|

시장보고서

상품코드

1910650

수술실 장비 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Operating Room Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

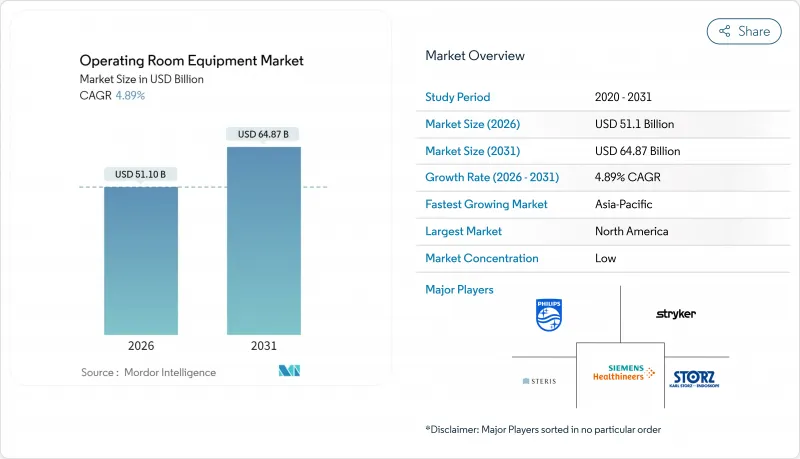

세계의 수술실 장비 시장 규모는 2026년 511억 달러로 추정되며, 2025년 487억 2,000만 달러에서 성장해, 2031년에는 648억 7,000만 달러에 이를 것으로 예측됩니다. 2026년부터 2031년까지 연평균 성장률(CAGR)은 4.89%가 될 전망입니다.

현재의 지출 경향은 순수한 용량 확대보다, 수술 시간의 단축, 시각화의 향상, 인공지능 임베디드라고 하는 기술에 중점을 두고 있습니다. 병원이 팬데믹 후 수술 지연에 대응하는 가운데, 수술 중 영상 진단과 AI 구동형 워크플로우 소프트웨어를 갖춘 하이브리드 수술실은 계속 예산 우선사항이 되고 있습니다. 자본지출은 인구동태의 변화에도 연동하고 있으며, 아시아태평양의 의료시스템은 새로운 수술실에 대한 투자를 추진하는 한편, 북미의 의료제공업체는 사이버 보안 대책이 실시되어 업그레이드 대응 가능한 플랫폼에서 기존 설비의 갱신을 진행하고 있습니다. 공급업체 간의 통합이 진행되고 경쟁 환경이 재구성되었습니다. 대형 벤더가 틈새 시장의 혁신자를 인수해 통합 포트폴리오를 확충하는 것과 동시에, 다년간에 걸친 서비스 계약을 확보하고 있는 상황입니다.

세계 수술실 장비 시장 동향과 통찰

수술이 필요한 만성 질환 증가 추세

심혈관 질환, 종양 질환, 근골격계 질환은 인구의 고령화와 생활 습관 위험 증가에 따라 수술 건수를 밀어 올리고 있습니다. 정형외과용 관절경 검사만으로도 고처리량 수술실 플랫폼에 대한 지속적인 수요를 보여줄 것으로 예측됩니다. 임상의는 다단계 개입이 필요한 합병증 환자를 수용하기 위해 다목적 수술대, 다목적 영상 진단 장비 및 고급 마취 워크스테이션이 필요합니다. 지불 기관이 1회당 비용을 조사하는 동안 안전을 유지하면서 수술실 전환 시간을 단축하는 상호 운용 가능한 시스템을 번들할 수 있는 벤더가 최대의 혜택을 받습니다.

증가하는 병원 수와 정부 자금

인도, 인도네시아, 중국 본토의 의료시설 확충 계획은 천장 매달아 수술등, 전기수술 기기, 기본 환자 모니터 등 핵심 기기의 지속적인 조달 안건으로 이어지고 있습니다. 국내 제조 장려책에 따라 수입 관세가 인하되고 가격대가 확대됨에 따라 세계 기업들은 현지 서비스 환경에 적합한 중급 라인의 제품 전개를 가속화하고 있습니다. 스웨덴에 거점을 둔 Getinge는 신흥 시장 예산에 맞는 모듈식 멸균처리 시스템과 수술대 패키지를 제공하여 인도 시장에서 45%의 점유율 획득을 목표로 하고 있습니다.

수술실 설비의 고액 자본 비용과 유지비

차폐 설비, 에어컨 설비 업그레이드, 유지 보수 계약을 포함한 종합적인 하이브리드 설치 비용은 300만 달러를 초과합니다. 따라서 비용에 중점을 둔 구매자는 자산 수명을 연장하는 모듈식 천장 기둥과 리노베이션 가능 이미징 그레일을 선호합니다. 임대 및 설비 서비스 모델은 설비 투자를 예측 가능한 운영 비용으로 변환하지만 소프트웨어 라이선스, 사이버 보안 패치 및 교육을 고려하면 총 소유 비용은 여전히 상승합니다.

