|

시장보고서

상품코드

1537588

스마트 임플란트 펌프 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Smart Implantable Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

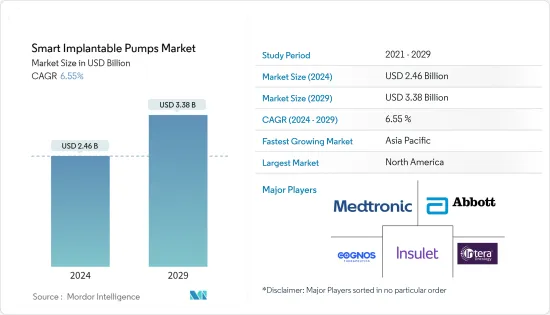

세계 스마트 임플란트 펌프 시장 규모는 2024년 24억 6,000만 달러, 2029년에는 33억 8,000만억 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 CAGR 6.55%를 나타낼 전망입니다.

스마트 이식형 펌프 시장은 경련 및 만성 통증과 같은 만성 질환의 유병률 증가, 노인 인구 증가, 건강 관리에 대한 인식 증가, 의료비 증가, 유리한 상환 정책 등의 주요 요인으로 인해 크게 성장하고 있습니다.

경련은 다발성 경화증, 뇌졸중, 뇌성마비 등 신경질환의 주요 증상입니다. 경련은 근육의 경직과 비자발적 인 근육 수축을 유발하여 이동성과 일상 생활에 영향을 미칩니다. 최근 몇 년동안 경련 사례가 증가함에 따라 스마트 이식형 펌프와 같은 새로운 치료법에 대한 수요가 증가하여 시장 성장을 가속하고 있습니다.

예를 들어, Physicians Group LLC가 2023년 12월에 발표한 기사에 따르면, 그 해에 전 세계적으로 약 1,200만 명이 경련을 앓고 있다고 합니다. 이 소식통은 또한 전자 이식형 펌프와 표적 약물 전달 시스템을 포함한 새로운 물리치료 접근 방식이 운동 기능을 강화하고 환자의 경련을 완화하는 데 높은 효율성을 보였습니다고 밝혔습니다.

Merz Therapeutics가 2024년 5월에 발표한 보고서에 따르면, 척수 손상 후 환자의 약 65%-74%에서 경련이 발생하며, 2023년에는 환자의 35%-45%에서 불쾌한 경련이나 문제가 있는 경련이 발생한다고 보고했습니다. 마찬가지로 미국에서는 교통사고와 직장에서 발생하는 외상성 뇌손상의 부담이 증가하고 있어 경련 및 기타 만성 통증의 사례가 증가할 수 있습니다.

노화가 진행됨에 따라 신체는 심혈관 질환, 당뇨병, 신경 질환과 같은 만성 질환에 걸리기 쉽기 때문에 이식형 펌프에 대한 수요가 증가하여 시장 성장을 가속하고 있습니다. 예를 들어, 세계보건기구(WHO)가 2024년 3월 발표한 보고서에 따르면 전 세계 노인 인구는 2030년까지 14억 명, 2050년까지 21억 명으로 증가할 것으로 예상됩니다. 이러한 증가는 전례 없는 속도로 일어나고 있으며, 특히 개발도상국에서는 향후 수십년동안 가속화될 것으로 보입니다. 이러한 인구 증가는 스마트 임플란트 펌프에 대한 수요를 증가시켜 시장 성장을 가속할 것으로 예상됩니다.

결론적으로, 만성질환 유병률 증가, 노인 인구 증가, 헬스케어에 대한 인식 증가 등의 요인이 시장 성장을 가속할 것으로 예상됩니다. 그러나 엄격한 규제 프레임워크와 제품 리콜은 시장 성장을 억제할 것으로 예상됩니다.

스마트 임플란트 펌프 시장 동향

스마트 임플란트 펌프 시장 동향심혈관 부문은 예측 기간 동안 큰 폭의 성장이 예상

심장 보조 장치, 약물 전달 펌프, 혈역학 모니터링 펌프와 같은 스마트 이식형 펌프는 다양한 심혈관 질환을 관리할 수 있는 최소 침습적이고 표적화된 접근 방식을 제공합니다. 심혈관 질환의 유병률 증가와 심혈관 이식형 펌프의 기술 발전과 같은 주요 요인은 예측 기간 동안 심혈관 부문의 성장을 가속할 것으로 예상됩니다.

심혈관 질환의 높은 유병률은 심혈관 이식형 펌프 부문의 성장을 가속하고 있습니다. 예를 들어, 관상 동맥 질환은 최근 몇 년동안 높은 비율로 증가하고 있으며, 2023년 5월미국 질병 예방 관리 센터가 발표 한 보고서에 따르면 관상 동맥 심장 질환은 가장 발병률이 높은 심장 질환으로 2022년에는 20 세 이상 성인의 약 5%, 즉 20 명 중 1 명이 관상 동맥 질환(CAD)을 앓고 있다고합니다.

이 소식통에 따르면, 미국에서는 매년 약 85만 명이 심장마비를 앓고 있습니다. 이 중 60만 5,000명이 처음으로 심장마비를 겪었고, 20만 명 이상이 이미 심장마비를 겪었습니다. 심부전 관리, 폐동맥 고혈압, 만성 협심증 완화 및 모니터링과 같은 치료 절차에 사용되는 이러한 펌프에 대한 수요가 심혈관 이식형 펌프 분야의 성장에 기여하고 있기 때문에 이식형 펌프에 대한 큰 시장 기회가 될 수 있습니다.

또한, 이 시장의 주요 기업들은 심혈관 질환 증가에 대응하기 위해 새로운 기술을 도입하기 위해 노력하고 있습니다. 예를 들어, 2022년 4월 Abiomed는 심장 펌프의 미국 식품의약국(FDA) 조기 타당성 시험(EFS)의 일환으로 Impella Bridge-to-Recovery(BTR)를 이식했다고 발표했습니다. 이 이식은 노스웨스턴 의대 블룸 심혈관 연구소의 Duc Thinh Pham 의학 박사와 Jane Wilcox 의학 박사가 수행했습니다.

결론적으로, 심혈관 질환 환자 증가와 시장의 최근 기술 발전은 예측 기간 동안 이 분야의 성장을 가속할 것으로 예상됩니다.

예측 기간 동안 북미가 시장에서 큰 비중을 차지할 것으로 예상

북미는 잘 구축된 의료 인프라, 더 나은 규제 프레임워크, 정부 지원 및 주요 기업의 존재로 인해 스마트 이식형 펌프 시장에서 급성장할 것으로 예상됩니다. 또한, 만성 질환 증가와 새로운 치료법에 대한 수요 증가가 시장 성장을 가속할 것으로 예상됩니다.

최근 몇 년동안 이 지역에서는 당뇨병 유병률이 급격히 증가하고 있습니다. 예를 들어, 2024년 1월 국립당뇨병-소화기신장병연구소가 발표한 보고서에 따르면, 2022년 국내 전 연령대의 당뇨병 환자는 3,840만 명(인구의 11.6%)에 달했습니다. 이 중 3,810만 명은 18세 이상 성인입니다. 또한, 전 연령층에서 2,970만 명(인구의 8.9%) 이상이 당뇨병 진단을 받은 것으로 나타났습니다.

자료에 따르면, 미국에는 9,760만 명 이상의 성인이 예비 당뇨병 진단을 받았으며, 이는 전체 성인 인구의 약 3분의 1에 해당합니다. 인구에서 당뇨병 및 당뇨병 예비 환자의 현저한 유병률은 포도당 수치 모니터링 및 관리에 대한 수요 증가로 인해 이식형 펌프 시장의 성장을 가속할 것으로 예상됩니다.

또한 미국당뇨병협회가 2023년 11월에 발표한 보고서에 따르면, 미국에서는 매년 약 120만 명이 당뇨병 진단을 받고 있습니다. 이 나라는 젊은 당뇨병 인구도 많아 2024년에는 20세 미만의 미국인 중 35만 2,000명 이상이 당뇨병 진단을 받을 것으로 추정됩니다. 이식형 펌프는 당뇨병 환자가 정기적으로 혈당 수치를 모니터링하고 안정화시키는 데 필수적입니다. 따라서 당뇨병 환자 증가는 이식형 펌프 시장의 성장을 가속하고 있습니다.

이 시장의 주요 기업들은 이 지역에서 더 큰 시장 점유율을 확보하기 위해 제품 출시 및 승인 등 다양한 성장 전략을 추진하고 있습니다. 예를 들어, 2023년 4월 미국 식품의약국(FDA)은 SmartGuard 기술이지만 핑거스틱이 필요 없는 Guardian 4 센서가 장착된 Medtronic의 MiniMed 780G 시스템을 승인했습니다.

결론적으로, 만성 질환 환자 증가와 주요 기업의 제품 출시 증가는 예측 기간 동안 북미 이식형 펌프 시장의 성장을 가속할 것으로 예상됩니다.

스마트 임플란트형 펌프 산업 개요

스마트 이식형 펌프 시장은 중간 정도의 경쟁이 치열하며, 여러 주요 업체로 구성되어 있습니다. 헬스케어 분야의 다양한 조직의 통합과 제품 리콜 증가로 인해 향후 주요 기업들 간의 경쟁은 더욱 치열해질 것으로 예상됩니다. 이 시장의 주요 기업으로는 Medtronic, Abbott Laboratories, Cognos Therapeutics, Insulet Corporation, Intera Oncology 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 경축이나 만성 통증등의 만성질환 높은 유병률과 발생률

- 고령자 인구 증가

- 헬스케어 의식의 고양, 의료비 증가, 유리한 상환 정책

- 시장 성장 억제요인

- 엄격한 규제 범위조와 제품 회수

- Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화(시장 규모 : 금액)

- 펌프 유형별

- 관류펌프

- 마이크로펌프

- 용도별

- 통증

- 경축

- 심혈관

- 기타

- 최종사용자별

- 병원

- 외래수술센터(ASC)

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Medtronic

- Abbott Laboratories

- Cognos Therapeutics, Inc.

- Insulet Corporation

- Tandem Diabetes

- Intera Oncology

- i2o Therapeutics, Inc.

- OrphaCare GmbH

제7장 시장 기회와 향후 동향

LSH 24.09.13The Smart Implantable Pumps Market size is estimated at USD 2.46 billion in 2024, and is expected to reach USD 3.38 billion by 2029, growing at a CAGR of 6.55% during the forecast period (2024-2029).

The smart implantable pumps market is experiencing significant growth owing to major factors such as the growing prevalence of chronic diseases such as spasticity and chronic pain, the growing geriatric population, growing healthcare consciousness, rising healthcare expenditure, and favorable reimbursement policies.

Spasticity can be a major symptom of neurological conditions like multiple sclerosis, stroke, and cerebral palsy; spasticity causes muscle stiffness and involuntary muscle contractions, impacting mobility and daily activities. Rising cases of spasticity in recent years are increasing the demand for novel treatment methods, such as smart implantable pumps, thereby propelling the market's growth.

For instance, as per an article published by Physicians Group LLC in December 2023, around 12.0 million people worldwide suffered from spasticity in that particular year. The same source also stated that novel physical therapy approaches, including electronic implantable pumps and targeted drug delivery systems, showcased high efficiency in enhancing motor function and reducing patient spasticity.

According to a report published by Merz Therapeutics in May 2024, after spinal cord injury, about 65% to 74% of patients were reported to have spasticity, while 35% to 45% of patients had troublesome or problematic spasticity in 2023. Similarly, in the United States, there is a growing burden of traumatic brain injury caused by road accidents or workplace-related injuries, which can lead to a rise in cases of spasticity or other chronic pains.

As individuals age, their bodies become more susceptible to chronic diseases such as cardiovascular diseases, diabetes, and neurological diseases, creating a demand for implantable pumps and boosting the market's growth. For instance, according to a report published by the World Health Organization in March 2024, the geriatric population worldwide is poised to increase to 1.4 billion by 2030 and 2.1 billion by 2050. This increase is occurring at an unprecedented pace and would accelerate in the coming decades, particularly in developing countries. This rising population is expected to increase the demand for smart implantable pumps, thereby propelling the market's growth.

In conclusion, factors such as increasing incidence of chronic diseases, rising geriatric population, and healthcare awareness are expected to propel the market's growth. However, stringent regulatory frameworks and product recalls are expected to restrain the market's growth.

Smart Implantable Pumps Market Trends

Cardiovascular Segment is Expected to Witness a Significant Growth Over the Forecast Period

Smart implantable pumps, such as cardiac assist devices, drug delivery pumps, and hemodynamic monitoring pumps, offer a minimally invasive and targeted approach to managing various cardiovascular conditions. Major factors such as the rising prevalence of cardiovascular diseases and technological advancements of cardiovascular implantable pumps are expected to propel the growth of the cardiovascular segment during the forecast period.

The high prevalence of cardiovascular diseases is propelling the growth of the cardiovascular implantable pumps segment. For instance, coronary artery disease has risen at a high rate in recent years. As per a report published by the Centers for Disease Control and Prevention in May 2023, coronary heart disease is the most highly occurring form of heart disease. Approximately 5% of adults aged 20 and older, or 1 in 20, were affected by Coronary Artery Disease (CAD) in 2022.

According to the same source, about 850,000 people in the United States have a heart attack every year. Among these, 605,000 have had their first heart attack, and over 200,000 people have already had one. This presents a substantial market opportunity for implantable pumps, as the demand for these pumps used in treatment procedures such as heart failure management, pulmonary hypertension, and chronic angina relief and monitoring contributes to the growth of the cardiovascular implantable pumps segment.

Major players in the market are also working on introducing novel technologies to address the rising cases of cardiovascular diseases. For instance, in April 2022, Abiomed informed that the Impella Bridge-to-Recovery (BTR) was implanted as part of the heart pump's US Food and Drug Administration (FDA) Early Feasibility Study (EFS). The implant was done by Duc Thinh Pham, MD, and Jane Wilcox, MD, at the Northwestern Medicine Bluhm Cardiovascular Institute.

In conclusion, the rising cases of cardiovascular diseases and recent technological advancements in the market are expected to propel the segment's growth during the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to grow rapidly in the smart implantable pumps market due to its well-established healthcare infrastructure, better regulatory framework, government support, and major player presence. In addition, the increasing number of chronic diseases and rising demand for novel treatment methods are expected to boost the market's growth in the country.

The prevalence of diabetes has increased dramatically in the region in recent years. For instance, according to a report published by the National Institute of Diabetes and Digestive and Kidney Diseases in January 2024, in 2022, 38.4 million people of all ages had diabetes (11.6% of the population) in the country. Among these, 38.1 million were adults ages 18 years or older. Moreover, over 29.7 million people of all ages have been diagnosed with diabetes (8.9% of the population).

According to the same source, over 97.6 million adults in the United States were diagnosed with prediabetes, representing approximately one-third of the total adult population. The significant prevalence of diabetes and prediabetes in the population is expected to drive growth in the implantable pumps market due to increased demand for monitoring and managing glucose levels.

Similarly, according to a report published by the American Diabetes Association in November 2023, about 1.2 million US citizens are diagnosed with diabetes every year. The country also has a high under-age diabetic population, with over 352,000 Americans under age 20 estimated to have been diagnosed with diabetes in 2024. Implantable pumps are vital for diabetic patients to monitor and stabilize their blood glucose levels regularly; thus, the rising number of diabetic patients is propelling the growth of the implantable pumps market.

Key players in the market are working on various growth strategies, such as product launches and approvals, to acquire a larger market share in the region. For instance, in April 2023, the United States Food and Drug Administration (FDA) approved Medtronic's MiniMed 780G system with the Guardian 4 sensor, which requires no fingersticks while in SmartGuard technology.

In conclusion, the increasing cases of chronic diseases and the increasing product launches adopted by key players are expected to propel the growth of the implantable pumps market in North America during the forecast period.

Smart Implantable Pumps Industry Overview

The smart implantable pumps market is moderately competitive and consists of several major players. The increasing consolidations of various organizations and product recalls in the healthcare sector are expected to generate competitive rivalry among the key players in the future. Some of the major players in the market are Medtronic, Abbott Laboratories, Cognos Therapeutics Inc., Insulet Corporation, and Intera Oncology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence and Incidence of Chronic Diseases such as Spasticity & Chronic Pain

- 4.2.2 Growing Geriatric Population

- 4.2.3 Growing Healthcare Consciousness, Rising Healthcare Expenditure and Favorable Reimbursement Policies

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Framework and Product Recalls

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Pump Type

- 5.1.1 Perfusion Pumps

- 5.1.2 Micro Pumps

- 5.2 By Application

- 5.2.1 Pain

- 5.2.2 Spasticity

- 5.2.3 Cardiovascular

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic

- 6.1.2 Abbott Laboratories

- 6.1.3 Cognos Therapeutics, Inc.

- 6.1.4 Insulet Corporation

- 6.1.5 Tandem Diabetes

- 6.1.6 Intera Oncology

- 6.1.7 i2o Therapeutics, Inc.

- 6.1.8 OrphaCare GmbH