직면하고 있습니다. 전환 실패는 보험 증권 발급 및 보험금 지급을 정체하고 고객의 신뢰를 저해하고 규제 당국을 감시할 수 있습니다. 또한 규정 준수를 위해 데이터 계보와 감사 추적을 저장해야 하는 경우 통합 프로젝트에 숨겨진 비용이 발생합니다. 그 결과, 기존 기업 중에는 기간 시스템의 개수가 아니라 신규 사업체와의 제휴를 선택하는 경우도 있어 모회사 내의 디지털 변혁이 지연되는 요인이 되고 있습니다.

부문 분석

손해보험은 2025년 인슈어테크 시장의 58.73%를 차지하여 수익을 견인했습니다. 이는 자동차보험과 주택보험 수요 기반이 확립되어 있음을 반영합니다. 그러나 사이버보험, 반려동물보험, 해상보험, 여행보험을 포함한 특수보험 분야는 2031년까지 연평균 복합 성장률(CAGR) 18.63%로 확대되어 가장 빠른 보험료 증가율을 가져올 것으로 예측되고 있습니다. 임베디드 IoT 센서와 파라메트릭 트리거링을 통해 특수 보험 제품은 기존의 손해 평가 지연을 피하고 높은 이익률을 실현하는 우수한 고객 경험을 제공합니다. AXA XL 등의 보험 회사는 기업용 AI 도입에 따른 데이터 오염 위험에 대응하기 위해 생성형 AI를 활용한 사이버 보험 상품을 이미 도입하고 있습니다. 틈새 위험이 증가함에 따라 전문가 분야의 혁신 기업은 월렛 점유율의 대폭적인 확대를 파악할 수 있으며 이러한 분야의 인슈어테크 시장 규모는 예측 기간 동안 크게 확대될 것으로 전망됩니다.

한편, 손해보험의 기존 기업은 텔레매틱스를 활용하여 가격 설정의 정확도를 회복하고 있지만, 방대한 레거시 계약이 변경 관리의 장벽이 되고 있습니다. 생명 보험 및 의료 보험 회사는 클라우드 플랫폼상에서 신속한 인수 업무의 시험 운용을 실시하고 있지만, 사망률 및 이환율에 관한 규제가 엄격하기 때문에 규제 대상외의 전문 보험 상품과 비교하면 속도는 억제되고 있습니다. 재보험 회사는 사이버 MGA(관리 총대리점)와의 제휴를 강화하고, 독자적인 보험금 청구 데이터 세트를 수집하는 것으로, 포트폴리오 모델링의 정밀도 향상을 도모하고 있습니다. 성장 곡선의 차이를 바탕으로 투자자는 견고한 리스크 관리와 확장 가능한 판매 시스템을 입증하는 전문 보험 인수 회사로 자본 배분을 이동할 수 있습니다.

지역별 분석

북미는 2025년 풍부한 벤처 캐피탈과 확립된 혁신 거점의 혜택을 받아 인슈어테크 시장 점유율 37.25%를 유지했습니다. 켄튀르키예 주 보험 혁신 샌드박스로 대표되는 주 수준의 규제 경쟁은 개념 실증 결과가 지불 능력 기준을 충족한 후 전국적으로 전개되는 파일럿 사업을 가속화하고 있습니다. 미국 자동차 보험 회사는 텔레매틱스의 조기 도입을 유지하는 반면 캐나다 보험 회사는 지리적 서비스 분산을 극복하기 위해 클라우드 네이티브 보험 계약 관리 시스템을 도입하고 있습니다. 기존 기업이 기술력을 인수하는 M&A 활동이 활발해졌습니다. Munich Re의 Next Insurance 26억 달러 인수는 2025년 미국 1차 보험 분야에 현저한 진출을 보였습니다. 시장 성숙에 의해 표면적인 성장은 억제지만, 북미의 보험 회사는 영업 경비 삭감과 부대 서비스(사이버 보험 및 개인정보 보호 패키지)의 크로스셀에 의해 수익을 확대하고 있습니다.