부문 분석

2025년 시점에서 마취 워크스테이션이 25.31%로 최대의 수익 점유율을 차지했습니다. 모든 절차에 기도 관리와 생리적 모니터링이 필수적이므로 수요는 비탄력적입니다. 마취기기 시장 규모는 급증하지 않고, 증례 수에 연동한 꾸준한 성장이 예상됩니다. 한편, 수술용 이미징 시스템은 실시간 지침을 필요로 하는 하이브리드 혈관 및 신경 수술실에 의해 2031년까지 연평균 복합 성장률(CAGR) 11.05%로 확대될 전망입니다. 이미징 솔루션을 위한 수술실 장비 시장 규모는 평판 감지기, 내비게이션 및 증강현실 오버레이를 결합한 솔루션을 제공함으로써 2031년까지 100억 달러 규모에 이를 것으로 예측됩니다.

전기 수술용 발전기는 저침습 기술이 보급되고 있는 가운데 여전히 중요성을 유지하지만, 현재는 조직 임피던스에 적응하는 지능적인 에너지 변조 기술이 혁신의 중심이 되고 있습니다. 천장 설치형 의료 펜던트는 전력, 가스 및 데이터를 제공하는 네트워크 허브로 진화해 접속형 수술실 에코시스템에 필수적인 존재가 되고 있습니다. 여러 미국 주가 사용을 의무화함에 따라 연기 배출 장치의 도입이 가속화되고 있습니다. 미주리 주에서는 2026년 1월부터 준수가 실시됩니다. LG 등의 디스플레이 제조업체는 섬세한 현미 수술에서 깊이 인식과 색 재현성을 높이는 4K 미니 LED 모니터를 도입하고 있습니다.

지역별 분석

북미는 수익의 37.55%를 차지하고 있습니다. 이는 AI 지원 워크플로 도구 및 사이버 보안 네트워크의 조기 도입을 지원하는 상환 제도 때문입니다. 미국 병원에서는 대기 수술 해소와 구식 설비 현대화를 위해 2026년까지 설비 투자를 9% 증가시킬 계획입니다. 캐나다의 주 보건 당국은 환자 이송을 줄이기 위해 하이브리드 수술실의 공동 출자를 진행하고, 멕시코의 민간 체인은 의료 관광객 유치를 위한 고급 캠퍼스를 정비하고 있습니다. 수술실 장비 시장에서는 시설이 플랫폼을 혼합하면서 FDA 사이버 보안 지침을 준수 할 수 있도록 공급업체 중립 통합 레이어가 계속 중요합니다.

아시아태평양은 6.54%라는 가장 빠른 CAGR을 기록하고 있으며 인도와 중국이 공적 및 민간 양 부문에서 수술 인프라를 확충하고 있기 때문입니다. 국제적인 공급업체는 직원의 기술 향상과 투자 대 효과 증명을 목적으로 교육 아카데미를 개설하고 있으며, 동남아시아에 개설된 Medtronic의 'Robotics Experience Studio'가 그 전략의 좋은 예입니다. 일본과 한국은 고령화 관련 전문 분야에 주력해 로봇 내시경과 스마트 마취 시스템에 투자함으로써 입원 기간의 단축을 도모하고 있습니다. 인도네시아, 베트남, 필리핀의 가격 감응도가 높은 부문은 종합적인 수술실 구축 입구로 모듈식 펜던트와 내구성이 높은 진단용 이미징 장치를 선호합니다.

유럽에서는 독일, 프랑스, 영국이 주도하여 탄소 삭감을 위한 개조와 헬륨 효율이 높은 MRI 스위트의 공동 출자를 실시해 완만한 확대를 유지하고 있습니다. Philips와 영상 진단 제공업체인 Evidia가 지속가능한 스캐너를 도입하기 위해 제휴한 것은 기후 변화 대책이 조달에 영향을 미친다는 것을 보여줍니다. 중동 및 아프리카의 성장은 걸프 협력 회의(GCC) 회원국에 집중하고 있으며, 주요 대학 병원은 해외에서 의료 관광객을 얻기 위해 풀 하이브리드 패키지를 구입하고 있습니다. 브라질이 선도하는 남미는 통화 변동 속에서 점차 현대화가 진행되고 있으며, 기본적인 테이블과 조명은 현지 조립업체에 의존하면서 고급 혈관 이미징 기기를 수입하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 수술을 필요로 하는 만성 질환 증가 경향

