|

시장보고서

상품코드

1911312

포장 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

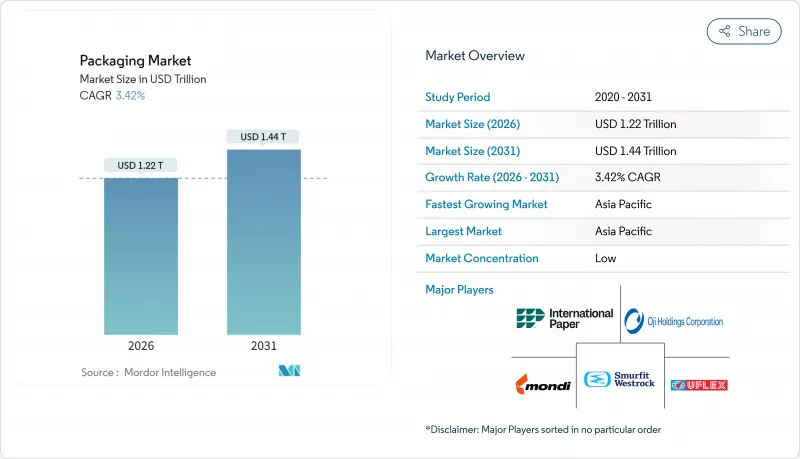

2026년 세계의 포장 시장의 규모는 1조 2,203억 6,000만 달러로 평가되었고, 2025년 1조 1,800억 달러에서 성장하여, 2031년에는 1조 4,439억 달러에 이를 것으로 예측됩니다.

2026년부터 2031년까지는 CAGR 3.42%로 확대될 전망입니다.

이 꾸준한 확대는 순환 경제의 의무와 관련된 규제 비용과 순수한 비용 성과 지표보다 지속가능성을 중시하는 소비자의 기대 변화를 흡수하면서 세계의 포장 시장이 계속 성숙하고 있음을 보여줍니다. 포장이 식품 및 음료, 의약품, EC 채널에 있어서 대체 불가능한 보호 기능, 브랜드 구축 기능 및 컴플라이언스 기능을 제공하면서 수요의 회복력이 높아지고 있습니다. 아시아태평양은 대규모 제조에 의해 자본 집약도를 낮게 억제하는 한편, 선진 지역에서는 고도의 재활용 기술, 단일 재료 필름 및 디지털 인쇄 기술에 대한 투자가 진행되어 거의 실시간 SKU 투입을 가능하게 하고 있습니다. 한편, 전자상거래 소포 증가, 일회용 플라스틱 규제금지, 그리고 기업의 지속가능성 목표는 경량 재료, 바이오 원료, 주문형 맞춤형 플랫폼으로의 자본 유입을 촉진하고 있습니다. 차별화를 목표로 하는 브랜드는 추적성, 소비자 참여, 진화하는 확대 생산자 책임(EPR) 방식을 준수하는 데 도움이 되는 디지털 식별자를 통합하는 경우가 증가하고 있습니다.

세계의 포장 시장의 동향 및 인사이트

지속가능성 연동형 조달 노력이 재료 혁신을 추진

기업 정책은 현재 재생 재질 함량과 재활용 가능성을 명시하고 분자 재활용 플랜트 및 바이오베이스 수지에 대한 투자를 가속화하고 있습니다. 에스티 로더는 2024년 '5개의 R' 포장 프레임워크에서 71%의 적합률을 달성했으며, 프리미엄 브랜드가 지속가능성 스토리를 수익화하는 방법을 제시했습니다. 조달 부서는 탄소 재활용 가능성 지표를 공급업체 스코어 카드에 통합하고 있으며, 이러한 동향은 재활용이 어려운 형태에 부과될 예정인 EPR 비용과 일치합니다. 플라스틱 재활용 협회(APR)의 '재활용 설계 가이드라인'과 같은 인증 프로그램은 개발 사이클을 단축하는 기술적 청사진을 제공합니다. 그 결과, 수지 공급업체는 탈중합 장치를 확대하여 PET와 폴리아미드를 버진 등급 원료로 변환하여 가공업자가 보존 기간을 손상시키지 않고 재생재 함량 목표를 달성할 수 있도록 하고 있습니다. 투자자들은 경영진의 보너스를 포장 환경 부하 저감과 연동시키는 기업을 평가하고 지속 가능한 재료의 도입을 더욱 제도화하고 있습니다.

전자상거래 소포량 급증이 보호포장을 변혁

도시의 풀필먼트 센터에서는 종래의 매장 배송보다 많은 취급 공정을 거치는 단품 주문이 수십억 건 가량 출하되어, 손상에 대한 방지 요구가 높아지고 있습니다. 아마존의 AI 구동 포장 라인 최적화는 플라스틱 에어 필로우의 95%를 제품 무결성을 유지하면서 수거 재활용성을 높이는 종이 완충재로 대체했습니다. 자동화된 맞춤 가공 기계는 주문당 골판지 공백을 재단하고 물자 사용량을 최대 30% 절감하는 동시에 체중 중량 요금을 대폭 저감합니다. 이러한 유통량의 변화에 의해 개봉용 스트립과 반송용 씰을 일체화한 경량 플렉서블 메일러의 수요가 높아지고 있습니다. 디지털 인쇄기는 소량의 그래픽을 인쇄하여 개봉 시의 브랜드 경험을 강화합니다. 그 결과, 데이터 분석과 가공 설비를 통합하는 컨버터는 확대하는 전자상거래 시장에서 점유율을 획득하고 있습니다. 한편, 종래의 대량 출하업자는 새로운 성형 및 밀봉 기술을 도입하여 공장을 개조하고 있습니다.

원유 가격 변동이 수지 예산에 영향

폴리에틸렌, 폴리프로필렌, PET의 가격은 브렌트 원유와 강하게 연동되어 분기 계약을 맺는 컨버터에게 예측 불가능한 마진 변동을 일으킵니다. 2024년에 배럴당 10달러의 급등이 발생하여 4주 이내에 수지의 추가 요금이 2자리 상승하고 헤지 수단이 없는 소규모 압출 제조업체에 부담이 걸렸습니다. 브랜드 소유자는 고정 가격 계약을 요구하고 비용 위험을 다운스트림으로 전가했기 때문에 컨버터는 다른 가격 곡선에 따른 재생재의 사용을 요구받고 있습니다. 또한 디젤 연료 가격 상승으로 수송비와 화학 원료비가 증가했기 때문에 판지 가격도 상승했습니다. 이러한 변동성으로 인해 자본은 지역 수지 공급업체를 향하고 공급망이 단축됩니다. 그러나 식품 등급 용도에 필요한 고순도 rPET 펠릿의 공급 능력 부족 현상은 여전히 남아 있습니다.

부문 분석

플라스틱 포장은 범용성, 씰링 속도 및 비용 효율성의 강점으로 2025년 세계의 포장 시장 점유율의 41.55%를 유지했습니다. 그러나 규제 당국과 브랜드가 석유 유래 소재보다 재생 가능 섬유를 우선시하는 가운데 종이 포장의 2031년까지의 CAGR 4.47%는 세계의 포장 시장 전체의 성장을 웃돌고 있습니다. 냉동고에서 전자레인지까지의 사이클을 견디는 장벽 코팅 기술의 발전으로 종이 포장에 대한 세계 시장 규모는 확대되는 추세에 있습니다. 골판지 가공업자는 디지털 싱글패스 인쇄기에 투자를 진행하여 소매점이 추가 디스플레이 트레이를 생략할 수 있는 진열 그래픽을 실현하고 있습니다. 재료 대체의 움직임은 발포 폴리스티렌을 섬유 용기로 대체하는 패스트 푸드 분야와 배향성 폴리 프로파일렌에서 재생 가능한 코트지로 이행하는 과자류의 멀티 팩 분야에서 가속하고 있습니다.

경질 플라스틱 분야에서는 기계적 재활용에 대응하는 단일 재료 PET 단지와 HDPE 병의 혁신에 의해 견인력을 유지하고, 소스, 유제품 및 가정용품 분야에서의 점유율을 유지합니다. 유연성 플라스틱 필름은 경량성과 변조 방지 씰의 특성으로 인해 전자상거래에서 보급되고 있습니다. 한편, 금속캔은 항공우주 및 자동차 수요와 포장 수요가 경쟁해 밸류체인의 한계에 직면하여 비용 압력이 증가하고 있습니다. 유리는 고급 음료 분야에서 틈새 역할을 유지하면서 에너지 가격 급등의 영향을 받아 경량화가 촉진되고 있습니다. 섬유 분야에서는 표백 폴리에틸렌 코팅 카톤을 대체하는 고성능 라이너 보드의 생산 확대에 따라 성장이 계속되어 세계의 포장 시장 내에 새로운 가치 창출의 기회가 탄생하고 있습니다.

지역별 분석

아시아태평양의 39.72%라는 점유율은 세계 최고 수준의 제조업 집적도에 더해 가처분 소득 증가에 따른 포장 식품 및 음료, 퍼스널케어 제품의 소비 확대를 반영하고 있습니다. 중국은 유연한 필름 압출 능력으로 주도적 입장에 있으며 인도의 블리스터 포장 생산량은 증가하는 의약품 수요와 아프리카에 대한 수출에 대응하고 있습니다. 일본이나 한국 등의 성숙 시장에서는 고정밀 가공 기술, 항균 코팅, 디지털 장식 기술에 의한 부가가치 창출이 진행되고 있습니다. 인도네시아와 베트남에서는 전자기기 수출 거점 수요를 지원하기 위해 골판지 공장을 확대하여 견조한 판지 수요를 견인하고 있습니다.

유럽은 에코디자인 분야에서 주도권을 유지하고 PPWR(포장 폐기물 규제)에 기반한 의무화를 통해 원료 절감형 및 재활용 가능 솔루션을 촉진하고 있습니다. 독일의 폐루프 PET 시스템은 회수율을 98% 가까이 달성하여 다른 회원국의 모범 사례가 되고 있습니다. 프랑스와 이탈리아에서는 재사용 수지 이용을 요금 할인으로 장려하는 생산자 책임 제도를 확대 중입니다. 동유럽은 임금 경쟁력과 EU 시장에의 근접성을 양립하는 연질 포장에 대한 투자를 유치해 컨버터 기업에 비용 및 컴플라이언스면의 우위성을 가져오고 있습니다.

북미에서는 성숙한 소비가 안정적인 대체 수요를 견인하는 한편, 옴니채널 대응 분야에서 성장의 조짐을 볼 수 있습니다. 미국의 가공업자는 로봇 기술로 골판지 공장을 자동화해 아마존의 '프러스트레이션 프리' 가이드라인에 준거한 손상 없는 배송을 실현하고 있습니다. 캐나다의 보증금 제도는 고품질 유리 재활용을 지원하고 수제 음료 충전업자에게 공급하고 있습니다. 멕시코의 수지 공장은 국내 시장과 미국 시장 모두에 공급하여 공급 충격을 헤지합니다.

중동 및 아프리카에서는 사우디아라비아와 UAE의 경제 다각화에 따라 성장이 가속화되고 있습니다. 신흥 메가시티에서는 고급 1차 및 2차 포장을 필요로 하는 현대적인 소매 형태가 대두하고 있습니다. 남아프리카는 회수 인프라 정비에 의해 재생 PET(rPET) 공급이 확보되어, 지역의 병 순환 시스템을 뒷받침하고 확대하는 세계의 포장 시장에서 순환형 실천을 보여주고 있습니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 지속가능한 연동형 조달 헌신

- 전자상거래 소포 취급량의 급증

- 브랜드의 단일 재료 필름으로의 이행

- 일회용 플라스틱에 대한 규제상의 금지 조치

- 현장 디지털 인쇄에 의한 SKU의 다양화

- 스마트하고 연결 가능한 포장(IoT, QR 코드, NFC 대응 솔루션)의 도입

- 억제요인

- 원유 가격의 변동이 수지 비용에 영향을 미침

- 선진국의 플라스틱 제품에 대한 반감 증가

- 알루미늄 캔용 시트 공급 부족

- 유리용기용 용광로의 에너지 가격 상승

- 업계 밸류체인 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 공급자의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 거시경제 요인이 시장에 미치는 영향

제5장 시장 규모 및 성장 예측

- 포장 유형별

- 플라스틱 포장

- 유형별

- 경질 플라스틱 포장

- 재료 유형별

- 폴리프로필렌(PP)

- 폴리에틸렌테레프탈레이트(PET)

- 폴리염화비닐(PVC)

- 폴리스티렌(PS) 및 발포 폴리스티렌(EPS)

- 기타 재료 유형

- 제품 유형별

- 병 및 단지

- 뚜껑 및 마개

- 트레이 및 용기

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 음료

- 의약품

- 화장품 및 퍼스널케어

- 산업

- 기타 최종 이용 산업

- 재료 유형별

- 연질 플라스틱 포장

- 재료 유형별

- 폴리에틸렌(PE)

- 2축 연신 폴리프로필렌(BOPP)

- 캐스팅 폴리프로필렌(CPP)

- 기타 재료 유형

- 제품 유형별

- 파우치 및 백

- 필름 및 랩

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 음료

- 의약품

- 화장품 및 퍼스널케어

- 산업

- 기타 최종 이용 산업

- 재료 유형별

- 경질 플라스틱 포장

- 제품 유형별

- 병 및 단지

- 파우치 및 백

- 벌크 등급 제품

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 음료

- 화장품 및 퍼스널케어

- 의약품

- 산업

- 기타 최종 이용 산업

- 유형별

- 종이 포장

- 제품 유형별

- 접이식 골판지 상자

- 골판지 상자

- 액체용 판지

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 음료

- 전자상거래

- 기타 최종 이용 산업

- 제품 유형별

- 용기용 유리

- 색별

- 그린

- 앰버

- 플린트

- 기타 색상

- 최종 이용 산업별

- 식품

- 음료

- 알코올 음료

- 무알코올 음료

- 퍼스널케어 및 화장품

- 의약품(바이알 및 앰풀 제외)

- 향수

- 색별

- 금속캔 및 용기

- 재료 유형별

- 강철

- 알루미늄

- 제품 유형별

- 캔

- 드럼캔 및 배럴

- 뚜껑 및 마개

- 기타 제품 유형

- 최종 이용 산업별

- 식품

- 음료

- 화학제품 및 석유

- 산업

- 도료 및 코팅

- 기타 최종 이용 산업

- 재료 유형별

- 플라스틱 포장

- 포장 형태별

- 경질

- 연질

- 최종 이용 산업별

- 식품

- 음료

- 의약품 및 의료

- 퍼스널케어 및 화장품

- 산업

- 전자상거래

- 기타 최종 이용 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 멕시코

- 기타 남미

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 폴란드

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 태국

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amcor plc

- International Paper Company

- Smurfit WestRock

- Ball Corporation

- Crown Holdings Inc.

- Mondi plc

- Oji Holdings Corporation

- UFlex Limited

- Huhtamaki Oyj

- Sealed Air Corporation

- Greif Inc.

- Sonoco Products Company

- AptarGroup Inc.

- ALPLA Group GmbH

- OI Glass Inc.

- Verallia SE

- Vidrala SA

- Gerresheimer AG

- Vitro SAB de CV

- Ardagh Group SA

- CANPACK SA

- Silgan Holdings Inc.

- AGI Glaspac

- Packman Packaging Pvt. Ltd.

- Tetra Pak International SA

제7장 시장 기회 및 미래 전망

CSM 26.01.23The global packaging market size in 2026 is estimated at USD 1,220.36 billion, growing from 2025 value of USD 1,180 billion with 2031 projections showing USD 1,443.9 billion, growing at 3.42% CAGR over 2026-2031.

This steady expansion demonstrates how the global packaging market continues to mature while absorbing regulatory costs linked to circular-economy mandates and shifting consumer expectations that favor sustainability over pure cost-performance metrics. Demand resilience arises from packaging's irreplaceable protection, brand-building, and compliance functions across food, beverage, pharmaceuticals, and e-commerce channels. Asia-Pacific keeps capital intensity low through large-scale manufacturing, whereas developed regions invest in advanced recycling, mono-material films, and digital printing that enable near-real-time SKU launches. Meanwhile, e-commerce parcel growth, regulatory bans on single-use plastics, and corporate sustainability targets reinforce capital flows toward lighter materials, bio-based feedstocks, and on-demand customization platforms. Brands pursuing differentiation increasingly embed digital identifiers that support traceability, consumer engagement, and compliance with evolving extended producer responsibility (EPR) schemes.

Global Packaging Market Trends and Insights

Sustainability-Linked Purchasing Commitments Drive Material Innovation

Corporate mandates now specify minimum recycled content and confirmed recyclability, accelerating investment in molecular recycling plants and bio-based resins. Estee Lauder reached 71% compliance with its "5 Rs" packaging framework in 2024, illustrating how premium brands monetize sustainability narratives. Procurement teams embed carbon and recyclability metrics into supplier scorecards, a trend that aligns with forthcoming EPR fees that penalize hard-to-recycle formats. Certification programs such as the Association of Plastic Recyclers' design-for-recycling guidelines supply technical blueprints that shorten development cycles. As a result, resin suppliers scale depolymerization units that return PET and polyamide to virgin-grade feedstock, letting converters hit recycled-content targets without compromising shelf life. Investors reward companies that link executive bonuses to packaging footprint reductions, further institutionalizing sustainable-material adoption.

E-Commerce Parcel Volume Explosion Reshapes Protective Packaging

Urban fulfillment centers ship billions of single-item orders that face more handling steps than traditional store deliveries, heightening damage-prevention needs. Amazon's AI-driven pack-line optimization removed 95% of plastic air pillows, substituting paper cushioning that maintains product integrity and improves curbside recyclability. Automated right-sizing machinery now cuts custom corrugated blanks per order, trimming material use by up to 30% while slashing dimensional-weight fees. These volume dynamics elevate demand for lightweight flexible mailers with integrated tear strips and return seals. Digital presses print small-batch graphics that reinforce brand storytelling during unboxing. Consequently, converters capable of integrating data analytics with converting assets capture growing e-commerce wallet share, while traditional bulk shippers retrofit plants with new forming and sealing technologies.

Crude-Oil Price Volatility Impacts Resin Budgets

Polyethylene, polypropylene, and PET prices correlate strongly with Brent crude, creating unpredictable margin swings for converters on quarterly contracts. Sudden USD 10 per-barrel spikes in 2024 translated into double-digit resin surcharges inside four weeks, straining small extruders that lack hedging tools. Brand owners demanded fixed-price agreements, shifting cost risk downstream and prompting converters to accelerate recycled-content usage that follows a different price curve. Paperboard prices also climbed because higher diesel rates elevated transport costs and chemical inputs. The volatility steers capital toward regional resin suppliers and shortens supply chains, although capacity gaps persist in high-purity rPET pellets needed for food-grade applications.

Other drivers and restraints analyzed in the detailed report include:

- Brand-Owner Shift to Mono-Material Films Simplifies Recycling

- Regulatory Bans on Single-Use Plastics Accelerate Alternatives

- Rising Anti-Plastic Sentiment Shapes Brand Decisions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic packaging retained 41.55% of the global packaging market share in 2025 on the strength of its versatility, sealing speed, and cost efficiency. Yet paper packaging's 4.47% CAGR through 2031 outpaces overall global packaging market growth as regulators and brand charters privilege renewable fiber over petroleum-based substrates. The global packaging market size allocated to paper formats widens, supported by barrier coatings that now survive freezer-to-microwave cycles. Corrugated converters invest in digital single-pass presses that enable shelf-ready graphics, letting retailers skip additional display trays. Material substitution accelerates in quick-service food, where fiber bowls replace expanded polystyrene, and in confectionery multipacks that migrate from oriented polypropylene to recyclable coated paper.

The rigid plastics segment preserves traction via innovations in mono-material PET jars and HDPE bottles compatible with mechanical recycling, sustaining share in sauces, dairy, and home-care. Flexible plastic films enjoy e-commerce tailwinds owing to their low weight and tamper-evident seals. Meanwhile, metal cans face supply-chain limits as aerospace and automotive demand collide with packaging orders, driving cost pressure. Glass maintains niche roles in premium beverages but absorbs energy-price shocks that encourage light-weighting. Fiber growth continues as mills ramp high-performance linerboards capable of replacing bleached polyethylene-coated cartons, creating new value pools inside the global packaging market.

The Packaging Market Report is Segmented by Packaging Type (Plastic Packaging, Paper Packaging, Container Glass, Metal Cans and Containers), Packaging Format (Rigid, Flexible), End-Use Industry (Food, Beverage, Pharmaceuticals and Healthcare, Personal Care and Cosmetics, Industrial, E-Commerce), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 39.72% share reflects unparalleled manufacturing density plus rising disposable incomes that expand packaged food, beverage, and personal-care consumption. China dominates flexible film extrusion capacity, while India's blister-pack output meets growing pharmaceutical demand and exports to Africa. Mature markets like Japan and South Korea add value through high-precision converting, antimicrobial coatings, and digital embellishment. Indonesia and Vietnam scale corrugated plants to support electronics export hubs, fueling steady cartonboard demand.

Europe maintains leadership in eco-design, leveraging PPWR-driven mandates that incentivize source-reduced and recyclable solutions. Germany's closed-loop PET system achieves collection rates near 98%, offering a blueprint for other member states. France and Italy expand producer-responsibility schemes that reward post-consumer resin usage with fee discounts. Eastern Europe attracts flexible-packaging investments that balance wage competitiveness with EU market proximity, giving converters cost and compliance advantages.

North America's mature consumption drives consistent replacement demand, yet growth pockets emerge in omnichannel fulfillment. U.S. converters automate corrugated factories with robotics, meeting Amazon Frustration-Free guidelines for damage-free delivery. Canada's deposit systems support high-quality glass recycling that supplies craft beverage fillers, while Mexico's resin plants feed both domestic and U.S. markets, hedging against supply shocks.

Middle East and Africa accelerates as Saudi Arabia and UAE diversify economies; new megacities attract modern retail formats requiring sophisticated primary and secondary packaging. South Africa's collection infrastructure upgrades enable rPET availability, feeding regional bottle loops and embedding circular practices into the expanding global packaging market.

- Amcor plc

- International Paper Company

- Smurfit WestRock

- Ball Corporation

- Crown Holdings Inc.

- Mondi plc

- Oji Holdings Corporation

- UFlex Limited

- Huhtamaki Oyj

- Sealed Air Corporation

- Greif Inc.

- Sonoco Products Company

- AptarGroup Inc.

- ALPLA Group GmbH

- O-I Glass Inc.

- Verallia SE

- Vidrala S.A.

- Gerresheimer AG

- Vitro S.A.B. de C.V.

- Ardagh Group S.A.

- CANPACK S.A.

- Silgan Holdings Inc.

- AGI Glaspac

- Packman Packaging Pvt. Ltd.

- Tetra Pak International S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability-linked purchasing commitments

- 4.2.2 E-commerce parcel volume explosion

- 4.2.3 Brand-owner shift to mono-material films

- 4.2.4 Regulatory bans on single-use plastics

- 4.2.5 On-site digital print enabling SKU proliferation

- 4.2.6 Adoption of smart and connected packaging (IoT, QR, NFC-enabled solutions)

- 4.3 Market Restraints

- 4.3.1 Crude-oil price volatility impacting resin costs

- 4.3.2 Rising anti-plastic sentiment in developed economies

- 4.3.3 Aluminum can sheet supply tightness

- 4.3.4 Container-glass furnace energy inflation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 The Impact of Macroeconomic Factors on the Market

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Plastic Packaging

- 5.1.1.1 By Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.1.1.1 Polypropylene (PP)

- 5.1.1.1.1.1.2 Polyethylene Terephthalate (PET)

- 5.1.1.1.1.1.3 Polyvinyl Chloride (PVC)

- 5.1.1.1.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.1.1.1.5 Other Material Types

- 5.1.1.1.1.2 By Product Type

- 5.1.1.1.1.2.1 Bottles and Jars

- 5.1.1.1.1.2.2 Caps and Closures

- 5.1.1.1.1.2.3 Trays and Containers

- 5.1.1.1.1.2.4 Other Product Types

- 5.1.1.1.1.3 By End-use Industry

- 5.1.1.1.1.3.1 Food

- 5.1.1.1.1.3.2 Beverage

- 5.1.1.1.1.3.3 Pharmaceutical

- 5.1.1.1.1.3.4 Cosmetics and Personal Care

- 5.1.1.1.1.3.5 Industrial

- 5.1.1.1.1.3.6 Other End-use Industries

- 5.1.1.1.1.1 By Material Type

- 5.1.1.1.2 Flexible Plastic Packaging

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.2.1.1 Polyethylene (PE)

- 5.1.1.1.2.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.1.2.1.3 Cast Polypropylene (CPP)

- 5.1.1.1.2.1.4 Other Material Types

- 5.1.1.1.2.2 By Product Type

- 5.1.1.1.2.2.1 Pouches and Bags

- 5.1.1.1.2.2.2 Films and Wraps

- 5.1.1.1.2.2.3 Other Product Types

- 5.1.1.1.2.3 By End-use Industry

- 5.1.1.1.2.3.1 Food

- 5.1.1.1.2.3.2 Beverage

- 5.1.1.1.2.3.3 Pharmaceutical

- 5.1.1.1.2.3.4 Cosmetics and Personal Care

- 5.1.1.1.2.3.5 Industrial

- 5.1.1.1.2.3.6 Other End-use Industries

- 5.1.1.1.2.1 By Material Type

- 5.1.1.1.1 Rigid Plastic Packaging

- 5.1.1.2 By Product Type

- 5.1.1.2.1 Bottles and Jars

- 5.1.1.2.2 Pouches and Bags

- 5.1.1.2.3 Bulk-Grade Products

- 5.1.1.2.4 Other Product Types

- 5.1.1.3 By End-use Industry

- 5.1.1.3.1 Food

- 5.1.1.3.2 Beverages

- 5.1.1.3.3 Cosmetics and Personal Care

- 5.1.1.3.4 Pharamceuticals

- 5.1.1.3.5 Industrial

- 5.1.1.3.6 Other End-use Industries

- 5.1.1.1 By Type

- 5.1.2 Paper Packaging

- 5.1.2.1 By Product Type

- 5.1.2.1.1 Folding Carton

- 5.1.2.1.2 Corrugated Boxes

- 5.1.2.1.3 Liquid Paperboard

- 5.1.2.1.4 Other Product Types

- 5.1.2.2 By End-use Industry

- 5.1.2.2.1 Food

- 5.1.2.2.2 Beverages

- 5.1.2.2.3 E-commerce

- 5.1.2.2.4 Other End-use Industry

- 5.1.2.1 By Product Type

- 5.1.3 Container Glass

- 5.1.3.1 By Color

- 5.1.3.1.1 Green

- 5.1.3.1.2 Amber

- 5.1.3.1.3 Flint

- 5.1.3.1.4 Other Colors

- 5.1.3.2 By End-use Industry

- 5.1.3.2.1 Food

- 5.1.3.2.2 Beverage

- 5.1.3.2.2.1 Alcoholic

- 5.1.3.2.2.2 Non-Alcoholic

- 5.1.3.2.3 Personal Care and Cosmetics

- 5.1.3.2.4 Pharmaceuticals (excluding Vials and Ampoules)

- 5.1.3.2.5 Perfumery

- 5.1.3.1 By Color

- 5.1.4 Metal Cans and Containers

- 5.1.4.1 By Material Type

- 5.1.4.1.1 Steel

- 5.1.4.1.2 Aluminum

- 5.1.4.2 By Product Type

- 5.1.4.2.1 Cans

- 5.1.4.2.2 Drums and Barrels

- 5.1.4.2.3 Caps and Closures

- 5.1.4.2.4 Other Product Types

- 5.1.4.3 By End-use Industry

- 5.1.4.3.1 Food

- 5.1.4.3.2 Beverage

- 5.1.4.3.3 Chemicals and Petroleum

- 5.1.4.3.4 Industrial

- 5.1.4.3.5 Paints and coatings

- 5.1.4.3.6 Other End-use Industries

- 5.1.4.1 By Material Type

- 5.1.1 Plastic Packaging

- 5.2 By Packaging Format

- 5.2.1 Rigid

- 5.2.2 Flexible

- 5.3 By End-Use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Industrial

- 5.3.6 E-commerce

- 5.3.7 Other End-use Industry

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Poland

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Thailand

- 5.4.4.5 Australia

- 5.4.4.6 South Korea

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 International Paper Company

- 6.4.3 Smurfit WestRock

- 6.4.4 Ball Corporation

- 6.4.5 Crown Holdings Inc.

- 6.4.6 Mondi plc

- 6.4.7 Oji Holdings Corporation

- 6.4.8 UFlex Limited

- 6.4.9 Huhtamaki Oyj

- 6.4.10 Sealed Air Corporation

- 6.4.11 Greif Inc.

- 6.4.12 Sonoco Products Company

- 6.4.13 AptarGroup Inc.

- 6.4.14 ALPLA Group GmbH

- 6.4.15 O-I Glass Inc.

- 6.4.16 Verallia SE

- 6.4.17 Vidrala S.A.

- 6.4.18 Gerresheimer AG

- 6.4.19 Vitro S.A.B. de C.V.

- 6.4.20 Ardagh Group S.A.

- 6.4.21 CANPACK S.A.

- 6.4.22 Silgan Holdings Inc.

- 6.4.23 AGI Glaspac

- 6.4.24 Packman Packaging Pvt. Ltd.

- 6.4.25 Tetra Pak International S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment