|

시장보고서

상품코드

1626318

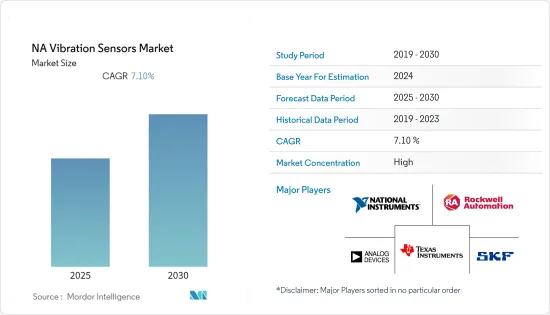

북미의 진동 센서 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)NA Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

북미의 진동 센서 시장은 예측 기간 동안 7.1%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 북미는 제조업 경쟁이 치열합니다. 첨단 제조 로봇 기술에 대한 수요가 이 지역의 시장 성장을 견인하고 있습니다.

- 자동차 산업도 이 시장의 성장을 견인하는 분야입니다. 이 지역의 자동차 생산량은 1,500만 대 이상으로 크게 증가하여 중국에 이어 세계 2위의 자동차 생산국 지위를 유지했습니다.

- 셰일가스 발견과 노후화된 인프라의 교체가 증가함에 따라 진동 센서에 대한 수요가 높아져 이 지역의 전체 시장 확대에 기여하고 있습니다.

- COVID-19는 이 지역의 원유 및 자동차 수요 감소로 인해 일부 생산 설비가 일시적으로 중단되거나 중단되어 업계에 악영향을 미쳤습니다. 이로 인해 진동 센서에 대한 수요가 감소했습니다.

북미의 진동 센서 시장 동향

가정용 전자제품의 큰 성장

- 스마트 전자기기에 대한 선호도 증가, 중산층 증가, 소비자의 가처분 소득 증가, 라이프스타일 선호도 변화 등은 가정용 전자기기 수요를 촉진하는 주요 요인으로 진동 센서의 성장에 간접적인 영향을 미치고 있습니다.

- 이러한 센서는 가전제품에 소음 감소 및 유지보수를 위한 진동 감지용으로 사용되며, PC 노트북이 떨어졌을 때 HDD의 데이터를 보호하기 위해 진동 및 충격 센서가 사용됩니다.

- 이 센서는 자세의 변화와 화면의 회전을 감지하고 3 방향의 움직임을 감지하는 데 사용됩니다. 진동 센서는 위치, 움직임, 가속도를 보정하는 데 사용되며, 휴대폰의 방향, 화면 회전의 변화, 이미지, 다양한 기능을 사용자의 목적에 따라 알 수 있기 때문에 가전제품에 대한 응용이 증가하고 있습니다.

- 예를 들어, 2021년 6월 Fluke Corporation의 사업회사인 Fluke Reliability는 최신 제품인 Fluke 3563 분석 진동 센서 시스템을 발표했습니다. 진동 모니터링은 유지보수 팀이 계획되지 않은 다운타임을 줄이고 치명적인 고장을 사전에 예방할 수 있도록 도와줍니다.

미국이 가장 높은 시장 점유율을 차지

- 미국은 국방 분야에 세계에서 가장 높은 예산을 할당하고 있으며, 2020년에는 5,970억 달러 이상을 지출할 것으로 보고되고 있습니다.

- F-35 전투기, 오하이오급 잠수함, KC-46 공중급유 유조선, 라팔 전투기 프로그램 등 미국의 주요 군사 프로그램은 미국이 국방 분야에 집중하고 있음을 보여줍니다.

- 새로운 연구 개발 이니셔티브는 자동차 산업이 21세기의 기회에 더 잘 대응하기 위해 자동차 산업을 변화시키고 있습니다. 오토 얼라이언스에 따르면 미국 자동차 산업의 연구 개발 비용은 180억 달러가 넘습니다.

- 예를 들어, 2021년 9월 리얼리티 AI는 후지쯔 컴포넌트(Fujitsu Components Corporation)와 파트너십을 맺고 후지쯔 컴포넌트의 비접촉식 진동 센서를 제조 및 산업용 애플리케이션에 도입했습니다. 도플러 레이더 센서를 기반으로 한 후지쯔 컴포넌트의 비접촉식 진동 센서를 이용한 산업용 이상 감지용 Reality AI의 RealityCheck ADTM은 9월 21일부터 23일까지 캘리포니아주 산호세에서 열린 Sensors Converge Expo에서 라이브 시연이 진행되었습니다.

북미의 진동 센서 산업 개요

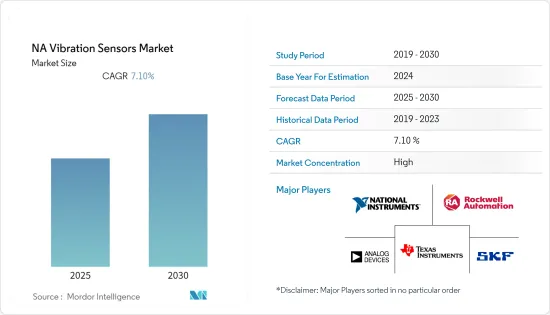

북미의 진동 센서 시장은 경쟁이 치열하고 여러 대기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 소수의 대기업이 시장을 독점하고 있습니다. 그러나 혁신적이고 지속가능한 포장을 통해 많은 기업들이 새로운 계약을 체결하고 새로운 시장을 개척하여 시장에서의 입지를 강화하고 있습니다.

- 2021년 11월 - IMI 센서 전문가가 '수력발전소 진동 모니터링 솔루션'이라는 무료 웹캐스트를 진행합니다. IMI Sensors는 고객에게 수력발전기를 적절하게 모니터링할 수 있는 다양한 옵션을 제공하고 있습니다. 이러한 옵션에는 거의 모든 예산에 맞는 매우 저렴한 비용의 솔루션도 포함되어 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- COVID-19의 업계에 대한 영향 평가

- 시장 성장 촉진요인

- 기계 상태 모니터링과 유지보수 요구 상승

- 진동 센서 장수명, 자가 발전기능, 폭넓은 주파수 범위

- 시장 성장 억제요인

- 오래된 기계와의 호환성

- 산업 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 제품별

- 가속도계

- 속도 센서

- 비접촉 변위계

- 기타

- 최종 이용 산업별

- 자동차

- 헬스케어

- 항공우주 및 방위

- 가정용 전자기기

- 석유 및 가스

- 기타

- 국가별

- 미국

- 캐나다

제6장 경쟁 구도

- 기업 개요

- Rockwell Automation Inc.

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Emerson Electric Corp.

- Honeywell International Inc.

- NXP Semiconductors NV

- TE Connectivity Ltd

- Hansford Sensors Ltd

- Bosch Sensortec GmbH(Robert Bosch GmbH)

제7장 투자 분석

제8장 시장 전망

ksm 25.01.16The NA Vibration Sensors Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- North America has a competitive manufacturing sector. The demand for advanced manufacturing robotic technologies is likely to help the growth of the market in the region.

- The automobile industry is another sector aiding the growth of the market. The vehicle production in the region increased significantly to more than 15 million passenger vehicles, and the country remained the second-largest global vehicle producer after China.

- Due to the increasing shale gas discoveries and replacement of aging infrastructure, the demand for vibrating sensors is high, which thereby helps in increasing the overall market in the region.

- The covdid-19 had an adverse impact on the industry as several production facilities were discontinued or stopped momentarily due to a dip in demand for Crude Oil and automobile in the region. This, in turn, decreased the demand for vibration sensors in the market.

North America Vibration Sensors Market Trends

Consumer Electronics to Show Significant Growth

- The rise in preference toward using smart electronic devices, growing middle-class, rising disposable income of consumers, and changing lifestyle preferences are some of the major factors driving the demand for consumer electronics, which has an indirect impact on the growth of vibration sensors.

- These sensors are used in consumer electronics for vibration detection to reduce noise and maintenance. When a PC Notebook falls, vibration and shock sensors are used to protect the data of HDDs.

- The sensors are used to detect changes in orientation and screen rotation and detect motion in three directions. The application of vibration sensors in consumer electronics is increasing as the sensors are used to calibrate the position, motion, and acceleration, with which the orientation of the phone and the changes in the screen rotation, images, and various features can be known for user purposes.

- For instance, in June 2021, Fluke Reliability, an operating company of Fluke Corporation, is proud to announce its newest product, the Fluke 3563 Analysis Vibration Sensor system. Vibration monitoring helps maintenance teams reduce unplanned downtime and prevent potentially catastrophic failures from occurring, but it has been difficult or cost-prohibitive to monitor every tier of an asset.

United States to Hold the Highest Market Share

- The United States has allocated the highest budget for defense applications globally, with reported spending of more than USD 597 billion in 2020, which is roughly more than one-third of the overall global military expenditure.

- Key military programs in the United States, including F-35 Fighter Jet, Ohio Class Submarine, KC-46 AAerial Refueling Tanker, Rafael Fighter Programs, etc., elucidate the country's focus on the defense sector.

- New R&D initiatives are transforming the automobile industry to better respond to the opportunities of the 21st century. According to the Auto Alliance, the expenditure on R&D in the US automobile industry is more than USD 18 billion.

- For instance, in September 2021, Reality AI partnered with Fujitsu Component Limited to bring Fujitsu Component's contactless vibration sensor to manufacturing and industrial applications. Reality AI's RealityCheck ADTM for industrial anomaly detection with the Fujitsu Component's contactless vibration sensor based on Doppler Radar Sensor was demonstrated live at the Sensors Converge Expo in San Jose, CA, from September 21 to 23.

North America Vibration Sensors Industry Overview

The North America Vibration sensor market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- November 2021 - IMI Sensors experts will present a free webcast called Vibration Monitoring Solutions for Hydropower Plants. IMI Sensors provides customers with several different options for properly monitoring a hydro machine. These options include some very low-cost solutions that can fall within almost any budget.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Increasing need for machine condition monitoring and maintenance

- 4.3.2 Longer service life, self-generating capability, and wide range of frequency of vibration sensors

- 4.4 Market Restraints

- 4.4.1 Compatibility with old machinery

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Accelerometer

- 5.1.2 Velocity Sensor

- 5.1.3 Non-Contact Displacement Transducer

- 5.1.4 Others

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare

- 5.2.3 Aerospace and Defense

- 5.2.4 Consumer Electronics

- 5.2.5 Oil & Gas

- 5.2.6 Others

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 SKF AB

- 6.1.3 National Instruments Corporation

- 6.1.4 Texas Instruments Incorporated

- 6.1.5 Analog Devices Inc.

- 6.1.6 Emerson Electric Corp.

- 6.1.7 Honeywell International Inc.

- 6.1.8 NXP Semiconductors NV

- 6.1.9 TE Connectivity Ltd

- 6.1.10 Hansford Sensors Ltd

- 6.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

샘플 요청 목록