|

시장보고서

상품코드

1627112

바이오폴리머 포장 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)Biopolymer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

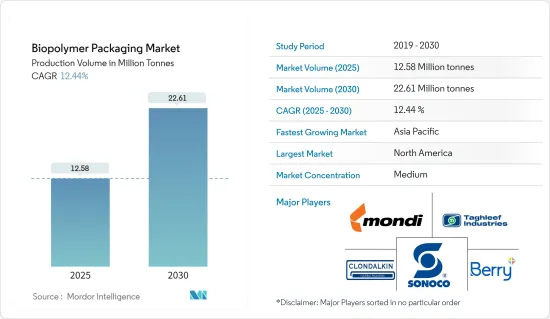

생산량 기준 바이오폴리머 포장 시장 규모는 2025년 1,258만 톤에서 2030년 2,261만 톤으로 확대될 것으로 예상되며, 예측 기간(2025-2030년) 동안 12.44%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

합성 고분자 사용으로 인한 환경에 대한 관심 증가와 플라스틱 포장에 대한 엄격한 규제 강화는 바이오 폴리머 포장 시장의 성장에 기여하는 중요한 요인 중 하나입니다.

다양한 농산물은 비용 효율적이고 재생 가능하며 생분해성 식품 포장의 원료가 될 수 있습니다. 생분해성 고분자의 화학 구조는 생분해성 관능기에 의한 에스테르 결합과 아미드 결합이 특징입니다.

플라스틱 봉투 사용에 대한 규제가 강화됨에 따라 도매업체와 소매업체들은 친환경 포장재를 채택하고 있습니다. 지속 가능한 포장에 대한 이러한 경향은 바이오 폴리머 포장 시장을 강화할 태세를 갖추고 있습니다. 또한, 바이오, 생분해성, 퇴비화 가능한 플라스틱과 같은 대체품은 화석 기반의 비생분해성 플라스틱에 비해 더 지속 가능한 선택이 될 수 있습니다.

바이오폴리머 포장재는 환경 친화적인 솔루션을 제공할 뿐만 아니라 원료가 저렴하고 풍부하다는 장점도 있습니다. 바이오폴리머 포장 시장은 식품 및 제약 산업 수요에 힘입어 강력한 성장세를 보이고 있습니다. 지속가능성에 대한 관심과 생분해성 플라스틱 포장의 잠재력에 따라 아시아태평양 국가, 특히 인도, 중국, 일본은 유럽 여러 국가와 함께 바이오폴리머 포장의 채택을 늘리고 있습니다.

최근 몇 년동안 바이오 복합재료는 식품과 직접 접촉하는 재료를 강화하여 활성 식품 포장의 주요 초점으로 부상했습니다. 이러한 첨단 바이오 복합재료는 우수한 기계적 특성, 장벽 특성, 항산화 특성 및 항균 특성을 자랑하는 혁신적인 식품 포장 재료의 길을 열었습니다.

바이오 생분해성 합성 바이오 폴리머를 채택하는 데는 장애물이 있습니다. 기존의 석유에서 추출한 비생분해성 소재에 비해 높은 비용과 여러 가지 제약 조건이 기존 플라스틱과의 경쟁을 가로막고 있습니다. 따라서 바이오 생분해성 합성 바이오폴리머를 기존 플라스틱의 직접적인 대체품으로 자리매김하는 데는 여전히 큰 장애물이 남아 있습니다.

바이오폴리머 포장 시장 동향

최대의 최종 사용자는 음료 및 식품 산업

- 바이오폴리머 포장 시장의 식음료 부문은 환경 인식 증가, 규제 필요성, 지속 가능한 포장으로 전환하는 소비자의 요구에 힘입어 강력한 성장세를 보이고 있습니다. 바이오폴리머는 생분해성이 있고 화석연료에 대한 의존도가 낮기 때문에 기존 플라스틱을 대체할 수 있는 친환경 소재로 떠오르고 있습니다.

- 바이오폴리머는 환경 친화적일 뿐만 아니라 식품 산업에서 매우 중요한 역할을 하고 있습니다. 특히 육류 제품의 신선도와 품질을 유지하여 유통기한을 연장하고 음식물 쓰레기를 줄일 수 있습니다. 이러한 추세에 따라 전 세계 정부 및 규제 기관은 지속 가능한 포장을 지지하는 정책을 내놓고 있으며, 이는 바이오폴리머 포장 시장을 더욱 활성화시키고 있습니다.