- 증가하는 병원 수와 정부 자금

- 저침습 수술 및 영상 유도 수술 도입 확대

- 첨단 수술 중 영상 진단 기능을 갖춘 하이브리드 수술실로 급속한 전환

- 수술실 효율화를 위한 AI 구동형 워크플로우 분석의 도입

- 팬데믹 후 선택적 수술의 백로그가 수술실의 업그레이드를 촉진

- 시장 성장 억제요인

- 수술실 설비의 고액의 자본 비용과 유지 관리비

- 숙련된 주술기 스탭의 부족

- 통합 수술실 플랫폼에서 사이버 보안 위험

- AI 탑재 수술 기기의 규제 지연

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측(금액은 달러)

- 제품별

- 마취 장치

- 수술용 이미징 시스템

- 전기 수술용 장치

- 수술대

- 수술용 및 진찰용 조명

- 환자 모니터

- 의료용 펜던트 및 붐

- 연기 배출 시스템

- 기타 수술실 장비

- 모빌리티별

- 고정식 및 내장식

- 모듈러 및 레트로핏

- 모바일 및 휴대용

- 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 외래 시설 및 전문 클리닉

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Koninklijke Philips NV

- STERIS

- Stryker Corporation

- Karl Storz SE & Co. KG

- Siemens Healthineers AG

- Baxter International

- Getinge AB

- Medtronic plc

- GE HealthCare

- Mizuho OSI

- Dragerwerk AG & Co. KGaA

- Olympus Corporation

- Hill-Rom Holdings Inc.

- Skytron LLC

- Commed Corporation

- Zimmer Biomet Holdings Inc.

- Leica Microsystems GmbH

- Sony Medical Systems

- EIZO Corp.

- Trumpf Medical

제7장 시장 기회와 미래 전망

SHW 26.01.26The Operating Room Equipment Market market size in 2026 is estimated at USD 51.1 billion, growing from 2025 value of USD 48.72 billion with 2031 projections showing USD 64.87 billion, growing at 4.89% CAGR over 2026-2031.

Spending patterns now favor technologies that compress procedure time, improve visualization, and embed artificial intelligence rather than pure capacity expansion. Hybrid theaters equipped with intra-operative imaging and AI-driven workflow software continue to draw budget priority as hospitals address post-pandemic surgical backlogs. Capital outlays also track demographic shifts, with Asia-Pacific health systems investing in new surgical suites, while North American providers refresh installed bases with cyber-secure, upgrade-ready platforms. Consolidation among suppliers is reshaping competitive dynamics, as large vendors buy niche innovators to round out integrated portfolios and secure multiyear service contracts.

Global Operating Room Equipment Market Trends and Insights

Growing Incidence of Chronic Diseases Requiring Surgeries

Cardiovascular, oncologic, and musculoskeletal disorders are pushing surgical volumes higher as populations age and lifestyle risks rise. Orthopedic arthroscopy alone is projected to illustrate sustained demand for high-throughput OR platforms. Clinicians require multipurpose tables, versatile imaging, and advanced anesthesia workstations to handle comorbid patients who often need staged interventions. Vendors able to bundle interoperable systems that shorten turnover while maintaining safety benefit most as payers scrutinize cost per episode.

Rising Number of Hospitals and Government Funding

Capacity expansion programs in India, Indonesia, and mainland China translate into repeat tenders for core devices such as ceiling pendants, electrosurgical generators, and basic patient monitors. Domestic manufacturing incentives lower import duties and widen price segments, prompting global companies to release mid-tier lines optimized for local service conditions. Sweden-based Getinge targets 45% unit share in India by offering modular sterile processing and table packages calibrated to emerging-market budgets.

High Capital & Maintenance Costs of OR Equipment

Comprehensive hybrid installations exceed USD 3 million including shielding, HVAC upgrades, and service contracts. Value-oriented buyers therefore prefer modular ceiling columns and retrofit-ready imaging rails that extend asset life. Leasing and equipment-as-a-service models convert capex to predictable opex, yet total cost of ownership still rises when software licenses, cybersecurity patches, and training are considered.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Minimally-Invasive & Image-Guided Surgeries

- Rapid Shift Toward Hybrid ORs With Advanced Intra-Op Imaging

- Shortage of Skilled Peri-Operative Personnel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anesthesia workstations generated the largest revenue slice in 2025 at 25.31%. Demand is inelastic because every procedure requires airway management and physiologic monitoring. The operating room equipment market size for anesthesia devices is forecast to grow steadily with case volumes rather than spike. In contrast, surgical imaging systems are on track for an 11.05% CAGR through 2031, propelled by hybrid vascular and neuro suites that need real-time guidance. The operating room equipment market size for imaging solutions is projected to reach double-digit billions by 2031 as providers bundle flat-panel detectors, navigation, and augmented reality overlays.

