|

시장보고서

상품코드

1624601

유럽의 안전 연결 장비 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)Europe Safety Connection Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

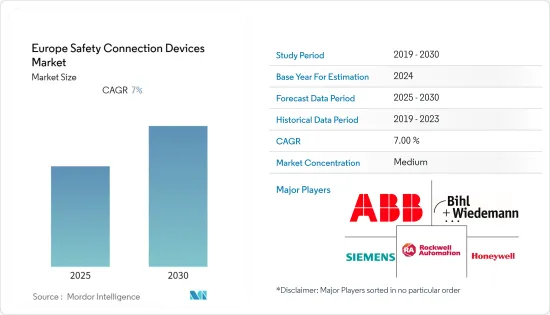

유럽의 안전 연결 장비 시장은 예측 기간 동안 CAGR 7%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 안전 연결 장비는 E-stop, 안전 인터록 스위치, 케이블 풀 스위치 등과 같은 안정적인 통신을 보장합니다. 네트워크 미디어, 제어망, 전력 미디어 및 장치망은 안전 연결 장비의 한 예입니다. 이러한 장비는 여러 기계 간의 연결을 개선하는 동시에 개인 안전을 향상시킵니다. 안전 연결 시스템은 안전 장비의 설치를 가능한 한 쉽게 하는 것을 목표로 합니다.

- 또한, 소비자의 기대치가 높아지고 휴대성과 웨어러블이라는 시장 전반의 트렌드에 대응하기 위해 5G 네트워크를 지원하는 고속 연결 솔루션, 초광대역폭, 저지연 신호, 소형화된 커넥터, 공간과 무게를 절약할 수 있는 고밀도 접점과 같은 새로운 기술이 계속 발전하고 있습니다. 기술들이 시장 성장을 견인하고 있습니다.

- 또한, 자동화 된 생산 설비에는 생산 작업자부터 엔지니어에 이르기까지 다양한 직종의 작업자가 근무하고 있습니다. 이러한 광범위한 범위와 자동화의 발전으로 인해 여러 최종 사용자 산업에서 안전 연결 장치가 필요합니다.

- 이와는 대조적으로, 코로나19는 전 세계 수많은 제조 및 가공 산업에 큰 영향을 미치고 있습니다. 로봇 공학, 건축 기술, 전자 제품, 가공 장비 등의 산업 공급망은 혼란에 빠졌습니다. 그러나 이들 산업은 광범위한 응용 분야를 다루고 있기 때문에 빠르게 회복될 것으로 예상됩니다.

- 또한 기술 개발 및 산업 발전에 대한 인식 부족과 함께 높은 생산 비용이 시장을 억제하는 요인으로 작용할 수 있습니다.

유럽 안전접속기기 시장 동향

유럽 안전접속기기 시장 동향자동화 발전이 시장 주도

- 유럽에서는 높은 신뢰성과 대량 생산에 대한 기대와 함께 제품 품질에 대한 요구가 높아지면서 자동화에 대한 수요가 빠르게 증가하고 있습니다.

- 또한 제조 공정의 자동화는 원활하고 정확한 모니터링, 낭비 감소, 일관된 생산 속도 등 많은 이점을 제공합니다. 이 기술은 고객에게 표준화된 우수한 제품을 적시에 저렴한 비용으로 제공할 수 있습니다.

- 영국 정부의 산업 전략은 기술 분야의 새로운 연구개발을 위해 2020년까지 연간 20억 파운드를 투자할 계획을 기본적으로 제시하였습니다. 스마트 제조와 산업용 사물인터넷(IoT)은 지난 몇 년동안 자동화가 이미 구축한 토대 위에 구축될 것으로 보입니다.

- 또한, 국제로봇연맹(IFS)에 따르면, EU는 현재 제조업 자동화 분야에서 세계 선두주자 중 하나로, 직원 1만 명당 산업용 로봇 도입 대수가 평균 이상인 국가의 65%가 EU에 위치하고 있습니다.

- 유럽의 모든 산업에서 자동화가 확산됨에 따라 데이터를 안전하고 안정적으로 통신하기 위한 안전 연결 장비에 대한 수요도 증가하고 있습니다. 예를 들어, 2020년 5월 허니웰은 신속한 자동화를 통해 백신 및 의료 요법의 개발 및 생산을 가속화했습니다.

자동차 분야가 큰 비중을 차지할 전망

- 자동차 산업은 유럽 경제 발전에 필수적입니다. 유럽연합 집행위원회에 따르면 자동차 산업은 1,380만 명의 유럽인을 직간접적으로 고용하고 있으며, 이는 유럽연합 전체 고용의 6.1%를 차지합니다. 자동차 직접 생산에는 260만 명이 종사하고 있으며, 이는 EU 전체 제조업 고용의 8.5%를 차지하며, EU는 전 세계적으로도 주요 자동차 제조업체 중 하나입니다.

- 또한 EU의 자동차 산업은 연구개발에 대한 민간 투자 규모가 가장 큰 산업 중 하나입니다. 유럽위원회는 EU 자동차 산업의 경쟁력을 높이고 세계 기술 리더십을 유지하기 위해 세계 기술 조화를 장려하고 연구 개발 자금을 지원하고 있습니다.

- 그 결과 유럽의 많은 자동차 제조업체들은 새로운 제조 인프라를 구축하거나 제조 공정을 수작업에서 로봇 기계로 전환하고 있습니다. 예를 들어, BMW는 2023년까지 헝가리에 연간 15만 대의 생산 능력을 갖춘 새로운 공장을 설립할 계획입니다.

- 그러나 코로나19 팬데믹은 유럽 자동차 산업을 근본적으로 흔들고 있으며, 여행 금지, 공장 폐쇄, 소비자의 소비력 제한 등이 겹치면서 신차 시장에 타격을 입히고 있습니다.

- 유럽자동차공업협회(ACEA)는 2020년 EU의 승용차 등록대수가 25% 감소하여 960만 대에 그칠 것으로 예측했습니다. 독일 연방 자동차 교통 당국이 최근 발표한 2020년수치에 따르면 4월에 신차 등록이 61%, 5월에 50% 감소한 것으로 나타났습니다.

유럽의 안전접속기기 산업 개요

유럽의 안전 연결 장비 시장은 경쟁이 치열하며 ABB Ltd., Bihl Wiedemann GmbH, Mouser Electronics, Rockwell Automation Inc. 등 여러 대기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 몇몇 대기업이 시장을 독점하고 있습니다. 압도적인 시장 점유율을 자랑하는 이들 대기업들은 해외 고객 기반을 확대하는 데 주력하고 있습니다. 이들 기업은 시장 점유율을 확대하고 수익성을 높이기 위해 전략적 공동 이니셔티브를 활용하고 있습니다. 경쟁과 급속한 기술 발전은 예측 기간 동안 시장 성장에 위협이 될 것으로 예상됩니다.

- 2021년 9월-ABB Ltd.는 Staubli Electrical Connectors와 양해각서를 체결하고 광산업에서 중장비 관련 온실 가스(GHG) 배출을 줄이는 솔루션을 시장에 제공하기로 했습니다. 커넥터 솔루션 제조업체인 Staubli와 세계 기술 기업인 ABB는 산업 응용 분야의 요구 사항을 충족하는 전기화 솔루션 개발을 모색하고 있습니다. 이러한 요구 사항에는 높은 전력 요구 사항, 자동화되고 안전한 작동, 가혹한 환경 조건에 대한 적응, 승인된 표준에 대한 적합성 등이 포함됩니다. 초점은 광산 인프라에 맞추어져 있습니다.

- 2021년 10월 - Bihl Wiedemann은 SIL3 BWU4001까지 안전 장치를 통합한 BTL 인증 ASi BACnet/IP 컨트롤러를 출시했습니다. 이 장치는 두 개의 ASi 마스터와 통합된 안전 유닛을 가지고 있으며, 일반적으로 SIL2의 안전 수준을 달성하는 안전한 화재 및 배연 댐퍼를 위한 독립형 소형 컨트롤러로 사용할 수 있습니다. 그럼에도 불구하고 더 높은 수준의 BACnet DDC 또는 GLT에 연결하여 컨트롤러와 ASi 설치를 연결하는 게이트웨이 역할을 할 수도 있습니다. 신속한 시스템 분석을 위한 진단 기능은 BACnet, 웹 서버 또는 게이트웨이의 내장 디스플레이에서 간단한 문자 메시지를 통해 이용할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 엄격한 안전 요건

- 산업 자동화 진전

- 소형화와 가변 설계

- 계속 진화하는 신기술

- 시장 성장 억제요인

- 안전 접속 장비 고비용

- 업계 안전 접속 장비 개발에 관한 인식 부족

제6장 시장 세분화

- 유형별

- 케이블과 코드

- 커넥터

- 게이트웨이

- 어댑터

- 릴레이

- T커플러

- 배전 박스

- 최종사용자별

- 자동차

- 제조업

- 헬스케어

- 에너지 및 전력

- 기타 업계별

- 국가별

- 독일

- 영국

- 프랑스

- 기타 유럽

제7장 경쟁 구도

- 기업 개요

- ABB Ltd.

- Bihl+Wiedemann GmbH

- Siemens AG

- Lumberg Automation

- Rockwell Automation Inc.

- Murrelektronik

- Schneider Electric Company

- Parmley Graham

- Mouser Electronics

- Honeywell International, Inc.

제8장 투자 분석

제9장 시장 향후

LSH 25.01.16The Europe Safety Connection Devices Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- The safety connection devices ensure that E-stops, safety interlock switches, and cable pull switches, among other things, communicate reliably. Network media, control net, power media, device net are some examples of safety connection devices. These gadgets improve the connection between multiple machines while also boosting personal safety. The safety connection system is intended to make the installation of safety devices as simple as possible.

- Additionally, the increasing consumer expectations and the ever-evolving new technologies like high-speed connectivity solutions to support 5G networks with faster, ultra-high-bandwidth, lower latency signals, miniaturized connectors, and high-density contacts to conserve space and weight to support prevailing cross-market trends towards portability and wearability are propelling the market's growth.

- Moreover, diverse categories of personnel work on automated production equipment, spanning from production workers to engineers. This wide range and increasing automation are necessitating safety connection devices from several end-user industries.

- In contrast, the COVID-19 pandemic has drastically impacted numerous manufacturing and processing industries across the globe. The supply chain of industries like robotics, building technology, electronics, and processing equipment have been disrupted. However, These industries are expected to recover rapidly due to the extensive range of applications they cater to.

- Also, the high production costs coupled with the lack of awareness about technological developments and industrial advances are the possible market constraints.

Europe Safety Connection Devices Market Trends

Increasing Automation to Drive the Market

- The demand for automation is rapidly growing in Europe due to the increased high product quality requirements, coupled with expectations of high reliability and large volume production.

- Additionally, automation of manufacturing processes has contributed to numerous benefits, such as smooth and accurate monitoring, reduction of waste, consistent production speed. This technology offers customers standardized and superior products within time and at a lower cost.

- The Industrial Strategy of the UK government fundamentally outlined a plan to invest GBP 2 billion per year by 2020 for new research and development in the technology sector. Smart manufacturing and the Industrial Internet of Things (IoT) would be built upon the work that automation has already forged over these years.

- Further, according to the International Federation of Robotics (IFS), as for automation in manufacturing, the European Union is currently one of the global frontrunners: 65 percent of countries with an above-average number of industrial robots per 10,000 employees are located in the EU.

- With automation becoming prevalent in every industry in Europe, the demand for safety connection devices to communicate data safely and securely is also increasing. For instance, in May 2020, Honeywell expedited the development and production of vaccines and medical therapies through fast-track automation.

Automotive segment is Expected to Hold a Major Share

- The automotive industry is essential to Europe's economic development. According to the European Commission, the automobile industry employs 13.8 million Europeans directly and indirectly, accounting for 6.1 percent of overall employment in the EU. Direct production of automobiles employs 2.6 million people, accounting for 8.5 percent of all manufacturing jobs in the EU. The European Union is one of the major makers of automobiles globally.

- Additionally, the EU's automotive industry is one of the largest private investors in R&D. (R&D). The European Commission encourages worldwide technology harmonization and provides money for R&D to boost the competitiveness of the EU automobile industry and maintain its global technological leadership.

- Resultantly, many automotive manufacturers in Europe are creating new manufacturing infrastructures or transitioning their manufacturing processes away from manual labor towards robotic machinery. For instance, BMW plans to open a new factory in Hungary by 2023, with a capacity of 150,000 vehicles per year.

- However, the COVID-19 pandemic has shaken Europe's automotive industry to its core, with a combination of travel bans, factory shutdowns, and limited consumer spending power spelling disaster for the new vehicle market.

- The European Automobile Manufacturers' Association (ACEA) estimated a 25% drop in passenger car registrations in the European Union to just 9.6 million units in 2020. Recent figures from Germany's federal motor transport authority in 2020 revealed that new car registrations had fallen 61% in April and 50% in May.

Europe Safety Connection Devices Industry Overview

The Europe Safety Connection Devices Market is moderately competitive and consists of several major players like ABB Ltd., Bihl+Wiedemann GmbH, Mouser Electronics, Rockwell Automation Inc., etc. In terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. The competition and rapid technological advancements are expected to pose a threat to the market's growth of the companies during the forecast period.

- September 2021 - ABB Ltd. signed a Memorandum of Understanding (MoU) with Staubli Electrical Connectors to bring solutions to the market to reduce the greenhouse gas (GHG) emissions associated with heavy machinery in mining. Staubli, a manufacturer of connector solutions, and global technology company ABB would explore the development of electrification solutions to meet the requirements of industrial applications. These involve high power requirements, automated and safe operations, adaptation to harsh environmental conditions, and the meeting approved standards. The focus would be on mine infrastructure.

- October 2021 - Bihl + Wiedemann launched a BTL-certified ASi BACnet / IP controller with an integrated safety unit up to SIL3 BWU4001. The device has two ASi masters and an integrated safety unit, can be used as a self-sufficient miniature controller for safe fire protection and smoke extraction dampers, which typically achieve a safety level of SIL2. Nonetheless, it can also be connected to a higher-level BACnet DDC or GLT and thus act as a gateway connecting the controller and the ASi installation. Diagnostic functions for fast system analysis are then available via BACnet, web server, or simple text messages on the gateway's integrated display.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Safety Requirements

- 5.1.2 Increasing Automation in Industries

- 5.1.3 Miniaturization and Variable Designs

- 5.1.4 Ever-evolving new technologies

- 5.2 Market Restraints

- 5.2.1 The high cost of safety connection devices

- 5.2.2 Lack of awareness about its developments in the industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Cables and Cords

- 6.1.2 Connectors

- 6.1.3 Gateways

- 6.1.4 Adaptors

- 6.1.5 Relays

- 6.1.6 T-Couplers

- 6.1.7 Distribution Box

- 6.2 By End-user

- 6.2.1 Automotive

- 6.2.2 Manufacturing

- 6.2.3 Healthcare

- 6.2.4 Energy and Power

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Bihl+Wiedemann GmbH

- 7.1.3 Siemens AG

- 7.1.4 Lumberg Automation

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Murrelektronik

- 7.1.7 Schneider Electric Company

- 7.1.8 Parmley Graham

- 7.1.9 Mouser Electronics

- 7.1.10 Honeywell International, Inc.