|

시장보고서

상품코드

1537602

디메틸 에테르 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Dimethyl Ether - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

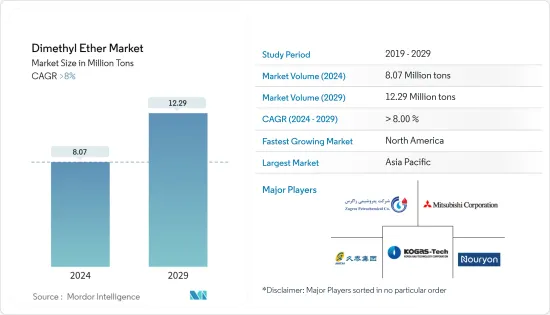

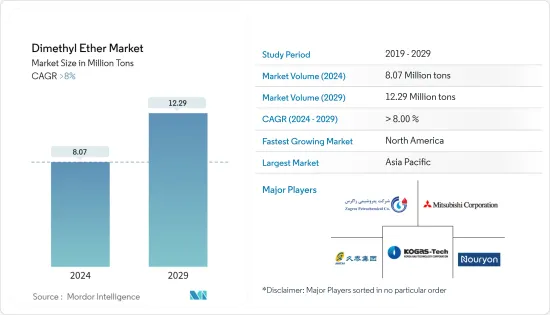

세계의 디메틸 에테르 시장 규모는 2024년 807만 톤으로 추정되고, 2024년부터 2029년까지 예측 기간 동안 CAGR 8% 이상으로 성장할 전망이며, 2029년 1,229만 톤에 이를 것으로 예측됩니다.

COVID-19는 시장에 부정적인 영향을 미쳤으며, 팬데믹 시나리오를 고려하면 사람들의 이동 빈도가 낮아 자동차 부문의 DME 기반 LPG 연료 수요가 감소했습니다. 그러나 봉쇄가 완화 후 산업은 회복되고 연료 수요는 세계적으로 증가하고 있습니다.

주요 하이라이트

- 단기적으로는 LPG 혼합 용도 수요 증가와 비전기자동차 및 전기자동차에 대한 관심 증가가 시장 성장의 원동력이 되고 있습니다.

- DME를 사용하기 위해 현재 인프라를 변경하기 위한 높은 비용 및 EV 사용 증가는 시장 성장 억제요인이 될 수 있습니다.

- 대체 연료로 DME를 사용하기 위한 조사가 증가하고 있으며 시장이 확립되지 않았기 때문에 향후 몇 년동안 시장에 기회가 될 가능성이 높습니다.

- 아시아태평양은 연료, LPG 및 기타에 대한 왕성한 수요를 배경으로 예측 기간 동안 조사된 시장을 독점할 가능성이 높습니다.

디메틸 에테르 시장 동향

시장을 독점하는 LPG 혼합 부문

- 액화 석유 및 가스(LPG)는 디메틸 에테르(DME)의 중요한 용도 중 하나이며, 많은 응용 분야에서 기존 LPG와 미리 지정된 비율로 혼합 할 수 있습니다.

- DME는 대체 연료 첨가제로서 LPG에 혼합되어 연소를 촉진하고 유해한 배출물을 줄이고 LPG에 대한 의존도를 낮춥니다. 현재, DME-LPG 블렌드에는 약 15-25%의 DME가 사용되고 있지만, 보다 우수한 블렌드에는 사용 설비의 변경이 필요할 경우가 있기 때문에 보다 높은 비율의 블렌드가 연구되고 있다 합니다.

- DME는 자동차의 프로판 오토 가스에 사용되는 LPG 블렌드에 사용됩니다. Propane Education and Research Council에 따르면 미국에서는 공인 연료 시스템을 탑재한 LPG 자동차가 26만대 가까이 달리고 있습니다. 그 대부분은 학교 버스, 셔틀 버스, 경찰 차량과 같은 플릿 용도에 사용됩니다.

- 마찬가지로 유럽 대체 연료 관측소(EAFO)에 따르면 헝가리에서 액화 석유 및 가스(LPG) 자동차의 수는 2022년 2만 3,194대가 됩니다. 그러나 2021년 2만 4,141대와 비교하면 가장 적습니다.

- 중국, 인도, 인도네시아와 같은 국가들은 대체 연료로 DME의 사용을 적극적으로 추진하고 있습니다.

- 중국국가통계국에 따르면 중국의 액화석유 및 가스(LPG) 생산량은 2023년 12월에 443만톤으로 2023년 11월 415만톤에 비해 성장세를 기록했습니다.

- 따라서 위의 요인은 향후 몇 년동안 시장에 큰 영향을 미칠 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 디메틸 에테르(DME)는 LPG 혼합, 추진제, 연료 등 다양한 최종 용도에서 아시아태평양이 가장 큰 소비 점유율을 차지합니다. 아시아태평양에서는 중국이 수요의 큰 점유율을 차지하고 있으며, 일본, 한국, 인도 등이 이에 이어집니다.

- 중국은 상업적 규모로 DME 혼합 LPG를 사용하기 시작한 최초의 국가입니다. 중국의 DME 수요의 대부분은 가정용(LPG 혼합 조리 가스 공급용)입니다. 중국에서는 DME 혼합 LPG 제품의 20%가 이 목적으로 사용됩니다.

- Petroleum Planning and Analysis Cell에 따르면 2023년 10월 현재 PSU의 OMC(IOCL, BPCL, HPCL)는 합계 31.54억명의 국내 LPG 고객을 보유하고 있으며, 2만 5,425개의 LPG 판매자가 서비스를 제공합니다.

- 경제산업성에 따르면 2022년 일본의 액화석유 및 가스(LPG) 생산량은 307만 톤입니다.

- 인도네시아는 에너지 수요를 위해 DME 혼합 LPG를 적극적으로 추진하는 또 다른 아시아 국가입니다. Air Products and Chemicals 및 PT Bukit Asam과 같은 기업이 LPG 혼합을 위해 석탄에서 DME를 생산하는 프로젝트를 진행하고 있습니다.

- 따라서 이 지역의 DME 수요는 위의 요인으로 인해 예측 기간 동안 증가할 것으로 예상됩니다.

디메틸 에테르 산업 개요

디메틸 에테르 시장은 부분적으로 통합되어 상위 5개 기업이 큰 점유율을 차지하고 있습니다. 시장의 주요 기업으로는 KOREA GAS CORPORATION, ZPCIR, Jiutai Energy Group, Mitsubishi Corporation, Nouryon 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- LPG 혼합 용도로부터 수요 증가

- 비전기자동차 및 전기자동차에 대한 관심 증가

- 기타

- 억제요인

- DME를 사용하기 위한 현행 인프라의 개조에 드는 높은 비용

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급자의 협상력

- 소비자의 협상력

- 신규 진입의 위협

- 대체 제품 및 서비스 위협

- 경쟁도

제5장 시장 세분화(시장 규모 : 수량 기준)

- 용도별

- 프로펠런트

- LPG 혼합

- 연료

- 기타 용도

- 유래별

- 천연가스

- 석탄

- 바이오 베이스 제품

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 카타르

- 이집트

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 합병, 인수, 합작사업, 제휴 및 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- DME-AEROSOL

- Grillo-Werke AG

- Jiutai Energy Group

- KOREA GAS CORPORATION

- Mitsubishi Corporation

- Nouryon

- Oberon Fuels, Inc.

- PCC Group

- Shell plc

- The Chemours Company

- ZPCIR

제7장 시장 기회 및 향후 동향

- 대체 연료로서의 DME 이용 연구 증가

- 확립되지 않은 시장은 DME 성장의 큰 가능성을 제공

The Dimethyl Ether Market size is estimated at 8.07 Million tons in 2024, and is expected to reach 12.29 Million tons by 2029, growing at a CAGR of greater than 8% during the forecast period (2024-2029).

COVID-19 negatively impacted the market, and considering the pandemic scenario, the demand for DME-based LPG fuel from the automotive segment decreased as people were not traveling frequently. However, after the easing of lockdowns, the industry picked up, and the fuel demand has increased worldwide.

Key Highlights

- Over the short term, the growing demand for LPG blending applications and increasing interest in non-electric and electric vehicles are driving the market growth.

- High costs for altering current infrastructure to use DME and increasing EV use can act as a restraint for the market.

- Growing research for using DME as an alternative fuel and an under-established market will likely create opportunities for the market in the coming years.

- Asia-Pacific is likely to dominate the market studied during the forecast period with robust demand for fuel, LPG, and others.

Dimethyl Ether Market Trends

LPG Blending Segment to Dominate the Market

- Liquefied petroleum gas (LPG) is one of the significant applications of dimethyl ether (DME), which can be blended with traditional LPG at a pre-specified ratio for many applications.

- DME is blended with LPG as an alternative fuel additive for enhancing combustion, reducing hazardous emissions, and reducing dependency on LPG. Currently, around 15-25% of DME is utilized in DME-LPG blends, with higher ratio blends being researched, as a better blend may require equipment changes for usage.

- DME is used for LPG blending that is in Propane autogas in vehicles. According to the Propane Education and Research Council, there are nearly 260,000 on-road LPG vehicles with certified fuel systems in the United States. Many are used in fleet applications, such as school buses, shuttles, and police vehicles.

- Similarly, according to the European Alternative Fuels Observatory (EAFO), the number of liquefied petroleum gas (LPG) vehicles in Hungary will be 23,194 in 2022. However, the number is lowest when compared to 24,141 in 2021.

- Countries like China, India, and Indonesia are aggressively pushing for the use of DME as an alternate fuel, as these countries are highly dependent on imports to meet their local LPG demand.

- According to the National Bureau of Statistics of China, the liquefied petroleum gas (LPG) production output in China was 4.43 million metric tons in December 2023 and registered growth when compared to 4.15 million metric tons in November 2023.

- Therefore, the factors above are expected to impact the market significantly in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the largest consumption share of dimethyl ether (DME) from various end-use applications such as LPG blending, propellants, fuels, and others. In Asia-Pacific, China has a significant share of demand, followed by Japan, South Korea, and India, among others.

- China is the first country to start using DME-blended LPG on a commercial scale. The majority of China's DME demand is from households (for LPG blended cooking gas supply). In China, 20% of DME blended LPG products are used for this purpose.

- According to the Petroleum Planning and Analysis Cell, as of October 2023, PSU OMCs (IOCL, BPCL, and HPCL) together have 31.54 crore active LPG customers in the domestic category whom 25,425 LPG distributors are serving.

- According to the METI (Japan), the production volume of liquified petroleum gas (LPG) in Japan accounted for 3.07 million metric tons in 2022.

- Indonesia is another Asian country aggressively pushing for DME blended LPG for its energy needs. Companies, such as Air Products and Chemicals and PT Bukit Asam, are moving forward with significant projects in the country to produce DME from coal for LPG blending applications.

- Thus, the demand for DME in the region is expected to increase during the forecast period due to the factors mentioned above.

Dimethyl Ether Industry Overview

The dimethyl ether market is partially consolidated, with the top five players accounting for a significant share. Some of the key players in the market include (not in any particular order) KOREA GAS CORPORATION, ZPCIR, Jiutai Energy Group, Mitsubishi Corporation, and Nouryon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from LPG Blending Applications

- 4.1.2 Increasing Interest in Non-Electric and Electric Vehicles

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 High Costs for the Alteration of Current Infrastructure to Use DME

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Propellants

- 5.1.2 LPG Blending

- 5.1.3 Fuel

- 5.1.4 Other Applications

- 5.2 Source

- 5.2.1 Natural Gas

- 5.2.2 Coal

- 5.2.3 Bio-based Products

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 DME-AEROSOL

- 6.4.2 Grillo-Werke AG

- 6.4.3 Jiutai Energy Group

- 6.4.4 KOREA GAS CORPORATION

- 6.4.5 Mitsubishi Corporation

- 6.4.6 Nouryon

- 6.4.7 Oberon Fuels, Inc.

- 6.4.8 PCC Group

- 6.4.9 Shell plc

- 6.4.10 The Chemours Company

- 6.4.11 ZPCIR

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research for Use of DME as an Alternative Fuel

- 7.2 Under Established Market Offers Huge Potential for DME Growth