|

시장보고서

상품코드

1537593

탄화규소 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Silicon Carbide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

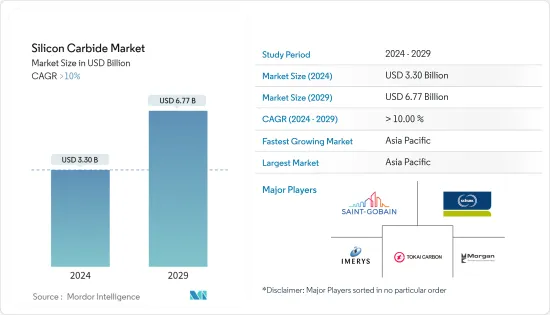

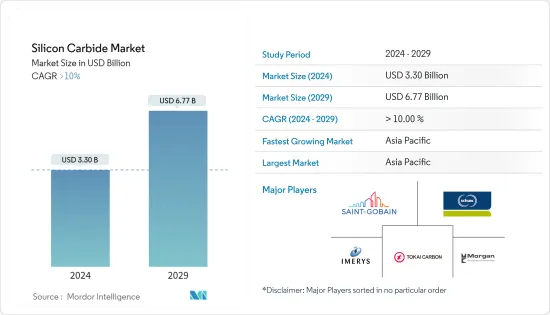

탄화규소 시장 규모는 2024년 33억 달러로 추정되며, 2029년에는 67억 7,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 10% 이상의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 시장을 주도하는 주요 요인은 철강 제조 및 철강 가공 산업의 강력한 수요와 전자 산업의 급속한 수요 증가입니다.

- 수요를 억제하는 요인으로는 석탄이나 석유 코크스와 같은 원자재 가격의 변동이 있습니다. 또한, 질화갈륨과 같은 대체품의 가용성도 문제점으로 지적되고 있습니다.

- 전기자동차 보급률의 증가는 시장 성장에 다양한 기회를 제공할 것으로 예상됩니다.

- 아시아태평양이 세계 시장을 독점하고 있으며, 중국, 인도, 일본 등 국가의 소비가 가장 큽니다.

탄화규소 시장 동향

전자 및 반도체 분야에서의 활용 확대

- 탄화규소는 실리콘과 탄소를 포함하는 반도체입니다. 탄화규소 입자를 함께 성형하여 매우 단단한 세라믹을 형성할 수 있으며, 높은 내구성이 요구되는 용도에 사용됩니다.

- 탄화규소는 고온, 고전압 또는 두 가지 모두에서 작동하고 폼팩터가 작다는 특성으로 인해 반도체 제조에 널리 사용되고 있습니다.

- 세계 반도체 무역 통계(WSTS)에 따르면, 세계 반도체 시장 매출은 2023년 5,201억 3,000만 달러보다 13.12% 증가한 5,883억 6,000만 달러를 기록할 것으로 예상됩니다. 이에 따라 2024년 이 부문의 탄화규소 수요는 크게 증가할 것으로 예상됩니다. 반도체는 전자제품의 가장 중요한 구성요소 중 하나이기 때문에 예측 기간 동안 시장이 크게 성장할 것으로 예상됩니다.

- 북미, 특히 미국에서는 전자 산업이 완만한 성장세를 보일 것으로 예상됩니다. 새로운 기술 제품에 대한 수요 증가는 향후 몇 년 동안 시장 확대에 기여할 것으로 예상됩니다.

- 독일의 전자산업은 유럽 최대 규모이며 세계 5위입니다. 전기 및 전자 산업은 독일 전체 산업 생산의 11%, 국내총생산(GDP)의 약 3%를 차지합니다.

- 영국은 유럽에서 가장 큰 고급 가전제품 시장이며, 영국에 기반을 둔 약 18,000개의 전자제품 기업이 있습니다.

- Canalys에 따르면, 세계 스마트워치 시장은 2023년 대비 2024년 금액 기준 17% 성장할 것으로 예상됩니다. 전 세계적으로 전자기기에 대한 수요가 증가하는 추세는 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다.

- 탄화규소는 위와 같은 요인으로 인해 예측 기간 동안 시장이 빠르게 성장할 것으로 예상됩니다.

아시아태평양이 시장을 지배

- 예측 기간 동안 아시아태평양이 탄화규소 시장을 지배할 것으로 예상됩니다. 중국, 인도, 일본과 같은 국가에서는 전자, 자동차, 방위 등 다양한 분야에서 첨단 업그레이드 기술에 대한 수요가 증가함에 따라 탄화규소에 대한 수요가 증가하고 있습니다.

- 중국은 반도체의 주요 소비국 중 하나이며, 반도체 생산을 확대하려고 노력하고 있습니다. 반도체는 정부 주도의 '메이드 인 차이나 2025' 계획의 주요 분야로, 고부가가치 제품 생산을 촉진하는 것을 목표로 하고 있습니다. 중국은 2025년까지 자국에서 사용되는 반도체의 70%를 생산하는 것을 목표로 하고 있습니다.

- 전자정보기술부의 보고에 따르면 인도에서는 매년 2,000개 이상의 반도체 칩이 설계되고 있습니다. 반도체 생산 증가는 향후 탄화규소 시장을 촉진 할 수 있습니다.

- 인도전자-반도체협회(IESA)는 싱가포르반도체산업협회(SSIA)와 양해각서를 체결하고 양국 전자-반도체 산업 간 무역-기술 협력을 구축-발전시킬 예정입니다. 이를 통해 다양한 획기적인 반도체 제조 기술이 개발되어 인도의 반도체 제조에서 탄화규소의 소비 범위가 더욱 확대될 것으로 예상됩니다.

- 인도 정부는 전자부품 및 반도체 제조 촉진 제도(SPECS)와 생산 연동 인센티브(PLI)와 함께 수정된 전자제품 제조 클러스터 제도(EMC 2.0)라는 새로운 제도를 도입하여 인도의 전자제품 제조를 촉진하기 위한 새로운 제도를 시행하고 있습니다. 정부는 제조업체가 인도에서 생산량을 늘릴 경우 5년간 55억 달러의 인센티브를 제공할 수 있습니다. 이는 인도의 전자제품 생산을 촉진할 가능성이 높습니다.

- 인도의 자동차 산업은 1,000억 달러 이상의 가치가 있으며, 전체 수출의 8%, 인도 GDP의 2.3%를 차지하며, 2025년에는 세계 3위를 차지할 것으로 예상됩니다.

- 2024년 3월, 중국은 국방 예산을 7.2% 증가한 약 2,330억 달러로 늘릴 것이라고 발표했습니다. 중국의 최근 계획은 2027년까지 미국 수준의 완전한 현대식 군대를 건설하는 것입니다. 중국은 최근 몇 년 동안 항공모함과 스텔스기에 투자하고 있습니다. 또한 중국의 뒷마당인 남중국해(SCS)를 포함해 전 세계에 항공모함을 5-6척으로 늘릴 계획입니다.

- 위의 요인들은 정부의 지원과 함께 예측 기간 동안 이 지역의 수요 증가에 기여하고 있습니다.

탄화규소 산업 개요

탄화규소 시장은 부분적으로 통합되어 있으며, 일부 기업이 큰 시장 점유율을 차지하고 있습니다. 주요 시장 기업으로는 Saint-Gobain, Imerys, Tokai Carbon, Schunk Ingenieurkeramik GmbH, Morgan Advanced Materials 등이 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 일렉트로닉스 산업으로부터의 왕성한 수요

- 첨단 세라믹 수요 증가

- 성장 억제요인

- 원재료 비용 변동

- 질화갈륨 등의 대체품의 입수 가능성

- 산업 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화

- 제품별

- 그린 SiC

- 블랙 SiC

- 기타 제품

- 용도별

- 철강

- 에너지

- 자동차

- 항공우주 및 방위

- 일렉트로닉스·반도체

- 기타 용도

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 러시아

- 터키

- 스페인

- 노르딕

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 카타르

- 나이지리아

- 아랍에미리트

- 이집트

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 상황

- M&A, 합작투자, 제휴, 협정

- 시장 점유율(%)/순위 분석

- 주요 기업의 전략

- 기업 개요

- Blasch Precision Ceramics Inc.

- Christy Refractories

- Imerys

- Keith Company

- Morgan Advanced Materials

- NGK Insulators Ltd

- Silcarb Recrystallized Private Limited

- Saint Gobain

- Termo Refractaires

- The Pottery Supply House

- Fiven ASA

- KEYVEST

- Navarro SiC

- Schunk Ingenieurkeramik GmbH

- Superior Graphite

- Tateho Chemical Industries Co. Ltd

- ESD-SIC BV

- ELSID SA

- Zaporozhsky Abrasinvy Combinat

제7장 시장 기회와 향후 동향

- 전기자동차와 자율주행차 보급 확대

- 나노기술 이용 확대

The Silicon Carbide Market size is estimated at USD 3.30 billion in 2024, and is expected to reach USD 6.77 billion by 2029, growing at a CAGR of greater than 10% during the forecast period (2024-2029).

Key Highlights

- The major factors driving the market studied are strong demand from the steel manufacturing and steel processing industry and rapidly growing demand from the electronics industry.

- Some factors restraining the demand for the market include fluctuating costs of raw materials like coal and petroleum coke. Moreover, the availability of substitutes such as gallium nitride might also cause challenges.

- The rising penetration of electric vehicles is expected to offer various opportunities for the growth of the market.

- Asia-Pacific dominated the market globally, with the most significant consumption from countries such as China, India, and Japan.

Silicon Carbide Market Trends

Increasing Usage in Electronics and Semiconductor Segment

- Silicon carbide is a semiconductor containing silicon and carbon. Grains of silicon carbide can be molded together to form very hard ceramics that are used in applications requiring high endurance.

- Silicon carbide is widely used in manufacturing semiconductors due to its properties, like the ability to work at high temperature, high voltage, or both, and reduced form factor.

- According to the World Semiconductor Trade Statistics (WSTS), the revenue of the global semiconductor market is expected to register USD 588.36 billion, 13.12% higher than USD 520.13 billion in 2023. This will result in a substantial boost in the demand for silicon carbide in the segment in 2024. As semiconductors are one of the most crucial components of electronic devices, the market is expected to witness a substantial boost during the forecast period.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. An increase in the demand for new technological products is expected to help the market expansion in the coming years.

- The German electronic industry is Europe's biggest and the fifth-largest, globally. The electrical and electronics industry accounted for 11% of the total German industrial production and about 3% of the country's gross domestic product (GDP).

- The United Kingdom is the largest European market for high-end consumer electronics products, with about 18,000 UK-based electronics companies in the market.

- According to Canalys, the global smartwatch market is expected to grow by 17% in value in 2024 compared to 2023. This trend of globally increasing demand for electronics is expected to propel the market's growth during the forecast period.

- Due to all the factors mentioned above for silicon carbide, its market is expected to grow rapidly during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for silicon carbide during the forecast period. In countries like China, India, and Japan, due to the increasing demand for advanced and upgraded technology across various sectors, including electronics, automotive, and defense, the demand for silicon carbide has been increasing in the region.

- China is one of the major consumers of semiconductors, and it is trying to ramp up semiconductor production. Semiconductors are a key area of the Made in China 2025 plan, a government initiative that aims to boost the production of higher-value products. China is aiming to produce 70% of the semiconductors it uses by 2025.

- According to reports from the Department of Electronics and Information Technology, over 2,000 semiconductor chips are designed in India every year. The increasing production of semiconductors may propel the silicon carbide market in the future.

- The India Electronics and Semiconductor Association (IESA) signed an MoU with the Singapore Semiconductor Industry Association (SSIA) to establish and develop trade and technical cooperation between the electronics and semiconductor industries of both countries. This is expected to result in the development of various breakthrough semiconductor manufacturing technologies that may further increase the scope for the consumption of silicon carbide in semiconductor manufacturing in India.

- The government launched new schemes to promote electronics production in India: the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) and the Scheme for Modified Electronics Manufacturing Clusters (EMC 2.0) alongside the Production Linked Incentive (PLI). According to the PLI scheme, the government is likely to offer incentives as manufacturers increase production in India, with USD 5.5 billion available over five years. This is likely to boost the country's production of electronics.

- The Indian automotive industry is worth more than USD 100 billion, contributes 8% of the country's total exports, and accounts for 2.3% of the Indian GDP. It is expected to become the third-largest in the world by 2025.

- In March 2024, China announced a 7.2% increase in its defense budget to about USD 233 billion. The country's recent plans are to build a fully modern military on par with the United States by 2027. The country has been investing in aircraft carriers and stealth aircraft in the past few years. Moreover, it plans to increase the number of aircraft carriers to about five to six worldwide, including Beijing's backyard, the South China Sea (SCS).

- The factors mentioned above, coupled with government support, contribute to the increasing demand in the region during the forecast period.

Silicon Carbide Industry Overview

The silicon carbide market is partially consolidated, with players accounting for a significant market share. Some key market players (not in any particular order) include Saint-Gobain, Imerys, Tokai Carbon Co. Ltd, Schunk Ingenieurkeramik GmbH, and Morgan Advanced Materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Electronics Industry

- 4.1.2 Increasing Demand for Advanced Ceramics

- 4.2 Restraints

- 4.2.1 Fluctuating Costs of Raw Materials

- 4.2.2 Availability of Substitutes such as Gallium Nitride

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product

- 5.1.1 Green SiC

- 5.1.2 Black SiC

- 5.1.3 Other Products

- 5.2 By Application

- 5.2.1 Steel Manufacturing

- 5.2.2 Energy

- 5.2.3 Automotive

- 5.2.4 Aerospace and Defense

- 5.2.5 Electronics and Semiconductor

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 Spain

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Blasch Precision Ceramics Inc.

- 6.4.2 Christy Refractories

- 6.4.3 Imerys

- 6.4.4 Keith Company

- 6.4.5 Morgan Advanced Materials

- 6.4.6 NGK Insulators Ltd

- 6.4.7 Silcarb Recrystallized Private Limited

- 6.4.8 Saint Gobain

- 6.4.9 Termo Refractaires

- 6.4.10 The Pottery Supply House

- 6.4.11 Fiven ASA

- 6.4.12 KEYVEST

- 6.4.13 Navarro SiC

- 6.4.14 Schunk Ingenieurkeramik GmbH

- 6.4.15 Superior Graphite

- 6.4.16 Tateho Chemical Industries Co. Ltd

- 6.4.17 ESD-SIC BV

- 6.4.18 ELSID SA

- 6.4.19 Zaporozhsky Abrasinvy Combinat

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase Market Penetration of Electric Cars and Self-driving Cars

- 7.2 Growth of Usage in Nanotechnology