Electrosurgical generators retain relevance as minimally invasive techniques proliferate, yet innovation now centers on intelligent energy modulation that adapts to tissue impedance. Ceiling-mounted medical pendants evolve into network hubs supplying power, gases, and data, making them indispensable to connected OR ecosystems. Smoke evacuation installations accelerate after multiple US states mandated their use, with Missouri enforcing compliance from January 2026. Display makers such as LG introduce 4 K mini-LED monitors that enhance depth perception and color fidelity for delicate microsurgery.

The Operating Room Equipment Market Report is Segmented by Product (Anesthesia Devices, Surgical Imaging Systems, Electrosurgical Devices, and More), Mobility (Fixed/In-built, Modular/Retrofit, Mobile/Portable), End User (Hospitals, Ambulatory Surgical Centers, Out-Patient Facilities/Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 37.55% revenue due to reimbursement systems that fund early adoption of AI-enabled workflow tools and cyber-secure networks. US hospitals plan a 9% uplift in capital spend through 2026 to combat elective backlogs and modernize legacy suites. Canadian provincial health authorities co-finance hybrid theaters to reduce patient transfers, while Mexican private chains equip high-end campuses to attract medical tourists. The operating room equipment market continues to value vendor-neutral integration layers so facilities can mix platforms while complying with FDA cybersecurity directives.

Asia-Pacific posts the fastest 6.54% CAGR as India and China ramp surgical infrastructure across public and private sectors. International suppliers open training academies-Medtronic's Robotics Experience Studio in Southeast Asia exemplifies the strategy-to upskill staff and prove return on investment. Japan and South Korea focus on aging-related specialties, investing in robotic scopes and smart anesthesia systems that cut length of stay. Price-sensitive segments in Indonesia, Vietnam, and the Philippines favor modular pendants and durable diagnostic imaging as gateways to comprehensive OR builds.

Europe sustains moderate expansion led by Germany, France, and the United Kingdom co-funding carbon-reduction retrofits and helium-efficient MRI suites. The partnership between Philips and imaging provider Evidia to deploy sustainable scanners shows climate alignment influencing procurement. Middle East & Africa growth concentrates in Gulf Cooperation Council states where flagship academic hospitals purchase full hybrid packages to capture inbound medical tourism. South America, spearheaded by Brazil, modernizes gradually amid currency swings, leaning on local assemblers for basic tables and lights while importing premium vascular imaging.

- Koninklijke Philips

- STERIS

- Stryker

- Karl Storz

- Siemens Healthineers

- Baxter

- Getinge

- Medtronic

- GE Healthcare

- Mizuho

- Dragerwerk

- Olympus

- Hill-Rom

- Skytron

- Conmed

- Zimmer Biomet

- Danaher

- Sony Medical Systems

- EIZO Corp.

- Trumpf Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidence of Chronic Diseases Requiring Surgeries

- 4.2.2 Rising Number of Hospitals and Government Funding

- 4.2.3 Increasing Adoption of Minimally-Invasive & Image-Guided Surgeries

- 4.2.4 Rapid Shift Toward Hybrid ORs With Advanced Intra-Op Imaging

- 4.2.5 Deployment of AI-Driven Workflow Analytics for OR Efficiency

- 4.2.6 Post-Pandemic Backlog of Electives Triggering OR Upgrades

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of OR Equipment

- 4.3.2 Shortage of Skilled Peri-Operative Personnel

- 4.3.3 Cyber-Security Risks in Integrated OR Platforms

- 4.3.4 Regulatory Delays for AI-Enabled Surgical Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Anesthesia Devices

- 5.1.2 Surgical Imaging Systems

- 5.1.3 Electrosurgical Devices

- 5.1.4 Operating Tables

- 5.1.5 Surgical & Exam Lights

- 5.1.6 Patient Monitors

- 5.1.7 Medical Pendants & Booms

- 5.1.8 Smoke Evacuation Systems

- 5.1.9 Other OR Equipment

- 5.2 By Mobility

- 5.2.1 Fixed / In-built

- 5.2.2 Modular / Retrofit

- 5.2.3 Mobile / Portable

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Out-patient Facilities / Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips NV

- 6.3.2 STERIS

- 6.3.3 Stryker Corporation

- 6.3.4 Karl Storz SE & Co. KG

- 6.3.5 Siemens Healthineers AG

- 6.3.6 Baxter International

- 6.3.7 Getinge AB

- 6.3.8 Medtronic plc

- 6.3.9 GE HealthCare

- 6.3.10 Mizuho OSI

- 6.3.11 Dragerwerk AG & Co. KGaA

- 6.3.12 Olympus Corporation

- 6.3.13 Hill-Rom Holdings Inc.

- 6.3.14 Skytron LLC

- 6.3.15 Conmed Corporation

- 6.3.16 Zimmer Biomet Holdings Inc.

- 6.3.17 Leica Microsystems GmbH

- 6.3.18 Sony Medical Systems

- 6.3.19 EIZO Corp.

- 6.3.20 Trumpf Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment