|

시장보고서

상품코드

1537605

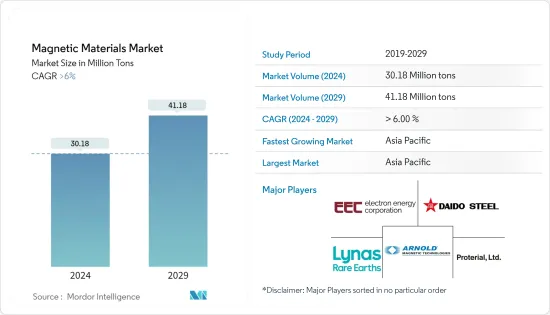

자성 재료 시장 : 점유율 분석, 산업 동향·통계, 성장 예측(2024-2029년)Magnetic Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

세계 자성 재료 시장 규모는 2024년에 3,018만 톤에 이르고, 2024-2029년에 걸쳐 CAGR 6% 이상으로 성장하고, 2029년에는 4,118만 톤에 이를 것으로 예측되고 있습니다.

자성 재료 시장은 COVID-19 팬데믹의 영향을 받아 일부 국가에서 전국적인 봉쇄조치가 취해져 엄격한 사회적 거리를 두는 조치가 취해졌기 때문에 자동차나 전자부품의 생산이 정지되고, 자성 재료 시장에 악영향을 미쳤습니다. 그러나 COVID-19 팬데믹 후에는 대부분의 공업생산시설과 자동차 제조업체가 조업을 재개해 자성재료 시장의 부활로 이어졌습니다. 최근 몇 년동안 자동차, 전자 및 발전 산업 수요 증가로 시장은 큰 성장률을 기록했습니다.

발전산업에서의 자성재료 채용률의 상승과 전자기기 최종사용자 산업에서의 사용량 증가가 현재의 연구시장을 견인할 것으로 예상됩니다.

반면에, 희토류 재료의 추출 비용이 높다는 것은 시장 성장을 방해할 것으로 예상됩니다.

하이브리드 전기자동차에서 자성 재료 수요가 증가함에 따라 예측 기간 동안 시장에 기회를 창출할 것으로 예상됩니다.

아시아태평양이 시장을 독점할 것으로 예상됩니다. 또한 자동차, 일렉트로닉스 및 발전 산업에서 자성 재료 수요가 증가함에 따라 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예상됩니다.

자성 재료 시장 동향

발전 부문 수요 증가

- 자성 재료는 발전 분야에서의 사용이 증가하고 있습니다. 이러한 재료는 발전 및 송전을 위한 모터에 사용됩니다. 자성 재료는 모터, 발전기, 변압기, 액추에이터 등의 장비에 적용됩니다.

- 전기 기계는 단단한 자성 물자로 만들어지고 자속을 공급하는 하나의 주요 기능에 사용됩니다. 아드 자성 재료는 전기 회로로부터의 감자와 고온 하에서의 열 감자를 견디는 높은 보자력을 가지고 있습니다.

- 에너지자원연구소에 따르면 세계발전능력은 2021년 2만 8,520테트라와트시에 비해 2022년에는 2만 9,165테트라와트시와 2.26% 성장률로 등록됐습니다. 이와 같이 발전 능력 증가가 자성 재료 시장을 견인할 것으로 예상됩니다.

- 미국은 발전 능력에 관해서 중국에 이어 2위를 차지하고 있습니다. 2022년에는 미국 유틸리티 규모의 발전시설에서 약 4조 2,430억킬로와트시(kWh)가 발전되었습니다. 이 발전의 약 60%는 화석 연료 인 석탄, 천연 가스, 석유 및 기타 가스 때문입니다.

- 또한 풍력발전소에서는 자성재료 수요가 증가하고 있습니다. 중국은 지난 2년간 풍력 발전 용량을 늘렸습니다. 2022년 중국은 풍력발전소를 증설해 유럽보다 46% 더 풍력발전을 실시했습니다. IEA에 따르면 중국의 육상 풍력 발전은 2022년 30.9GW를 기록했으며 2023년 말에는 59GW에 이를 것으로 예상됩니다.

- 이 때문에 예측기간 중에는 발전용도 분야가 자성재료 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 아시아태평양

- 아시아태평양은 중국과 인도에서 발전 부문이 고도로 발전하고 있는 것 외에도 전자 및 자동차 산업을 발전시키기 위한 투자가 수년간 지속되고 있기 때문에 세계 시장을 독점할 것으로 예상됩니다.

- 또한 아시아태평양의 환경 문제가 증가함에 따라 내연 기관차에 대한 정부의 규제가 강화되고 있습니다. 이 때문에 이 지역에서는 전기자동차의 요구가 높아지고, 다양한 용도에서의 자성 재료의 소비를 지원하고 있습니다.

- 중국에서는 소비자의 배터리 구동 차량에 대한 지향이 높아지면서 자동차 산업이 전환 경향을 보이고 있습니다. 또한 중국 정부는 2025년까지 전기차 생산 보급률이 20%가 될 것으로 예측했습니다. 이는 2022년 과거 최고를 기록한 이 나라의 전기차 판매 동향에 반영되어 있습니다.

- 중국 승용차 협회에 따르면 2022년에 이 나라에서 판매된 EV와 플러그인은 567만대로 2021년에 달성한 판매 대수의 거의 2배입니다. 이 나라에서는 윤활유 첨가제에 대한 요구가 줄어들 것으로 예상되기 때문에 이 시장은 현재의 속도로 판매를 유지할 계획입니다.

- 마찬가지로 인도에서도 온실가스 배출량을 줄이기 위해 전기차에 초점을 맞추었습니다. 정부는 2023년까지 인도의 신차 판매량의 30%를 전기차로 만들겠다고 약속했습니다. 또한 전기차 생산량을 늘리기 위해 다양한 기업들이 국내에 전기차 제조시설을 설립하고 있습니다.

- 예를 들어 Nissan과 Renault는 2023년 2월 승용차와 전기차 시장 점유율을 확대하기 위해 향후 3-5년간 인도에 6억 달러를 투자할 계획을 발표했습니다. 이것은 전기자동차 시장을 밀어 올리고 자성 재료 수요를 촉진합니다.

- 위의 요인들로부터 자성 재료 수요는 예측 기간 동안 이 지역에서 증가할 가능성이 높습니다.

자성 재료 산업 개요

자성 재료 시장은 부분적으로 통합되어 있습니다. 시장의 주요 기업(순부동)에는 Arnold Magnetic Technologies, Daido Steel, Electron Energy Corporation, PROTERIAL, Ltd., Lynas Rare Earths Ltd. 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 발전 산업에 있어서의 자성 재료의 채용 증가

- 일렉트로닉스 분야에서의 용도 확대

- 기타 촉진요인

- 억제요인

- 희토류의 채굴 비용이 높다

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(시장 규모 : 수량 기준)

- 유형

- 경질 자성 재료

- 연자성 재료

- 반경질 자성 재료

- 최종 사용자 산업

- 자동차

- 일렉트로닉스

- 발전

- 산업용

- 기타 최종 사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 합병·인수, 합작 사업, 제휴, 협정

- 시장 점유율(%)/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Adams Magnetic Products

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies

- Electron Energy Corporation

- GKN Powder Metallurgy

- Lynas Rare Earths Ltd.

- Molycorp Inc

- PROTERIAL, Ltd.

- Quadrant.

- Shin-Etsu Chemical Co., Ltd.

- Steward Advanced Materials LLC.

- TDK Corporation

- Tengam

- Toshiba Materials Co., Ltd.

제7장 시장 기회와 앞으로의 동향

- 하이브리드 전기자동차의 자성 재료 수요 증가

- 기타 기회

The Magnetic Materials Market size is estimated at 30.18 Million tons in 2024, and is expected to reach 41.18 Million tons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The magnetic materials market was negatively affected by the COVID-19 pandemic due to nationwide lockdowns in several countries and strict social distancing measures, which resulted in production halts of automotive vehicles and electronic components, thereby affecting the market for magnetic materials. However, post-COVID-19 pandemic, most of the industrial manufacturing facilities and automotive manufacturers resumed their operations, which helped to revive the market for magnetic materials. In recent years, the market registered a significant growth rate due to increasing demand from the automotive, electronics, and power generation industries.

The rising adoption of magnetic materials in the power generation industry and the increasing usage in the electronics end-user industry are expected to drive the current studied market.

On the flip side, the high cost of extracting rare earth materials is expected to hinder the growth of the market.

The rising demand for magnetic materials in hybrid electric vehicles is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to the rising demand for magnetic materials in the automotive, electronics, and power generation industries.

Magnetic Materials Market Trends

Growing Demand from Power Generation Sector

- Magnetic Materials have been increasingly used in the power generation sector. These materials are used in motors to generate power and transmission of electricity. Magnetic materials are applied in equipment such as motors, generators, transformers, and actuators, amongst others.

- Electric machines are made of hard magnetic materials and are used for one primary function, which is to provide magnetic flux. Ard magnetic materials have high coercivity to resist demagnetization from the electric circuit and thermal demagnetization under high operating temperatures.

- According to the Energy and Resource Institute, the global electricity generation capacity is registered at 29,165 tetra watt-hours in the year 2022 at a growth rate of 2.26% as compared to 28,520 tetra watt-hours of electricity generated in the year 2021. Thus, the increasing electricity generation capacity is anticipated to drive the market for magnetic materials.

- The United States occupies second place after China regarding power generation capacity. In 2022, about 4,243 billion kilowatt hours (kWh) of electricity were generated at utility-scale electricity generation facilities in the United States.1 About 60% of this electricity generation was from fossil fuels-coal, natural gas, petroleum, and other gases.

- Furthermore, the demand for magnetic materials is increasing in wind power stations. China added more wind generation capacity in the past two years. In 2022, China generated 46% more wind power than Europe by installing more wind power stations. According to the IEA, the onshore wind electricity generation in China registered at 30.9 GW in 2022, and it is expected to reach 59 GW by the end of 2023.

- Thus, the power generation applications segment is anticipated to dominate the market for magnetic materials during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market owing to the highly developed power generation sector in China and India, coupled with continuous investments in the region to advance the electronics and automotive industry through the years.

- Moreover, the growing environmental issues in the Asia-Pacific region have increased government regulations on combustion engine vehicles. This has increased the need for electric cars in the area, supporting the consumption of magnetic materials in various applications.

- In China, the automotive industry is witnessing switching trends as the consumer inclination toward battery-operated vehicles is higher. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went to a record-breaking high in 2022.

- As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. Anticipating a decline in the nation's need for lubricant additives, the market is poised to sustain sales at the current pace.

- Similarly, in India, the focus is shifting to electric vehicles to reduce greenhouse gas emissions. The government has committed that 30% of the new vehicle sales in India will be electric by 2023. Furthermore, various companies are establishing electric vehicle manufacturing facilities in the country to increase the production volume of electric vehicles.

- For instance, in February 2023, Nissan and Renault announced their plan to invest USD 600 million in India over the next 3-5 years to expand their market share in passenger cars and electric vehicles. It will boost the market for electric vehicles, thereby driving the demand for magnetic materials.

- Due to the factors above, the demand for magnetic materials will likely increase in the region during the forecast period.

Magnetic Materials Industry Overview

The magnetic materials market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Arnold Magnetic Technologies, Daido Steel Co., Ltd, Electron Energy Corporation, PROTERIAL, Ltd., and Lynas Rare Earths Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 The Rising Adaption of Magnetic Materials in Power Generation Industry

- 4.1.2 Increasing Applications in Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost in Extracting Rare Earth Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Hard Magnetic Materials

- 5.1.2 Soft Magnetic Materials

- 5.1.3 Semi-Hard Magnetic Materials

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electronics

- 5.2.3 Power Generation

- 5.2.4 Industrial

- 5.2.5 Other End-user Industries (Consumer Goods, Communication and Technology, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adams Magnetic Products

- 6.4.2 Arnold Magnetic Technologies

- 6.4.3 Daido Steel Co., Ltd.

- 6.4.4 Dexter Magnetic Technologies

- 6.4.5 Electron Energy Corporation

- 6.4.6 GKN Powder Metallurgy

- 6.4.7 Lynas Rare Earths Ltd.

- 6.4.8 Molycorp Inc

- 6.4.9 PROTERIAL, Ltd.

- 6.4.10 Quadrant.

- 6.4.11 Shin-Etsu Chemical Co., Ltd.

- 6.4.12 Steward Advanced Materials LLC.

- 6.4.13 TDK Corporation

- 6.4.14 Tengam

- 6.4.15 Toshiba Materials Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Magnetic Materials in Hybrid Electric Vehicles

- 7.2 Other Opportunities