|

시장보고서

상품코드

1626888

북미의 냉동식품 포장 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)North America Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

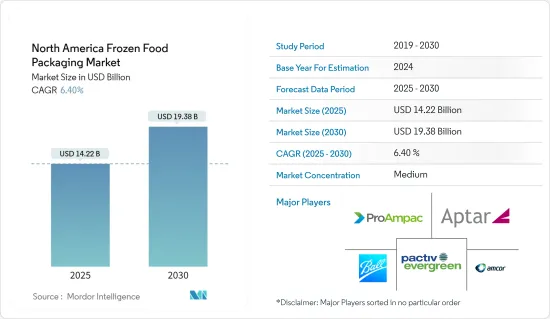

북미의 냉동식품 포장 시장 규모는 2025년 142억 2,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 6.4%의 연평균 복합 성장률(CAGR)을 기록하여 2030년에는 193억 8,000만 달러에 이를 것으로 예상됩니다.

주요 하이라이트

- 냉동식품은 기존 가정식 요리보다 시간과 노력이 덜 들기 때문에 편리함을 추구하는 소비자 니즈가 증가하면서 냉동식품 판매 성장에 박차를 가하고 있습니다. 바쁜 라이프 스타일로 인해 소비자들이 가공식품을 선호하게 되면서 냉동식품에 대한 수요가 급증하고 있습니다. 포장 냉동식품의 주요 카테고리로는 베이커리 제품과 냉동 가공식품이 있으며, 냉동 조리식품은 주목할 만한 카테고리로 부상하고 있습니다. 식품의 품질에 대한 소비자의 기대치가 계속 높아지는 가운데, 저온 보존은 유통기한을 크게 연장할 수 있습니다.

- 냉동식품에 대한 소비자의 관심이 높아짐에 따라 지속 가능한 포장재에 대한 수요가 증가하고 있습니다. 많은 제조업체와 소매업체들이 기존 포장재에서 재활용, 재사용, 퇴비화 가능한 대체 포장재로 전환하고 있습니다. 냉동식품 및 개별 포장 제품에 대한 수요가 급증함에 따라 포장 업계는 이에 적응하기 위해 경쟁하고 있습니다. 냉동식품 포장의 혁신이 증가하고 있으며, 전자 레인지로 가열할 수 있는 제품을 위한 스팀 포장과 같은 주목할 만한 발전이 이루어지고 있습니다. 또한, 콜드체인 기술이나 온도 변화를 사용자에게 경고하는 스마트 포장의 개발은 이러한 진화하는 요구에 부응할 것으로 기대됩니다.

- 식료품 쇼핑 습관이 급변하고 있습니다. 점점 더 많은 소비자들이 온라인 플랫폼을 통해 식품을 구매하고 있으며, 편의성과 안전성을 우선시하고 있습니다. 이러한 소비자의 취향 변화에 따라 소매업체들은 주문 처리 방식을 다양화하고 있습니다. 경쟁 가격, 도로변 픽업, 택배, 음식 배달 앱, 원격 픽업 등 다양한 방식으로 주문 처리 방식을 다양화하고 있습니다.

- 소매업체들은 지방, 티어 I, 티어 II 지역에서 리콜 가치와 존재감을 높이기 위해 노력하고 있으며, 판촉 프로그램을 더욱 매력적으로 만들기 위한 노력을 강화하고 있습니다. 이러한 역동적인 움직임은 식료품 소매업의 진화하는 상황을 강조할 뿐만 아니라, 이들 지역에서 냉동식품에 대한 수요를 형성하는 급성장하는 기회를 강조하고 있습니다.

북미의 냉동식품 포장 시장 동향

소매 채널을 통한 신선육에 대한 수요 증가

- 소비자들이 생고기 포장에 독성 플라스틱보다 바이오 소재를 선호하는 경향이 강화되면서 시장 전망은 향후 몇 년동안 진전될 것입니다. 환경 문제에 대한 관심 증가와 정부의 엄격한 규제가 결합되어 시장 참여자들에게 새로운 비즈니스 기회를 창출할 수 있습니다. 이러한 역학은 생육 포장 부문의 혁신적인 솔루션에 대한 이러한 진입 업체를 촉진하고 전체 시장의 성장을 가속할 수 있습니다.

- 이러한 변화는 육류가 함유된 단백질의 건강상의 이점에 대한 인식, 케토 다이어트와 같은 고단백 식단의 부상, 포장된 가공육에 대한 의존도 증가 등의 이유로 온라인 및 오프라인 소매 채널을 통한 신선육 및 가금류 수요에 긍정적인 영향을 미치고 있습니다. 또한, 이 지역의 경제 성장도 육류 소비를 증가시킬 것으로 예상됩니다.

- 미국 육류 산업은 최근 몇 년동안 일관성을 보이고 있습니다. 미국 농무부 경제조업체국의 데이터에 따르면 미국의 쇠고기 생산량은 2023년 26억 9,960만 파운드에 달할 것으로 예상되며, 2022년 282억 9,000만 파운드에서 감소할 것으로 예상되며, 2021년 기준 쇠고기는 미국 내 신선육 소매 판매량 1위를 차지할 것으로 예상되며, 그 해 매출은 300억 달러를 넘어설 것으로 예상됩니다. 2022년 100% 다진 고기의 소매 가격은 2020년 3.95달러에서 상승한 파운드당 4.8달러를 기록할 것으로 예상됩니다. 반면 주요 식료품 소매점의 쇠고기 양지머리 평균 가격은 파운드당 약 8.84달러였습니다.

- 식품산업협회에 따르면 최근 몇 년동안 백화점에서 육류 판매가 가장 안정적이며, 평균 가구 보급률이 98% 이상, 연간 50회 가까이 쇼핑을 하고 있습니다. 신선육은 쇠고기와 닭고기가 가장 많이 팔리고, 가공육은 베이컨과 조리된 점심용 고기가 가장 많이 팔리고 있습니다.

- Progressive Grocer가 발표한 연구에 따르면, 미국 내 신선육 소매 매출은 지난 몇 년동안 648억 8,000만 달러에서 2022년에는 866억 2,000만 달러로 증가할 것으로 예상됩니다. 이러한 긍정적인 추세는 예측 기간 동안 지속될 것으로 예상되며, 이 지역의 육류 포장에 대한 수요를 증가시킬 것으로 예상됩니다.

미국, 괄목할 만한 성장률 기록

- 냉동식품 포장에 대한 수요가 급증하면서 업계는 제품 혁신에 적극적으로 투자하여 시장 성장에 박차를 가하고 있으며, 전자상거래는 쇼핑 편의성을 높일 뿐만 아니라 다양한 부문에서 가격 하락 압력을 가하고 있습니다. 전자상거래는 쇼핑의 편의성을 높일 뿐만 아니라 다양한 부문에서 가격 하락 압력을 가하고 있으며, Business Insider에 따르면 전자상거래가 소매업의 성장을 가속하는 한편, 연질 포장의 영향력도 이 지역에서 확대될 것으로 보입니다. 포장에 미치는 영향도 이 지역에서 확대될 것으로 보입니다.

- 미국은 Walmart, Kroger, Albertsons와 같은 유력 기업들이 주도하는 경쟁이 치열한 소매 산업을 자랑합니다. 미국 출신의 월마트는 세계 최대 소매업체입니다. 특히 세계 10대 소매업체 중 5곳이 미국에 본사를 두고 있어 미국이 세계 소매산업에서 매우 중요한 역할을 담당하고 있음을 알 수 있습니다.

- 미국에서는 밀레니얼 세대의 소비자들이 1회분씩 휴대할 수 있는 식품 및 음료에 대한 선호도가 높아 냉동식품 포장 제품에 대한 수요를 주도하고 있습니다. 휴대가 간편하고 내구성이 뛰어나며 가벼운 무게로 설계된 냉동 식품 포장은 이러한 제품에 대한 인기 있는 선택이 되고 있습니다. 또한, 가공식품과 신선한 스낵 식품에 대한 식욕이 증가함에 따라 이러한 수요를 더욱 촉진할 것으로 보입니다.

북미의 냉동식품 포장 산업 개요

북미의 냉동식품 포장 시장은 여러 유력한 진입자들이 경쟁하는 시장입니다. 시장 점유율 측면에서 이들 주요 시장 진출기업 중 일부는 현재 시장을 선도하고 있습니다. 시장 점유율이 높은 이들 주요 업체들은 해외 고객 기반을 확대하는 데 주력하고 있습니다. 시장 주요 기업으로는 Pactiv Evergreen Inc., Amcor PLC, ProAmpac LLC, Aptar-Food Protection Inc. AptarGroup Inc.

- 2024년 3월, Amcor Group은 유기농 요구르트 브랜드인 Stonyfield Organic 및 스파우츠 파우치 포장의 선두 제조업체인 Cheer Pack North America와 제휴했습니다. 양사는 업계 최초의 올 폴리에틸렌(PE) 스파우츠 파우치 'YoBaby' 냉장 요구르트를 출시하여 기존의 멀티 라미네이트 구조에서 보다 책임감 있는 디자인으로 전환했습니다. 이 파트너십은 지속가능성 리더인 세 회사를 하나로 묶어 최고의 성능을 유지하면서 지속가능성을 지지하는 시장 최초의 솔루션을 개발했습니다.

- 2023년 10월, 냉동 유기농 및 유기농 과일 시장에서 유명한 Nature's Touch는 SunOpta Inc의 냉동 과일 사업부인 Sunrise Growers의 특정 자산을 인수한다고 발표했습니다. 이번 인수를 통해 Nature's Touch는 북미 전역에 걸쳐 고객 중심 접근 방식을 강화할 수 있게 되었으며, 그 결과 친환경적이고 편리한 포장의 최고급 유기농 냉동 식품을 공급업체와 소매업체에 제공할 수 있는 등 많은 이점을 제공할 수 있게 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업 매력 - Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업에 대한 지정학적 시나리오 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 재료별

- 유리

- 종이

- 금속

- 플라스틱

- 기타

- 식품별

- 레디밀

- 과일 및 채소

- 고기 및 가금육

- 어개류

- 구워 제과

- 기타

- 포장 제품별

- 백

- 박스

- 캔

- 카톤

- 트레이

- 래퍼

- 기타

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 개요

- Pactiv Evergreen Inc.

- Amcor PLC

- ProAmpac LLC

- Aptar-Food Protection(AptarGroup Inc.)

- Ball Corporation Inc.

- Sonoco Products Company

- Tetra Pak International

- Genpack LLC

- WestRock Company

- Sealed Air Corporation

- Universal Plastic Bag Manufacturing Co.

제8장 투자 분석

제9장 시장의 미래

LSH 25.01.21The North America Frozen Food Packaging Market size is estimated at USD 14.22 billion in 2025, and is expected to reach USD 19.38 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Key Highlights

- With frozen items requiring less time and effort than traditional home-cooked meals, the rising consumer demand for convenience is fueling the growth of frozen product sales. Busy lifestyles are pushing consumers toward processed foods, leading to a surge in demand for frozen food. The primary categories of packaged frozen foods include bakery products and frozen processed foods, with frozen ready-to-eat items emerging as a notable category. Colder storage temperatures can significantly extend shelf life, all while consumer expectations for food quality continue to rise.

- As consumers increasingly turn to frozen foods, there is a growing demand for sustainable packaging materials. Numerous manufacturers and retailers are transitioning from traditional packaging to recyclable, reusable, and compostable alternatives. This surge in demand for frozen foods and individually wrapped items has the packaging industry racing to adapt. Innovations in frozen food packaging are on the rise, with notable advancements like steamable packaging for microwavable products. Furthermore, developments in cold-chain technology and smart packaging, like alerting users to temperature changes, are expected to address these evolving needs.

- Grocery shopping habits have undergone a seismic shift. A growing number of consumers are turning to online platforms for their food purchases, prioritizing convenience and safety. In response to these evolving preferences, retailers are diversifying their order fulfillment methods. These include competitive pricing, curbside pickups, home deliveries, food delivery apps, and pickups from remote locations.

- As retailers strive to enhance their recall value and presence in rural, tier I, and tier II regions, they are intensifying efforts to make their promotional programs more enticing. This dynamic not only underscores the evolving landscape of grocery retailing but also highlights the burgeoning opportunities that are shaping the demand for frozen foods in these regions.

North America Frozen Food Packaging Market Trends

Growing Demand for Fresh Meat Through Retail Channels

- As consumers increasingly demand bio-based materials over toxic plastics for fresh meat packaging, the market outlook is set to evolve in the coming years. Heightened environmental concerns, coupled with stringent government regulations, are poised to create fresh opportunities for market players. Such dynamics could propel these players toward innovative solutions in the fresh meat packaging arena, fueling overall market growth.

- This change has positively impacted the demand for fresh meat and poultry through online and offline retail channels owing to reasons, including the recognition of the health advantages of meat-rich protein, the rise of high-protein diets such as the keto diet, and the upswing in reliance on pre-packaged processed meat. Also, the region's economic growth is expected to boost meat consumption.

- The US meat industry has displayed consistency over recent years. Data from the US Department of Agriculture and Economic Research Service indicates that beef production in the country was projected to reach 26.96 billion pounds in 2023, a decrease from 28.29 billion pounds in 2022. As of 2021, beef led the pack in retail sales among fresh meats in the United States, with sales surpassing USD 30 billion that year. In 2022, the retail price for 100% ground beef reached USD 4.8 per pound, a rise from USD 3.95 in 2020. Meanwhile, beef brisket averaged around USD 8.84 per pound at major grocery retailers.

- According to the Food Industry Association, meat sales have been the most consistent in department retail stores during the last few years, with an average household penetration of more than 98% and nearly 50 shopping trips per year. The top sellers in fresh meat are beef and chicken, while bacon and pre-packed lunch meat are the top sellers in processed meats.

- As per the research published by Progressive Grocer, retail sales of fresh meat in the United States increased in the past few years from USD 64.88 billion to USD 86.62 billion in 2022. This positive trend is also anticipated to be witnessed during the forecast period, pushing the demand for meat packaging in the region.

United States to Witness Significant Growth Rate

- As demand for frozen food packaging surges, industry players are heavily investing in product innovation, fueling market growth in the country. The booming e-commerce landscape is further amplifying the need for packaging solutions. E-commerce not only enhances shopping convenience but also exerts downward pressure on prices across various sectors. According to Business Insider, while e-commerce is propelling retail growth, its impact on flexible packaging is poised to expand in the region.

- The United States boasts a fiercely competitive retail industry, largely propelled by dominant players like Walmart, Kroger, and Albertsons. Walmart, hailing from the United States, stands as the world's largest retailer. Notably, five out of the top ten global retail giants are US-based, underscoring the nation's pivotal role in the global retail landscape.

- In the country, millennial consumers, with their strong preference for single-serving and on-the-go food and beverage items, primarily drive the demand for frozen food packaging products. Designed to be portable, durable, and lightweight, frozen food packaging has emerged as a popular choice for such items. Additionally, the rising appetite for both processed and fresh snack foods is poised to further fuel this demand.

North America Frozen Food Packaging Industry Overview

The North American frozen food packaging market is competitive with several influential players. Some of these important players in terms of market share are currently leading the market. These influential players with significant market shares are focused on expanding their customer base abroad. Some of the key players in the market include Pactiv Evergreen Inc., Amcor PLC, ProAmpac LLC, Aptar-Food Protection Inc. (AptarGroup Inc.), and Ball Corporation Inc.

- March 2024: Amcor Group teamed up with Stonyfield Organic, an organic yogurt producer, and Cheer Pack North America, a premier manufacturer of spouted pouch packaging. Together, they unveiled the industry's inaugural all-polyethylene (PE) spouted pouch for YoBaby refrigerated yogurt, moving away from the previous multi-laminate structure to a more responsible design. This partnership united three sustainability leaders, pioneering a market-first solution that champions sustainability while maintaining top-notch performance.

- October 2023: Nature's Touch, a prominent player in the market of frozen organic and conventional fruits, announced the acquisition of specific assets of Sunrise Growers, the frozen fruit operations of SunOpta Inc. Through this acquisition, Nature's Touch will be able to enhance its customer-centric approach throughout North America, resulting in numerous advantages for suppliers and retailers, such as access to top-notch organic frozen food items in eco-friendly and convenient packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience Food

- 5.1.2 Increase in Popularity of QSRs (Quick-service Restaurants)

- 5.2 Market Restraints

- 5.2.1 Rising Preference for Natural Food Products

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Other Materials

- 6.2 By Food Product

- 6.2.1 Readymade Meals

- 6.2.2 Fruits and Vegetables

- 6.2.3 Meat and Poultry

- 6.2.4 Seafood

- 6.2.5 Baked Goods

- 6.2.6 Other Food Products

- 6.3 By Packaging Product

- 6.3.1 Bags

- 6.3.2 Boxes

- 6.3.3 Cans

- 6.3.4 Cartons

- 6.3.5 Trays

- 6.3.6 Wrappers

- 6.3.7 Other Packaging Products

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Amcor PLC

- 7.1.3 ProAmpac LLC

- 7.1.4 Aptar - Food Protection (AptarGroup Inc.)

- 7.1.5 Ball Corporation Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 Tetra Pak International

- 7.1.8 Genpack LLC

- 7.1.9 WestRock Company

- 7.1.10 Sealed Air Corporation

- 7.1.11 Universal Plastic Bag Manufacturing Co.