|

시장보고서

상품코드

1689846

암호화폐 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Cryptocurrency - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

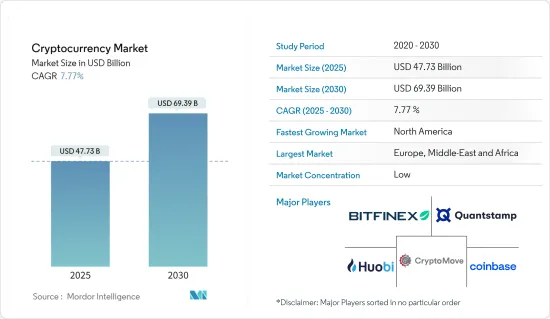

세계의 암호화폐 시장 규모는 2025년에 477억 3,000만 달러로 추정되며, 예측기간 중(2025-2030년) CAGR 7.77%로 확대되어, 2030년에는 693억 9,000만 달러에 달할 것으로 예측됩니다.

암호화폐(가상화폐)는 감독하는 규제기관을 가지지 않고 디지털 영역에서만 운영되고 있습니다. 분산형 대장 기술의 채용이 급증하고 있기 때문에 암호 통화 시장의 성장이 전망됩니다. 암호화폐 시장의 세분화에는 수많은 암호 통화의 시가 총액이 사용됩니다. 복잡한 성질, 큰 변동, 비합법적인 거래를 가능하게 할 가능성으로 인해 세계 규제 당국과 시책 입안자들은 현재 시스템에 통합하고 그에 따라 시스템을 적응시킬 필요성에 대해 우려를 표명합니다.

암호화폐는 당초 정부와 중앙은행 모니터링에서 독립형 피어 투 피어 거래를 촉진하기 위해 개발되었으며 최첨단 금융 혁신으로 등장했습니다. 암호 화폐는 많이 존재하며, 각각이 특정 목적을 가지고 있습니다. 또한, 특정 암호화폐는 토큰 작성을 통해서 피어 투 피어 거래를 가능하게 하는(RMG나 Maecenas 등) 한편, 직접 거래로 상품이나 서비스에의 안전한 액세스를 제공하는 것도 있습니다(Golem이나 Filecoin 등).기반이 되는 플랫폼이나 프로토콜을 서포트하는 암호화폐도 있습니다(Ether나 NEO등).

암호화폐 시장 동향

디지털 자산 도입 증가가 시장 성장의 원동력으로

디지털 자산의 채용이 급증하고 있는 것이 암호화폐 시장을 전진시키고 있습니다. 또한 금융 기관도 암호화 서비스를 통합함으로써 동향에 가세해 시장의 정당성을 높이고 있습니다. 가용성 향상 등의 이점을 가져오고 있습니다.이 동향은 기술의 진보나 규제 상황의 명확화에 따라 앞으로도 계속될 것으로 예상되고, 세계의 금융 정세에 있어서의 암호화폐의 지위는 한층 더 견고한 것으로 예상됩니다.

북미가 시장을 독점

예측 기간 동안 북미는 세계 시장의 성장에 48% 기여할 것으로 예측됩니다. 통화 시장의 성장을 더욱 강화하고 있습니다. 미국은 디지털 통화의 기술 진보의 최전선에 있으며, 이 지역의 주요 기업 중 하나로 여겨지고 있습니다.

또한, NFT에서의 암호화폐의 이용, 가치 보관의 한 형태로서 암호화폐가 받아들여지고 있는 것도, 동지역 시장 확대에 기여하고 있습니다. 또한, 블록체인 기술이나 암호화폐 마이닝 시스템의 혁신적 솔루션에 주력하는 기업에 대한 투자가, 이 지역에서 현저하게 증가하고 있습니다. 이 투자는 보다 높은 해시 레이트를 제공하고, 전력 효율을 높이는 것을 목적으로 하고 있습니다.

암호화폐 산업 개요

암호 화폐 시장도 매우 세분화되어 있습니다. 암, 리플, 라이트 코인 등 그 밖에도 다수 있습니다.각각의 암호화폐는 독립적으로 운영되고 있어 사용자나 개발자의 네트워크를 가지고 있습니다. 중요 시장 기업에는 Bitfinex, Quantstamp Inc., CryptoMove Inc., Coinbase, and Huobi Global. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 금융결제 시스템의 운영 효율화와 투명성에 대한 수요 증가

- 신흥 국가의 송금 수요 증가

- 시장 성장 억제요인

- 각국의 정부 규제의 차이가 시장에 영향

- 시장 규모의 변동에 의한 암호화폐 보유 리스크의 증대

- 시장 기회

- 기업이 새로운 디지털 자산을 창출할 기회 증가

- 암호화폐는 보다 높은 리턴으로 자금을 투자할 기회로 대두하고 있습니다.

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 세계의 암호화폐 시장에 영향을 미치는 동향

- 세계의 암호화폐 시장에서의 기술 혁신

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화 및 분석

- 시가총액별

- 비트코인

- 이더리움

- 리플

- 비트코인 캐시

- 카르다노

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Bitfinex

- Quantstamp Inc.

- CryptoMove Inc.

- Coinbase

- Huobi Global

- CoinCheck

- Gemini

- Bitfury

- Binance

- Cannan Inc*

제7장 시장 기회와 앞으로의 동향

제8장 면책사항

JHS 25.05.07The Cryptocurrency Market size is estimated at USD 47.73 billion in 2025, and is expected to reach USD 69.39 billion by 2030, at a CAGR of 7.77% during the forecast period (2025-2030).

