|

시장보고서

상품코드

1851300

염료 및 안료 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Dyes And Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

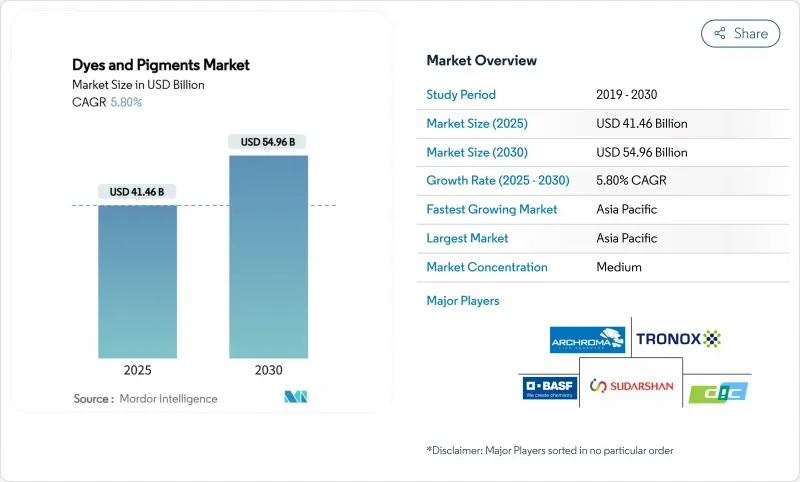

염료 및 안료 시장 규모는 2025년에 414억 6,000만 달러로 추정되고, 예측 기간(2025-2030년) CAGR 5.80%로 성장할 전망이며, 2030년에는 549억 6,000만 달러에 달할 것으로 예측됩니다.

환경규제의 강화, 제조에 있어서의 급속한 기술 도입, 아시아태평양 전역에서의 지속적인 생산 능력 증강이 이 궤도를 뒷받침하고 있습니다. 아시아태평양은 페인트, 코팅제 및 플라스틱에서 안료 소비를 증가시키는 인프라 지출에 힘입어 생산의 주도권을 보유하고 있습니다. 액상 분산 기술은 3D 프린팅 및 수계 코팅 시스템을 위한 보다 미세한 입자 분포를 가능하게 하고 그 스캐폴드를 굳게 합니다. 수달산 케미칼이 호이바흐 그룹 인수로 대표되는 주요 공급업체의 통합은 원료 가격이 변동하는 동안 포트폴리오 최적화를 시사합니다. 천연 착색료의 상업적 이용가능성은 아직 확립되지 않았지만, REACH 규칙과 EPA 규칙의 엄격화로 인해 공급 기반을 다양화하는 바이오 화학물질에 대한 연구 개발이 가속화되고 있습니다.

세계의 염료 및 안료 시장 동향 및 인사이트

아시아태평양의 페인트 및 코팅 수요 증가

아시아태평양의 인프라 파이프라인은 건축용 페인트 및 보호 페인트에서 이산화티타늄 안료와 산화철 안료의 생산량을 밀어 올리고 있습니다. 중국의 2035년 저탄소화 지침과 같은 수계 제형을 선호하는 지역 정책 이니셔티브는 솔벤트 기반 분배의 대안을 가속화하고 있습니다. Lancces는 산화철 생산 능력을 확대하고 환경 라벨의 요구 사항을 충족하기 위해 환경 제품 선언을 발행했습니다. 다국적 페인트 제조업체는 지역 포뮬레이터와 제휴하여 색상 기준을 현지화함으로써 규제 무결성과 신속한 시장 진출을 실현하고 있습니다.

섬유 생산 확대

중국, 인도, 베트남의 텍스타일 생산 능력 증강은 반응 염료 및 분산 염료, 특히 방습 및 항균 가공을 실시한 테크니컬 텍스타일 수요를 재구축하고 있습니다. 인도는 2025년까지 450억 달러의 섬유 수출을 목표로 하고 있으며 공장에 물 소비량을 줄이고 색역을 넓히는 디지털 인쇄 플랫폼의 채용을 촉구하고 있습니다. Archroma의 Huntsman Textile Effects 인수로 42개국에 걸쳐 5,000명의 직원이 통합되어 고성능 염료와 지속가능성 인증을 결합한 포트폴리오가 구축되었습니다. 염료 재생 시스템 및 콜드 패드 배치 처리를 포함한 순환 이니셔티브는 패스트 패션 브랜드가 환경 실적를 공개함에 따라 지지를 받고 있습니다. 라미와 코튼 원단의 에너지 절약 염색 경로의 조사는 수평도 및 정착률을 계속 개선하고 있습니다.

중금속 안료에 대한 REACH 및 EPA의 엄격한 규제

카드뮴, 6가 크롬, 납 화합물은 페인트 및 플라스틱에서 거의 0에 가까운 허용 범위에 직면하고 있으며, REACH에서는 폴리머 매트릭스 중의 카드뮴을 0.01wt%로 제한하고 있습니다. 2024년에 시행되는 문신 잉크의 규칙은 프탈로시아닌 블루 15와 그린 7을 포함한 4,000개 이상의 물질에 적용 범위를 넓혀 처방 담당자에게 유기 대체 물질의 탐구를 촉구하고 있습니다. 미국 화장품 규제 현대화법은 FDA에 안전성 데이터의 요구와 안료 함유 제품의 회수를 인정하는 것으로 컴플라이언스 비용을 인상하고 있습니다. 크롬이 없는 옐로우 및 바나디네이트 비스무트 대체품 포트폴리오를 가진 기업은 규제 시장에서 점유율을 확대하고 있습니다. 중금속 안료 제조업체는 시장이 보다 안전한 화학물질로 축발을 옮기기 때문에 판매량 축소와 마진 압축에 직면하고 있습니다.

부문 분석

염료는 2024년에 세계 염료 및 안료 시장의 57.10%를 차지하였고, 2030년까지 연평균 복합 성장률(CAGR) 5.98%로 성장할 것으로 예측됩니다. 반응 염료는 공유 결합이 강하기 때문에 면과 라미의 용도를 지배하고 있으며, 생생한 의류에 대한 전자상거래 수요를 지원하고 있습니다. 아조 염료는 덴마크의 규칙으로 방향족 아민이 0.003wt%로 제한되어 있기 때문에 아동복에 대한 사용이 제한되고 있습니다.

염료 하위 부문은 형광 증백제로부터 레이저 마크 가능한 플라스틱용 근적외선 흡수제에 이르기까지 특수 용도가 확대되고 있습니다. 한편 안료는 내식성이나 열제어를 필요로 하는 기능성 코팅에 있어서 그 존재감을 늘리고 있습니다. 나노 엔지니어링된 하이브리드 착색제가 안료 수준의 내광성을 가지면서 가용성과 같은 광택을 실현함에 따라, 이 두 범주 사이의 기술적 장벽은 모호해지고 있습니다. '요람에서 요람까지'의 인증 취득을 목표로 하는 브랜드는 금속을 사용하지 않는 레시피에 매료되어, 분야 횡단적인 혁신을 자극하고 있습니다.

합성 착색료는 2024년 총 판매량의 85.17%를 차지했으며, 예측 가능한 음영 강도, 넓은 색역, 비용 효율성으로 계속 이어지고 있습니다. 석유 기반 중간체는 고속 패션 및 패키징 컨버터의 저스트 인 타임 물류에 대응하는 대규모 생산을 지원합니다. 천연 대체물은 CAGR 7.12%로 성장하여 클린 라벨에 대한 소비자의 선호와 규제상 인센티브로 뒷받침됩니다.

미생물 발효의 진보는 폐기 글리세롤로부터 베탈레인과 카로티노이드의 생산을 가능하게 하고, 공급의 안전성을 높입니다. 합성 제조업체 각사는 리그노셀룰로오스 유래의 바이오아로마틱스에 투자하고 재생 가능한 루트에서 헤지를 도모하고 있습니다. 바이오 인디고와 안트라퀴논 중간체의 파일럿 라인은 검증 단계로 들어가고 있습니다. 이해관계자들은 높은 실적 수입품에 페널티를 부과하고 저탄소 합성 루트를 경제적으로 매력적으로 만드는 EU의 탄소 국경 조정 메커니즘을 기대하고 있습니다.

지역 분석

아시아태평양이 염료 및 안료 시장을 독점하고 2024년 점유율은 47.41%를 차지했으며, 2030년까지 CAGR 6.22%로 확대될 전망입니다. 2025년까지 섬유 자동화를 70% 달성한다는 중국의 계획이 배치 사이클을 단축하고 물 사용량을 줄이는 디지털 대응 액체 염료의 주문을 뒷받침하고 있습니다. VOXCO Pigments의 크롬 옐로우 및 몰리브덴산 오렌지에서 6,000만 달러의 확장과 같은 지역 안료 공급에 대한 투자는 수출 시장을 목표로 하고 세계 고객 리드 타임을 단축합니다.

유럽은 엄격한 규정에도 불구하고 전략적 중요성을 유지하고 있습니다. 중국산 산화티타늄에 대한 반덤핑 관세는 프랑스, 독일, 네덜란드의 국내 생산자에게 문을 열고 조달처를 재조정합니다. 독일은 여전히 산화철의 중요한 공급원이며, 트로녹스의 네덜란드 공장 휴면은 에너지 집약적인 공정에서 비용 압력을 반영합니다.

북미는 성숙하면서도 활기차고 EPA의 VOC 기준이 수계 처방의 업그레이드를 촉진하고 있습니다. 랭크세스는 인산철 리튬 양극용 인산철 중간체를 판매하고 있어 안료를 전지 용도로 확대하고 있습니다.

남미에서는 브라질의 산화철 생산량이 국내 건설을 지원합니다. 중동 및 아프리카에서는 사우디아라비아의 NEOM과 같은 거대한 프로젝트로 인한 안료 수요 증가 및 기후 변화에 강한 외관에 대한 코팅 수요가 예상됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아태평양의 페인트 및 코팅 수요 증가

- 텍스타일 생산 확대

- 건설용 안료(시멘트 및 기와)의 인프라 주도 상승

- 낮은 VOC, 수성 처방으로의 이동

- 적층 조형에서 염료 함유 필라멘트의 채용

- 시장 성장 억제요인

- 중금속 안료에 대한 REACH와 EPA의 엄격한 규제

- 휘발성 원유 유래의 원료 가격

- 아동복에 있어서 특정 아조 염료의 사용 금지

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 규모 및 성장 예측

- 제품 유형별

- 염료

- 반응성

- 분산

- Vat

- 유황

- 산

- Azo

- 안료

- 유기 안료

- 무기 안료

- 염료

- 유래별

- 합성

- 천연 및 바이오베이스

- 제형별

- 파우더

- 입상

- 액체 분산

- 최종 사용자 업계별

- 페인트 및 코팅

- 섬유

- 인쇄 잉크

- 플라스틱

- 기타 최종 사용자 산업(건축 자재, 종이 및 펄프, 화장품 및 퍼스널케어)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Altana AG

- BASF

- Archroma

- artience Co., Ltd.

- Bodal Chemicals Ltd

- Cathay Industries

- DIC Corporation

- Flint Group

- ISHIHARA SANGYO KAISHA, LTD.

- Kronos Worldwide, Inc.

- Lanxess

- Meghmani Group

- Merck KGaA

- Sudarshan Chemical Industries Limited

- Tronox Holdings plc

- Venator Materials PLC

- Vibrantz

제7장 시장 기회 및 향후 전망

AJY 25.11.21The Dyes and Pigments Market size is estimated at USD 41.46 billion in 2025, and is expected to reach USD 54.96 billion by 2030, at a CAGR of 5.80% during the forecast period (2025-2030).

Strengthening environmental rules, rapid technology adoption in manufacturing, and continuous capacity additions across Asia-Pacific drive this trajectory. Asia-Pacific commands production leadership, underpinned by infrastructure spending that amplifies pigment consumption in paints, coatings, and plastics. Liquid dispersion technologies enable finer particle distribution for 3D printing and waterborne coating systems, strengthening their foothold. Consolidation among key suppliers, exemplified by Sudarshan Chemical's purchase of Heubach Group, points to portfolio optimization amid raw-material price volatility. Natural colorant commercial viability is still emerging; however, stricter REACH and EPA rules are accelerating research and development around bio-based chemistries that diversify the supply base.

Global Dyes And Pigments Market Trends and Insights

Growing Demand from Paints and Coatings in APAC

Asia-Pacific infrastructure pipelines are propelling titanium dioxide and iron oxide pigment volumes in architectural and protective coatings. Regional policy initiatives that prioritize waterborne formulations, such as China's 2035 low-carbon guideline, accelerate substitutions away from solvent-borne dispersions. LANXESS expanded iron-oxide capacities and published Environmental Product Declarations that help specifiers meet ecolabel requirements. Multinational paint makers partner with regional formulators to localize color standards, ensuring regulatory alignment and faster market entry.

Expanding Textile Production

Textile capacity additions in China, India, and Vietnam are reshaping demand for reactive and disperse dyes, particularly for technical textiles with moisture-management and antimicrobial finishes. India targets USD 45 billion in textile exports by 2025, encouraging mills to adopt digital printing platforms that cut water consumption and broaden color gamut. Archroma's acquisition of Huntsman Textile Effects merged 5,000 employees across 42 countries, creating a portfolio that combines high-performance dyes with sustainability certifications. Circularity initiatives, including dye reclamation systems and Cold Pad-Batch processing, are gaining traction as fast-fashion brands disclose environmental footprints. Research into energy-saving dyeing routes for ramie and cotton fabrics continues to improve levelness and fixation rates.

Stringent REACH and EPA Restrictions on Heavy-Metal Pigments

Cadmium, chromium VI, and lead compounds face near-zero tolerance in coatings and plastics, with REACH limiting cadmium in polymer matrices to 0.01 wt%. Tattoo-ink rules effective in 2024 widened the scope to more than 4,000 substances, including phthalocyanine Blue 15 and Green 7, pushing formulators to explore organic alternatives. The US Modernization of Cosmetics Regulation Act grants the FDA the ability to request safety data and recall pigment-containing products, elevating compliance costs. Companies holding portfolios of chromium-free yellows or bismuth vanadate substitutes are gaining share in regulated markets. Heavy-metal pigment producers confront shrinking volumes and margin compression as markets pivot to safer chemistries.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure-Led Rise in Construction Pigments

- Shift Toward Low-VOC, Water-Borne Formulations

- Volatile Crude-Derived Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dyes control 57.10% of the global dyes and pigments market in 2024 and will advance at 5.98% CAGR to 2030, fueled by penetrating textile, leather, and paper workflows that need molecular-level color dispersion. Reactive dyes dominate cotton and ramie applications due to strong covalent bonding, supporting e-commerce demand for vibrant apparel. Azo dye proliferation is now curbed in children's wear, with Danish rules capping aromatic amines at 0.003 wt%.

The dyes subsegment showcases a widening specialty range, from fluorescent optical brighteners to near-infrared absorbers for laser-markable plastics. Meanwhile, pigments keep gaining ground in functional coatings that demand corrosion resistance or thermal control. Technological barriers between the two categories blur as nano-engineered hybrid colorants deliver soluble-like brilliance with pigment-level lightfastness. Brands pursuing cradle-to-cradle certification gravitate toward metal-free recipes, stimulating cross-disciplinary innovation.

Synthetic colorants represented 85.17% of total volume in 2024 and continue to lead due to predictable shade strength, wide color coverage, and cost efficiency. Petroleum-based intermediates support high-scale production that meets just-in-time logistics for fast-fashion and packaging converters. Natural alternatives grow at a 7.12% CAGR, buoyed by consumer preference for clean labels and regulatory incentives.

Microbial fermentation advances enable production of betalains and carotenoids from waste glycerol, enhancing supply security. Synthetic producers are hedging with renewable routes, investing in bio-aromatics derived from lignocellulose. Pilot lines for bio-based indigo and anthraquinone intermediates are entering validation stages. Stakeholders anticipate carbon-border adjustment mechanisms in the EU that could penalize high-footprint imports, making low-carbon synthetic routes financially attractive.

The Dyes and Pigments Market Report is Segmented by Product Type (Dyes and Pigments), Source (Synthetic and Natural/Bio-based), Formulation (Powder, Granular, and Liquid Dispersion), End-User Industry (Paints and Coatings, Textiles, Printing Inks, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the dyes and pigments market, holding 47.41% share in 2024 and expanding at 6.22% CAGR through 2030. China's program to reach 70% textile automation by 2025 fuels orders for digitally compatible liquid dyes that shorten batch cycles and cut water usage. Regional pigment supply investments, such as VOXCO Pigments' USD 60 million expansion in chrome yellow and molybdate orange, target export markets and reduce lead times for global customers.

Europe retains strategic significance despite stringent regulation. Anti-dumping duties on Chinese titanium dioxide recalibrate sourcing, offering openings for domestic producers in France, Germany, and the Netherlands. Germany remains a critical source of iron oxides, while Tronox's idling of a Dutch plant reflects cost pressures in energy-intensive processes.

North America is mature yet dynamic, with EPA VOC standards catalyzing waterborne formulation upgrades. LANXESS markets iron-phosphate intermediates for lithium iron phosphate cathodes, expanding pigment reach into battery applications.

South America leans on Brazil's iron oxide output, supporting domestic construction. The Middle East and Africa observe pigment demand growth from megaprojects such as Saudi Arabia's NEOM, combined with coatings demand for climate-resilient facades.

- Altana AG

- BASF

- Archroma

- artience Co., Ltd.

- Bodal Chemicals Ltd

- Cathay Industries

- DIC Corporation

- Flint Group

- ISHIHARA SANGYO KAISHA, LTD.

- Kronos Worldwide, Inc.

- Lanxess

- Meghmani Group

- Merck KGaA

- Sudarshan Chemical Industries Limited

- Tronox Holdings plc

- Venator Materials PLC

- Vibrantz

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from Paints and Coatings in APAC

- 4.2.2 Expanding Textile Production

- 4.2.3 Infrastructure-Led Rise in Construction Pigments (Cement and Roof Tiles)

- 4.2.4 Shift Toward Low-VOC, Water-Borne Formulations

- 4.2.5 Adoption of Dye-Infused Filaments for Additive Manufacturing

- 4.3 Market Restraints

- 4.3.1 Stringent REACH and EPA Restrictions on Heavy-Metal Pigments

- 4.3.2 Volatile Crude-Derived Feedstock Prices

- 4.3.3 Ban on Certain Azo Dyes in Children's Apparel

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Dyes

- 5.1.1.1 Reactive

- 5.1.1.2 Disperse

- 5.1.1.3 Vat

- 5.1.1.4 Sulfur

- 5.1.1.5 Acid

- 5.1.1.6 Azo

- 5.1.2 Pigments

- 5.1.2.1 Organic Pigments

- 5.1.2.2 Inorganic Pigments

- 5.1.1 Dyes

- 5.2 By Source

- 5.2.1 Synthetic

- 5.2.2 Natural / Bio-based

- 5.3 By Formulation

- 5.3.1 Powder

- 5.3.2 Granular

- 5.3.3 Liquid Dispersion

- 5.4 By End-user Industry

- 5.4.1 Paints and Coatings

- 5.4.2 Textiles

- 5.4.3 Printing Inks

- 5.4.4 Plastics

- 5.4.5 Other End-user Industries (Construction Materials, Paper and Pulp, Cosmetics and Personal Care)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Altana AG

- 6.4.2 BASF

- 6.4.3 Archroma

- 6.4.4 artience Co., Ltd.

- 6.4.5 Bodal Chemicals Ltd

- 6.4.6 Cathay Industries

- 6.4.7 DIC Corporation

- 6.4.8 Flint Group

- 6.4.9 ISHIHARA SANGYO KAISHA, LTD.

- 6.4.10 Kronos Worldwide, Inc.

- 6.4.11 Lanxess

- 6.4.12 Meghmani Group

- 6.4.13 Merck KGaA

- 6.4.14 Sudarshan Chemical Industries Limited

- 6.4.15 Tronox Holdings plc

- 6.4.16 Venator Materials PLC

- 6.4.17 Vibrantz

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment