|

시장보고서

상품코드

1624587

염소: 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Chlorine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

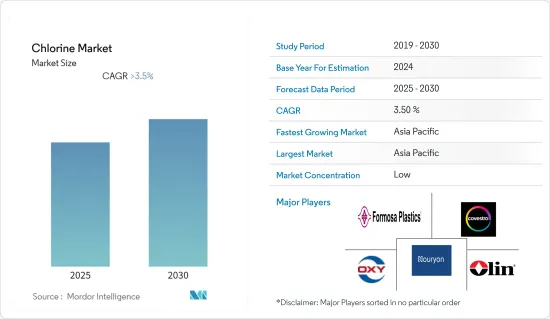

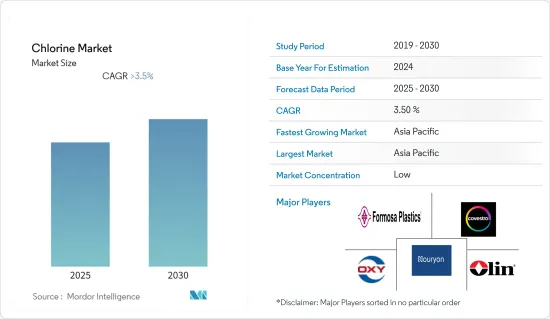

염소 시장은 예측 기간 동안 3.5% 이상의 CAGR을 나타낼 것으로 예상됩니다.

코로나19가 발생하면서 전 세계 곳곳에서 봉쇄가 발생하여 제조 활동, 공급망 중단, 생산 중단, 노동력 확보가 염료 및 안료 시장에 부정적인 영향을 미쳤습니다. 그러나 2021 년에는 상황이 회복되기 시작하여 예측 기간 동안 시장의 성장 궤도가 회복 될 가능성이 높습니다.

주요 하이라이트

- 중기적으로 제약 및 농약 산업 수요 증가와 건설 산업의 PVC 수요 증가가 시장 성장의 주요 촉진요인입니다.

- 그러나 염소 사용에 대한 정부의 엄격한 규제가 시장 성장에 걸림돌이 될 것으로 예상됩니다.

- 폐수 산업 수요 증가는 해당 산업에 기회를 창출할 수 있습니다.

- 아시아태평양이 세계 시장을 독점하고 있으며, 중국과 인도의 소비량이 가장 많습니다.

염소 시장 동향

PVC 수요 증가

- 폴리염화비닐(PVC)은 건설, 건축, 인프라에 널리 사용되고 있습니다. 일부 건축물과 유틸리티는 부분적으로 또는 전체적으로 폴리머를 사용하는 경우가 많습니다. 지붕재, 벽 패널, 씰, 배관 시스템, 코팅 및 기타 여러 가지 제품으로 실용화되어 있습니다.

- PVC에는 경질 수지와 연질 수지의 두 가지 유형이 있습니다. 경질 수지는 성장 기회의 대부분을 제공하며 주요 최종 용도는 피팅, 파이프 및 피팅, 창문, 울타리, 지붕 타일, 자동차 부품입니다. 연질 PVC는 필름, 시트, 바닥재, 전선 및 케이블 피복, 합성 피혁 제품, 샤워 커튼 등에 사용되며, EDC는 금속 세척, 섬유 및 접착제 산업에서 용매로 사용됩니다.

- EDC와 PVC 생산 공정은 원료로 다량의 염소가 필요하며, Euro Chlor에 따르면 2022년 6월 유럽의 염소 생산량은 68만 2,760톤으로 2022년 6월 일평균 생산량은 2만 2,759톤으로 전월 대비 5.7% 감소, 2021년 6월 대비 15.3% 감소했습니다. 3% 감소했습니다.

- 관개, 물 및 위생 관리, 건축 및 건설, 운송, 전력, 소매 등의 분야에서 대규모 투자가 계속되고 있으며, PVC는 전선 및 케이블, 파이프, 목재 PVC 복합재, 방수막 등 다양한 제품을 통해 이들 분야의 지속 가능한 경영에 중요한 역할을 하고 있습니다.

- 2021년 3월, 중국은 5개년 폐수 로드맵을 발표하여 2,000만 m3/d의 폐수 처리 능력을 추가로 개발하는 것을 목표로 하고 있습니다. 중국은 또한 재사용 가능한 기준에 맞게 처리해야 하는 하수의 비율을 향후 7년간 25%까지 끌어올릴 것이라고 밝혔습니다.

- 또한, 전 세계적으로 "녹색 건설" 증가 추세는 건설 분야에서 PVC의 사용을 그 어느 때보다 촉진하고 있습니다. 따라서 건설 활동이 증가함에 따라 폴리 염화 비닐의 사용량은 예측 기간 동안 증가할 것으로 예상됩니다.

- 폴리염화비닐 수요 증가는 염소 수요를 증가시킬 것으로 예상됩니다. 이는 예측 기간 동안 염소 시장에 이익을 가져다 줄 것으로 보입니다.

시장을 독점하는 아시아태평양

- 아시아태평양이 세계 시장을 독점하고 있습니다. 중국, 인도와 같은 국가에서 도시화가 진행되면서 담수의 필요성이 증가함에 따라 염소 사용량이 증가하고 있습니다.

- 2.4%의 토지와 4%의 수자원을 보유한 인도는 전 세계 인구의 18%에 가까운 인구를 부양하고 있습니다. 최근 농산물의 품질이 떨어지면서 농업의 지속가능성에 대한 심각한 의문이 제기되고 있습니다. 이 문제를 해결하기 위해 밭 관개 시스템에 PVC 파이프를 도입하여 토지 생산성을 높이고 공급망 효율성을 높이고(동시에 탄소 발자국을 줄이는) 노력을 기울이고 있습니다.

- 또한, 염소는 주로 수처리에 사용됩니다. 차아염소산나트륨과 같은 염소 또는 염소 화합물을 물에 첨가하는 과정을 물의 염소 처리라고 합니다. 이 방법은 물 속의 박테리아, 바이러스 및 기타 미생물을 제거하는 데 사용됩니다. 염소 처리는 콜레라, 이질, 장티푸스 등 수인성 전염병의 확산을 방지하는 데 특히 효과적입니다.

- 지난 7월, 프놈펜 수도국의 론 나로 국장은 박천 정수장 1단계 공사가 66%의 공정률을 보이고 있으며 2023년까지 완공될 것이라고 발표했습니다. 이 정수장은 매일 39만m3의 물을 처리할 수 있는 능력을 갖추게 됩니다.

- 인도 포장 산업은 가장 빠르게 성장하는 산업 중 하나이며, 모든 산업에 직간접적으로 영향을 미치고 있습니다. 도시화, 1인당 소득 증가, 노동 인구 증가로 인해 포장 식품에 대한 지출이 증가하고 있습니다.

- 인도 포장 산업 협회(PIAI)에 따르면 인도의 포장 소비량은 지난 10년동안 200% 증가하여 1인당 연간 4.3kg에서 8.6kg으로 증가했습니다. 이는이 시장이 충분히 침투하지 않은 시장이며 인도 플라스틱 산업에 큰 비즈니스 기회라는 것을 분명히 보여줍니다.

- 전체적으로 염소 시장은 2020년 코로나19의 영향을 받았지만 예측 기간 동안 건강한 성장을 보일 것으로 예상됩니다.

염소 산업 개요

염소 시장은 부분적으로 단편화되어 있으며 소수의 기업이 지배하고 있습니다. 주요 기업으로는 Olin Corporation, Occidental Petroleum Corporation, Covestro AG, Formosa Plastic Corporation, Nouryon 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 업계 밸류체인 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 정도

- 기술 현황

- 수출입 동향

- 가격 동향

제5장 시장 세분화 : 시장 규모(수량, 매출)

- 용도

- EDC/PVC

- Isocyanates/Oxygenates

- 클로로메탄

- 용제 및 에피클로로히드린

- 무기 화학제품

- 기타 용도

- 최종사용자 산업

- 수처리

- 의약품

- 화학제품

- 종이 및 펄프

- 플라스틱

- 농약

- 기타 최종사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- ANWIL SA(PKN ORLEN SA)

- Covestro AG

- Ercros SA

- Formosa Plastics Corporation

- Hanwha Solutions/Chemical Corporation

- INEOS

- Kem One

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- Spolchemie

- Tata Chemicals Limited

- Tosoh USA, Inc.

- Westlake Vinnolit GmbH & Co KG

- Vynova Group

제7장 시장 기회와 향후 동향

LSH 25.01.15

The Chlorine Market is expected to register a CAGR of greater than 3.5% during the forecast period.

During the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability negatively impacted the dyes and pigment market. However, in 2021 the conditions started recovering, which will likely restore the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, the rising demand from the pharmaceutical and agrochemical industries and the increasing demand for PVC from the construction industry are the major driving factors augmenting the growth of the market studied.

- However, stringent government regulations on the use of chlorine are expected to hinder the market's growth.

- Increasing demand from the wastewater industry may create opportunities in the industry.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Chlorine Market Trends

Increasing Demand for PVC

- Polyvinyl chloride (PVC) is widely used in construction, building, and infrastructure. Construction and utility parts in buildings are often partly or completely polymeric. This can be implemented as roofing materials, wall panels, seals, piping systems, coatings, and many other products.

- There are two types of PVC, namely, rigid resins and flexible resins. Rigid resins provide most of the growth opportunities, with major end uses being fittings, pipe and fittings, windows, fencing, roof tiles, and automobile parts. Flexible PVC finds outlets in film and sheets, flooring, wire and cable coating, synthetic leather products, and shower curtains. EDC is used as a solvent in the metal cleaning, textile, and adhesives industries.

- A large amount of chlorine is required as a raw material in the manufacturing process of EDC and PVC. According to Euro Chlor, in June 2022, European chlorine production stood at 682,760 tons. The average daily production in June 2022 was 22,759 tons, which was 5.7% lower than in the previous month and 15.3% lower than in June 2021.

- Large investments in sectors, such as irrigation, water and sanitation management, building and construction, transport, power, retail, etc., continue to be made. PVC plays an important role in the sustainable management of these sectors through various products, like wires and cables, pipes, wood PVC composites, and waterproofing membranes.

- In March 2021, China disclosed its five-year wastewater roadmap that targets the development of 20 million m3/d of additional wastewater treatment capacity. China has also raised the proportion of sewage water that must be treated to comply with reusable standards to 25% over the next seven years.

- Also, the growing trend of 'green construction' across the world is encouraging the usage of PVC in the construction sector more than ever. Thus, with the increase in construction activities, the usage of PVC is expected to increase during the forecast period.

- The rising demand for polyvinyl chloride is expected to boost the demand for chlorine. This, in turn, shall benefit the market for chlorine during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share. With the growing urbanization and the increasing need for fresh water in countries such as China and India, the usage of chlorine is increasing in the region.

- With 2.4% land and 4% water resources, India supports nearly 18% of the world's population. Lately, the dwindling quality of agricultural products has raised serious questions on the sustainability of the agricultural practice. To counter the problem, efforts have been made to improve the land's productivity and increase the efficiency of the supply chain (while reducing the carbon footprint) by implementing PVC pipes in field irrigation systems.

- Moreover, chlorine is majorly used for water treatment. The process of adding chlorine or chlorine compounds to water, such as sodium hypochlorite, is known as water chlorination. In order to kill bacteria, viruses, and other microbes in water, this method is used. Chlorination is particularly useful in preventing the spread of waterborne diseases like cholera, dysentery, and typhoid.

- In July 2022, the Director General of the Phnom Penh Water Supply Authority, Long Naro, announced that the construction of the 1st phase of the Bak Kheng water treatment plant has reached 66% completion and is likely to finish by 2023. This plant will have the capacity for treating 390,000 cubic meters of water each day.

- The packaging industry in India is one of the fastest-growing industries, with direct or indirect influence on all industries. The spending on packaged foods is increasing due to urbanization, increase in per capita income, and the growing number of workforces.

- According to the Packaging Industry Association of India (PIAI), the packaging consumption in India has increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. This clearly indicates that the market is underpenetrated and offers a great business opportunity for the Indian plastics industry.

- Overall, the market for chlorine is projected to witness healthy growth in the country over the forecast period, even though the market remained affected in 2020 due to the COVID-19 outbreak.

Chlorine Industry Overview

The chlorine market is partially fragmented and dominated by very few players. These major players include Olin Corporation, Occidental Petroleum Corporation, Covestro AG, Formosa Plastic Corporation, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Pharmaceutical and Agrochemical Industries

- 4.1.2 Increasing Demand for PVC from Various Sectors

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Import and Export Trends

- 4.7 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Application

- 5.1.1 EDC/PVC

- 5.1.2 Isocyanates and Oxygenates

- 5.1.3 Chloromethanes

- 5.1.4 Solvents and Epichlorohydrin

- 5.1.5 Inorganic Chemicals

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical

- 5.2.3 Chemicals

- 5.2.4 Paper and Pulp

- 5.2.5 Plastic

- 5.2.6 Pesticides

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (PKN ORLEN SA)

- 6.4.2 Covestro AG

- 6.4.3 Ercros SA

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 Hanwha Solutions/Chemical Corporation

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 Nouryon

- 6.4.9 Occidental Petroleum Corporation

- 6.4.10 Olin Corporation

- 6.4.11 Spolchemie

- 6.4.12 Tata Chemicals Limited

- 6.4.13 Tosoh USA, Inc.

- 6.4.14 Westlake Vinnolit GmbH & Co KG

- 6.4.15 Vynova Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from the Wastewater Industry

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 정도

- EDC/PVC

- Isocyanates/Oxygenates

- 클로로메탄

- 용제 및 에피클로로히드린

- 무기 화학제품

- 기타 용도

- 수처리

- 의약품

- 화학제품

- 종이 및 펄프

- 플라스틱

- 농약

- 기타 최종사용자 산업

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- ANWIL SA(PKN ORLEN SA)

- Covestro AG

- Ercros SA

- Formosa Plastics Corporation

- Hanwha Solutions/Chemical Corporation

- INEOS

- Kem One

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- Spolchemie

- Tata Chemicals Limited

- Tosoh USA, Inc.

- Westlake Vinnolit GmbH & Co KG

- Vynova Group

The Chlorine Market is expected to register a CAGR of greater than 3.5% during the forecast period.

During the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability negatively impacted the dyes and pigment market. However, in 2021 the conditions started recovering, which will likely restore the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, the rising demand from the pharmaceutical and agrochemical industries and the increasing demand for PVC from the construction industry are the major driving factors augmenting the growth of the market studied.

- However, stringent government regulations on the use of chlorine are expected to hinder the market's growth.

- Increasing demand from the wastewater industry may create opportunities in the industry.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Chlorine Market Trends

Increasing Demand for PVC

- Polyvinyl chloride (PVC) is widely used in construction, building, and infrastructure. Construction and utility parts in buildings are often partly or completely polymeric. This can be implemented as roofing materials, wall panels, seals, piping systems, coatings, and many other products.

- There are two types of PVC, namely, rigid resins and flexible resins. Rigid resins provide most of the growth opportunities, with major end uses being fittings, pipe and fittings, windows, fencing, roof tiles, and automobile parts. Flexible PVC finds outlets in film and sheets, flooring, wire and cable coating, synthetic leather products, and shower curtains. EDC is used as a solvent in the metal cleaning, textile, and adhesives industries.

- A large amount of chlorine is required as a raw material in the manufacturing process of EDC and PVC. According to Euro Chlor, in June 2022, European chlorine production stood at 682,760 tons. The average daily production in June 2022 was 22,759 tons, which was 5.7% lower than in the previous month and 15.3% lower than in June 2021.

- Large investments in sectors, such as irrigation, water and sanitation management, building and construction, transport, power, retail, etc., continue to be made. PVC plays an important role in the sustainable management of these sectors through various products, like wires and cables, pipes, wood PVC composites, and waterproofing membranes.

- In March 2021, China disclosed its five-year wastewater roadmap that targets the development of 20 million m3/d of additional wastewater treatment capacity. China has also raised the proportion of sewage water that must be treated to comply with reusable standards to 25% over the next seven years.

- Also, the growing trend of 'green construction' across the world is encouraging the usage of PVC in the construction sector more than ever. Thus, with the increase in construction activities, the usage of PVC is expected to increase during the forecast period.

- The rising demand for polyvinyl chloride is expected to boost the demand for chlorine. This, in turn, shall benefit the market for chlorine during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share. With the growing urbanization and the increasing need for fresh water in countries such as China and India, the usage of chlorine is increasing in the region.

- With 2.4% land and 4% water resources, India supports nearly 18% of the world's population. Lately, the dwindling quality of agricultural products has raised serious questions on the sustainability of the agricultural practice. To counter the problem, efforts have been made to improve the land's productivity and increase the efficiency of the supply chain (while reducing the carbon footprint) by implementing PVC pipes in field irrigation systems.

- Moreover, chlorine is majorly used for water treatment. The process of adding chlorine or chlorine compounds to water, such as sodium hypochlorite, is known as water chlorination. In order to kill bacteria, viruses, and other microbes in water, this method is used. Chlorination is particularly useful in preventing the spread of waterborne diseases like cholera, dysentery, and typhoid.

- In July 2022, the Director General of the Phnom Penh Water Supply Authority, Long Naro, announced that the construction of the 1st phase of the Bak Kheng water treatment plant has reached 66% completion and is likely to finish by 2023. This plant will have the capacity for treating 390,000 cubic meters of water each day.

- The packaging industry in India is one of the fastest-growing industries, with direct or indirect influence on all industries. The spending on packaged foods is increasing due to urbanization, increase in per capita income, and the growing number of workforces.

- According to the Packaging Industry Association of India (PIAI), the packaging consumption in India has increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. This clearly indicates that the market is underpenetrated and offers a great business opportunity for the Indian plastics industry.

- Overall, the market for chlorine is projected to witness healthy growth in the country over the forecast period, even though the market remained affected in 2020 due to the COVID-19 outbreak.

Chlorine Industry Overview

The chlorine market is partially fragmented and dominated by very few players. These major players include Olin Corporation, Occidental Petroleum Corporation, Covestro AG, Formosa Plastic Corporation, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Pharmaceutical and Agrochemical Industries

- 4.1.2 Increasing Demand for PVC from Various Sectors

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Import and Export Trends

- 4.7 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Application

- 5.1.1 EDC/PVC

- 5.1.2 Isocyanates and Oxygenates

- 5.1.3 Chloromethanes

- 5.1.4 Solvents and Epichlorohydrin

- 5.1.5 Inorganic Chemicals

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical

- 5.2.3 Chemicals

- 5.2.4 Paper and Pulp

- 5.2.5 Plastic

- 5.2.6 Pesticides

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (PKN ORLEN SA)

- 6.4.2 Covestro AG

- 6.4.3 Ercros SA

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 Hanwha Solutions/Chemical Corporation

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 Nouryon

- 6.4.9 Occidental Petroleum Corporation

- 6.4.10 Olin Corporation

- 6.4.11 Spolchemie

- 6.4.12 Tata Chemicals Limited

- 6.4.13 Tosoh USA, Inc.

- 6.4.14 Westlake Vinnolit GmbH & Co KG

- 6.4.15 Vynova Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from the Wastewater Industry