|

시장보고서

상품코드

1624577

중동 및 아프리카의 앰플 포장 시장 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)MEA Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

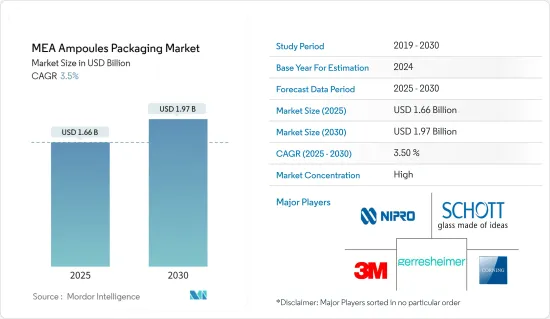

중동 및 아프리카의 앰플 포장 시장 규모는 2025년 16억 6,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 3.5%의 연평균 복합 성장률(CAGR)로 성장하여 2030년에는 19억 7,000만 달러에 달할 전망입니다.

제약 산업의 성장이 시장 성장을 견인하고 있습니다. 이 지역에서는 의약품 생산이 증가하고 있으며, 앰플에 대한 수요가 증가하고 있습니다.

주요 하이라이트

- 중동 및 아프리카는 제약 산업 성장에 큰 잠재력을 가지고 있으며, 앰플 제조업체에 여러 가지 기회를 제공합니다. 또한 지역 정부는 장기 계획에 대한 지속적인 지원과 투자를 통해 제약 산업의 지속 가능한 발전을 지원하고 있습니다.

- 두바이 산업 전략 2030과 아부다비 비전 2030은 제약 산업을 성장 잠재력이 큰 산업으로 보고 있습니다. 두바이 산업 전략 2030과 아부다비 비전 2030은 제약 산업을 성장 잠재력이 큰 산업으로 보고 있으며, 제약 산업의 성장 전망, 수출 잠재력, 중장기적 경제 효과로 인해 상당한 발전을 목표로 하고 있습니다.

- 이 산업은 성장하고 있으며 전염병 및 비 전염성 질병을 치료하기 위해 포장이 필요합니다. 따라서 의약품을 손상, 생물학적 오염 및 외부 영향으로부터 보호하는 앰플 포장에 대한 의약품 제조 수요가 증가하고 있습니다.

- 아프리카에는 임상시험 인프라와 역량이 있으며, 그 대부분은 남아공에 있습니다. Ardagh 그룹의 아프리카 사업부인 Ardagh Glass Packaging-Africa(AGP-Africa)는 남아공 하우텡 주에 위치한 나이젤 공장의 생산 능력을 확장하기 위해 투자를 발표했습니다. 투자를 발표했습니다. 향후 몇 년동안 예상되는 수요를 충족시키기 위해 세 번째 용광로를 추가하여 시설을 확장하여 지속 가능한 유리 포장을 생산할 수 있도록할 것입니다.

- 국내에서 생산되는 의약품의 품질과 무결성을 향상시키기 위해 엄격한 규칙과 규제가 도입되면서 의약품 포장 제품의 재료로 유리의 사용량이 증가하고 있습니다. 각국 정부와 규제 기관은 환경에 악영향을 미치기 때문에 일회용 플라스틱 및 특정 비재활용 플라스틱 등 의약품 포장에 사용되는 특정 유형의 플라스틱 사용을 금지하거나 제한하고 있습니다.

중동 및 아프리카 앰플 포장 시장 동향

유리 앰플의 채택이 두드러질 전망

남아공이 큰 비중을 차지할 것으로 예상

- 남아프리카공화국 경제는 비교적 안정적인 정치 상황과 전 세계 기업들의 막대한 투자로 인해 호황을 누리고 있습니다. 이 나라에서는 제약 산업도 크게 성장하고 있습니다.

- 남아프리카공화국 제약 산업의 급속한 성장은 급속한 도시화, 의료비 지출 증가, 주요 기업들의 투자 증가에 기인합니다. 국제적인 기업들은 남아공 제약 산업에서 입지를 확대하도록 장려되고 있으며, Aspen Pharmacare와 같은 기업은 2023년 22억 561만 달러, 2020년에는 18억 2,360만 달러로 평가되는 등 성장을 목격하고 있습니다. 이러한 매출 성장은 앰플 시장에 활력을 불어넣을 것으로 보입니다.

- 남아프리카공화국 제약 산업의 급격한 성장과 함께 적절한 포장 솔루션에 대한 수요도 증가하고 있습니다. 이는 제조에서 소비에 이르는 의약품 공급망의 다양한 과정에서 의약품을 신중하게 취급해야 하기 때문입니다. 이는 주로 외부 환경에 노출되면 치료 효과와 약효를 잃을 수 있는 약품의 섬세함 때문입니다. 따라서 제약회사는 엄격한 소비자 안전 규제와 환경 규제를 준수해야 합니다.

