|

시장보고서

상품코드

1537667

해군 미사일 및 미사일 발사 시스템 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Naval Missiles And Missile Launch Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

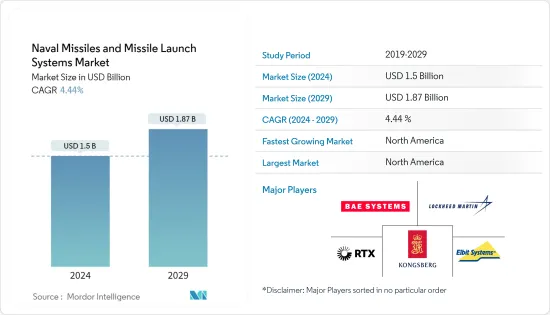

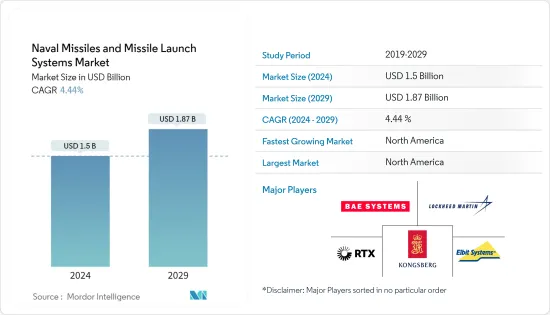

해군 미사일 및 미사일 발사 시스템 시장 규모는 2024년 15억 달러로 추정되며, 2029년에는 18억 7,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029) 동안 4.44%의 CAGR로 성장할 것으로 예상됩니다.

주요 하이라이트

- 남중국해와 지중해에서 국가 간 해양 분쟁이 격화되면서 신형 함정 조달 및 배치에 대한 투자가 촉진되고 있습니다. 해군은 현재 기존 함정을 업그레이드하고 노후화된 함정을 차세대 함정으로 교체하는 등 함정 현대화를 추진하고 있습니다. 신형 함정에 대한 수요 증가는 향후 몇 년 동안 미사일 및 미사일 발사 시스템에 대한 수요를 촉진할 것으로 예상됩니다.

- 또한 세계 각국은 해상과 지상의 위협을 추적하고 무력화하기 위해 위치 기반 유도 시스템을 사용하여 표적을 정확하게 제거할 수 있는 차세대 미사일 시스템 조달에 투자하고 있습니다. 마찬가지로 해군은 수상함정과 잠수함의 미사일 발사 시스템을 현대화하기 위해 노력하고 있습니다. 이는 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다.

- 미사일 시장은 시장 개발에 수반되는 높은 비용으로 인해 한계에 직면할 수 있습니다. 미사일에 필요한 고도의 유도 시스템과 로켓은 복잡한 기술을 필요로 하기 때문에 전체 비용을 증가시킵니다. 또한 미사일은 일단 발사되면 방향을 바꿀 수 없기 때문에 대미사일 시스템에 의한 요격에 취약하여 시장에 부정적인 영향을 미칠 수 있습니다.

- 그러나 군과 해군의 첨단 기술 도입 증가는 시장에 유리한 기회를 가져올 것으로 예상됩니다. 예를 들어, 해군 미사일과 미사일 발사 시스템에 인공지능(AI)을 통합하는 것은 시장 성장을 가속화할 것으로 예상됩니다. 해군 미사일 및 미사일 발사 시스템의 AI는 과거 데이터를 분석하고 다양한 시나리오를 평가하여 해군 사령관에게 향상된 의사 결정 능력을 갖추기 위해 다양한 시나리오를 평가할 수 있습니다. 예측 기간 동안 이 시장의 수요를 촉진하는 것은 검색 요인 또는 둘 다일 것으로 예상됩니다.

해군 미사일 및 미사일 발사 시스템 시장 동향

예측 기간 동안 미사일 부문이 시장 점유율을 독식

- 현재 이 시장에서는 미사일 부문이 시장을 독점하고 있으며, 미사일 발사 시스템에 비해 상대적으로 납품 건수가 많기 때문에 앞으로도 미사일 부문의 지배력이 지속될 것으로 예상됩니다.

- 이 부문의 성장은 세계 주요 국가의 군사비 증가와 다양한 현대화 노력으로 인해 증가할 것으로 예상됩니다. 예를 들어, 2022년 세계 군사비는 2조 2,400억 달러에 달할 것으로 예상되며, 이는 2021년 대비 6% 성장한 수치입니다.

- 이러한 막대한 국방비 투자로 인해 각국은 첨단 순항미사일과 탄도미사일의 무기고가 급속히 확대되고 있으며, 증가하는 함정군에 강화된 공격 능력을 갖추기 위해 노력하고 있습니다. 예를 들어, 인도 국방부는 2023년 12월 인도 해군 수상 플랫폼용 중거리 대함 미사일(MRAShM) 450기의 조달 자금을 승인했으며, MRAShM은 인도 해군의 함정에 탑재되어 주요 공격 무기가 될 경량 지대지 미사일입니다. 이 터보 제트 추진 미사일의 사거리는 약 300km이며 IIR 시커 또는 RF 시커를 장착할 수 있습니다.

- 마찬가지로 2023년 12월 스페인 해군은 콩스버그 디펜스 앤 에어로스페이스(Kongsberg Defense & Aerospace)에 3억 3,400만 달러 규모의 해군 공격 미사일(NSM) 납품 계약을 발주했습니다. 이 미사일은 나반티아가 현재 건조 중인 F-110급 호위함 NSM에 탑재될 예정입니다.

- 또한 일부 국가는 해군 역량을 강화하고 다양한 유형의 해양 위협에 효과적으로 대응하기 위해 인공지능(AI)과 같은 첨단 기술 개발을 추진하고 있습니다. 예를 들어, 이란은 2023년 12월 해군 군함에 아부 마흐디 순항미사일을 장착했다고 발표했습니다. 이 미사일은 인공지능과 공중에서 경로를 변경하는 명령 안내 등의 기술을 탑재하고 있으며, 사거리는 1000km가 넘습니다. 이러한 해군용 신형 미사일의 개발은 예측 기간 동안 이 분야의 성장을 촉진할 것으로 예상됩니다.

예측 기간 동안 북미가 시장 점유율을 독식

- 북미가 시장 점유율을 독식하는 주요 이유는 미국의 막대한 군사비 지출이 해군의 개발 및 조달 프로그램을 뒷받침하고 있기 때문입니다. 예를 들어, 2022년 미국의 국방비는 8,770억 달러로 2021년 대비 9% 성장했습니다.

- 이러한 막대한 국방비를 바탕으로 미국은 주로 해군 및 해병대 함대 현대화에 투자하고 있으며, 균형 잡힌 해군력으로 해양 지배력을 확립하고 유지하며 모든 영역에서 살상력을 강화하는 것을 목표로 하고 있습니다. 이러한 조달 프로그램은 전 세계 해양 환경의 복잡해지는 위협에 대응하기 위해 시행되고 있습니다.

- 예를 들어, 미 해군은 2024년 예산요구안의 일환으로 9척의 전투함 조달을 위해 328억 달러를 투자할 계획입니다. 이 요청에는 콜롬비아급 잠수함 2척, 블록 V 버지니아급 고속 공격형 잠수함 2척, 미래형 SSN 4척, 얼레이 버크급 구축함 2척, 컨스텔레이션급 유도 미사일 호위함 2척에 대한 선행 조달 자금이 포함되어 있습니다.

- 이러한 강력한 해군 함대 및 유도 프로그램은 새로운 첨단 미사일 시스템에 대한 수요를 창출할 것으로 예상됩니다. 예를 들어, 2024년 예산안에서 미 해군은 해군 공격 미사일(NSM) 13기, 표준 미사일-6(SM-6) 125기, RAM 블록 II 미사일 120기, 진화형 시스패로우 미사일(ESSM) 147기, 해병대는 NSM 미사일 90기, 블록 V 전술 미사일(Block V) 34기를 조달할 계획입니다. 토마호크(TACTOM) 미사일을 조달할 계획을 발표했습니다.

해군 미사일 및 미사일 발사 시스템 산업 개요

해군 미사일 및 미사일 발사 시스템 시장은 소수의 기업이 시장 대부분을 점유하고 있어 통합되어 있습니다. 해군 미사일 및 미사일 발사 시스템 시장의 주요 기업으로는 RTX Corporation, Lockheed Martin Corporation, BAE Systems plc, Elbit Systems Ltd, Kongsberg Gruppen ASA 등이 있습니다.

RTX Corporation은 전 세계 해군에 미사일 시스템을 공급하는 대기업입니다. 국제적인 기업 외에도 국방연구개발기구(DRDO), ROKETSAN A.S. 등 시장 개척을 추진하고 있는 국내 기업들도 많습니다. 현재 각국에서 국산 방산장비의 개발이 중요시되고 있어, 시장 개척에 있어 국내 기업의 존재감이 더욱 커질 것으로 예상됩니다. 또한, 시장 점유율을 확대하기 위해 각 업체들은 전 세계 군대를 위해 함정에 탑재할 새로운 미사일 시스템을 개발하고 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 시스템별

- 미사일

- 발사 시스템

- 용도별

- 수상함

- 잠수함

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트

- 사우디아라비아

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 상황

- 벤더 시장 점유율

- 기업 개요

- Lockheed Martin Corporation

- RTX Corporation

- Elbit Systems Ltd.

- MBDA

- Kongsberg Gruppen ASA

- Saab AB

- Rafael Advanced Defense Systems Ltd.

- BAE Systems plc

- ROKETSAN A.S.

- Rostec State Corporation

- IAI

- Defense Research and Development Organization(DRDO)

제7장 시장 기회와 향후 동향

ksm 24.08.29The Naval Missiles And Missile Launch Systems Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 4.44% during the forecast period (2024-2029).

Key Highlights

- The growing maritime disputes in the South China Sea and the Mediterranean Sea among various countries are propelling the investments towards procurement and deployment of new naval vessels. The naval forces are currently modernizing their naval fleet by upgrading their existing naval fleets or replacing their aging fleets with newer-generation vessels. The growing demand for new naval vessels is expected to propel the demand for missile and missile launch systems in the coming years.

- Various countries globally are also investing in the procurement of new-generation missile systems that can precisely eliminate the targets using a position-based guidance system to track and neutralize seaborne and ground-based threats. Similarly, the naval forces are also modernizing the missile firing systems on surface ships and submarines. This is anticipated to drive the growth of the market during the forecast period.

- The market for missiles may face limitations due to the high cost associated with their development. The sophisticated guidance systems and rockets required for missiles necessitate complex technologies that add to their overall expense. Furthermore, the inability of missiles to change direction once launched can make them susceptible to interception by anti-missile systems, which could have an adverse impact on the market.

- However, the increasing implementation of advanced technologies in military and naval forces is expected to bring forth a lucrative opportunity in the market. For instance, the integration of artificial intelligence (AI) in naval missiles and missile launch systems is anticipated to accelerate market growth. AI in naval missiles and missile launch systems is capable of analyzing historical data and assessing various scenarios to equip naval commanders with enhanced decision-making capabilities. Search factors or expected to drive the demand for this market during the forecast period.

Naval Missiles and Missile Launch Systems Market Trends

Missiles Segment To Dominate Market Share During the Forecast Period

- The missiles segment of the market currently dominates the market and is expected to continue its dominance primarily due to their relatively higher deliveries compared to missile launching systems.

- The growth of this segment is expected to increase due to rising military expenditure and various modernization efforts by major global powers. For instance, in 2022, the global military expenditure reached USD 2,240 billion; this was a growth of 6% from the year 2021.

- With this huge investment in defense expenditure, various countries are rapidly expanding their arsenal of advanced cruise and ballistic missiles to equip their growing naval vessel fleet with enhanced attack capabilities. For instance, in December 2023, the Indian MoD approved the funds for the procurement of 450 Medium Range Anti-Ship Missiles (MRAShM) for surface platforms of the Indian Navy. The MRAShM is a lightweight Surface-to-Surface Missile that will be equipped onboard Indian Naval Ships as a primary offensive weapon. The turbojet-propelled missile will have a range of about 300 km, and it can be equipped with an IIR seeker or RF seeker.

- Similarly, in December 2023, the Spanish Navy awarded a USD 334 million contract to Kongsberg Defence & Aerospace to deliver Naval Strike Missiles (NSM). The missiles are planned to be equipped with NSM, a F-110 class frigate, which is currently under construction by Navantia.

- Furthermore, several nations are making progress in developing cutting-edge technologies like artificial intelligence (AI) to enhance their naval capabilities and effectively respond to different types of maritime threats. For instance, in December 2023, Iran announced that it had equipped its naval warships with Abu Mahdi cruise missiles. These missiles feature technologies such as artificial intelligence and command guidance for changing their course mid-air with a range of over 1,000 kilometers. Such developments of new naval missiles for the naval forces are anticipated to drive the growth of the segment during the forecast period.

North America to Dominate Market Share During the Forecast Period

- The North American region dominates market share primarily due to the large military spending of the United States, which in turn supports the development and procurement programs for naval forces. For instance, in 2022, the US military defense expenditure rose to USD 877 billion, with a growth of 9% compared to 2021.

- With this huge defense spending, the US is investing in naval fleet modernization of the Navy and Marine Corps primarily to establish and maintain maritime dominance with a balanced naval force and by employing increased lethality across all domains. These procurement programs are carried out to address increasingly complex threats in the global maritime environment.

- For instance, as part of the FY2024 proposed budget request, the US Navy plans to invest USD 32.8 billion for the procurement of nine battle force ships. The request includes funds for the second Columbia class submarine, two Block V Virginia class fast attack submarines, and advance procurement funds for four future SSNs, two Arleigh Burke-class destroyers, and two Constellation class guided missile frigates.

- With this robust naval fleet and induction programs, it is anticipated to generate demand for new advanced missile systems. For instance, in the FY2024 budget document, the US Navy announced that it plans to procure 13 Naval Strike Missile (NSM) missiles, 125 Standard Missile-6 (SM-6), 120 RAM Block II missiles, 147 Evolved Sea Sparrow Missile (ESSM) and the Marine Corps will procure 90 NSM missiles and 34 Block V Tactical Tomahawk (TACTOM) missiles.

Naval Missiles and Missile Launch Systems Industry Overview

The market of naval missiles and missile launch systems is consolidated with very few players accounting for the majority share in the market. Some of the prominent players in the naval missiles and missile launch systems market are RTX Corporation, Lockheed Martin Corporation, BAE Systems plc, Elbit Systems Ltd., and Kongsberg Gruppen ASA.

RTX Corporation is a major provider of missile systems to naval forces around the world. In addition to the international, there are many local players in the market, such as the Defence Research and Development Organisation (DRDO) and ROKETSAN A.S., among others. Currently, the increasing emphasis on developing local defense equipment in various countries is expected to strengthen local players' presence in the market. Further to increase their share in the market, the companies are developing new missile systems onboard naval vessels for the armed forces around the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Systems

- 5.1.1 Missiles

- 5.1.2 Launch Systems

- 5.2 Application

- 5.2.1 Surface Vessels

- 5.2.2 Submarines

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lockheed Martin Corporation

- 6.2.2 RTX Corporation

- 6.2.3 Elbit Systems Ltd.

- 6.2.4 MBDA

- 6.2.5 Kongsberg Gruppen ASA

- 6.2.6 Saab AB

- 6.2.7 Rafael Advanced Defense Systems Ltd.

- 6.2.8 BAE Systems plc

- 6.2.9 ROKETSAN A.S.

- 6.2.10 Rostec State Corporation

- 6.2.11 IAI

- 6.2.12 Defense Research and Development Organization (DRDO)