- 소비자들이 점점 더 친환경적인 제품을 선호함에 따라 음료 및 식품 기업들은 이러한 기호에 부합할 뿐만 아니라 브랜드 이미지를 높이기 위해 바이오 폴리머로 눈을 돌리고 있습니다.

- 바이오폴리머는 신선식품, 육류, 유제품, 스낵, 기타 신선식품에 이르기까지 다양한 식품을 포장하는 데 있어 최적의 선택이 되고 있습니다. 효과적인 장벽 특성으로 수분, 산소 및 오염 물질로부터 식품을 보호합니다.

- OECD와 FAO의 데이터에 따르면, 세계 육류 생산량은 2016년 3억 1,700만 톤에서 2024년 3억 5,075만 톤으로 급증할 것으로 예상됩니다. 이러한 육류 생산량 증가는 당연히 포장 솔루션에 대한 수요를 증가시켰고, 바이오폴리머는 육류 포장의 지속 가능한 대안으로 각광받고 있습니다.

- 일회용 분야에서는 바이오폴리머를 기반으로 한 병, 컵, 용기가 특히 재활용성이 가장 중요한 분야에서 인기가 급상승하고 있습니다. 외식 산업에서도 바이오폴리머를 일회용 수저, 접시, 테이크아웃 용기에 사용하고 있습니다.

눈에 띄는 성장이 기대되는 아시아태평양

- 아시아태평양은 세계 최고의 바이오폴리머 소비국이자 생산국입니다. 특히 유통기한 만료로 인한 식품 폐기물에 대한 우려가 커지면서 이 지역 기업들은 혁신적인 솔루션을 모색하고 있습니다. 또한, 식품 폐기물에 대한 정부 규제는 지속 가능한 포장으로의 전환을 더욱 촉진하여 바이오폴리머 포장 시장을 강화하고 있습니다.

- 인도, 중국, 파키스탄, 인도네시아 등 인구 밀도가 높은 국가에서는 바이오플라스틱으로의 전환이 서서히 진행되고 있습니다. 이러한 변화는 환경 규제 강화, 정부의 인식 제고 프로그램, 기존 플라스틱 사용 금지 조치 증가로 인해 가속화되고 있습니다.

- 국제 피트니스 보디빌딩 연맹의 보고서에 따르면 세계 바이오플라스틱 생산 능력은 2023년 202만 톤에 달할 것이며, 아시아가 50% 이상을 차지할 것으로 예상됩니다.

- 또한 소비자의 인식이 높아지고 인도와 같은 신흥국이 친환경 솔루션에 대한 세제 혜택을 제공함에 따라 아시아태평양의 투자가 증가할 것으로 예상됩니다. 이러한 추세는 바이오 폴리머 패키징 시장을 견인할 것으로 보입니다.

- DPIIT(Department for Promotion of Industry and Internal Trade)에 따르면, 식음료 제조 분야의 세계 리더인 인도는 2,000년 4월부터 2024년 3월까지 식품 가공 산업에 약 125억 8,000만 달러의 외국간접투자(FDI) 자금이 유입되었습니다. 이는 전체 FDI 총액의 1.85%에 해당하며, 2023-24 회계연도에는 채소 가공에 6억 5,242만 달러, 기타 가공품에 16억 5,222만 달러, 과일 및 주스 가공에 9억 7,093만 달러가 유입된 것으로 집계됐습니다.

- 또한 인도 정부는 식품가공산업부를 통해 식품가공산업에 대한 투자를 강화하기 위해 적극적으로 노력하고 있습니다. 정부는 이러한 노력을 계속하여 종합적인 PMKSY 제도를 2026년3 월까지 연장하고 46 억 루피(미화 559 억 4,000만 달러)를 대폭 할당했습니다. 이러한 노력은 이 지역에서 연구되고 있는 시장의 성장을 크게 촉진할 것으로 예상됩니다.

바이오폴리머 포장산업 개요

바이오폴리머 포장 시장은 Mondi Group, Taghleef Industries Inc. 등 유력 기업들이 존재하며 반고체화되어 있습니다. 이들 기업은 소비자의 요구에 따라 제품 라인을 지속적으로 강화할 수 있는 능력을 갖추고 있어 다른 기업보다 경쟁 우위를 유지하고 있습니다. 이들 기업은 경쟁력을 유지하기 위해 R&D 활동, M&A, 다른 기업 및 기관과의 전략적 파트너십에 투자하고 있습니다.

- 2023년 8월 - CJ 제일제당의 자회사인 CJ 바이오머티리얼즈(CJ Biomaterials Inc.)가 한국 리만(Riman)과 파트너십을 맺었습니다. 이번 제휴는 CJ Biomaterials Inc.의 특허 받은 PHA 기술과 폴리유산(PLA)을 결합하여 리만의 고급 인셀덤 제품 라인의 포장을 개발하기 위한 것입니다. 이 첨단 패키징은 리만의 지속가능성에 대한 약속에 부합할 뿐만 아니라 스킨케어 제품의 기존 화석연료 기반 패키징에 대한 의존도를 크게 낮출 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 매력 - Porter의 Five Forces 분석

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 재료 유형별

- 비생분해성

- PET

- PA

- PTT

- 기타 비생분해성 재료

- 생분해성

- PLA

- 전분 블렌드

- PBAT

- 기타 생분해성 재료

- 비생분해성

- 제품별

- 백

- 파우치

- 필름

- 최종사용자별

- 식품 및 음료

- 소매

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 이집트

- 북미

제7장 경쟁 구도

- 기업 개요

- Mondi Group

- Taghleef Industries Inc.

- Clondalkin Group Holdings BV

- Sonoco Products Company

- Berry Plastics Group Inc.

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- Tetra Pak International SA

- United Biopolymers SA

- Amcor PLC

- NatureWorks LLC

- CJ Biomaterials Inc.

제8장 투자 분석

제9장 시장 기회와 향후 동향

LSH 25.01.21The Biopolymer Packaging Market size in terms of production volume is expected to grow from 12.58 million tonnes in 2025 to 22.61 million tonnes by 2030, at a CAGR of 12.44% during the forecast period (2025-2030).

Increasing environmental concerns owing to the use of synthetic polymers, coupled with rising strict regulations on plastic packaging, are some of the crucial factors contributing to the growth of the biopolymers packaging market.

A variety of agricultural by-products serve as raw materials for cost-effective, renewable, and biodegradable food packaging. The chemical structure of biodegradable polymers features ester and amide bonds attributed to their biodegradable functional groups.

As regulations tighten on plastic bag usage, wholesalers and retailers are increasingly adopting eco-friendly packaging. This rising inclination toward sustainable packaging is poised to bolster the biopolymers packaging market. Furthermore, alternatives like bio-based, biodegradable, and compostable plastics present a more sustainable choice compared to their fossil-based, non-biodegradable counterparts.

Biopolymer packaging materials not only offer an eco-friendly solution but also benefit from the affordability and abundance of their raw materials. The bio-polymers packaging market is set for robust growth, driven largely by demand from the food and pharmaceutical industries. In response to sustainability concerns and the potential of biodegradable plastic packaging, countries in Asia-Pacific, notably India, China, and Japan, alongside several European nations, are increasingly adopting bio-polymer packaging.

In recent years, biocomposites have emerged as a leading focus for active food packaging, enhancing materials in direct contact with food. These advanced biocomposites are paving the way for innovative food packaging materials boasting superior mechanical, barrier, antioxidant, and antimicrobial attributes.

Nonetheless, the adoption of bio-based biodegradable synthetic biopolymers faces hurdles. Their higher costs, surpassing those of conventional petroleum-derived non-biodegradable materials, coupled with certain limitations, challenge their competitiveness against traditional plastics. As a result, positioning bio-based biodegradable synthetic biopolymers as direct replacements for conventional plastics remains a formidable obstacle.

Biopolymer Packaging Market Trends

The Food and Beverages Industry to be the Largest End User

- The food and beverage segment of the biopolymers packaging market is witnessing robust growth fueled by heightened environmental awareness, regulatory imperatives, and a consumer shift toward sustainable packaging. Biopolymers, with their biodegradable properties and diminished dependence on fossil fuels, are emerging as a greener alternative to traditional plastics.

- Beyond their eco-friendliness, biopolymers play a pivotal role in the food industry, notably in preserving the freshness and quality of meat products, thereby extending shelf life and curbing food waste. In response to these trends, governments and regulatory entities worldwide are rolling out policies to champion sustainable packaging, further energizing the biopolymers packaging market.

- As consumers increasingly gravitate toward eco-friendly products, food and beverage companies are turning to biopolymers, not just to align with these preferences but also to bolster their brand image.

- From fresh produce and meat to dairy, snacks, and other perishables, biopolymers are becoming the go-to choice for packaging. Their effective barrier properties shield food from moisture, oxygen, and contaminants.

- Data from the OECD and FAO highlights a surge in global meat production, climbing from 317 million metric tons in 2016 to an anticipated 350.75 million metric tons in 2024. This uptick in meat production naturally escalates the demand for packaging solutions, with biopolymers standing out as a sustainable choice for meat packaging.

- In the realm of single-use applications, biopolymer-based bottles, cups, and containers are witnessing a surge in popularity, especially where recyclability is paramount. The foodservice industry is also embracing biopolymers, utilizing them for disposable cutlery, plates, and takeaway containers.

Asia-Pacific Expected to Witness Significant Growth

- Asia-Pacific stands out as the world's leading consumer and producer of biopolymers. Heightened concerns over food wastage, particularly due to product expiry, have driven companies in the region to seek innovative solutions. Additionally, government regulations addressing food wastage have further propelled the shift toward sustainable packaging, bolstering the biopolymers packaging market.

- Countries like India, China, Pakistan, and Indonesia, with their dense populations, are witnessing a gradual shift toward bio-based plastics. This shift is fueled by rising environmental regulations, government awareness programs, and an increasing number of bans on conventional plastics.

- As reported by the International Fitness and Bodybuilding Federation, global bioplastics production capacity hit 2.02 million metric tons in 2023, with Asia accounting for over 50% of this capacity.

- Furthermore, as consumer awareness rises and emerging economies like India offer tax incentives for eco-friendly solutions, investments in Asia-Pacific are expected to increase. This trend is poised to boost the biopolymers packaging market.

- As per the Department for Promotion of Industry and Internal Trade (DPIIT), India, a global leader in food and beverage manufacturing, attracted approximately USD 12.58 billion in foreign direct investment (FDI) equity inflow in its food processing industry from April 2000 to March 2024. This inflow represented 1.85% of the total FDI across sectors. In the fiscal year 2023-24, the industry saw processed vegetables earning USD 652.42 million, miscellaneous processed items at USD 1,652.22 million, and processed fruits and juices reaching USD 970.93 million.

- Moreover, the Indian government, through its Ministry of Food Processing Industries, is actively working to bolster investments in the food processing industry. Continuing its commitment, the government extended the umbrella PMKSY scheme with a substantial allocation of INR 4,600 crore (USD 559.4 million) until March 2026. Such initiatives are expected to significantly drive the growth of the market studied in the region.

Biopolymer Packaging Industry Overview

The biopolymers packaging market is semi-consolidated, with the presence of prominent players, such as Mondi Group, Taghleef Industries Inc., Clondalkin Group Holdings BV, Sonoco Products Company, and Berry Plastics Group Inc. These firms hold a competitive advantage over other players due to their ability to continually enhance their product lines as per consumers' demands. These companies are investing in research and development activities, mergers and acquisitions, and strategic partnerships with other firms or institutions to maintain their competitive position.

- August 2023 - CJ Biomaterials Inc., a prominent player in polyhydroxyalkanoate (PHA) biopolymers and a subsidiary of South Korea's CJ CheilJedang, forged a partnership with Riman Korea. The collaboration displays the fusion of CJ Biomaterials' patented PHA technology with polylactic acid (PLA) to develop packaging for Riman's premium IncellDerm product line. This forward-thinking packaging not only resonates with Riman's commitment to sustainability but also drastically reduces the brand's dependence on traditional fossil-fuel-derived packaging for its skincare products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Government Regulations for Bio-based Packaging

- 5.1.2 Increasing Awareness of Human Well-being and Eco-friendly Products

- 5.2 Market Restraints

- 5.2.1 Performance Issues with Bio-based Materials

- 5.2.2 High Cost of Bio-packaging Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Non-biodegradable

- 6.1.1.1 PET

- 6.1.1.2 PA

- 6.1.1.3 PTT

- 6.1.1.4 Other Non-biodegradable Materials

- 6.1.2 Biodegradable

- 6.1.2.1 PLA

- 6.1.2.2 Starch Blends

- 6.1.2.3 PBAT

- 6.1.2.4 Other Biodegradable Materials

- 6.1.1 Non-biodegradable

- 6.2 By Products

- 6.2.1 Bags

- 6.2.2 Pouches

- 6.2.3 Films

- 6.3 By End User

- 6.3.1 Food and Beverages

- 6.3.2 Retail

- 6.3.3 Other End User

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 South Africa

- 6.4.6.3 Egypt

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 Taghleef Industries Inc.

- 7.1.3 Clondalkin Group Holdings BV

- 7.1.4 Sonoco Products Company

- 7.1.5 Berry Plastics Group Inc.

- 7.1.6 Constantia Flexibles Group GmbH

- 7.1.7 Sealed Air Corporation

- 7.1.8 Tetra Pak International SA

- 7.1.9 United Biopolymers SA

- 7.1.10 Amcor PLC

- 7.1.11 NatureWorks LLC

- 7.1.12 CJ Biomaterials Inc.