|

시장보고서

상품코드

1626903

유럽의 수처리 자동화 및 계측 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Water Automation and Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

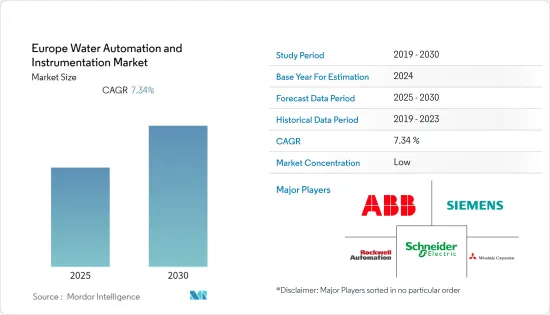

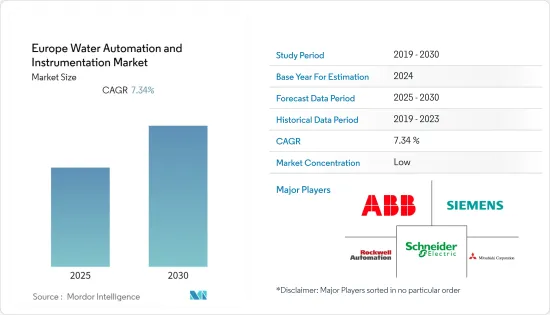

유럽의 수처리 자동화 및 계측 시장은 예측 기간 동안 CAGR 7.34%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 식수 자원의 고갈과 정부의 규제 강화로 인해 운영 비용 관리는 상수도 업계 이해관계자들이 직면한 가장 큰 과제 중 하나로 떠올랐습니다. 인건비와 에너지 관련 비용은 상수도 사업 OPEX에서 가장 큰 비중을 차지합니다.

- 현재 시장에서 검토되고 있는 물 자동화 관련 기술 개발에는 압력 센서와 음향 센서를 사용하여 무선 모니터링 시스템을 통해 물 손실을 감지, 보고 및 감소시키는 스마트 모니터링 기술, 추적 데이터와 과학적 이해가 지속적으로 향상됨에 따라 폐수 처리 및 재활용 최적화를 통한 물 관리의 최근 발전이 포함됩니다. 폐수 처리 및 재활용 최적화를 통한 물 관리의 최근 발전 등이 있습니다.

- 무수익수(NRW)는 고객에게 도달하기 전에 손실되는 물로 알려져 있습니다. 손실은 배관망 누수, 도난 등으로 인해 발생합니다. 세계은행에 따르면, 전 세계 상수도 사업이 무수익수로 인해 발생하는 총 비용은 아무리 적게 잡아도 연간 1,410억 달러에 달하며, 그 중 3분의 1은 개발도상국에서 발생한다고 합니다. 물 손실 감소에 대한 요구가 높아짐에 따라 상수도 사업자들은 첨단 물 관리 솔루션을 채택하고 있습니다.

- 수산업과 관련된 계측 장비 및 자동화 솔루션은 정기적인 유지보수가 필요합니다. 따라서 장비의 최종 사용자는 제품 수명 동안 유지보수 비용을 부담해야 한다는 압박을 받게 됩니다. 또한, 유지보수 및 취급에는 높은 기술력이 요구됩니다. 결과적으로 제조업체는 자격을 갖춘 숙련된 지원자 부족으로 인해 자동화 및 제어 시스템을 운영하는 데 어려움을 겪고 있습니다.

- COVID-19의 발생은 생산을 중단하고 공급망을 혼란에 빠뜨려 산업 생산량 증가를 약화시키고 송신기와 같은 여러 유형의 장비의 생산 감소로 이어져 HMI SCADA 시스템 및 분산 제어 시스템의 사용에 영향을 미쳤습니다.

유럽의 수처리 자동화 및 계측기기 시장 동향

수요 증가율이 두드러지게 나타나는 음료 및 식품업계

- 음용식품의 제조에는 많은 양의 물이 필요합니다. 물은 식음료 가공 산업의 중요한 원료 중 하나이기 때문에 수질은 제품의 품질과 운영의 신뢰성에 매우 중요합니다. 식음료 산업에서 물 및 폐수 자동화를 도입하면 오류와 낭비를 없애고 효율성과 생산성을 향상시키며 수익률을 높여 기업의 수익을 크게 절약할 수 있습니다.

- 또한, 식음료 산업의 다양한 기업들이 다양한 자동화 및 계측 방법을 도입하고 있습니다. 예를 들어, 페루의 한 식품 가공 공장은 천연 지하수가 높은 탁도와 비소로 오염되어 식품 가공에 사용할 수 없는 상황에 직면해 있었는데, AMI의 맞춤형 솔루션은 한외여과막과 응집제 전처리, 심층 여과, 여과액의 염소 소독을 통합하여 식품 가공에 사용되는 고객의 고품질 표준을 충족하는 물을 생산합니다. 식품 가공에 사용되는 고객의 고품질 기준을 충족하는 물을 생산합니다. 이 시스템은 중앙 제어 인클로저와 터치스크린 HMI 운영자 인터페이스를 사용하는 AMI PLC 자동화 시스템입니다.

- 또한 액체 분석기, 압력 측정 시스템, 유량 측정 시스템과 같은 계측 기술이 식음료 산업에 도입되어 라인에서 제품을 배출할 때 위의 계측 기술을 사용하여 공정 중 폐수량을 줄입니다. 또한, 원수, 공정수 또는 폐수는 모듈형 공간 절약형 분석 패널을 통해 효율적으로 모니터링할 수 있습니다. 이를 통해 식음료 산업에서 일상적인 공정 통합 및 운영을 간소화할 수 있습니다.

- 또한 DCS, SCADA와 같은 자동화 기술은 다양한 식음료 산업에서 가변 속도 드라이브, 품질 관리 시스템, 모터 제어 센터(MCC), 가마, 제조 장비, 물 및 폐수 처리 관리 등 다양한 장비를 제어하는 데 사용됩니다.

프랑스, 이 지역의 수처리 자동화 및 계측을 선도하는 기업

- 프랑스에서 식수로 취수되는 물의 양은 EU 평균보다 약간 적지만 미국이나 일본과 같은 다른 선진국의 평균 수준보다 훨씬 적습니다. 또한 fp2e.org에 게시 된 보고서에 따르면 프랑스 수도권에서 식수로 취수 된 총 물의 양은 54 억 m3이며 이는 1인당 연간 85m3 이상, 하루 234 리터에 해당합니다. 이 지역의 물 부족을 모니터링하고 효율적으로 분배하고 통제하기 위해서는 이 물 사용량을 억제하는 것이 시급합니다.

- 정부는 이 지역의 폐수 처리장 신규 프로젝트를 장려하고 있으며, 유틸리티, 운송, 정부, 인프라, 자원 및 제조 산업에서 경쟁이 치열해지고 수익성이 악화됨에 따라 자동화 기술이 매우 중요해짐에 따라 2021년 3월 SUEZ와 Schneider Electric 그룹은 물 순환 관리를 위한 혁신적인 디지털 솔루션을 공동으로 개발 및 판매하는 디지털 물 분야 선도 기업을 설립한다고 발표했습니다. 이 합작회사는 수처리 인프라의 계획, 운영, 유지보수 및 최적화를 위한 독자적인 소프트웨어 솔루션을 제공함으로써 지방 상수도 사업자와 산업의 디지털 전환을 가속화할 수 있도록 지원할 예정입니다.

- 전 세계가 전염병으로 인해 혼란에 빠졌고, 프랑스 식수 공급업체는 물 공급망의 염소 양을 늘렸습니다. 많은 기업들이 활동을 중단했기 때문입니다. 배관 내 물이 오랫동안 정체되어 있었기 때문에 염소를 늘리면 미생물과 바이러스의 발생을 막을 수 있었습니다.

- 이러한 사례는 조사 대상 시장에서 자동화 센서 및 모니터링 시스템에 대한 수요를 촉진하여 더 많은 기업이 에너지 소비를 줄이고 운영 효율성을 높이는 것을 목표로 하고 있습니다.

유럽의 수처리 자동화 및 계측 산업 개요

주요 기업으로는 ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, Endress Hauser Pvt. Ltd, EurotekIndia, Phoenix Contact, NALCO, MJK Automation, Blue Water Automation 등이 있습니다. 시장이 세분화되어 있기 때문에 대기업 간의 경쟁도 치열합니다. 따라서 시장 집중도는 낮을 것으로 예상됩니다.

- 2021년 4월-SUEZ 그룹은 프랑스 최초의 공공 상하수도 관리 전문 멀티 서비스 반공개 회사(SEMOP)를 설립한다고 발표함. 디종 도시권 15개 도시 및 마을의 주민 22만 명에게 서비스를 제공한다고 밝혔습니다.

- 2020년 11월 - 환경 IoT의 선구자이자 베올리아 워터 프랑스(Veolia Water France)의 자회사인 버즈(Birdz)가 물 관리 커뮤니티 용도 전문기업인 플룩스아쿠아(FluksAqua)와 합병을 발표했습니다. 이번 합병은 Birdz의 디지털 데이터 기술과 FluksAqua의 디지털 사용자 문화를 결합하는 것을 목표로 합니다. 새 회사는 수도 사업자에게 보다 종합적이고 사용하기 쉬우며 고성능의 디지털 서비스를 제공할 예정입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

제6장 시장 세분화

- 물 자동화 솔루션별

- DCS

- SCADA

- PLC

- HMI

- 기타 수처리 자동화 솔루션

- 물 계측 솔루션별

- 압력 트랜스미터

- 레벨 트랜스미터

- 온도 트랜스미터

- 액체 분석계

- 가스 분석계

- 누설 감지 시스템

- 유량 센서/트랜스미터

- 기타 계측 솔루션

- 최종사용자 산업별(정성 분석)

- 화학

- 제조업

- 식품 및 음료

- 유틸리티

- 종이 및 펄프

- 기타

- 국가별

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

제7장 경쟁 구도

- 기업 개요

- ABB Group

- Siemens AG

- Schneider Electric SE

- GE Corporation

- Rockwell Automation Inc.

- Mitsubishi Motors Corporation

- Emerson Electric

- Yokogawa Electric Corporation

- Endress+Hauser Pvt. Ltd

- Eurotek India

- Phoenix Contact

- NALCO

- MJK Automation

- KROHNE LTD

제8장 투자 분석

제9장 시장의 미래

LSH 25.01.21The Europe Water Automation and Instrumentation Market is expected to register a CAGR of 7.34% during the forecast period.

Key Highlights

- Managing operational costs emerged as one of the biggest challenges posed by stakeholders of the water industry, as the governments are imposing regulations, along with depletion of potable water resources. Expenses relating to labor and energy constitute the largest share in OPEX for water utilities.

- Several water automation-related technology developments currently being explored in the market include smart monitoring technologies using pressure and acoustic sensors to detect, report, and reduce water loss via wireless monitoring systems; and recent advances in water management through optimizing wastewater processing and recycling, as tracking data and scientific understanding continues to improve.

- Non-revenue water (NRW) is known as water lost before it reaches a customer. Losses can occur from leaks in the distribution network, during a theft, etc. According to the World Bank, the total cost to water utilities is from non-revenue water worldwide can be conservatively estimated at USD 141 billion per year, with a third of it occurring in the developing world. The rising demand to reduce non-revenue water losses led water utilities to adopt advanced water management solutions.

- The instrumentation and automation solutions involved in the water industry need periodic maintenance. Therefore, the pressure lies on the end-user of the equipment, who must bear the maintenance expenses throughout the product's lifetime. Also, their maintenance and handling require high skill. Consequently, manufacturers face difficulties while operating automation and control systems due to a lack of qualified and skilled applicants.

- The outbreak of COVID-19 halted the production and disrupted the supply chain, which led to weakened industrial output growth and the decline in the production of multiple types of equipment, such as transmitters, and affected the use of HMI SCADA systems and distributed control systems.

Europe Water Automation & Instrumentation Market Trends

Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- The production of food and beverages requires a large amount of water. Water quality is crucial to product quality and operational reliability as water is one of the important raw materials in the food and beverage processing industry. The implementation of water and wastewater automation in the food and beverage industry can save significant revenues for the company along with eliminating errors and waste, enhancing efficiency and productivity, and expanding profit margins.

- Further, various companies in the Food and beverage industry are deploying various automation and instrumentation methods. For instance, a food processing plant in Peru was faced with natural groundwater contaminated with high turbidity and arsenic, making it unsuitable for use in food processing. AMI's custom-engineered solution incorporates ultrafiltration membranes with pretreatment by coagulant and depth filtration, as well as chlorination of the filtrate to produce water meeting the customer's high-quality standards for use in food product processing. The system is AMI PLC automated using a central control enclosure and touchscreen HMI operator interface.

- Moreover, instrumentation technology such as liquid analyzer, pressure measurement system, flow measurement system is being deployed in the food and beverage industry to reduce the volume of wastewater during the process by using the above-mentioned instrumentation technology when discharging products from the lines. Further, Raw water, process water, or wastewater can be efficiently monitored with modular, space-saving analysis panels. This simplifies daily process integration and operation in the food and beverage industries.

- Also, automation technologies such as DCS, SCADA, among others, are used in various food and beverage industries to control various instrumentality types, including variable speed drives, quality control systems, motor control centers (MCC), kilns, manufacturing equipment, and manage the water and wastewater treatment.

France to lead the Water Automation and Instrumentation in the region

- In France, the amount of water withdrawn for drinking water is marginally smaller than the EU average but far smaller than average levels in other developed countries like the USA or Japan. Moreover, according to a report published in fp2e.org, the total amount of water withdrawn for drinking water purposes in Metropolitan France was 5.4 billion m3, representing an annual amount of just over 85 m3 of water per person, 234 liters per person per day. There is an urgent need to bring this water usage in check to monitor, efficiently distribute, and control the water shortage in the region.

- The government is encouraging new projects of wastewater treatment plants in the region, and increased competition and eroding margins in utilities, transport, government, infrastructure, resources, and manufacturing make automation technologies very critical. In March 2021, The SUEZ and Schneider Electric groups announced the creation of a leader in digital water to develop and market a joint offering of innovative digital solutions for the management of the water cycle. This joint venture will support municipal water operators and industrial players in accelerating their digital transformations by providing them with a unique range of software solutions for planning, operation, maintenance, and optimization of water treatment infrastructure.

- The pandemic did cause havoc across the world due to which the French drinking water suppliers have increased the dose of chlorine in the water distribution networks. It was mainly done since many companies have ceased their activities. The water in the pipes remained stagnant for a longer period, so adding more chlorine prevented possible microbes or viruses from appearing.

- Such an instance would drive the demand for automated sensors and monitoring systems in the studied market, and more and more companies are aiming to reduce their energy consumption and increase their operational efficiency.

Europe Water Automation & Instrumentation Industry Overview

The major players include ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc., Mitsubishi Motors Corporation, Emerson Electric, Yokogawa Electric Corporation, Endress+ Hauser Pvt. Ltd, EurotekIndia, Phoenix Contact, NALCO, MJK Automation, and Blue Water Automation. As the market is fragmented, there is major competition between the major players. Therefore, the market concentration is expected to be low.

- April 2021 - SUEZ Group announced creating the first multiservice Semi-Public Company with a Single Operation (SEMOP) in France dedicated to both public water and wastewater management services. It will serve 220,000 inhabitants of 15 towns and cities of the Dijon metropole.

- November 2020 - Birdz, a pioneer in environmental IoT and a subsidiary of Veolia Water France, announces its merger with FluksAqua, a specialist in community applications for water management. This merger aims to collate Birdz's Digital Data skills with FluksAqua's Digital User culture. The new entity will offer the water operators even more comprehensive, easy-to-use, and high-performance digital services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulation to Save Water Resources and Energy

- 5.1.2 Increase in Adoption of Smart Water Technologies

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Personnel to Operate Instrumentation

6 MARKET SEGMENTATION

- 6.1 By Water Automation Solution

- 6.1.1 DCS

- 6.1.2 SCADA

- 6.1.3 PLC

- 6.1.4 HMI

- 6.1.5 Other Water Automation Solutions

- 6.2 By Water Instrumentation Solution

- 6.2.1 Pressure Transmitter

- 6.2.2 Level Transmitter

- 6.2.3 Temperature Transmitter

- 6.2.4 Liquid Analyzers

- 6.2.5 Gas Analyzers

- 6.2.6 Leakage Detection Systems

- 6.2.7 Flow Sensors/Transmitters

- 6.2.8 Other Water Instrumentation Solutions

- 6.3 By End-User Industry (Qualitative Analysis)

- 6.3.1 Chemical

- 6.3.2 Manufacturing

- 6.3.3 Food and Beverages

- 6.3.4 Utilities

- 6.3.5 Paper and Pulp

- 6.3.6 Other End-user Industries

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric SE

- 7.1.4 GE Corporation

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Mitsubishi Motors Corporation

- 7.1.7 Emerson Electric

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 Endress + Hauser Pvt. Ltd

- 7.1.10 Eurotek India

- 7.1.11 Phoenix Contact

- 7.1.12 NALCO

- 7.1.13 MJK Automation

- 7.1.14 KROHNE LTD