- 질병 증가와 외부 환경으로부터 의료 용액을 안전하게 유지해야 할 필요성이 증가함에 따라 제약 회사는 제조, 보관 및 포장 과정에서 의약품의 품질을 보장하고 있습니다. 또한, 제약회사들은 국내에서 유행하는 주요 질병을 치료하는 의약품을 출시하여 남아공의 앰플 수요를 더욱 증가시키고 있습니다.

- 아프리카에서는 소득 수준 상승, 환경 인식 증가, 양호한 인구 통계, 일방향 포장으로의 전환 등 여러 요인에 힘입어 지속 가능한 포장에 대한 수요가 크게 증가하고 있습니다.

- 아프리카 대륙자유무역지대(AfCFTA) 민간부문 전략에 따르면 아프리카 대륙의 질병 장애의 40%는 HIV/AIDS, 결핵, 말라리아, 설사, 호흡기 질환으로 인해 발생하며, 이 모든 질병은 일반적으로 포장된 의약품으로 치료됩니다. 따라서 아프리카에서는 앰플과 같은 의약품 포장 제품에 대한 비즈니스 기회가 창출될 수 있습니다.

중동 및 아프리카 앰플 포장 산업 개요

유리 앰플은 투명성이 뛰어나고 내용물을 쉽게 검사하고 모니터링할 수 있습니다. 제약 산업이 확대됨에 따라 유리 앰플에 대한 수요도 증가하고 있습니다. 이 지역에서는 생산량이 증가함에 따라 제약용 유리제품에 대한 수요가 급증하고 있습니다.

Corning Incorporated, 3M Company, Schott AG, Gerresheimer AG, Nipro Corporation 등 주요 기업이 매우 적기 때문에 시장이 통합되어 있습니다. 시장 기업들은 시장에서의 입지와 점유율을 확대하기 위해 여러 지역 조직과 중요한 협력 관계를 구축하기 위해 노력하고 있습니다. 이 지역의 제약 산업에서 시장 개척은 기존 기업뿐만 아니라 신규 진출기업에게도 기회를 제공할 것으로 예상됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 소재

- 유리

- 플라스틱

- 국가명

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카공화국

- 이집트

제7장 경쟁 구도

- 기업 개요

- SCHOTT AG

- Corning Incorporated

- 3M Company

- Gerresheimer AG

- Nurrin Pharmalab Pty(Ltd)

- Yadong Pharma Packaging Industry Co. Ltd

- Nipro Corporation

제8장 투자 분석

제9장 시장 기회와 향후 동향

LSH 25.01.15The MEA Ampoules Packaging Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 1.97 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

The growing pharmaceutical industry is helping the market grow. The need for ampoules increases with the increasing pharmaceutical production in the region.

Key Highlights

- Middle East and Africa has enormous potential for the pharmaceutical industry's growth, posing several opportunities for ampoule manufacturers. Additionally, the regional government supports the pharmaceutical industry's sustainable development through continued support and investments in long-term plans.

- The Dubai Industrial Strategy 2030 and the Abu Dhabi Vision 2030 view the pharmaceutical industry as one with major growth potential. They aim to make significant developments due to the growth prospects, export potential, and mid-term to long-term economic impact of the industry.

- The industry is growing, and there is a need for packaging to heal communicable and non-communicable diseases. Thus, the demand for ampoule packaging in pharmaceutical manufacturing is increasing as it protects pharmaceuticals from damage, biological contamination, and external influences.

- Africa has clinical trial infrastructure and capabilities, most of which are in South Africa, as it has invested more heavily in R&D than others on the continent. The African business division of Ardagh Group, Ardagh Glass Packaging - Africa (AGP - Africa), announced an investment to expand the manufacturing capacity of its Nigel factory in Gauteng, South Africa. To satisfy anticipated demand over the coming years, the company will expand its facility by adding a third furnace, enabling it to produce sustainable glass packaging.

- Introducing stringent rules and regulations to improve the quality and integrity of domestically manufactured drugs increases the usage of glass as a material for pharmaceutical packaging products. Due to adverse environmental impact, governments and regulatory bodies have introduced bans or restrictions on several specific types of plastics used for pharmaceutical packaging, such as single-use plastics or certain non-recycled plastics.

MEA Ampoules Packaging Market Trends

Glass Ampoules Are Expected to Witness Significant Adoption

- Glass ampoules are widely adopted as a type of primary packaging in the pharmaceutical industry for injection drugs due to their various benefits, such as 100% tamper-proof packaging. Also, ampoules are a popular choice for primary packaging for injectables and are widely adopted in cost-sensitive or emerging markets like Middle East and Africa.

- The region is witnessing an increase in government initiatives and support to foster the adoption of generic products, coupled with the move to start generic medical stores. The high prevalence of infectious diseases in the region is expected to drive the adoption of injectables, increasing the adoption of glass ampoules during the forecast period. According to Alpen Capital, the healthcare expenditure was USD 60.7 billion in 2022, which increased to USD 63.8 billion in 2023. Such increases in healthcare expenditures drive the market's growth.

- In the case of diseases like HIV/AIDS treatment, the need for sterile drug injection equipment for injecting drugs increases, as the disease can easily be transmitted by using the same equipment to inject the drug. Hence, ampoules may be used for drug storage and transport. This is expected to increase the adoption of glass ampoules in the region, as the risk of HIV/AIDS is high.

- The UAE pharmaceutical market is one of the most developed and has a robust healthcare infrastructure. Domestic medication manufacturers in the United Arab Emirates have increased their production of medicines. With their long-standing presence in the nation through manufacturing or local distribution channels, major research-based pharmaceutical companies and top multi-nationals, like Pfizer, Novartis, GlaxoSmithKline (GSK), Merck, AbbVie, Eli Lily, Bayer, AstraZeneca, Sanofi, BMS, and Amgen, have opened up opportunities for market growth.

- The Saudi National Industrial Development and Logistics Program (NDLP) estimates that Saudi Arabia's pharmaceutical business will be worth SAR 44 billion (USD 11.72 billion approximately) by 2030. According to ITA, healthcare and social development were estimated to be valued at USD 36.8 billion in 2022, or 14.4% of its overall budget, and the third-largest category after education and the military. Privatizing the healthcare sector is a goal of the Saudi Arabian government. The increase in growth would create opportunities for various glass ampoule packaging companies to invest in the sector.

South Africa Expected to Hold a Significant Share

- South Africa's economy is booming due to a relatively stable political scenario and the enormous investments made by companies worldwide. The country has also seen significant growth in the pharmaceutical industry.

- The rapid growth in the pharmaceutical industry in South Africa can be attributed to rapid urbanization, an increase in healthcare spending, and a rise in investments by leading pharmaceutical companies. International players are encouraged to expand their presence in the pharmaceutical landscape of South Africa. Companies such as Aspen Pharmacare are witnessing growth; it was valued at USD 2205.61 million in 2023 and USD 1823.6 million in 2020. Such revenue growth would leverage the market for ampoules.

- With rapid growth in the pharmaceutical industry in South Africa, the need for proper packaging solutions also increases. This is because during the various processes in the supply chain of a pharmaceutical product, starting from manufacture to consumption, the pharmaceutical products need to be handled carefully. This is mainly due to the sensitivity of narcotics, which lose their therapeutic or medicinal properties when exposed to any exterior environment. Hence, pharmaceutical companies must follow stringent consumer safety and environmental regulations.

- Due to the growing number of diseases and the growing need to keep medical solutions safe from the external environment, pharmaceutical companies ensure the quality of pharmaceuticals throughout the manufacturing, storing, and packaging processes. Also, pharmaceutical companies are launching drugs to treat major diseases prevalent in the country, further boosting the demand for ampoules in South Africa.

- Africa is experiencing a significant increase in the need for sustainable packaging, fueled by several factors, including rising income levels, growing environmental consciousness, favorable demographics, and a move toward one-way packaging.

- According to the African Continental Free Trade Area (AfCFTA) Private Sector Strategy, 40% of the disease hindrance on the continent is due to HIV/AIDS, tuberculosis, malaria, diarrhea, and respiratory diseases, all of which are commonly treated by packaged medicines. This might create opportunities for pharmaceutical packaging products, including ampoules, in the country.

MEA Ampoules Packaging Industry Overview

Glass ampoules offer superior transparency, facilitating effortless inspection and monitoring of their contents. As the pharmaceutical industry expands, it fuels the demand for glass ampoules. The region is witnessing a surge in demand for these pharmaceutical glass products, driven by escalating production levels.

The market is consolidated due to very few major players, such as Corning Incorporated, 3M Company, Schott AG, Gerresheimer AG, and Nipro Corporation. The market players strive to create significant collaborations with several regional organizations to expand their market presence and share. Developments in the pharmaceutical industry in the region are expected to provide opportunities for the existing as well as new market players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safe and Reliable Pharmaceutical Packaging

- 5.1.2 Increasing Government Mandates Regarding Packaging Material

- 5.2 Market Restraints

- 5.2.1 Environmental and Sustainability Issues

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.2 Country

- 6.2.1 Saudi Arabia

- 6.2.2 United Arab Emirates

- 6.2.3 South Africa

- 6.2.4 Egypt

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SCHOTT AG

- 7.1.2 Corning Incorporated

- 7.1.3 3M Company

- 7.1.4 Gerresheimer AG

- 7.1.5 Nurrin Pharmalab Pty (Ltd)

- 7.1.6 Yadong Pharma Packaging Industry Co. Ltd

- 7.1.7 Nipro Corporation