Cryptocurrency, or virtual currency, operates solely in the digital realm without any overseeing regulatory body. Utilizing distributed ledger technology like blockchain and cryptocurrency ensures transaction validation. The surge in distributed ledger technology adoption is forecasted to drive growth in the cryptocurrency market. Additionally, the rising use of cryptocurrencies for cross-border remittances is projected to expand the market by lowering consumer fees and exchange costs. The market capitalization of numerous cryptocurrencies is used to segment the cryptocurrency market. These digital currencies intersect with crucial aspects of the monetary and financial systems. Due to their rapid expansion, intricate nature, significant fluctuations, and potential for enabling unlawful transactions, regulators and policymakers worldwide express apprehension regarding their integration into the current system and the need to adapt the system accordingly.

Cryptocurrencies, developed initially to facilitate peer-to-peer transactions independent of government or central bank oversight, have emerged as a cutting-edge financial innovation. These digital assets are currently under examination to assess their potential risks and rewards within the financial industry and their diverse design objectives. There are numerous cryptocurrencies, each serving a specific purpose. Some seek an alternative to traditional currency (such as Bitcoin, Monero, and Bitcoin Cash), while others focus on supporting cost-effective payment systems (like Ripple, Particl, and Utility Settlement Coin). Additionally, specific cryptocurrencies enable peer-to-peer trading through token creation (such as RMG and Maecenas), while others provide secure access to goods or services in direct transactions (like Golem and Filecoin). Some cryptocurrencies support underlying platforms or protocols (such as Ether and NEO). It is essential to recognize that new cryptocurrencies are continually being developed, so this list of design objectives is incomplete.

Cryptocurrency Market Trends

Increasing Adoption of Digital Assets is Expected to Drive the Growth of this Market

The surge in the adoption of digital assets is propelling the cryptocurrency market forward. The growing recognition of the advantages of cryptocurrencies in terms of secure and efficient transactions and their ability to safeguard against inflation has resulted in a surge in their acceptance among individuals and enterprises. Moreover, financial institutions are joining the trend by integrating crypto services, thereby enhancing the legitimacy of the market. This acceptance is not limited to Bitcoin and Ethereum but also includes a wide range of altcoins and tokens, providing diverse investment opportunities. Cryptocurrencies' decentralized structure offers benefits compared to conventional financial systems, including reduced transaction costs and enhanced availability of financial services, especially in areas with limited banking access. This trend is expected to continue as technology advances and regulatory frameworks become more defined, further solidifying cryptocurrencies in the global financial landscape.

North America Region Dominates the Market

During the forecast period, North America is projected to contribute 48% to the global market growth. The cryptocurrency market in North America holds the largest share due to numerous market players and continuous innovations in the region. The growing demand for digital payments has further fueled the growth of the North American cryptocurrency market. The United States, being at the forefront of technological advancements in digital currencies, is considered one of the key players in the region. Investments by vendors to expand their operations in North America are expected to drive the growth of the cryptocurrency market in the area during the forecast period.

Additionally, the use of cryptocurrencies in NFTs and the increasing acceptance of cryptocurrencies as a form of value storage contribute to the regional market's expansion. Additionally, there has been a notable increase in regional investments towards companies focusing on blockchain technology and innovative solutions for cryptocurrency mining systems. These investments aim to provide higher hash rates and enhance power efficiency.

Cryptocurrency Industry Overview

The cryptocurrency market is also highly fragmented. Thousands of cryptocurrencies are available, each with unique features, use cases, and communities. Bitcoin, for example, is the most well-known and widely adopted cryptocurrency, but there are numerous others, such as Ethereum, Ripple, Litecoin, and many more. Each cryptocurrency operates independently and has a network of users and developers. Some significant players are Bitfinex, Quantstamp Inc., CryptoMove Inc., Coinbase, and Huobi Global.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Operational Efficiency and Transparency in Financial Payment Systems

- 4.2.2 Increasing Demand for Remittances in Developing Countries

- 4.3 Market Restraints

- 4.3.1 Varying Government Regulations in Different Countries Affecting the Market

- 4.3.2 Volatility in Market Value Increases the Risk of Holding Cryptocurrency

- 4.4 Market Opportunities

- 4.4.1 Rising Opportunities for Companies to Create New Digital Assets

- 4.4.2 Cryptocurrency Emerging as an Opportunity to Invest Money with Higher Returns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Trends Influencing Global Cryptocurrency Market

- 4.7 Technological Innovations in Global Cryptocurrency Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION AND ANALYSIS

- 5.1 By Market Capitalization

- 5.1.1 Bitcoin

- 5.1.2 Ethereum

- 5.1.3 Ripple

- 5.1.4 Bitcoin Cash

- 5.1.5 Cardano

- 5.1.6 Others

- 5.2 Geography

- 5.3 North America

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

- 5.4 Europe

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Russia

- 5.4.5 Italy

- 5.4.6 Spain

- 5.4.7 Rest of Europe

- 5.5 Asia-Pacific

- 5.5.1 India

- 5.5.2 China

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 Rest of Asia-Pacific

- 5.6 South America

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Rest of South America

- 5.7 Middle East & Africa

- 5.7.1 United Arab Emirates

- 5.7.2 South Africa

- 5.7.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Bitfinex

- 6.2.2 Quantstamp Inc.

- 6.2.3 CryptoMove Inc.

- 6.2.4 Coinbase

- 6.2.5 Huobi Global

- 6.2.6 CoinCheck

- 6.2.7 Gemini

- 6.2.8 Bitfury

- 6.2.9 Binance

- 6.2.10 Cannan Inc*