아시아태평양은 2031년까지 연률 16.25%의 성장이 전망되어 높은 스마트폰 보급률, 정부 주도의 핀텍 정책, 레거시 시스템의 제약이 적은 것이 추풍이 되고 있습니다. 중국과 인도는 외자 소유 제한을 완화하고 세계 보험 회사가 지역 데이터센터를 갖춘 하이퍼스케일 클라우드에서 AI 인수 엔진을 현지화하는 움직임을 촉진하고 있습니다. 싱가포르 금융관리국은 명확한 규제 샌드박스를 운용하고, 생명, 손해 및 의료보험을 포괄하는 디지털 복합 라이선스를 인가하는 것으로, 지역 전개를 가속시키고 있습니다. 일본의 보험사는 AI를 활용한 연금 상품 가격 설정으로 장수 리스크에 대응하고, 한국의 플랫폼은 라이드 쉐어링 및 슈퍼 앱에 이용 기반 모빌리티 보험을 통합하고 있습니다. 보험 보급률이 낮기 때문에 신규 고객 획득의 여지가 크고, 전자상거래 구입시에 부대 판매되는 임베디드형 마이크로 보험은 보험 금액이 겸손해도 판매 수량을 견인하고 있습니다.

유럽에서는 GDPR(EU 개인정보보호규정)에 준거한 데이터 거버넌스 틀이 기반이 되어 한 자리대의 꾸준한 성장을 유지합니다. 이에 따라 현지 인슈어테크 기업은 프라이버시 면에서 신뢰성을 획득하고 있습니다. 향후 시행 예정인 EU 데이터법은 차량 데이터 액세스의 표준화를 의무화하고 텔레매틱스 제품의 혁신을 더욱 촉진할 전망입니다. 영국은 브렉짓 후 규제 유연성을 추구하고 제품 승인을 가속화하면서 크로스 보더 자본 완화를위한 Solvency II 상당 기준을 유지합니다. 독일의 산업 기반은 고급 상업 리스크 및 사이버 리스크 솔루션에 대한 수요를 불러 일으키고 프랑스에서는 대규모 개인 보험 시장이 행동 기반 가격 설정의 규모 경제를 지원합니다. ESG 공개 규제가 강화되고 있는 가운데, 유럽 보험사는 농업·재생에너지 프로젝트용 파라메트릭 기후 리스크 보험을 혁신해, 다른 지역에 전개 가능한 틀을 창출하고 있습니다.

남미와 중동 및 아프리카은 미성숙하면서도 유망합니다. 브라질, 케냐, 나이지리아의 모바일 머니 환경에서는 기존의 대리점망을 뛰어넘어 미소사고보험과 입원현금급여 상품을 조합한 상품이 확대되고 있습니다. 정부에서 개인에 대한 지불 플랫폼은 즉시 보험료 징수 경로를 제공하여 소액 상품의 위험 완화를 실현합니다. 카리브해 지역과 동아프리카의 소블린 리스크 풀에서는 24시간 이내에 긴급 자금을 기동하는 파라메트릭형 허리케인 가뭄 솔루션을 채택하여 보다 광범위한 재해 시장을 위한 개념 실증을 확립하고 있습니다. 국제개발기관은 초기 포트폴리오의 공동 인수를 빈번히 실시하고, 손실 빈도 모델이 성숙한 단계에서 민간 보험사의 진입을 촉진하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 인수 업무 및 보험금 청구 처리에 AI 및 머신러닝 채용 확대

- 개인화된 온디맨드 보험 상품에 대한 수요 증가

- 클라우드 네이티브 기간 시스템으로의 전환 증가

- 규제 샌드박스에 의한 제품 투입의 가속

- 모빌리티 및 IoT 플랫폼과의 데이터 제휴

- 내장형 유통 모델의 급속한 성장

- 시장 성장 억제요인

- 레거시 기간 시스템 통합의 복잡성

- 규제 및 컴플라이언스 단편화

- MGA용 재보험 용량의 제약

- 투자자의 시선이 지상주의에서 수익성 중시로 이동

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자 및 자금 조달 환경

- 스타트업 및 생태계 분석

제5장 시장 규모와 성장 예측

- 제품 라인별(보험의 유형)

- 생명 보험

- 건강 보험

- 손해보험(P&C;) : 자동차보험, 주택보험, 상업보험, 배상책임보험 등

- 전문분야(예: 사이버보험, 반려동물보험, 해상보험, 여행보험)

- 유통 채널별

- Direct-to-Consumer(D2C) 디지털

- 어그리게이터 및 마켓플레이스

- 디지털 브로커 및 MGA

- 임베디드 보험 플랫폼

- 기존 대리점 및 브로커(디지털 대응)

- 방카슈랑스(디지털 대응)

- 기타 채널

- 최종 사용자별

- 소매 및 개인용

- 중소기업 및 법인용

- 대기업 및 법인

- 정부 및 공공 부문

- 지역별(금액, 10억 달러)

- 북미

- 캐나다

- 미국

- 멕시코

- 남미

- 브라질

- 페루

- 칠레

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 베네룩스(벨기에, 네덜란드, 룩셈부르크)

- 북유럽 국가(덴마크, 핀란드, 아이슬란드, 노르웨이, 스웨덴)

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 한국

- 동남아시아(싱가포르, 말레이시아, 태국, 인도네시아, 베트남, 필리핀)

- 기타 아시아태평양

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향과 전개

- 시장 점유율 분석

- 기업 프로파일

- Lemonade

- Hippo Insurance

- Root Insurance

- Oscar Health

- Bright Health

- Clover Health

- Next Insurance

- ZhongAn

- Wefox

- Alan

- Devoted Health

- Coalition

- Slice Labs

- Metromile

- PolicyBazaar

- Digit Insurance

- ManyPets

- Pie Insurance

- Doma

- Kin Insurance

제7장 시장 기회와 미래 전망

SHW 26.01.26The insurtech market was valued at USD 1.19 trillion in 2025 and estimated to grow from USD 1.34 trillion in 2026 to reach USD 2.44 trillion by 2031, at a CAGR of 12.72% during the forecast period (2026-2031).

The sharp growth reflects a structural change in how insurers design, distribute, and service policies as digital-first experiences become table stakes. Cloud-native migrations, AI-enabled underwriting, and embedded insurance have shifted from pilot initiatives to enterprise standards, allowing carriers to cut operating costs, improve speed-to-market, and reach new customer segments. Government sandboxes in more than a dozen jurisdictions have accelerated solution rollouts, while strategic partnerships with mobility and IoT platforms are redefining risk assessment in auto and property lines. Competitive differentiation now rests on data access, platform agility, and the ability to embed coverage seamlessly into non-insurance purchase journeys, rather than on balance-sheet scale alone.

Global Insurtech Market Trends and Insights

Rising adoption of AI & ML for underwriting and claims

AI-driven decision engines now automate large portions of policy issuance and claims triage, shrinking average handling times and improving predictive accuracy. Swiss Re reported that shifting its claims analytics to Microsoft Azure enabled the majority of infrastructure automation, cutting assessment time in half. Insurers that master supervised learning on proprietary datasets gain defensible underwriting moats, pushing competitors to accelerate data-engineering roadmaps. The technology also unlocks new micro-duration products, such as usage-based mobility cover, because risk can be priced in real time. As regulators grow comfortable with explainable models, AI penetration is expected to rise fastest in personal auto, small commercial, and cyber lines. Vendor ecosystems offering pre-trained models on cloud marketplaces further lower adoption barriers.

Growing demand for personalized, on-demand insurance products

Consumers increasingly expect insurance to mimic e-commerce checkout flows, selecting coverage amounts and durations as easily as adding items to a cart. Allianz's partnership with Cosmo Connected embeds accident coverage in connected helmets for a fixed monthly fee, illustrating how IoT data can trigger automatic policy activation without paperwork . Parametric products are likewise filling gaps in travel, agriculture, and climate risk because they pay when predefined triggers hit, sidestepping lengthy claims adjustment. Marketplaces that bundle ancillary value-added services, such as health coaching or cyber monitoring, see higher renewal rates because propositions resonate with everyday needs. This shift forces carriers to re-platform legacy policy administration so riders and limits can adjust dynamically, moving away from static annual contracts.

Legacy core-system integration complexity

Decades-old mainframes often lack modern APIs, making real-time data exchange expensive and risky. Carriers, therefore, face a trade-off between wholesale replacement and piecemeal wrap-and-renew approaches. Failed conversions can stall policy issuance or claims payouts, eroding customer trust and drawing regulator scrutiny. Integration projects also carry hidden costs when data lineage and audit trails need preservation for compliance. As a result, some incumbents partner with greenfield entities instead of renovating core estates, slowing digital change within the mothership.

Other drivers and restraints analyzed in the detailed report include:

- Increasing migration to cloud-native core systems

- Regulatory sandboxes accelerating product launches

- Regulatory and compliance fragmentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Property & Casualty dominated revenue with a 58.73% insurtech market share in 2025, reflecting entrenched auto and homeowner demand foundations. Nonetheless, Specialty Lines, encompassing cyber, pet, marine, and travel, are forecast to expand at a 18.63% CAGR through 2031, delivering the fastest incremental premium. Embedded IoT sensors and parametric triggers allow Specialty products to circumvent traditional loss-adjustment delays, creating superior customer experiences that command higher margins. Carriers such as AXA XL have already debuted generative-AI cyber covers to address data-poisoning exposures arising from enterprise AI rollouts. As niche risks proliferate, Specialty innovators can capture outsized wallet-share increases, suggesting the insurtech market size for these lines will compound materially over the forecast window.

Property & Casualty incumbents, meanwhile, leverage telematics to reclaim pricing precision, yet their extensive legacy books create change-management headwinds. Life and Health insurers pilot accelerated underwriting on cloud platforms, but stricter mortality and morbidity regulations temper speed relative to non-regulated specialty covers. Reinsurers increasingly partner with cyber MGAs to collect proprietary claims datasets, improving portfolio modelling accuracy. Given the divergent growth curves, investors may shift capital allocations toward Specialty underwriters that demonstrate robust risk controls and scalable distribution frameworks.

The Insurtech Market Report is Segmented by Product Line (Insurance Type) (Life Insurance, Health Insurance, and More), Distribution Channel (Direct-To-Consumer (D2C) Digital, Aggregators/Marketplaces, and More), End User (Retail/Individual, SME/Commercial, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.25% insurtech market share in 2025, benefiting from deep venture capital pools and established innovation hubs. State-level regulatory competition, exemplified by the Kentucky Insurance Innovation Sandbox, accelerates pilots that often expand nationwide after proof-of-concept results meet solvency criteria. US auto insurers remain early adopters of telematics, while Canadian carriers deploy cloud-native policy administration to overcome geographic service dispersion. M&A activity intensifies as incumbents buy capabilities; Munich Re's USD 2.6 billion purchase of Next Insurance marked a notable 2025 expansion into US primary lines. Although market maturity constrains headline growth, North American carriers drive profit through operating expense reductions and cross-selling of ancillary cyber and identity-protection bundles.

Asia-Pacific, forecast to grow 16.25% annually to 2031, benefits from high smartphone penetration, government-backed fintech policies, and limited legacy system drag. China and India liberalised foreign ownership caps, encouraging global insurers to localise AI underwriting engines on hyperscale clouds with regional data centres. Singapore's Monetary Authority operates a well-defined sandbox and grants digital composite licences that cover life, general, and health, accelerating regional scaling. Japanese carriers tackle longevity risk with AI-enabled annuity pricing, and South Korean platforms integrate usage-based mobility cover into ride-hailing super-apps. Lower insurance penetration leaves ample headroom for first-time buyers, so embedded micro-policies sold alongside e-commerce purchases drive volume even at modest ticket sizes.

Europe sustains steady single-digit growth anchored by GDPR-aligned data-governance frameworks, which give local insurtechs credibility on privacy. The forthcoming EU Data Act will mandate standardised vehicle data access, further catalysing telematics product innovation. The UK pursues post-Brexit regulatory agility, enabling faster product approvals while remaining Solvency II-equivalent for cross-border capital relief. Germany's industrial base spurs demand for advanced commercial and cyber risk solutions, whereas France's sizeable personal-lines market supports scale economics for behavioural-based pricing. As ESG disclosure rules tighten, European carriers innovate parametric climate-risk covers for agriculture and renewable-energy projects, creating exportable frameworks for other regions.

South America along with the Middle East & Africa remain nascent but promising. Mobile-money ecosystems in Brazil, Kenya, and Nigeria increasingly bundle micro-accident and hospital-cash products, leapfrogging traditional agency networks. Government-to-person payment platforms provide instant premium-collection rails, de-risking small-ticket offerings. Sovereign risk pools in the Caribbean and East Africa adopt parametric hurricane and drought solutions that trigger emergency funds within 24 hours, validating proof of concept for broader disaster markets. International development agencies often co-underwrite early portfolios, encouraging private carriers to enter once loss-frequency models mature.

- Lemonade

- Hippo Insurance

- Root Insurance

- Oscar Health

- Bright Health

- Clover Health

- Next Insurance

- ZhongAn

- Wefox

- Alan

- Devoted Health

- Coalition

- Slice Labs

- Metromile

- PolicyBazaar

- Digit Insurance

- ManyPets

- Pie Insurance

- Doma

- Kin Insurance

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of AI & ML for underwriting & claims

- 4.2.2 Growing demand for personalized, on-demand insurance products

- 4.2.3 Increasing migration to cloud-native core systems

- 4.2.4 Regulatory sandboxes accelerating product launches

- 4.2.5 Data partnerships with mobility & IoT platforms

- 4.2.6 Rapid growth of embedded distribution models

- 4.3 Market Restraints

- 4.3.1 Legacy core-system integration complexity

- 4.3.2 Regulatory & compliance fragmentation

- 4.3.3 Re-insurance capacity constraints for MGAs

- 4.3.4 Investor pivot from "growth at all costs" to profitability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment & Funding Landscape

- 4.9 Start-up Ecosystem Analysis

5 Market Size & Growth Forecasts

- 5.1 By Product Line (Insurance Type)

- 5.1.1 Life Insurance

- 5.1.2 Health Insurance

- 5.1.3 Property & Casualty (P&C): Motor, Home, Commercial, Liability, etc.

- 5.1.4 Specialty Lines (e.g., cyber, pet, marine, travel)

- 5.2 By Distribution Channel

- 5.2.1 Direct-to-Consumer (D2C) Digital

- 5.2.2 Aggregators/Marketplaces

- 5.2.3 Digital Brokers/MGAs

- 5.2.4 Embedded Insurance Platforms

- 5.2.5 Traditional Agents/Brokers (digitally enabled)

- 5.2.6 Bancassurance (digitally enabled)

- 5.2.7 Other Channels

- 5.3 By End User

- 5.3.1 Retail/Individual

- 5.3.2 SME/Commercial

- 5.3.3 Large Enterprise/Corporate

- 5.3.4 Government/Public Sector

- 5.4 By Geography (Value, USD Bn)

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Lemonade

- 6.4.2 Hippo Insurance

- 6.4.3 Root Insurance

- 6.4.4 Oscar Health

- 6.4.5 Bright Health

- 6.4.6 Clover Health

- 6.4.7 Next Insurance

- 6.4.8 ZhongAn

- 6.4.9 Wefox

- 6.4.10 Alan

- 6.4.11 Devoted Health

- 6.4.12 Coalition

- 6.4.13 Slice Labs

- 6.4.14 Metromile

- 6.4.15 PolicyBazaar

- 6.4.16 Digit Insurance

- 6.4.17 ManyPets

- 6.4.18 Pie Insurance

- 6.4.19 Doma

- 6.4.20 Kin Insurance

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment