|

시장보고서

상품코드

1624582

중국의 플라스틱 포장 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

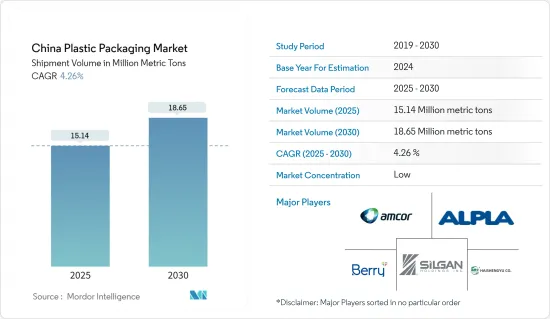

중국의 플라스틱 포장 시장 규모는 출하량 기준으로 2025년 1,514만 톤에서 2030년 1,865만 톤으로 확대될 것이며, 예측 기간(2025-2030년) 동안 4.26%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

중국에서는 소비자 인식 증가와 제조업의 급격한 성장이 플라스틱 포장 시장의 성장을 주도하고 있습니다. 이러한 성장은 급성장하는 식품 산업과 번성하는 포장 부문에 의해 더욱 촉진되고 있습니다.

주요 하이라이트

- 중국은 플라스틱의 주요 생산국이자 소비국으로서 세계 무대에서 압도적인 존재감을 드러내고 있습니다. 중국이 플라스틱 생산과 수출에 주력하게 된 것은 PET(폴리에틸렌 테레프탈레이트), HDPE(고밀도 폴리에틸렌) 및 기타 고분자 기반 병과 용기에 대한 의존도가 높아졌기 때문입니다. 이러한 소재는 식음료, 의약품, 퍼스널케어 등의 분야에서 매우 중요합니다.

- 중국을 필두로 한 아시아 지역의 생수 수요 증가가 플라스틱 시장을 주도하고 있습니다. 유엔기구인 유엔대학 물, 환경 및 건강 연구소의 데이터는 이러한 추세를 잘 보여주고 있으며, 아시아태평양 국가들이 생수 소비의 대부분을 차지하고 있다는 것을 보여줍니다. 미국에 이어 세계 2위의 생수 시장인 중국은 PET 플라스틱에 대한 수요를 더욱 증가시키고 있습니다.

- 친환경 제품에 대한 수요가 급증함에 따라 중국 제조업체들은 지속 가능한 포장재로 눈에 띄게 방향을 전환하고 있습니다. 예를 들어, 2024년 5월, 중국에 진출한 오스트리아의 Alpla Werke Alwin Lehner GmbH &Co KG는 재활용 가능한 PET 와인 병을 출시했습니다. 이 혁신적인 병은 기존 유리병에 비해 탄소 소비를 38% 절감할 뿐만 아니라 회사의 환경적 신뢰도를 높입니다.

- 그러나 시장은 대체 포장 솔루션으로의 전환이라는 문제에 직면해 있습니다. 전 세계 폐기물과 해양 쓰레기의 주요 원인인 플라스틱 오염에 대한 중국의 투쟁은 환경 문제를 부각시키고 있습니다. 세계 최고의 플라스틱 생산국이자 소비국인 중국은 특히 종이 포장과 같은 대체품으로의 소비자 이동이 두드러지면서 시장 성장이 위기에 처해 있습니다.

중국 플라스틱 포장 시장 동향

식품산업이 시장을 독점할 것으로 예상

- 국가통계국(NBS) 보고서에 따르면 2023년 중국의 국내총생산(GDP)은 17조 5,200억 달러(126조 6,000억 위안)에 달하고, 전년 대비 5.2% 증가할 것으로 예상했습니다. 미국 농무부(USDA)는 세계 최대 식량 수입국인 중국의 총 식량 수입액이 2023년 1,400억 달러가 넘을 것이라고 강조했습니다.

- 중국 소비자의 기호 변화, 특히 포장 식품 증가 추세는 플라스틱 포장에 대한 수요 증가를 촉진하고 있습니다. 미국 농무부는 중국 식품 시장의 중요한 추세는 급성장하는 전자상거래 부문이라고 지적했습니다. 예측에 따르면 중국의 식품 전자상거래 시장은 2024년1,480억 달러에 도달하여 경질 플라스틱 포장 솔루션에 대한 수요를 더욱 촉진할 것으로 예상됩니다.

