|

시장보고서

상품코드

1689872

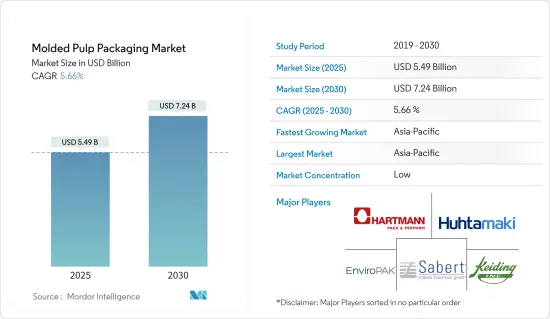

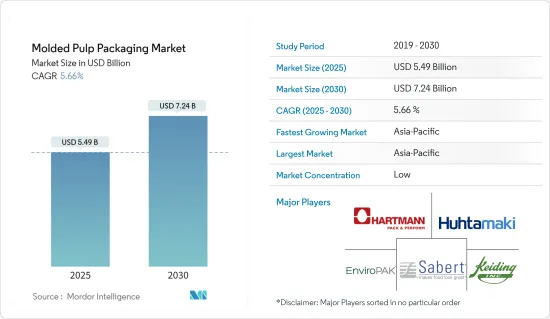

성형 펄프 포장 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Molded Pulp Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

세계의 성형 펄프 포장 시장 규모는 2025년 54억 9,000만 달러로 예측되고 예측기간 중(2025-2030년) CAGR 5.66%로 확대되어, 2030년에는 72억 4,000만 달러에 달할 것으로 예측됩니다.

편리하고 지속 가능한 포장 대체품에 대한 수요가 급속히 높아지고 있고, 플라스틱 대체품으로서 경쟁력 있는 섬유 성형품의 개발이 진행되고 있으며, 일렉트로닉스, 식품 포장, 헬스케어 분야로부터의 수주가 증가하고 있는 것 등이, 성형 펄프 포장 시장의 주요 촉진요인이 되고 있습니다.

주요 하이라이트

- 소비자 일렉트로닉스와 같은 최종 사용자 산업이 높은 수요를 목격하고 있는 동안, 지속가능한 패키징 제품은 운송을 위한 보호층으로 점점 더 많이 사용되고 있으며, 보호를 돕고 환경 파괴를 일으키지 않습니다. 또한, 성형 펄프는 엔드 캡, 크램 쉘 용기, 트레이, 접시, 그릇 등 여러 제품을 만들 수 있습니다.

- 다양한 경제권에서 계란의 소비와 생산이 세계적으로 확대되고 있는 것이 이 시장 수요를 견인하고 있습니다. PrintWeek에 따르면 2030년 말 세계의 계란 소비량은 1인당 10.3kg 가까이 될 것으로 예상됩니다. 여러 알을 수납할 수 있는 튼튼한 포장 트레이가 필요해, 결국 성형 펄프 포장으로 향하는 길이 열렸습니다.

- 성형 펄프 포장은 기업의 지속가능성 목표에 도움이 되는 상당한 비용 절감을 제공합니다. 성형 펄프 포장의 비용은 저렴하고 신뢰할 수있는 원료를 사용하여 낮게 억제됩니다. 플라스틱 및 발포 스티롤 포장재의 대부분은 석유로 만들어지므로 원유 가격의 변동에 따라 가격이 변동합니다. 성형 펄프 포장의 제조에는 널리 사용 가능하고 가격도 저렴한 천연섬유와 소비자 사용 후 종이 제품이 사용됩니다.

- 제지 산업에서는 모든 섬유의 가용성이 우려됩니다. 수입량은 300만 톤으로 늘어나고, 각국 정부는 수입법이나 수입 제한을 채용해, 관세나 물품세를 인상하고 있습니다. 최근 컨테이너 부족으로 인해 국제 정기 선박 회사는 가격을 인상했습니다. 40피트 컨테이너의 폐지 수송료는 2,800달러에서 3,600달러로 인상되었습니다. 이전에는 1,600-1,800달러 이하였습니다.

성형 펄프 포장 시장 동향

식품 포장이 큰 시장 점유율을 차지

- 성형 펄프 제품은 플라스틱을 대체하고 환경 친화적이고 지속 가능한 제품에 대한 수요가 증가함에 따라 식품 관련 분야에서 점점 더 많이 사용되고 있습니다. 식품 시장을 위한 용도에는 엄격한 표준이 있으며 이를 준수해야 합니다. 식품 시장 분야의 재료는 인장 강도와 내열성과 같은 몇 가지 기본적인 강도 사양 외에도 장벽 특성 향상이 매우 중요합니다.

- 성형 펄프로 만든 식품 포장 제품에는 크램 쉘과 테이크 아웃용 식사 용기, 계란 트레이와 카톤, 과일, 야채, 베리, 버섯 트레이 등이 있습니다. 시장에 나와 있는 식품 포장의 대부분은 트레이를 이용하고 있습니다. 성형 종이 펄프 포장은 계란과 같은 섬세하고 깨지기 쉬운 제품에 최적의 보호를 제공합니다. 그 신뢰성으로 인해 생산자나 소매업체가 입는 손실이나 손해는 적습니다. 계란 트레이는 보호 포장이며 재생 신문을 사용하여 만들어집니다.

- 펄프나 섬유로 성형된 트레이는 계란의 포장이나 보관에 필수적인 통기성이나 흡습성이 뛰어납니다. 또한 계란과 과일의 소비량이 증가할 것으로 예상되며 경량이면서 재활용 가능하다는 장점도 있기 때문에 트레이 수요는 증가할 것으로 예측되고 있습니다. 계란 포장용 트레이에 대한 수요는 큽니다. 계란 소비 증가는 계란 트레이 포장용 성형 펄프의 동향을 나타냅니다. 예를 들어 독일에서는 1인당 닭고기 소비가 2021년 14.40킬로그램에서 2023년 14.60킬로그램으로 증가했습니다.

- 포장은 식품과 환경 사이의 가스 및 수증기 교환을 줄이고 식품의 화학적, 물리적 및 미생물학적 변화를 늦추는 장벽 특성을 요구합니다. 그 결과, 식품 관련 제품의 포장을 목적으로 하는 재료에서는 수증기와 산소에 대한 투과성이 고려해야 할 중요한 특성입니다.

현저한 성장을 이루는 아시아태평양

- 유엔 식량농업기관(FAO)에 따르면 중국은 최근 세계 최대의 목재 펄프 수입국이 되고 있습니다. 이 나라에서는 푸드서비스, 식품 포장, 헬스케어, FMCG, 일렉트로닉스 등 최종 사용자를 위한 펄프 몰드 패키지 제품에 대한 수요가 증가하고 있습니다. 신흥국 펄프 포장 시장의 추가 견인역이 될 것으로 기대됩니다.

- 중국국가개발개혁위원회와 생태환경부의 공동 제안은 일회용 발포 식기, 일회용 플라스틱 면봉 판매, 플라스틱 비드 등 일용 화학제품의 제조를 금지하고 있습니다. 플라스틱 금지 및 제한이 넓게 실시되는 신상황 하에서 펄프 성형품은 환경 보호와 분해성이 뛰어나기 때문에 「플라스틱 제한령」후의 주된 대체품이 됩니다.

- 식품과 밀접하게 접촉하는 클램 쉘, 트레이, 컵과 같은 포장 제품의 제조에 버진 펄프를 필요로 하는 외식용 디스포저블 산업은 최근 몇 년동안 큰 성장을 이루고 있습니다. 인도에서는 외식 산업에서 사용되는 버진 펄프의 대부분은 바가스와 벼 짚과 같은 비 목재에서 유래합니다. Nirmal Bang에 따르면 인도의 조직화된 외식산업은 2025년 2조 3,000억 루피(약 280억 2,000만 달러) 이상 시장 규모에 이릅니다.

- 지속가능한 포장으로의 대폭적인 변화, 친환경 포장 솔루션에 대한 소비자 선호도, 제조업체가 제품을 포장하는 방법에 대한 환경과 건강에 대한 우려가 인도 성형 펄프 포장 시장의 성장을 가속할 것으로 예상됩니다.

- 온라인 식료품 쇼핑 및 조합 식품 택배는 일본에서 가장 중요한 두 가지 식품 택배 분야(외부 환경과 습기로부터 식품 및 식료품을 보호하기 위해 섬유 성형 포장을 사용)입니다. 그러나 이동의 제한과 안전에 대한 우려에 대응하기 위해 수요가 급증했기 때문에 외식 식품 배달 분야는 최근 크게 확대되고 있습니다. 최근에는 온라인 소비 증가에도 변화가 나타나 시장 성장을 뒷받침할 것으로 기대되고 있습니다.

성형 펄프 포장 산업 개요

성형 펄프 포장 시장은 국내외에 여러 기업이 존재하기 때문에 단편화되고 있습니다. 각 회사는 주로 고객의 요구를 충족하기 위해 맞춤형 솔루션을 제공합니다. 중요한 기업은 시장 실적을 늘리기 위해 제품 출시, 계약, 인수 등 다양한 전략을 사용합니다. 시장의 주요 기업은 Keiding Inc., EnviroPAK Corporation, Huhtamaki Oyj 등입니다.

- 2023년 11월, 핀란드에 본사를 둔 포장 회사 Huhtamaki의 북미 사업부는 100% 재활용 재료로 만든 성형 펄프 계란 판지를 출시했습니다. 이 카톤은 인디애나 주 하몬드의 Huhtamaki 시설에서 제조됩니다.

- 2023년 6월, Sabert Corporation은 섬유 혼합 성형품의 최신 제품 Pulp MaxTM 및 Pulp PlusTM을 발표했습니다. 이러한 환경 친화적 인 패키징 솔루션은 재활용 종이 섬유로 만들어져 식품 용도로 설계되었으며 지속가능성 목표에 따라 친환경 패키징 옵션을 고객에게 제공합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 업계의 규제와 표준

- 생태계 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 재활용 가능하고 친환경 소재에 대한 소비자의 기호

- 플라스틱이나 EPS 포장에 비해 비용 절감의 장점이 크다

- 시장의 과제/억제요인

- 엄격한 정부 규제

제6장 시장 세분화

- 섬유 유형별

- 재활용 섬유

- 버진 섬유

- 제품 유형별

- 트레이

- 그릇 및 컵

- 클램 쉘

- 접시

- 기타 제품 유형

- 최종 사용자별

- 식품 포장

- 푸드서비스 산업

- 가전제품

- 헬스케어

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 아시아

- 호주 및 뉴질랜드

- 중동 및 아프리카

- 라틴아메리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Maspack Ltd

- Enviropak Corporation

- Brodrene Hartmann AS

- Huhtamaki Oyj

- Primeware Solutions(Amercare Royal)

- UFP Technologies Inc.

- Henry Molded Products Inc.

- Keiding Inc.

- Sabert Corporation

- Pacific Pulp Molding Inc.

- Protopak Engineering Corporation

제8장 투자 분석

제9장 시장의 미래

JHS 25.04.07The Molded Pulp Packaging Market size is estimated at USD 5.49 billion in 2025, and is expected to reach USD 7.24 billion by 2030, at a CAGR of 5.66% during the forecast period (2025-2030).

Rapidly growing demand for convenient and sustainable packaging alternatives, ongoing development of molded fiber products that are more competitive as a plastic alternative, and increasing orders from electronics, food packaging, and healthcare sectors are some of the primary drivers of the molded pulp packaging market.

Key Highlights

- As end-user industries such as consumer electronics are witnessing high demand, sustainable packaging products are increasingly used as a protective layer for transporting, benefiting in protection and not causing environmental damage. Moreover, the molded pulp can make several products, such as end caps, clamshell containers, trays, plates, and bowls.

- The expanding egg consumption and production in various economies globally drove the demand for the market studied. In fact, according to PrintWeek, the global consumption of eggs is expected to be nearly 10.3 kg/person by the end of 2030. There is a need to have a sturdy packaging tray that can hold multiple eggs, eventually paving the way for molded pulp packaging.

- Molded pulp packaging offers considerable cost savings that can help corporate sustainability goals. Molded pulp packing costs are kept low using inexpensive and reliable raw materials. As most of the plastic and foam packaging is made from petroleum, the price fluctuates according to changes in oil prices. Natural fibers and post-consumer paper products are used to make molded pulp packaging, which is widely available and affordable.

- Total fiber availability is a concern in the paper industry. Imports increased to 3 million tons, and governments of several countries have adopted import laws and restrictions and increased tariffs and excise levies. Due to a recent container shortage, international liners have raised their prices. The rate for transporting waste papers in a 40-foot container has increased from USD 2,800 to USD 3,600. It was formerly under USD 1,600-1,800.

Molded Pulp Packaging Market Trends

Food Packaging to Hold Significant Market Share

- Molded pulp products are increasingly used in the food-related sector to replace plastics and meet the growing demand for eco-friendly and sustainable products. Applications for the food market are subject to strict standards and must comply with them. In addition to some basic strength specifications, such as tensile and thermal qualities, improved barrier properties are crucial for materials in the food market sector.

- The food packaging products made of molded pulp include clam-shell and takeout meal containers, egg trays and cartons, and fruit, vegetable, berry, and mushroom trays. The majority of the food packaging items on the market utilize trays. Molded paper pulp packing offers the best protection for delicate or fragile goods like eggs. Due to its dependability, the producers and retailers suffer fewer losses and damages. Egg trays are protective packaging and are made using recycled newspapers.

- Molded pulp and fiber trays offer good air permeability and hygroscopic ability, which are essential in egg packaging and storage. Moreover, the demand for trays is predicted to rise due to expected increases in egg and fruit consumption, as well as advantages such as low weight and recyclability. The demand for egg packaging trays is significant. The growing consumption of eggs shows the trend of molded pulp for egg tray packaging. For instance, in Germany, per capita consumption of eggs has increased from 14.40 kilograms in 2021 to 14.60 kilograms in 2023.

- The packaging must have barrier qualities that reduce the exchanges of gases and water vapor between the food and the environment to slow down food's chemical, physical, and microbiological changes. As a result, for materials intended for food-related product packaging, the permeability to water vapor and oxygen are crucial properties to consider.

Asia-Pacific to Witness Significant Growth

- China has been the world's largest importer of wood pulp in recent years, according to the Food and Agriculture Organization (FAO). The country is witnessing a growing demand for molded pulp packaged products for end-users, such as food service, food packaging, healthcare, FMCG, and electronics. It is further expected to drive the developed pulp packaging market.

- The joint proposal from the Reform Commission of China's National Development and the Ministry of Ecology and Environment prohibits the sale of disposable foam tableware, disposable plastic cotton swabs, and the production of daily chemical products containing plastic beads. Under the new situation of widespread implementation of the plastic ban and restriction, pulp molded products will become the main substitute after the "plastic restriction order" due to their excellent environmental protection and degradability.

- The food service disposable industry, which demands virgin pulp for manufacturing packaging products, such as clamshells, trays, cups, etc., that come in close contact with food items, has been experiencing substantial growth over the last few years. In India, most virgin pulp used in food service is derived from non-wood sources, such as bagasse and rice straw. According to Nirmal Bang, India's organized food services industry will reach a market value of over INR 2.3 trillion (USD 28.02 billion) in 2025.

- The significant shift to sustainable packaging, consumer preference for eco-friendly packaging solutions, and environmental and health concerns over how manufacturers pack their products are expected to fuel the growth of the molded pulp packaging market in India.

- Online grocery shopping and co-op food deliveries are Japan's two most significant food delivery segments (which use molded fiber packaging to protect food and groceries from external environment and moisture). However, the restaurant food delivery segment has expanded considerably in recent years as demand soared in response to mobility restrictions and safety concerns. The increase in online spending has seen a shift in recent years, which is expected to aid the market's growth.

Molded Pulp Packaging Industry Overview

The molded pulp packaging market is fragmented due to the presence of several domestic and global players. The companies mainly offer customized solutions to meet customer requirements. Significant players use various strategies, such as product launches, agreements, and acquisitions, to increase their footprints in the market. The key players in the market are Keiding Inc., EnviroPAK Corporation, Huhtamaki Oyj, etc.

- In November 2023, The Huhtamaki North America business unit of Finland-based packaging company Huhtamaki launched molded pulp egg cartons made from 100% recycled materials. The cartons are being made at a Huhtamaki facility in Hammond, Indiana.

- In June 2023, Sabert Corporation unveiled its latest offerings in molded fiber blends: Pulp MaxTM and Pulp PlusTM. These eco-friendly packaging solutions are crafted from recycled paper fibers and designed for food applications, aligning with sustainability goals and providing customers with environmentally responsible packaging choices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Regulations and Standards

- 4.4 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Consumer Preference Toward Recyclable and Eco-friendly Materials

- 5.1.2 Better Benefit of Cost Saving Compared to Plastic and EPS Packaging

- 5.2 Market Challenges/Restraints

- 5.2.1 Stringent Government Rules and Regulations

6 MARKET SEGMENTATION

- 6.1 By Fiber Type

- 6.1.1 Recycled Fiber

- 6.1.2 Virgin Fiber

- 6.2 By Product Type

- 6.2.1 Trays

- 6.2.2 Bowls and Cups

- 6.2.3 Clamshells

- 6.2.4 Plates

- 6.2.5 Other Product Types

- 6.3 By End User

- 6.3.1 Food Packaging

- 6.3.2 Foodservice

- 6.3.3 Consumer Electronics

- 6.3.4 Healthcare

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Middle East and Africa

- 6.4.6 Latin America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Maspack Ltd

- 7.1.2 Enviropak Corporation

- 7.1.3 Brodrene Hartmann AS

- 7.1.4 Huhtamaki Oyj

- 7.1.5 Primeware Solutions (Amercare Royal)

- 7.1.6 UFP Technologies Inc.

- 7.1.7 Henry Molded Products Inc.

- 7.1.8 Keiding Inc.

- 7.1.9 Sabert Corporation

- 7.1.10 Pacific Pulp Molding Inc.

- 7.1.11 Protopak Engineering Corporation