|

시장보고서

상품코드

1549825

모노 카톤 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Mono Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

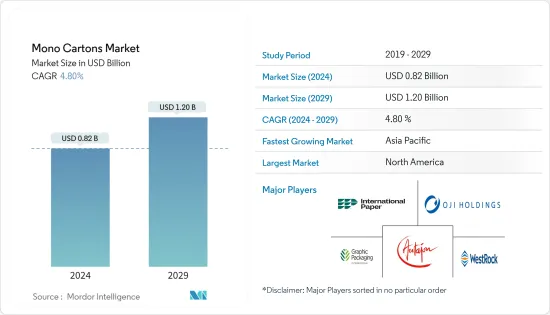

세계의 모노 카톤(Mono Cartons) 시장 규모는 2024년에 8억 2,000만 달러로 추정되며, 2029년에는 12억 달러에 달할 것으로 예상되며, 예측 기간 중(2024-2029년) CAGR 4.80%로 성장할 것으로 예측됩니다.

모노 카톤은 가볍고 심미적으로 매력적인 포장 및 솔루션입니다. 모노 카톤은 보호를 제공하는 접이식 판지의 일종이며 다양한 최종 사용자 용도의 요구 사항에 따라 판지를 사용자 정의 할 수 있습니다.

주요 하이라이트

- 모노 카톤은 제품을 컴팩트하게 포장하는 데 사용되며 고도로 사용자 정의 가능하며 다양한 최종 사용자 업계의 많은 용도를 용이하게합니다. 지속 가능한 포장에 대한 수요 증가는 시장 성장을 가속합니다. 코팅 및 비 코팅 모노 카톤은 여러 디자인, 모양 및 크기로 생산되며 매력적인 디자인에 대한 수요가 증가하고 카톤의 성장 기회를 창출합니다.

- 모노 카톤은 보관 및 사용에 편리합니다. 이 카톤은 가벼운 구조로 포장 무게를 줄이는 데 도움이되며 포장 된 제품의 보안을 보장하기 위해 적당한 강도를 제공합니다. 또한 접을 수 있으며 충분한 보관 및 배송 편의성을 제공합니다. 생산, 유통, 소비에 있어서 비용 대비 효과가 높기 때문에 수요가 높아지고 있습니다.

- 빠르게 움직이는 소비재(FMCG) 산업은 치약, 비누, 비스킷, 페이스 크림 등 소형 제품의 지속적인 보관 및 출하로 인해 모노 카톤 소비에 필수적입니다. 또한 FMCG 산업에서는 제품 사양이 라벨이 지정된 인쇄 판지를 주요 포장재로 사용합니다. 소매점 증가와 개발도상국에서 개인 가처분소득 증가로 FMCG 산업의 성장은 예측 기간 동안 모노 카톤 수요를 촉진할 것으로 예상됩니다.

- 전자상거래용 모노 카톤은 전자상거래용 포장의 대체품으로 주목받고 있습니다. 모노 카톤은 더 많은 개인이 온라인으로 구입하고 제품이 안전하고 좋은 상태로 도착하기를 원하기 때문에 중요한 옵션이되었습니다. 게다가, 기업은 브랜딩과 마케팅에 모노 카톤의 큰 표면적을 활용할 수 있어 노출을 늘리고 보다 강력한 브랜드 아이덴티티를 만들 수 있습니다.

- 플라스틱과 같은 대체 포장재로 인해 시장은 어려움을 겪고 있습니다. 지속 가능한 포장재의 인기가 높아지고 있음에도 불구하고 플라스틱 포장재는 여전히 시장의 주요 성장 동력 중 하나입니다. 많은 고객이 여전히 플라스틱 포장의 편리함과 비용을 선호하기 때문에 모노 카톤의 광범위한 채택이 어렵습니다. 소비자와 기업이 플라스틱 포장을 포기하도록 설득하려면 모노팩 사용의 환경적 이점에 대한 효과적인 교육 및 인식 제고 이니셔티브가 필요합니다.

모노 카톤 시장 동향

식음료 업계는 큰 성장이 예상

- 식음료 포장은 식품 산업에 중요한 부분이며 식품 및 음료의 안전을 보장하는 데 필수적입니다. 식품을 오염과 손상으로부터 보호하고, 유통 기한을 연장하고, 운송 및 보관을 용이하게 합니다.

- 식품 포장에 사용되는 모노 상자는 단일 층의 판지로 만들어집니다. 모노 상자는 재활용이 가능하고 내구성이 뛰어나며 다용도로 사용할 수 있으며 신선 및 냉동 식품, 스낵, 제빵 제품 등 다양한 식품을 포장할 수 있습니다. 모노 카톤 포장은 식품을 신선하고 안전하게 보호하며 시각적으로도 보기 좋게 포장할 수 있습니다.

- 카톤 보드 수요는 세계적으로 늘고 있습니다. Suzano Papel e Celulose에 따르면, 카톤 보드 소비는 2022년에는 5,400만 톤으로, 2024년에는 5,600만 톤에 이를 것으로 예상됩니다. 세계 판지 소비량 증가는 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다. 또한 Frozen & Refrigerated Buyer와 Cirnca에 따르면 2023년 미국의 냉동식품 매출은 피자가 15억 6,404만 달러로 톱에 이어 아이스크림이 14억 6,349만 달러였습니다.

- 카톤 포장은 제품에서 습기를 차단하고 긴 배송 시간을 견디기 때문에 다양한 브랜드에서 주로 2차 또는 3차 포장 수단으로 소비자에게 더 나은 결과를 제공하기 위해 채택하고 있는 사례가 늘고 있습니다. 빵, 케이크, 부패하기 쉬운 품목과 같은 가공 식품은 이러한 포장재를 사용해야 하므로 수요가 증가하고 있습니다.

- 다양한 국가에서 가공식품, 신선식품, 육류분야의 소비 증가가 일어나고 있습니다. 식품 소비의 성장은 건강과 웰빙 동향과 소비자의 윤리적 관심 증가에 의해 계속 추진되고 있습니다. 게다가 예측 기간 동안 인구 증가는 신선한 식품 수요를 지원하는 주요 원동력이 될 것으로 예상됩니다. 유기적으로 생산된 식품을 추구하는 동향은 현대 식료품 소매점에서 프리미엄 가격대의 지속 가능한 신선한 식품의 존재감을 높일 것으로 예상됩니다.

아시아 태평양이 가장 빠른 성장을 이룰 전망

- 아시아 태평양은 모노 카톤을 포함한 세계 최대의 종이 포장 시장 중 하나이며, 큰 잠재적 진화로 수요가 확대될 가능성이 높습니다. 아시아의 일부 신흥국 수요는 견조할 것으로 예상됩니다. 아시아 태평양은 중국, 인도 등 반찬 수요가 증가함에 따라 세계 종이 포장 시장을 독점합니다.

- 소비자가 환경 친화적이고 지속 가능한 관행으로의 변화에 주목하는 동안, 모노 카톤 수요는 음식, 헬스케어, 개인 관리, 소매 등 여러 지역의 산업에서 성장합니다. 지속가능한 포장의 선택에 대한 소비자의 의식, 원료의 가용성, 종이의 가볍고 재활용 가능한 특성, 삼림 감소 모두가 이 지역의 종이 포장에 대한 수요에 기여합니다.

- 2023년 6월에 팩맨 팀이 실시한 조사에서는 인도의 모노 카톤 기업 그룹의 재무 분석을 보여주었으며, 상위 5개사의 매출은 20억 루피를 넘어, 하위 5개사의 매출은 4억 5,000 만 루피에서 9억 루피였습니다. 많은 기업들이 식품, 알코올 및 의약품을 포함한 다양한 FMCG 부문에 모노 카톤을 공급했습니다.

- 경제산업성(일본)과 재단법인 고지재생촉진센터(PRPC)에 따르면 2023년 일본 종이 생산량은 약 1,160만 톤, 판지 생산량은 약 1,040만 톤이었습니다. 종이 및 판지의 생산량은 약 2,200만 톤으로 증가했습니다.

- 2023년 5월, Omya International AG는 종이 및 판지 산업에 대한 투자를 발표했습니다. 중국과 인도네시아의 판지 공장에 분쇄 탄산 칼슘과 침전 탄산 칼슘의 현장 플랜트 7기를 건설했습니다. 중국의 새로운 플랜트에는 광서 티완족 자치구, 광동성, 산동성에 3개의 분쇄탄산칼슘(GCC)플랜트, 산동성에 2개의 침전탄산칼슘(PCC)플랜트, 복건성에 추가로 1개의 PCC플랜트가 포함됩니다. 제지에 사용되는 이러한 원료는 인쇄 적합성, 광택, 평활성과 같은 종이의 특성을 향상시킵니다. 이 지역의 제지 회사에 의한 이러한 확장은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

모노 카톤 산업 개요

모노 카톤 시장은 세분화되어 있으며 다음과 같은 다양한 기업이 존재합니다. Graphic Packaging International LLC, Oji Holdings Corporation, Westrock Company, and International Paper. The companies operating are focused on innovating new solutions through investments, collaborations, mergers and acquisitions, etc., to expand their business in the region.

- 2024년 2월 : Oji Holdings와 Nihon Tetra Pak K.K.는 무균 포장 전용 일본 최초의 재활용 시스템을 개발하기 위해 제휴했습니다. 이 재활용 시스템은 소매점과 지자체의 회수, 포장 제조업체의 폐지 등 다양한 공급원으로부터 아셉틱 팩 포장을 회수합니다.

- 2023년 9월 : Graphic Packaging International은 2억 6,250만 달러로 Bell을 인수했습니다. Bell은 사우스다코타주에 2개소, 오하이오주에 1개소 총 3개소의 컨버팅 시설을 운영합니다. Graphic은 이전에 Bell을 인수함으로써 2억 달러의 매출과 1,000만 달러의 이익이 추가될 것으로 예상했습니다. Bell은 이러한 시설에서 연간 9만 5,000톤의 판지를 소모하여 종이 기기 및 관련 제품으로 전환합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 매력도-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 지속 가능한 포장 솔루션에 대한 수요

- 시장 성장을 견인하는 전자상거래

- 시장 성장 억제요인

- 대체 포장 솔루션과의 경쟁

제6장 시장 세분화

- 코팅별

- 코트 있음

- 코트 없음

- 최종 사용자 산업별

- 음식

- 의약품

- 퍼스널케어

- 일렉트로닉스

- 기타 최종 사용자 산업

- 지역별

- 북미

- 유럽

- 아시아

- 남미

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Graphic Packaging International LLC

- Oji Holdings Corporation

- Westrock Company

- International Paper Company

- Stora Enso

- Georgia-Pacific LLC

- Autajon Group

- Parksons Packaging Ltd

- Packman Packaging Private Limited

- Packtek

제8장 투자 분석

제9장 시장 기회 및 향후 동향

LYJThe Mono Cartons Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 1.20 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

Mono cartons are lightweight, esthetically appealing packaging solutions. Mono cartons are a type of folding carton that provides protection, and the cartons can be customized based on the requirements of various end-user applications.

Key Highlights

- Mono cartons are used for compact packaging of products, are highly customizable, and facilitate many applications across various end-user industries. An increase in demand for sustainable packaging is driving the market growth. Coated and uncoated mono cartons are produced in multiple designs, shapes, and sizes, increasing the demand for appealing designs and creating growth opportunities for the cartons.

- Mono cartons facilitate convenience for their storage and usage. These cartons help reduce the weight of the package due to their lightweight structure and offer a reasonable amount of strength to ensure the security of the packaged products. It also comes foldable, providing ample storage and shipment easement. It is cost-effective in production, distribution, and consumption, thus, is in high demand.

- The fast-moving consumable goods (FMCG) industry is critical to the consumption of mono cartons due to the continuous storage and shipment of small-sized products such as toothpaste, soap, biscuits, and face cream. The FMCG industry also uses printed cartons labeled with product specifications as the primary packaging material. Due to the increasing number of retail stores, coupled with rising individual disposable income in developing countries, the growing FMCG industry is anticipated to fuel the demand for mono cartons over the forecast period.

- E-commerce mono cartons have emerged as a favored alternative for e-commerce packaging. Mono cartons are a significant choice as more individuals buy online and want their products to arrive securely and in shape. Furthermore, companies can use the large surface area of mono cartons for branding and marketing, increasing exposure and creating a stronger brand identity.

- The market witnesses challenges due to alternate packaging materials such as plastic. Despite the rising popularity of sustainable packaging, plastic packaging remains one of the market's leading growth drivers. Many customers still favor the comfort and cost of plastic packaging, which makes the widespread adoption of mono cartons difficult. Persuading consumers and businesses to abandon plastic packaging necessitates effective educational and awareness initiatives on the environmental benefits of utilizing mono cartons.

Mono Cartons Market Trends

The Food and Beverage Industry is Expected To Witness Significant Growth

- Food and beverage packaging is a critical part of the industry and essential in ensuring the food or beverage is safe. It protects food from contamination and damage, helps extend its shelf life, and makes it easier to transport and store.

- Mono cartons used for food packaging are made from a single layer of cardboard. Mono cartons are recyclable, durable, and versatile and can package various food products, including fresh and frozen food products, snacks, and baked goods. Mono-carton packaging guarantees the food stays fresh, protected, and visually appealing.

- The demand for carton boards globally is witnessing growth. According to Suzano Papel e Celulose, cartonboard consumption was 54 million tons in 2022 and is expected to reach 56 million tons by 2024. The increase in the worldwide consumption of cartons is expected to drive the market growth over the forecast period. Also, according to Frozen & Refrigerated Buyer and Cirnca, the frozen food sales in the United States in 2023 were topped by pizza at USD 1,564.04 million, followed by ice cream at USD 1,463.49 million.

- As carton packaging keeps moisture away from products and resists long shipping times, it is increasingly being adopted by various brands to offer better results to their consumers, mainly as a means to secondary or tertiary packaging. Processed foods, such as bread, cakes, and perishable items, need such packaging materials to be used, thereby driving the demand.

- Various countries are witnessing a rise in the consumption of processed food, fresh produce, and meat sectors. Food consumption growth continues to be fueled by health and wellness trends and the increase in consumers' ethical concerns. Additionally, population growth is expected to be the key driver behind the demand for fresh food during the forecast period. A trend for organically produced foods is expected to increase the presence of sustainable fresh food at premium price points in modern grocery retailers.

The Asia-Pacific Region is Expected to Witness the Fastest Growth

- The Asia-Pacific region is one of the largest global folding carton packaging markets, including mono cartons, and demand is likely to grow due to its significant potential evolution. Demand in some emerging Asian countries is anticipated to be strong. The Asia-Pacific region dominates the global folding carton packaging market due to the rising demand for ready-to-eat meals in China, India, etc.

- As consumers focus on changes to eco-friendly and sustainable practices, mono-carton demand is growing across several regional industries, including food and beverage, healthcare, personal care, retail, etc. Consumer awareness of sustainable packaging choices, raw material availability, paper's lightweight and recyclable characteristics, and deforestation have all contributed to the region's demand for folding carton packaging.

- A survey conducted by the Packman team in June 2023 showed a financial analysis of a group of Indian mono-carton companies; the top five companies had turnovers exceeding INR 200 crore, while the bottom five had turnovers ranging from INR 45 crore to INR 90 crore. Many companies supplied mono cartons for various FMCG segments, including food, alcohol, and pharma products.

- According to METI (Japan) and the Paper Recycling Promotion Center (PRPC), in 2023, the paper production volume in Japan amounted to approximately 11.6 million metric tons, and the production volume for paperboard stood at around 10.4 million metric tons. The paper and paperboard production volume increased to around 22 million metric tons.

- In May 2023, Omya International AG announced investments in its paper and board industry. The company invested in seven onsite plants for ground and precipitated calcium carbonate at paperboard mill locations in China and Indonesia. The new plants in China include three ground calcium carbonate (GCC) plants in Guangxi, Guangdong, and Shandong, two precipitated calcium carbonate (PCC) plants in Shandong, and one more PCC plant in Fujian. These raw materials used for paper manufacturing will improve the paper's properties, such as printability, gloss, smoothness, etc. Such expansions by paper manufacturing companies in the region are expected to drive the market growth over the forecast period.

Mono Cartons Industry Overview

The market is fragmented with the presence of various players such as Graphic Packaging International LLC, Oji Holdings Corporation, Westrock Company, and International Paper. The companies operating are focused on innovating new solutions through investments, collaborations, mergers and acquisitions, etc., to expand their business in the region.

- February 2024: Oji Holdings and Nihon Tetra Pak K.K. partnered to pioneer Japan's first recycling system specifically for aseptic carton packages, a significant step toward gaining a circular economy for paper resources in the country. The recycling system collects aseptic carton packages from various sources, including retail and municipal collections and waste paper from packaging manufacturers.

- September 2023: Graphic Packaging International acquired Bell Inc. for USD 262.5 million. Bell operates three converting facilities: two in South Dakota and one in Ohio. Graphic previously estimated the Bell acquisition would add USD 200 million in sales and yield USD 10 million. Bell consumes an estimated 95,000 tons of paperboard annually at those facilities to convert into folding cartons and related products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Sustainable Packaging Solutions

- 5.1.2 E-commerce to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Competition from Alternative Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Coating

- 6.1.1 Coated

- 6.1.2 Uncoated

- 6.2 By End-User Industry

- 6.2.1 Food & Beverage

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care & Comsetics

- 6.2.4 Electronics

- 6.2.5 Other End-User Industries

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Graphic Packaging International LLC

- 7.1.2 Oji Holdings Corporation

- 7.1.3 Westrock Company

- 7.1.4 International Paper Company

- 7.1.5 Stora Enso

- 7.1.6 Georgia-Pacific LLC

- 7.1.7 Autajon Group

- 7.1.8 Parksons Packaging Ltd

- 7.1.9 Packman Packaging Private Limited

- 7.1.10 Packtek