- 또한 중국의 외식 산업은 2023년에 특히 조리된 식품 분야에서 강력한 부활을 이루었습니다. 이동식 식품 소비 증가는 경질 및 연질 플라스틱 포장 솔루션의 사용에 박차를 가하고 있습니다. 이러한 추세는 중국의 테이크아웃 식품 산업의 호황으로 더욱 증폭되어 플라스틱 포장에 대한 수요 증가로 이어지고 있습니다.

- 중국의 식품 수입에는 유제품, 가공식품, 육류(특히 쇠고기에 중점을 둔) 등 다양한 소비자 제품이 포함됩니다. 미국 농무부 데이터에 따르면 2023년 중국의 이러한 소비자 제품 수입액은 1,064억 달러에 달할 전망입니다. 중국의 주요 수출국인 뉴질랜드, 태국, 브라질, 미국은 각각 10-12%의 점유율을 차지하며 중국의 플라스틱 포장 수요를 견인하는 데 매우 중요한 역할을 하고 있습니다.

병과 병이 가장 높은 시장 점유율을 차지합니다.

- 폴리에틸렌 테레프탈레이트(PET), 폴리 프로파일렌(PP) 및 폴리에틸렌(PE)은 포장 솔루션용 플라스틱 병 및 병 생산에 사용되는 주요 재료입니다. 이들 재료는 가볍고 깨지기 쉽지 않으며 자재 취급이 용이합니다. 중국에서는 음료 및 식품 산업에서 병과 병에 대한 수요가 급증하면서 경질 플라스틱 포장에 대한 수요가 빠르게 증가하고 있습니다. 특히 생수, 주스, 청량음료, 의약품, 가정용 세제, 개인 위생용품의 포장에 PET 병의 사용이 증가하면서 플라스틱 포장 시장 확대에 영향을 미치고 있습니다.

- 중국에서 급성장하고 있는 제약 분야에서 PET 병과 용기를 포장에 사용하는 경우가 증가하고 있으며, 이는 이 분야의 성장을 더욱 촉진하고 있습니다. 미디어 플랫폼인 Policy Circle의 데이터에 따르면, 2023-24년 중국은 인도 의약품 수입의 43.45%를 차지할 것으로 예상되며, 플라스틱 포장 솔루션에 대한 수요가 증가하고 있는 것으로 나타났습니다.

- 재활용 및 재사용 가능한 포장에 대한 소비자의 선호도가 높아짐에 따라 Amcor Group과 같은 중국 제조업체는 음료수 병을 포함한 지속 가능한 경질 포장 솔루션 출시에 우선순위를 두고 있습니다.2024년4월스위스에 본사를두고 중국에 본사를 둔 Amcor Group은 탄산 청량음료용으로 특별히 설계된 100% 소비자 재사용(PCR) 소재로만 만들어진 1리터 페트병을 출시했습니다.

- 플라스틱 제품 제조의 주요 기지로서 중국은 중요한 생산 이정표를 보였고, ChemmAnalyst의 보고서에 따르면 2023년 12월 중국의 플라스틱 제품 생산량은 약 698만 톤에 달하고, 전년 대비 2.8% 증가했다고 합니다. 특히 중국은 플라스틱 제품, 특히 병을 미국, 호주, 말레이시아, 일본을 포함한 아시아 국가에 수출하고 있습니다.

중국 플라스틱 포장 산업 개요

중국 플라스틱 포장 시장은 단편적인 양상을 보이고 있으며, Amcor Group, Berry Global Inc, ALPLA Werke Alwin Lehner GmbH &Co KG, Silgan Holdings Inc. Plastic Industry 등 주요 기업들은 시장에서 더 큰 점유율을 확보하기 위해 적극적으로 제품 포트폴리오를 강화하고 있습니다. 이들 기업은 M&A, 파트너십, 사업 확장, 신제품 출시, 제휴 등 유기적 전략과 무기적 전략을 결합하여 중국 시장에서 우위를 점하기 위해 노력하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

제6장 업계 규제와 정책과 기준

제7장 시장 내역

- 포장 유형별

- 연질 플라스틱 포장

- 제품 유형별

- 파우치

- 대

- 필름 및 랩

- 기타 제품 유형

- 최종사용자 산업별

- 식품

- 음료

- 헬스케어

- 화장품 및 퍼스널케어

- 가정관리용품

- 기타 최종사용자 산업(산업, E-Commerce, 기타)

- 경질 플라스틱 포장

- 제품 유형별

- 보틀 및 쟈(jar)

- 트레이 및 용기

- 뚜껑 및 마개

- 기타 제품 유형

- 최종사용자 산업별

- 식품

- 음료

- 헬스케어

- 화장품 및 퍼스널케어

- 가정관리용품

- 기타 최종사용자 산업(산업, 자동차, 기타)

- 연질 플라스틱 포장

제8장 경쟁 구도

- 기업 개요

- Shangdong Haishengyu Plastic Industry Co. Ltd

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Amcor Group

- Berry Global Inc.

- Silgan Holdings Inc.

- Taizhou Huangyan Baitong Plastic Co. Ltd

- Shenyang Powerful Packing, Co., Ltd.

- Jieshou Tianhong New Material Co. Ltd

- Qingdao Haoyu Packing Co. Ltd

- Ningbo Kinpack Commodity Co. Ltd

제9장 재활용과 지속가능성 전망

제102장 시장의 미래

LSH 25.01.15The China Plastic Packaging Market size in terms of shipment volume is expected to grow from 15.14 million metric tons in 2025 to 18.65 million metric tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

In China, heightened consumerism and a burgeoning manufacturing sector are driving the expansion of the plastic packaging market. This growth is further fueled by a surging food industry and a thriving packaging sector.

Key Highlights

- China is a dominant player on the global stage, both as a leading producer and consumer of plastic. The nation's intensified focus on plastic production and export is largely due to its heightened reliance on PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), and other polymer-based bottles and containers. These materials are pivotal for sectors like food and beverage, pharmaceuticals, and personal care.

- Asia's rising appetite for bottled water, with China leading the charge, is propelling the plastic market. Data from the United Nations University Institute for Water, Environment and Health, a UN agency, underscores this trend, revealing that Asia-Pacific nations dominate bottled water consumption. China, as the world's second-largest bottled water market, only behind the United States, further amplifies the demand for PET plastics.

- Responding to the surging demand for eco-friendly products, Chinese manufacturers are making a notable pivot towards sustainable packaging. For instance, in May 2024, Alpla Werke Alwin Lehner GmbH & Co KG, an Austrian firm operating in China, unveiled a recyclable PET wine bottle. This innovative bottle not only slashes carbon consumption by 38% compared to traditional glass but also enhances the company's environmental credentials.

- However, the market faces challenges from a growing shift towards alternative packaging solutions. China's battle with plastic pollution, a significant contributor to global waste and marine debris, highlights the environmental stakes. As the world's top producer and consumer of plastic, China's market growth is at risk, especially with a noticeable consumer shift towards alternatives like paper packaging.

China Plastic Packaging Market Trends

Food Industry is Expected to Dominate the Market

- In 2023, China's gross domestic product (GDP) reached USD 17.52 trillion (126.06 trillion yuan), marking a year-on-year increase of 5.2%, as reported by the National Bureau of Statistics (NBS). The United States Department of Agriculture (USDA) highlighted that China, the world's largest food-importing nation, saw its total food import value exceed USD 140 billion in 2023.

- Shifting consumer preferences in China, especially the rising trend of packaged foods, are driving an increased demand for plastic packaging. The USDA notes that a significant trend in China's food market is the burgeoning e-commerce sector. Forecasts suggest that China's food e-commerce market will hit USD 148 billion in 2024, further fueling the demand for rigid plastic packaging solutions.

- Moreover, China's food service industry made a strong comeback in 2023, particularly in the prepared food segment. The uptick in on-the-go food consumption has spurred using rigid and flexible plastic packaging solutions. This trend is further amplified by the booming takeaway food industry in China, leading to a heightened demand for plastic packaging.

- China's food imports encompass a range of consumer-oriented products, including dairy, processed foods, and meat, with a notable emphasis on beef. USDA data reveals that in 2023, China's imports of these consumer-oriented products totaled USD 106.4 billion. Key exporters to China, New Zealand, Thailand, Brazil, and the United States each holding a 10-12% share, play a pivotal role in driving the nation's demand for plastic packaging.

Bottles and Jars Segment to Register Highest Market Share

- Polyethylene terephthalate (PET), polypropylene (PP), and polyethylene (PE) are the primary materials used in the production of plastic bottles and jars for packaging solutions. These materials are lightweight and unbreakable, enhancing their ease of handling. In China, the food and beverage industry's surging demand for bottles and jars is rapidly boosting the need for rigid plastic packaging. Specifically, the rising use of PET bottles for packaging bottled water, juices, soft drinks, medicines, household cleaners, and personal care items is a key driver of the plastic packaging market's expansion.

- China's burgeoning pharmaceutical sector is increasingly turning to PET bottles and containers for packaging, further fueling this segment's growth. Data from Policy Circle, a media platform, highlights that in 2023-24, China constituted 43.45% of India's pharmaceutical imports, underscoring the heightened demand for plastic packaging solutions.

- In response to the rising consumer preference for recyclable and reusable packaging, Chinese manufacturers such as Amcor Group prioritise launching sustainable rigid packaging solutions, including beverage bottles. In April 2024, Amcor Group, a Switzerland-based entity with a footprint in China, unveiled a one-liter PET bottle crafted entirely from 100% post-consumer recycled (PCR) content, specifically designed for carbonated soft drinks.

- As a leading hub for plastic product manufacturing, China has seen significant production milestones. ChemAnalyst reported that in December 2023, China's plastic product output reached around 6.98 million tons, marking a 2.8% increase from the previous year. Notably, China exports its plastic products, especially bottles, to the United States and several Asian nations, including Australia, Malaysia, and Japan.

China Plastic Packaging Industry Overview

The plastic packaging market in China exhibits a fragmented landscape. Key players, including Amcor Group, Berry Global Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc., and Shangdong Haishengyu Plastic Industry Co. Ltd., are actively enhancing their product portfolios in a bid to capture a larger share of the market. These companies are employing a mix of organic and inorganic strategies, such as mergers and acquisitions, partnerships, expansions, new product launches, and collaborations, to assert their dominance in the Chinese market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surging Demand for Plastic Packaging in the Food and Beverage Sector

- 5.1.2 Increasing Adoption of Eco-Friendly Packaging Options

- 5.2 Market Challenges

- 5.2.1 Rising Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Flexible Plastic Packaging

- 7.1.1.1 By Product Type

- 7.1.1.1.1 Pouches

- 7.1.1.1.2 Bags

- 7.1.1.1.3 Films & Wraps

- 7.1.1.1.4 Other Product Types

- 7.1.1.2 By End-User Industry

- 7.1.1.2.1 Food

- 7.1.1.2.2 Beverage

- 7.1.1.2.3 Healthcare

- 7.1.1.2.4 Cosmetics and Personal Care

- 7.1.1.2.5 Household Care

- 7.1.1.2.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 7.1.2 Rigid Plastic Packaging

- 7.1.2.1 By Product Type

- 7.1.2.1.1 Bottles and Jars

- 7.1.2.1.2 Trays and Containers

- 7.1.2.1.3 Caps and Closures

- 7.1.2.1.4 Other Product Types

- 7.1.2.2 By End-User Industry

- 7.1.2.2.1 Food

- 7.1.2.2.2 Beverage

- 7.1.2.2.3 Healthcare

- 7.1.2.2.4 Cosmetics and Personal Care

- 7.1.2.2.5 Household Care

- 7.1.2.2.6 Other End-User Industries (Industrial, Automotive, Among Others)

- 7.1.1 Flexible Plastic Packaging

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Shangdong Haishengyu Plastic Industry Co. Ltd

- 8.1.2 ALPLA Werke Alwin Lehner GmbH & Co KG

- 8.1.3 Amcor Group

- 8.1.4 Berry Global Inc.

- 8.1.5 Silgan Holdings Inc.

- 8.1.6 Taizhou Huangyan Baitong Plastic Co. Ltd

- 8.1.7 Shenyang Powerful Packing, Co., Ltd.

- 8.1.8 Jieshou Tianhong New Material Co. Ltd

- 8.1.9 Qingdao Haoyu Packing Co. Ltd

- 8.1.10 Ningbo Kinpack Commodity Co. Ltd